Match Group (MTCH)

We’re skeptical of Match Group. Its sluggish sales growth shows demand is soft, a worrisome sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Match Group Is Not Exciting

Originally started as a dial-up service before widespread internet adoption, Match (NASDAQ:MTCH) was an early innovator in online dating and today has a portfolio of apps including Tinder, Hinge, Archer, and OkCupid.

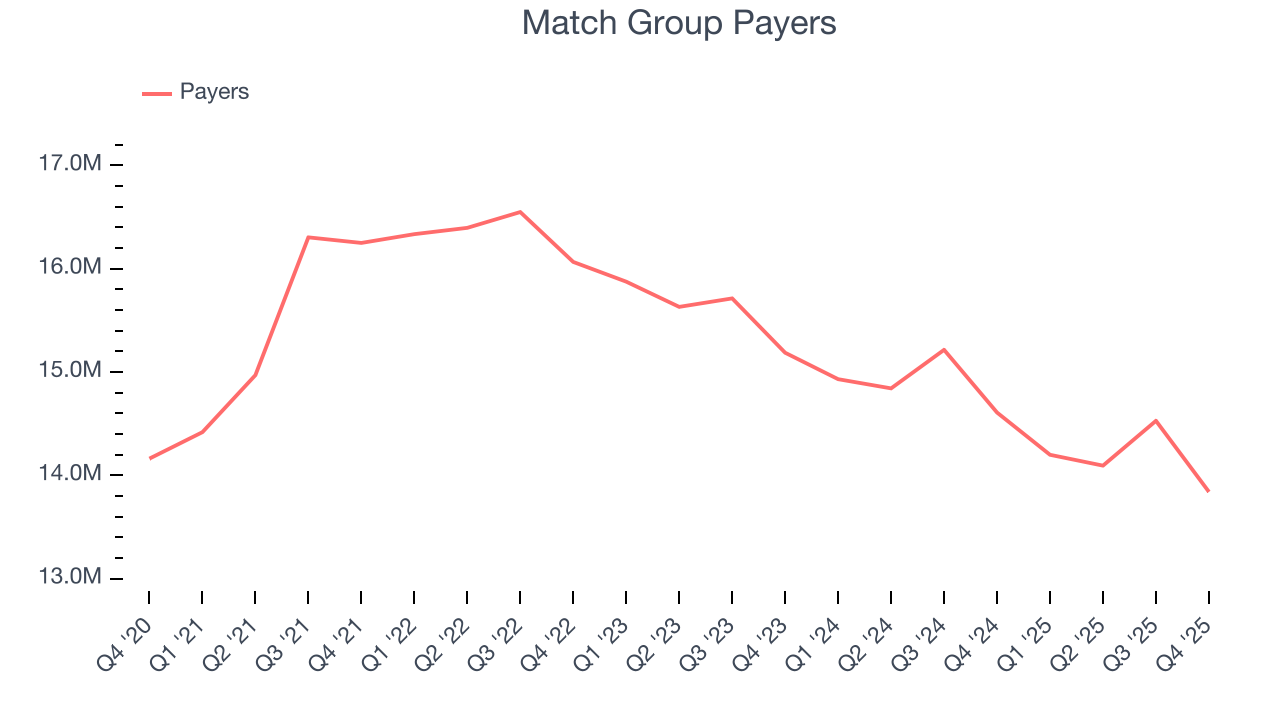

- Payers have declined by 4.7% annually over the last two years, suggesting it may need to revamp its features or user experience to stay competitive

- Concerning trends in both user engagement and monetization suggest its platform’s efficacy is declining as its average revenue per user fell by 21% annually

- A silver lining is that its successful business model is illustrated by its impressive EBITDA margin

Match Group is in the doghouse. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Match Group

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Match Group

Match Group’s stock price of $30.75 implies a valuation ratio of 8.2x forward EV/EBITDA. The current valuation may be fair, but we’re still passing on this stock due to better alternatives out there.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Match Group (MTCH) Research Report: Q4 CY2025 Update

Dating app company Match (NASDAQ:MTCH) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 2.1% year on year to $878 million. The company expects next quarter’s revenue to be around $855 million, close to analysts’ estimates. Its GAAP profit of $0.83 per share was 17.3% above analysts’ consensus estimates.

Match Group (MTCH) Q4 CY2025 Highlights:

- Revenue: $878 million vs analyst estimates of $871.6 million (2.1% year-on-year growth, 0.7% beat)

- EPS (GAAP): $0.83 vs analyst estimates of $0.71 (17.3% beat)

- Adjusted EBITDA: $370 million vs analyst estimates of $352.1 million (42.1% margin, 5.1% beat)

- Revenue Guidance for Q1 CY2026 is $855 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for Q1 CY2026 is $317.5 million at the midpoint, above analyst estimates of $299.4 million

- Operating Margin: 32.4%, up from 26% in the same quarter last year

- Free Cash Flow Margin: 35.1%, up from 33.6% in the previous quarter

- Payers: 13.84 million, down 768,000 year on year

- Market Capitalization: $7.45 billion

Company Overview

Originally started as a dial-up service before widespread internet adoption, Match (NASDAQ:MTCH) was an early innovator in online dating and today has a portfolio of apps including Tinder, Hinge, Archer, and OkCupid.

These apps are used by millions globally to find love, friendship, or just a fun night out, although dating is the primary use case for consumers. The problem Match tries to address is simply that dating and finding love is hard, both logistically and emotionally. Specifically, meeting new people with shared interests, putting yourself out there, and trying to find someone you connect with can be a daunting task. Match provides a platform that facilitates connections while also filtering for practical aspects such as location and age.

Match generates revenue largely through paid subscriptions. Tinder and Hinge, the two highest revenue apps for Match, both offer free versions. However, users can access premium features through paid subscription tiers. For example, Tinder Plus gives users unlimited swipes and the option to change their location to connect with people in different cities. Hinge’s paid version allows users to see who has already liked their profile without needing to wait for a match, which can help save time and increase the probability of high-quality matches. The company also generates revenue through advertising, where brands can pay to have their products or services featured within the app.

4. Consumer Subscription

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

Competitors offering dating platforms include Bumble (NASDAQ:BMBL), Grindr (NYSE:GRND), and Spark Networks (NYSE:LOV), along with social networks where people can potentially make romantic connections like Snap (NYSE:SNAP) and Meta Platforms (NASDAQ:META).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Match Group grew its sales at a sluggish 3% compounded annual growth rate. This wasn’t a great result compared to the rest of the consumer internet sector, but there are still things to like about Match Group.

This quarter, Match Group reported modest year-on-year revenue growth of 2.1% but beat Wall Street’s estimates by 0.7%. Company management is currently guiding for a 2.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.9% over the next 12 months, similar to its three-year rate. This projection is underwhelming and suggests its newer products and services will not lead to better top-line performance yet. At least the company is tracking well in other measures of financial health.

6. Payers

User Growth

As a subscription-based app, Match Group generates revenue growth by expanding both its subscriber base and the amount each subscriber spends over time.

Match Group struggled with new customer acquisition over the last two years as its payers have declined by 4.7% annually to 13.84 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Match Group wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q4, Match Group’s payers once again decreased by 768,000, a 5.3% drop since last year. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating user growth just yet.

Revenue Per User

Average revenue per user (ARPU) is a critical metric to track because it measures how much the average user spends. ARPU is also a key indicator of how valuable its users are (and can be over time).

Match Group’s ARPU growth has been strong over the last two years, averaging 6.7%. Although its payers shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing users.

This quarter, Match Group’s ARPU clocked in at $20.72. It grew by 7.4% year on year, faster than its payers.

7. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For internet subscription businesses like Match Group, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer service, data center and infrastructure expenses, royalties, and other content-related costs if the company’s offerings include features such as video or music.

Match Group has robust unit economics, an output of its asset-lite business model and pricing power. Its margin is better than the broader consumer internet industry and enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 72.2% gross margin over the last two years. That means Match Group only paid its providers $27.81 for every $100 in revenue.

Match Group produced a 74.7% gross profit margin in Q4, up 1.9 percentage points year on year. Match Group’s full-year margin has also been trending up over the past 12 months, increasing by 1.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

8. User Acquisition Efficiency

Consumer internet businesses like Match Group grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

Match Group is very efficient at acquiring new users, spending only 24.7% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation, giving Match Group the freedom to invest its resources into new growth initiatives while maintaining optionality.

9. EBITDA

EBITDA is a good way of judging operating profitability for consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a more standardized view of the business’s profit potential.

Match Group’s EBITDA margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 35.7% over the last two years. This profitability was elite for a consumer internet business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Match Group’s EBITDA margin might fluctuated slightly but has generally stayed the same over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Match Group generated an EBITDA margin profit margin of 42.1%, up 4.5 percentage points year on year. The increase was encouraging, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

10. Earnings Per Share

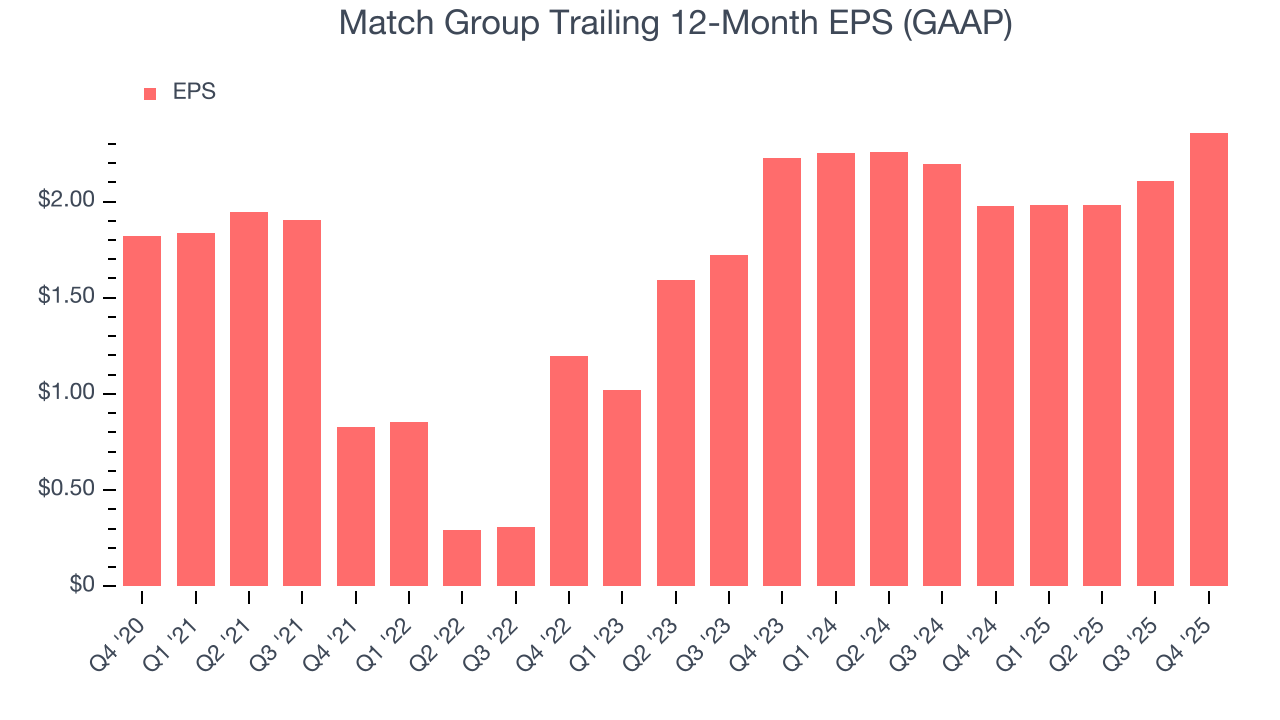

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Match Group’s EPS grew at an astounding 25.3% compounded annual growth rate over the last three years, higher than its 3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Match Group’s earnings to better understand the drivers of its performance. A three-year view shows that Match Group has repurchased its stock, shrinking its share count by 12.3%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q4, Match Group reported EPS of $0.83, up from $0.58 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Match Group’s full-year EPS of $2.36 to grow 16.1%.

11. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Match Group has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging 27.4% over the last two years.

Taking a step back, we can see that Match Group’s margin expanded by 14.4 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Match Group’s free cash flow clocked in at $308.1 million in Q4, equivalent to a 35.1% margin. This result was good as its margin was 6.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

12. Balance Sheet Assessment

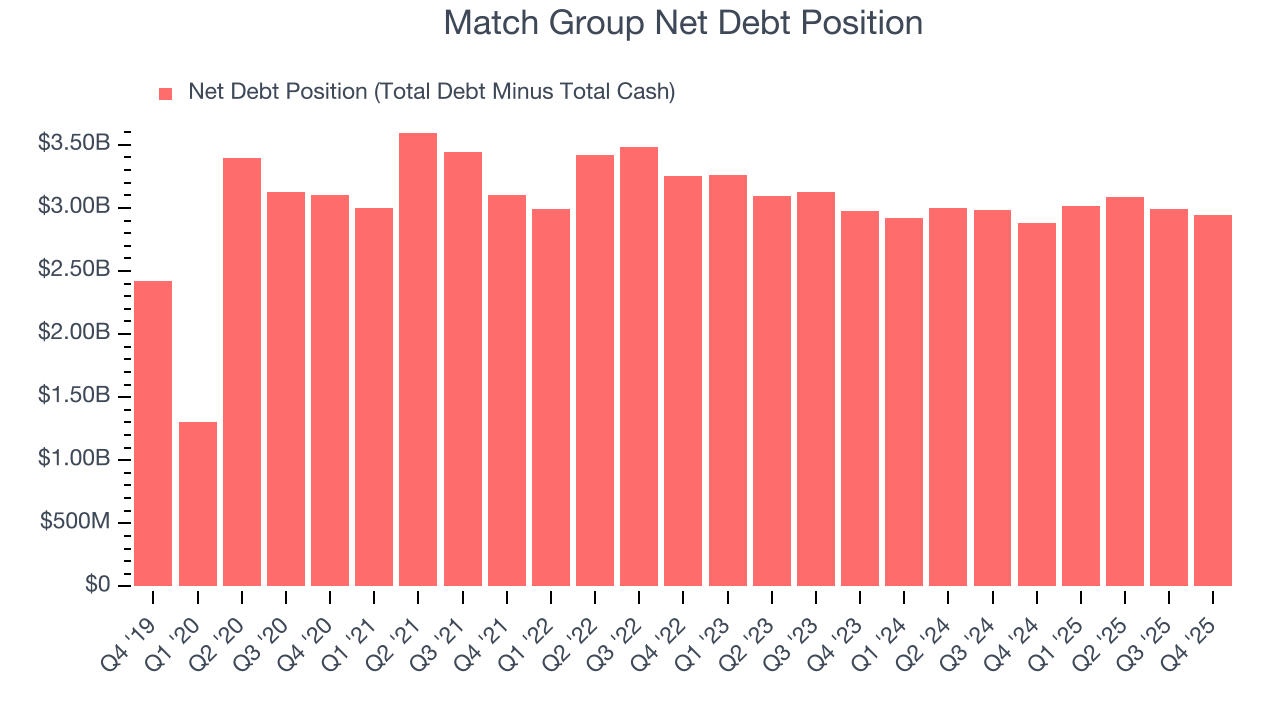

Match Group reported $1.03 billion of cash and $3.97 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.24 billion of EBITDA over the last 12 months, we view Match Group’s 2.4× net-debt-to-EBITDA ratio as safe. We also see its $48.13 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Match Group’s Q4 Results

It was great to see Match Group’s EBITDA guidance for next quarter top analysts’ expectations. We were also glad its EBITDA outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its number of users declined. Overall, this quarter could have been better. The stock traded up 6.7% to $30.92 immediately following the results.

14. Is Now The Time To Buy Match Group?

Updated: March 4, 2026 at 9:35 PM EST

Are you wondering whether to buy Match Group or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Match Group isn’t a terrible business, but it doesn’t pass our quality test. For starters, its revenue growth was weak over the last three years, and analysts expect its demand to deteriorate over the next 12 months. While its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its users have declined. On top of that, its ARPU has declined over the last two years.

Match Group’s EV/EBITDA ratio based on the next 12 months is 8.2x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $36.47 on the company (compared to the current share price of $30.75).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.