Perma-Fix (PESI)

Perma-Fix is up against the odds. Its falling revenue and negative returns on capital suggest it’s destroying value as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Perma-Fix Will Underperform

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ:PESI) provides environmental waste treatment services.

- Sales tumbled by 9.4% annually over the last five years, showing market trends are working against its favor during this cycle

- Sales were less profitable over the last two years as its earnings per share fell by 31.1% annually, worse than its revenue declines

- Depletion of cash reserves could lead to a fundraising event that triggers shareholder dilution

Perma-Fix doesn’t satisfy our quality benchmarks. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than Perma-Fix

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Perma-Fix

Perma-Fix is trading at $13 per share, or 437.3x forward P/E. This valuation is extremely expensive, especially for the weaker revenue growth you get.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Perma-Fix (PESI) Research Report: Q3 CY2025 Update

Environmental waste treatment and services provider Perma-Fix (NASDAQ:PESI) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 3.8% year on year to $17.45 million. Its GAAP loss of $0.10 per share was 16.7% above analysts’ consensus estimates.

Perma-Fix (PESI) Q3 CY2025 Highlights:

- Revenue: $17.45 million vs analyst estimates of $16.3 million (3.8% year-on-year growth, 7.1% beat)

- EPS (GAAP): -$0.10 vs analyst estimates of -$0.12 (2c beat)

- Adjusted EBITDA: -$1.46 million vs analyst estimates of -$1.7 million (-8.4% margin, relatively in line)

- Operating Margin: -10.7%, up from -15.5% in the same quarter last year

- Market Capitalization: $237.7 million

Company Overview

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ:PESI) provides environmental waste treatment services.

Perma-Fix focuses on nuclear, low-level radioactive, mixed, hazardous, and non-hazardous waste treatment, processing, and disposal services. The company operates through two primary segments: Treatment and Services.

The Treatment Segment operates through four uniquely licensed and permitted facilities. These facilities provide various waste treatment and processing services, including research and development activities to identify waste processing techniques for problematic waste streams.

The Services Segment offers technical and nuclear services. These include radiological measurement, health physics services, safety and health assessments, waste management services, and decontamination and decommissioning of facilities. The segment also provides consulting, engineering, project management, and technical services to commercial and government customers.

Perma-Fix's customer base is primarily composed of U.S. government entities, particularly the Department of Energy and Department of Defense. In terms of international expansion, Perma-Fix has signed a joint venture term sheet with Springfields Fuels Limited to develop and manage a nuclear waste-materials treatment facility in the United Kingdom.

4. Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

Competitors of Perma-Fix include US Ecology (NASDAQ:ECOL), Clean Harbors (NYSE:CLH), and Heritage-Crystal Clean (NASDAQ:HCCI).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Perma-Fix struggled to consistently generate demand over the last five years as its sales dropped at a 9.4% annual rate. This was below our standards and suggests it’s a low quality business.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Perma-Fix’s recent performance shows its demand remained suppressed as its revenue has declined by 14.9% annually over the last two years.

This quarter, Perma-Fix reported modest year-on-year revenue growth of 3.8% but beat Wall Street’s estimates by 7.1%.

Looking ahead, sell-side analysts expect revenue to grow 59.7% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and suggests its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

Perma-Fix has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 11.1% gross margin over the last five years. That means Perma-Fix paid its suppliers a lot of money ($88.86 for every $100 in revenue) to run its business.

This quarter, Perma-Fix’s gross profit margin was 14.6%, marking a 6.7 percentage point increase from 7.9% in the same quarter last year. Perma-Fix’s full-year margin has also been trending up over the past 12 months, increasing by 3.3 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

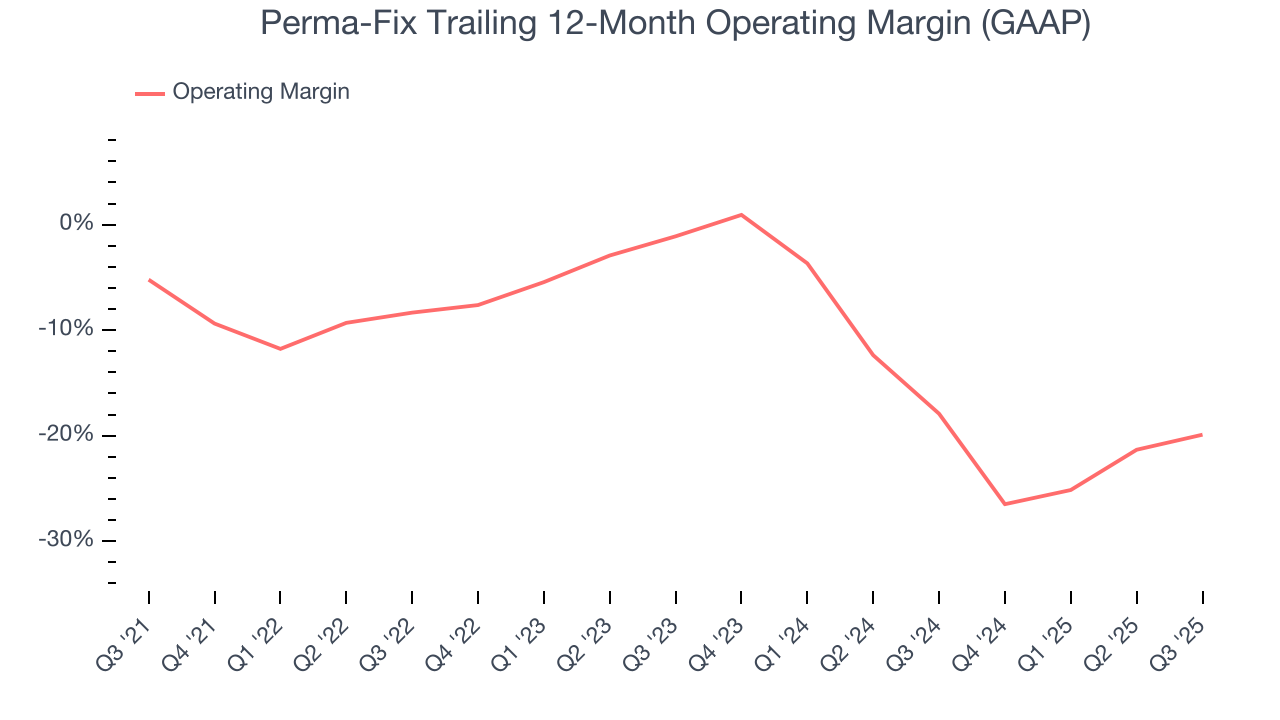

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Perma-Fix’s high expenses have contributed to an average operating margin of negative 9.6% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Perma-Fix’s operating margin decreased by 14.7 percentage points over the last five years. Perma-Fix’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, Perma-Fix generated a negative 10.7% operating margin. The company's consistent lack of profits raise a flag.

8. Cash Is King

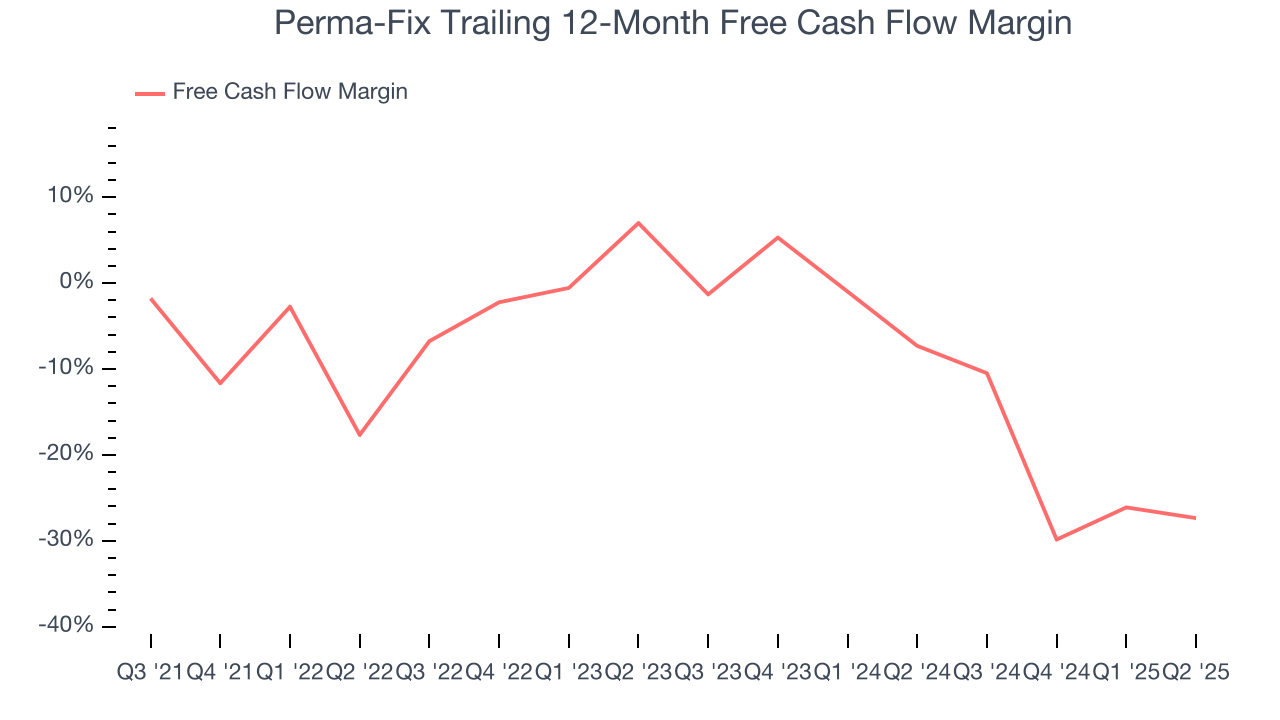

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Perma-Fix’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 7%, meaning it lit $6.98 of cash on fire for every $100 in revenue.

Taking a step back, we can see that Perma-Fix’s margin dropped by 28.6 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

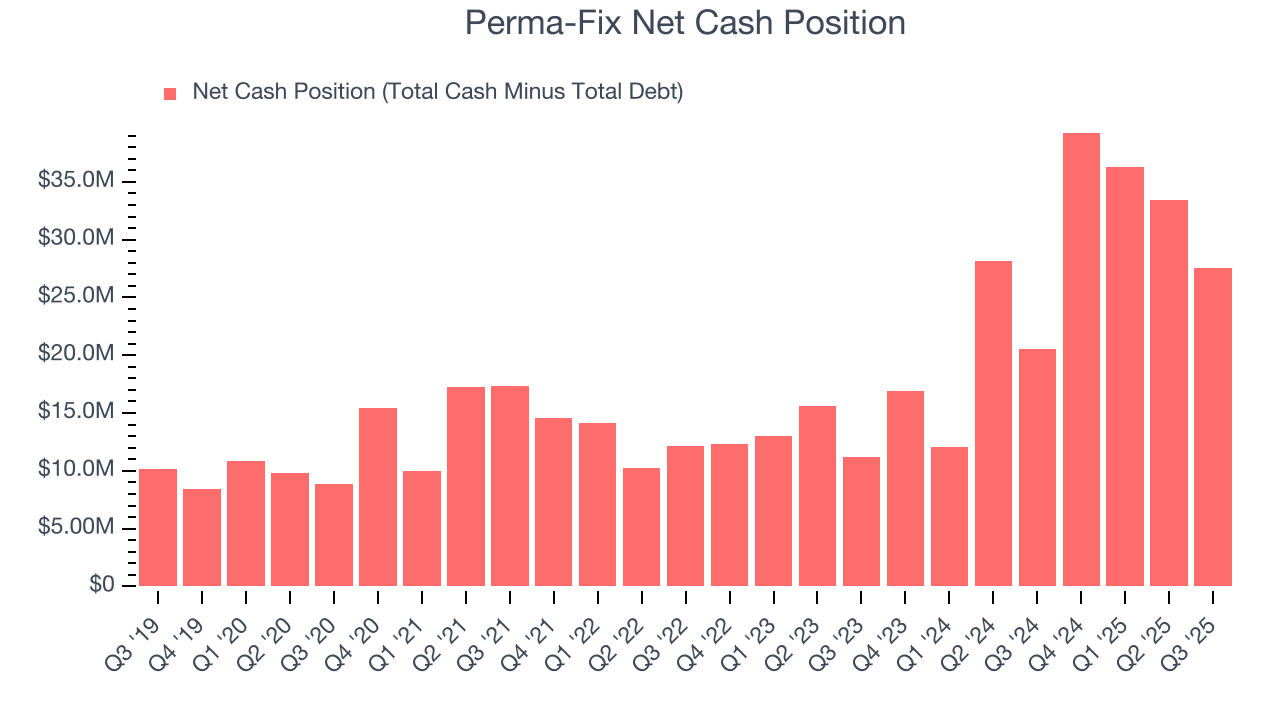

9. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Perma-Fix burned through $15.72 million of cash over the last year. With $29.5 million of cash on its balance sheet, the company has around 23 months of runway left (assuming its $1.95 million of debt isn’t due right away).

Unless the Perma-Fix’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Perma-Fix until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

10. Key Takeaways from Perma-Fix’s Q3 Results

We were impressed by how significantly Perma-Fix blew past analysts’ revenue expectations this quarter. EPS also managed to come in ahead of Wall Street’s. Zooming out, we think this was a solid print. The stock remained flat at $12.87 immediately following the results.

11. Is Now The Time To Buy Perma-Fix?

Updated: February 24, 2026 at 10:50 PM EST

Are you wondering whether to buy Perma-Fix or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Perma-Fix doesn’t pass our quality test. To begin with, its revenue has declined over the last five years. While its projected EPS for the next year implies the company will start generating shareholder value, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Perma-Fix’s P/E ratio based on the next 12 months is 437.3x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $20 on the company (compared to the current share price of $13).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.