Merit Medical Systems (MMSI)

We’re wary of Merit Medical Systems. Its poor returns on capital indicate it barely generated any profits, a must for high-quality companies.― StockStory Analyst Team

1. News

2. Summary

Why Merit Medical Systems Is Not Exciting

Founded in 1987 and now offering over 1,700 patented products across global markets, Merit Medical Systems (NASDAQ:MMSI) manufactures and markets specialized medical devices used in minimally invasive procedures for cardiology, radiology, oncology, critical care, and endoscopy.

- Modest revenue base of $1.48 billion gives it less fixed cost leverage and fewer distribution channels than larger companies

- Below-average returns on capital indicate management struggled to find compelling investment opportunities

- The good news is that its incremental sales significantly boosted profitability as its annual earnings per share growth of 19.8% over the last five years outstripped its revenue performance

Merit Medical Systems doesn’t measure up to our expectations. There are better opportunities in the market.

Why There Are Better Opportunities Than Merit Medical Systems

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Merit Medical Systems

Merit Medical Systems’s stock price of $82.21 implies a valuation ratio of 20.8x forward P/E. This multiple is high given its weaker fundamentals.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. Merit Medical Systems (MMSI) Research Report: Q3 CY2025 Update

Medical device company Merit Medical Systems (NASDAQ:MMSI) announced better-than-expected revenue in Q3 CY2025, with sales up 13% year on year to $384.2 million. The company’s full-year revenue guidance of $1.51 billion at the midpoint came in 0.6% above analysts’ estimates. Its non-GAAP profit of $0.92 per share was 11.4% above analysts’ consensus estimates.

Merit Medical Systems (MMSI) Q3 CY2025 Highlights:

- Revenue: $384.2 million vs analyst estimates of $372.1 million (13% year-on-year growth, 3.2% beat)

- Adjusted EPS: $0.92 vs analyst estimates of $0.83 (11.4% beat)

- Adjusted EBITDA: $87.54 million vs analyst estimates of $76.69 million (22.8% margin, 14.2% beat)

- The company slightly lifted its revenue guidance for the full year to $1.51 billion at the midpoint from $1.50 billion

- Management raised its full-year Adjusted EPS guidance to $3.73 at the midpoint, a 2.9% increase

- Operating Margin: 11.1%, in line with the same quarter last year

- Free Cash Flow Margin: 13.7%, up from 11.2% in the same quarter last year

- Organic Revenue rose 7.8% year on year vs analyst estimates of 4.8% growth (302.9 basis point beat)

- Market Capitalization: $4.82 billion

Company Overview

Founded in 1987 and now offering over 1,700 patented products across global markets, Merit Medical Systems (NASDAQ:MMSI) manufactures and markets specialized medical devices used in minimally invasive procedures for cardiology, radiology, oncology, critical care, and endoscopy.

Merit Medical's product portfolio spans two main segments: Cardiovascular and Endoscopy. The Cardiovascular segment includes devices for peripheral intervention (like drainage catheters and microcatheters), cardiac intervention (such as introducer sheaths and guide wires), custom procedural solutions, and OEM products. The Endoscopy segment focuses on gastroenterology and pulmonary products, including esophageal stents and balloon dilators.

Healthcare professionals use Merit's devices to gain vascular access, diagnose conditions, deliver treatments, and monitor patients. For example, an interventional radiologist might use Merit's SwiftNINJA Steerable Microcatheter to navigate through small, tortuous blood vessels to deliver treatment precisely where needed, while a breast surgeon might employ the SCOUT Radar Localization System to accurately locate and remove breast tumors without requiring uncomfortable wire placement before surgery.

The company generates revenue by selling its products to hospitals and physicians through both direct sales forces and distributors. In the United States, Merit sells directly to healthcare facilities and through buying groups, while internationally it employs a combination of direct sales representatives and independent distributors. The company maintains a significant global presence with distribution centers and sales offices across North America, Europe, the Middle East, Africa, Asia, and Latin America.

Merit also operates an OEM division that sells components and finished devices to other medical device manufacturers, who may combine these with their own products or sell them under their own labels. These OEM offerings include molded components, sub-assembled goods, custom kits, and bulk non-sterile products that can be customized to customer specifications.

The company invests substantially in research and development to expand its product offerings, with recent innovations including advanced inflation devices, microcatheters, and micro-access systems. Merit's manufacturing and distribution operations are subject to stringent regulations by the FDA and international regulatory bodies, requiring compliance with quality system regulations and various approval processes.

4. Medical Devices & Supplies - Cardiology, Neurology, Vascular

The medical devices and supplies industry, particularly in the fields of cardiology, neurology, and vascular care, benefits from a business model that balances innovation with relatively predictable revenue streams. These companies focus on developing life-saving devices such as stents, pacemakers, neurostimulation implants, and vascular access tools, which address critical and often chronic conditions. The recurring need for these devices, coupled with growing global demand for advanced treatments, provides stability and opportunities for long-term growth. However, the industry faces hurdles such as high research and development costs, rigorous regulatory approval processes, and reliance on reimbursement from healthcare systems, which can exert downward pressure on pricing. Looking ahead, the industry is positioned to benefit from tailwinds such as aging populations (which tend to have higher rates of disease) and technological advancements like minimally invasive procedures and connected devices that improve patient monitoring and outcomes. Innovations in robotic-assisted surgery and AI-driven diagnostics are also expected to accelerate adoption and expand treatment capabilities. However, potential headwinds include pricing pressures stemming from value-based care models and continued complexity changing from navigating regulatory frameworks that may prioritize further lowering healthcare costs.

Merit Medical Systems competes with several large medical device companies across its product categories, including Teleflex, Cook Medical, Medtronic, Boston Scientific, and Becton, Dickinson and Company in the peripheral and cardiac intervention markets. In its spine business, key competitors include Medtronic, Stryker Corporation, and Johnson & Johnson, while its endoscopy products compete with offerings from Getinge AB, Boston Scientific, Cook Medical, and Olympus Corporation.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $1.48 billion in revenue over the past 12 months, Merit Medical Systems is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

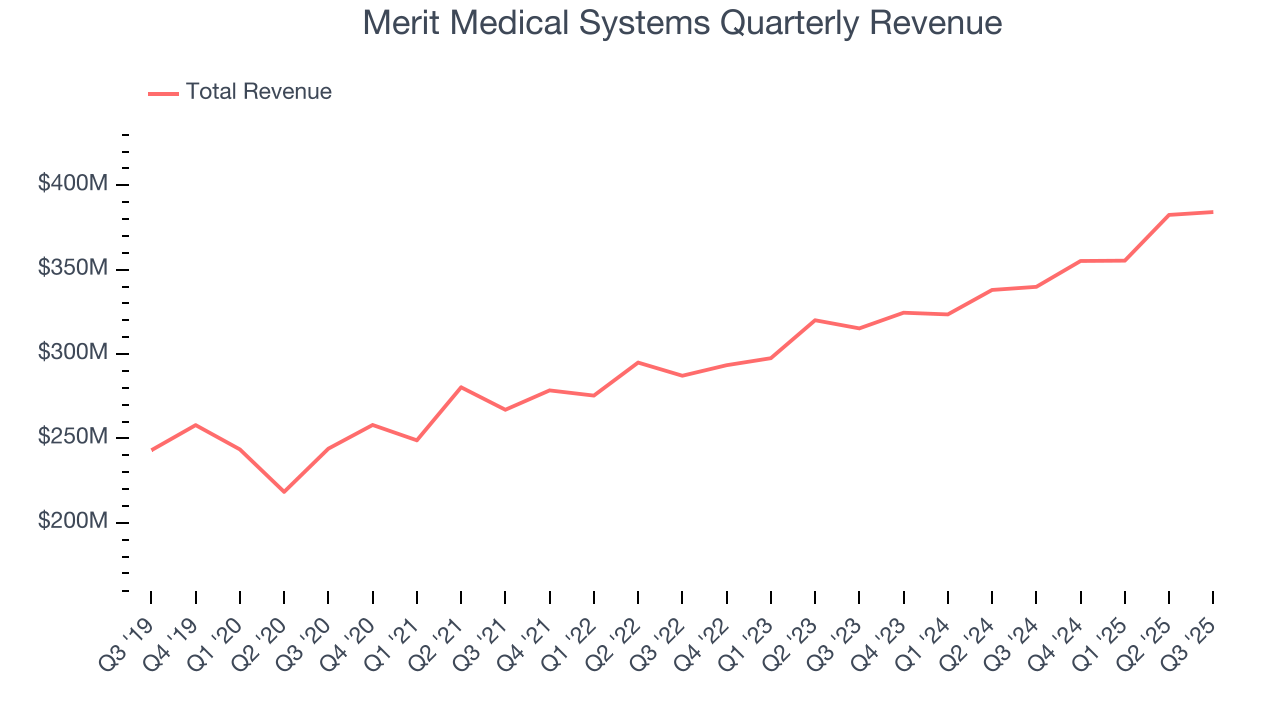

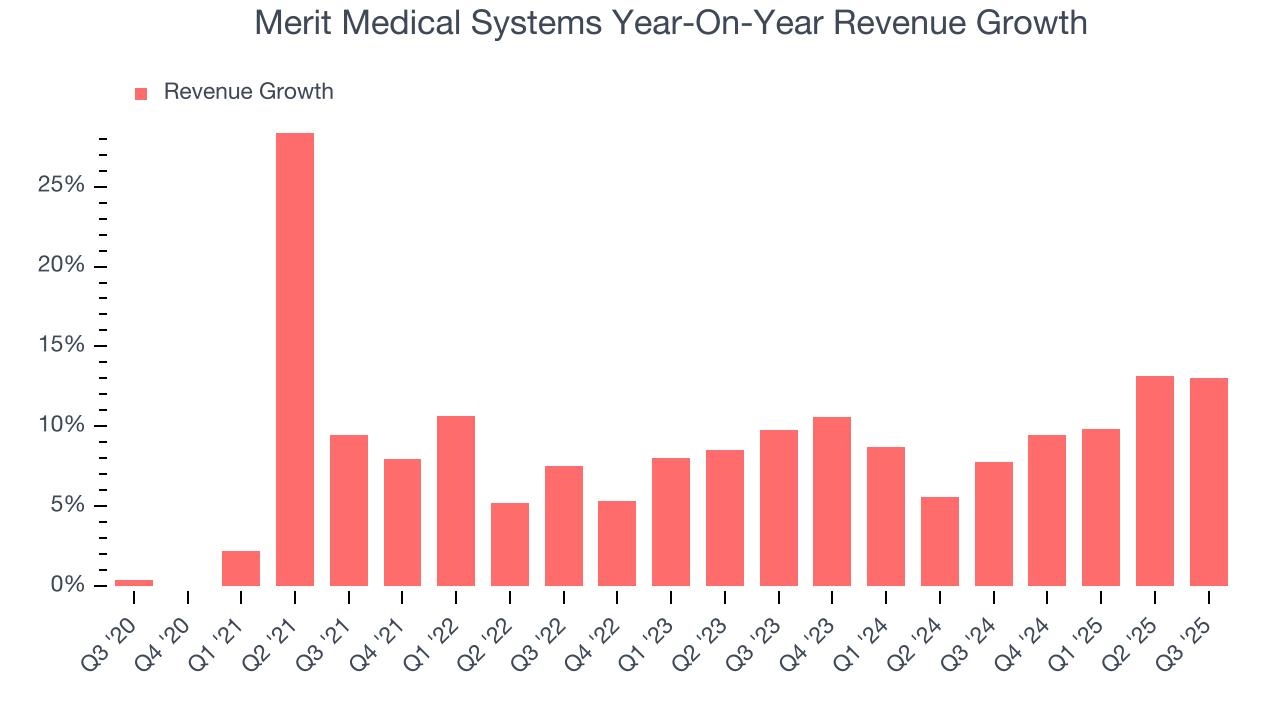

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Merit Medical Systems grew its sales at a decent 8.9% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Merit Medical Systems’s annualized revenue growth of 9.8% over the last two years aligns with its five-year trend, suggesting its demand was stable.

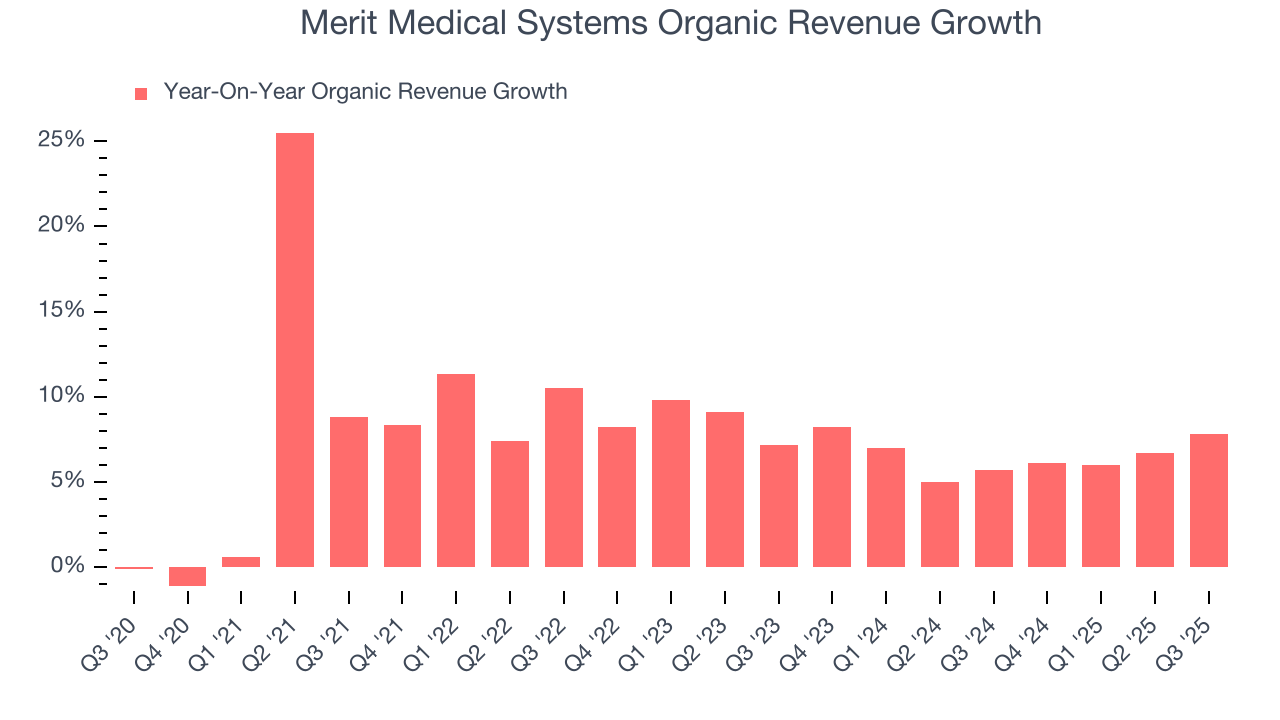

We can dig further into the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Merit Medical Systems’s organic revenue averaged 6.6% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, Merit Medical Systems reported year-on-year revenue growth of 13%, and its $384.2 million of revenue exceeded Wall Street’s estimates by 3.2%.

Looking ahead, sell-side analysts expect revenue to grow 6.4% over the next 12 months, a deceleration versus the last two years. Still, this projection is above average for the sector and suggests the market is forecasting some success for its newer products and services.

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

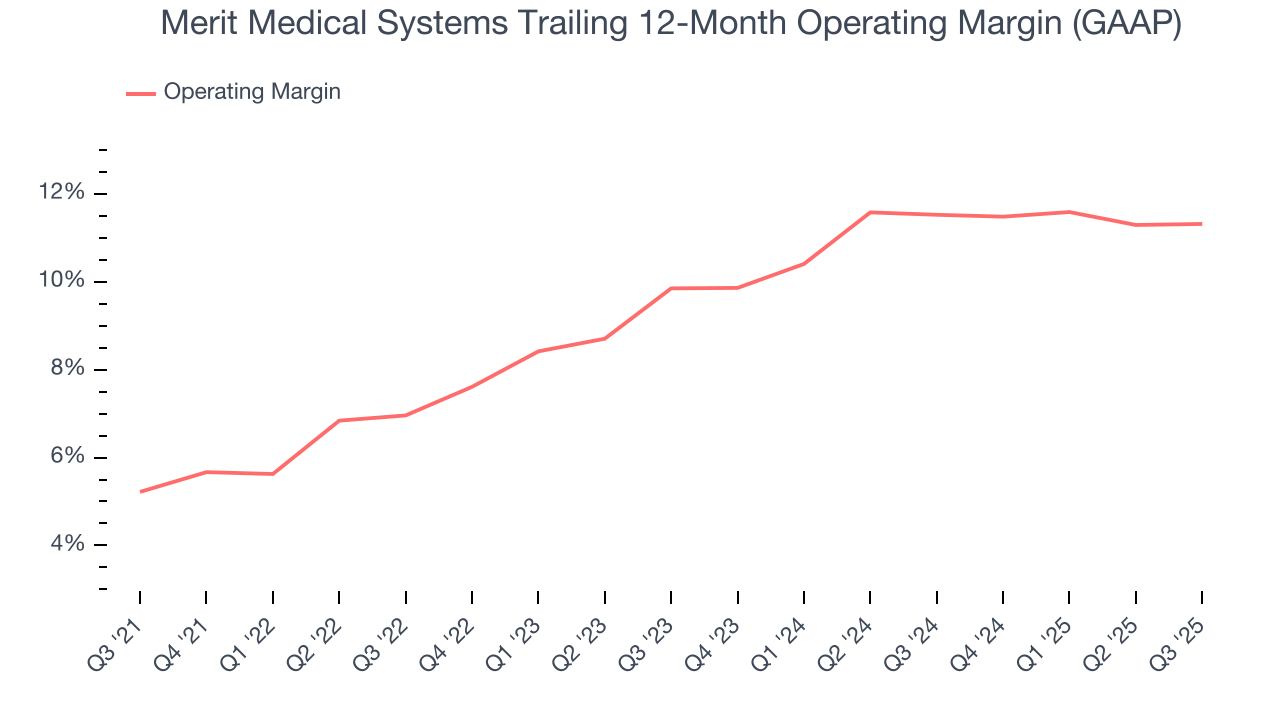

Merit Medical Systems was profitable over the last five years but held back by its large cost base. Its average operating margin of 9.2% was weak for a healthcare business.

On the plus side, Merit Medical Systems’s operating margin rose by 6.1 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 1.5 percentage points on a two-year basis.

In Q3, Merit Medical Systems generated an operating margin profit margin of 11.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

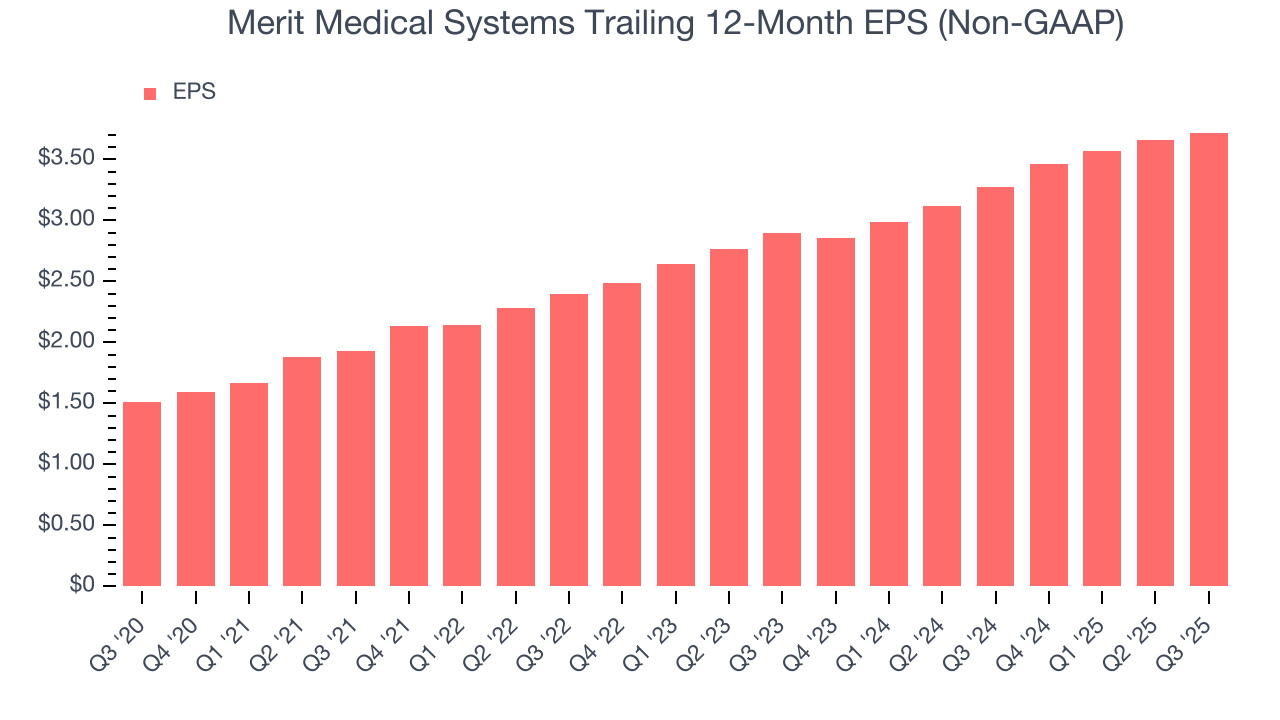

Merit Medical Systems’s EPS grew at an astounding 19.8% compounded annual growth rate over the last five years, higher than its 8.9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Merit Medical Systems’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Merit Medical Systems’s operating margin was flat this quarter but expanded by 6.1 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Merit Medical Systems reported adjusted EPS of $0.92, up from $0.86 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Merit Medical Systems’s full-year EPS of $3.72 to grow 3.2%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

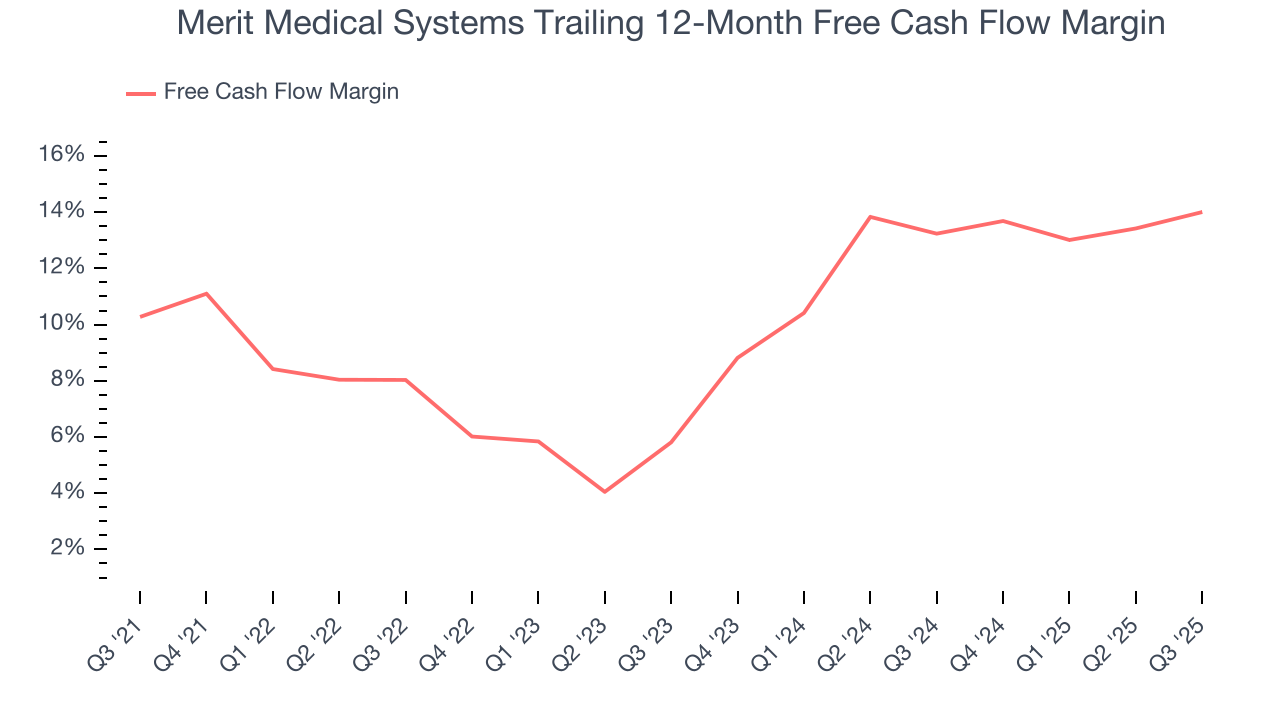

Merit Medical Systems has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.5% over the last five years, better than the broader healthcare sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Merit Medical Systems’s margin expanded by 3.7 percentage points during that time. This is encouraging because it gives the company more optionality.

Merit Medical Systems’s free cash flow clocked in at $52.54 million in Q3, equivalent to a 13.7% margin. This result was good as its margin was 2.5 percentage points higher than in the same quarter last year, building on its favorable historical trend.

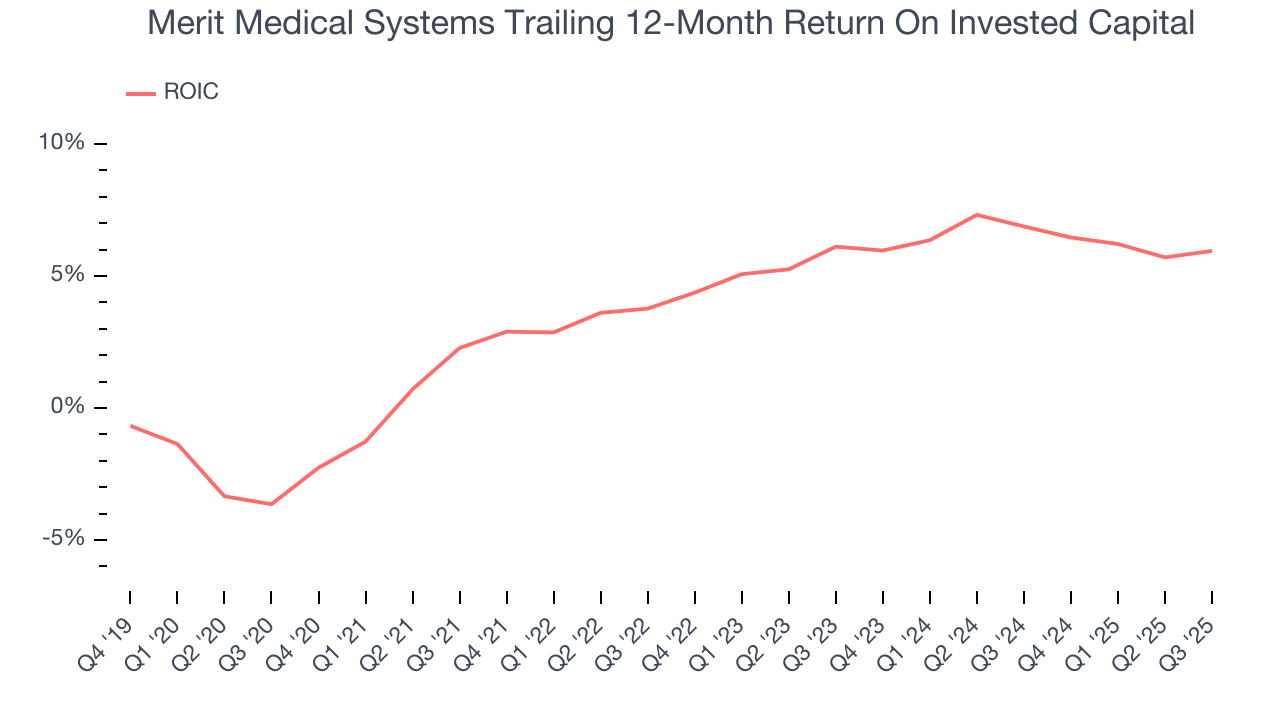

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Merit Medical Systems historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Merit Medical Systems’s ROIC increased by 3.4 percentage points annually over the last few years. This is a good sign, and if its returns keep rising, there’s a chance it could evolve into an investable business.

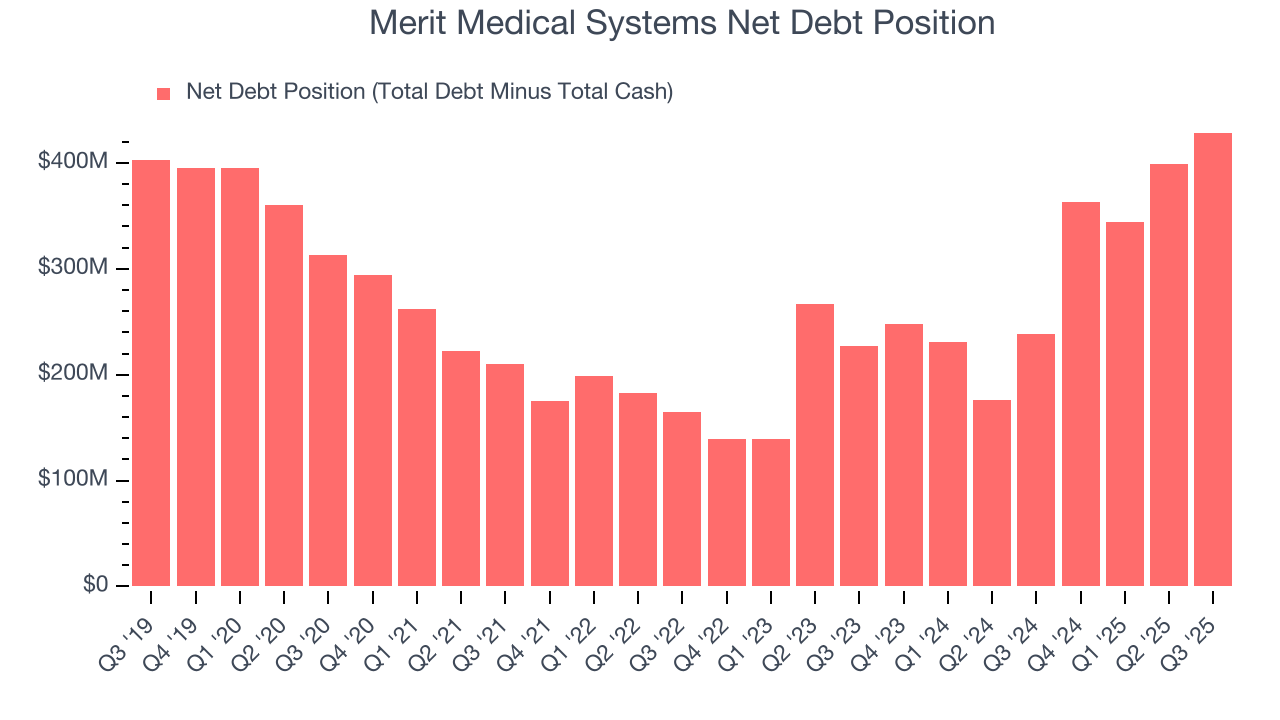

11. Balance Sheet Assessment

Merit Medical Systems reported $392.5 million of cash and $821.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $356.7 million of EBITDA over the last 12 months, we view Merit Medical Systems’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $5.91 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Merit Medical Systems’s Q3 Results

We were impressed by how significantly Merit Medical Systems blew past analysts’ organic revenue expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. Full-year guidance was also raised for revenue and EPS. Zooming out, we think this was a very good print with some key areas of upside. The stock traded up 7.7% to $89.46 immediately after reporting.

13. Is Now The Time To Buy Merit Medical Systems?

Updated: February 19, 2026 at 11:28 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Merit Medical Systems, you should also grasp the company’s longer-term business quality and valuation.

Merit Medical Systems isn’t a terrible business, but it isn’t one of our picks. Although its revenue growth was decent over the last five years, it’s expected to deteriorate over the next 12 months and its subscale operations give it fewer distribution channels than its larger rivals. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its mediocre ROIC lags the market and is a headwind for its stock price.

Merit Medical Systems’s P/E ratio based on the next 12 months is 21.1x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $103.64 on the company (compared to the current share price of $81.82).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.