Qorvo (QRVO)

Qorvo faces an uphill battle. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Qorvo Will Underperform

Formed by the merger of TriQuint and RF Micro Devices, Qorvo (NASDAQ: QRVO) is a designer and manufacturer of RF chips used in almost all smartphones globally, along with a variety of chips used in networking equipment and infrastructure.

- Estimated sales growth of 2.9% for the next 12 months implies demand will slow from its two-year trend

- Low returns on capital reflect management’s struggle to allocate funds effectively, and its decreasing returns suggest its historical profit centers are aging

- Sales over the last five years were less profitable as its earnings per share fell by 3.5% annually while its revenue was flat

Qorvo doesn’t fulfill our quality requirements. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than Qorvo

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Qorvo

At $82.06 per share, Qorvo trades at 12.6x forward P/E. This multiple is lower than most semiconductor companies, but for good reason.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Qorvo (QRVO) Research Report: Q4 CY2025 Update

Communications chips maker Qorvo (NASDAQ: QRVO) met Wall Streets revenue expectations in Q4 CY2025, with sales up 8.4% year on year to $993 million. The company expects next quarter’s revenue to be around $800 billion, coming in 88,732% above analysts’ estimates. Its non-GAAP profit of $2.17 per share was 16.4% above analysts’ consensus estimates.

Qorvo (QRVO) Q4 CY2025 Highlights:

- Revenue: $993 million vs analyst estimates of $988.6 million (8.4% year-on-year growth, in line)

- Adjusted EPS: $2.17 vs analyst estimates of $1.86 (16.4% beat)

- Adjusted Operating Income: $247.6 million vs analyst estimates of $215.6 million (24.9% margin, 14.8% beat)

- Revenue Guidance for Q1 CY2026 is $800 billion at the midpoint, above analyst estimates of $900.6 million

- Adjusted EPS guidance for Q1 CY2026 is $1.20 at the midpoint, below analyst estimates of $1.37

- Operating Margin: 19.4%, up from 5.8% in the same quarter last year

- Free Cash Flow Margin: 23.9%, up from 19.2% in the same quarter last year

- Inventory Days Outstanding: 91, down from 99 in the previous quarter

- Market Capitalization: $7.62 billion

Company Overview

Formed by the merger of TriQuint and RF Micro Devices, Qorvo (NASDAQ: QRVO) is a designer and manufacturer of RF chips used in almost all smartphones globally, along with a variety of chips used in networking equipment and infrastructure.

Qorvo's technology serves as the invisible backbone of modern wireless communications. The company operates through three main segments: Advanced Cellular Group (ACG), which provides RF solutions for smartphones and other mobile devices; High Performance Analog (HPA), which delivers RF, analog, and power management components; and Connectivity and Sensors Group (CSG), which focuses on technologies like ultra-wideband, Bluetooth, Wi-Fi, and sensors.

In the mobile device market, Qorvo's highly integrated RF modules enable smartphones to connect to cellular networks across multiple frequency bands while maintaining signal quality and battery efficiency. For example, when a user streams video on their smartphone while moving between 4G and 5G networks, Qorvo's components help maintain a seamless connection by managing the complex signal transitions.

Beyond mobile, Qorvo serves diverse markets including infrastructure, automotive, defense, and the Internet of Things (IoT). The company's power management solutions improve efficiency in applications ranging from data centers to electric vehicles, while its connectivity products enable smart home devices to communicate wirelessly. In defense applications, Qorvo's components power radar systems and satellite communications.

Qorvo generates revenue by selling its components to device manufacturers and original equipment manufacturers (OEMs). The company maintains manufacturing facilities across the United States and Asia, utilizing specialized processes to produce its semiconductor products. As wireless standards evolve toward higher frequencies and greater complexity, Qorvo's engineering expertise in RF design becomes increasingly valuable to its customers.

Qorvo’s peers and competitors include Broadcom (NASDAQ:AVGO), Cirrus Logic (NASDAQ:CRUS), MACOM Technology (NASDAQ:MTSI), Qorvo (NASDAQ:QRVO), Qualcomm (NASDAQ:QCOM), Skyworks (NASDAQ:SWKS) and Texas Instruments (NASDAQ:TXN).

4. Processors and Graphics Chips

Chips need to keep getting smaller in order to advance on Moore’s law, and that is proving increasingly more complicated and expensive to achieve with time. That has caused most digital chip makers to become “fabless” designers, rather than manufacturers, instead relying on contracted foundries like TSMC to manufacture their designs. This has benefitted the digital chip makers’ free cash flow margins, as exiting the manufacturing business has removed large cash expenses from their business models.

5. Revenue Growth

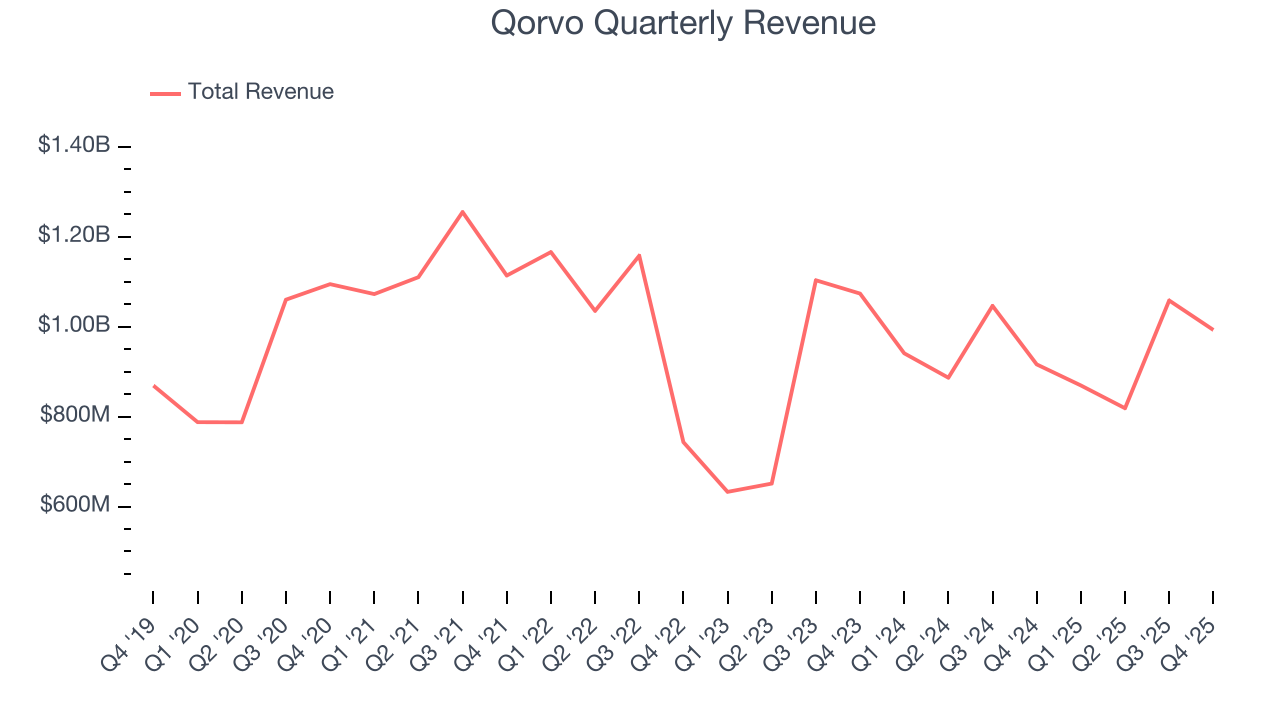

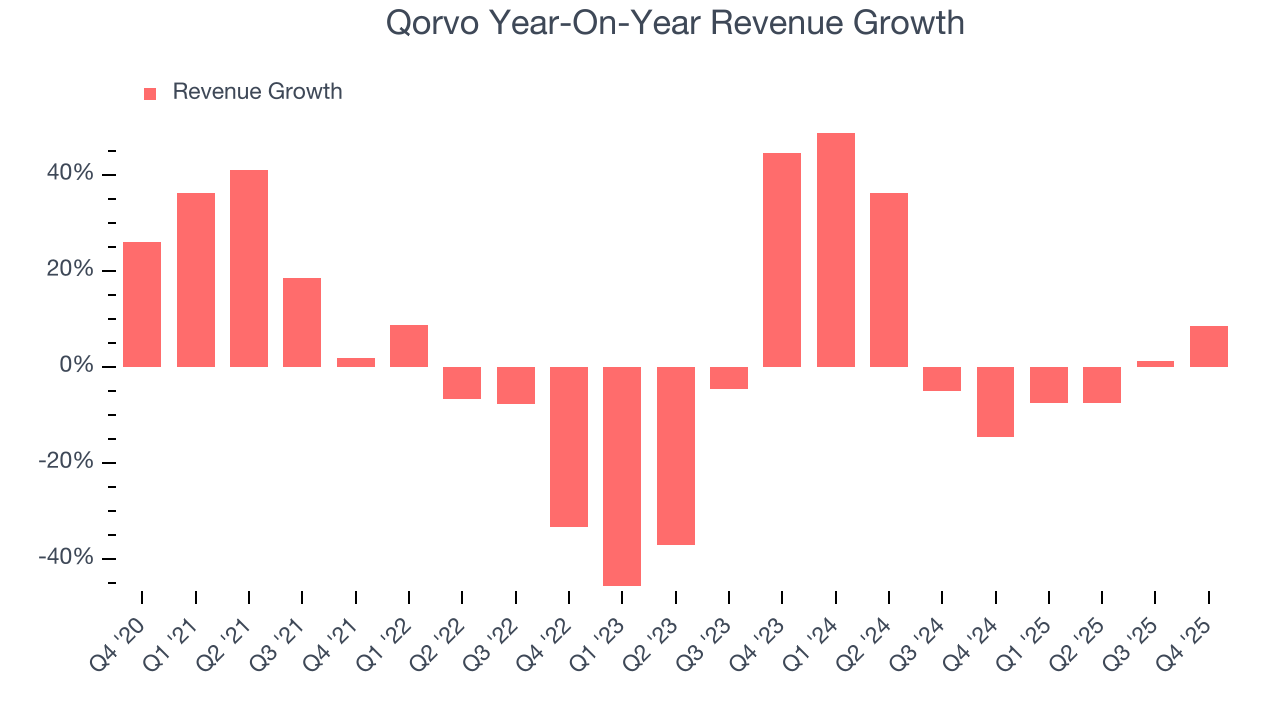

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Qorvo struggled to consistently increase demand as its $3.74 billion of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and suggests it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. Qorvo’s annualized revenue growth of 3.9% over the last two years is above its five-year trend, suggesting some bright spots.

This quarter, Qorvo grew its revenue by 8.4% year on year, and its $993 million of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 91,910% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.8% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

6. Product Demand & Outstanding Inventory

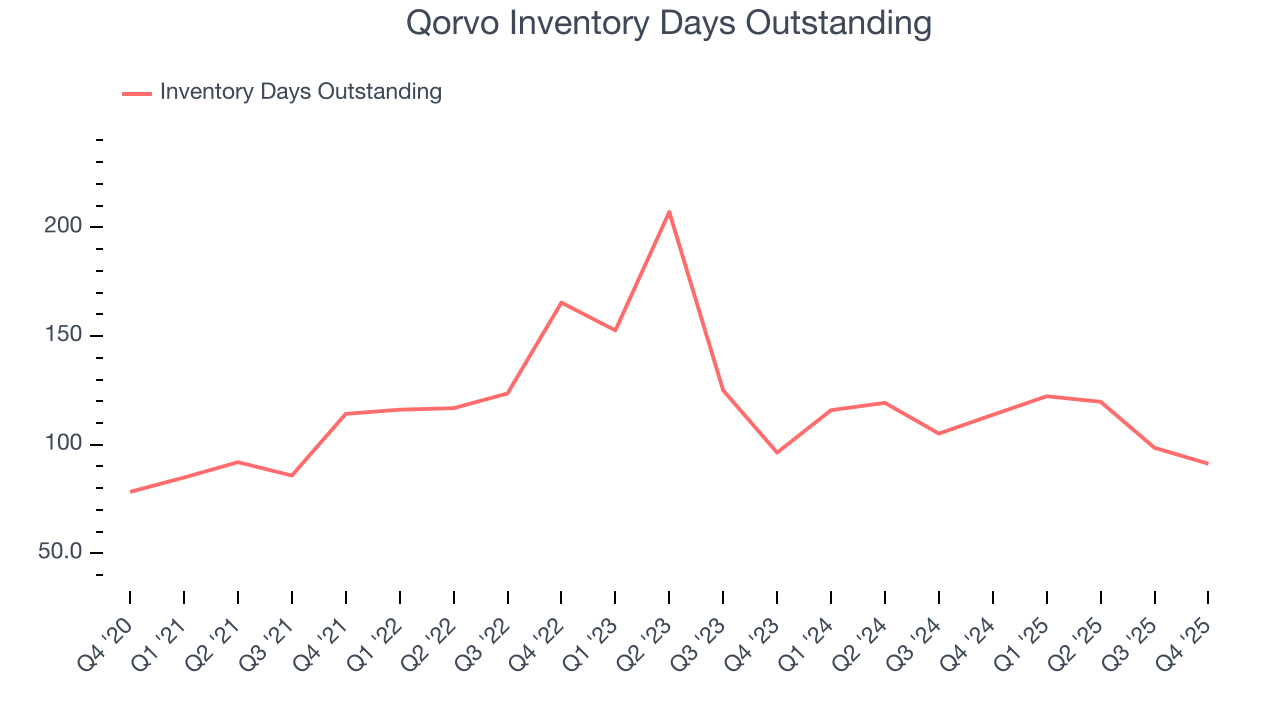

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Qorvo’s DIO came in at 91, which is 27 days below its five-year average. At the moment, these numbers show no indication of an excessive inventory buildup.

7. Gross Margin & Pricing Power

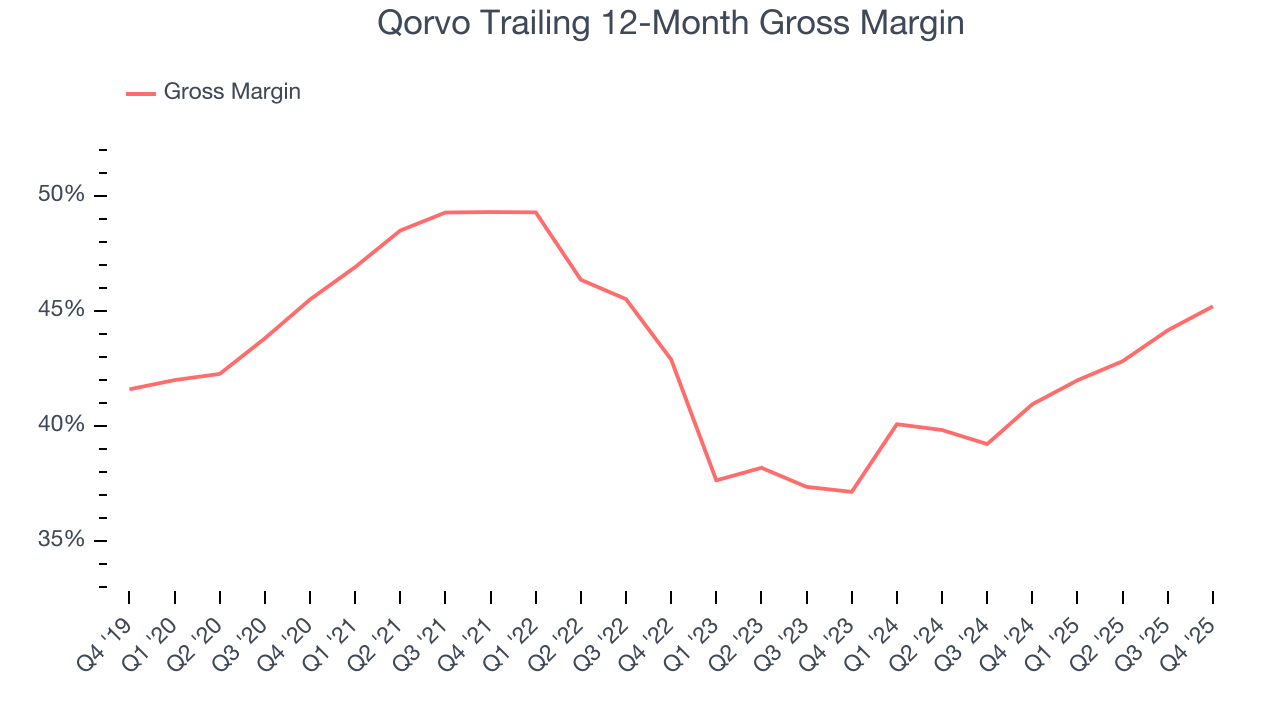

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Qorvo’s gross margin is well below other semiconductor companies, indicating a lack of pricing power and a competitive market. As you can see below, it averaged a 43.1% gross margin over the last two years. That means Qorvo paid its suppliers a lot of money ($56.94 for every $100 in revenue) to run its business.

Qorvo produced a 46.7% gross profit margin in Q4, marking a 4 percentage point increase from 42.7% in the same quarter last year. Qorvo’s full-year margin has also been trending up over the past 12 months, increasing by 4.3 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

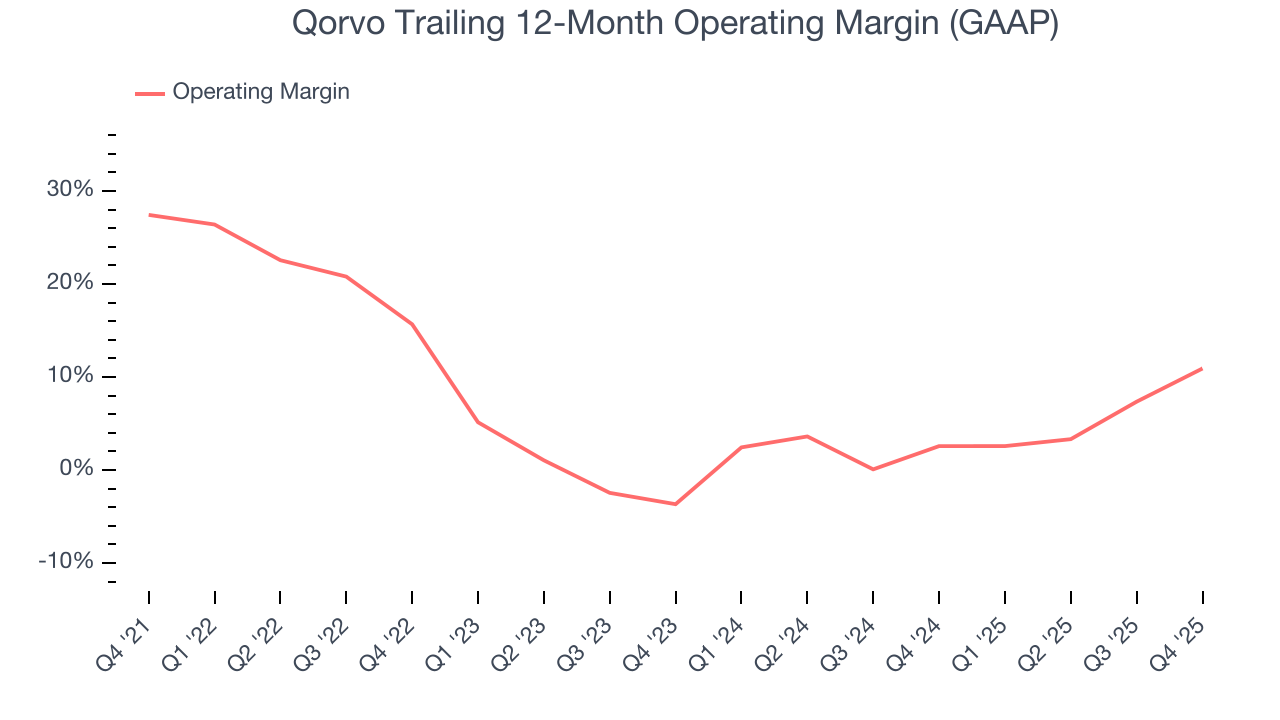

8. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Qorvo was profitable over the last two years but held back by its large cost base. Its average operating margin of 6.7% was weak for a semiconductor business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, Qorvo’s operating margin decreased by 16.5 percentage points over the last five years. Qorvo’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Qorvo generated an operating margin profit margin of 19.4%, up 13.6 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

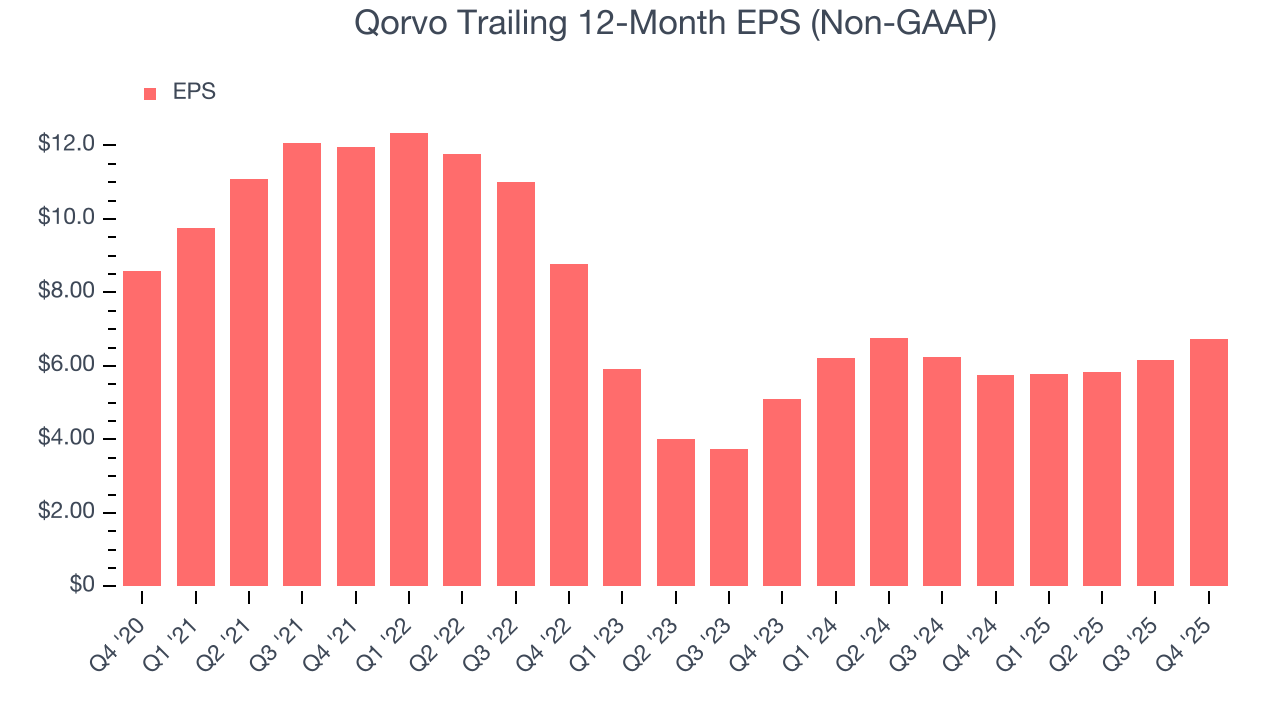

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Qorvo, its EPS declined by 4.7% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

We can take a deeper look into Qorvo’s earnings to better understand the drivers of its performance. As we mentioned earlier, Qorvo’s operating margin expanded this quarter but declined by 16.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Qorvo reported adjusted EPS of $2.17, up from $1.61 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Qorvo’s full-year EPS of $6.73 to shrink by 2%.

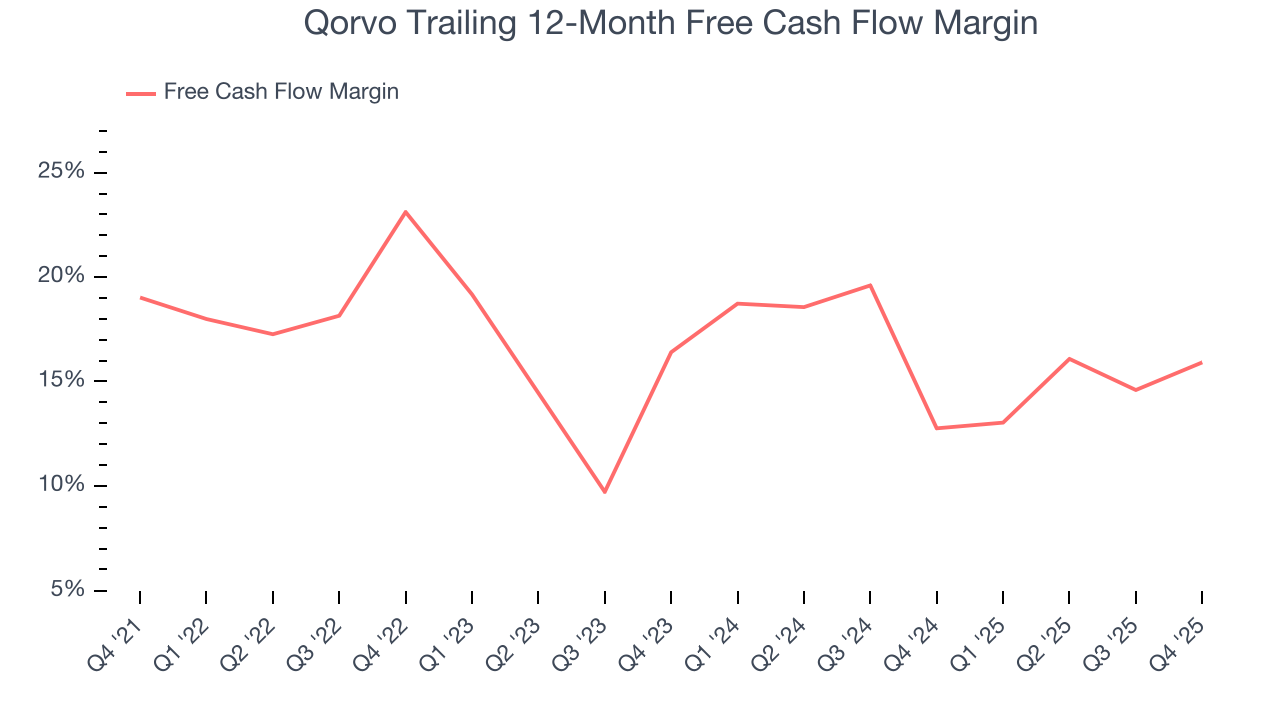

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Qorvo has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 14.3%, subpar for a semiconductor business.

Qorvo’s free cash flow clocked in at $236.9 million in Q4, equivalent to a 23.9% margin. This result was good as its margin was 4.6 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

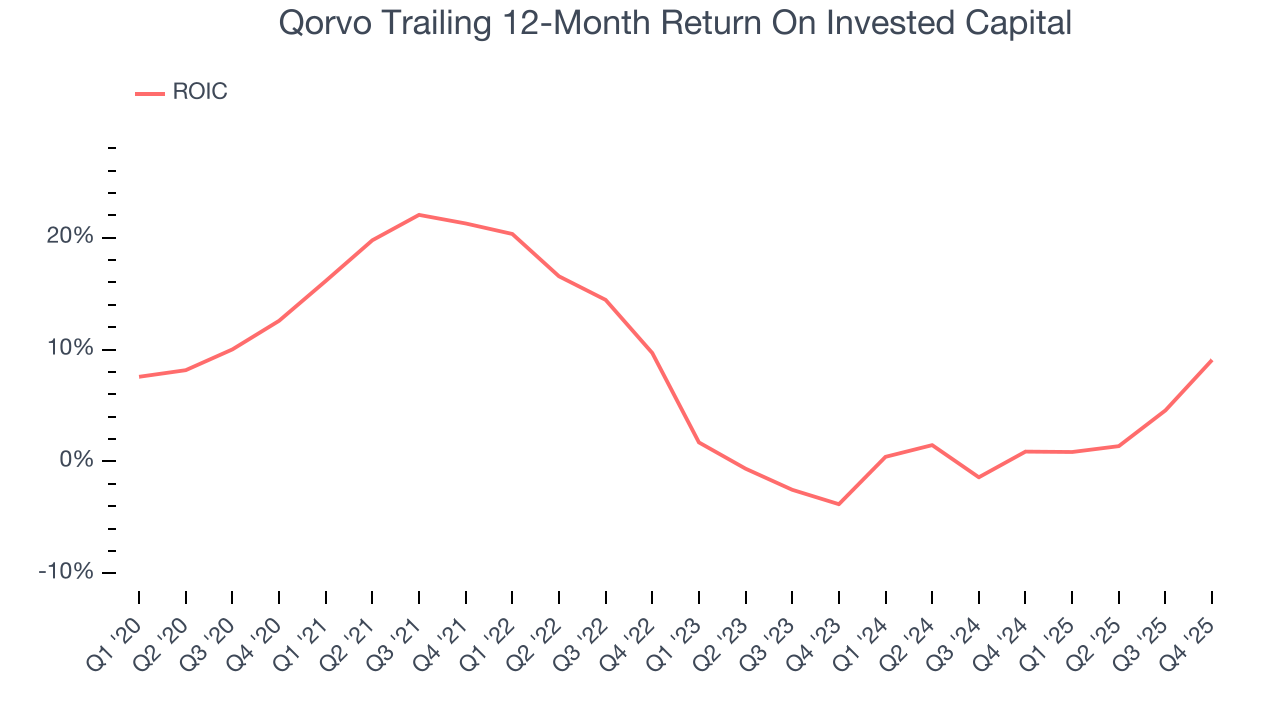

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Qorvo historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.4%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

12. Key Takeaways from Qorvo’s Q4 Results

It was good to see Qorvo beat analysts’ EPS expectations this quarter. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 4.2% to $75.94 immediately following the results.

13. Is Now The Time To Buy Qorvo?

Updated: January 27, 2026 at 4:10 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

We cheer for all companies solving complex technology issues, but in the case of Qorvo, we’ll be cheering from the sidelines. For starters, its revenue growth was weak over the last five years. On top of that, Qorvo’s projected EPS for the next year is lacking, and its declining operating margin shows the business has become less efficient.

Qorvo’s P/E ratio based on the next 12 months is 11.4x. At this valuation, there’s a lot of good news priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $98.78 on the company (compared to the current share price of $75.94).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.