Impinj (PI)

Impinj is intriguing. Its revenue and EPS are soaring, showing it can grow quickly and become more profitable as it scales.― StockStory Analyst Team

1. News

2. Summary

Why Impinj Is Interesting

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ:PI) is a maker of radio-frequency identification (RFID) hardware and software.

- Performance over the past five years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 49.4% outpaced its revenue gains

- Annual revenue growth of 20.2% over the past five years was outstanding, reflecting market share gains this cycle

- One pitfall is its negative returns on capital show management lost money while trying to expand the business

Impinj has some noteworthy aspects. This is a good stock to keep your eye on.

Why Should You Watch Impinj

High Quality

Investable

Underperform

Why Should You Watch Impinj

Impinj’s stock price of $152.89 implies a valuation ratio of 59.9x forward P/E. The market has high expectations, which are reflected in the premium multiple. This can result in short-term volatility if anything (e.g. a quarterly earnings miss) remotely dampens those hopes.

Impinj could improve its business quality by stringing together a few solid quarters. We’d be more open to buying the stock when that time comes.

3. Impinj (PI) Research Report: Q4 CY2025 Update

RFID manufacturer Impinj (NASDAQ:PI) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 1.4% year on year to $92.85 million. On the other hand, next quarter’s revenue guidance of $72.5 million was less impressive, coming in 19.9% below analysts’ estimates. Its GAAP loss of $0.04 per share was in line with analysts’ consensus estimates.

Impinj (PI) Q4 CY2025 Highlights:

- Revenue: $92.85 million vs analyst estimates of $92.44 million (1.4% year-on-year growth, in line)

- EPS (GAAP): -$0.04 vs analyst estimates of -$0.04 (in line)

- Adjusted EBITDA: $16.43 million vs analyst estimates of $18.14 million (17.7% margin, 9.4% miss)

- Revenue Guidance for Q1 CY2026 is $72.5 million at the midpoint, below analyst estimates of $90.56 million

- EBITDA guidance for Q1 CY2026 is $1.95 million at the midpoint, below analyst estimates of $12.78 million

- Operating Margin: -2.9%, up from -3.9% in the same quarter last year

- Free Cash Flow Margin: 14.7%, up from 9.3% in the same quarter last year

- Inventory Days Outstanding: 173, down from 177 in the previous quarter

- Market Capitalization: $4.58 billion

Company Overview

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ:PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj was founded in 2000, and the company’s name stands for “impact-ionized hot-electron injection”. Impinj went public in 2016, touted as a cornerstone in the ‘Internet of Things’ revolution.

Visibility into exact inventory positions can help retailers avoid costly out-of-stock positions. Data related to units passing through a supply chain can increase operational efficiencies. However, digitally connecting every consumer product on a grocer’s shelf or every component passing through an automotive supply chain was historically too difficult or costly.

Impinj addresses this problem with the RFID technology it pioneered. The company’s key product consists of endpoint chips that can wirelessly connect to most physical things, leading to item-to-cloud connectivity. Because these radios-on-a-chip cost pennies, they can be deployed at a massive scale. Each of Impinj’s chips attaches to a host item and includes an identifying number. The chip may also include features such as user data storage, security or loss prevention. When a consumer uses self-checkout, for example, RFID can help the retailer manage inventory by highlighting exactly what is being bought while also providing insights on theft by identifying items that leave the store without being scanned.

Competitors offering endpoint chips include NXP B.V., EM Microelectronic, and Alien Technology.

4. Revenue Growth

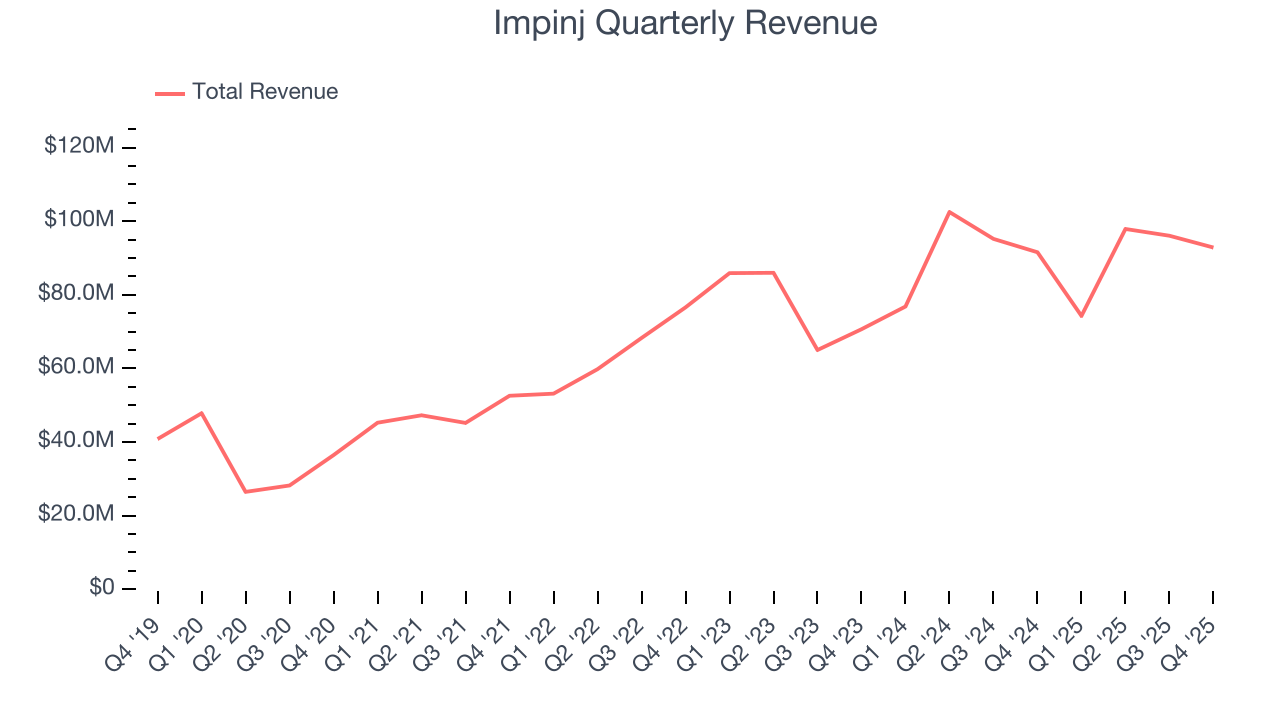

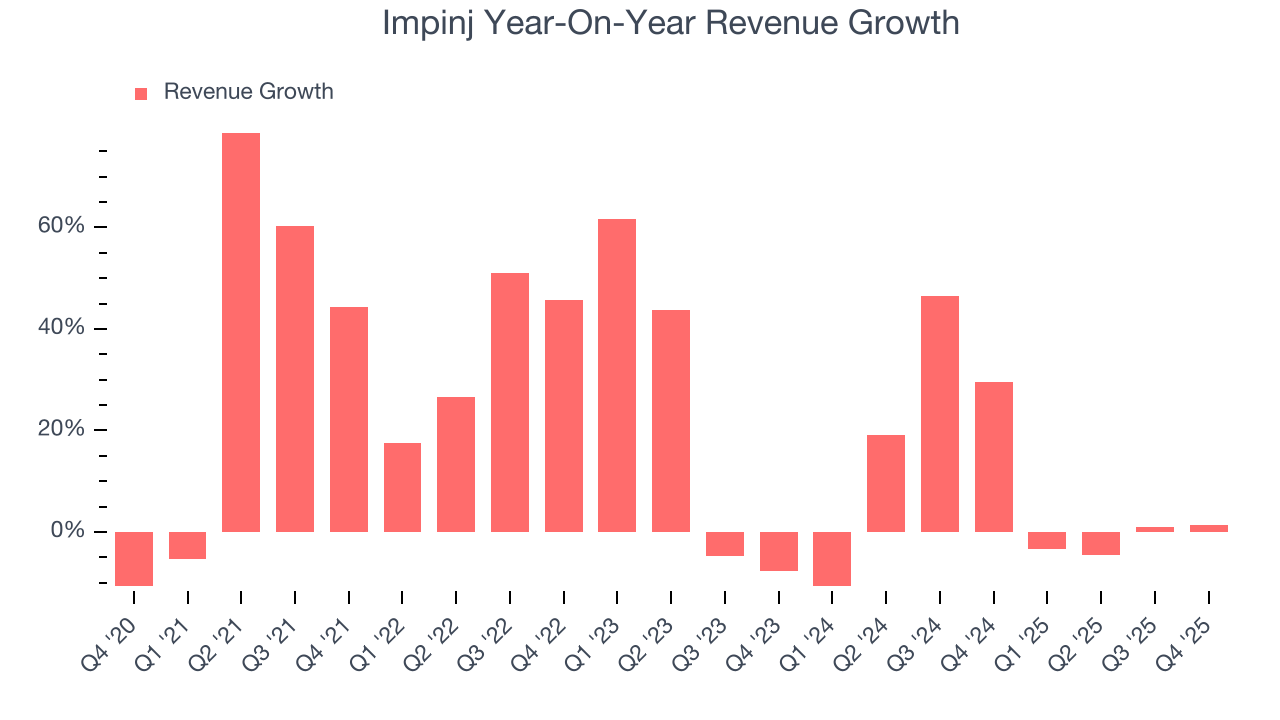

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Impinj grew its sales at an exceptional 21% compounded annual growth rate. Its growth beat the average semiconductor company and shows its offerings resonate with customers, a helpful starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Impinj’s annualized revenue growth of 8.4% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Impinj grew its revenue by 1.4% year on year, and its $92.85 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 2.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 22.5% over the next 12 months, an improvement versus the last two years. This projection is commendable and suggests its newer products and services will spur better top-line performance.

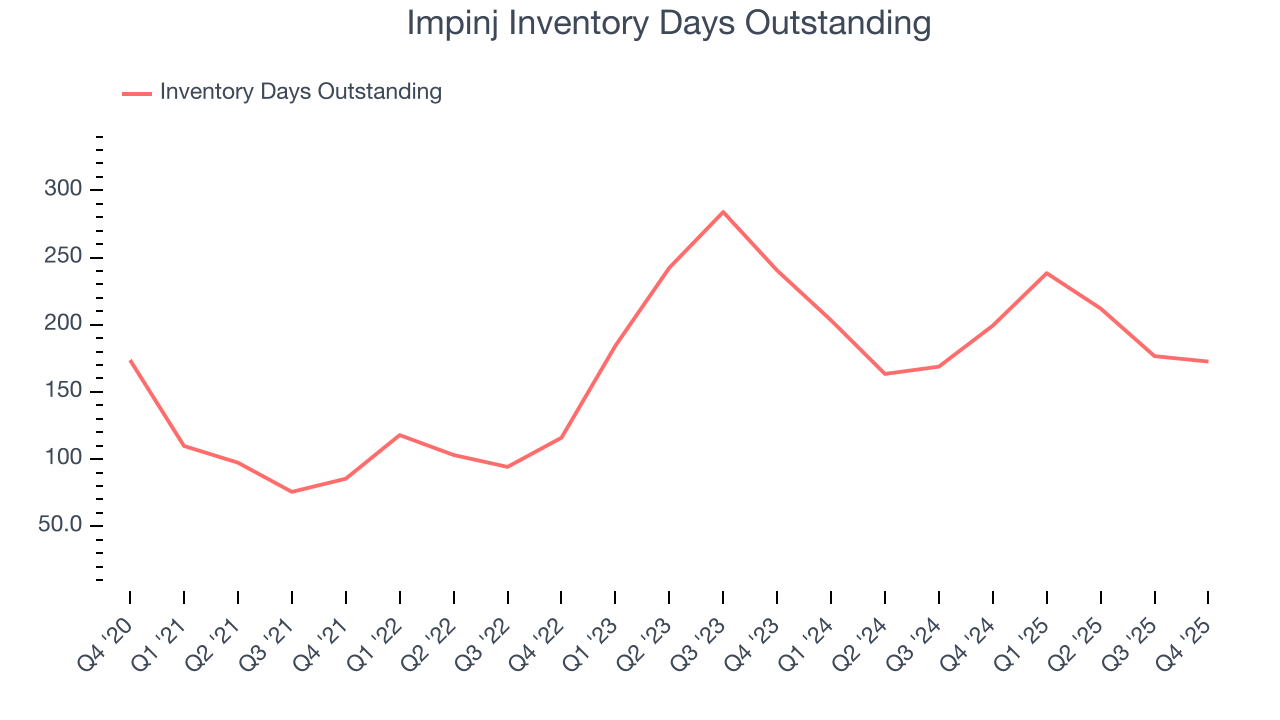

5. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Impinj’s DIO came in at 173, which is 8 days above its five-year average. These numbers suggest that despite the recent decrease, the company’s inventory levels are higher than what we’ve seen in the past.

6. Gross Margin & Pricing Power

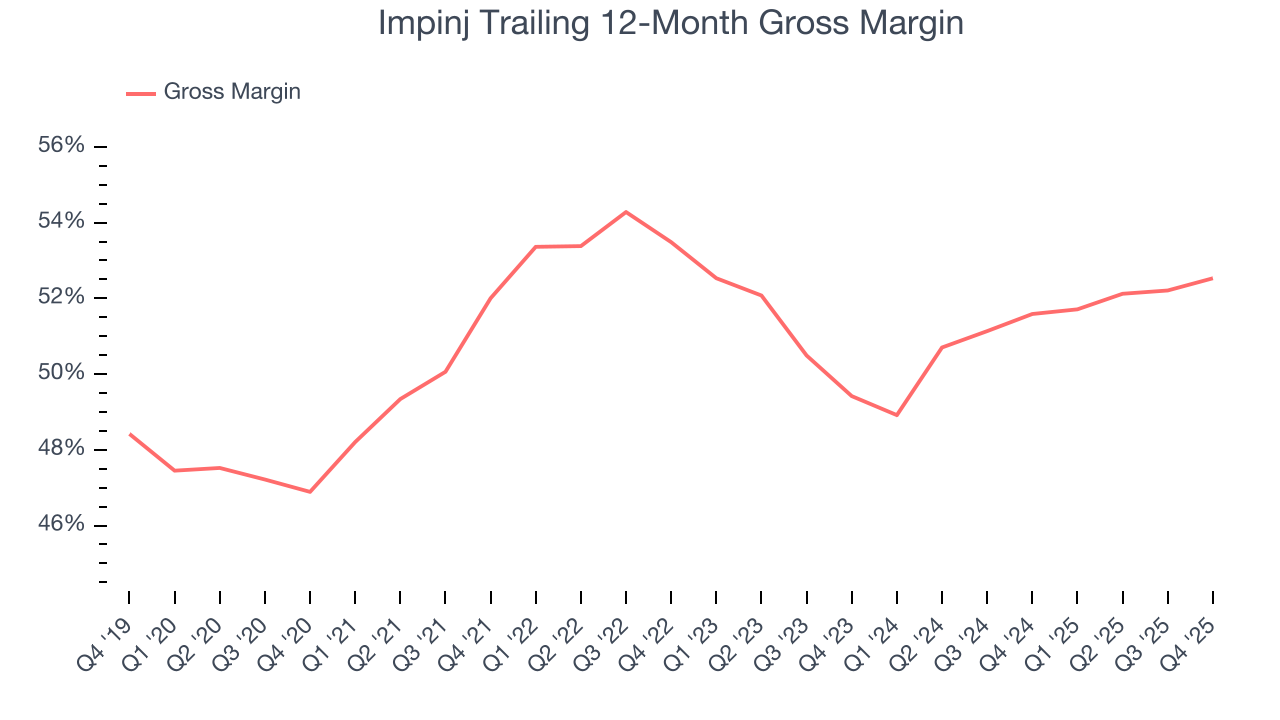

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Impinj’s unit economics are reasonably high for a semiconductor business, pointing to a lack of meaningful pricing pressure and its products’ solid competitive positioning. As you can see below, it averaged an impressive 52.1% gross margin over the last two years. Said differently, Impinj paid its suppliers $47.94 for every $100 in revenue.

In Q4, Impinj produced a 51.8% gross profit margin, marking a 1.3 percentage point increase from 50.5% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

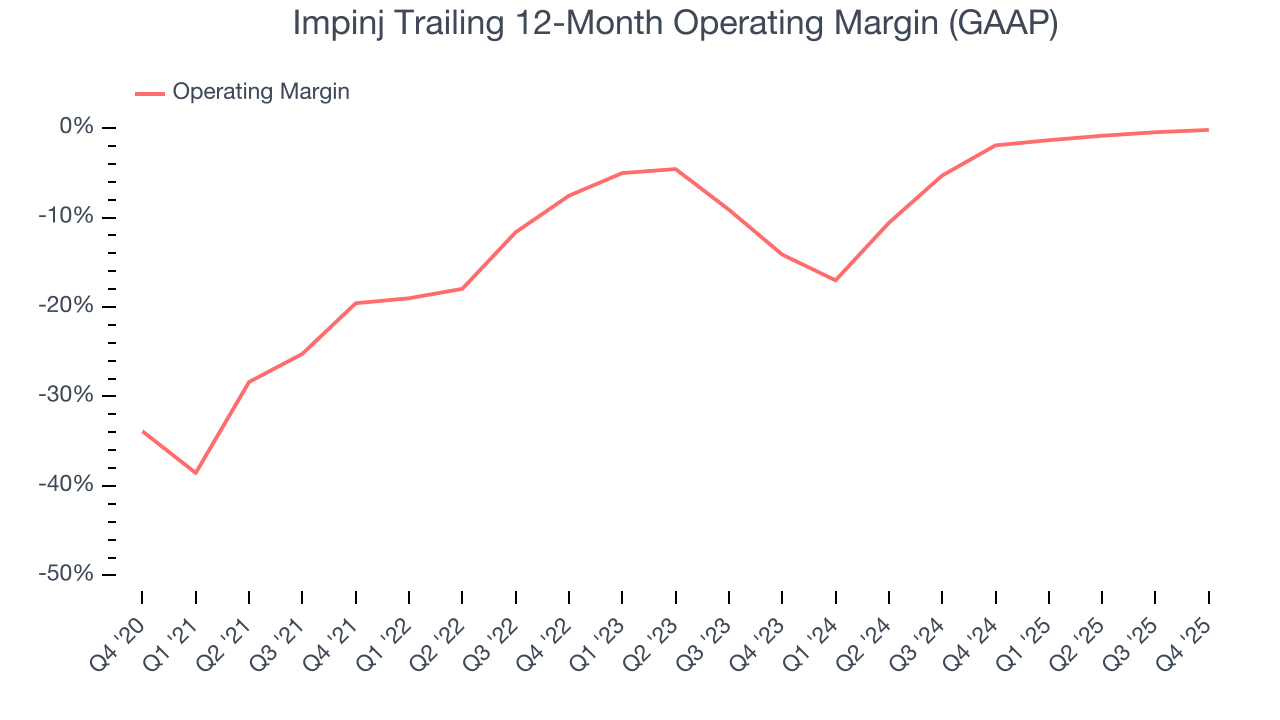

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Impinj’s high expenses have contributed to an average operating margin of negative 1.1% over the last two years. Unprofitable semiconductor companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Impinj’s operating margin rose by 19.4 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

This quarter, Impinj generated a negative 2.9% operating margin.

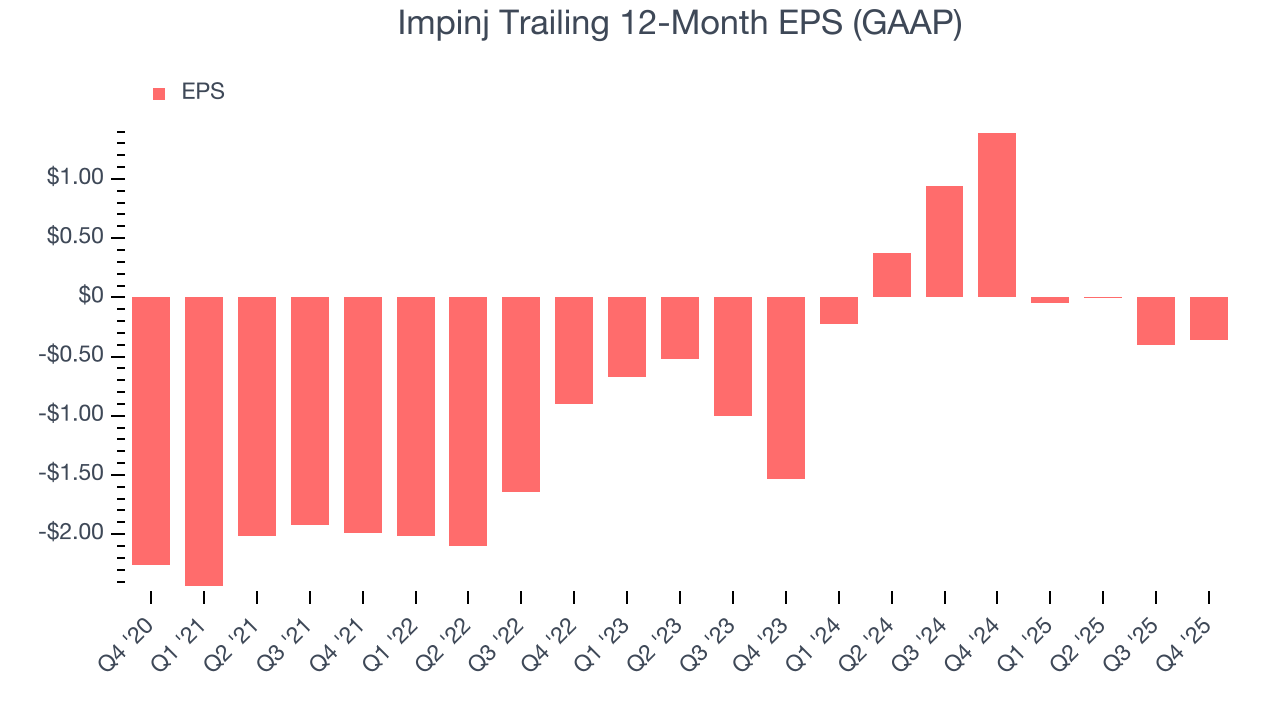

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Although Impinj’s full-year earnings are still negative, it reduced its losses and improved its EPS by 30.7% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q4, Impinj reported EPS of negative $0.04, up from negative $0.08 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast Impinj’s full-year EPS of negative $0.36 will flip to positive $0.68.

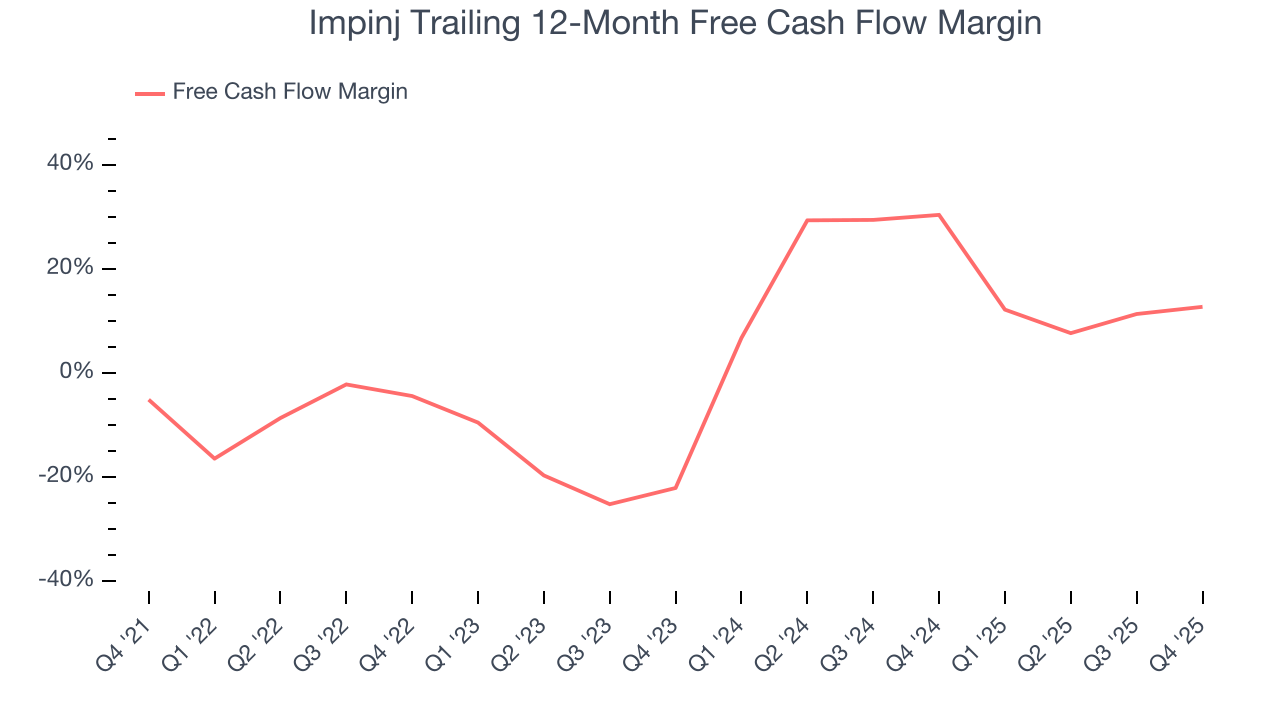

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Impinj has shown impressive cash profitability, and if maintainable, will be in a position to ride out cyclical downturns more easily while continuing to invest in new and existing products. The company’s free cash flow margin averaged 21.6% over the last two years, better than the broader semiconductor sector.

Taking a step back, we can see that Impinj’s margin expanded by 17.8 percentage points over the last five years. This is encouraging because it gives the company more optionality.

Impinj’s free cash flow clocked in at $13.62 million in Q4, equivalent to a 14.7% margin. This result was good as its margin was 5.4 percentage points higher than in the same quarter last year, building on its favorable historical trend.

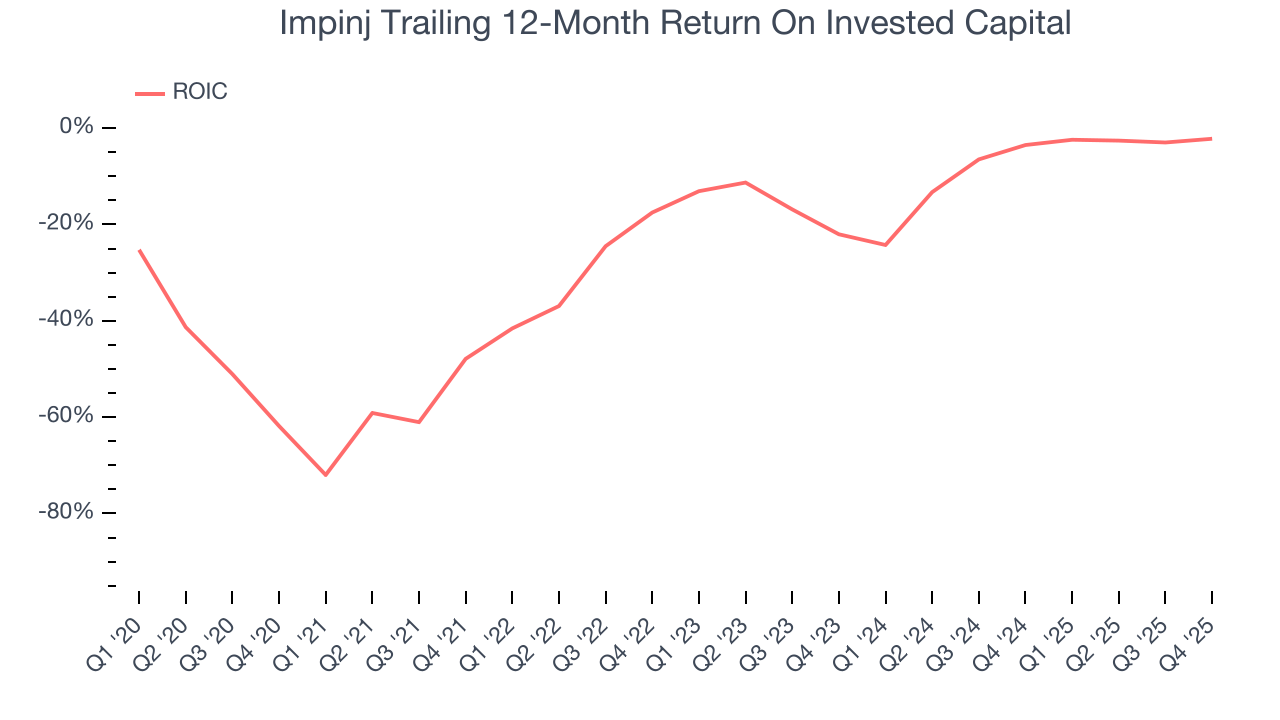

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Impinj has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 18.6%, meaning management lost money while trying to expand the business.

11. Balance Sheet Assessment

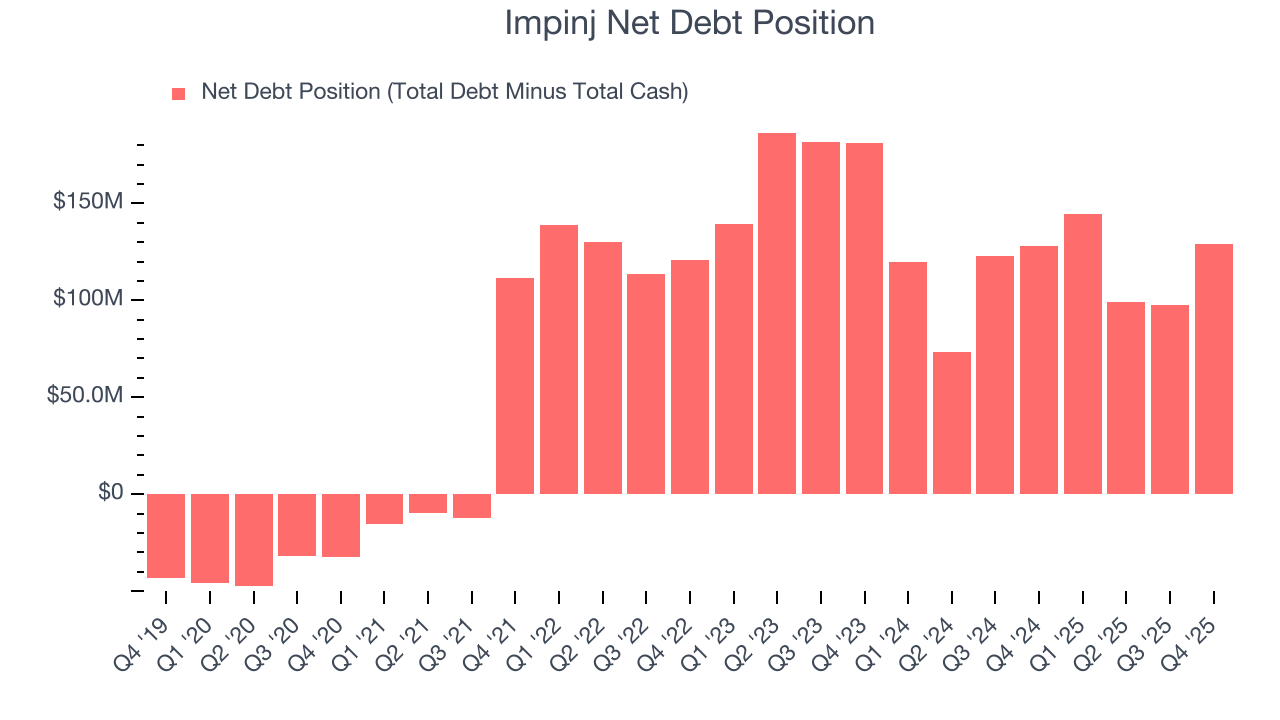

Impinj reported $175.3 million of cash and $304.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $69.57 million of EBITDA over the last 12 months, we view Impinj’s 1.9× net-debt-to-EBITDA ratio as safe. We also see its $3.93 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Impinj’s Q4 Results

It was good to see Impinj improve its inventory levels, even if just slightly. On the other hand, its EBITDA missed and revenue guidance for next quarter missed. Overall, this was a weaker quarter. The stock traded down 18.4% to $126.09 immediately following the results.

13. Is Now The Time To Buy Impinj?

Updated: February 5, 2026 at 4:45 PM EST

Before investing in or passing on Impinj, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

We think Impinj is a good business. First off, its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

Impinj’s P/E ratio based on the next 12 months is 54x. Looking at the semiconductor space right now, Impinj trades at a compelling valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $240 on the company (compared to the current share price of $126.09), implying they see 90.3% upside in buying Impinj in the short term.