MillerKnoll (MLKN)

MillerKnoll is up against the odds. Its poor returns on capital indicate it barely generated any profits, a must for high-quality companies.― StockStory Analyst Team

1. News

2. Summary

Why We Think MillerKnoll Will Underperform

Created through the 2021 merger of industry icons Herman Miller and Knoll, MillerKnoll (NASDAQ:MLKN) designs, manufactures, and distributes interior furnishings for offices, healthcare facilities, educational settings, and homes worldwide.

- Flat sales over the last two years suggest it must find different ways to grow during this cycle

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- Low free cash flow margin gives it little breathing room, constraining its ability to self-fund growth or return capital to shareholders

MillerKnoll is in the penalty box. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than MillerKnoll

High Quality

Investable

Underperform

Why There Are Better Opportunities Than MillerKnoll

MillerKnoll is trading at $18.98 per share, or 0.3x trailing 12-month price-to-sales. The market typically values companies like MillerKnoll based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. MillerKnoll (MLKN) Research Report: Q4 CY2025 Update

Office furniture manufacturer MillerKnoll (NASDAQ:MLKN) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 1.6% year on year to $955.2 million. On top of that, next quarter’s revenue guidance ($943 million at the midpoint) was surprisingly good and 3.7% above what analysts were expecting. Its non-GAAP profit of $0.43 per share was 7.5% above analysts’ consensus estimates.

MillerKnoll (MLKN) Q4 CY2025 Highlights:

- Revenue: $955.2 million vs analyst estimates of $941.4 million (1.6% year-on-year decline, 1.5% beat)

- Adjusted EPS: $0.43 vs analyst estimates of $0.40 (7.5% beat)

- Revenue Guidance for Q1 CY2026 is $943 million at the midpoint, above analyst estimates of $909.6 million

- Adjusted EPS guidance for Q1 CY2026 is $0.45 at the midpoint, above analyst estimates of $0.41

- Operating Margin: 5.1%, down from 6.6% in the same quarter last year

- Backlog: $708.3 million at quarter end

- Market Capitalization: $1.14 billion

Company Overview

Created through the 2021 merger of industry icons Herman Miller and Knoll, MillerKnoll (NASDAQ:MLKN) designs, manufactures, and distributes interior furnishings for offices, healthcare facilities, educational settings, and homes worldwide.

MillerKnoll operates through a portfolio of design brands that includes not only Herman Miller and Knoll, but also Design Within Reach, HAY, Muuto, Maharam, and several other specialized subsidiaries. The company's products range from office chairs and desk systems to textiles, lighting, and residential furniture pieces, many of which have become recognized as design classics.

The company serves its markets through three main segments. The Americas Contract segment focuses on workplace, healthcare, and educational environments across North and South America. The International Contract & Specialty segment handles similar markets in Europe, the Middle East, Africa, and Asia-Pacific, while also managing specialty brands focused on textiles and high-end furnishings. The Global Retail segment sells directly to consumers and third-party retailers.

A typical corporate client might work with MillerKnoll to outfit an entire office building with ergonomic workstations, collaborative spaces, and executive suites. Meanwhile, a residential customer might purchase an iconic Eames lounge chair through a Design Within Reach store or the company's e-commerce platform.

MillerKnoll generates revenue through multiple channels: independent furniture dealers (who account for over half of sales), direct sales to organizations, company-owned retail stores, e-commerce websites, and catalogs. The company maintains manufacturing facilities across the United States as well as in the United Kingdom, Italy, China, Brazil, Mexico, and India.

Beyond manufacturing, MillerKnoll invests significantly in research and design, spending over $60 million annually to develop new products and improve existing ones. The company holds numerous patents and trademarks, with many of its furniture designs considered iconic in the industry.

4. Office & Commercial Furniture

The sector faces a tepid outlook as workplace dynamics continue to evolve. Hybrid work means that enterprise demand for office furniture is lower. Consumer demand for the same products likely will not offset the loss from enterprises, as individual workers tend to have less space and need for the sector's wares. The Trump administration also possesses a high willingness to impose tariffs on key partners, which could result in retaliatory actions, all of which could pressure those selling furniture that may feature components or labor from overseas. Lastly, the COVID-19 pandemic showed that there is always a risk that something disrupts supply chains, and companies need contingency plans for this.

MillerKnoll's primary competitors in the contract furniture industry include Steelcase Inc. (NYSE:SCS), Haworth, and HNI Corporation (NYSE:HNI). In the retail home furnishings market, the company competes with Restoration Hardware (NYSE:RH), Wayfair (NYSE:W), Williams-Sonoma (NYSE:WSM), and Crate & Barrel.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $3.75 billion in revenue over the past 12 months, MillerKnoll is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

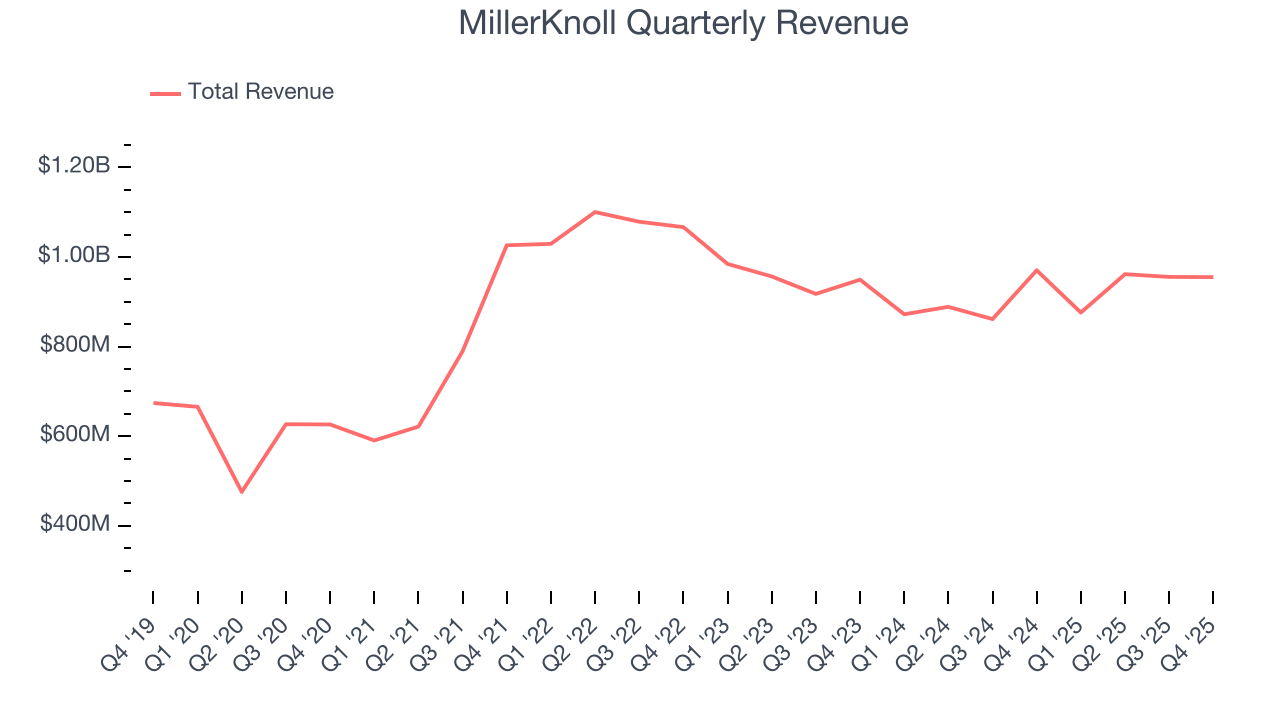

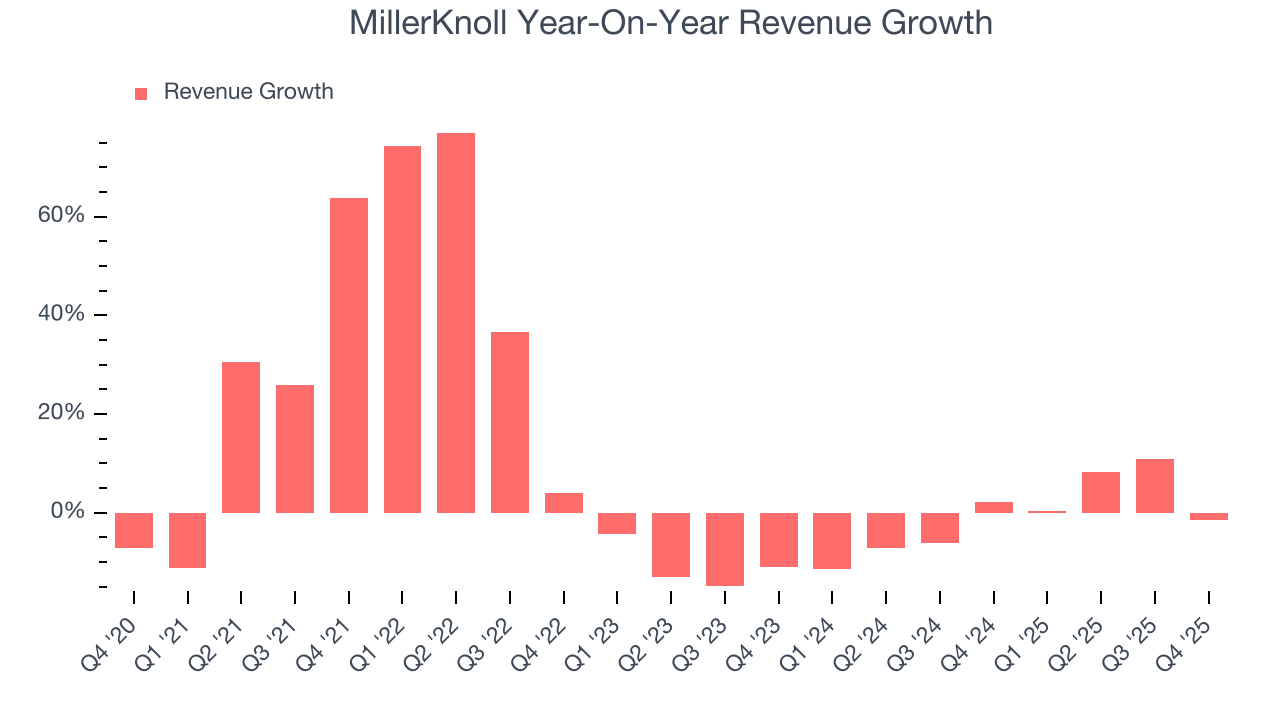

As you can see below, MillerKnoll’s sales grew at an impressive 9.4% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. MillerKnoll’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

This quarter, MillerKnoll’s revenue fell by 1.6% year on year to $955.2 million but beat Wall Street’s estimates by 1.5%. Company management is currently guiding for a 7.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

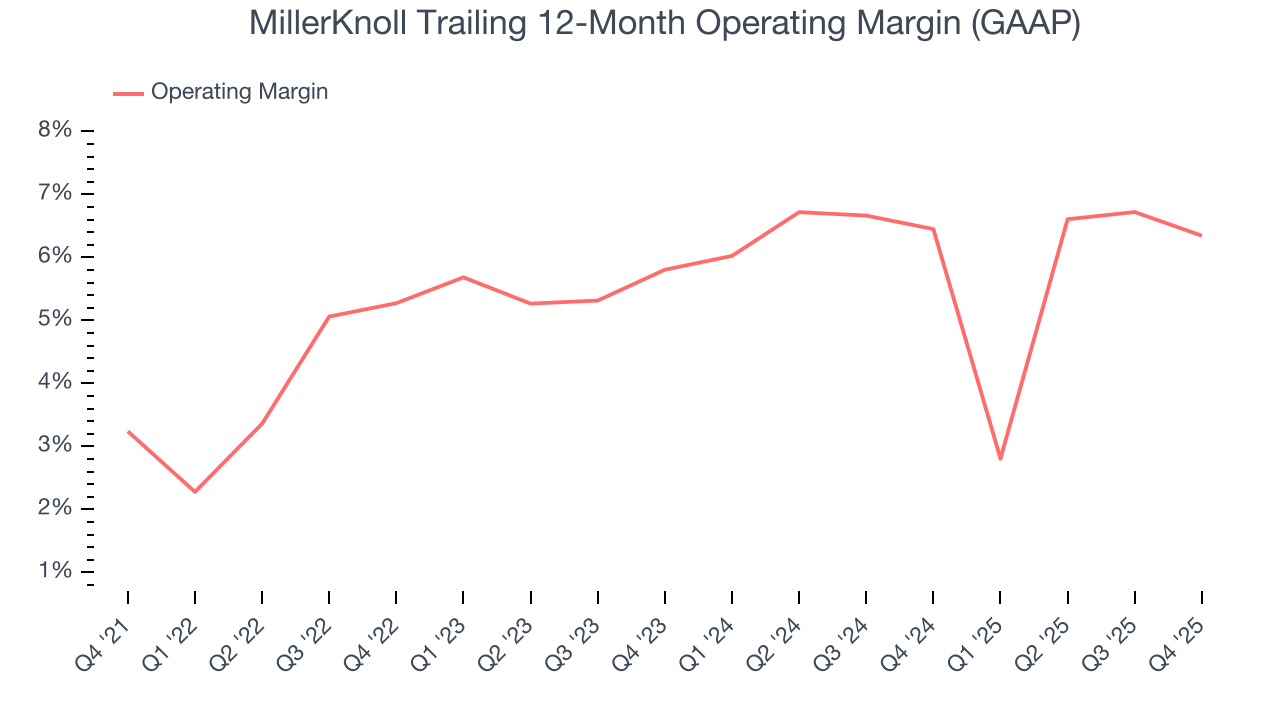

MillerKnoll was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.5% was weak for a business services business.

On the plus side, MillerKnoll’s operating margin rose by 3.1 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, MillerKnoll generated an operating margin profit margin of 5.1%, down 1.5 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

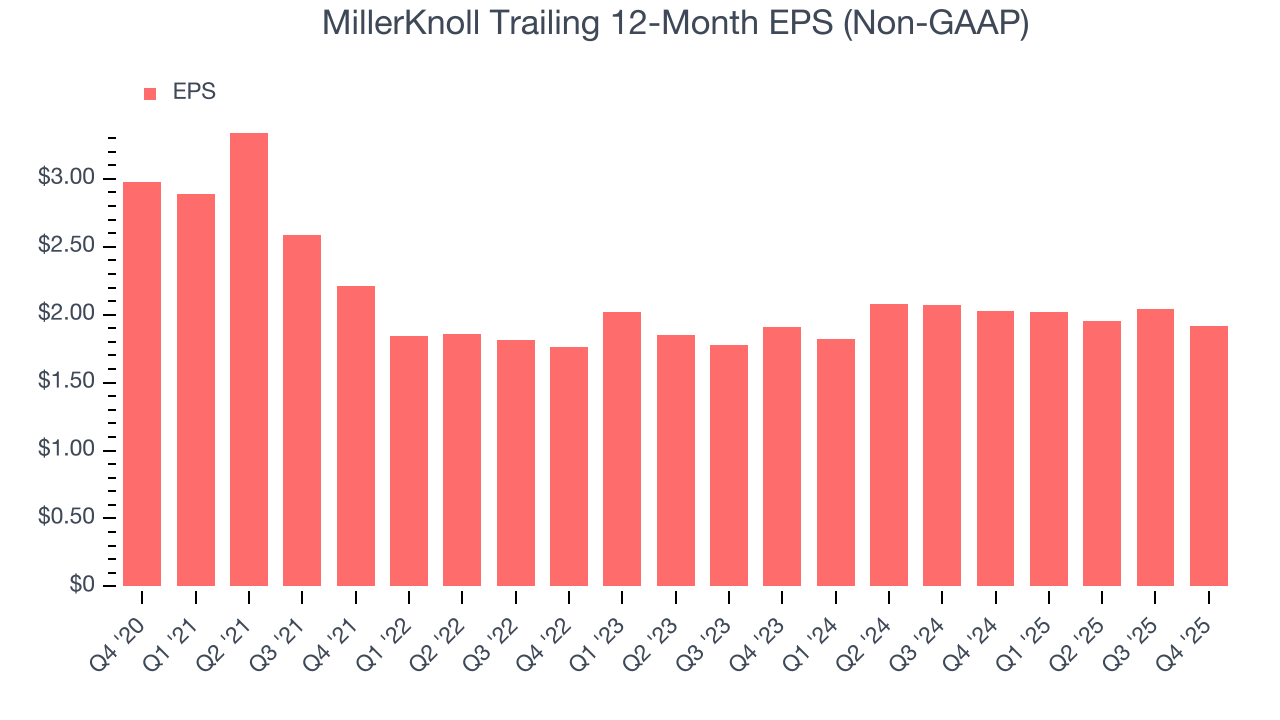

Sadly for MillerKnoll, its EPS declined by 8.4% annually over the last five years while its revenue grew by 9.4%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

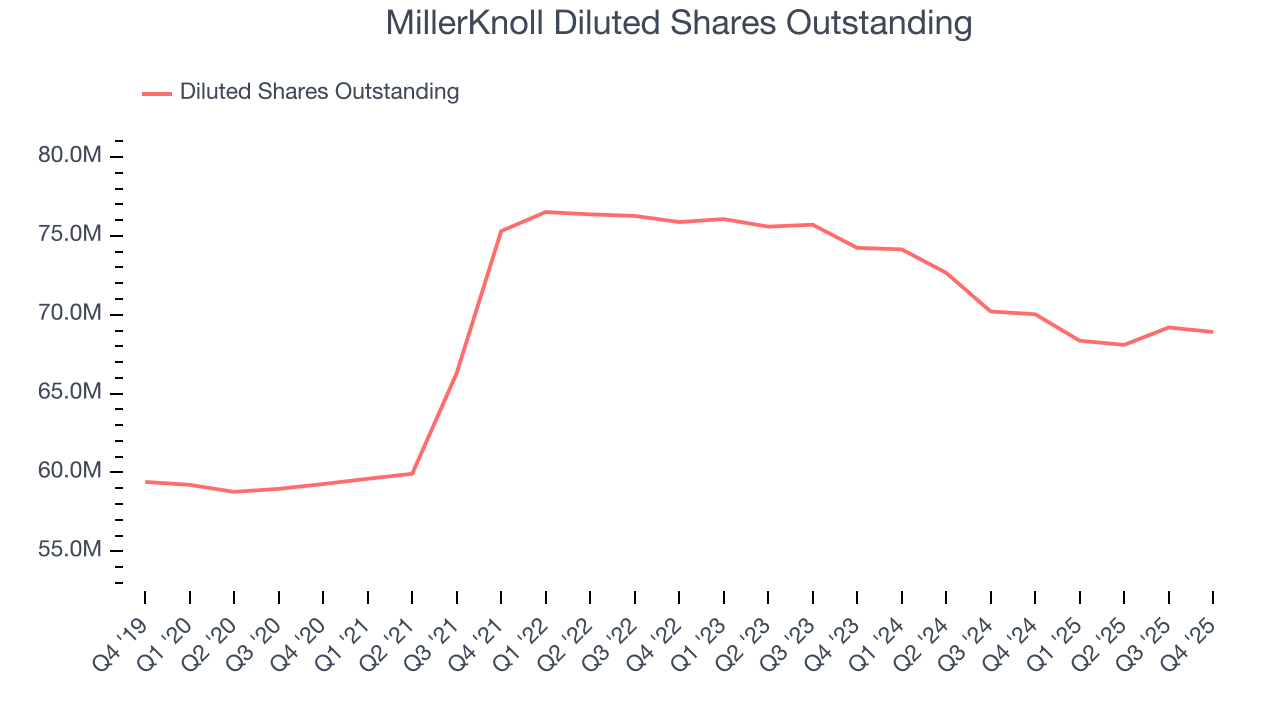

We can take a deeper look into MillerKnoll’s earnings to better understand the drivers of its performance. A five-year view shows MillerKnoll has diluted its shareholders, growing its share count by 16.3%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For MillerKnoll, EPS didn’t budge over the last two years, but at least that was better than its five-year trend. We hope its earnings can grow in the coming years.

In Q4, MillerKnoll reported adjusted EPS of $0.43, down from $0.55 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 7.5%. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

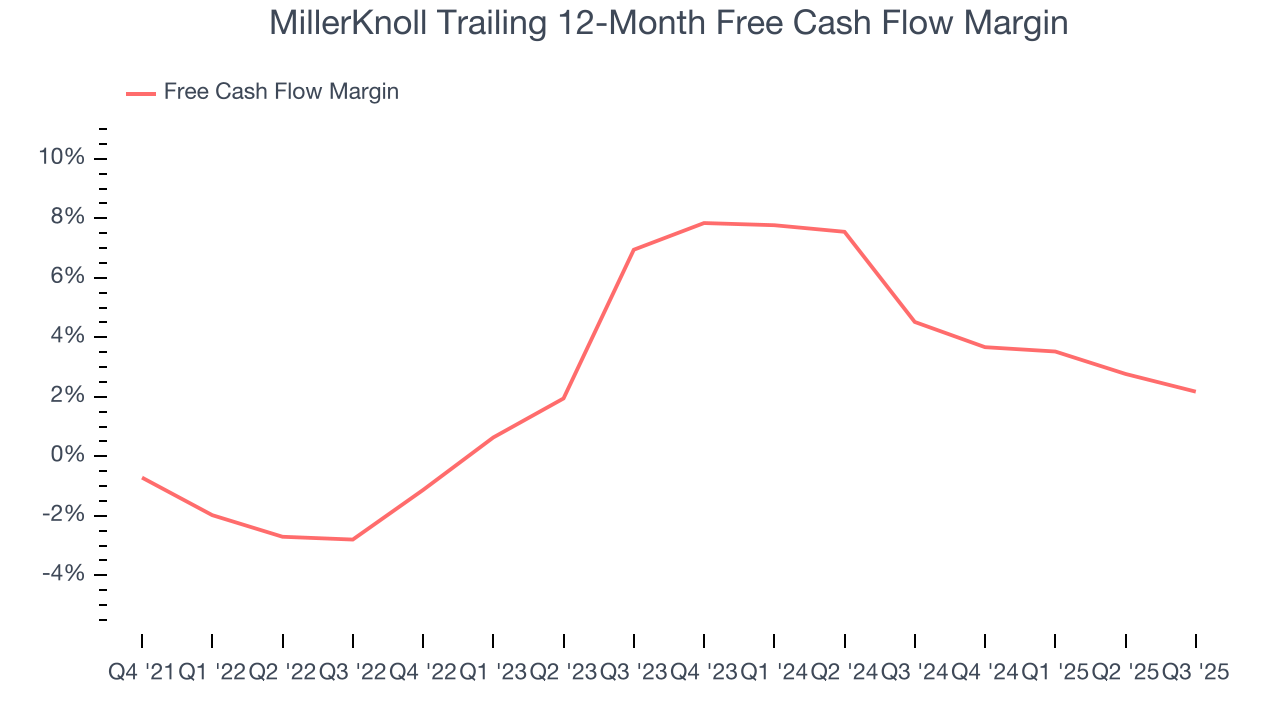

MillerKnoll has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2.3%, lousy for a business services business.

Taking a step back, an encouraging sign is that MillerKnoll’s margin expanded by 1.2 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

MillerKnoll historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.5%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, MillerKnoll’s ROIC averaged 1.8 percentage point increases over the last few years. This is a good sign, and we hope the company can continue improving.

10. Key Takeaways from MillerKnoll’s Q4 Results

We were impressed by how significantly MillerKnoll blew past analysts’ EPS guidance for next quarter expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 4.9% to $18.40 immediately after reporting.

11. Is Now The Time To Buy MillerKnoll?

Updated: December 17, 2025 at 10:23 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We cheer for all companies making their customers lives easier, but in the case of MillerKnoll, we’ll be cheering from the sidelines. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its projected EPS for the next year is lacking. And while the company’s expanding operating margin shows the business has become more efficient, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets.

MillerKnoll’s price-to-sales ratio based on the trailing 12 months is 0.3x. The market typically values companies like MillerKnoll based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $32 on the company (compared to the current share price of $18.98).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.