Strategy (MSTR)

We wouldn’t recommend Strategy. The company is a leveraged proxy for Bitcoin, meaning any crypto downturn - or tighter credit conditions — could rock the stock.― StockStory Analyst Team

1. News

2. Summary

Why We Think Strategy Will Underperform

Once a traditional business intelligence software provider, Strategy (NASDAQ:MSTR) develops AI-powered enterprise analytics software while also functioning as a major corporate holder of Bitcoin cryptocurrency.

- MicroStrategy’s core analytics software has been eclipsed by its all-in Bitcoin strategy, leaving product innovation and enterprise deals starved for attention

- The company’s debt-financed Bitcoin buying ties shareholder fortunes to crypto swings and interest rates, amplifying downside risk and uncertainty

- On the bright side, its vast Bitcoin treasury gives Executive Chairman Michael Saylor a unique springboard to capture crypto upside and court investors seeking leveraged exposure to digital assets

Strategy is in the penalty box. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than Strategy

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Strategy

At $124.55 per share, Strategy trades at 73.5x forward price-to-sales. This valuation multiple seems a bit much considering the tepid revenue growth profile.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Strategy (MSTR) Research Report: Q4 CY2025 Update

Bitcoin development company Strategy (NASDAQ:MSTR) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 1.9% year on year to $123 million. Its GAAP loss of $42.93 per share was significantly below analysts’ consensus estimates.

Strategy (MSTR) Q4 CY2025 Highlights:

- Revenue: $123 million vs analyst estimates of $122.3 million (1.9% year-on-year growth, 0.6% beat)

- EPS (GAAP): -$42.93 vs analyst estimates of -$20.99 (significant miss)

- Operating Margin: -14,185%, down from -842% in the same quarter last year

- Billings: $196.5 million at quarter end, up 13.6% year on year

- Market Capitalization: $34.66 billion

Company Overview

Once a traditional business intelligence software provider, Strategy (NASDAQ:MSTR) develops AI-powered enterprise analytics software while also functioning as a major corporate holder of Bitcoin cryptocurrency.

Note that our analysis is rooted in fundamentals, not Bitcoin-driven technicals.

Strategy operates with a dual focus business model. Its enterprise analytics division produces the Strategy ONE platform, which delivers business intelligence tools to help organizations transform complex data into actionable insights. For example, a retail chain might use Strategy's software to analyze customer purchasing patterns across thousands of stores, enabling more effective inventory management and marketing campaigns. The platform incorporates generative AI capabilities that allow non-technical users to access analytics through conversational interfaces.

The company's Bitcoin strategy represents its second major focus. Strategy acquires Bitcoin using cash from operations and financing activities, maintaining custody of its holdings through institutional-grade custodians with strict security protocols. As of early 2024, the company held approximately 190,000 bitcoins, making it one of the largest corporate Bitcoin holders globally. This strategy positions Strategy as a proxy for Bitcoin exposure in public markets.

Strategy monetizes its software through perpetual licenses for on-premise deployments and subscription models for cloud-based installations. It supports customers through dedicated services teams and maintains strategic partnerships with major cloud providers like AWS, Microsoft, and Google. The company also holds FedRAMP authorization, allowing it to serve government clients with its cloud solutions that meet strict federal security standards.

4. Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

In the enterprise analytics space, Strategy competes with global software vendors including IBM, Microsoft, Oracle, Salesforce, and SAP. As a Bitcoin development company and major holder, it offers investors an alternative to direct cryptocurrency ownership, Bitcoin ETFs, and crypto-focused companies like Coinbase (NASDAQ: COIN) and Marathon Digital (NASDAQ: MARA).

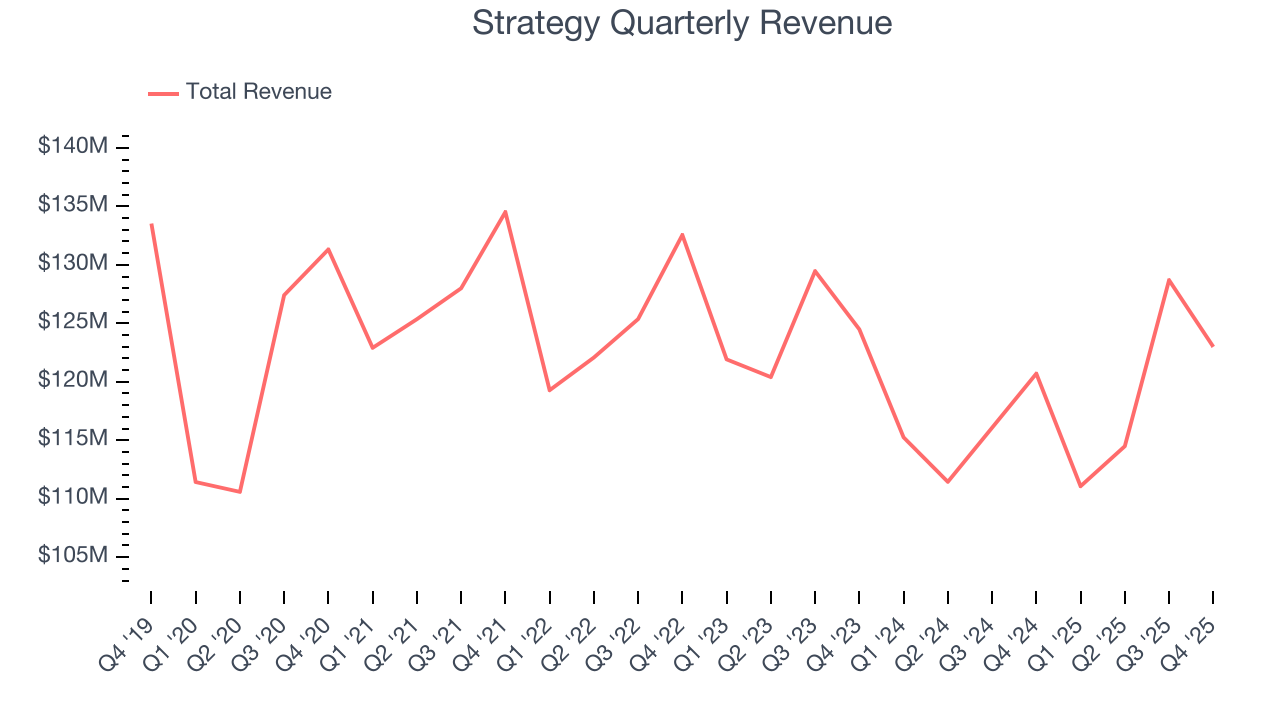

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Strategy struggled to consistently increase demand as its $477.2 million of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Strategy’s recent performance shows its demand remained suppressed as its revenue has declined by 1.9% annually over the last two years.

This quarter, Strategy reported modest year-on-year revenue growth of 1.9% but beat Wall Street’s estimates by 0.6%.

Looking ahead, sell-side analysts expect revenue to grow 2.7% over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

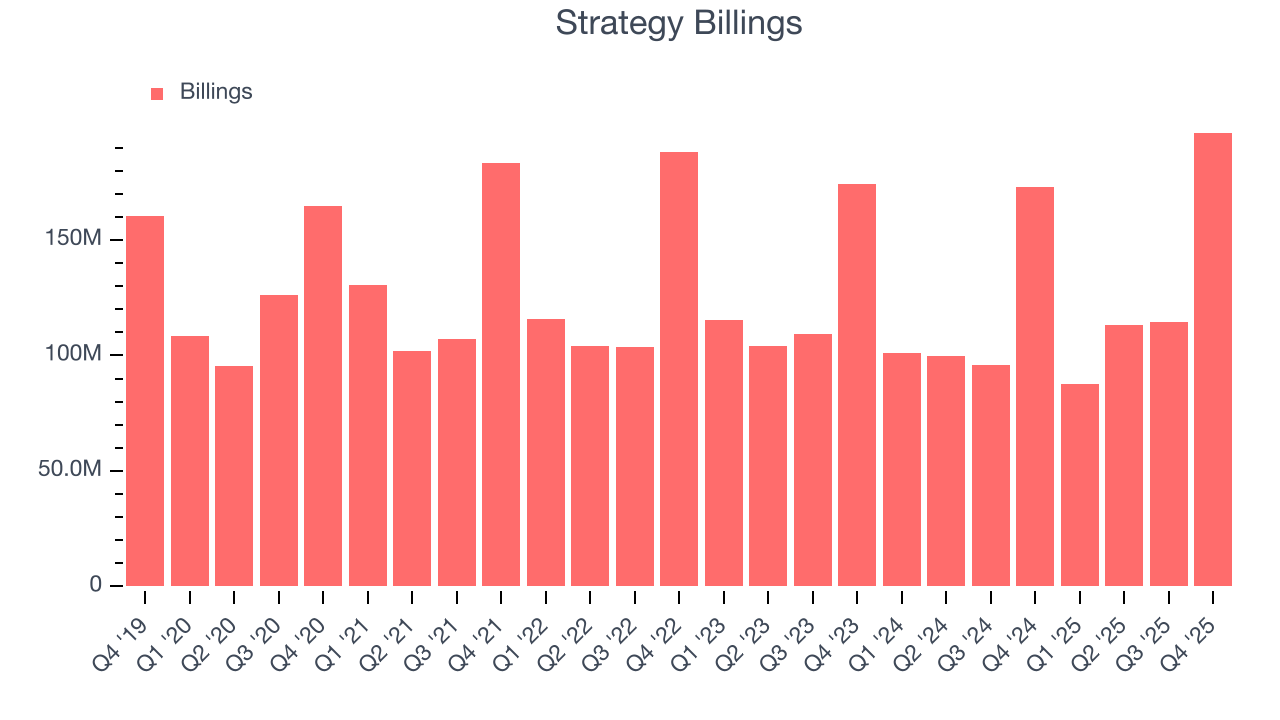

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Strategy’s billings came in at $196.5 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 8.3% year-on-year increases. However, this alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

7. Gross Margin & Pricing Power

For software companies like Strategy, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Strategy’s gross margin is worse than the software industry average, giving it less room than its competitors to hire new talent that can expand its products and services. As you can see below, it averaged a 68.7% gross margin over the last year. Said differently, Strategy had to pay a chunky $31.31 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Strategy has seen gross margins decline by 9.2 percentage points over the last 2 year, which is among the worst in the software space.

In Q4, Strategy produced a 66.1% gross profit margin, marking a 5.6 percentage point decrease from 71.7% in the same quarter last year. Strategy’s full-year margin has also been trending down over the past 12 months, decreasing by 3.4 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

8. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Strategy’s expensive cost structure has contributed to an average operating margin of negative 1,141% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Strategy reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Analyzing the trend in its profitability, Strategy’s operating margin decreased significantly over the last two years. Strategy’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Strategy generated a negative 14,185% operating margin. The company's consistent lack of profits raise a flag.

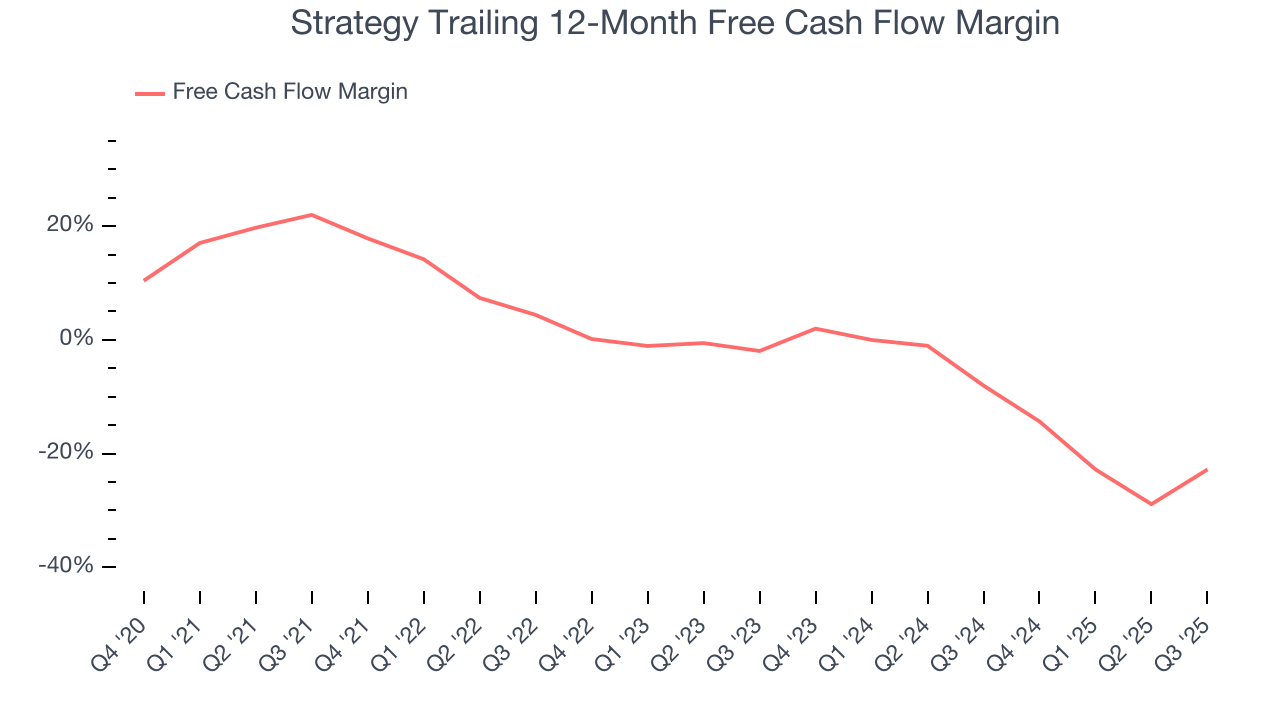

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Strategy’s demanding reinvestments have drained its resources over the last year, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 22.7%, meaning it lit $22.65 of cash on fire for every $100 in revenue.

10. Balance Sheet Assessment

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

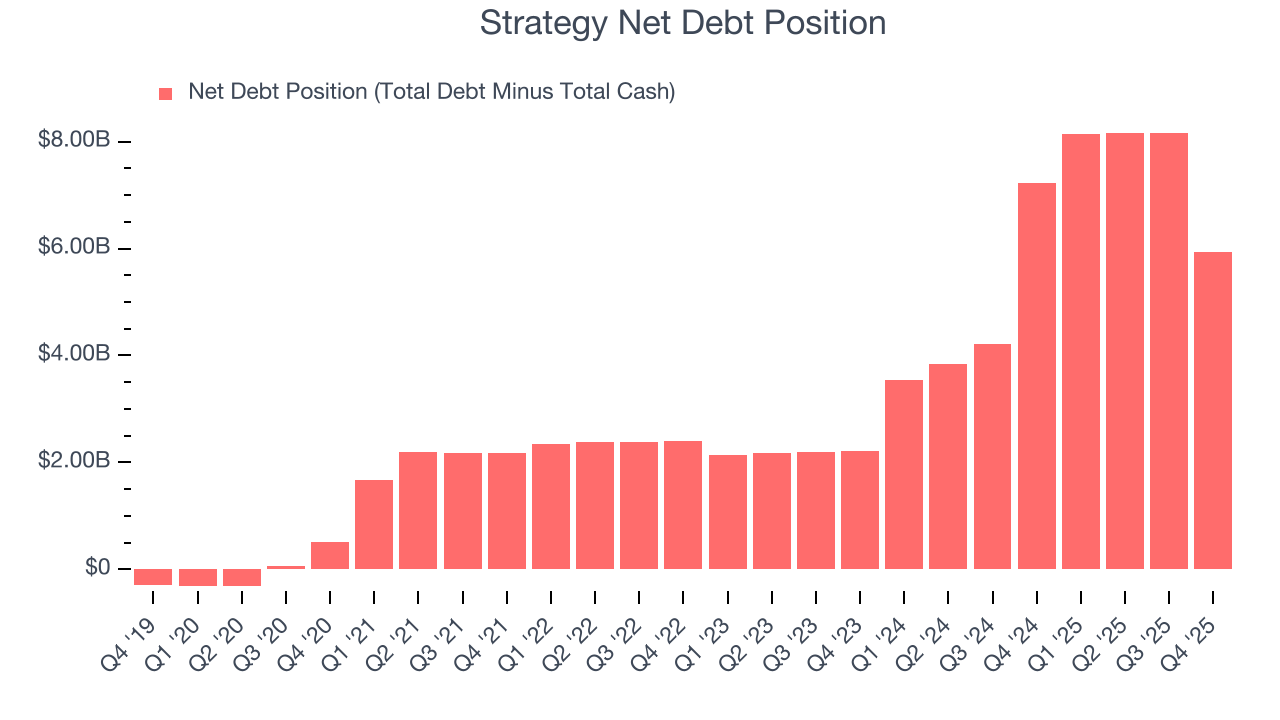

Strategy burned through $338.8 million of cash over the last year. Although the company has $8.24 billion of debt on its balance sheet, we think its $2.30 billion of cash gives it enough runway (we typically look for at least two years) to prioritize growth over profitability.

11. Key Takeaways from Strategy’s Q4 Results

We were impressed by how significantly Strategy blew past analysts’ billings expectations this quarter. Zooming out, we think this quarter featured some important positives. The stock remained flat at $105.90 immediately following the results.

12. Is Now The Time To Buy Strategy?

Updated: February 22, 2026 at 11:45 PM EST

Before deciding whether to buy Strategy or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Strategy doesn’t pass our quality test. To kick things off, its revenue has declined over the last five years. On top of that, Strategy’s declining operating margin shows it’s becoming less efficient at building and selling its software, and its operating margins reveal poor profitability compared to other software companies.

Strategy’s price-to-sales ratio based on the next 12 months is 77x. This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $394.38 on the company (compared to the current share price of $130.99).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.