QuinStreet (QNST)

We love companies like QuinStreet. Its sales and EPS are anticipated to grow nicely over the next 12 months, a welcome sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why We Like QuinStreet

Founded during the dot-com era in 1999 and specializing in high-intent consumer traffic, QuinStreet (NASDAQ:QNST) operates digital performance marketplaces that connect clients in financial and home services with consumers actively searching for their products.

- Impressive 16.3% annual revenue growth over the last five years indicates it’s winning market share this cycle

- Earnings growth has trumped its peers over the last two years as its EPS has compounded at 454% annually

- Market share will likely rise over the next 12 months as its expected revenue growth of 26.2% is robust

We’re optimistic about QuinStreet. The price seems fair relative to its quality, so this could be an opportune time to invest in some shares.

Why Is Now The Time To Buy QuinStreet?

High Quality

Investable

Underperform

Why Is Now The Time To Buy QuinStreet?

QuinStreet is trading at $12.54 per share, or 8x forward P/E. This multiple is cheap, and we think the stock is a bargain considering its quality characteristics.

A powerful one-two punch is a company that can both grow earnings and earn a higher multiple over time. High-quality companies trading at big discounts to intrinsic value are good ways to set up this combination.

3. QuinStreet (QNST) Research Report: Q4 CY2025 Update

Performance marketing company QuinStreet (NASDAQ:QNST) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 1.9% year on year to $287.8 million. On top of that, next quarter’s revenue guidance ($335 million at the midpoint) was surprisingly good and 4.5% above what analysts were expecting. Its non-GAAP profit of $0.24 per share was 21.2% above analysts’ consensus estimates.

QuinStreet (QNST) Q4 CY2025 Highlights:

- Revenue: $287.8 million vs analyst estimates of $276.2 million (1.9% year-on-year growth, 4.2% beat)

- Adjusted EPS: $0.24 vs analyst estimates of $0.20 (21.2% beat)

- Adjusted EBITDA: $20.98 million vs analyst estimates of $19.43 million (7.3% margin, 8% beat)

- Revenue Guidance for the full year is $1.28 billion at the midpoint, above analyst estimates of $1.23 billion

- EBITDA guidance for the full year is $112.5 million at the midpoint, above analyst estimates of $101.5 million

- Operating Margin: 0.4%, in line with the same quarter last year

- Free Cash Flow Margin: 6.3%, down from 12.7% in the same quarter last year

- Market Capitalization: $654.3 million

Company Overview

Founded during the dot-com era in 1999 and specializing in high-intent consumer traffic, QuinStreet (NASDAQ:QNST) operates digital performance marketplaces that connect clients in financial and home services with consumers actively searching for their products.

QuinStreet's business revolves around delivering measurable marketing results through its proprietary technologies and expertise in digital customer acquisition. The company acts as an intermediary, helping businesses reach potential customers who are actively searching for specific products or services online.

When consumers search for financial products like loans, insurance, or credit cards, or home services such as contractors or moving companies, QuinStreet's technology helps match them with relevant providers. The company earns revenue primarily on a cost-per-action basis—getting paid when it delivers qualified clicks, leads, calls, applications, or completed customer transactions to its clients.

For example, when someone searches for "best mortgage refinance rates," QuinStreet might connect this high-intent visitor to a mortgage lender through one of its owned websites or partner sites. The lender pays QuinStreet only when the consumer takes a specific action, such as submitting a loan inquiry.

Behind the scenes, QuinStreet manages a complex ecosystem of media sources including owned-and-operated websites, search engine marketing campaigns, social media programs, email databases, and partnerships with online publishers. The company's technology platform analyzes millions of data points to optimize these campaigns, determining which consumers to show which offers based on likelihood of conversion.

QuinStreet's value proposition to clients includes cost-effective customer acquisition and the ability to navigate fragmented online media sources. For large financial institutions or home service providers, QuinStreet offers a way to reach qualified prospects without having to develop the specialized expertise in performance marketing themselves.

The company maintains extensive data on consumer behavior and campaign performance, which it leverages to continuously refine its targeting capabilities and improve results for clients. This data-driven approach allows QuinStreet to run thousands of campaigns simultaneously across different verticals and media channels.

4. Advertising & Marketing Services

The sector is on the precipice of both disruption and growth as AI, programmatic advertising, and data-driven marketing reshape how things are done. For example, the advent of the Internet broadly and programmatic advertising specifically means that brand building is not a relationship business anymore but instead one based on data and technology, which could hurt traditional ad agencies. On the other hand, the companies in the sector that beef up their tech chops by automating the buying of ad inventory or facilitating omnichannel marketing, for example, stand to benefit. With or without advances in digitization and AI, the sector is still highly levered to the macro, and economic uncertainty may lead to fluctuating ad spend, particularly in cyclical industries.

QuinStreet competes with digital marketing agencies, lead generation companies like EverQuote (NASDAQ:EVER) and MediaAlpha (NYSE:MAX), as well as larger tech platforms where clients can advertise directly, including Google (NASDAQ:GOOGL), Meta (NASDAQ:META), and Microsoft (NASDAQ:MSFT).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.11 billion in revenue over the past 12 months, QuinStreet is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels. On the bright side, it can grow faster because it has more room to expand.

As you can see below, QuinStreet’s 16.3% annualized revenue growth over the last five years was incredible. This is a great starting point for our analysis because it shows QuinStreet’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. QuinStreet’s annualized revenue growth of 41.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, QuinStreet reported modest year-on-year revenue growth of 1.9% but beat Wall Street’s estimates by 4.2%. Company management is currently guiding for a 24.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.3% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is admirable and indicates the market sees success for its products and services.

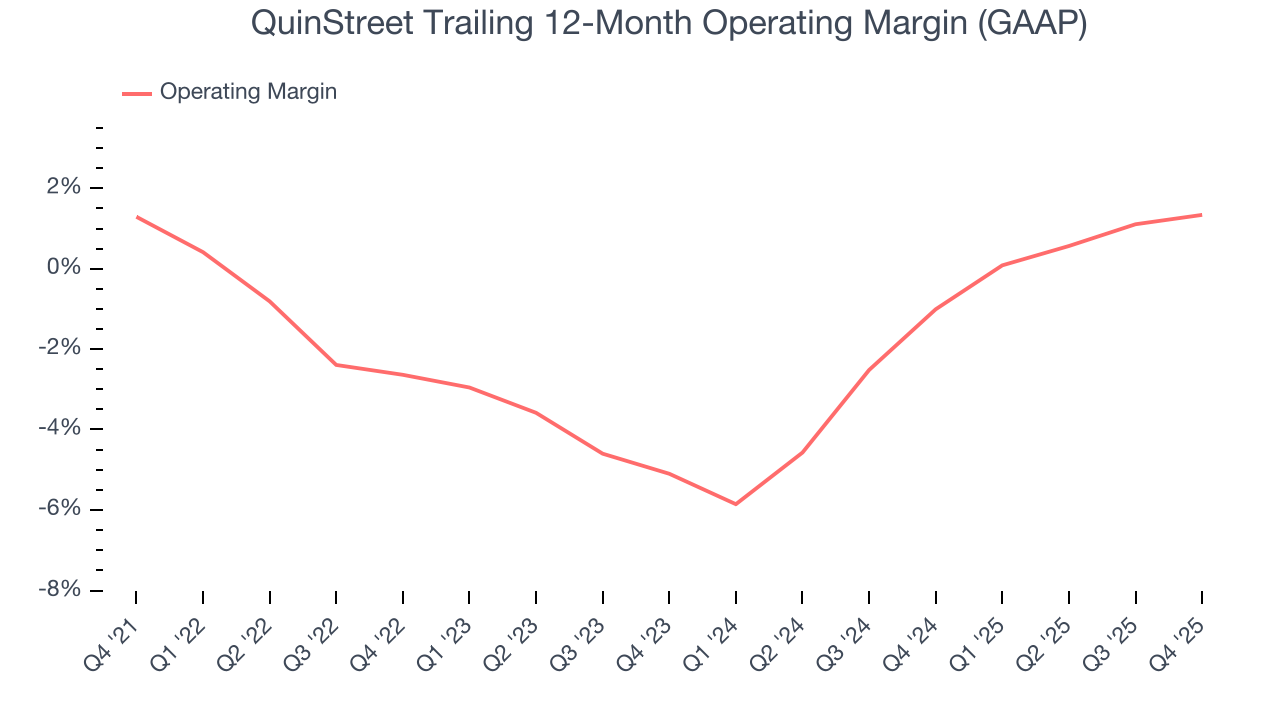

6. Operating Margin

QuinStreet’s operating margin has risen over the last 12 months, leading to break even profits over the last five years. Although this result isn’t exceptional, we can see its elite revenue growth is giving it operating leverage as it scales. This gives it a shot at long-term profitability if it can keep expanding.

Looking at the trend in its profitability, QuinStreet’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, QuinStreet’s breakeven margin was 0.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

QuinStreet’s EPS grew at a solid 10.4% compounded annual growth rate over the last five years. However, this performance was lower than its 16.3% annualized revenue growth, telling us the company became less profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For QuinStreet, its two-year annual EPS growth of 454% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, QuinStreet reported adjusted EPS of $0.24, up from $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects QuinStreet’s full-year EPS of $0.92 to grow 43.4%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

QuinStreet has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.9%, subpar for a business services business.

QuinStreet’s free cash flow clocked in at $18.15 million in Q4, equivalent to a 6.3% margin. The company’s cash profitability regressed as it was 6.4 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although QuinStreet has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 14.6%, meaning management lost money while trying to expand the business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, QuinStreet’s ROIC has unfortunately decreased significantly. If its returns keep falling, it could suggest its profitable growth opportunities are drying up. We’ll keep a close eye.

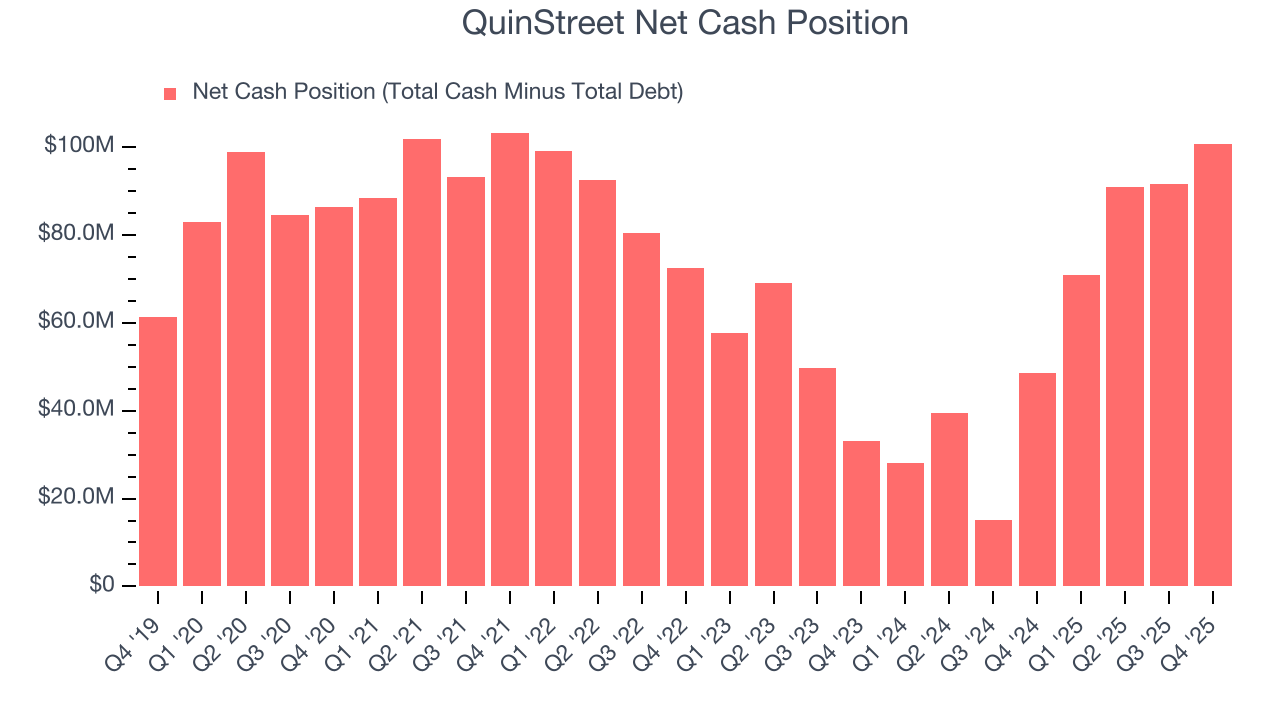

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

QuinStreet is a profitable, well-capitalized company with $107 million of cash and $6.38 million of debt on its balance sheet. This $100.6 million net cash position is 15.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from QuinStreet’s Q4 Results

It was good to see QuinStreet beat analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 1.6% to $11.24 immediately following the results.

12. Is Now The Time To Buy QuinStreet?

Updated: March 5, 2026 at 11:31 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in QuinStreet.

QuinStreet is a rock-solid business worth owning. For starters, its revenue growth was exceptional over the last five years and is expected to accelerate over the next 12 months. And while its relatively low ROIC suggests management has struggled to find compelling investment opportunities, its projected EPS for the next year implies the company’s fundamentals will improve. Additionally, QuinStreet’s rising returns show management's prior bets are starting to pay off.

QuinStreet’s P/E ratio based on the next 12 months is 8x. Looking across the spectrum of business services businesses, QuinStreet’s fundamentals shine bright. We like the stock at this bargain price.

Wall Street analysts have a consensus one-year price target of $20.25 on the company (compared to the current share price of $12.54), implying they see 61.5% upside in buying QuinStreet in the short term.