Pure Storage (PSTG)

Pure Storage is a special business. Its fusion of growth, outstanding profitability, and encouraging prospects makes it a beloved asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like Pure Storage

Founded in 2009 as a pioneer in enterprise all-flash storage technology, Pure Storage (NYSE:PSTG) provides all-flash data storage hardware and software that helps organizations manage their data more efficiently across on-premises and cloud environments.

- Annual revenue growth of 15.8% over the last five years was superb and indicates its market share increased during this cycle

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 44.3% outpaced its revenue gains

- Demand for the next 12 months is expected to accelerate above its two-year trend as Wall Street forecasts robust revenue growth of 17.4%

Pure Storage is a remarkable business. This is one of our favorite business services stocks.

Is Now The Time To Buy Pure Storage?

High Quality

Investable

Underperform

Is Now The Time To Buy Pure Storage?

Pure Storage is trading at $74.05 per share, or 33.8x forward P/E. The lofty multiple means expectations are high for this company over the next six to twelve months.

Are you a fan of the business model? If so, you can own a smaller position, as high-quality companies tend to outperform the market over a long-term period regardless of entry price.

3. Pure Storage (PSTG) Research Report: Q3 CY2025 Update

Data storage solutions provider Pure Storage (NYSE:PSTG) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 16% year on year to $964.5 million. Guidance for next quarter’s revenue was better than expected at $1.03 billion at the midpoint, 0.7% above analysts’ estimates. Its non-GAAP profit of $0.58 per share was in line with analysts’ consensus estimates.

Pure Storage (PSTG) Q3 CY2025 Highlights:

- Revenue: $964.5 million vs analyst estimates of $955.8 million (16% year-on-year growth, 0.9% beat)

- Adjusted EPS: $0.58 vs analyst estimates of $0.58 (in line)

- Adjusted EBITDA: $226.2 million vs analyst estimates of $227.5 million (23.5% margin, 0.6% miss)

- Revenue Guidance for Q4 CY2025 is $1.03 billion at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 5.6%, down from 7.2% in the same quarter last year

- Free Cash Flow Margin: 5.5%, up from 4.2% in the same quarter last year

- Market Capitalization: $29.1 billion

Company Overview

Founded in 2009 as a pioneer in enterprise all-flash storage technology, Pure Storage (NYSE:PSTG) provides all-flash data storage hardware and software that helps organizations manage their data more efficiently across on-premises and cloud environments.

Pure Storage's business revolves around its integrated data storage platform that combines specialized hardware systems with proprietary software. The company's product lineup includes FlashArray for block storage needs and FlashBlade for unstructured data workloads, both powered by its Purity operating software and DirectFlash hardware technology that's designed to work directly with NAND flash memory chips rather than traditional solid-state drives (SSDs).

What sets Pure Storage apart is its "Evergreen" architecture, which allows customers to upgrade their storage systems without disruptive migrations or complete replacements. This approach enables continuous improvement through non-disruptive hardware and software updates, extending the useful life of storage investments.

The company serves organizations across various industries that need to store and process large amounts of data efficiently. For example, a hospital might use Pure Storage's FlashArray to run its electronic health record system and medical imaging applications, benefiting from faster data access and reduced power consumption compared to traditional disk-based storage.

Pure Storage has evolved its business model to include subscription-based offerings. Its Evergreen//One service provides storage as a service with consumption-based pricing, while Evergreen//Flex offers a hybrid approach with hardware ownership but flexible capacity scaling. The company also offers Portworx, a platform for managing data in Kubernetes environments, addressing the needs of organizations developing cloud-native applications.

Revenue comes from both hardware sales and recurring subscription services. Pure Storage has expanded its focus to include artificial intelligence workloads, which require high-performance storage to process massive datasets efficiently. The company's global operations serve over 12,500 customers, including approximately 60% of Fortune 500 companies.

4. Hardware & Infrastructure

The Hardware & Infrastructure sector will be buoyed by demand related to AI adoption, cloud computing expansion, and the need for more efficient data storage and processing solutions. Companies with tech offerings such as servers, switches, and storage solutions are well-positioned in our new hybrid working and IT world. On the other hand, headwinds include ongoing supply chain disruptions, rising component costs, and intensifying competition from cloud-native and hyperscale providers reducing reliance on traditional hardware. Additionally, regulatory scrutiny over data sovereignty, cybersecurity standards, and environmental sustainability in hardware manufacturing could increase compliance costs.

Pure Storage competes primarily with legacy data storage vendors including Dell EMC, NetApp, Hitachi Vantara, IBM, and HPE. The company also faces competition from cloud storage services offered by major public cloud providers like AWS, Microsoft Azure, and Google Cloud.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

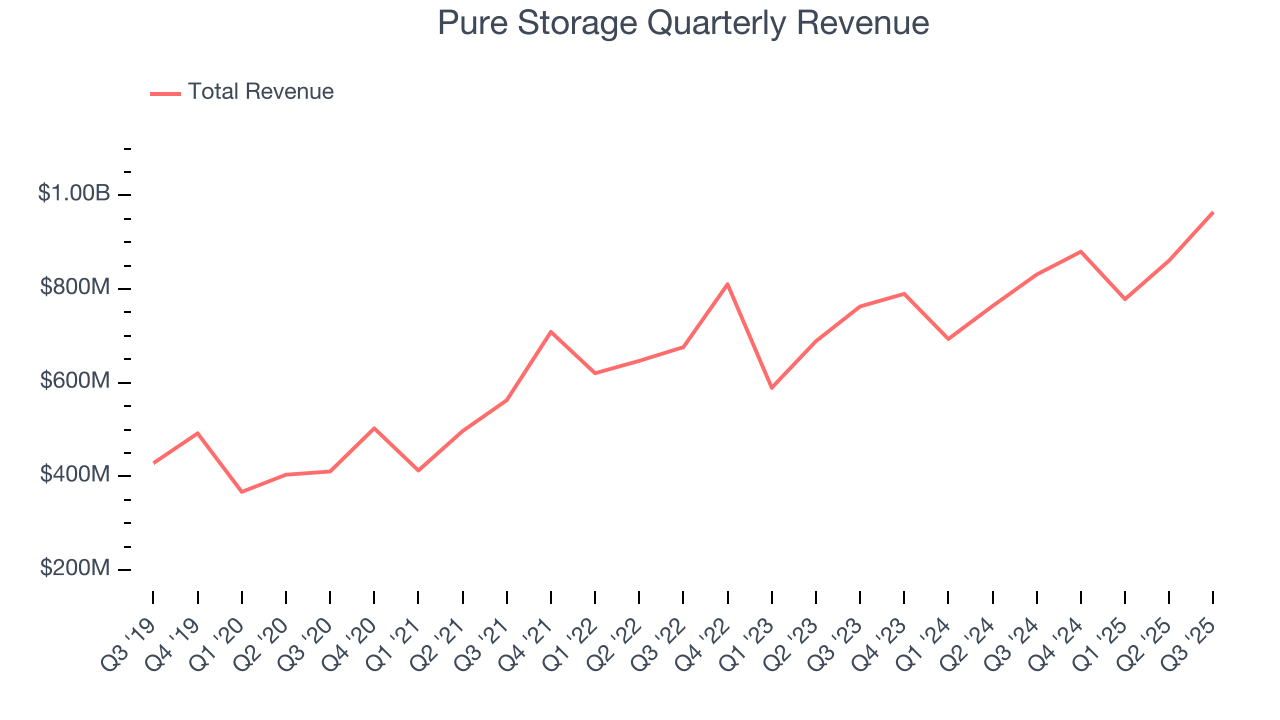

With $3.48 billion in revenue over the past 12 months, Pure Storage is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

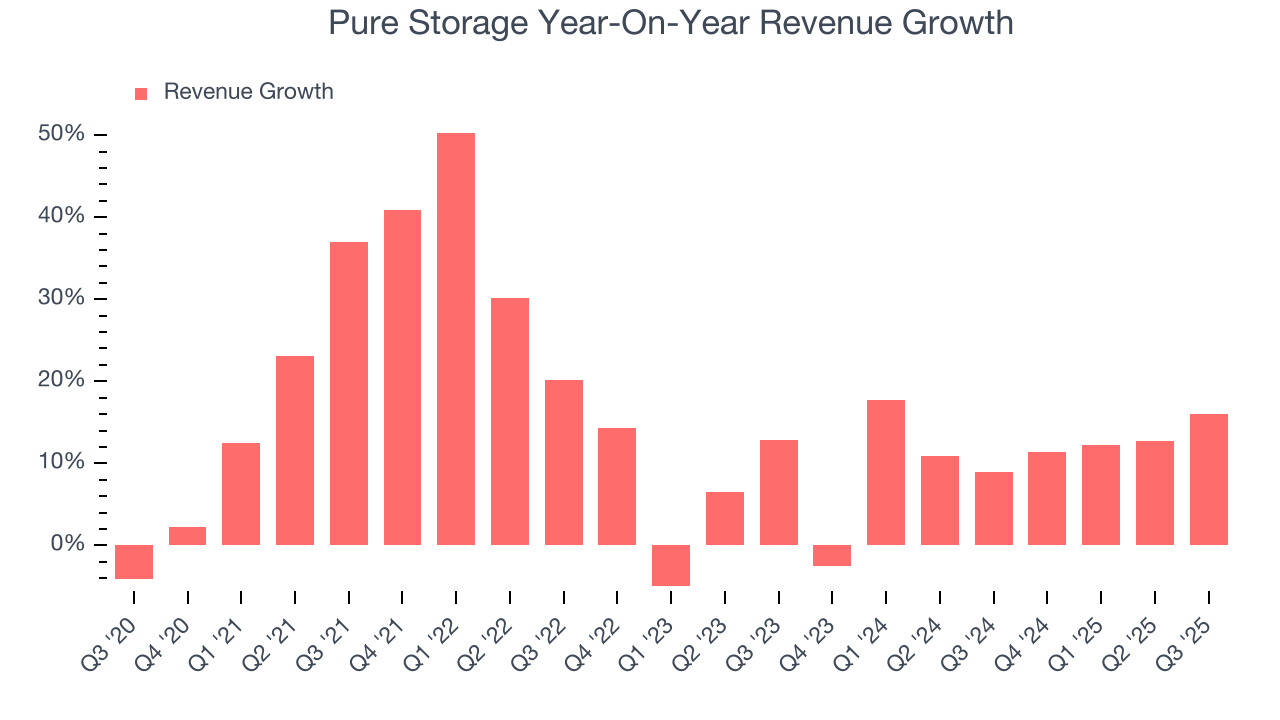

As you can see below, Pure Storage’s sales grew at an incredible 15.8% compounded annual growth rate over the last five years. This is a great starting point for our analysis because it shows Pure Storage’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Pure Storage’s annualized revenue growth of 10.5% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Pure Storage reported year-on-year revenue growth of 16%, and its $964.5 million of revenue exceeded Wall Street’s estimates by 0.9%. Company management is currently guiding for a 17.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.8% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will catalyze better top-line performance.

6. Operating Margin

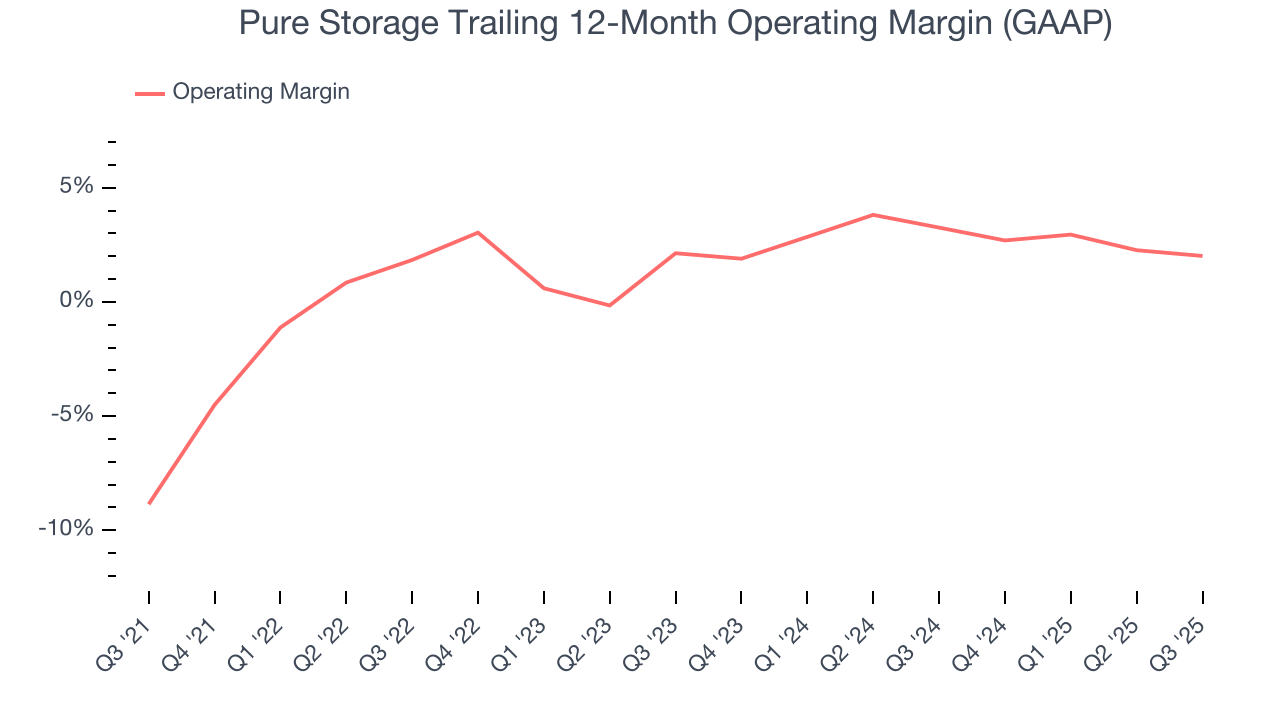

Pure Storage was roughly breakeven when averaging the last five years of quarterly operating profits, inadequate for a business services business.

On the plus side, Pure Storage’s operating margin rose by 10.9 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, Pure Storage generated an operating margin profit margin of 5.6%, down 1.6 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

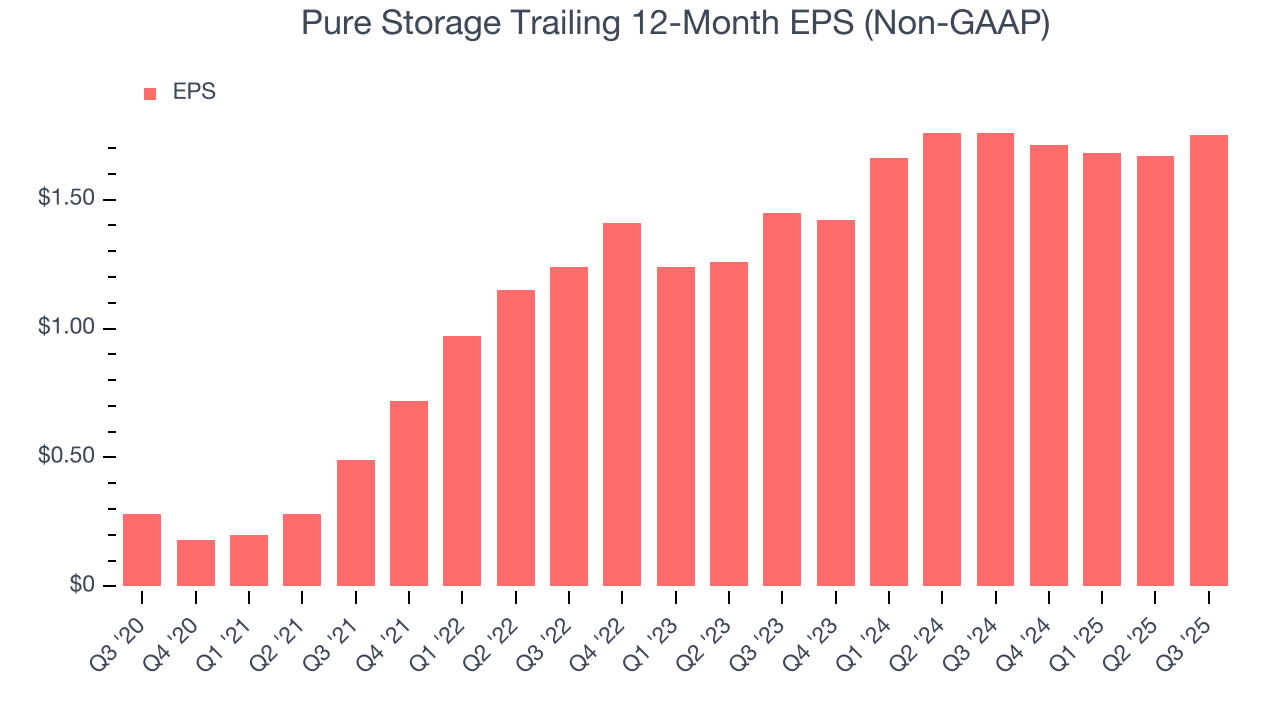

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Pure Storage’s EPS grew at an astounding 44.3% compounded annual growth rate over the last five years, higher than its 15.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Pure Storage’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Pure Storage’s operating margin declined this quarter but expanded by 10.9 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Pure Storage, its two-year annual EPS growth of 9.9% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q3, Pure Storage reported adjusted EPS of $0.58, up from $0.50 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Pure Storage’s full-year EPS of $1.75 to grow 32.8%.

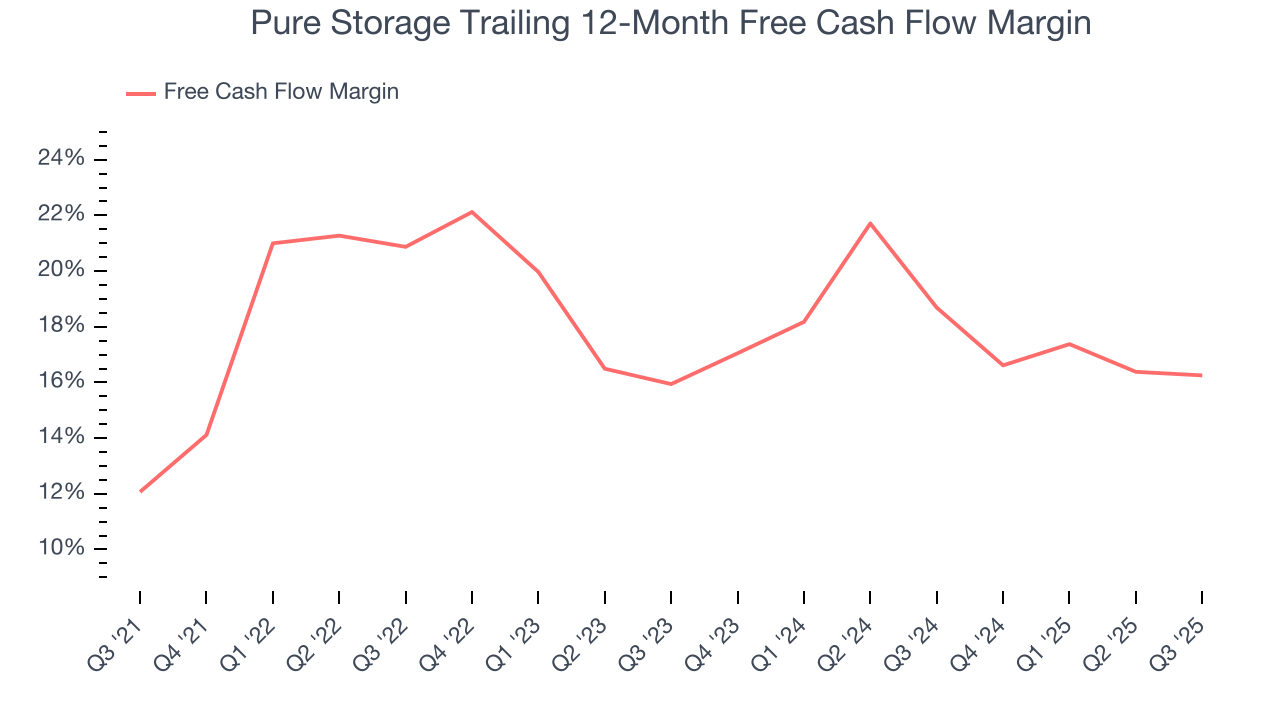

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Pure Storage has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the business services sector, averaging 17% over the last five years. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that Pure Storage’s margin expanded by 4.2 percentage points during that time. This is encouraging because it gives the company more optionality.

Pure Storage’s free cash flow clocked in at $52.57 million in Q3, equivalent to a 5.5% margin. This result was good as its margin was 1.2 percentage points higher than in the same quarter last year, building on its favorable historical trend.

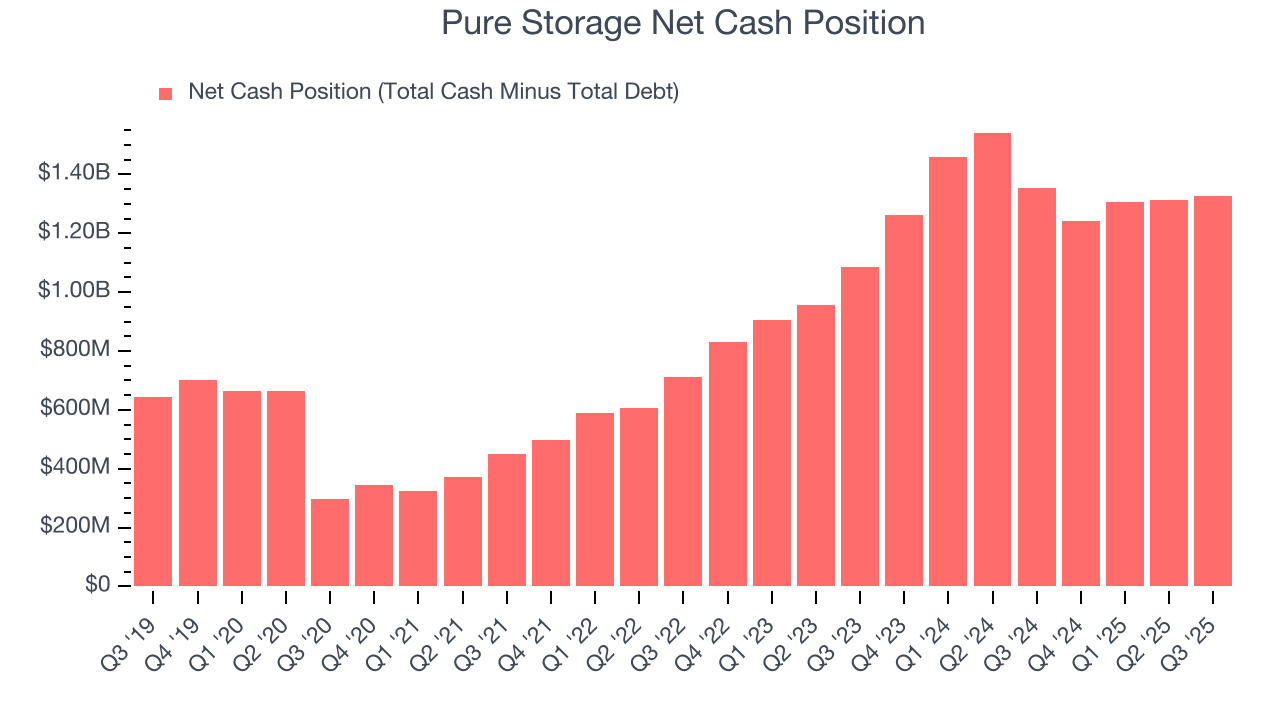

9. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Pure Storage is a profitable, well-capitalized company with $1.55 billion of cash and $225.5 million of debt on its balance sheet. This $1.33 billion net cash position is 4.6% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

10. Key Takeaways from Pure Storage’s Q3 Results

It was good to see Pure Storage provide revenue guidance for next quarter that slightly beat analysts’ expectations. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS was in line. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 11.2% to $84.89 immediately following the results.

11. Is Now The Time To Buy Pure Storage?

Updated: February 16, 2026 at 11:36 PM EST

Before investing in or passing on Pure Storage, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

There are multiple reasons why we think Pure Storage is an elite business services company. For starters, its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months. On top of that, its ARR growth has been marvelous, and its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Pure Storage’s P/E ratio based on the next 12 months is 33.8x. This multiple isn’t necessarily cheap, but we’ll happily own Pure Storage as its fundamentals illustrate it’s clearly doing something special. We’re in the camp that investments like this should be held for at least three to five years to negate the short-term price volatility that can come with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $94.11 on the company (compared to the current share price of $74.05).