SAIC (SAIC)

SAIC keeps us up at night. Its weak sales growth shows demand is soft and its low margins are a cause for concern.― StockStory Analyst Team

1. News

2. Summary

Why We Think SAIC Will Underperform

With over five decades of experience supporting national security missions, Science Applications International Corporation (NASDAQ:SAIC) provides technical, engineering, and enterprise IT services primarily to U.S. government agencies and military branches.

- Annual sales declines of 2.1% for the past two years show its products and services struggled to connect with the market during this cycle

- Sales are projected to be flat over the next 12 months and imply weak demand

- Poor expense management has led to an adjusted operating margin that is below the industry average

SAIC doesn’t check our boxes. There are more promising alternatives.

Why There Are Better Opportunities Than SAIC

Why There Are Better Opportunities Than SAIC

SAIC’s stock price of $94.41 implies a valuation ratio of 10x forward P/E. This sure is a cheap multiple, but you get what you pay for.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. SAIC (SAIC) Research Report: Q3 CY2025 Update

Government IT services provider Science Applications International Corporation (NASDAQ:SAIC) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 5.6% year on year to $1.87 billion. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $7.3 billion at the midpoint. Its non-GAAP profit of $2.58 per share was 20.2% above analysts’ consensus estimates.

SAIC (SAIC) Q3 CY2025 Highlights:

- Revenue: $1.87 billion vs analyst estimates of $1.87 billion (5.6% year-on-year decline, in line)

- Adjusted EPS: $2.58 vs analyst estimates of $2.15 (20.2% beat)

- Adjusted EBITDA: $185 million vs analyst estimates of $176.2 million (9.9% margin, 5% beat)

- The company slightly lifted its revenue guidance for the full year to $7.3 billion at the midpoint from $7.29 billion

- Management raised its full-year Adjusted EPS guidance to $9.90 at the midpoint, a 4.2% increase

- EBITDA guidance for the full year is $695 million at the midpoint, above analyst estimates of $683.1 million

- Operating Margin: 6.9%, down from 8.1% in the same quarter last year

- Free Cash Flow Margin: 7.2%, up from 0.5% in the same quarter last year

- Backlog: $23.79 billion at quarter end

- Market Capitalization: $4.03 billion

Company Overview

With over five decades of experience supporting national security missions, Science Applications International Corporation (NASDAQ:SAIC) provides technical, engineering, and enterprise IT services primarily to U.S. government agencies and military branches.

SAIC operates at the intersection of technology and national security, delivering complex solutions that help government agencies modernize their IT infrastructure, enhance digital capabilities, and address evolving threats. The company's services span the entire technology lifecycle—from design and development to integration, deployment, and ongoing management.

The company's portfolio includes IT modernization, where SAIC helps agencies transition to cloud computing environments while maintaining security and compliance requirements. Its digital engineering services create virtual models of complex systems before physical development, reducing costs and accelerating delivery. SAIC has also expanded into artificial intelligence solutions, helping government clients harness data for improved decision-making and operational efficiency.

For defense customers, SAIC provides critical support for weapon systems across all military branches. For example, when the Army needs to upgrade vehicle fleets with new communications or protection systems, SAIC engineers can design, integrate, and implement these modifications while ensuring interoperability with existing systems. The company also delivers training and simulation technologies that prepare military personnel for complex missions without the risks and costs of live exercises.

SAIC generates revenue primarily through government contracts, operating approximately 1,800 active contracts and task orders. The company maintains long-term relationships with key customers including the Army, Navy, Air Force, and intelligence agencies. While predominantly serving U.S. federal clients, SAIC's business model relies on winning competitive contract awards and delivering solutions that meet strict government requirements for security, reliability, and performance.

4. Government & Technical Consulting

The sector has historically benefitted from steady government spending on defense, infrastructure, and regulatory compliance, providing firms long-term contract stability. However, the Trump administration is showing more willingness than previous administrations to upend government spending and bloat. Whether or not defense budgets get cut, the rising demand for cybersecurity, AI-driven defense solutions, and sustainability consulting should benefit the sector for years, as agencies and enterprises seek expertise in navigating complex technology and regulations. Additionally, industrial automation and digital engineering are driving efficiency gains in infrastructure and technical consulting projects, which could help profit margins.

SAIC competes with large defense contractors that offer IT services alongside hardware systems, such as General Dynamics (NYSE:GD), Northrop Grumman (NYSE:NOC), and RTX Corporation (NYSE:RTX), as well as technical services specialists like Booz Allen Hamilton (NYSE:BAH), CACI International (NYSE:CACI), and Leidos Holdings (NYSE:LDOS).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $7.35 billion in revenue over the past 12 months, SAIC is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To expand meaningfully, SAIC likely needs to tweak its prices, innovate with new offerings, or enter new markets.

As you can see below, SAIC’s sales grew at a sluggish 1.3% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. SAIC’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.1% annually.

This quarter, SAIC reported a rather uninspiring 5.6% year-on-year revenue decline to $1.87 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products and services will spur better top-line performance, it is still below the sector average.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

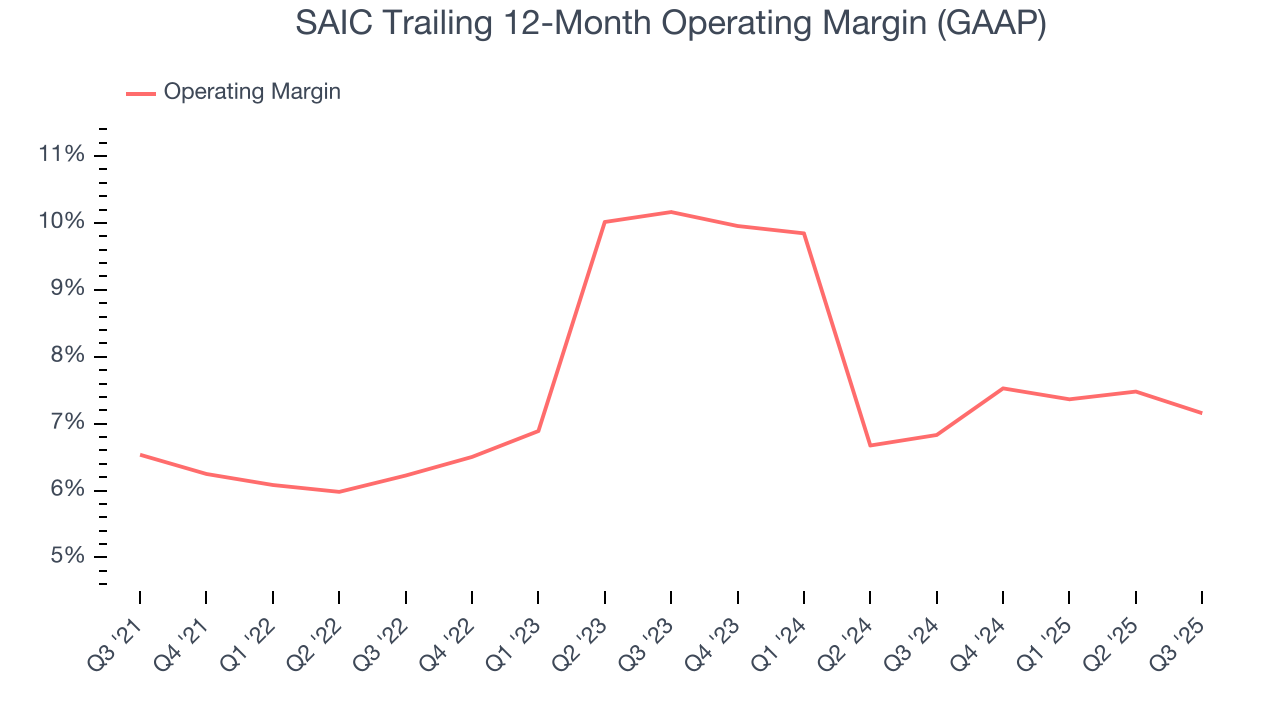

SAIC’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 7.4% over the last five years. This profitability was paltry for a business services business and caused by its suboptimal cost structure.

Looking at the trend in its profitability, SAIC’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, SAIC generated an operating margin profit margin of 6.9%, down 1.2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

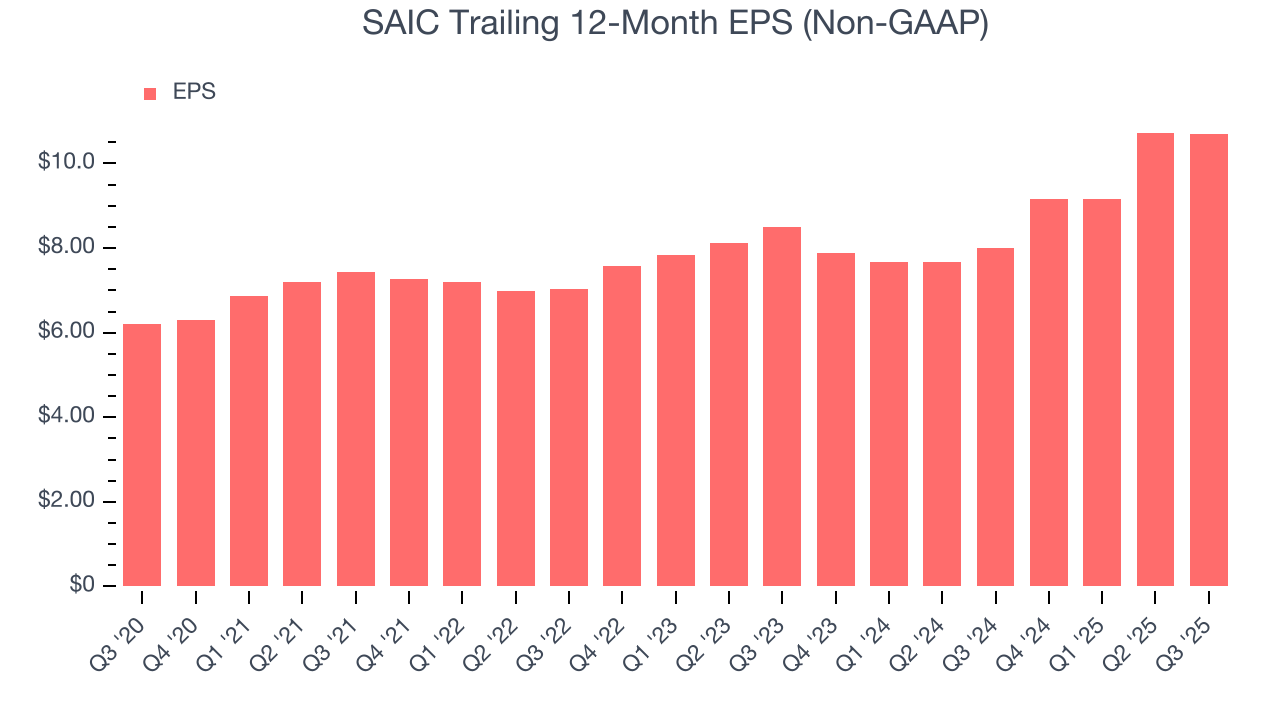

SAIC’s EPS grew at a remarkable 11.5% compounded annual growth rate over the last five years, higher than its 1.3% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For SAIC, its two-year annual EPS growth of 12.2% is similar to its five-year trend, implying strong and stable earnings power.

In Q3, SAIC reported adjusted EPS of $2.58, down from $2.61 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects SAIC’s full-year EPS of $10.70 to shrink by 17.6%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

SAIC has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.8% over the last five years, slightly better than the broader business services sector.

SAIC’s free cash flow clocked in at $135 million in Q3, equivalent to a 7.2% margin. This result was good as its margin was 6.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

SAIC’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 12.5%, slightly better than typical business services business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, SAIC’s ROIC averaged 2.7 percentage point increases each year. This is a good sign, and we hope the company can keep improving.

10. Balance Sheet Assessment

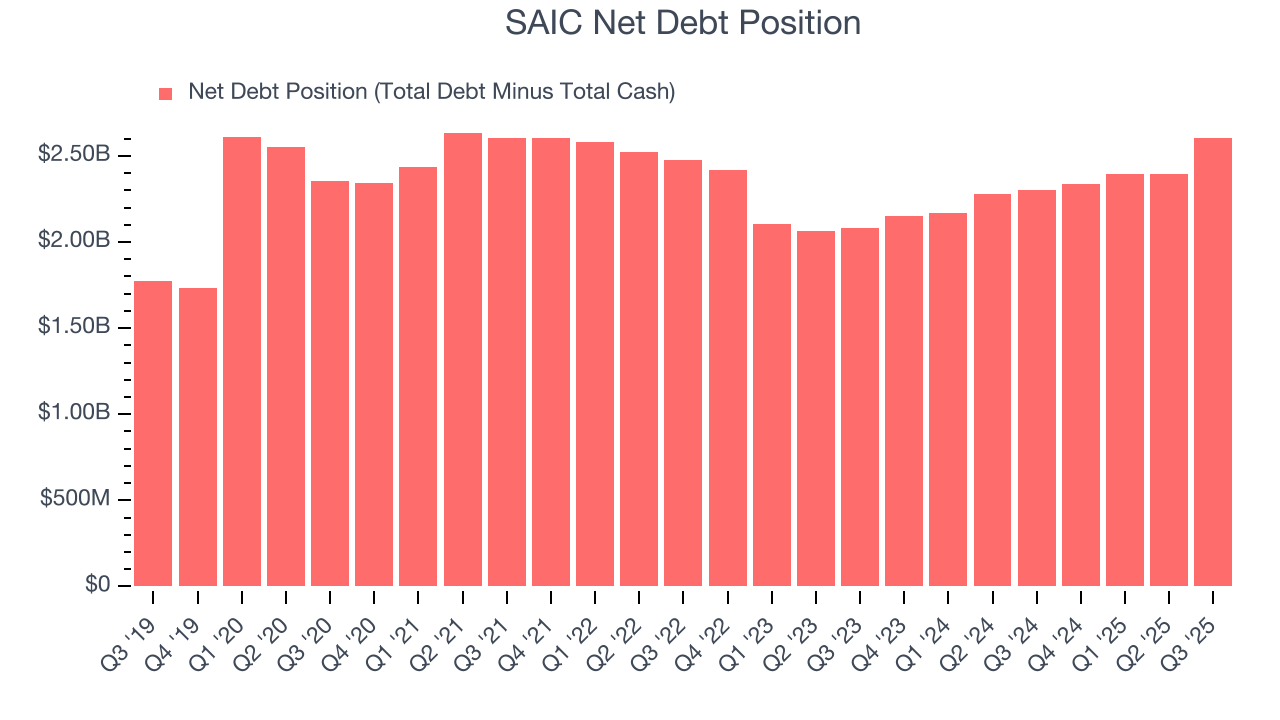

SAIC reported $45 million of cash and $2.65 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $704 million of EBITDA over the last 12 months, we view SAIC’s 3.7× net-debt-to-EBITDA ratio as safe. We also see its $57 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from SAIC’s Q3 Results

It was good to see SAIC beat analysts’ EBITDA and EPS expectations this quarter. We were also glad its full-year EPS guidance outperformed Wall Street’s estimates. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 4.8% to $91.75 immediately following the results.

12. Is Now The Time To Buy SAIC?

Updated: March 4, 2026 at 11:52 PM EST

Before making an investment decision, investors should account for SAIC’s business fundamentals and valuation in addition to what happened in the latest quarter.

We cheer for all companies making their customers lives easier, but in the case of SAIC, we’ll be cheering from the sidelines. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking. On top of that, its operating margins are low compared to other business services companies.

SAIC’s P/E ratio based on the next 12 months is 10.2x. This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $116.22 on the company (compared to the current share price of $93.61).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.