Insulet (PODD)

Insulet is a great business. Its revenue is growing quickly while its profitability is rising, giving it multiple ways to win.― StockStory Analyst Team

1. News

2. Summary

Why We Like Insulet

Revolutionizing diabetes care with its tubeless "Pod" technology, Insulet (NASDAQ:PODD) develops and manufactures innovative insulin delivery systems for people with diabetes, primarily through its Omnipod product line.

- Incremental sales significantly boosted profitability as its annual earnings per share growth of 58% over the last five years outstripped its revenue performance

- Market share will likely rise over the next 12 months as its expected revenue growth of 22.9% is robust

- Annual revenue growth of 27.3% over the past two years was outstanding, reflecting market share gains this cycle

Insulet is a market leader. This is easily one of the top healthcare stocks.

Is Now The Time To Buy Insulet?

High Quality

Investable

Underperform

Is Now The Time To Buy Insulet?

At $253.50 per share, Insulet trades at 42.1x forward P/E. The lofty multiple means expectations are high for this company over the next six to twelve months.

Do you like the company and believe the bull case? If so, you can own a smaller position, as our work shows that high-quality companies outperform the market over a multi-year period regardless of entry price.

3. Insulet (PODD) Research Report: Q4 CY2025 Update

Insulin delivery company Insulet Corporation (NASDAQ:PODD) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 31.2% year on year to $783.8 million. The company expects next quarter’s revenue to be around $716.9 million, close to analysts’ estimates. Its non-GAAP profit of $1.55 per share was 6% above analysts’ consensus estimates.

Insulet (PODD) Q4 CY2025 Highlights:

- Revenue: $783.8 million vs analyst estimates of $768.2 million (31.2% year-on-year growth, 2% beat)

- Adjusted EPS: $1.55 vs analyst estimates of $1.46 (6% beat)

- Adjusted EBITDA: $194 million vs analyst estimates of $187.2 million (24.8% margin, 3.6% beat)

- Revenue Guidance for Q1 CY2026 is $716.9 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: 18.7%, in line with the same quarter last year

- Free Cash Flow Margin: 6.1%, down from 15.7% in the same quarter last year

- Constant Currency Revenue rose 29% year on year (17.1% in the same quarter last year)

- Market Capitalization: $17.33 billion

Company Overview

Revolutionizing diabetes care with its tubeless "Pod" technology, Insulet (NASDAQ:PODD) develops and manufactures innovative insulin delivery systems for people with diabetes, primarily through its Omnipod product line.

The company's flagship Omnipod platform consists of small, lightweight, waterproof disposable Pods that adhere directly to the body, eliminating the need for external tubing required by conventional insulin pumps. Each Pod can be worn for up to three days, delivering insulin through a small flexible tube called a cannula. Users can place Pods on multiple body locations including the abdomen, arm, thigh, or lower back.

Insulet's product portfolio includes several generations of technology. The Omnipod 5 Automated Insulin Delivery System represents their most advanced offering, featuring an embedded algorithm that integrates with continuous glucose monitors to automatically adjust insulin dosing. The system can be controlled via a dedicated handheld device or through smartphone apps. Omnipod DASH, an earlier generation, provides continuous insulin delivery through a smartphone-like controller. The company has also developed Omnipod GO, a simplified system specifically designed for people with Type 2 diabetes who require daily long-acting insulin.

For a person with Type 1 diabetes, the Omnipod system might replace multiple daily injections. Instead of having to administer separate injections throughout the day, they wear a small Pod that automatically delivers a steady background dose of insulin, with the ability to administer additional doses for meals or to correct high blood glucose levels.

Insulet generates revenue by selling its disposable Pods and associated controllers. The company distributes its products through direct-to-consumer channels, distribution partners, and in the U.S., through pharmacy channels. Insulet has expanded its global footprint to 25 countries across North America, Europe, the Middle East, and Australia.

4. Patient Monitoring

Patient monitoring companies within the healthcare equipment industry offer devices and technologies that track chronic conditions and support real-time health management, such as continuous glucose monitors (CGMs) and sleep apnea machines. These businesses benefit from recurring revenue from consumables and software subscriptions tied to device sales (razor, razor blade model). The rising prevalence of chronic diseases like diabetes and respiratory disorders due to an aging population as well as growing adoption of digitization are good for the industry. However, these companies face challenges from high R&D costs and reliance on regulatory approvals. Looking ahead, the sector is positioned for growth due to tailwinds like the rising burden of chronic diseases from an aging population, the shift toward value-based care, and increased adoption of digital health solutions. Innovations in AI and machine learning are expected to enhance device accuracy and functionality, improving patient outcomes and driving demand. However, there are headwinds such as pricing pressures as healthcare costs are a key focus, especially in the US. An evolving regulatory landscape and competition from more tech-forward new entrants could present additional challenges.

Insulet's main competitors in the insulin pump market include Medtronic's MiniMed division (NYSE:MDT) and Tandem Diabetes Care (NASDAQ:TNDM), both of which offer traditional tubed insulin pump systems.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $2.71 billion in revenue over the past 12 months, Insulet has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

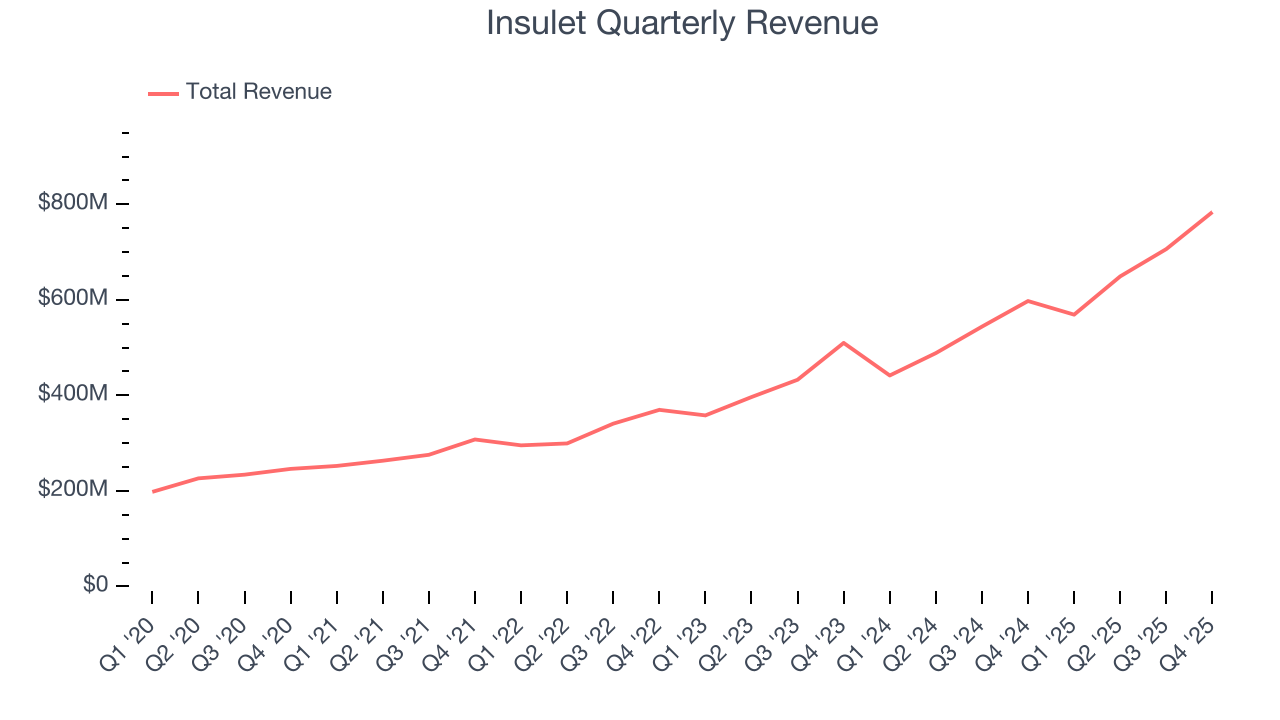

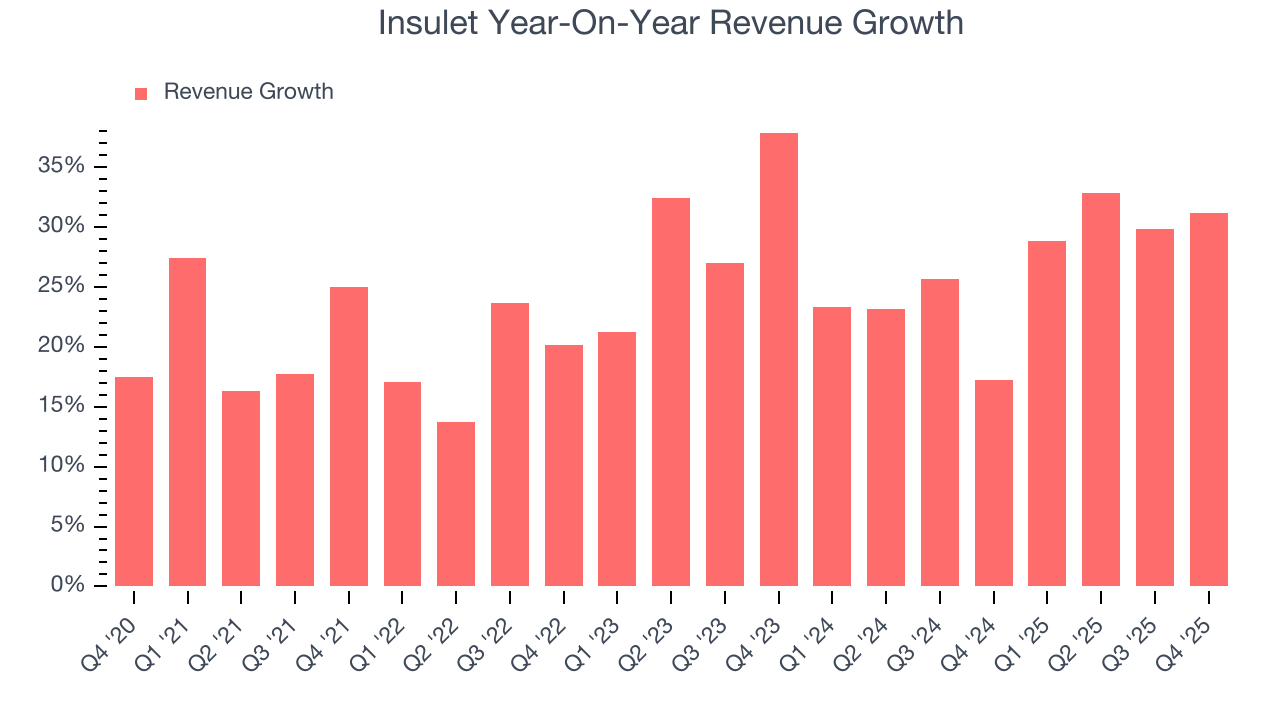

6. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Insulet grew its sales at an excellent 24.5% compounded annual growth rate. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Insulet’s annualized revenue growth of 26.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

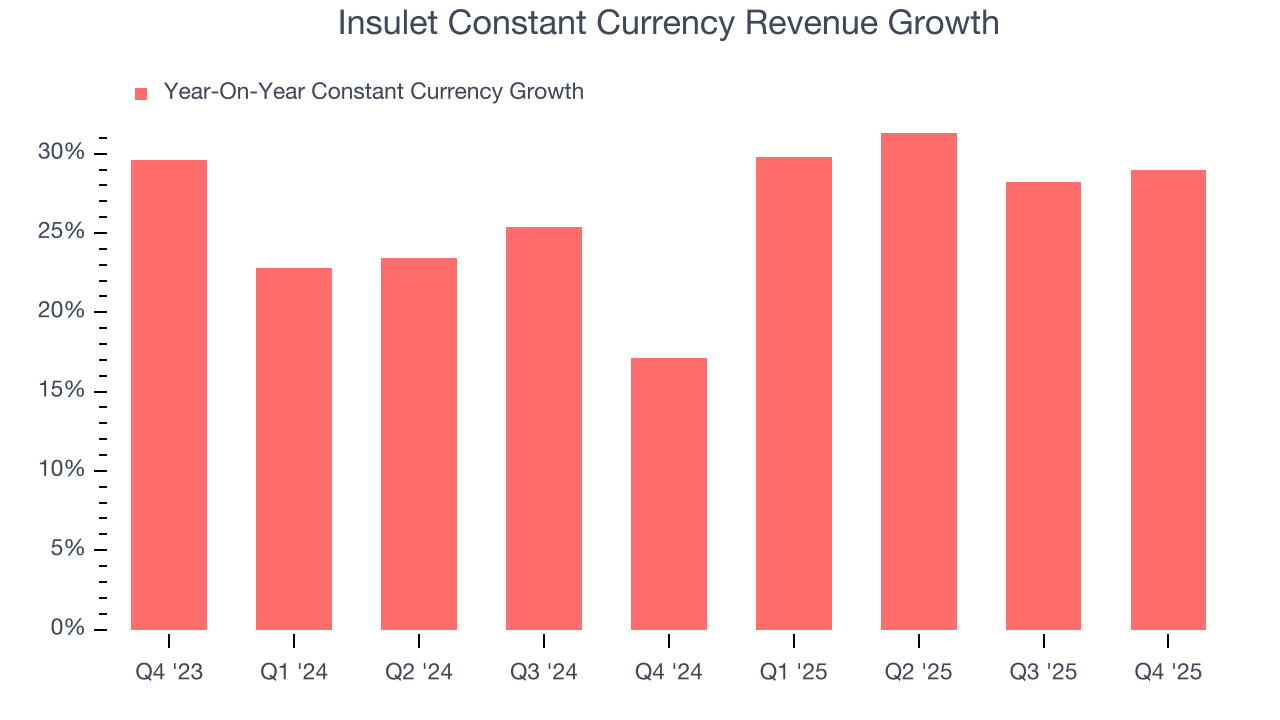

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 25.9% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that Insulet has properly hedged its foreign currency exposure.

This quarter, Insulet reported wonderful year-on-year revenue growth of 31.2%, and its $783.8 million of revenue exceeded Wall Street’s estimates by 2%. Company management is currently guiding for a 26% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.9% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and indicates the market sees success for its products and services.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

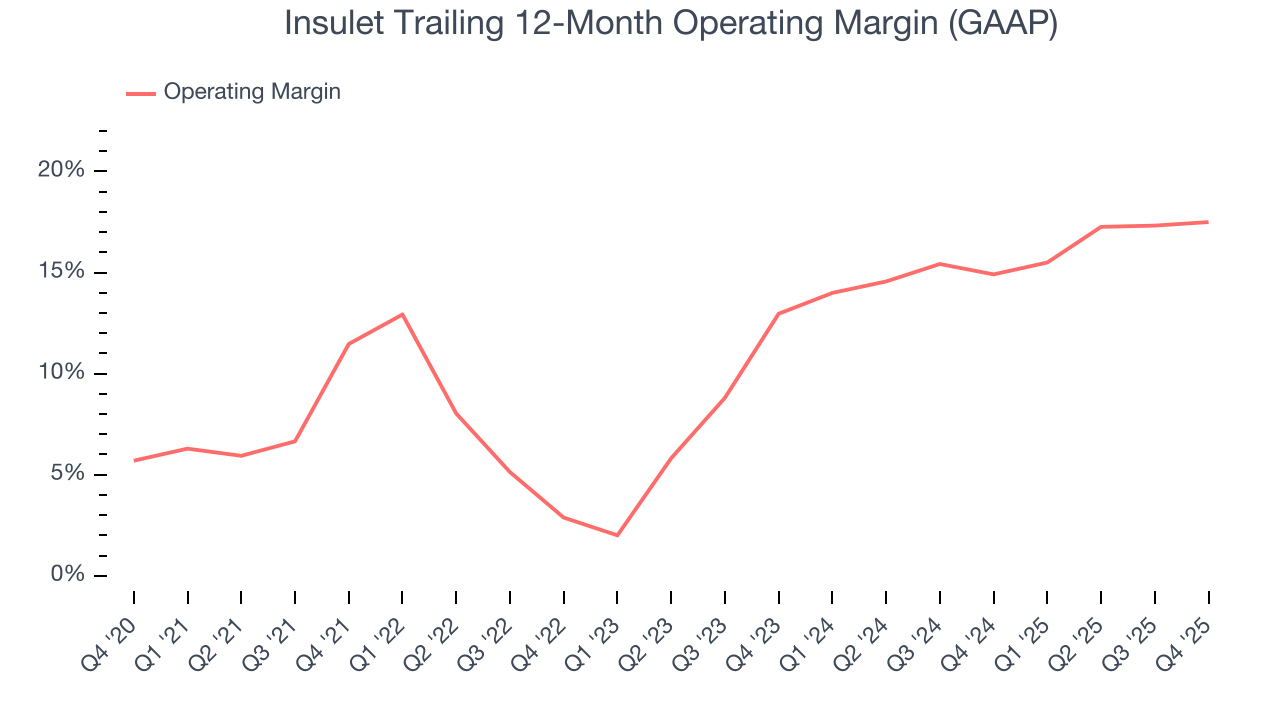

Insulet has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.1%, higher than the broader healthcare sector.

Looking at the trend in its profitability, Insulet’s operating margin rose by 6 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 4.5 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

In Q4, Insulet generated an operating margin profit margin of 18.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

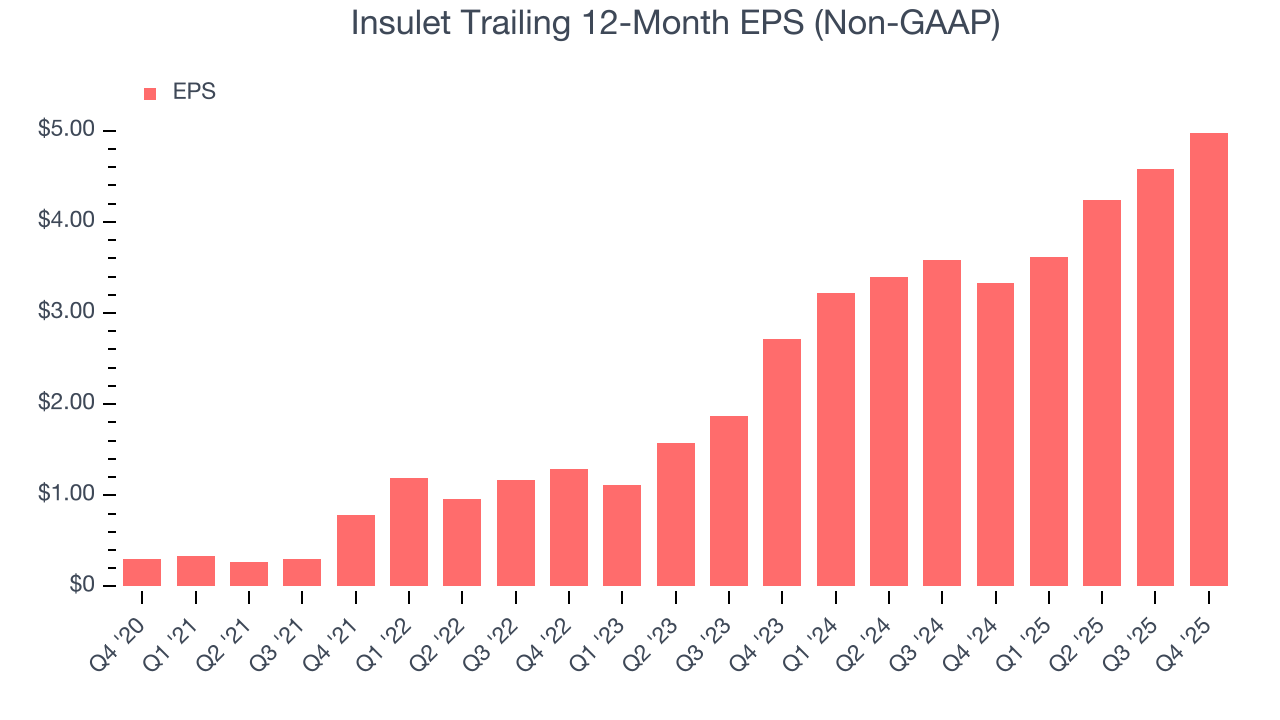

Insulet’s EPS grew at an astounding 74.8% compounded annual growth rate over the last five years, higher than its 24.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Insulet’s earnings to better understand the drivers of its performance. As we mentioned earlier, Insulet’s operating margin was flat this quarter but expanded by 6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Insulet reported adjusted EPS of $1.55, up from $1.15 in the same quarter last year. This print beat analysts’ estimates by 6%. Over the next 12 months, Wall Street expects Insulet’s full-year EPS of $4.98 to grow 25%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

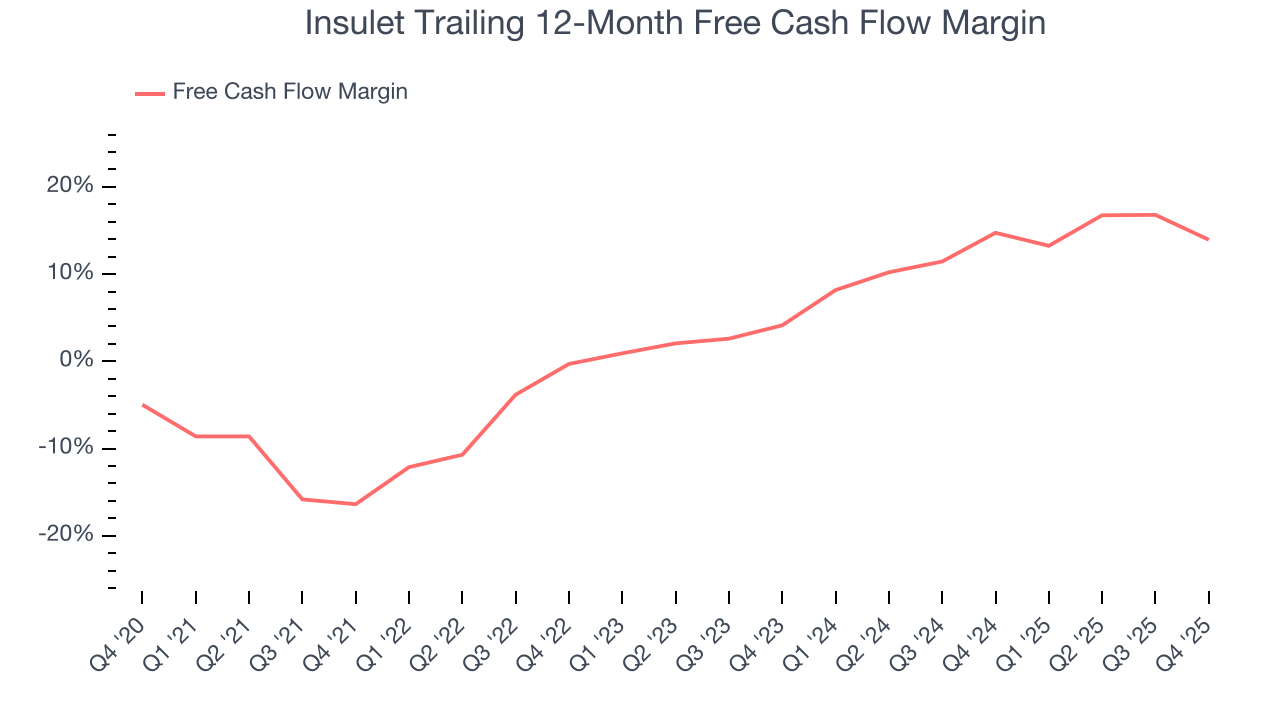

Insulet has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.4% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that Insulet’s margin expanded by 30.3 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Insulet’s free cash flow clocked in at $48.2 million in Q4, equivalent to a 6.1% margin. The company’s cash profitability regressed as it was 9.6 percentage points lower than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

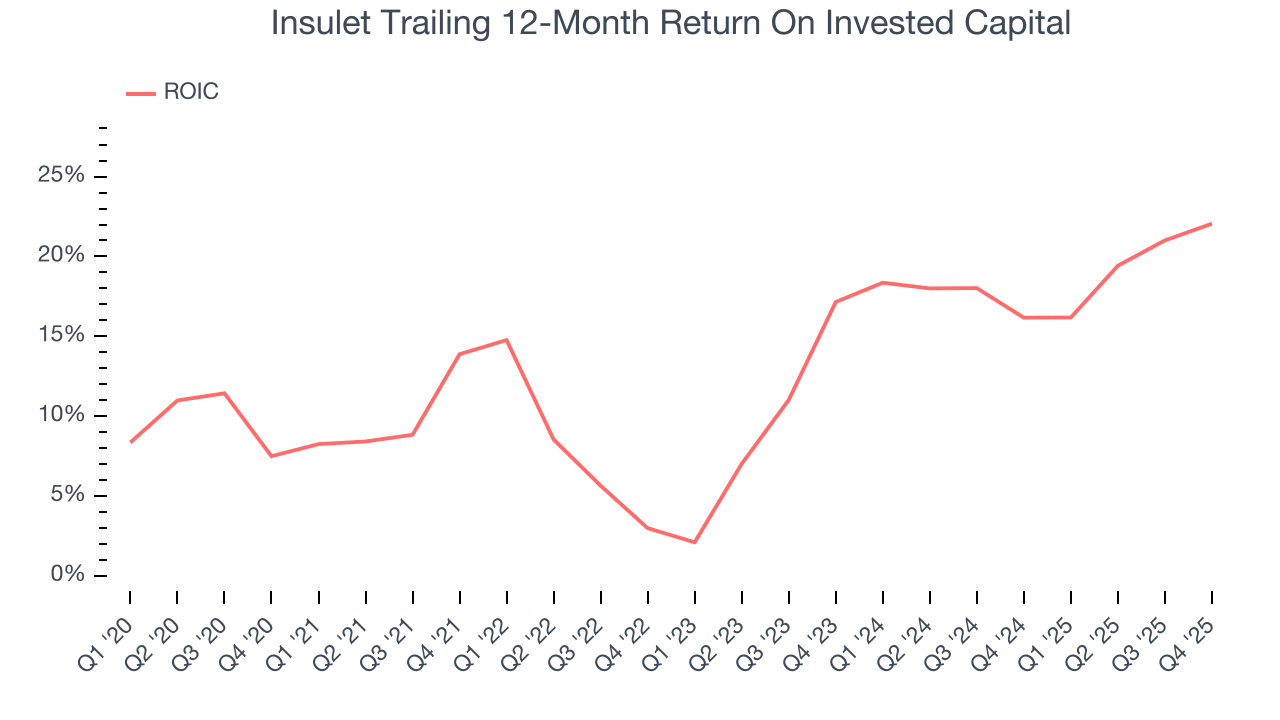

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Insulet’s five-year average ROIC was 14.4%, higher than most healthcare businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Insulet’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

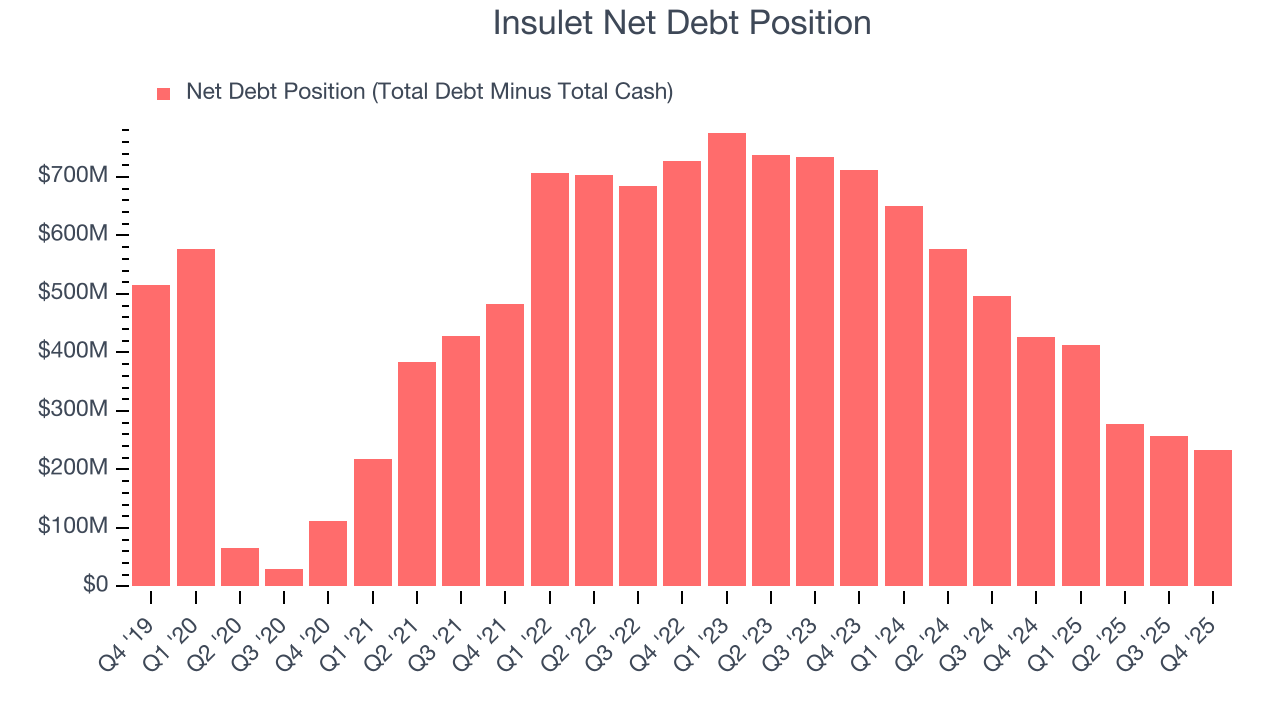

11. Balance Sheet Assessment

Insulet reported $716.1 million of cash and $949.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $645.4 million of EBITDA over the last 12 months, we view Insulet’s 0.4× net-debt-to-EBITDA ratio as safe. We also see its $24.6 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Insulet’s Q4 Results

It was encouraging to see Insulet beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 2.4% to $252.18 immediately following the results.

13. Is Now The Time To Buy Insulet?

Updated: February 18, 2026 at 7:07 AM EST

When considering an investment in Insulet, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Insulet is a high-quality business worth owning. First of all, the company’s revenue growth was impressive over the last five years. On top of that, its constant currency growth has been marvelous, and its rising cash profitability gives it more optionality.

Insulet’s P/E ratio based on the next 12 months is 39.6x. This multiple isn’t necessarily cheap, but we’ll happily own Insulet as its fundamentals shine bright. Investments like this should be held patiently for at least three to five years as they benefit from the power of long-term compounding, which more than makes up for any short-term price volatility that comes with relatively high valuations.

Wall Street analysts have a consensus one-year price target of $369.64 on the company (compared to the current share price of $252.18).