Quest Resource (QRHC)

We wouldn’t buy Quest Resource. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Quest Resource Will Underperform

Recycling corporate waste to help companies be more sustainable, Quest Resource (NASDAQ:QRHC) is a provider of waste and recycling services.

- Annual sales declines of 3.6% for the past two years show its products and services struggled to connect with the market during this cycle

- Incremental sales over the last five years were much less profitable as its earnings per share fell by 49.1% annually while its revenue grew

- High net-debt-to-EBITDA ratio of 7× increases the risk of forced asset sales or dilutive financing if operational performance weakens

Quest Resource doesn’t meet our quality criteria. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Quest Resource

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Quest Resource

Quest Resource is trading at $1.85 per share, or 47.8x forward P/E. The current multiple is quite expensive, especially for the fundamentals of the business.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Quest Resource (QRHC) Research Report: Q3 CY2025 Update

Waste and recycling services provider Quest Resource (NASDAQ:QRHC) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 13% year on year to $63.34 million. Its non-GAAP loss of $0.02 per share was $0.01 below analysts’ consensus estimates.

Quest Resource (QRHC) Q3 CY2025 Highlights:

- Revenue: $63.34 million vs analyst estimates of $59.83 million (13% year-on-year decline, 5.9% beat)

- Adjusted EPS: -$0.02 vs analyst estimates of -$0.01 ($0.01 miss)

- Adjusted EBITDA: $2.94 million vs analyst estimates of $2.35 million (4.6% margin, relatively in line)

- Operating Margin: 1.7%, up from -1.3% in the same quarter last year

- Market Capitalization: $30.03 million

Company Overview

Recycling corporate waste to help companies be more sustainable, Quest Resource (NASDAQ:QRHC) is a provider of waste and recycling services.

Founded in 2002, Quest Resource creates customer-specific programs for the collection, processing, recycling, disposal, and tracking of waste streams and recyclables. The company operates through two primary service offerings: Waste and Recycling Services and Data and Reporting.

In the Waste and Recycling Services segment, Quest Resource provides a single-source solution for the reuse, recycling, and disposal of waste streams and recyclables generated by its customers' operations. This includes services for cardboard, paper, metals, used motor oil, scrap tires, plastics, grease, cooking oil, food waste, glass, and various other materials.

Quest Resource serves a range of industries, including automotive, industrial/manufacturing, distribution and logistics, hospitality and retail, property management, and construction and demolition. Additionally, it has made a few notable acquisitions in recent years, including the purchase of Green Remedies Waste and Recycling in 2020 and RWS Facility Services in 2021. These acquisitions expanded Quest's range of environmental services and product lines, adding new capabilities in waste management, recycling, and facility services.

4. Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

Competitors of Quest Resource include Waste Management (NYSE:WM), Republic Services (NYSE:RSG), and Waste Connections (NYSE:WCN).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Quest Resource’s sales grew at an incredible 22.7% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Quest Resource’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 3.6% over the last two years.

This quarter, Quest Resource’s revenue fell by 13% year on year to $63.34 million but beat Wall Street’s estimates by 5.9%.

Looking ahead, sell-side analysts expect revenue to decline by 3.4% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its newer products and services will not lead to better top-line performance yet.

6. Gross Margin & Pricing Power

For industrials businesses, cost of sales is usually comprised of the direct labor, raw materials, and supplies needed to offer a product or service. These costs can be impacted by inflation and supply chain dynamics in the short term and a company’s purchasing power and scale over the long term.

Quest Resource has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 17.5% gross margin over the last five years. That means Quest Resource paid its suppliers a lot of money ($82.47 for every $100 in revenue) to run its business.

This quarter, Quest Resource’s gross profit margin was 18.1%, marking a 2 percentage point increase from 16.1% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

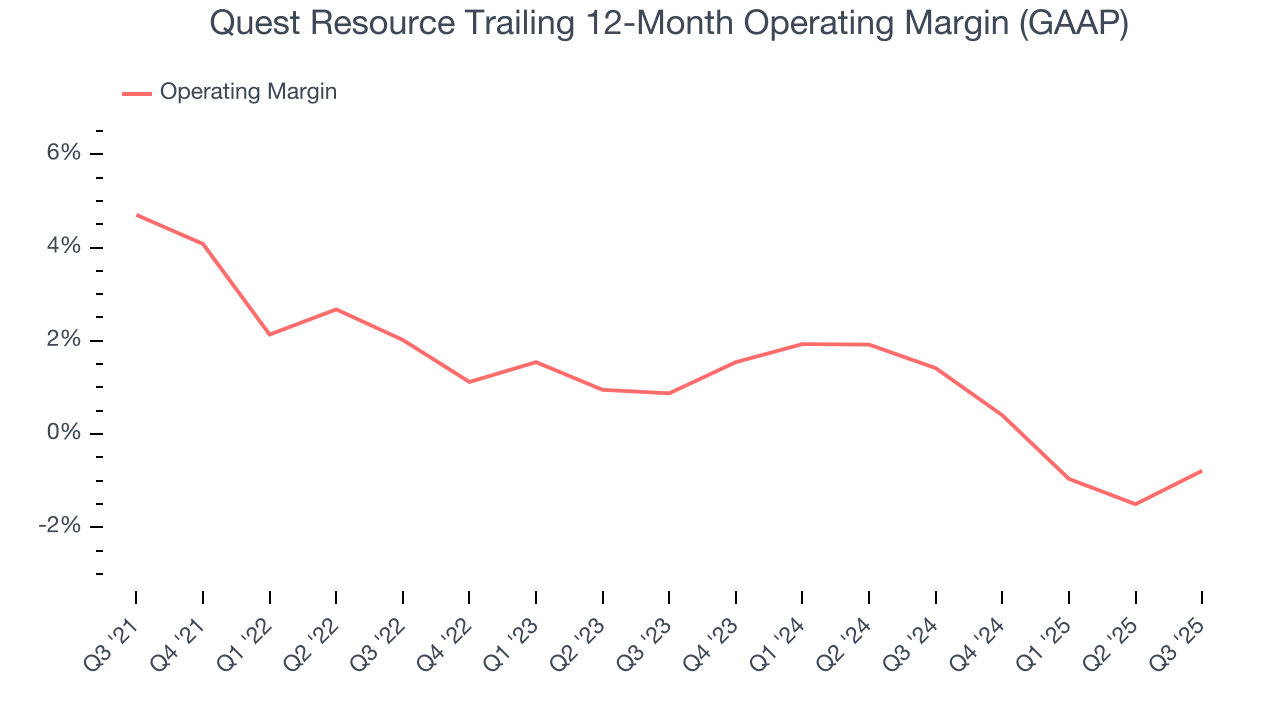

7. Operating Margin

Quest Resource was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.3% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Quest Resource’s operating margin decreased by 5.5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Quest Resource’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q3, Quest Resource generated an operating margin profit margin of 1.7%, up 3 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

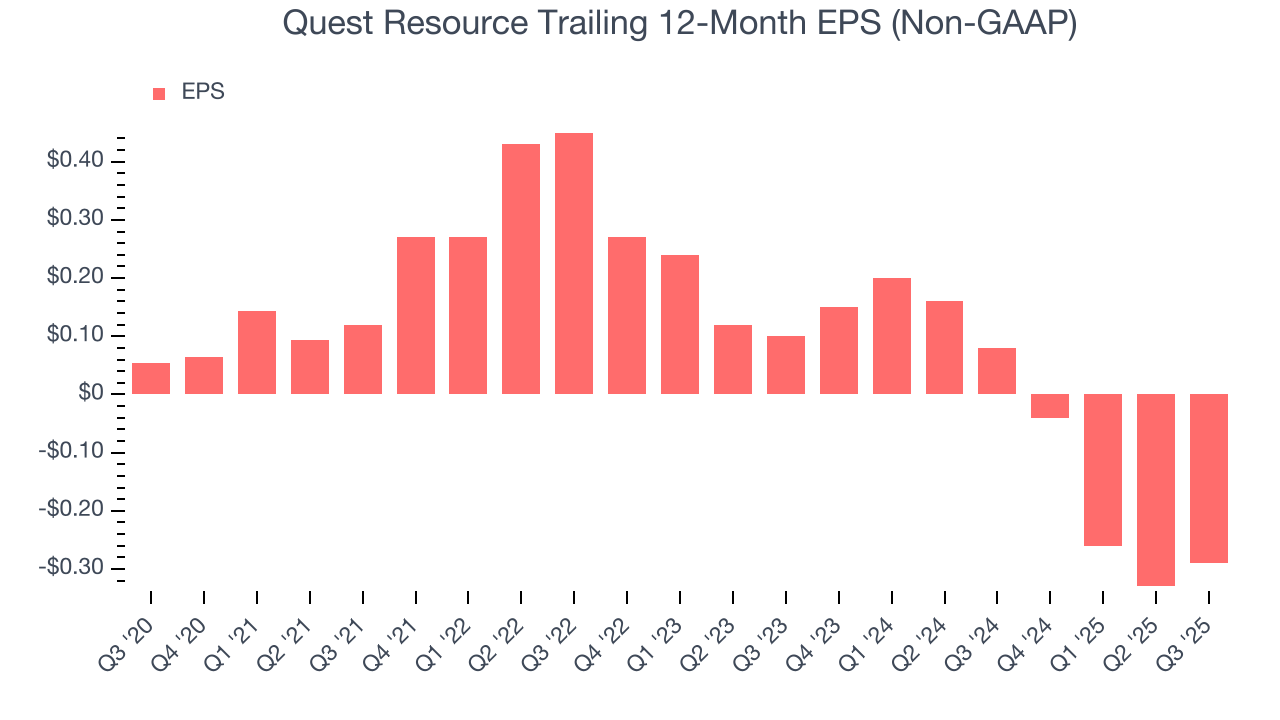

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Quest Resource, its EPS declined by 49.1% annually over the last five years while its revenue grew by 22.7%. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

Diving into the nuances of Quest Resource’s earnings can give us a better understanding of its performance. As we mentioned earlier, Quest Resource’s operating margin expanded this quarter but declined by 5.5 percentage points over the last five years. Its share count also grew by 21.6%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Quest Resource, its two-year annual EPS declines of 121% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q3, Quest Resource reported adjusted EPS of negative $0.02, up from negative $0.06 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Quest Resource’s full-year EPS of negative $0.29 will flip to positive $0.04.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Quest Resource broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, we can see that Quest Resource’s margin dropped by 8.4 percentage points during that time. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Quest Resource historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.9%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Quest Resource’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

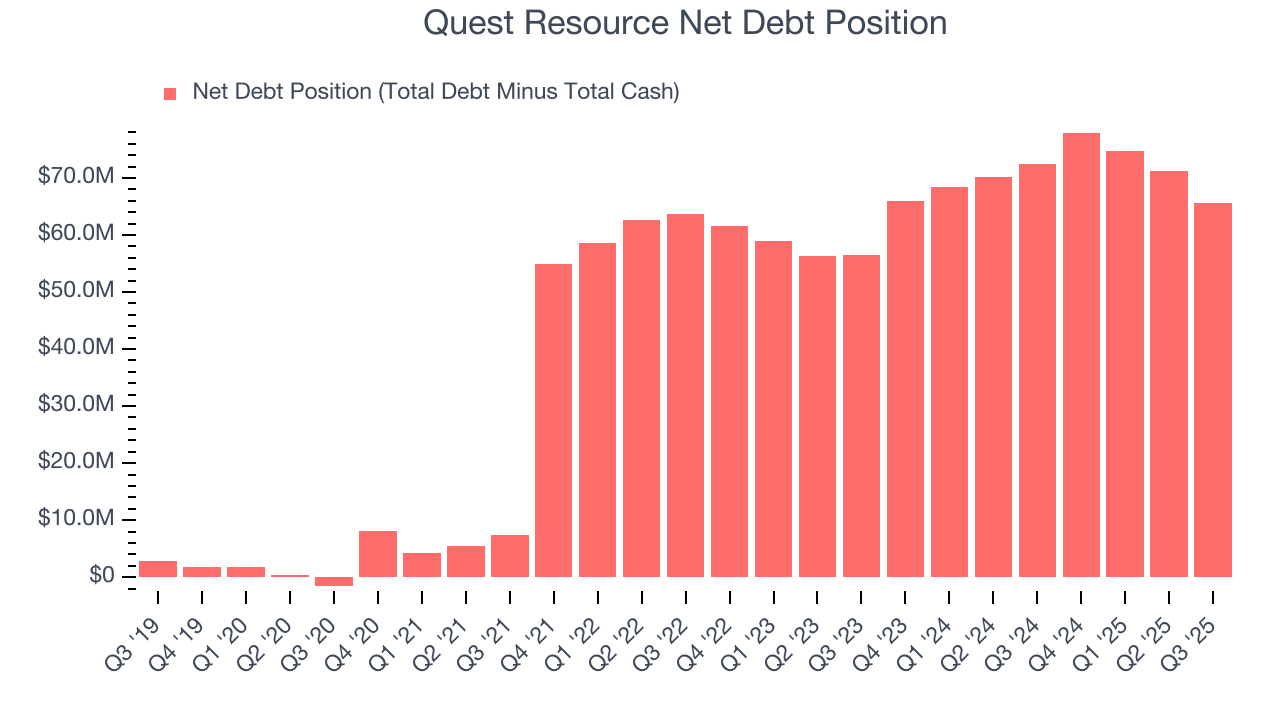

11. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Quest Resource’s $66.8 million of debt exceeds the $1.15 million of cash on its balance sheet. Furthermore, its 7× net-debt-to-EBITDA ratio (based on its EBITDA of $8.85 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Quest Resource could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Quest Resource can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

12. Key Takeaways from Quest Resource’s Q3 Results

We were impressed by how significantly Quest Resource blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its EPS was in line. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $1.41 immediately following the results.

13. Is Now The Time To Buy Quest Resource?

Updated: February 26, 2026 at 10:38 PM EST

Before deciding whether to buy Quest Resource or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We cheer for all companies making their customers lives easier, but in the case of Quest Resource, we’ll be cheering from the sidelines. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Quest Resource’s P/E ratio based on the next 12 months is 47.8x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $3.08 on the company (compared to the current share price of $1.85).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.