Palantir Technologies (PLTR)

Not many stocks excite us like Palantir Technologies. Its rare blend of high growth, robust profitability, and a strong outlook makes it a wonderful asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like Palantir Technologies

Named after the all-seeing stones in "Lord of the Rings," Palantir Technologies (NASDAQ:PLTR) develops software platforms that help government agencies and enterprises integrate, analyze, and operationalize their data for decision-making.

- Billings have averaged 52.2% growth over the last year, showing it’s securing new contracts that could potentially increase in value over time

- Projected revenue growth of 48% for the next 12 months is above its two-year trend, pointing to accelerating demand

- Excellent operating margin highlights the strength of its business model, and its operating leverage amplified its profits over the last year

Palantir Technologies is a top-tier company. No coincidence the stock is up 374% over the last five years.

Is Now The Time To Buy Palantir Technologies?

High Quality

Investable

Underperform

Is Now The Time To Buy Palantir Technologies?

Palantir Technologies is trading at $146.96 per share, or 67.7x forward price-to-sales. There’s no arguing the market has lofty expectations given its premium multiple.

If you’re a fan of the business, we suggest making it a smaller position as our analysis shows high-quality companies outperform the market over a multi-year period regardless of valuation.

3. Palantir Technologies (PLTR) Research Report: Q4 CY2025 Update

Data analytics company Palantir Technologies (NASDAQ:PLTR) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 70% year on year to $1.41 billion. On top of that, next quarter’s revenue guidance ($1.53 billion at the midpoint) was surprisingly good and 15.3% above what analysts were expecting. Its non-GAAP profit of $0.25 per share was 8.6% above analysts’ consensus estimates.

Palantir Technologies (PLTR) Q4 CY2025 Highlights:

- Revenue: $1.41 billion vs analyst estimates of $1.34 billion (70% year-on-year growth, 4.9% beat)

- Adjusted EPS: $0.25 vs analyst estimates of $0.23 (8.6% beat)

- Adjusted Operating Income: $798.5 million vs analyst estimates of $701.1 million (56.8% margin, 13.9% beat)

- Revenue Guidance for Q1 CY2026 is $1.53 billion at the midpoint, above analyst estimates of $1.33 billion

- Operating Margin: 40.9%, up from 1.3% in the same quarter last year

- Free Cash Flow Margin: 56.3%, up from 45.7% in the previous quarter

- Market Capitalization: $349.4 billion

Company Overview

Named after the all-seeing stones in "Lord of the Rings," Palantir Technologies (NASDAQ:PLTR) develops software platforms that help government agencies and enterprises integrate, analyze, and operationalize their data for decision-making.

Palantir's core offerings include four main platforms: Gotham, Foundry, Apollo, and its Artificial Intelligence Platform (AIP). Gotham, originally designed for intelligence and defense agencies, helps users discover hidden patterns in complex datasets and facilitates operational responses to identified threats. Foundry serves as a central operating system for an organization's data, allowing users across technical skill levels to integrate, analyze, and collaborate on information. Apollo enables continuous software delivery across various environments, while AIP connects large language models with enterprise data systems.

The company's platforms are distinguished by their ability to handle massive datasets and complex integrations while maintaining rigorous security protocols. For example, a law enforcement agency might use Gotham to analyze intelligence from multiple sources to identify criminal networks, while a manufacturing company could use Foundry to optimize supply chains by integrating production, inventory, and logistics data.

Palantir generates revenue through software subscriptions and implementation services. Its customer base spans approximately 80 industries across both public and private sectors, with government contracts—particularly with U.S. defense and intelligence agencies—forming a significant portion of its business. The company has been expanding its commercial customer base and developing industry-specific operating systems through partnerships with major cloud providers and companies in sectors including healthcare, automotive, and insurance.

4. Data Analytics

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the siloed data.

Palantir's competitors include large enterprise software providers like Microsoft (NASDAQ:MSFT) and Salesforce (NYSE:CRM), data analytics firms such as Snowflake (NYSE:SNOW) and Databricks (NASDAQ:DBKS), as well as specialized government contractors like Booz Allen Hamilton (NYSE:BAH) and internal software development teams at large organizations.

5. Revenue Growth

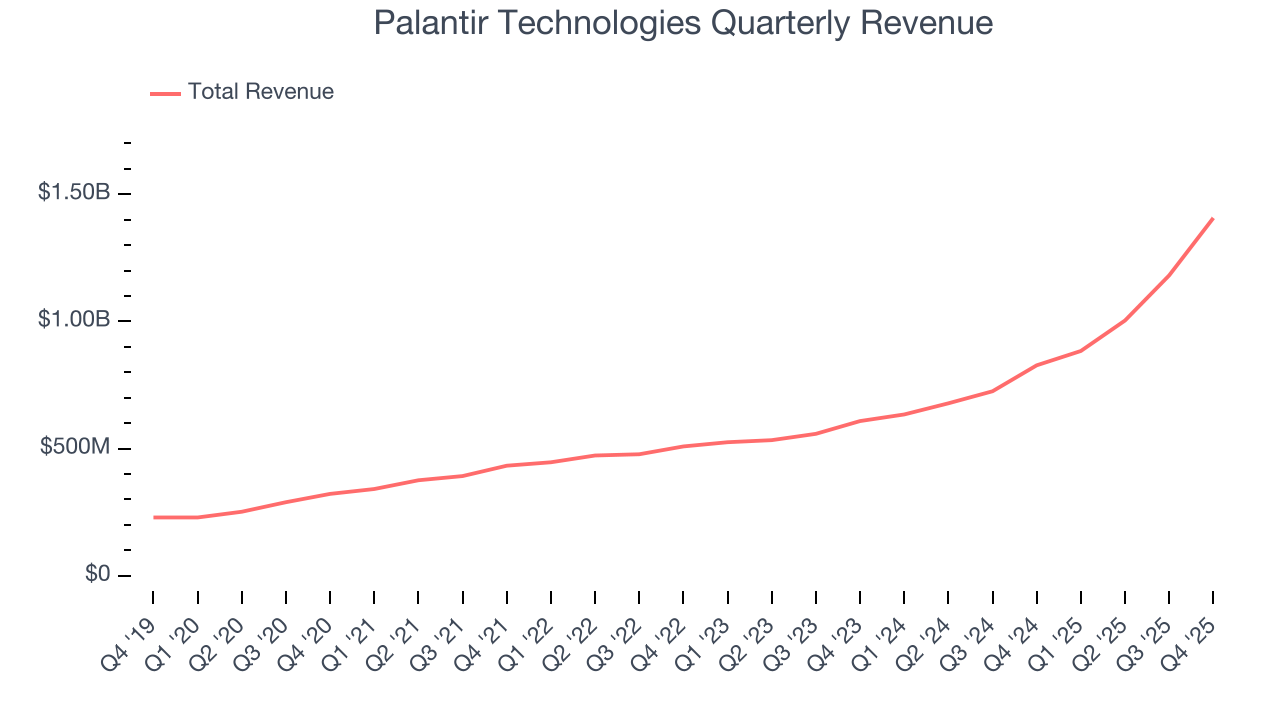

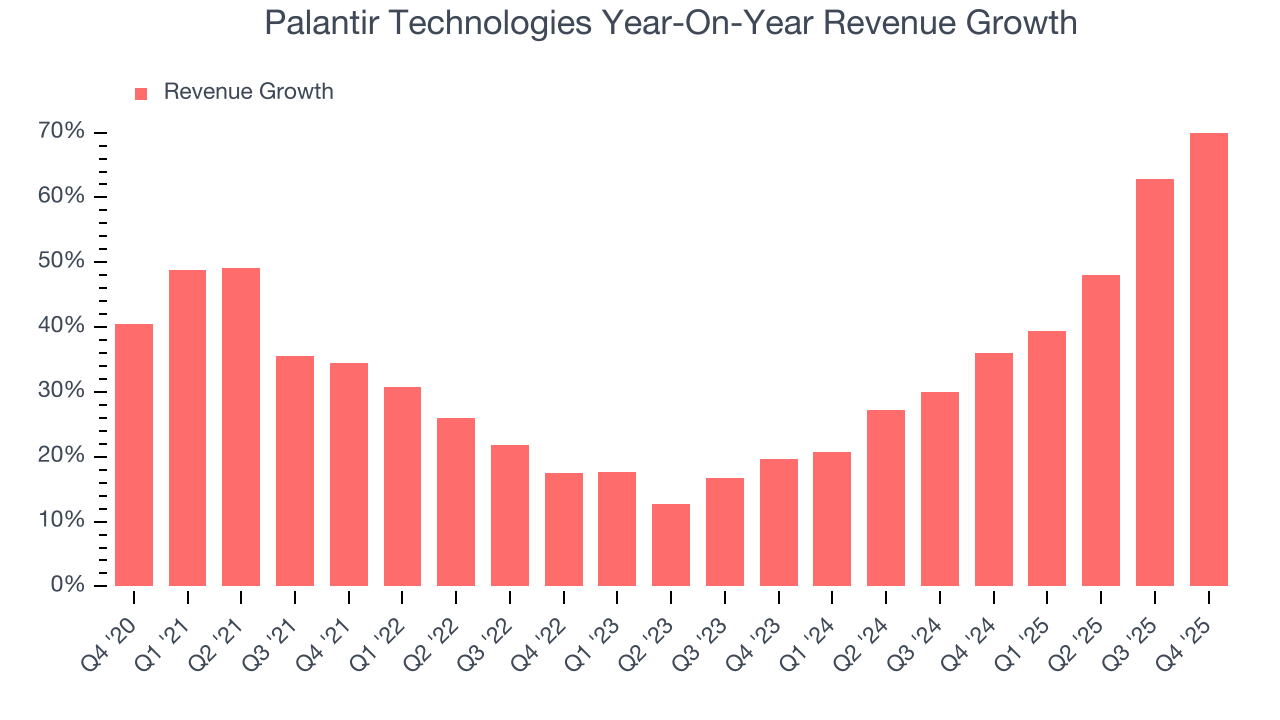

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Palantir Technologies’s sales grew at an excellent 32.6% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Palantir Technologies’s annualized revenue growth of 41.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Palantir Technologies reported magnificent year-on-year revenue growth of 70%, and its $1.41 billion of revenue beat Wall Street’s estimates by 4.9%. Company management is currently guiding for a 73.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 39.5% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is commendable and implies the market is forecasting success for its products and services.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Palantir Technologies is extremely efficient at acquiring new customers, and its CAC payback period checked in at 8.9 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Palantir Technologies more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

7. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

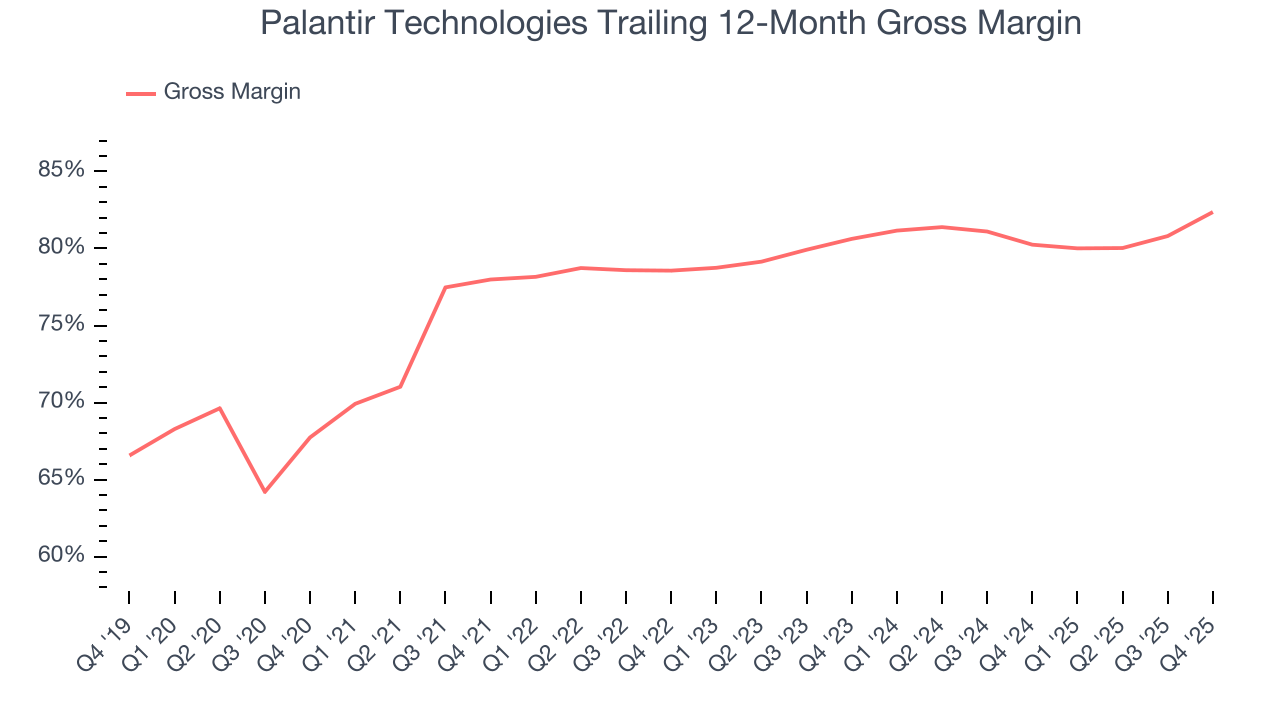

Palantir Technologies’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 82.4% gross margin over the last year. That means Palantir Technologies only paid its providers $17.63 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Palantir Technologies has seen gross margins improve by 1.7 percentage points over the last 2 year, which is solid in the software space.

This quarter, Palantir Technologies’s gross profit margin was 84.6%, up 5.7 percentage points year on year. Palantir Technologies’s full-year margin has also been trending up over the past 12 months, increasing by 2.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

8. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

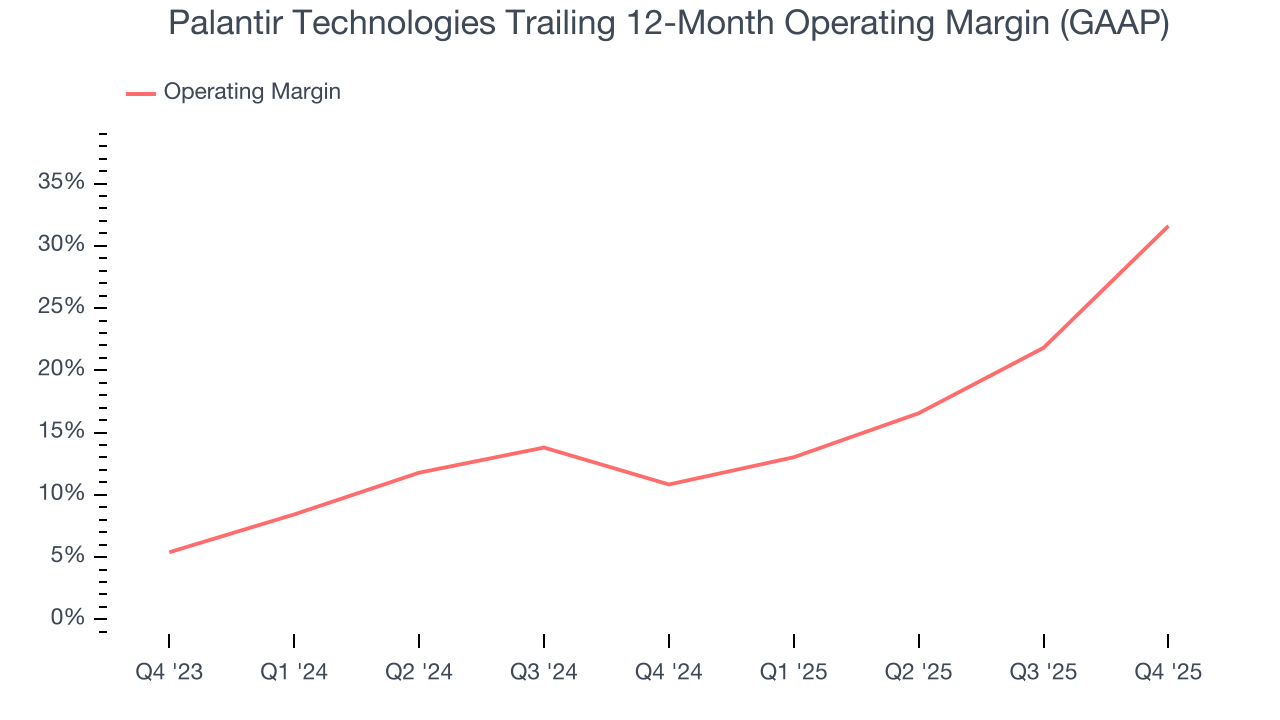

Palantir Technologies has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 31.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Palantir Technologies’s operating margin rose by 20.8 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, Palantir Technologies generated an operating margin profit margin of 40.9%, up 39.6 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

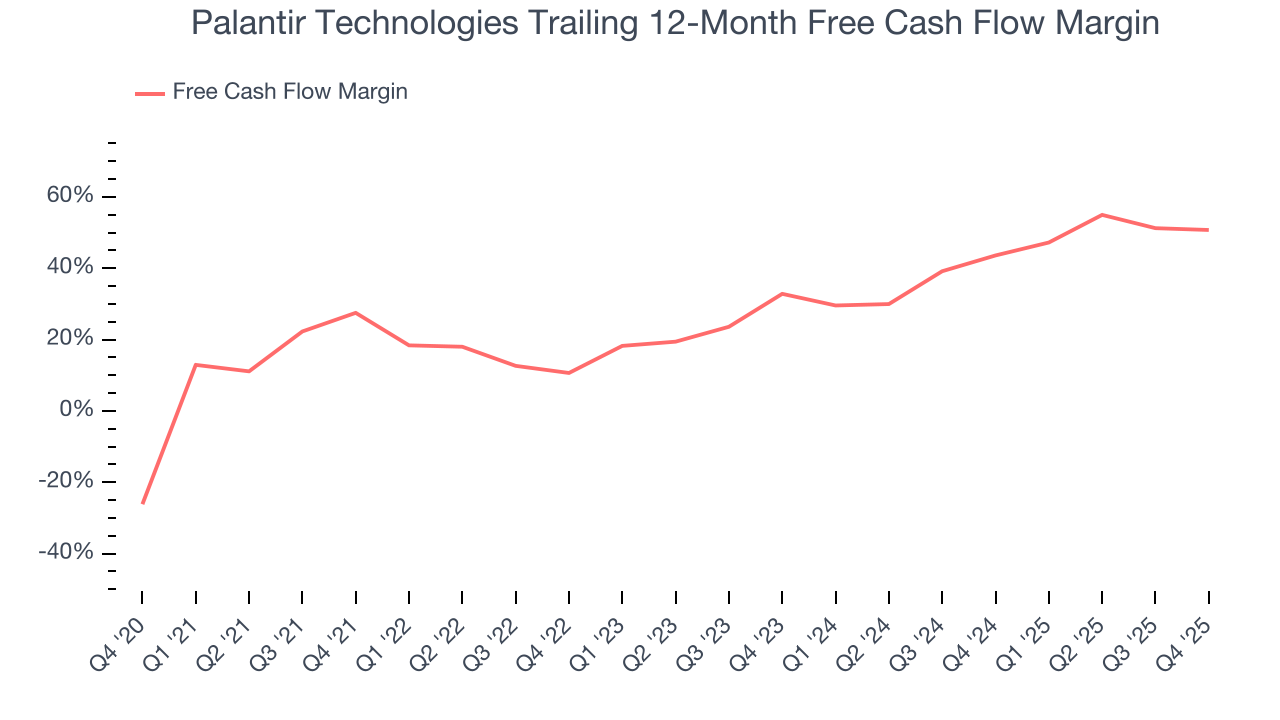

Palantir Technologies has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 50.7% over the last year.

Palantir Technologies’s free cash flow clocked in at $791.4 million in Q4, equivalent to a 56.3% margin. The company’s cash profitability regressed as it was 6.3 percentage points lower than in the same quarter last year, but it’s still above its one-year average. We wouldn’t put too much weight on this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Over the next year, analysts predict Palantir Technologies’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 50.7% for the last 12 months will decrease to 40.3%.

10. Balance Sheet Assessment

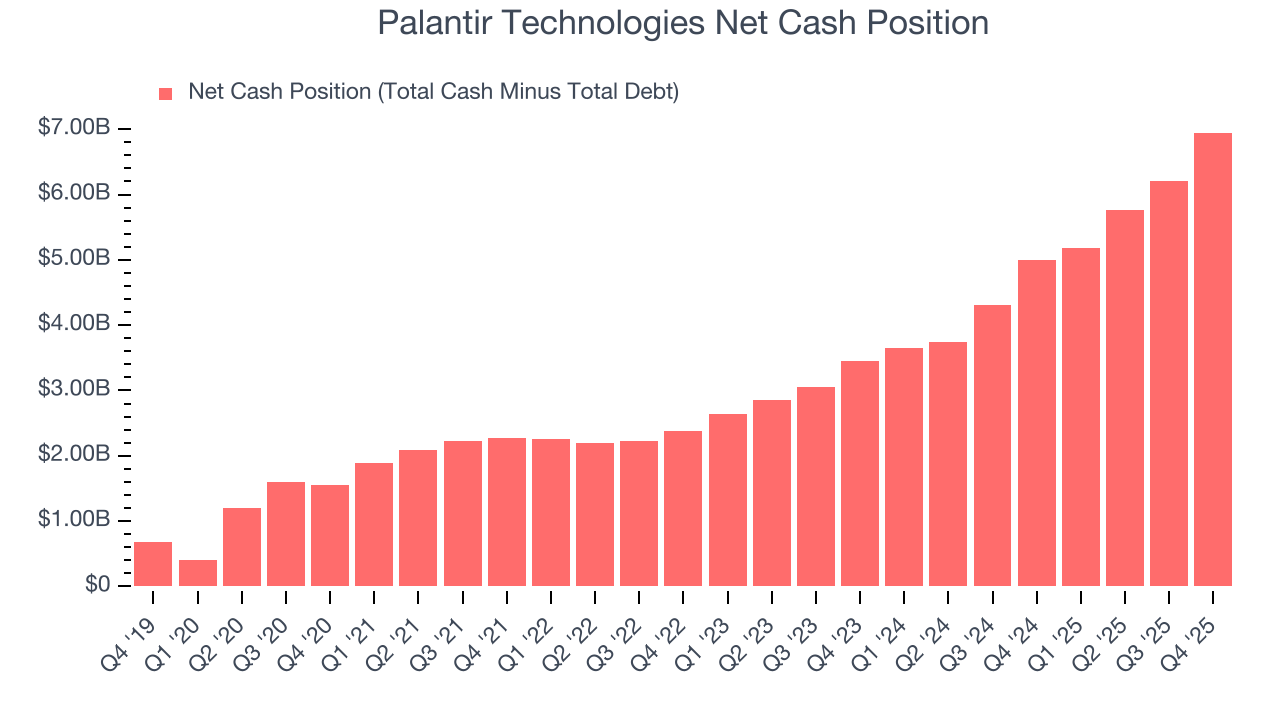

Big corporations like Palantir Technologies are attractive to many investors in times of instability thanks to their fortress balance sheets that buffer pockets of soft demand.

Palantir Technologies is a profitable, well-capitalized company with $7.18 billion of cash and $229.3 million of debt on its balance sheet. This $6.95 billion net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Palantir Technologies’s Q4 Results

We were impressed by how significantly Palantir Technologies blew past analysts’ adjusted operating come expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 4.2% to $154.49 immediately after reporting.

12. Is Now The Time To Buy Palantir Technologies?

Updated: February 2, 2026 at 4:23 PM EST

Before making an investment decision, investors should account for Palantir Technologies’s business fundamentals and valuation in addition to what happened in the latest quarter.

Palantir Technologies is a cream-of-the-crop software company. For starters, its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months. On top of that, its bountiful generation of free cash flow empowers it to invest in growth initiatives, and its efficient sales strategy allows it to target and onboard new users at scale.

Palantir Technologies’s price-to-sales ratio based on the next 12 months is 60.9x. There’s no doubt it’s a bit of a market darling given the lofty multiple, but we don’t mind owning an elite business, even if it’s expensive. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with high valuations.

Wall Street analysts have a consensus one-year price target of $189.84 on the company (compared to the current share price of $154.49).