Universal Display (OLED)

Universal Display piques our interest. It repeatedly invests in lucrative growth initiatives, generating robust cash flows and returns on capital.― StockStory Analyst Team

1. News

2. Summary

Why Universal Display Is Interesting

Serving major consumer electronics manufacturers, Universal Display (NASDAQ:OLED) is a provider of organic light emitting diode (OLED) technologies used in display and lighting applications.

- Offerings are mission-critical for businesses and lead to a best-in-class gross margin of 75.3%

- Excellent operating margin highlights the strength of its business model

- A blemish is its demand will likely be soft over the next 12 months as Wall Street’s estimates imply tepid growth of 8%

Universal Display shows some promise. If you like the stock, the valuation looks reasonable.

Why Is Now The Time To Buy Universal Display?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Universal Display?

Universal Display’s stock price of $119.92 implies a valuation ratio of 22.5x forward P/E. A number of semiconductor companies feature higher multiples, but that doesn’t make Universal Display a bargain. In fact, we think the current price justly reflects the top-line growth.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Universal Display (OLED) Research Report: Q4 CY2025 Update

OLED provider Universal Display (NASDAQ:OLED) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 6.6% year on year to $172.9 million. On the other hand, the company’s full-year revenue guidance of $675 million at the midpoint came in 6.3% below analysts’ estimates. Its GAAP profit of $1.39 per share was 8.4% above analysts’ consensus estimates.

Universal Display (OLED) Q4 CY2025 Highlights:

- Revenue: $172.9 million vs analyst estimates of $173.4 million (6.6% year-on-year growth, in line)

- EPS (GAAP): $1.39 vs analyst estimates of $1.28 (8.4% beat)

- Operating Margin: 38.9%, up from 32.3% in the same quarter last year

- Free Cash Flow Margin: 8.7%, down from 13.6% in the same quarter last year

- Inventory Days Outstanding: 531, up from 515 in the previous quarter

- Market Capitalization: $5.70 billion

Company Overview

Serving major consumer electronics manufacturers, Universal Display (NASDAQ:OLED) is a provider of organic light emitting diode (OLED) technologies used in display and lighting applications.

Universal Display Corporation was founded in 1994 by Sherwin Seligsohn after he visited the electrical engineering school at Princeton University and observed research on self-emissive organic materials. In 1996, Universal Display went public with a research contract with Princeton, 3 part-time employees, and one patent pending.

Organic light emitting diodes or OLEDs are thin, lightweight devices that emit light that can be manufactured on both flexible and rigid substrates, which make them suitable for color displays and other lighting products. OLED displays have been capturing market share from inorganic light emitting diodes or LEDs due to superior power efficiency, contrast ratio, video response time, and manufacturing cost. As such, OLED technology is commonly employed in mobile phones, TVs, wearables, AR/VR devices, and automotive markets among others.

Universal Display generates revenue by entering into long-term agreements with our customers through (1) commercial supply agreements for the purchase of specific OLED materials and/or (2) patent license agreements related to the manufacture of display and lighting devices. Commercial supply agreements often involve multi-year purchase commitments for mass production facilities, which gives customers volume discounts and preferential pricing.

Competitors offering OLED or competing lighting technologies include Sumitomo Chemical (TSE:4005), Idemitsu Kosan (TSE:5019), and Cynora.

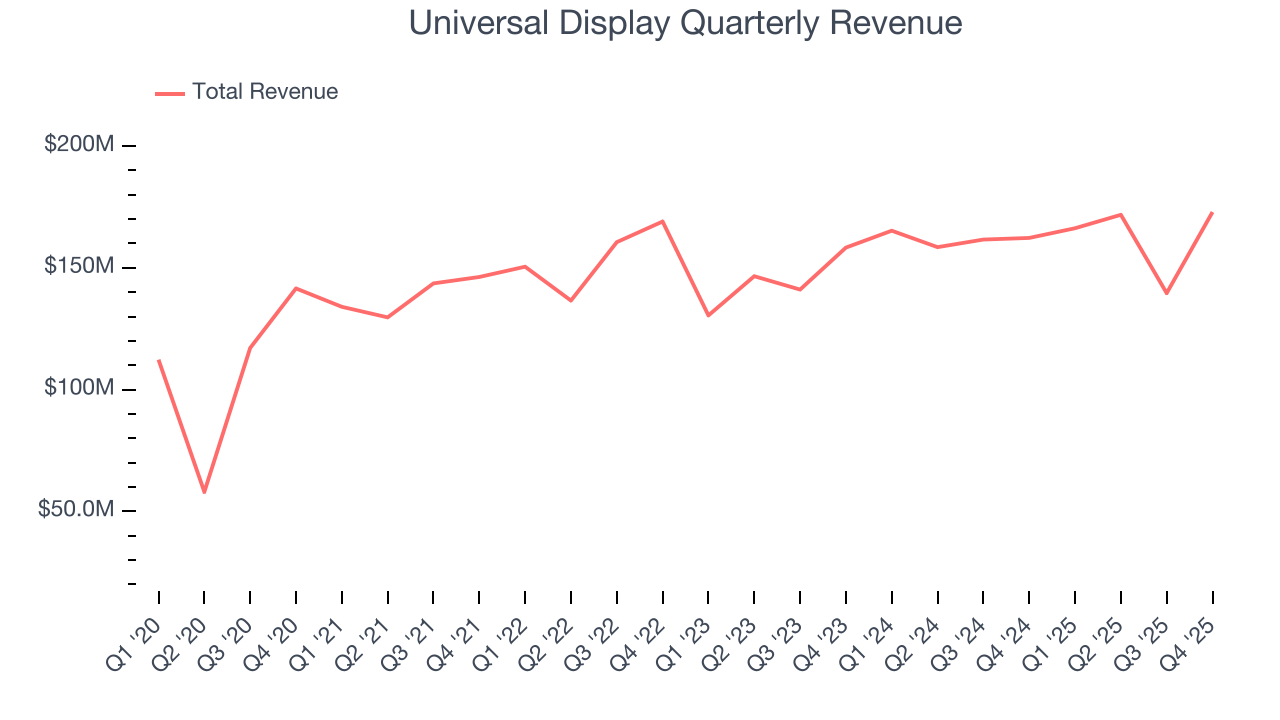

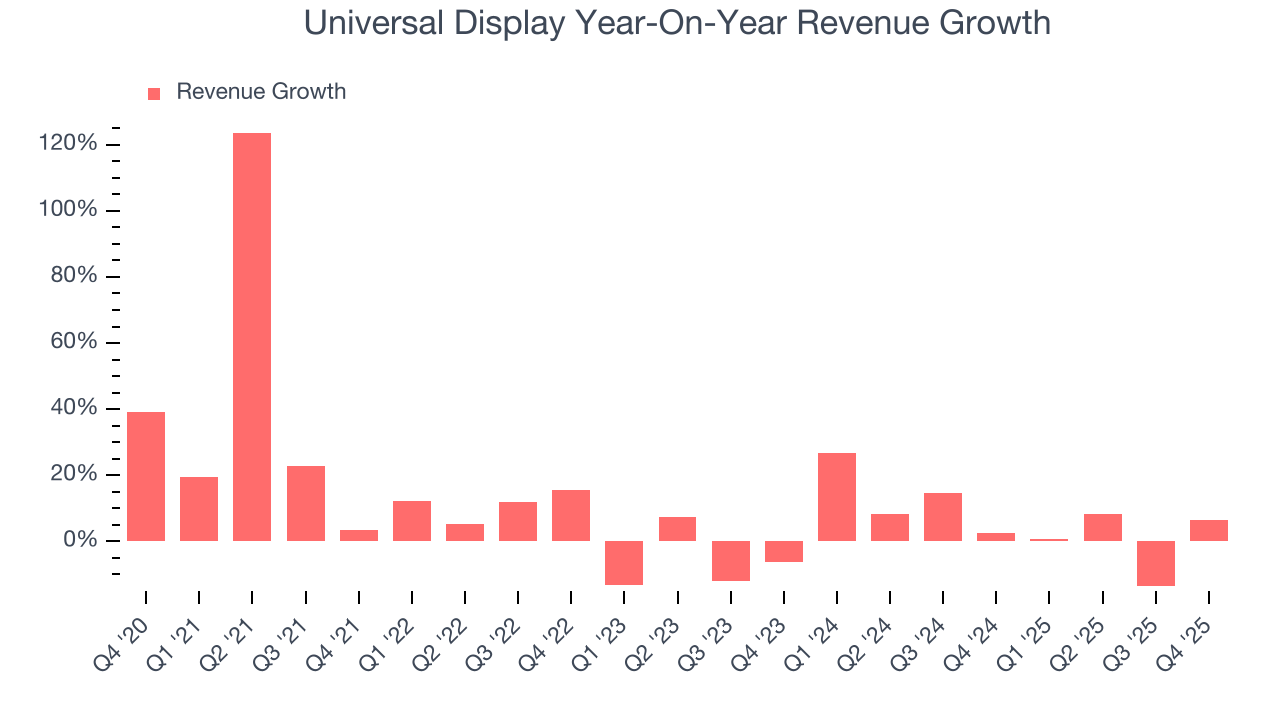

4. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Universal Display grew its sales at a decent 8.7% compounded annual growth rate. Its growth was slightly above the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Universal Display’s annualized revenue growth of 6.2% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Universal Display grew its revenue by 6.6% year on year, and its $172.9 million of revenue was in line with Wall Street’s estimates. Additionally, Universal Display’s growth inflected positively this quarter, news that will likely give some shareholders hope.

Looking ahead, sell-side analysts expect revenue to grow 8.8% over the next 12 months. Although this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector. At least the company is tracking well in other measures of financial health.

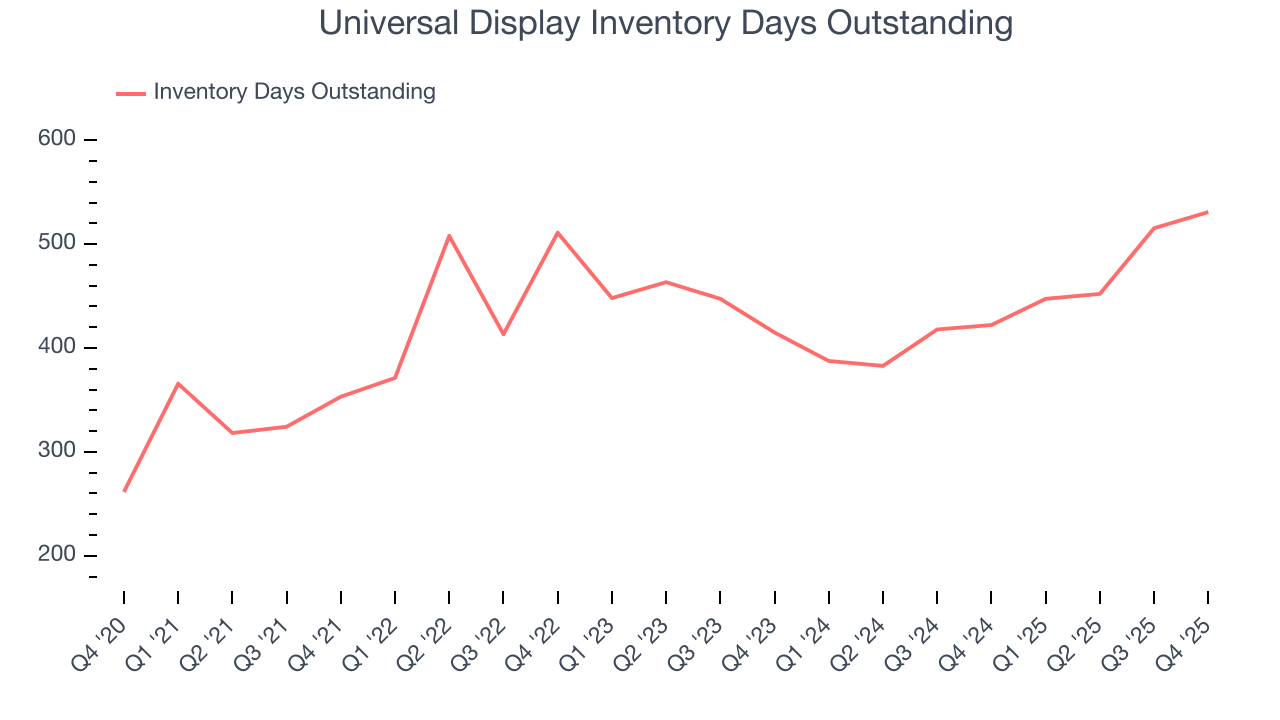

5. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Universal Display’s DIO came in at 531, which is 106 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

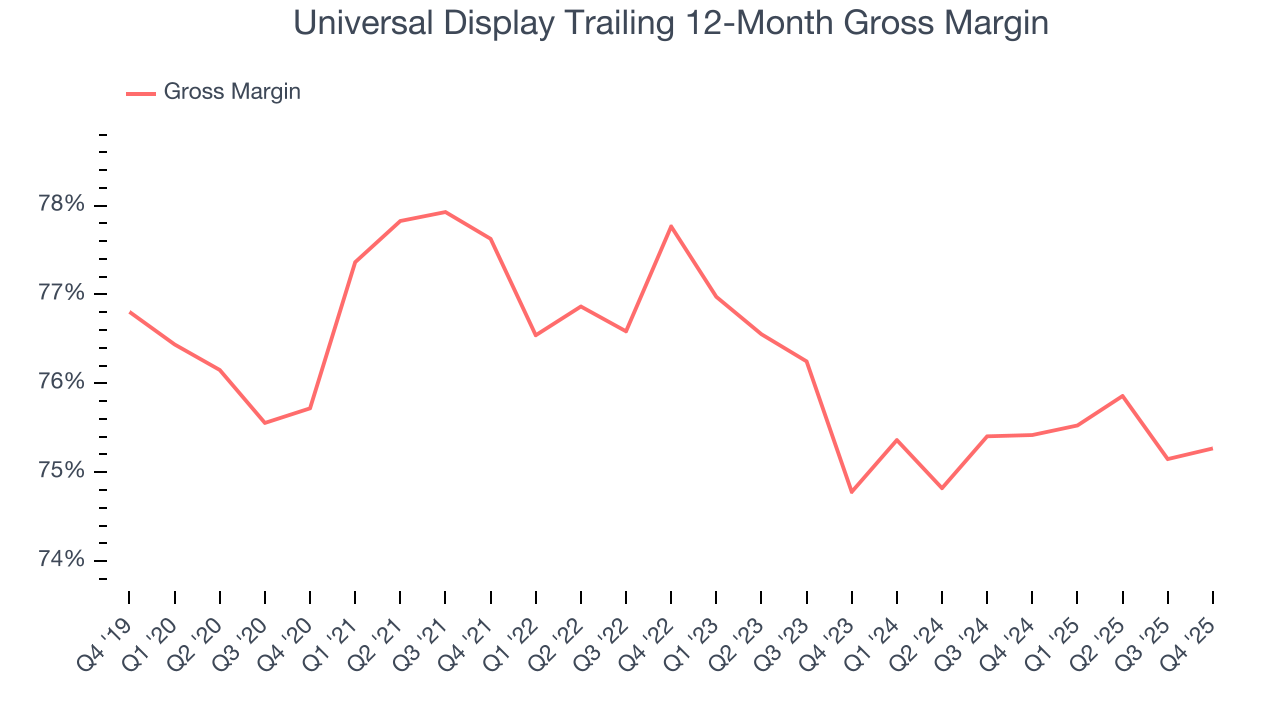

6. Gross Margin & Pricing Power

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Universal Display’s gross margin is one of the best in the semiconductor sector, and its strong pricing power is a direct result of its differentiated products and technological expertise. As you can see below, it averaged an elite 75.3% gross margin over the last two years. Said differently, roughly $75.34 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Universal Display produced a 76.1% gross profit margin in Q4, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

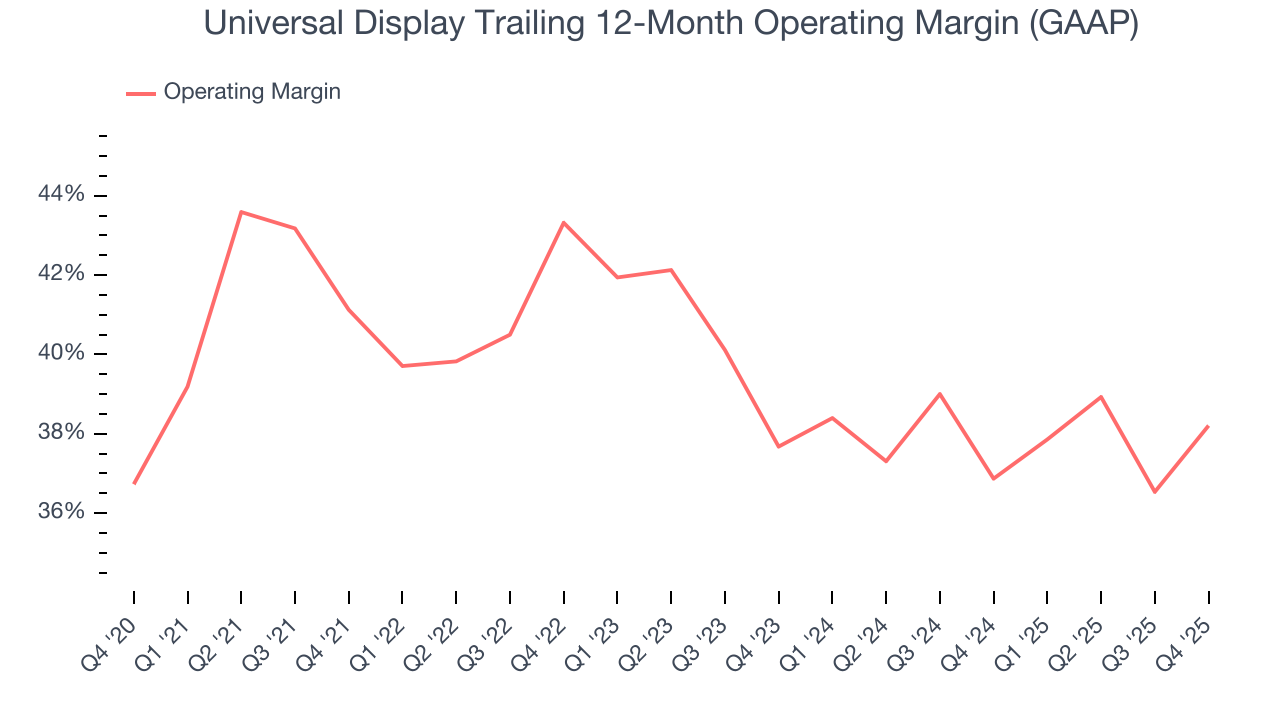

7. Operating Margin

Universal Display has been a well-oiled machine over the last two years. It demonstrated elite profitability for a semiconductor business, boasting an average operating margin of 37.5%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Universal Display’s operating margin decreased by 2.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Universal Display generated an operating margin profit margin of 38.9%, up 6.5 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

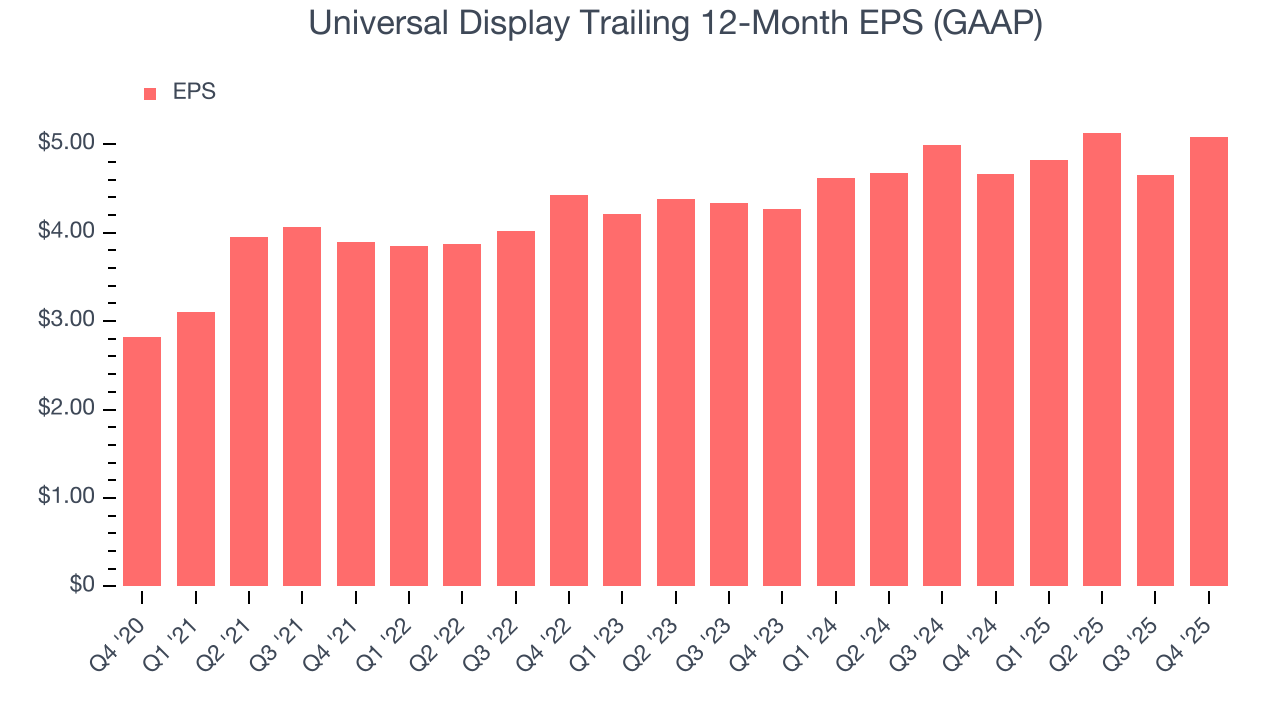

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Universal Display’s EPS grew at an unimpressive 12.4% compounded annual growth rate over the last five years. This performance was better than its flat revenue, but we take it with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, Universal Display reported EPS of $1.39, up from $0.97 in the same quarter last year. This print beat analysts’ estimates by 8.4%. Over the next 12 months, Wall Street expects Universal Display’s full-year EPS of $5.08 to grow 8.1%.

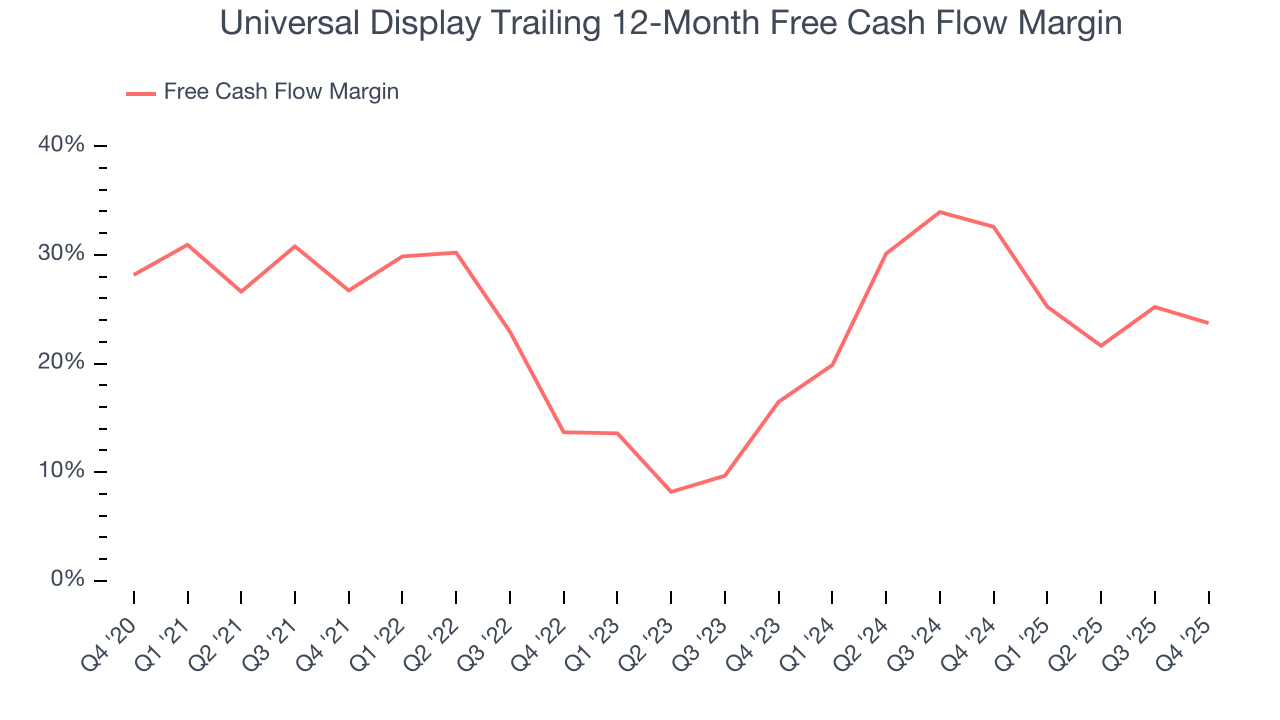

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Universal Display has shown terrific cash profitability, and if sustainable, puts it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the semiconductor sector, averaging 28.1% over the last two years.

Taking a step back, we can see that Universal Display’s margin dropped by 3 percentage points over the last five years. We’re willing to live with its performance for now but hope its cash conversion can rise soon. Continued declines could signal it is in the middle of an investment cycle.

Universal Display’s free cash flow clocked in at $15.06 million in Q4, equivalent to a 8.7% margin. The company’s cash profitability regressed as it was 4.9 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

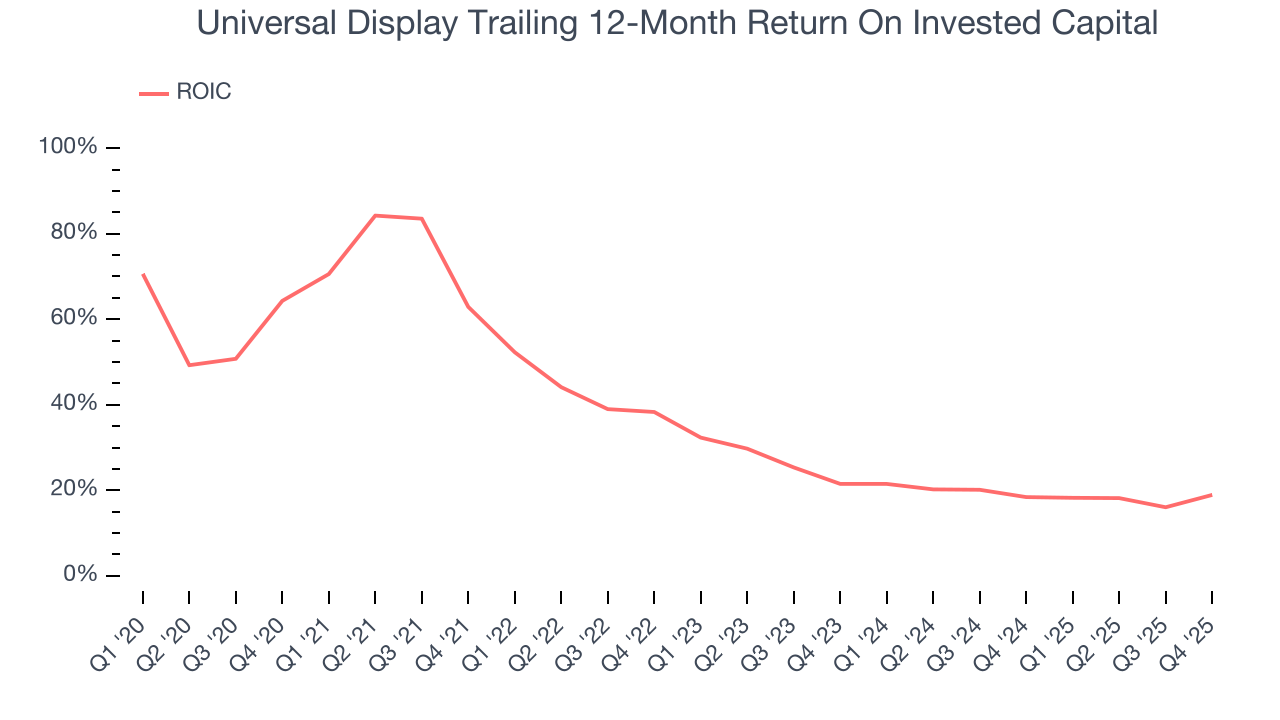

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Universal Display’s five-year average ROIC was 32%, beating other semiconductor companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

11. Key Takeaways from Universal Display’s Q4 Results

It was good to see Universal Display beat analysts’ EPS expectations this quarter on in-line revenue. On the other hand, its full-year revenue guidance missed. Overall, this was a mixed quarter. The stock traded up 1.8% to $119.15 immediately after reporting.

12. Is Now The Time To Buy Universal Display?

Updated: February 19, 2026 at 5:25 PM EST

Are you wondering whether to buy Universal Display or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

There are some positives when it comes to Universal Display’s fundamentals. To begin with, the its revenue growth was good over the last five years, and analysts believe it can continue growing at these levels. And while Universal Display’s projected EPS for the next year is lacking, its admirable gross margins indicate robust pricing power.

Universal Display’s P/E ratio based on the next 12 months is 21x. Looking at the semiconductor space right now, Universal Display trades at a compelling valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $163.11 on the company (compared to the current share price of $119.15), implying they see 36.9% upside in buying Universal Display in the short term.