Middleby (MIDD)

Middleby keeps us up at night. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Middleby Will Underperform

Holding a Guinness World Record for creating the world’s fastest conveyor pizza oven, Middleby (NYSE:MIDD) is a food service and equipment manufacturer.

- Annual sales declines of 3.8% for the past two years show its products and services struggled to connect with the market during this cycle

- Earnings per share have contracted by 2.3% annually over the last two years, a headwind for returns as stock prices often echo long-term EPS performance

- Projected sales decline of 10.8% over the next 12 months indicates demand will continue deteriorating

Middleby doesn’t measure up to our expectations. We’d rather invest in businesses with stronger moats.

Why There Are Better Opportunities Than Middleby

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Middleby

Middleby is trading at $160.66 per share, or 17.2x forward P/E. Middleby’s valuation may seem like a bargain, especially when stacked up against other industrials companies. We remind you that you often get what you pay for, though.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Middleby (MIDD) Research Report: Q4 CY2025 Update

Kitchen product manufacturer Middleby (NYSE:MIDD) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 14.5% year on year to $866.4 million. Next quarter’s revenue guidance of $774 million underwhelmed, coming in 14% below analysts’ estimates. Its non-GAAP profit of $2.42 per share was 7.2% above analysts’ consensus estimates.

Middleby (MIDD) Q4 CY2025 Highlights:

- Revenue: $866.4 million vs analyst estimates of $977.5 million (14.5% year-on-year decline, 11.4% miss)

- Adjusted EPS: $2.42 vs analyst estimates of $2.26 (7.2% beat)

- Adjusted EBITDA: $219.2 million vs analyst estimates of $204.9 million (25.3% margin, 7% beat)

- Revenue Guidance for Q1 CY2026 is $774 million at the midpoint, below analyst estimates of $899.8 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $9.28 at the midpoint, missing analyst estimates by 1.9%

- EBITDA guidance for the upcoming financial year 2026 is $762.5 million at the midpoint, below analyst estimates of $820.2 million

- Operating Margin: 17.3%, in line with the same quarter last year

- Free Cash Flow Margin: 19.1%, down from 22.3% in the same quarter last year

- Organic Revenue was flat year on year (miss)

- Market Capitalization: $7.95 billion

Company Overview

Holding a Guinness World Record for creating the world’s fastest conveyor pizza oven, Middleby (NYSE:MIDD) is a food service and equipment manufacturer.

Middleby has a rich history that began in 1888 as a manufacturer of bakery machinery. The company grew significantly through acquisitions, continuously expanding its product offerings and market reach. Today, Middleby is recognized globally, serving not only the commercial foodservice market but also residential kitchen customers and food processing industries.

Middleby specializes in providing foodservice and cooking technology, catering to various markets including commercial foodservice operations, food processing industries, and residential kitchens. Its offerings range from commercial ovens, refrigeration systems, and beverage equipment used in restaurants and hotels, to specialized food processing machinery for creating baked goods and packaged meats. For example, Middleby supplies conveyor ovens that are essential in quick-service restaurants for efficient, high-volume cooking. Additionally, the company produces high-end residential kitchen appliances, such as professional-grade ranges and ovens, which appeal to both home chefs and culinary enthusiasts seeking restaurant-quality results at home.

Middleby generates revenue from customers across multiple sectors. This includes supplying equipment to fast food, casual dining, and quick-service restaurants, as well as non-traditional settings like ghost kitchens. Retail environments such as convenience stores, supermarkets, and department stores also contribute to the company’s sales. Furthermore, institutional facilities such as hotels, schools, and hospitals rely on Middleby's offerings for their food service needs.

The company primarily sells through independent dealers and distributors in the U.S., who are often part of buying groups that negotiate purchasing terms. This distribution network is supported by Middleby's own sales personnel and a network of independent manufacturers' representatives. Additionally, Middleby serves a significant market in food processing, providing specialized equipment to major international food processing companies.

4. Professional Tools and Equipment

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

Competitors offering similar products include Rational AG (FWB:RAA), Welbilt (NYSE:WBT), and Illinois Tool Works (NYSE:ITW).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Middleby’s sales grew at a decent 8.2% compounded annual growth rate over the last five years. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Middleby’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.8% over the last two years.

Middleby also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Middleby’s organic revenue averaged 2.4% year-on-year declines. Because this number aligns with its two-year revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, Middleby missed Wall Street’s estimates and reported a rather uninspiring 14.5% year-on-year revenue decline, generating $866.4 million of revenue. Company management is currently guiding for a 14.6% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

Middleby’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 37.4% gross margin over the last five years. That means Middleby only paid its suppliers $62.61 for every $100 in revenue.

This quarter, Middleby’s gross profit margin was 38.8%, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Middleby has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 13%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Middleby’s operating margin decreased by 22.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Middleby generated an operating margin profit margin of 17.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

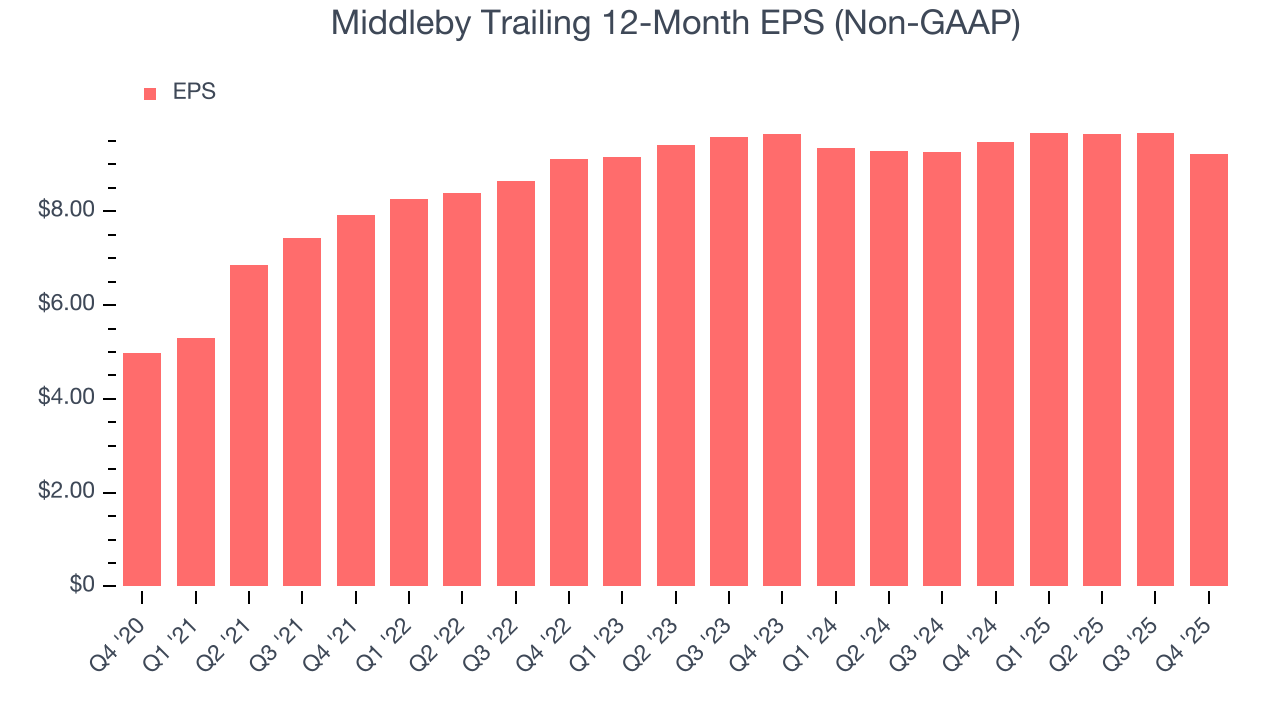

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Middleby’s EPS grew at a remarkable 13.2% compounded annual growth rate over the last five years, higher than its 8.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Middleby’s quality of earnings can give us a better understanding of its performance. A five-year view shows that Middleby has repurchased its stock, shrinking its share count by 9.2%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Middleby, its two-year annual EPS declines of 2.3% mark a reversal from its (seemingly) healthy five-year trend. We hope Middleby can return to earnings growth in the future.

In Q4, Middleby reported adjusted EPS of $2.42, down from $2.88 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 7.2%. Over the next 12 months, Wall Street expects Middleby’s full-year EPS of $9.22 to grow 3.4%.

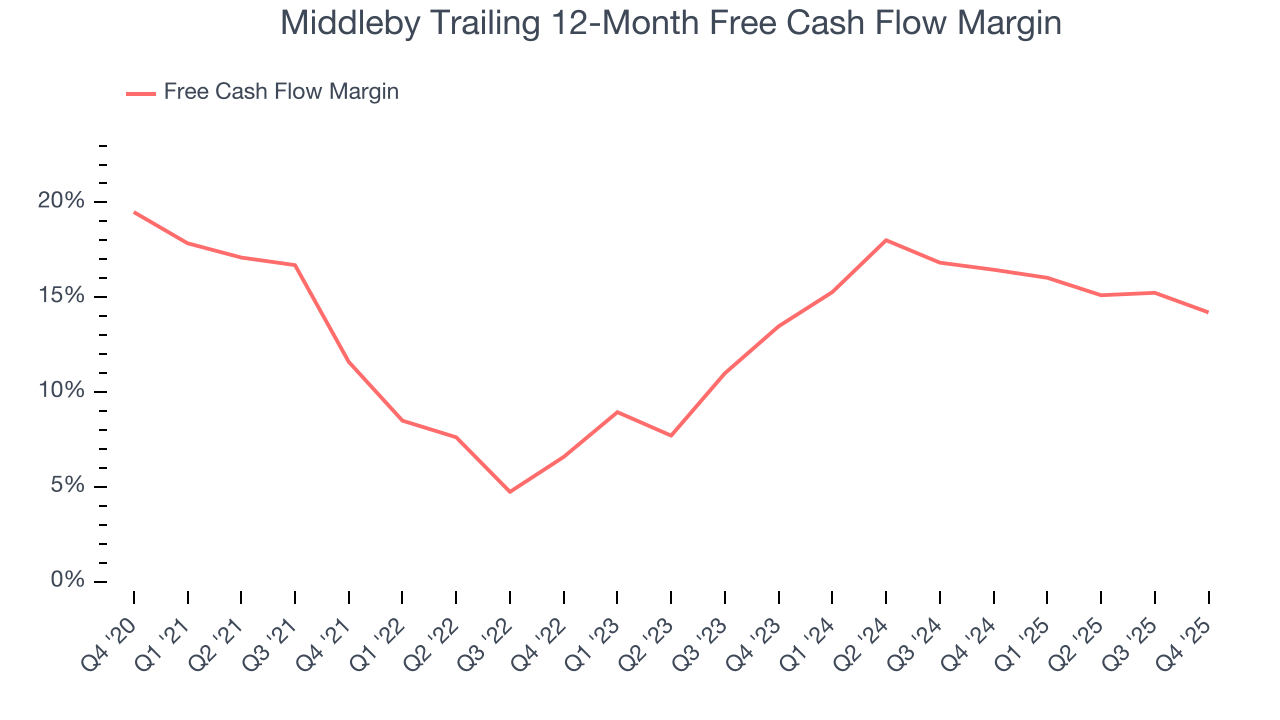

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Middleby has shown robust cash profitability, enabling it to comfortably ride out cyclical downturns while investing in plenty of new offerings and returning capital to investors. The company’s free cash flow margin averaged 12.4% over the last five years, quite impressive for an industrials business.

Taking a step back, we can see that Middleby’s margin expanded by 2.6 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Middleby’s free cash flow clocked in at $165.5 million in Q4, equivalent to a 19.1% margin. The company’s cash profitability regressed as it was 3.2 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Middleby historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.4%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Middleby’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

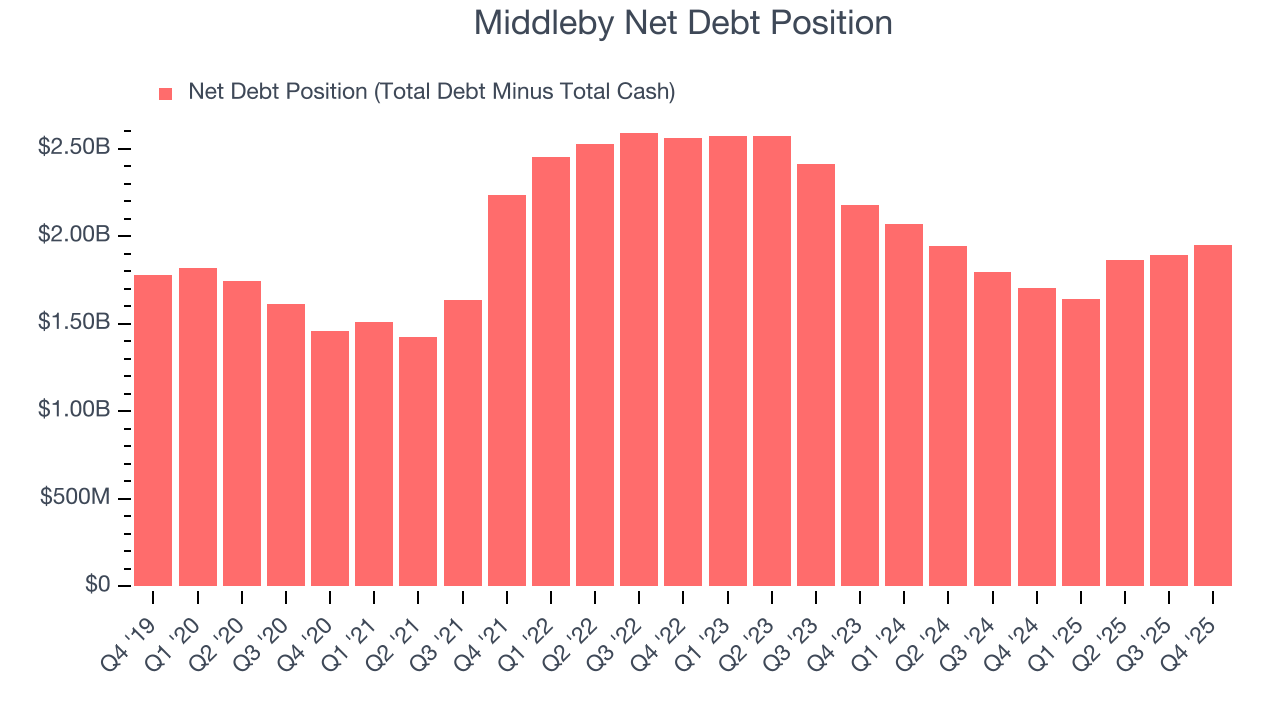

11. Balance Sheet Assessment

Middleby reported $222.2 million of cash and $2.17 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $797.9 million of EBITDA over the last 12 months, we view Middleby’s 2.4× net-debt-to-EBITDA ratio as safe. We also see its $33.91 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Middleby’s Q4 Results

We enjoyed seeing Middleby beat analysts’ EBITDA expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $157.50 immediately following the results.

13. Is Now The Time To Buy Middleby?

Updated: March 5, 2026 at 10:32 PM EST

Before deciding whether to buy Middleby or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Middleby falls short of our quality standards. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s strong free cash flow generation allows it to invest in growth initiatives while maintaining an ample cushion, the downside is its declining operating margin shows the business has become less efficient.

Middleby’s P/E ratio based on the next 12 months is 17.1x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $189 on the company (compared to the current share price of $156.25).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.