Mobileye (MBLY)

Mobileye is in for a bumpy ride. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Mobileye Will Underperform

With its EyeQ chips installed in over 200 million vehicles worldwide, Mobileye (NASDAQ:MBLY) develops advanced driver assistance systems and autonomous driving technologies that help vehicles detect and respond to road conditions.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 4.6% annually over the last two years

- Earnings per share decreased by more than its revenue over the last two years, showing each sale was less profitable

- Mounting operating losses demonstrate the tradeoff between growth and profitability

Mobileye doesn’t fulfill our quality requirements. Better stocks can be found in the market.

Why There Are Better Opportunities Than Mobileye

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Mobileye

Mobileye is trading at $8.01 per share, or 31.3x forward P/E. Not only is Mobileye’s multiple richer than most industrials peers, but it’s also expensive for its fundamentals.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Mobileye (MBLY) Research Report: Q4 CY2025 Update

Autonomous driving technology company Mobileye (NASDAQ:MBLY) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales fell by 9% year on year to $446 million. On the other hand, the company’s full-year revenue guidance of $1.94 billion at the midpoint came in 3% below analysts’ estimates. Its non-GAAP profit of $0.06 per share was in line with analysts’ consensus estimates.

Mobileye (MBLY) Q4 CY2025 Highlights:

- Revenue: $446 million vs analyst estimates of $432.4 million (9% year-on-year decline, 3.1% beat)

- Adjusted EPS: $0.06 vs analyst estimates of $0.06 (in line)

- Adjusted EBITDA: -$30 million vs analyst estimates of $58.45 million (-6.7% margin, significant miss)

- Operating Margin: -31.4%, down from -17.6% in the same quarter last year

- Free Cash Flow Margin: 19.3%, down from 39% in the same quarter last year

- Market Capitalization: $8.85 billion

Company Overview

With its EyeQ chips installed in over 200 million vehicles worldwide, Mobileye (NASDAQ:MBLY) develops advanced driver assistance systems and autonomous driving technologies that help vehicles detect and respond to road conditions.

The company's technology is built on several pillars, including computer vision processing, Road Experience Management (REM) mapping, compound AI systems, imaging radar, and its proprietary EyeQ System-on-Chip (SoC) family. Mobileye offers a spectrum of solutions ranging from basic driver assistance features (eyes-on/hands-on) to premium autonomous solutions where no driver is needed.

At the foundation is Mobileye Base ADAS, which provides safety features like collision warnings and lane departure alerts. More advanced offerings include Cloud-Enhanced ADAS, which leverages crowdsourced data; Mobileye Surround ADAS, which processes data from multiple cameras and radars; and SuperVision, which enables hands-off driving while requiring driver attention. The company is also developing Mobileye Chauffeur for consumer vehicles and Mobileye Drive for robotaxis and delivery fleets.

When automakers integrate Mobileye's technology, they typically work through Tier 1 automotive suppliers like Aptiv, Magna, and Valeo. The company has a long-standing partnership with STMicroelectronics for manufacturing its EyeQ chips, and maintains strategic collaborations with Intel for technological development and manufacturing resources.

4. Automobile Manufacturing

Much capital investment and technical know-how are needed to manufacture functional, safe, and aesthetically pleasing automobiles for the mass market. Barriers to entry are therefore high, and auto manufacturers with economies of scale can boast strong economic moats. However, this doesn’t insulate them from new entrants, as electric vehicles (EVs) have entered the market and are upending it. This has forced established manufacturers to not only contend with emerging EV-first competitors but also decide how much they want to invest in these disruptive technologies, which will likely cannibalize their legacy offerings.

Mobileye competes with numerous companies across the autonomous driving spectrum, including chip providers like Nvidia, Qualcomm, and NXP; software companies like StradVision and Wayve; and autonomous vehicle developers such as Waymo, Cruise, and Tesla.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Mobileye’s sales grew at an exceptional 14.4% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Mobileye’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.6% over the last two years. Mobileye isn’t alone in its struggles as the Automobile Manufacturing industry experienced a cyclical downturn, with many similar businesses observing lower sales at this time.

This quarter, Mobileye’s revenue fell by 9% year on year to $446 million but beat Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 4.8% over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

Mobileye has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 48.1% gross margin over the last five years. That means Mobileye only paid its suppliers $51.94 for every $100 in revenue.

This quarter, Mobileye’s gross profit margin was 45.3%, down 3.9 percentage points year on year. Zooming out, however, Mobileye’s full-year margin has been trending up over the past 12 months, increasing by 2.9 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

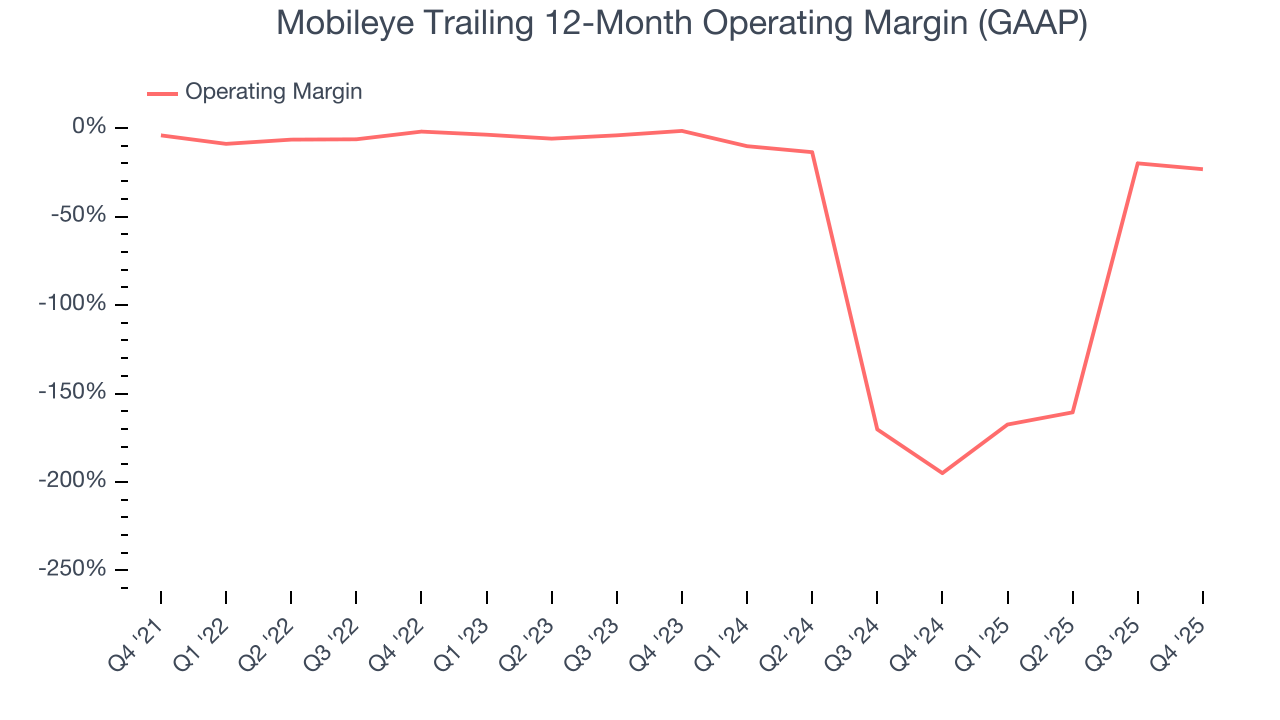

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Mobileye’s high expenses have contributed to an average operating margin of negative 42.7% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, Mobileye’s operating margin decreased by 19.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. We’ve noticed many Automobile Manufacturing companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction, but Mobileye’s performance was poor no matter how you look at it. It shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Mobileye generated a negative 31.4% operating margin.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Mobileye has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 22.8% over the last five years. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Mobileye’s margin dropped by 5.2 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal it is in the middle of an investment cycle.

Mobileye’s free cash flow clocked in at $86 million in Q4, equivalent to a 19.3% margin. The company’s cash profitability regressed as it was 19.7 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

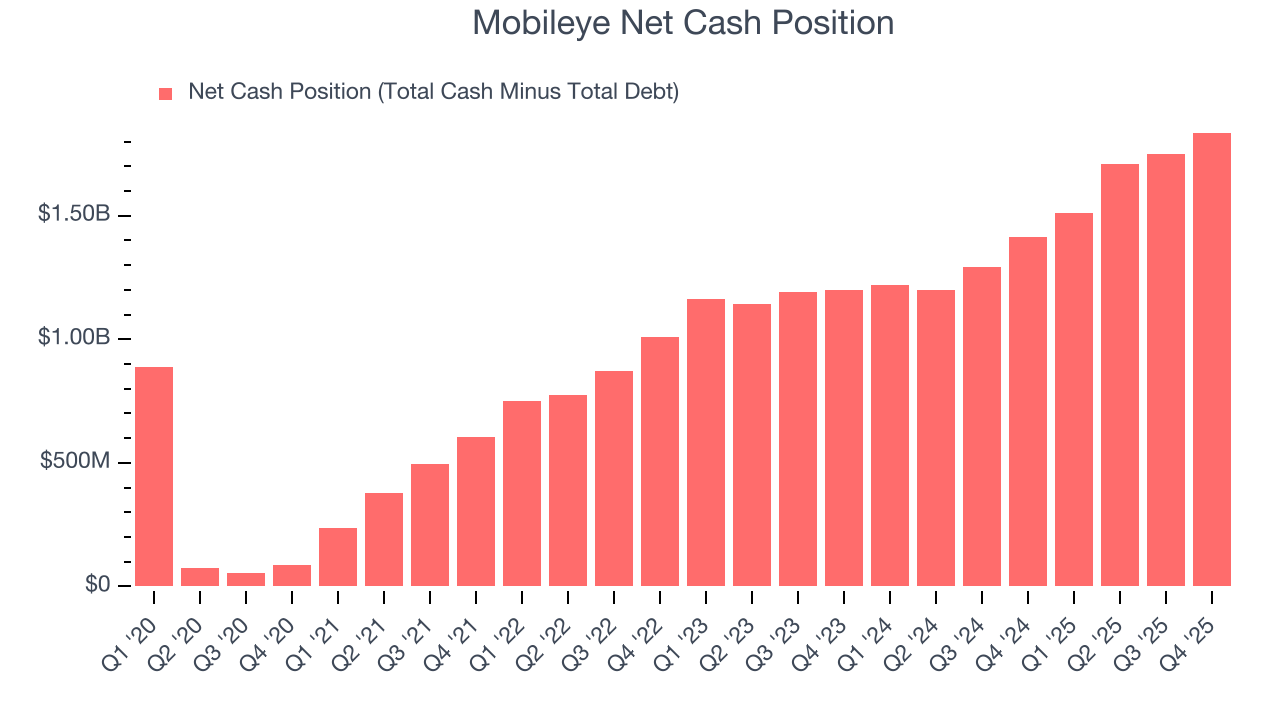

9. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Mobileye is a well-capitalized company with $1.84 billion of cash and no debt. This position is 20.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

10. Key Takeaways from Mobileye’s Q4 Results

We enjoyed seeing Mobileye beat analysts’ revenue expectations this quarter. We were also glad its EPS was in line with Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2.7% to $10.49 immediately after reporting.

11. Is Now The Time To Buy Mobileye?

Updated: March 7, 2026 at 12:31 AM EST

When considering an investment in Mobileye, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies helping their customers, but in the case of Mobileye, we’re out. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s admirable gross margins indicate the mission-critical nature of its offerings, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Mobileye’s P/E ratio based on the next 12 months is 31.3x. This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $15.71 on the company (compared to the current share price of $8.01).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.