Penguin Solutions (PENG)

Penguin Solutions is in for a bumpy ride. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Penguin Solutions Will Underperform

Based in the US, Penguin Solutions (NASDAQ:PENG) is a diversified semiconductor company offering memory, digital, and LED products.

- High input costs result in an inferior gross margin of 28.8% that must be offset through higher volumes

- Lacking free cash flow limits its freedom to invest in growth initiatives, execute share buybacks, or pay dividends

- Low returns on capital reflect management’s struggle to allocate funds effectively, and its falling returns suggest its earlier profit pools are drying up

Penguin Solutions doesn’t meet our quality standards. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Penguin Solutions

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Penguin Solutions

At $19.11 per share, Penguin Solutions trades at 8.9x forward P/E. Penguin Solutions’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Penguin Solutions (PENG) Research Report: Q4 CY2025 Update

Semiconductor maker Penguin Solutions (NASDAQ:PENG) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales were flat year on year at $343.1 million. Its non-GAAP profit of $0.49 per share was 10.6% above analysts’ consensus estimates.

Penguin Solutions (PENG) Q4 CY2025 Highlights:

- Revenue: $343.1 million vs analyst estimates of $339.1 million (flat year on year, 1.2% beat)

- Adjusted EPS: $0.49 vs analyst estimates of $0.44 (10.6% beat)

- Adjusted EBITDA: $45.24 million vs analyst estimates of $43.21 million (13.2% margin, 4.7% beat)

- Management reiterated its full-year Adjusted EPS guidance of $2 at the midpoint

- Operating Margin: 5.7%, in line with the same quarter last year

- Free Cash Flow Margin: 8.2%, up from 3.5% in the same quarter last year

- Inventory Days Outstanding: 79, down from 96 in the previous quarter

- Market Capitalization: $1.11 billion

Company Overview

Based in the US, Penguin Solutions (NASDAQ:PENG) is a diversified semiconductor company offering memory, digital, and LED products.

SMART was founded in 1988 by Mukesh Patel and went public went public for the first time in 1995. It was then acquired by both strategic (Solectron) and financial (Silver Lake) buyers, taken private and then public again in 2017.

SMART’s product portfolio is divided into three segments: Memory Solutions, LED Solutions, and the emerging Intelligent Platform Solutions (“IPS”). The Memory Solutions segment, upon which the company was built, designs and manufactures DRAM (dynamic random access memory) and flash memory for computers, servers, and smartphones. The LED Solutions segment consists of application-optimized LEDs (light-emitting diodes) focused on the density, intensity, and reliability of lights in video screens, gaming displays, etc. The IPS segment is a portfolio of hardware, software, and services to enable edge computing. For example, SMART IPS architected and manages a private hybrid cloud environment (nodes, storage, etc.) for a US Federal government customer to enable AI and analytics use cases.

While SMART does not operate wafer fabrication facilities, the company has facilities in Brazil, the US, China, and Malaysia for subsequent stages of semiconductor manufacturing. These facilities receive unmounted chips and package die into semiconductor and LED components. Testing and assembly also occurs in these facilities.

While no company offers the same diversified product portfolio, some competitors include Intel (NASDAQ:INTC), Dell (NYSE:DELL), NVIDIA (NASDAQ:NVDA), and SK hynix (KOSE:A000660).

4. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Penguin Solutions grew its sales at a mediocre 3.7% compounded annual growth rate. This was below our standard for the semiconductor sector and is a rough starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Penguin Solutions’s recent performance shows its demand has slowed as its annualized revenue growth of 1.8% over the last two years was below its five-year trend.

This quarter, Penguin Solutions’s $343.1 million of revenue was flat year on year but beat Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 13.3% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will catalyze better top-line performance.

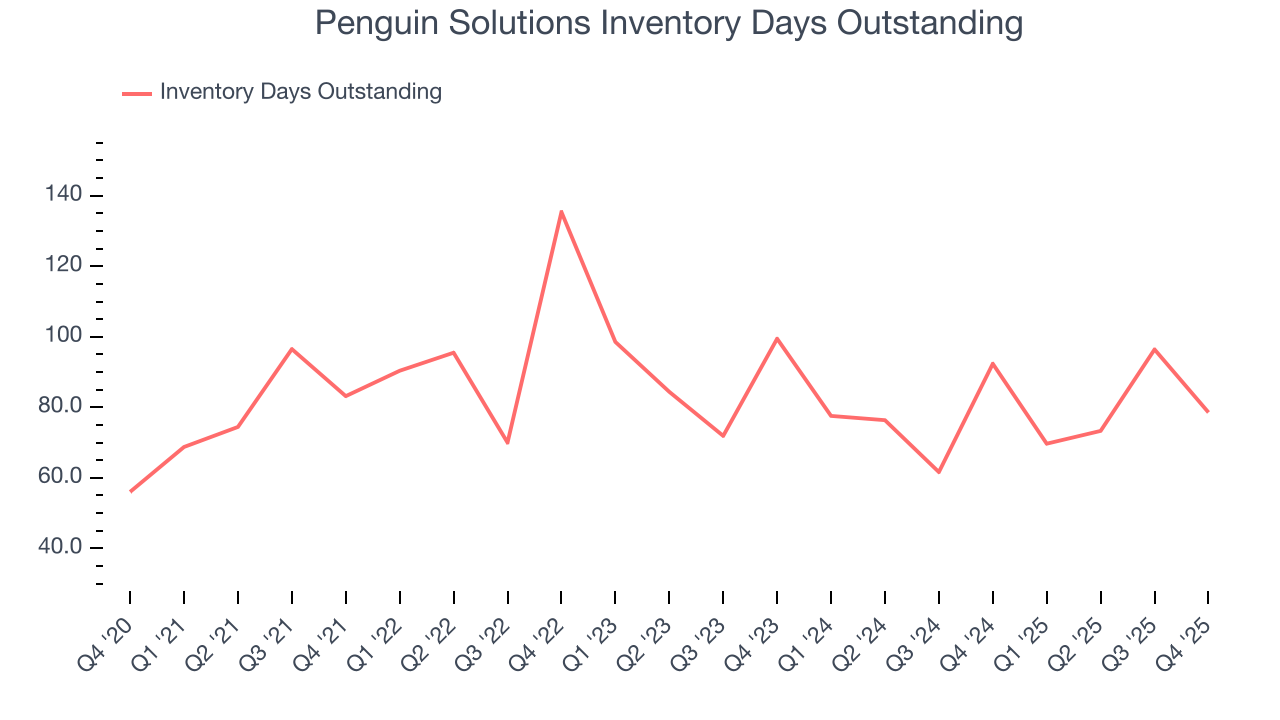

5. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Penguin Solutions’s DIO came in at 79, which is 6 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

6. Gross Margin & Pricing Power

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

Penguin Solutions’s gross margin is one of the worst in the semiconductor industry, signaling it operates in a competitive market and lacks pricing power. As you can see below, it averaged a 28.8% gross margin over the last two years. That means Penguin Solutions paid its suppliers a lot of money ($71.23 for every $100 in revenue) to run its business.

This quarter, Penguin Solutions’s gross profit margin was 28%, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

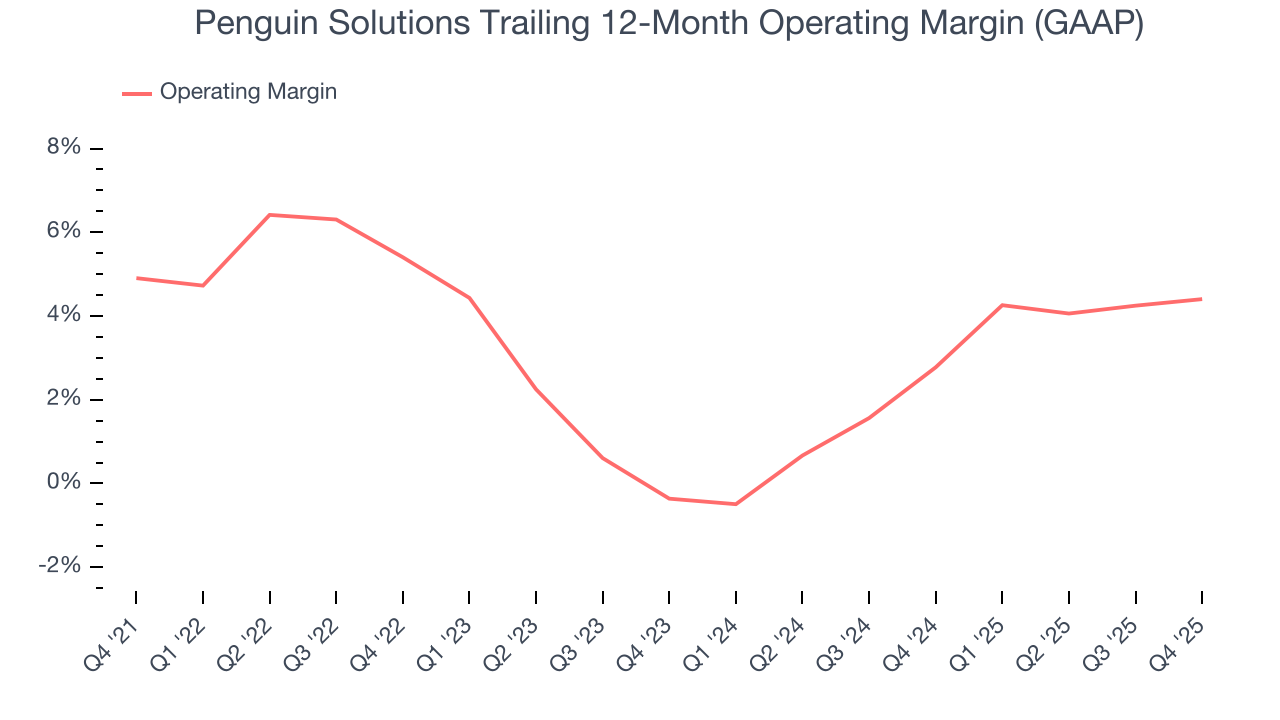

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Penguin Solutions was profitable over the last two years but held back by its large cost base. Its average operating margin of 3.6% was weak for a semiconductor business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Penguin Solutions’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Penguin Solutions generated an operating margin profit margin of 5.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

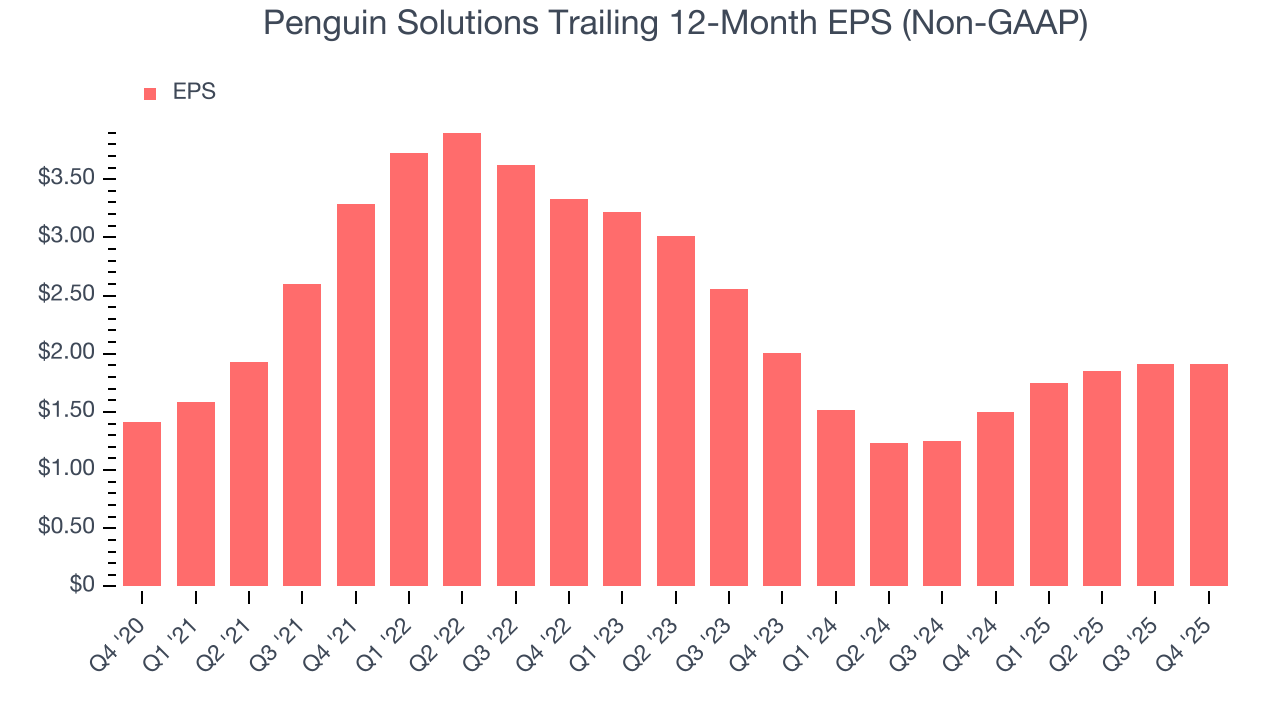

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Penguin Solutions’s EPS grew at an unimpressive 6.3% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3.7% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Penguin Solutions reported adjusted EPS of $0.49, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Penguin Solutions’s full-year EPS of $1.91 to grow 17%.

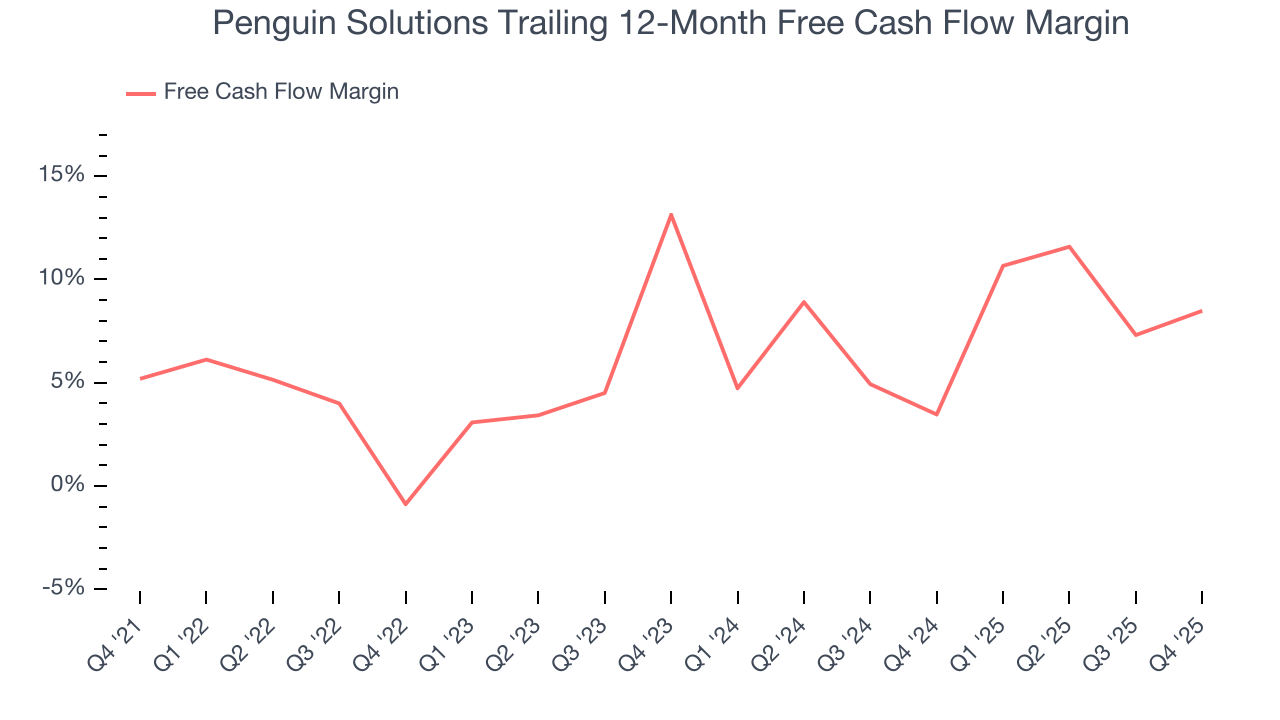

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Penguin Solutions has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 6.1%, lousy for a semiconductor business.

Taking a step back, an encouraging sign is that Penguin Solutions’s margin expanded by 3.3 percentage points over the last five years. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Penguin Solutions’s free cash flow clocked in at $28.21 million in Q4, equivalent to a 8.2% margin. This result was good as its margin was 4.7 percentage points higher than in the same quarter last year, building on its favorable historical trend.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Penguin Solutions historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.9%, lower than the typical cost of capital (how much it costs to raise money) for semiconductor companies.

11. Balance Sheet Assessment

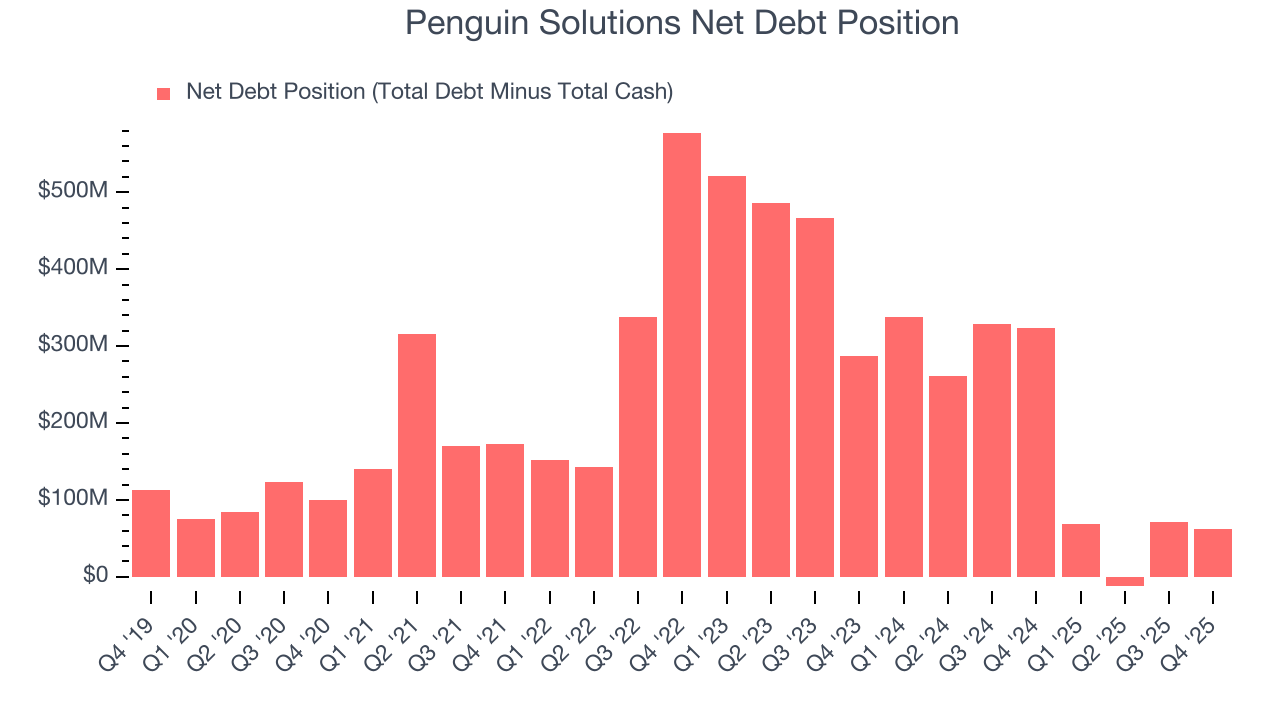

Penguin Solutions reported $461.5 million of cash and $523.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $187.1 million of EBITDA over the last 12 months, we view Penguin Solutions’s 0.3× net-debt-to-EBITDA ratio as safe. We also see its $2.86 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Penguin Solutions’s Q4 Results

We were impressed by Penguin Solutions’s strong improvement in inventory levels. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 4.4% to $22.54 immediately following the results.

13. Is Now The Time To Buy Penguin Solutions?

Updated: February 22, 2026 at 9:39 PM EST

When considering an investment in Penguin Solutions, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Penguin Solutions doesn’t pass our quality test. To begin with, its revenue growth was mediocre over the last five years. While its rising cash profitability gives it more optionality, the downside is its low gross margins indicate some combination of pricing pressures or rising production costs. On top of that, its low free cash flow margins give it little breathing room.

Penguin Solutions’s P/E ratio based on the next 12 months is 8.9x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $26.88 on the company (compared to the current share price of $19.11).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.