Qualcomm (QCOM)

Qualcomm catches our eye. Its marriage of growth and profitability makes it a strong business with attractive upside.― StockStory Analyst Team

1. News

2. Summary

Why Qualcomm Is Interesting

Having been at the forefront of developing the standards for cellular connectivity for over four decades, Qualcomm (NASDAQ:QCOM) is a leading innovator and a fabless manufacturer of wireless technology chips used in smartphones, autos and internet of things appliances.

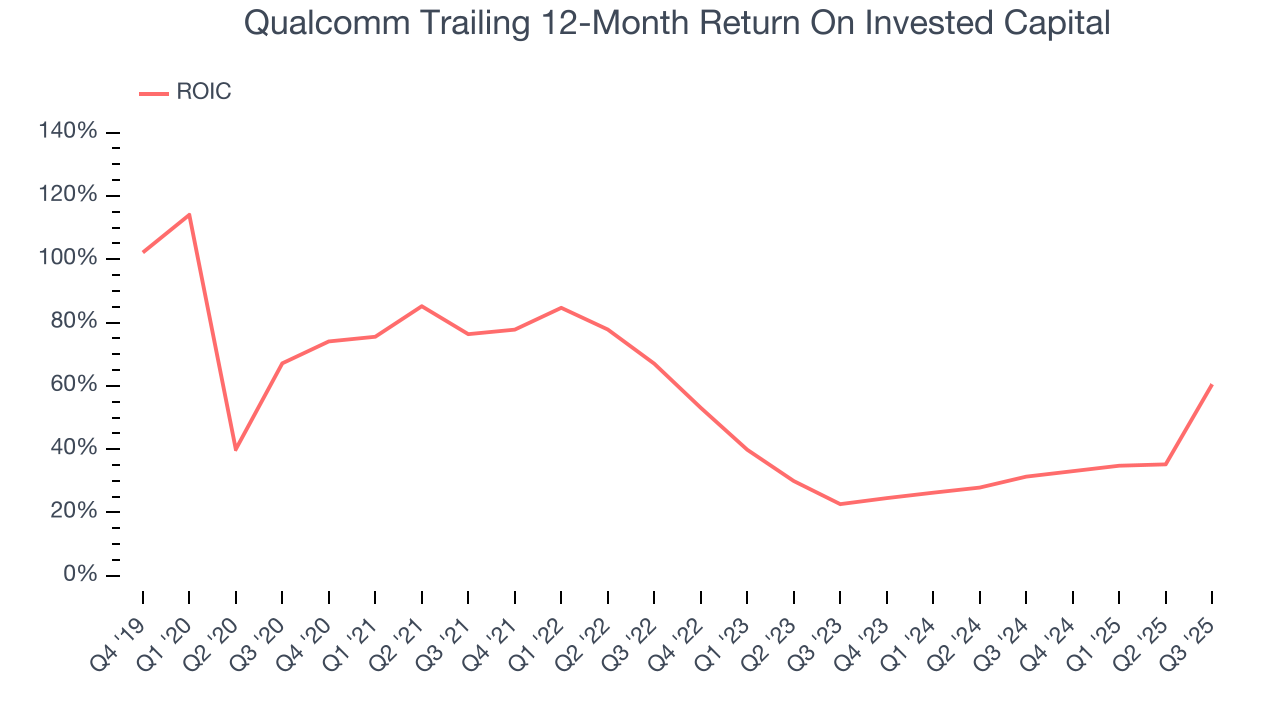

- ROIC punches in at 47%, illustrating management’s expertise in identifying profitable investments

- Strong free cash flow margin of 28.9% gives it the option to reinvest, repurchase shares, or pay dividends, and its improved cash conversion implies it’s becoming a less capital-intensive business

- A downside is its estimated sales growth of 2.9% for the next 12 months implies demand will slow from its two-year trend

Qualcomm has some noteworthy aspects. If you’re a believer, the valuation looks reasonable.

Why Is Now The Time To Buy Qualcomm?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Qualcomm?

Qualcomm is trading at $154.46 per share, or 13.3x forward P/E. A number of semiconductor companies feature higher multiples, but that doesn’t make Qualcomm a bargain. In fact, we think the current price justly reflects the top-line growth.

If you think the market is undervaluing the company, now could be a good time to build a position.

3. Qualcomm (QCOM) Research Report: Q3 CY2025 Update

Wireless chipmaker Qualcomm (NASDAQ:QCOM) announced better-than-expected revenue in Q3 CY2025, with sales up 10% year on year to $11.27 billion. On top of that, next quarter’s revenue guidance ($12.2 billion at the midpoint) was surprisingly good and 5.5% above what analysts were expecting. Its non-GAAP profit of $3 per share was 4.4% above analysts’ consensus estimates.

Qualcomm (QCOM) Q3 CY2025 Highlights:

- Revenue: $11.27 billion vs analyst estimates of $10.77 billion (10% year-on-year growth, 4.6% beat)

- Adjusted EPS: $3 vs analyst estimates of $2.87 (4.4% beat)

- Adjusted Operating Income: $3.81 billion vs analyst estimates of $3.64 billion (33.8% margin, 4.6% beat)

- Revenue Guidance for Q4 CY2025 is $12.2 billion at the midpoint, above analyst estimates of $11.57 billion

- Adjusted EPS guidance for Q4 CY2025 is $3.40 at the midpoint, above analyst estimates of $3.30

- Operating Margin: 25.9%, in line with the same quarter last year

- Free Cash Flow was -$10.41 billion, down from $2.39 billion in the same quarter last year

- Inventory Days Outstanding: 118, down from 163 in the previous quarter

- Market Capitalization: $185.1 billion

Company Overview

Having been at the forefront of developing the standards for cellular connectivity for over four decades, Qualcomm (NASDAQ:QCOM) is a leading innovator and a fabless manufacturer of wireless technology chips used in smartphones, autos and internet of things appliances.

Qualcomm has one of the more unique semiconductor business models. Its research has created the intellectual property that is the foundation for the global wireless industry. In the 1990s they developed the original code division multiple access (CDMA) technology that became the standard for cell phone networks first in the US, then around the world. Qualcomm has had a hand in developing Wi-Fi, GPS, and Bluetooth, along with RFID (Radio Frequency ID), and 4G and 5G technology.

It monetizes its portfolio of more than 140,000 patents through designing semiconductors used in handsets, autos, and IoT and also through licensing its patents for others to incorporate in their own products. Qualcomm outsources manufacturing of its chips, its main product family is the Snapdragon chip, an all in one chip used to power mobile devices: it includes a cellular modem, integrated Wi-Fi, Bluetooth, and GPS, along with a CPU (central processing unit) and GPU (graphics processing unit). Different versions of Snapdragon are used in different types of devices (tablets, laptops, handsets) based on the different battery life or processing requirements.

Qualcomm’s stranglehold on wireless’s foundational technology has enmeshed it in disputes over royalty payments, which are highly consequential to Qualcomm’s business model as it receives a royalty of roughly 5% of the average price of every smartphone sold, and those licensing revenues are nearly pure profit. In 2017, Apple refused to continue paying the royalty which degenerated into a lawsuit with Apple switching to Intel modem chips, only to return to Qualcomm in 2019, when Intel decided not to make 5G modems. Qualcomm also ran into similar disputes with Chinese handset makers such as Huawei in the past few years, all of which have since been resolved, with Qualcomm continuing to receive its royalty payments. Because of its unique position in the semiconductor world, Qualcomm became a geopolitical football during China-US trade tensions over the past few years: China blocked Qualcomm’s attempted acquisition of NXPI over antitrust concerns, while the US blocked Broadcom proposed hostile takeover of Qualcomm over national security concerns.

Qualcomms peers and competitors include AMD (NASDAQ:AMD), Broadcom (NASDAQ:AVGO), Intel (NASDAQ:INTC), MediaTek (TWSE:2454), NXP Semiconductors NV (NASDAQ:NXPI), Nvidia (NASDAQ: NVDA), and Samsung (KOSI:005930).

4. Processors and Graphics Chips

Chips need to keep getting smaller in order to advance on Moore’s law, and that is proving increasingly more complicated and expensive to achieve with time. That has caused most digital chip makers to become “fabless” designers, rather than manufacturers, instead relying on contracted foundries like TSMC to manufacture their designs. This has benefitted the digital chip makers’ free cash flow margins, as exiting the manufacturing business has removed large cash expenses from their business models.

5. Revenue Growth

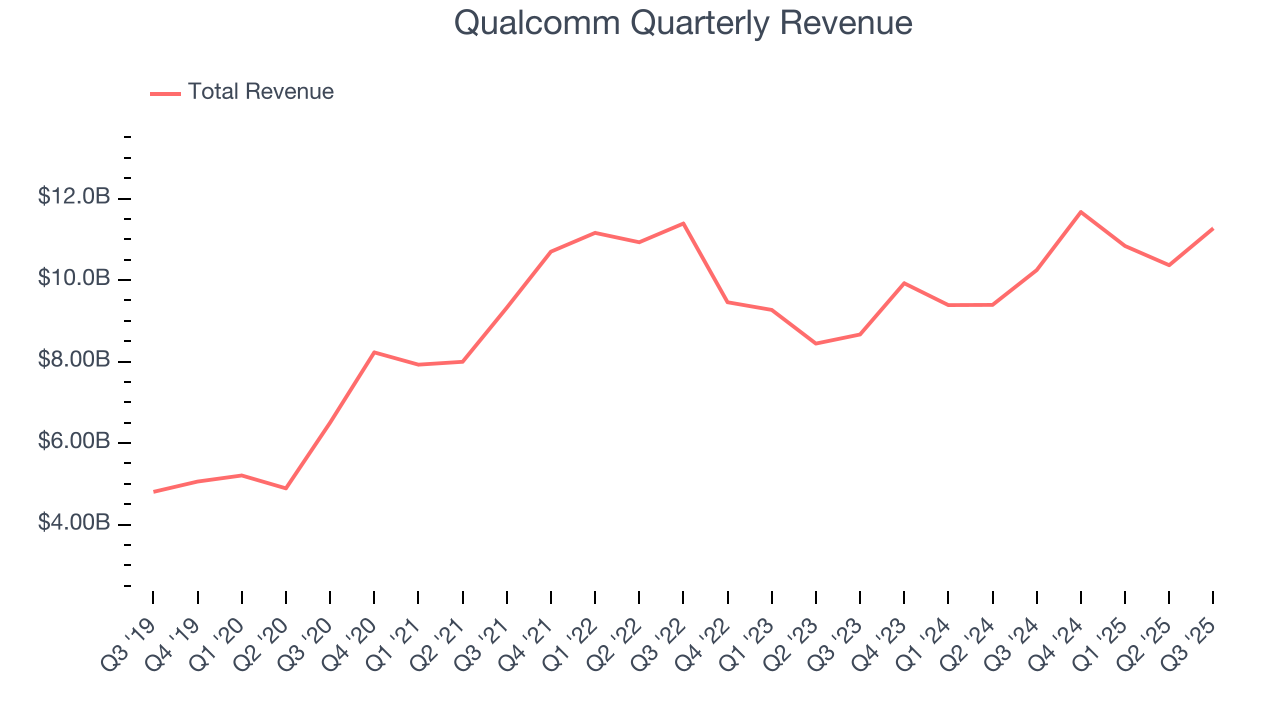

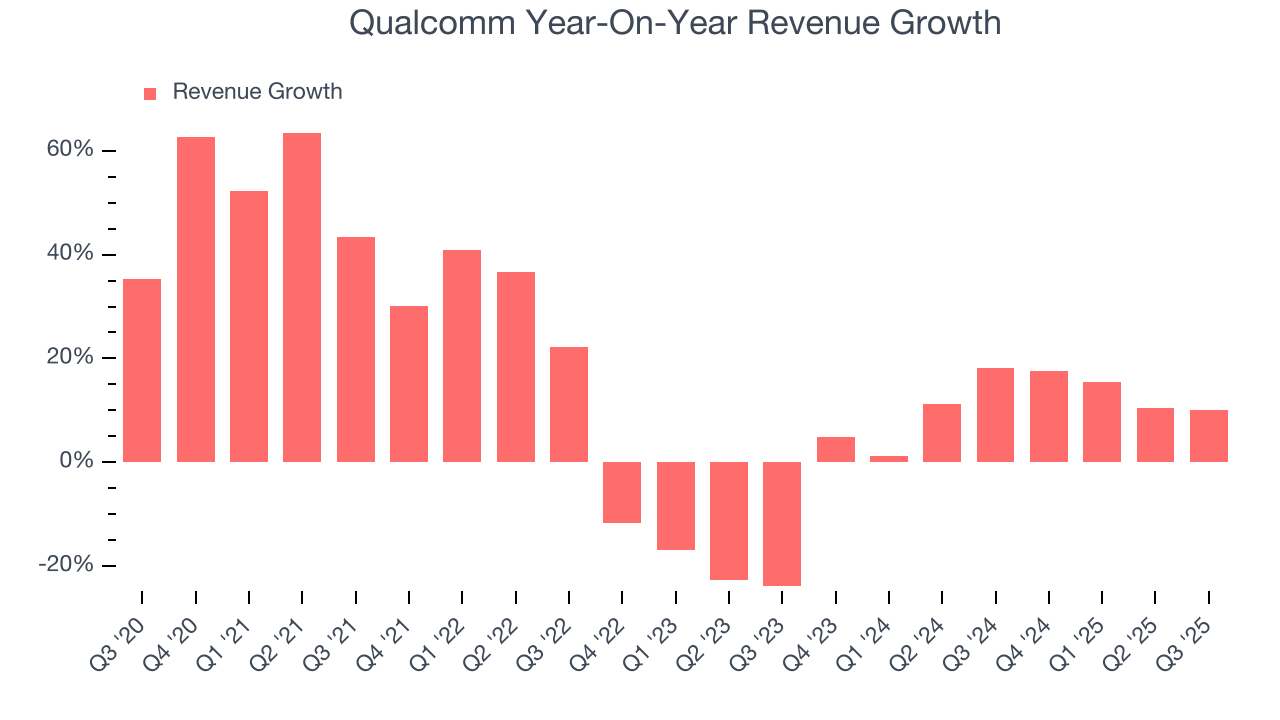

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Qualcomm’s sales grew at an excellent 15.3% compounded annual growth rate over the last five years. Its growth beat the average semiconductor company and shows its offerings resonate with customers, a helpful starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Qualcomm’s annualized revenue growth of 11% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Qualcomm reported year-on-year revenue growth of 10%, and its $11.27 billion of revenue exceeded Wall Street’s estimates by 4.6%. Beyond the beat, this marks 8 straight quarters of growth, showing that the current upcycle has had a good run - a typical upcycle usually lasts 8-10 quarters. Company management is currently guiding for a 4.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Product Demand & Outstanding Inventory

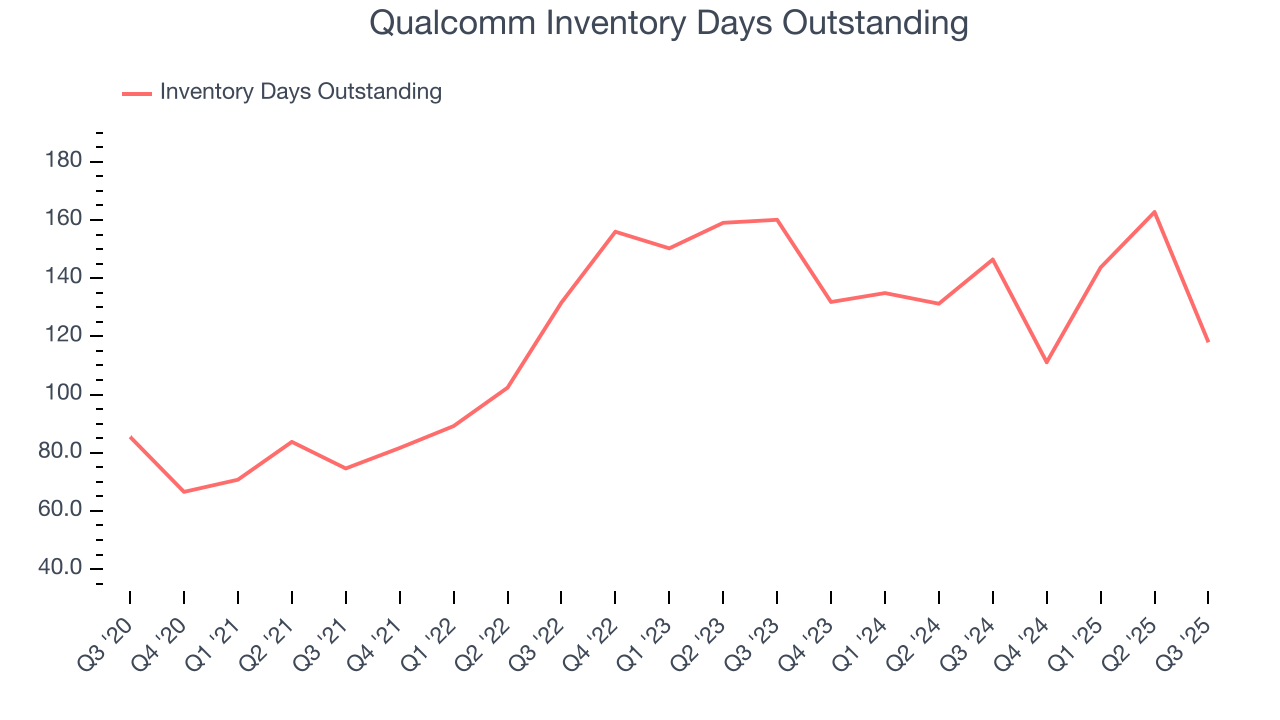

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Qualcomm’s DIO came in at 118, which is 2 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

7. Gross Margin & Pricing Power

Gross profit margin is a key metric to track because it shows how much money a semiconductor company gets to keep after paying for its raw materials, manufacturing, and other input costs.

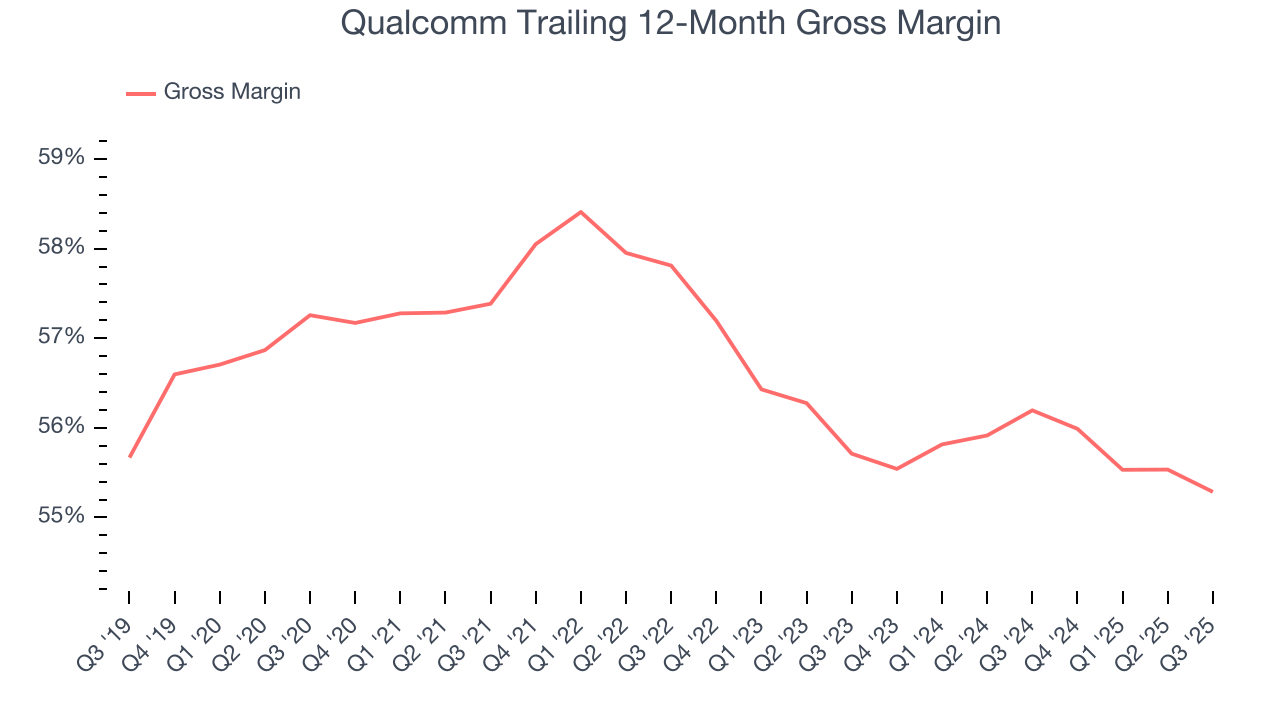

Qualcomm’s gross margin is well ahead of its semiconductor peers, and its strong pricing power is an output of its differentiated, value-add products. As you can see below, it averaged an excellent 55.7% gross margin over the last two years. That means Qualcomm only paid its suppliers $44.29 for every $100 in revenue.

Qualcomm’s gross profit margin came in at 55.3% this quarter, marking a 1.1 percentage point decrease from 56.4% in the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

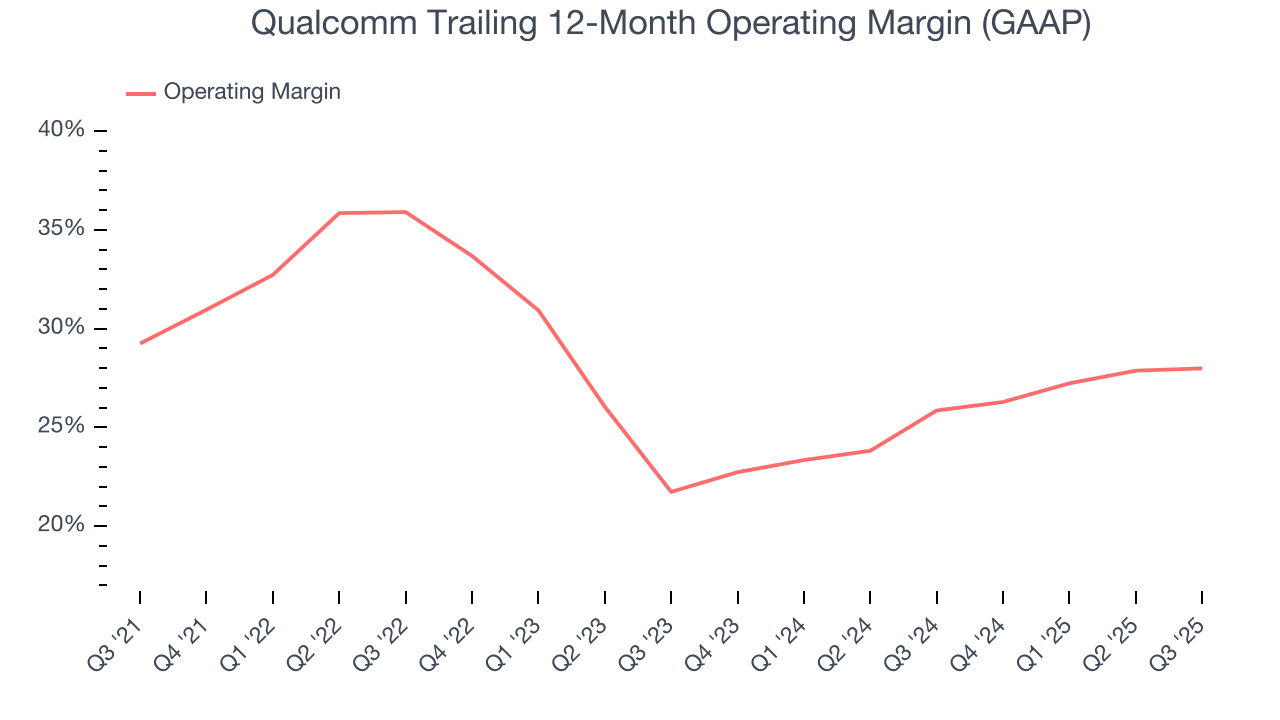

8. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Qualcomm has been an efficient company over the last two years. It was one of the more profitable businesses in the semiconductor sector, boasting an average operating margin of 27%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Qualcomm’s operating margin decreased by 1.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Qualcomm generated an operating margin profit margin of 25.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

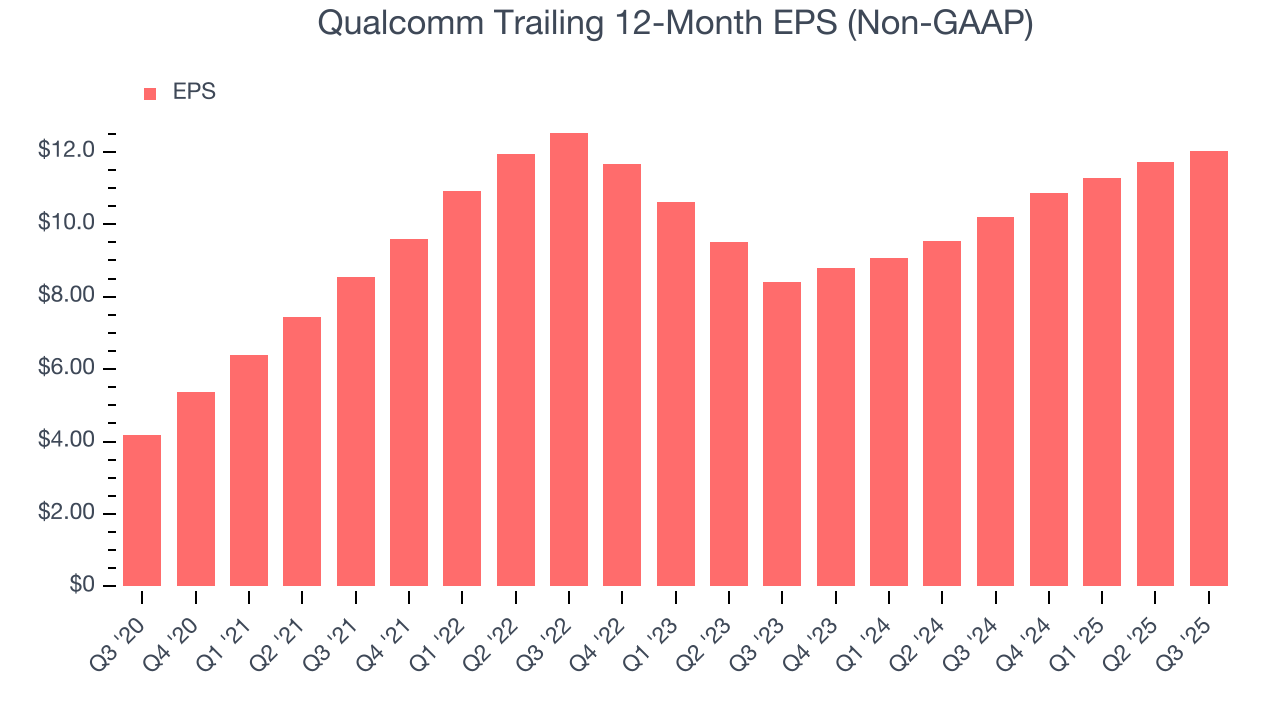

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

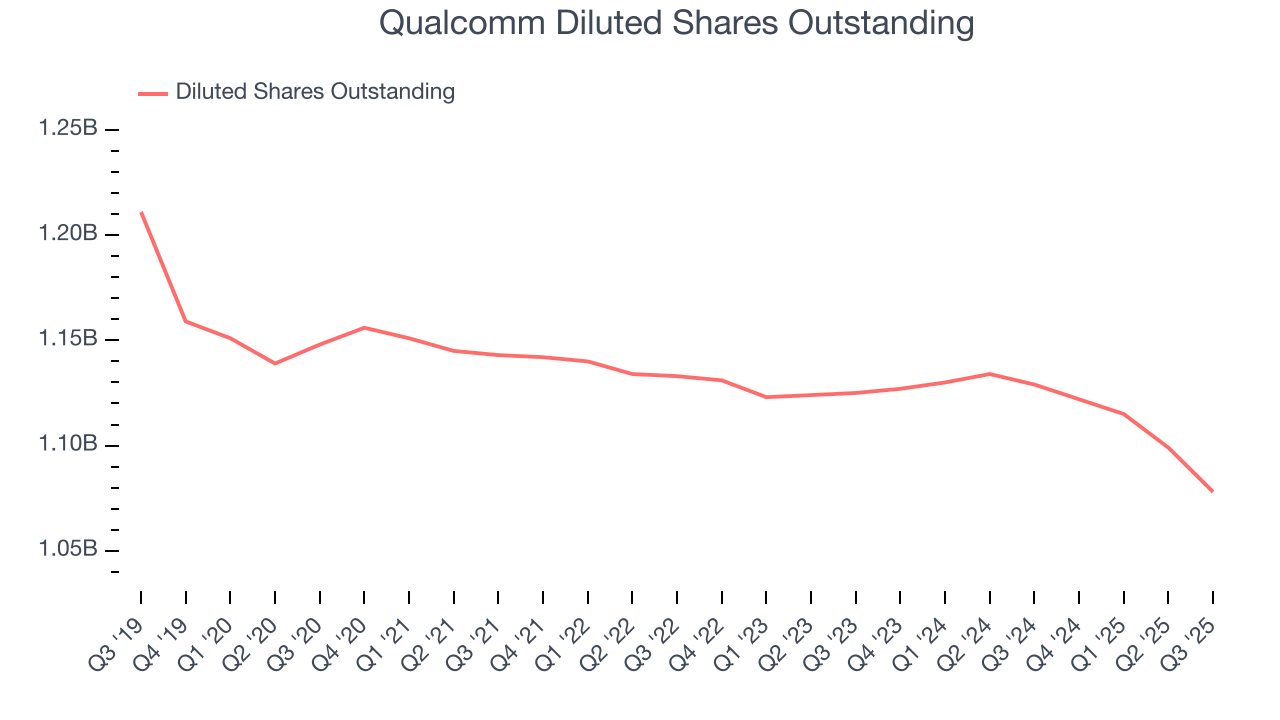

Qualcomm’s EPS grew at a remarkable 23.5% compounded annual growth rate over the last five years, higher than its 15.3% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

We can take a deeper look into Qualcomm’s earnings to better understand the drivers of its performance. A five-year view shows that Qualcomm has repurchased its stock, shrinking its share count by 6.1%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Qualcomm reported adjusted EPS of $3, up from $2.69 in the same quarter last year. This print beat analysts’ estimates by 4.4%. Over the next 12 months, Wall Street expects Qualcomm’s full-year EPS of $12.03 to stay about the same.

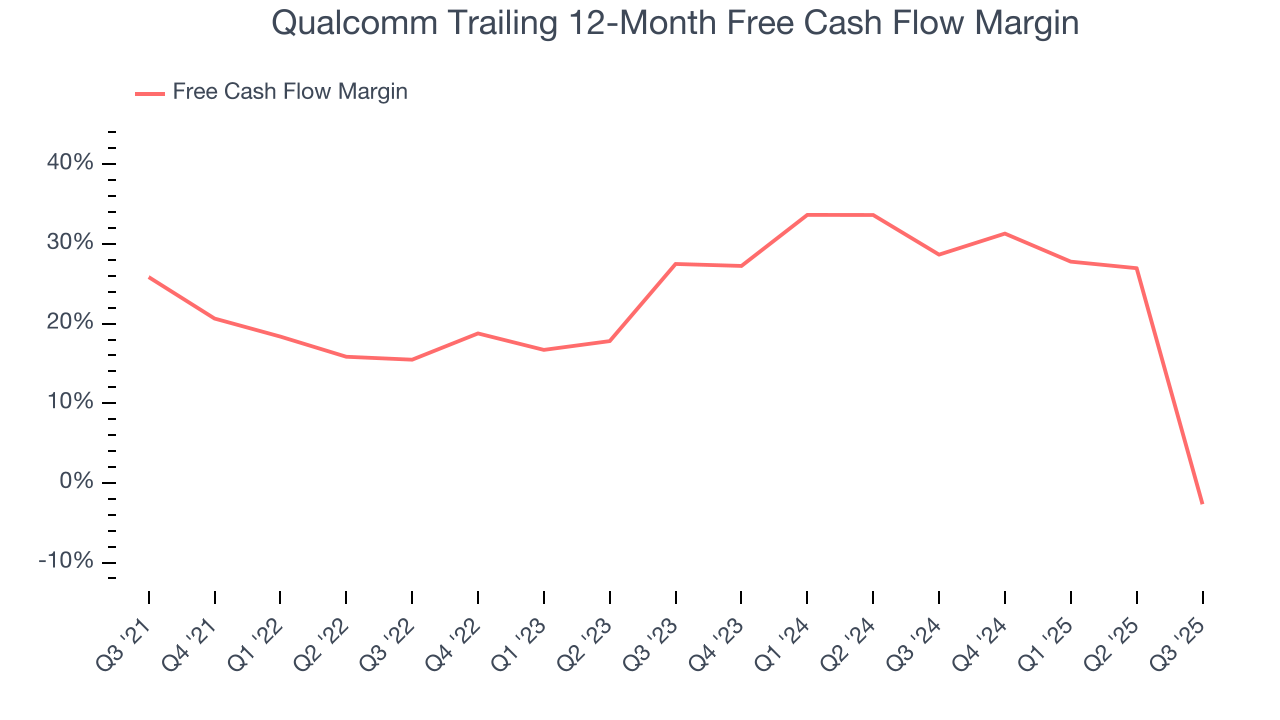

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Qualcomm has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 12%, subpar for a semiconductor business. The divergence from its good operating margin stems from its capital-intensive business model, which requires Qualcomm to make large cash investments in working capital and capital expenditures.

Taking a step back, we can see that Qualcomm’s margin dropped by 28.5 percentage points over the last five years. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Qualcomm burned through $10.41 billion of cash in Q3, equivalent to a negative 92.4% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Qualcomm’s five-year average ROIC was 51.6%, placing it among the best semiconductor companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

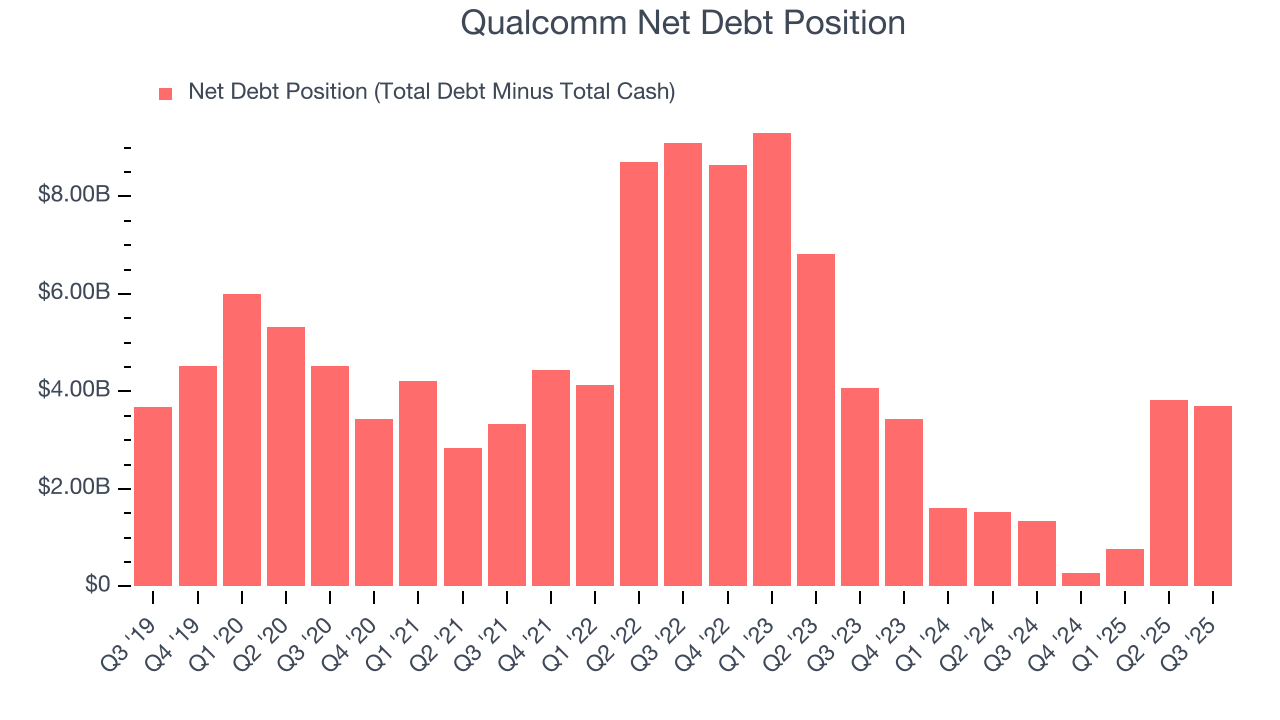

12. Balance Sheet Assessment

Qualcomm reported $12.48 billion of cash and $16.18 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $17.06 billion of EBITDA over the last 12 months, we view Qualcomm’s 0.2× net-debt-to-EBITDA ratio as safe. We also see its $25 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Qualcomm’s Q3 Results

We were impressed by Qualcomm’s strong improvement in inventory levels. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. Zooming out, we think this was a good print with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 1.5% to $176.40 immediately following the results.

14. Is Now The Time To Buy Qualcomm?

Updated: January 20, 2026 at 9:16 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We think Qualcomm is a solid business. First off, its revenue growth was impressive over the last five years. And while its projected EPS for the next year is lacking, its stellar ROIC suggests it has been a well-run company historically. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Qualcomm’s P/E ratio based on the next 12 months is 13.3x. When scanning the semiconductor space, Qualcomm trades at a fair valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $191.35 on the company (compared to the current share price of $154.46), implying they see 23.9% upside in buying Qualcomm in the short term.