Ollie's (OLLI)

Ollie's is intriguing. Its demand is through the roof, as seen by its rapid growth in same-store sales and physical locations.― StockStory Analyst Team

1. News

2. Summary

Why Ollie's Is Interesting

Often located in suburban or semi-rural shopping centers, Ollie’s Bargain Outlet (NASDAQ:OLLI) is a discount retailer that acquires excess inventory then sells at meaningful discounts.

- Exciting sales outlook for the upcoming 12 months calls for 14.8% growth, an acceleration from its three-year trend

- Rapid rollout of new stores to capitalize on market opportunities makes sense given its strong same-store sales performance

- A drawback is its modest revenue base of $2.54 billion means it has less operating leverage but can also grow faster if it executes the right sales strategy

Ollie's has some noteworthy aspects. If you like the company, the valuation looks fair.

Why Is Now The Time To Buy Ollie's?

Why Is Now The Time To Buy Ollie's?

At $113.10 per share, Ollie's trades at 26.1x forward P/E. Compared to companies in the consumer retail space, we think this multiple is warranted for the revenue growth you get.

Now could be a good time to invest if you believe in the story.

3. Ollie's (OLLI) Research Report: Q3 CY2025 Update

Discount retail company Ollie’s Bargain Outlet (NASDAQ:OLLI) met Wall Streets revenue expectations in Q3 CY2025, with sales up 18.6% year on year to $613.6 million. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $2.65 billion at the midpoint. Its non-GAAP profit of $0.75 per share was 2.4% above analysts’ consensus estimates.

Ollie's (OLLI) Q3 CY2025 Highlights:

- Revenue: $613.6 million vs analyst estimates of $615.3 million (18.6% year-on-year growth, in line)

- Adjusted EPS: $0.75 vs analyst estimates of $0.73 (2.4% beat)

- Adjusted EBITDA: $72.88 million vs analyst estimates of $71.99 million (11.9% margin, 1.2% beat)

- The company slightly lifted its revenue guidance for the full year to $2.65 billion at the midpoint from $2.64 billion

- Management raised its full-year Adjusted EPS guidance to $3.84 at the midpoint, a 1.1% increase

- Operating Margin: 9%, in line with the same quarter last year

- Free Cash Flow was -$25.97 million compared to -$35.38 million in the same quarter last year

- Locations: 645 at quarter end, up from 546 in the same quarter last year

- Same-Store Sales rose 3.3% year on year (-0.5% in the same quarter last year)

- Market Capitalization: $7.28 billion

Company Overview

Often located in suburban or semi-rural shopping centers, Ollie’s Bargain Outlet (NASDAQ:OLLI) is a discount retailer that acquires excess inventory then sells at meaningful discounts.

For example, if Walmart orders huge quantities of toys based on a new Disney movie but the movie flops and the popularity of that toy never materializes, Walmart may sell those in bulk to Ollie’s at pennies on the dollar rather than discount the items and try to sell them individually. This is often done to clear shelf space for new products.

Ollie’s buying approach focuses on finding excess inventory or overstocked items from other retailers, so selection can change quickly and be varied. Shopping at Ollie’s is often a treasure hunt–what the consumer loses in reliable selection or the latest trends is made up for with very low prices. Prices of Ollie’s merchandise can be as much as 70% off other full-price retailers. Housewares and home decor, snacks, toys and games, and electronics are key product categories at the typical Ollie’s store.

The core customer is the value-conscious shopper who values a one-stop shop for many of a household’s needs. This customer is willing to physically go to stores and spend more time searching for the right merchandise since Ollie’s has a very limited online presence.

4. Discount Retailer

Discount retailers understand that many shoppers love a good deal, and they focus on providing excellent value to shoppers by selling general merchandise at major discounts. They can do this because of unique purchasing, procurement, and pricing strategies that involve scouring the market for trendy goods or buying excess inventory from manufacturers and other retailers. They then turn around and sell these snacks, paper towels, toys, clothes, and myriad other products at highly enticing prices. Despite the unique draw and lure of discounts, these discount retailers must also contend with the secular headwinds of online shopping and challenged retail foot traffic in places like suburban strip malls.

Off-price and discount retail competitors include TJX (NYSE:TJX), Ross Stores (NASDAQ:ROST), and Burlington Stores (NYSE:BURL).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $2.54 billion in revenue over the past 12 months, Ollie's is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers. On the bright side, it can grow faster because it has more white space to build new stores.

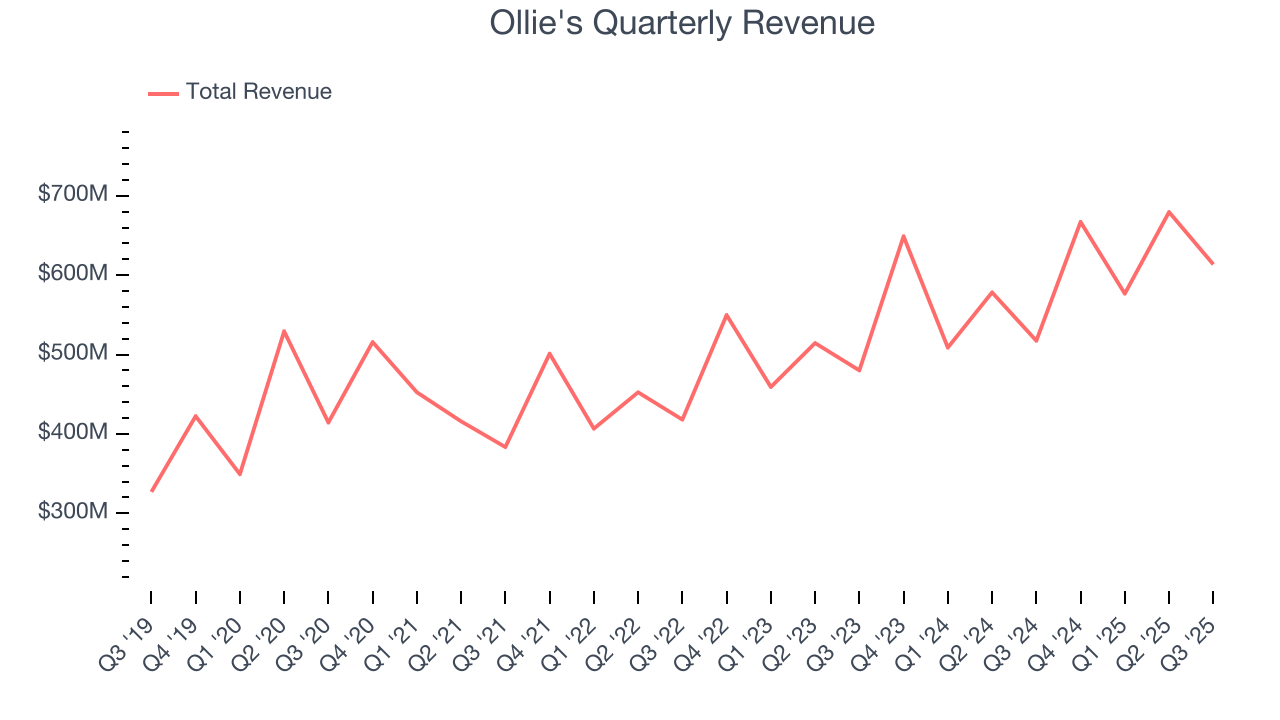

As you can see below, Ollie’s 12.6% annualized revenue growth over the last three years (we compare to 2019 to normalize for COVID-19 impacts) was solid as it opened new stores and increased sales at existing, established locations.

This quarter, Ollie’s year-on-year revenue growth was 18.6%, and its $613.6 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 14% over the next 12 months, similar to its three-year rate. This projection is eye-popping and implies its newer products will fuel better top-line performance.

6. Store Performance

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Ollie's operated 645 locations in the latest quarter. It has opened new stores at a rapid clip over the last two years, averaging 11.5% annual growth, much faster than the broader consumer retail sector. This gives it a chance to scale into a mid-sized business over time.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales gives us insight into this topic because it measures organic growth for a retailer's e-commerce platform and brick-and-mortar shops that have existed for at least a year.

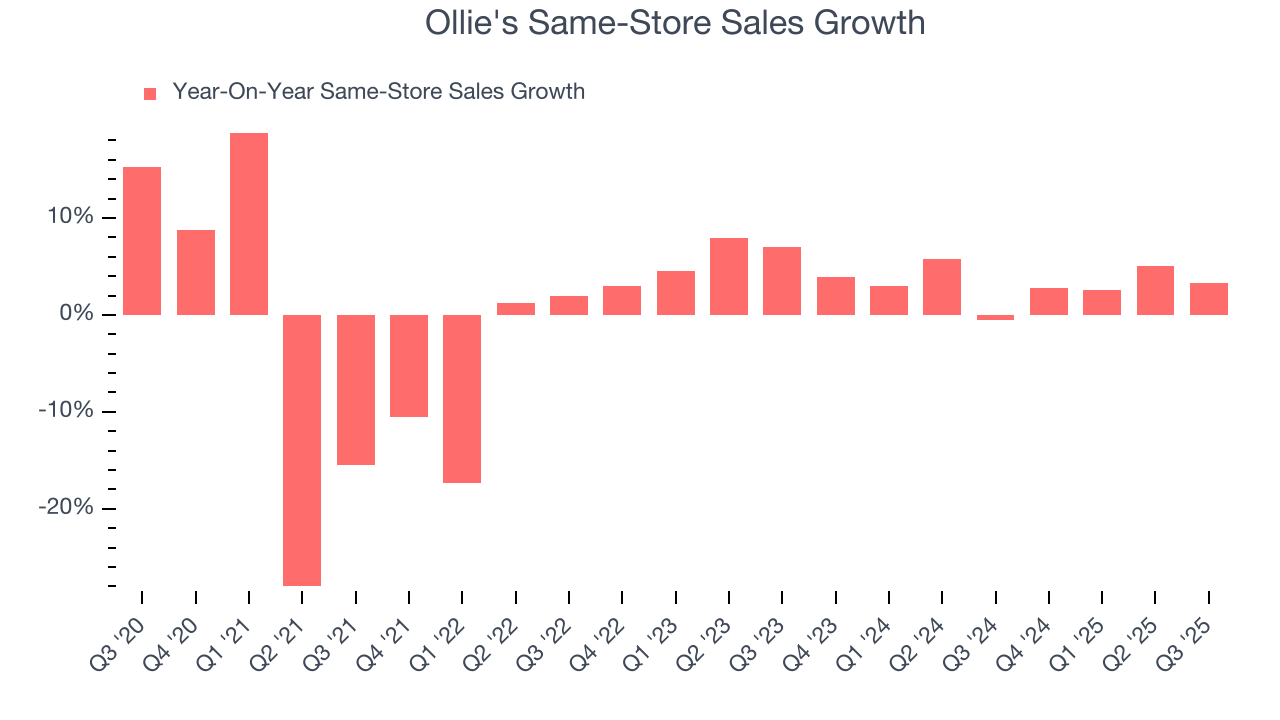

Ollie’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.2% per year. This performance along with its meaningful buildout of new stores suggest it’s playing some aggressive offense.

In the latest quarter, Ollie’s same-store sales rose 3.3% year on year. This performance was more or less in line with its historical levels.

7. Gross Margin & Pricing Power

We prefer higher gross margins because they not only make it easier to generate more operating profits but also indicate product differentiation, negotiating leverage, and pricing power.

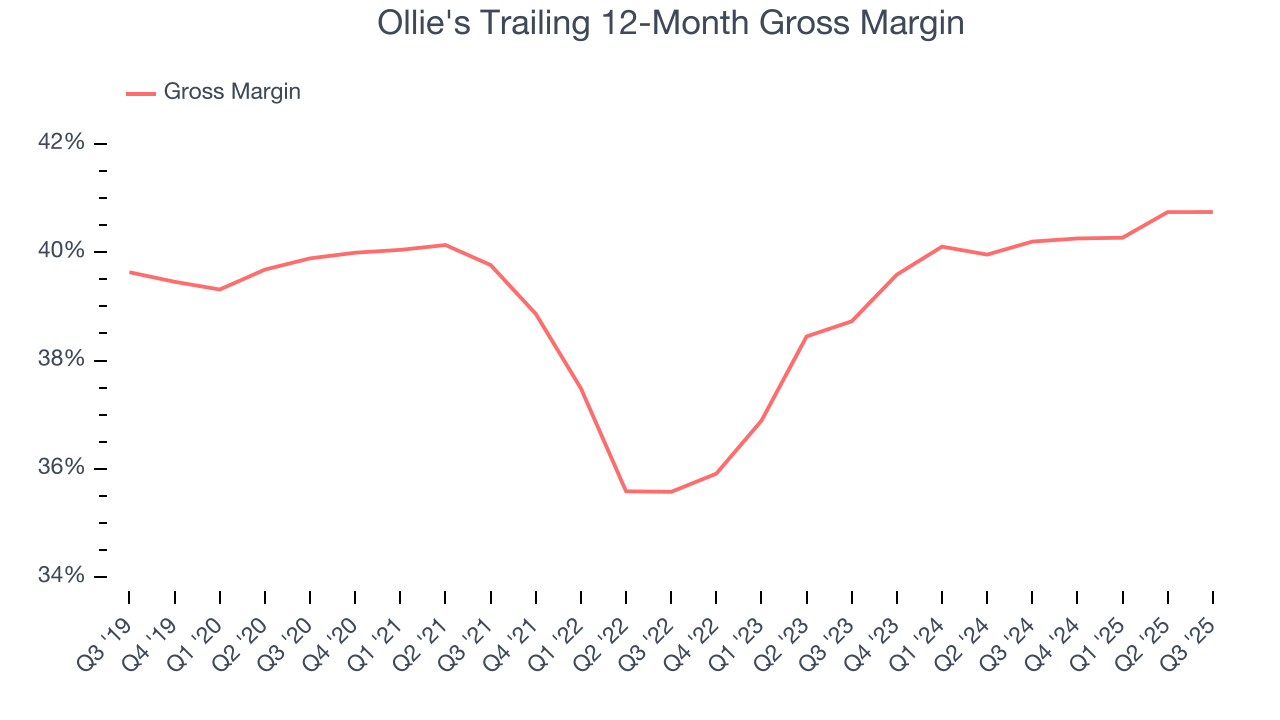

Ollie’s unit economics are higher than the typical retailer, giving it the flexibility to invest in areas such as marketing and talent to reach more consumers. As you can see below, it averaged a decent 40.5% gross margin over the last two years. That means for every $100 in revenue, $59.51 went towards paying for inventory, transportation, and distribution.

Ollie’s gross profit margin came in at 41.3% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting it strives to keep prices low for customers and has stable input costs (such as labor and freight expenses to transport goods).

8. Operating Margin

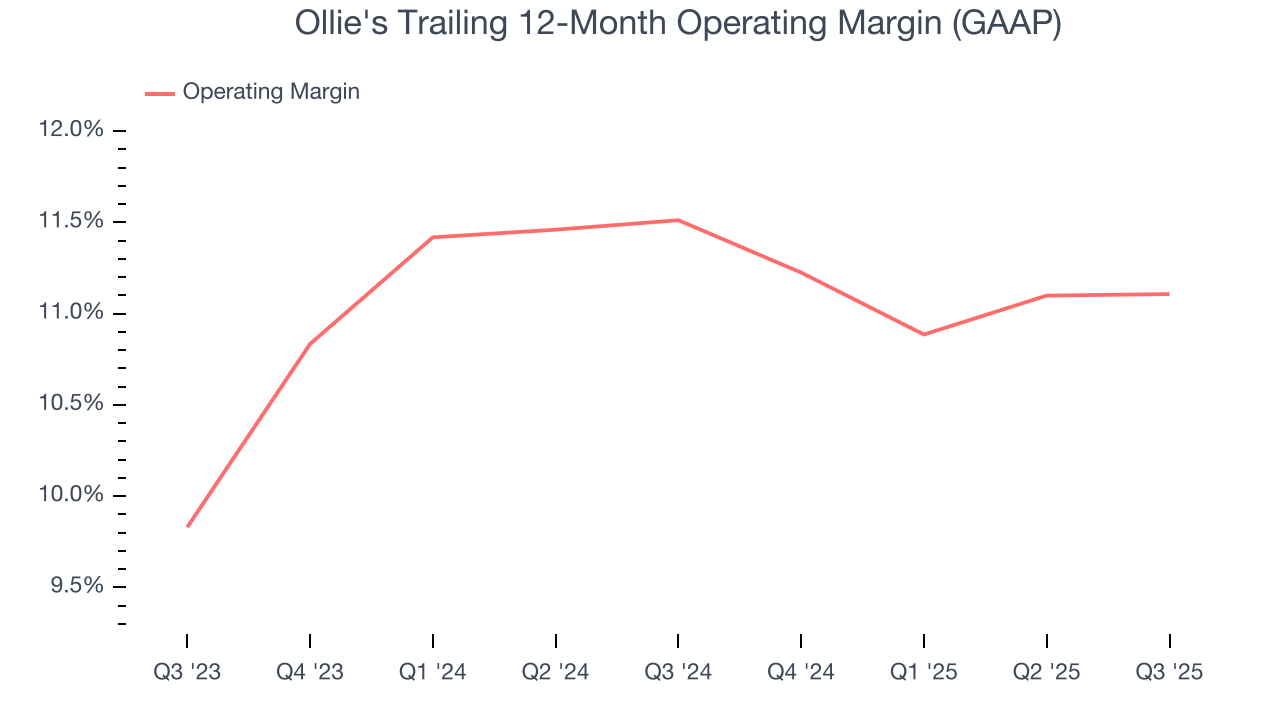

Ollie’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 11.3% over the last two years. This profitability was solid for a consumer retail business and shows it’s an efficient company that manages its expenses well. This is seen in its fast historical revenue growth, which is why we look at both data points together.

Analyzing the trend in its profitability, Ollie’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Ollie's generated an operating margin profit margin of 9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

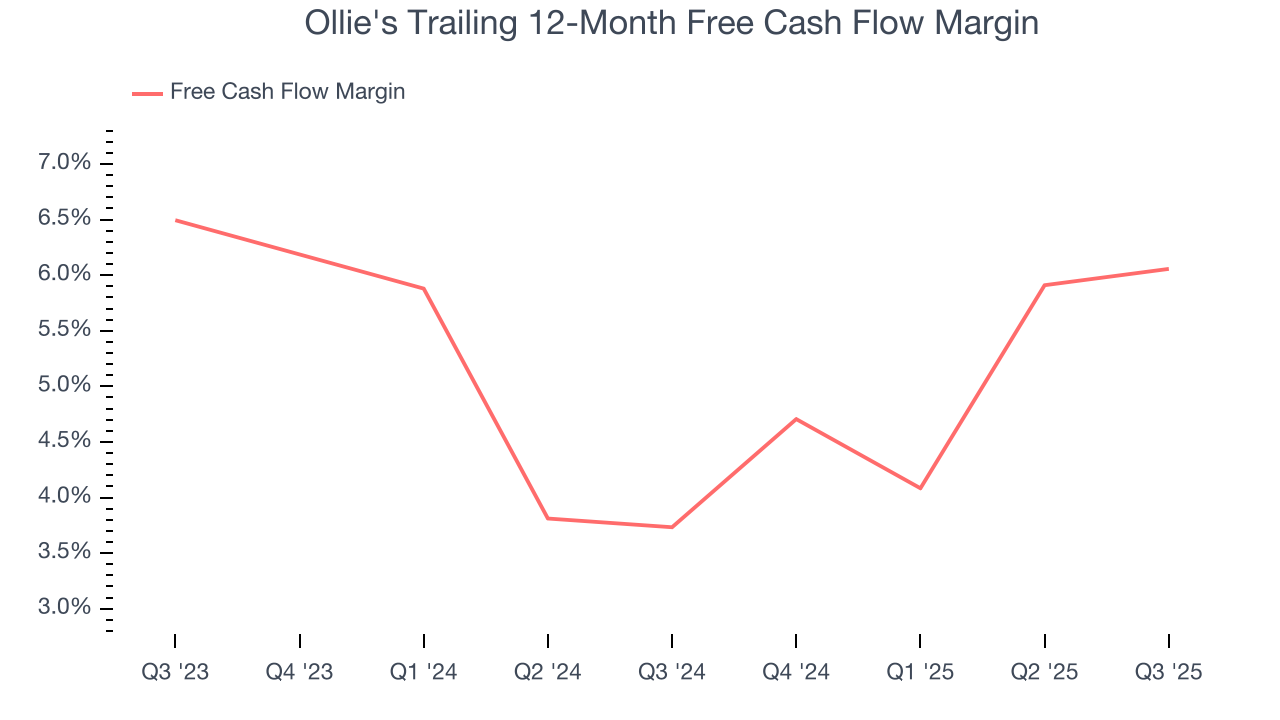

Ollie's has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 5% over the last two years, better than the broader consumer retail sector.

Taking a step back, we can see that Ollie’s margin expanded by 2.3 percentage points over the last year. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Ollie's burned through $25.97 million of cash in Q3, equivalent to a negative 4.2% margin. The company’s cash burn was similar to its $35.38 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Ollie's has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.8%, somewhat low compared to the best consumer retail companies that consistently pump out 25%+.

11. Balance Sheet Assessment

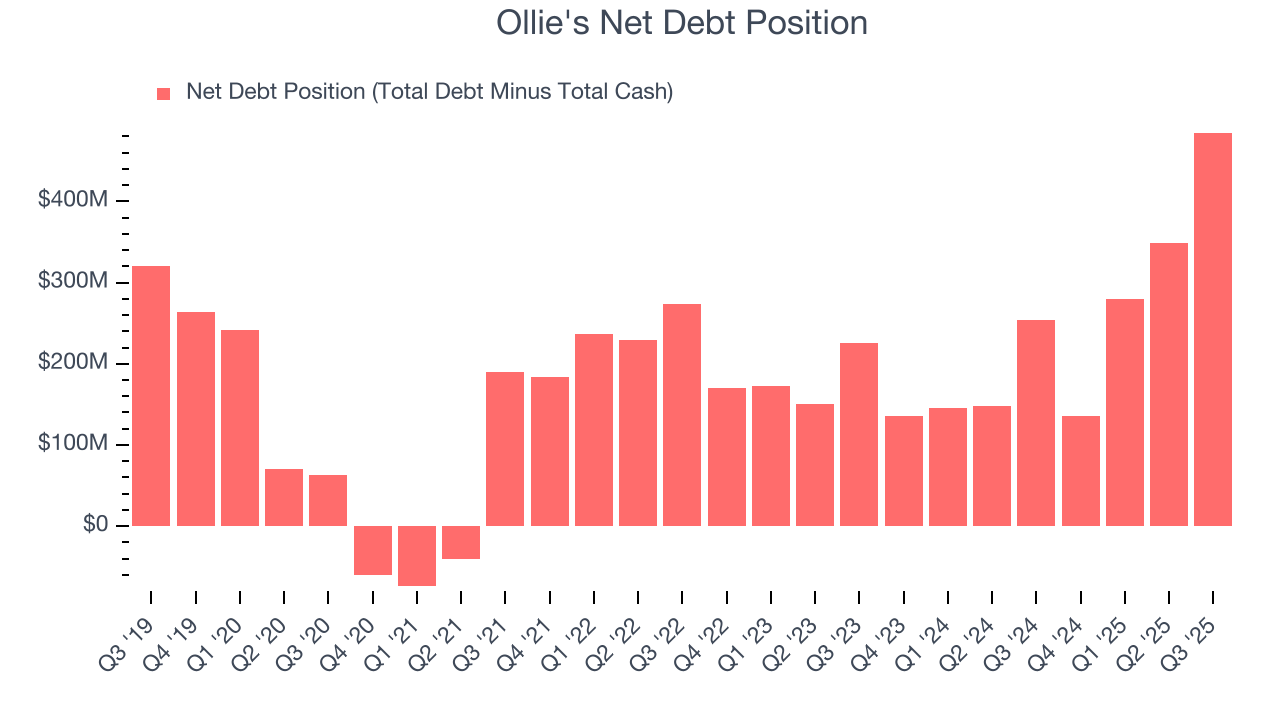

Ollie's reported $186 million of cash and $670.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $348.2 million of EBITDA over the last 12 months, we view Ollie’s 1.4× net-debt-to-EBITDA ratio as safe. We also see its $8.85 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Ollie’s Q3 Results

It was good to see Ollie's narrowly top analysts’ EBITDA expectations this quarter. We were also happy its gross margin narrowly outperformed Wall Street’s estimates.Zooming out, we think this was a decent quarter. The market seemed to be hoping for more, and the stock traded down 6.8% to $110.68 immediately after reporting.

13. Is Now The Time To Buy Ollie's?

Updated: January 24, 2026 at 9:39 PM EST

Before investing in or passing on Ollie's, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Ollie's is a fine business. First off, its revenue growth was solid over the last three years and is expected to accelerate over the next 12 months. And while its brand caters to a niche market, its new store openings have increased its brand equity. On top of that, its projected EPS for the next year implies the company will continue generating shareholder value.

Ollie’s P/E ratio based on the next 12 months is 26.1x. Looking at the consumer retail landscape right now, Ollie's trades at a pretty interesting price. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $141.67 on the company (compared to the current share price of $113.10), implying they see 25.3% upside in buying Ollie's in the short term.