NetApp (NTAP)

NetApp is interesting. Despite its slow growth, its highly profitable model gives it a margin of safety during times of stress.― StockStory Analyst Team

1. News

2. Summary

Why NetApp Is Interesting

Founded in 1992 as a pioneer in networked storage technology, NetApp (NASDAQ:NTAP) provides data storage and management solutions that help organizations store, protect, and optimize their data across on-premises data centers and public clouds.

- Disciplined cost controls and effective management have materialized in a strong adjusted operating margin

- Powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently, and its recently improved profitability means it has even more resources to invest or distribute

- A downside is its sales trends were unexciting over the last five years as its 3.7% annual growth was below the typical business services company

NetApp is close to becoming a high-quality business. If you believe in the company, the valuation seems reasonable.

Why Is Now The Time To Buy NetApp?

High Quality

Investable

Underperform

Why Is Now The Time To Buy NetApp?

At $100.55 per share, NetApp trades at 12.4x forward P/E. The current valuation is below that of most business services companies, but this isn’t a bargain. Instead, the price is appropriate for the quality you get.

It could be a good time to invest if you see something the market doesn’t.

3. NetApp (NTAP) Research Report: Q3 CY2025 Update

Data storage company NetApp (NASDAQ:NTAP) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 2.8% year on year to $1.71 billion. On the other hand, next quarter’s revenue guidance of $1.69 billion was less impressive, coming in 1.1% below analysts’ estimates. Its non-GAAP profit of $2.05 per share was 8.8% above analysts’ consensus estimates.

NetApp (NTAP) Q3 CY2025 Highlights:

- Revenue: $1.71 billion vs analyst estimates of $1.69 billion (2.8% year-on-year growth, 1.1% beat)

- Adjusted EPS: $2.05 vs analyst estimates of $1.88 (8.8% beat)

- Adjusted EBITDA: $553 million vs analyst estimates of $531.1 million (32.4% margin, 4.1% beat)

- The company reconfirmed its revenue guidance for the full year of $6.75 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $7.90 at the midpoint, a 1.9% increase

- Operating Margin: 23.4%, up from 20.8% in the same quarter last year

- Free Cash Flow Margin: 4.6%, similar to the same quarter last year

- Market Capitalization: $21.75 billion

Company Overview

Founded in 1992 as a pioneer in networked storage technology, NetApp (NASDAQ:NTAP) provides data storage and management solutions that help organizations store, protect, and optimize their data across on-premises data centers and public clouds.

NetApp's business is organized into two main segments: Hybrid Cloud and Public Cloud. The Hybrid Cloud segment offers unified data storage solutions that help customers modernize their data centers with hardware and software that supports file, block, and object storage. Its flagship product is the ONTAP operating system, which powers NetApp's storage arrays and includes features like ransomware protection, data transport, and storage efficiency capabilities.

The company's hardware portfolio includes All-Flash FAS (AFF) systems for high-performance workloads, Fabric Attached Storage (FAS) for balanced performance and capacity, and StorageGRID for object storage. These systems serve various customer needs from high-speed transaction processing to large-scale data archives.

In the Public Cloud segment, NetApp offers cloud storage services natively integrated with major cloud providers. These include Azure NetApp Files on Microsoft Azure, Amazon FSx for NetApp ONTAP on AWS, and Google Cloud NetApp Volumes. The company also provides CloudOps solutions like Cloud Insights for infrastructure monitoring and Spot by NetApp for cloud cost optimization.

NetApp generates revenue through hardware sales, software licenses, subscription services, and professional services. A healthcare provider might use NetApp's all-flash storage arrays to host patient records and medical imaging data, with automatic backup to the cloud for disaster recovery. A financial services firm might leverage NetApp's cloud storage to analyze market data while maintaining compliance with data sovereignty regulations.

The company sells through both direct sales channels and an ecosystem of partners, including value-added resellers, system integrators, and cloud providers. This partner network is crucial to NetApp's go-to-market strategy, with indirect channels accounting for approximately three-quarters of its revenue.

4. Hardware & Infrastructure

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

NetApp competes with Dell Technologies (NYSE:DELL) through its storage division Dell EMC, Pure Storage (NYSE:PSTG) in the all-flash storage market, and Hewlett Packard Enterprise (NYSE:HPE). In cloud storage, it faces competition from cloud providers' native storage offerings from Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), and Google (NASDAQ:GOOGL).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $6.64 billion in revenue over the past 12 months, NetApp is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To accelerate sales, NetApp likely needs to optimize its pricing or lean into new offerings and international expansion.

As you can see below, NetApp’s 3.7% annualized revenue growth over the last five years was tepid. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. NetApp’s annualized revenue growth of 4.3% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, NetApp reported modest year-on-year revenue growth of 2.8% but beat Wall Street’s estimates by 1.1%. Company management is currently guiding for a 3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not lead to better top-line performance yet.

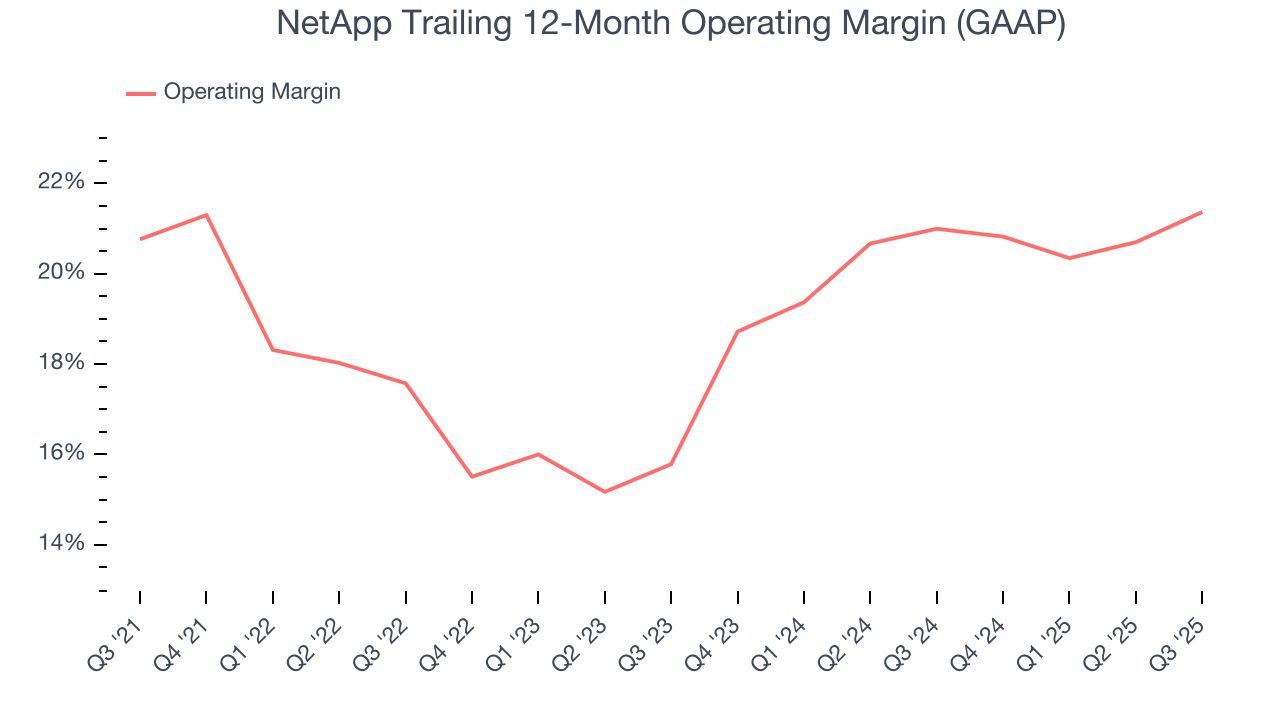

6. Operating Margin

NetApp’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 19.3% over the last five years. This profitability was elite for a business services business thanks to its efficient cost structure and economies of scale.

Looking at the trend in its profitability, NetApp’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q3, NetApp generated an operating margin profit margin of 23.4%, up 2.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

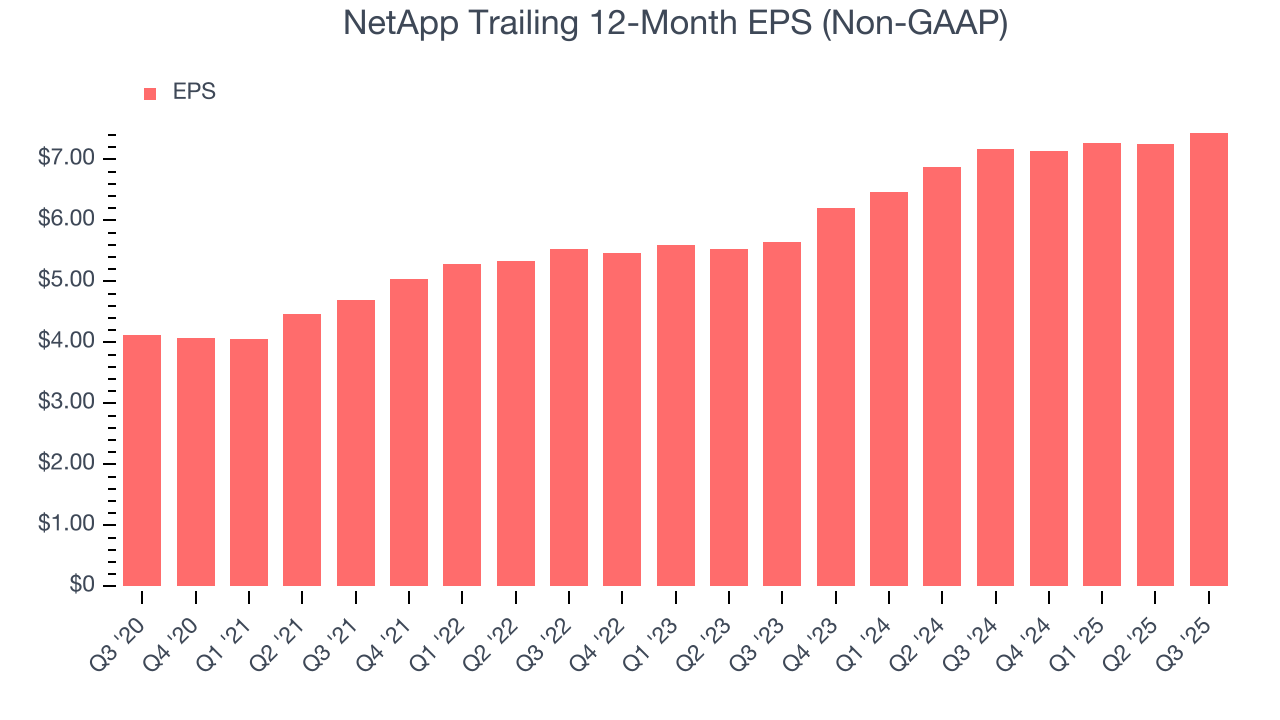

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

NetApp’s EPS grew at a remarkable 12.5% compounded annual growth rate over the last five years, higher than its 3.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For NetApp, its two-year annual EPS growth of 14.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, NetApp reported adjusted EPS of $2.05, up from $1.87 in the same quarter last year. This print beat analysts’ estimates by 8.8%. Over the next 12 months, Wall Street expects NetApp’s full-year EPS of $7.44 to grow 11%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

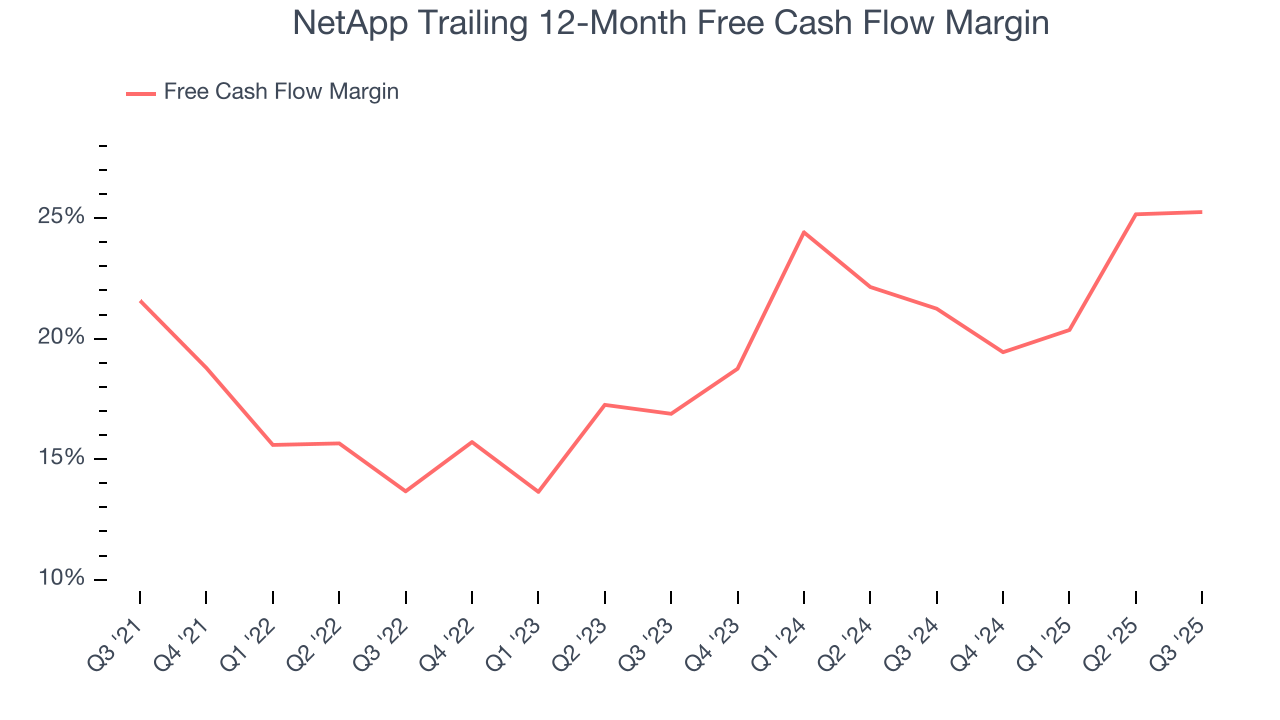

NetApp has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 19.7% over the last five years.

Taking a step back, we can see that NetApp’s margin expanded by 3.7 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

NetApp’s free cash flow clocked in at $78 million in Q3, equivalent to a 4.6% margin. This cash profitability was in line with the comparable period last year but below its five-year average. We wouldn’t read too much into it because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

9. Balance Sheet Assessment

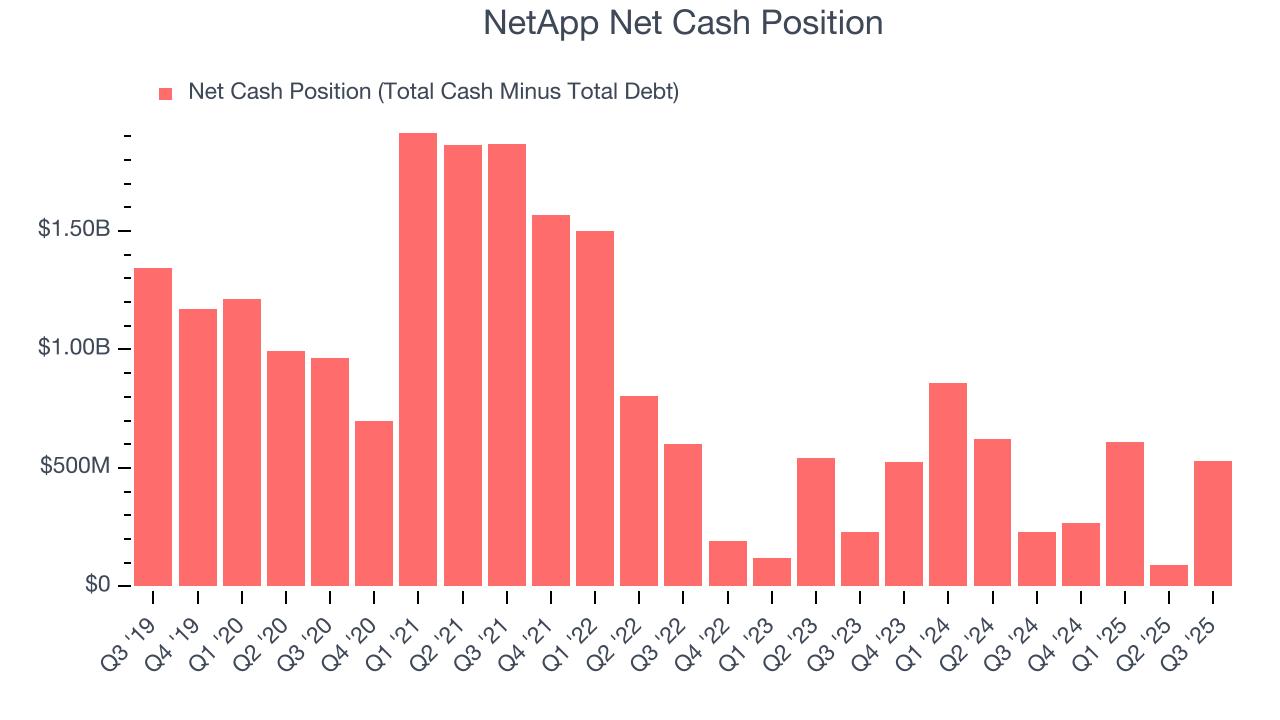

Businesses that maintain a cash surplus face reduced bankruptcy risk.

NetApp is a profitable, well-capitalized company with $3.01 billion of cash and $2.49 billion of debt on its balance sheet. This $528 million net cash position is 2.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

10. Key Takeaways from NetApp’s Q3 Results

It was good to see NetApp beat analysts’ EPS expectations this quarter. We were also happy its full-year EPS guidance outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter slightly missed. Overall, this print had some key positives. The stock traded up 2.1% to $113.80 immediately following the results.

11. Is Now The Time To Buy NetApp?

Updated: February 23, 2026 at 11:59 PM EST

Before investing in or passing on NetApp, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

There are some positives when it comes to NetApp’s fundamentals. Although its revenue growth was uninspiring over the last five years, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits. Plus, NetApp’s impressive operating margins show it has a highly efficient business model.

NetApp’s P/E ratio based on the next 12 months is 12.4x. Looking at the business services landscape right now, NetApp trades at a pretty interesting price. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $120.69 on the company (compared to the current share price of $100.55), implying they see 20% upside in buying NetApp in the short term.