Saia (SAIA)

We’re skeptical of Saia. Its weak sales growth and declining returns on capital show its demand and profits are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think Saia Will Underperform

Pivoting its business model after realizing there was more success in delivering produce than selling it, Saia (NASDAQ:SAIA) is a provider of freight transportation solutions.

- Investment activity picked up over the last five years, pressuring its weak free cash flow profitability

- Estimated sales growth of 2.2% for the next 12 months implies demand will slow from its two-year trend

- A positive is that its earnings per share have outperformed its peers over the last five years, increasing by 17.7% annually

Saia is in the penalty box. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than Saia

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Saia

At $406.46 per share, Saia trades at 41.5x forward P/E. This valuation multiple seems a bit much considering the quality you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Saia (SAIA) Research Report: Q4 CY2025 Update

Freight transportation and logistics provider Saia (NASDAQ:SAIA) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales were flat year on year at $790 million. Its GAAP profit of $1.77 per share was 7% below analysts’ consensus estimates.

Saia (SAIA) Q4 CY2025 Highlights:

- Revenue: $790 million vs analyst estimates of $777 million (flat year on year, 1.7% beat)

- EPS (GAAP): $1.77 vs analyst expectations of $1.90 (7% miss)

- Adjusted EBITDA: $127 million vs analyst estimates of $135.3 million (16.1% margin, 6.1% miss)

- Operating Margin: 8.1%, down from 12.9% in the same quarter last year

- Free Cash Flow was $37.48 million, up from -$2.90 million in the same quarter last year

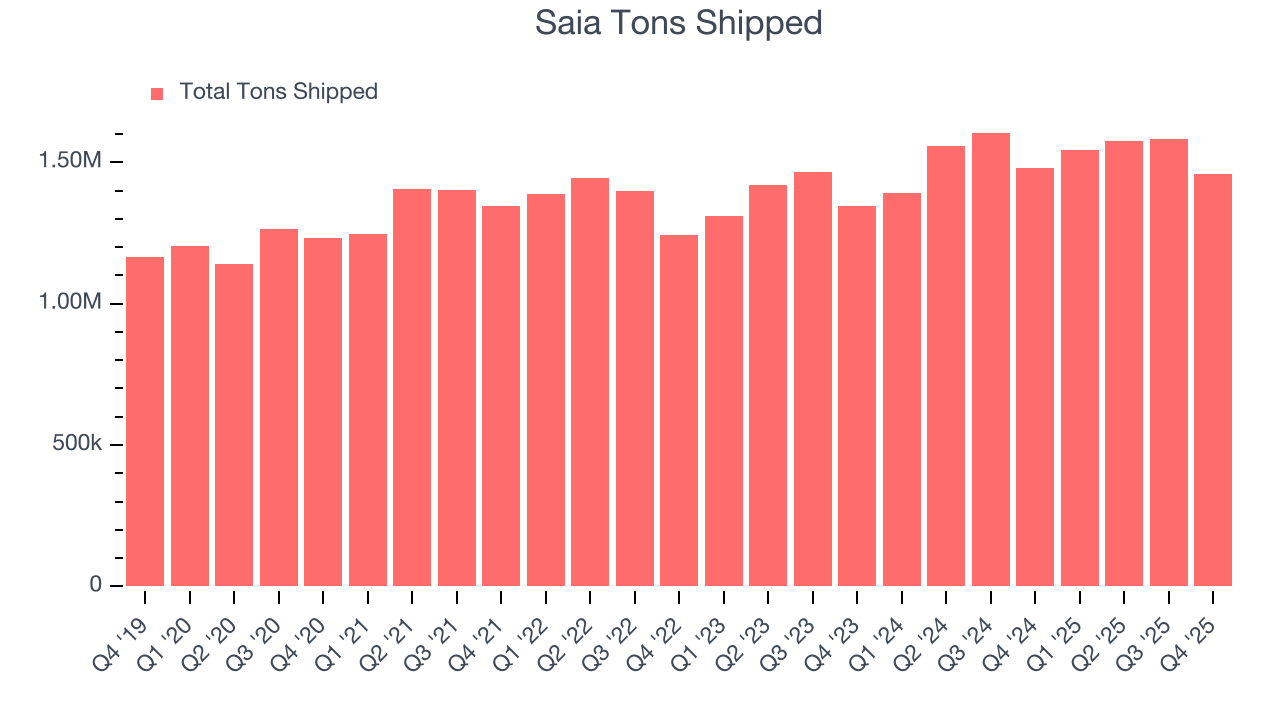

- Sales Volumes fell 1.5% year on year (10.1% in the same quarter last year)

- Market Capitalization: $10.88 billion

Company Overview

Pivoting its business model after realizing there was more success in delivering produce than selling it, Saia (NASDAQ:SAIA) is a provider of freight transportation solutions.

Saia was founded in 1924 with a singular truck delivering produce in Louisiana. The company grew organically and focused on increasing its fleet and number of terminals (where trucks are loaded and unloaded with shipments).

Saia has targeted the acquisition of smaller companies to increase its market share, many of which offered similar products and services. For example, it acquired The Connection Company in 2006 and Madison Freight Systems in 2007, two less-than-truckload delivery companies.

Saia makes less-than-truckload (LTL) deliveries for businesses primarily in the United States, though the company also makes international deliveries. These deliveries are made by collecting smaller shipments from various customers, combining them at a central hub, and then transporting them with its own fleet of trucks.

It engages in various types of contracts with its customers, including long-term contracts which typically last from one to three years and shorter-term agreements for specific projects or seasonal needs. These contracts can include fixed rates or pricing based on the volume of shipments. Additionally, Saia may enter into one-time contracts for individual shipments based on current market rates. Going forward, the company continues to purchase new terminals across the United States to cover more areas, improve delivery times, and handle more shipments.

4. Ground Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

Competitors offering similar products include FedEx (NYSE:FDX), UPS (NYSE:UPS), and Old Dominion (NASDAQ:ODFL).

5. Revenue Growth

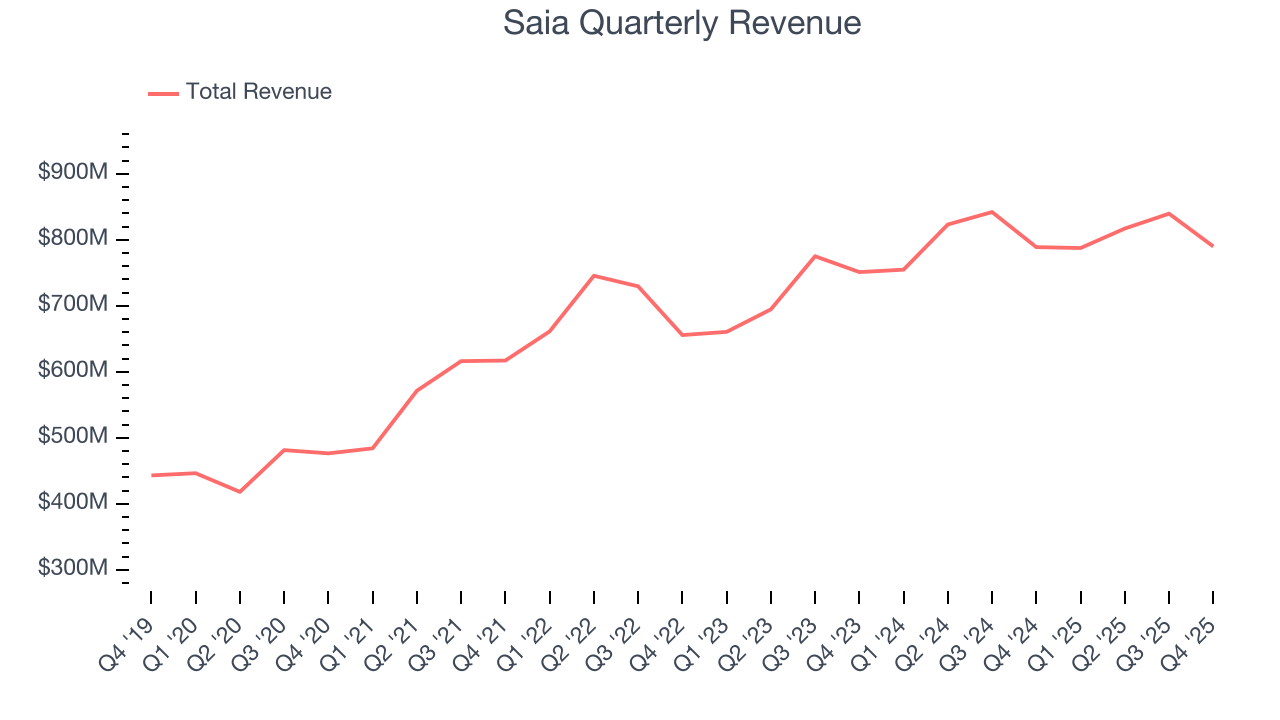

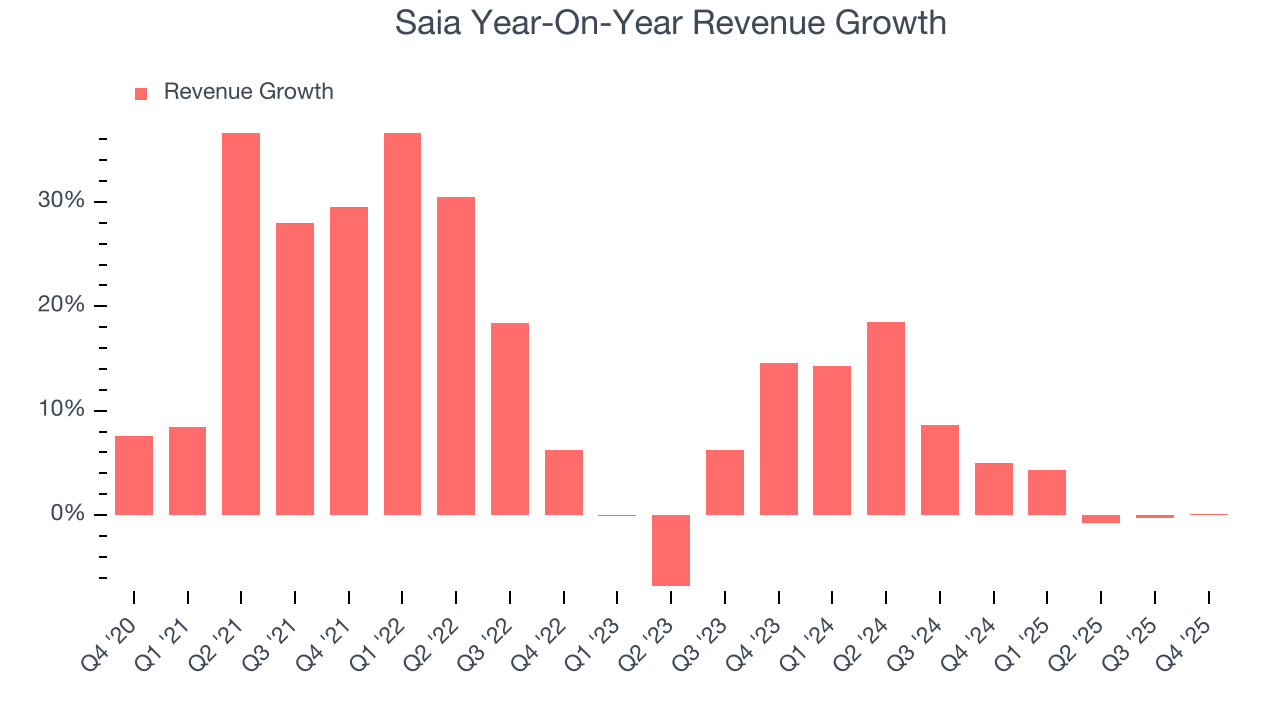

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Saia’s sales grew at an excellent 12.2% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Saia’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 5.9% over the last two years was well below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its number of tons shipped, which reached 1.46 million in the latest quarter. Over the last two years, Saia’s tons shipped averaged 5.6% year-on-year growth. Because this number is in line with its revenue growth, we can see the company kept its prices fairly consistent.

This quarter, Saia’s $790 million of revenue was flat year on year but beat Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds.

6. Gross Margin & Pricing Power

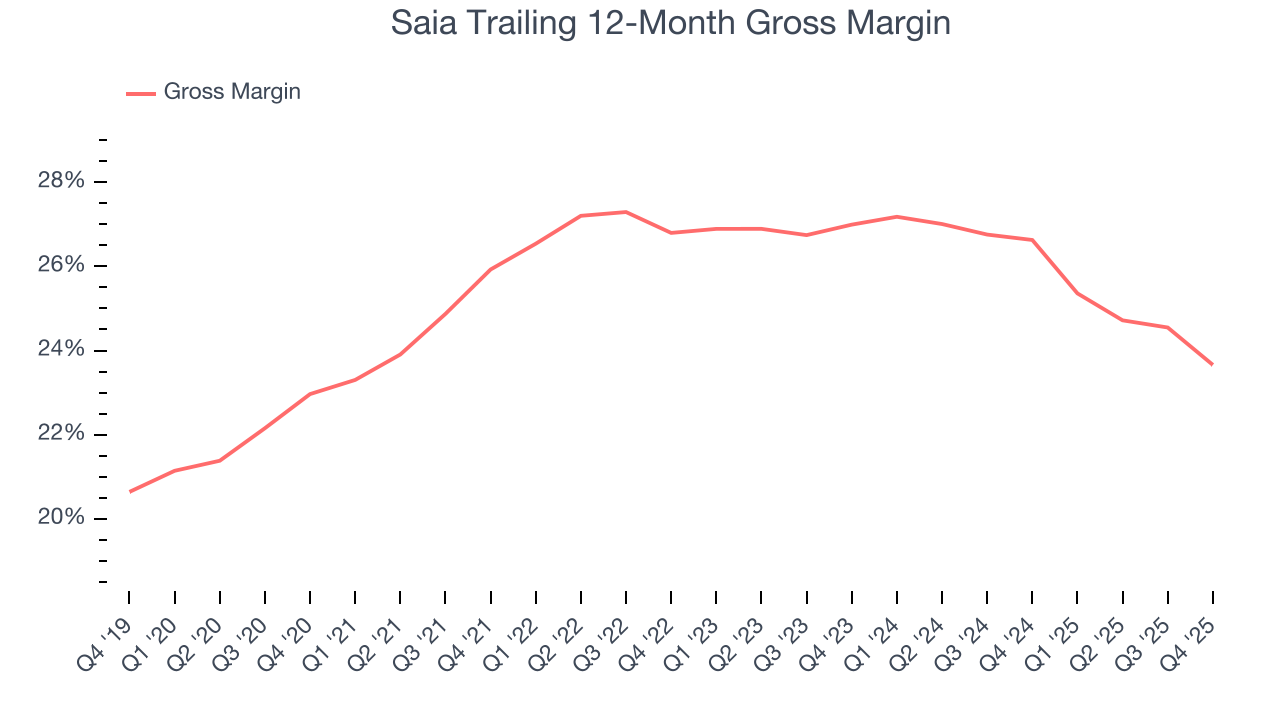

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Saia has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 26% gross margin over the last five years. That means Saia paid its suppliers a lot of money ($74.04 for every $100 in revenue) to run its business.

Saia produced a 21.9% gross profit margin in Q4, marking a 3.6 percentage point decrease from 25.5% in the same quarter last year. Saia’s full-year margin has also been trending down over the past 12 months, decreasing by 3 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

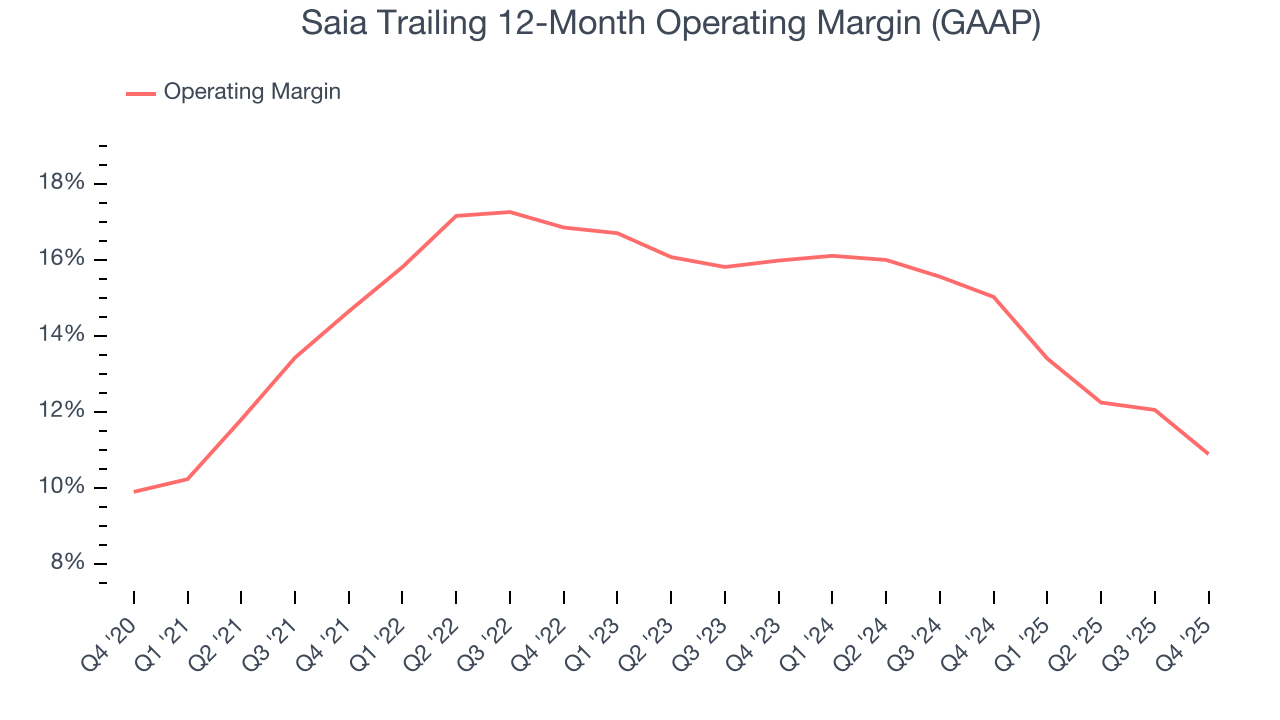

Saia has been an efficient company over the last five years. It was one of the more profitable businesses in the industrials sector, boasting an average operating margin of 14.6%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Saia’s operating margin decreased by 3.8 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Saia generated an operating margin profit margin of 8.1%, down 4.8 percentage points year on year. Since Saia’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

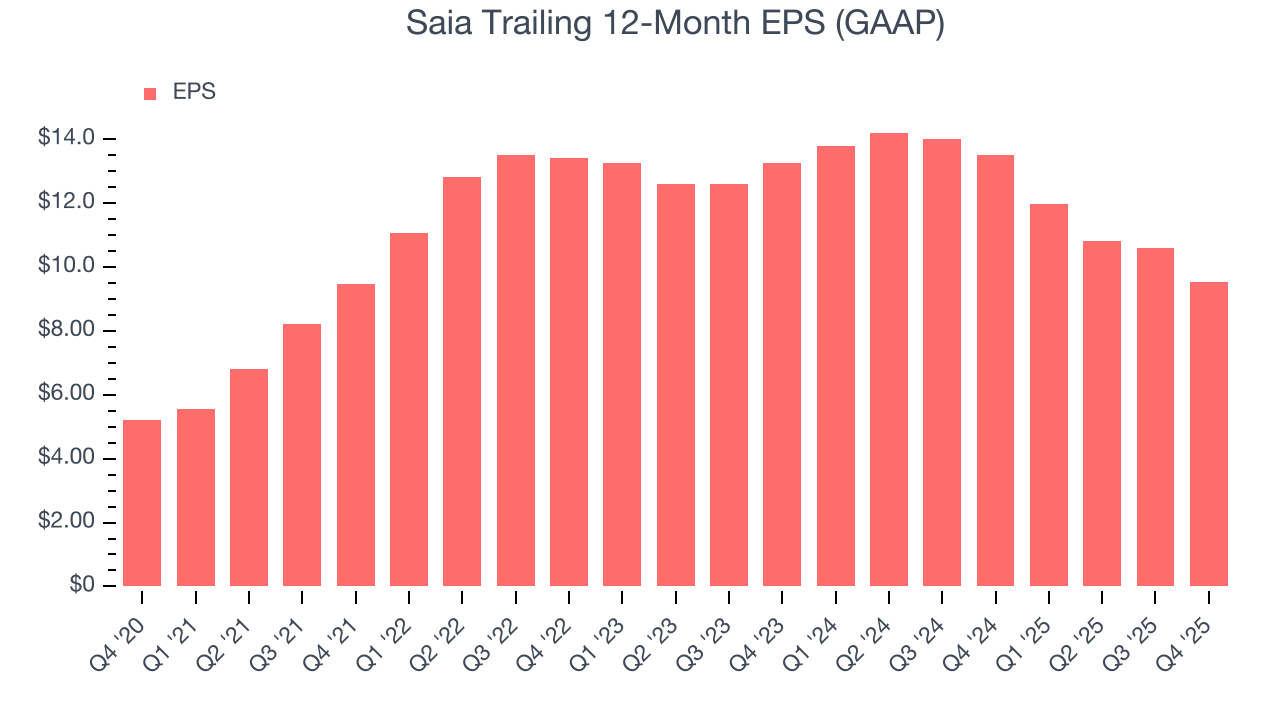

Saia’s remarkable 12.8% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Saia’s two-year annual EPS declines of 15.3% were bad and lower than its 5.9% two-year revenue growth.

We can take a deeper look into Saia’s earnings to better understand the drivers of its performance. Saia’s operating margin has declined over the last two years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Saia reported EPS of $1.77, down from $2.84 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Saia’s full-year EPS of $9.52 to grow 12.2%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

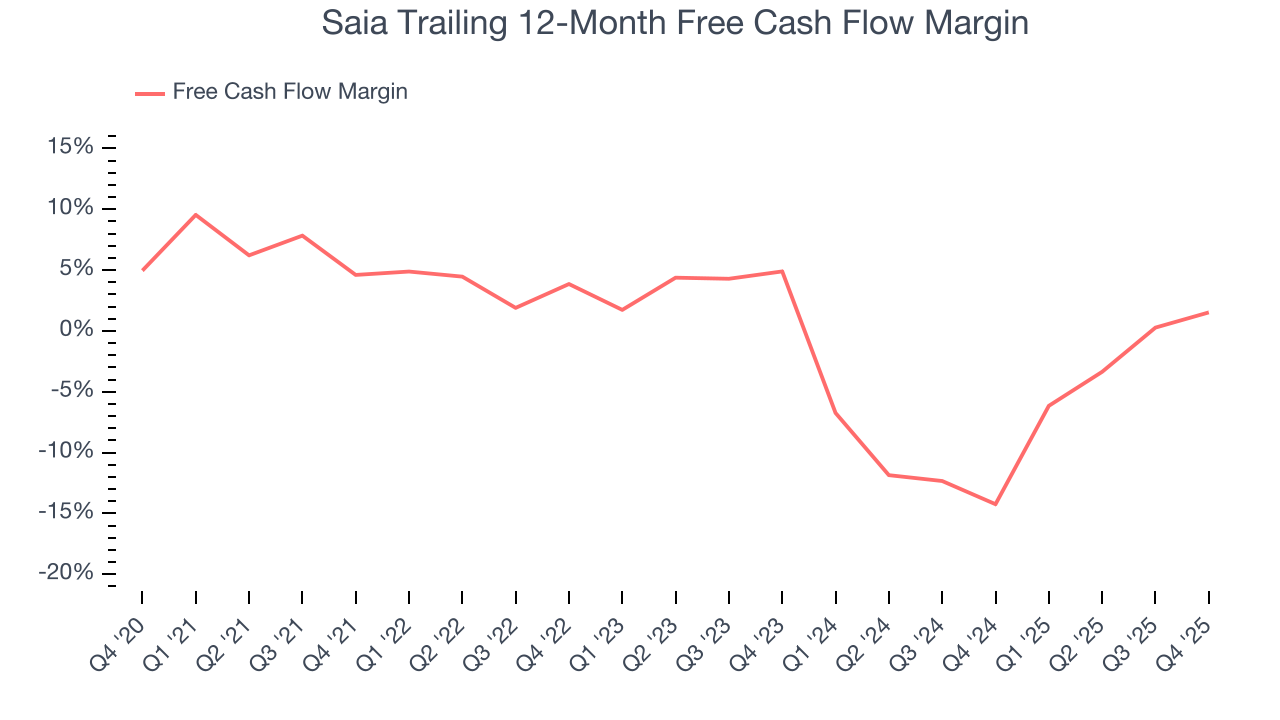

Saia broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders. The divergence from its good operating margin stems from its capital-intensive business model, which requires Saia to make large cash investments in working capital and capital expenditures.

Taking a step back, we can see that Saia’s margin dropped by 3.1 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the longer-term trend returns, it could signal it’s in the middle of an investment cycle.

Saia’s free cash flow clocked in at $37.48 million in Q4, equivalent to a 4.7% margin. This result was good as its margin was 5.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

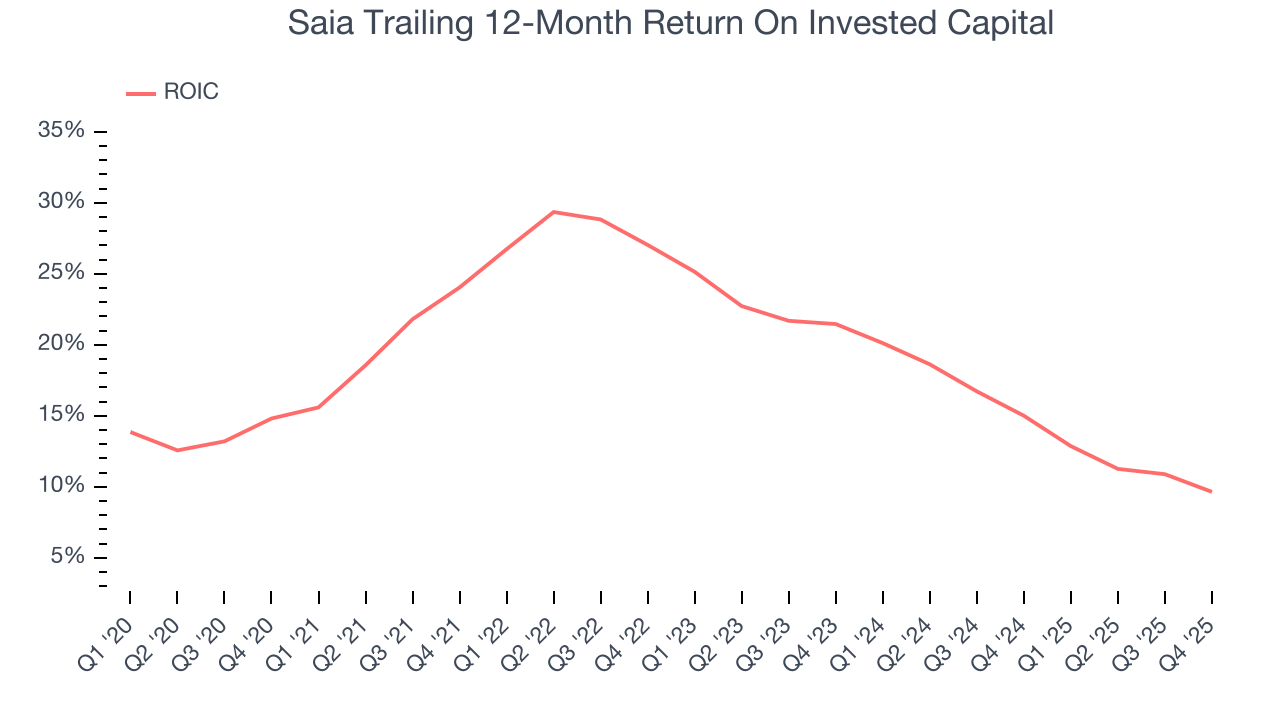

Although Saia hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 19.4%, splendid for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Saia’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

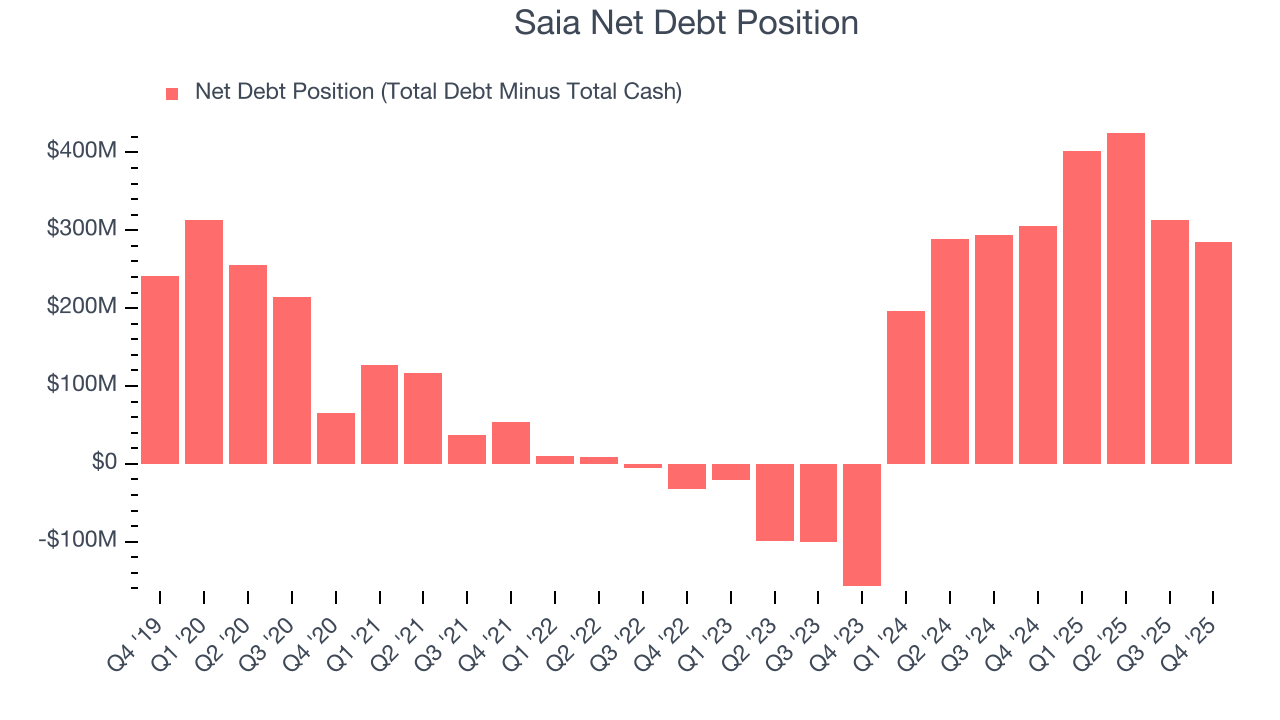

Saia reported $19.72 million of cash and $305 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $586.3 million of EBITDA over the last 12 months, we view Saia’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $10.49 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Saia’s Q4 Results

It was encouraging to see Saia beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 3% to $393.96 immediately after reporting.

13. Is Now The Time To Buy Saia?

Updated: February 10, 2026 at 9:08 PM EST

Before investing in or passing on Saia, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Saia’s business quality ultimately falls short of our standards. Although its revenue growth was impressive over the last five years, it’s expected to deteriorate over the next 12 months and its diminishing returns show management's prior bets haven't worked out. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its low free cash flow margins give it little breathing room.

Saia’s P/E ratio based on the next 12 months is 37.8x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $351.47 on the company (compared to the current share price of $382.35), implying they don’t see much short-term potential in Saia.