Shopify (SHOP)

We love companies like Shopify. Its efficient sales engine has led to first-class growth, showing it can win market share organically.― StockStory Analyst Team

1. News

2. Summary

Why We Like Shopify

Starting with just three people selling snowboards online in 2004, Shopify (NYSE:SHOP) provides a comprehensive platform that enables merchants of all sizes to create, manage and grow their businesses across multiple sales channels.

- Winning new contracts that can potentially increase in value as its billings growth has averaged 30.8% over the last year

- Market share will likely rise over the next 12 months as its expected revenue growth of 25.3% is robust

- Software platform has product-market fit given the rapid recovery of its customer acquisition costs

Shopify is a standout company. The valuation looks fair relative to its quality, so this could be an opportune time to buy some shares.

Why Is Now The Time To Buy Shopify?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Shopify?

Shopify’s stock price of $128.94 implies a valuation ratio of 11.6x forward price-to-sales. Most companies in the software sector may feature a cheaper multiple, but we think Shopify is priced fairly given its fundamentals.

Our work shows, time and again, that buying high-quality companies and holding them routinely leads to market outperformance. Over a multi-year investment horizon, entry price doesn’t matter nearly as much as business quality.

3. Shopify (SHOP) Research Report: Q4 CY2025 Update

E-commerce platform Shopify (NYSE:SHOP) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 30.6% year on year to $3.67 billion. Its GAAP profit of $0.57 per share was 33.9% above analysts’ consensus estimates.

Shopify (SHOP) Q4 CY2025 Highlights:

- Revenue: $3.67 billion vs analyst estimates of $3.60 billion (30.6% year-on-year growth, 2% beat)

- EPS (GAAP): $0.57 vs analyst estimates of $0.43 (33.9% beat)

- Adjusted EBITDA: $753 million vs analyst estimates of $709.3 million (20.5% margin, 6.2% beat)

- Operating Margin: 17.2%, in line with the same quarter last year

- Free Cash Flow Margin: 19.5%, up from 17.8% in the previous quarter

- Market Capitalization: $165.6 billion

Company Overview

Starting with just three people selling snowboards online in 2004, Shopify (NYSE:SHOP) provides a comprehensive platform that enables merchants of all sizes to create, manage and grow their businesses across multiple sales channels.

Shopify's platform serves as the backbone for millions of merchants worldwide, from small startups to large enterprises, offering the tools needed to run an omnichannel retail operation. The company's subscription-based model provides varying tiers of service, with the entry-level Basic plan aimed at new businesses and the Shopify Plus plan designed for high-volume merchants with complex needs.

Merchants use Shopify to design online storefronts, process payments, manage inventory, and handle shipping logistics. A business owner might use Shopify to set up an online store, synchronize inventory between their physical location and e-commerce site, process customer payments through Shopify Payments, and print shipping labels directly from the platform.

Revenue comes from two main sources: subscription solutions (monthly fees for access to the platform) and merchant solutions (transaction-based services like payment processing and shipping). The company extends its functionality through its App Store, where third-party developers offer over 16,000 specialized tools for tasks like marketing, customer service, and accounting.

Shopify has expanded globally with a presence in more than 175 countries, with significant concentrations in North America and Europe. The platform supports multiple currencies and languages, allowing merchants to sell internationally without technical barriers.

4. E-commerce Software

While e-commerce has been around for over two decades and enjoyed meaningful growth, its overall penetration of retail still remains low. Only around $1 in every $5 spent on retail purchases comes from digital orders, leaving over 80% of the retail market still ripe for online disruption. It is these large swathes of the retail where e-commerce has not yet taken hold that drives the demand for various e-commerce software solutions.

Shopify competes with other e-commerce platforms such as BigCommerce (NASDAQ:BIGC), WooCommerce (owned by Automattic), Adobe Commerce (formerly Magento) (NASDAQ:ADBE), as well as broader commerce solutions from companies like Amazon (NASDAQ:AMZN) with its Amazon Webstore, and Salesforce (NYSE:CRM) with its Commerce Cloud.

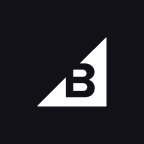

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Shopify’s sales grew at an excellent 31.6% compounded annual growth rate over the last five years. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Shopify’s annualized revenue growth of 27.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Shopify reported wonderful year-on-year revenue growth of 30.6%, and its $3.67 billion of revenue exceeded Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 23.5% over the next 12 months, a deceleration versus the last two years. Still, this projection is eye-popping given its scale and implies the market is forecasting success for its products and services.

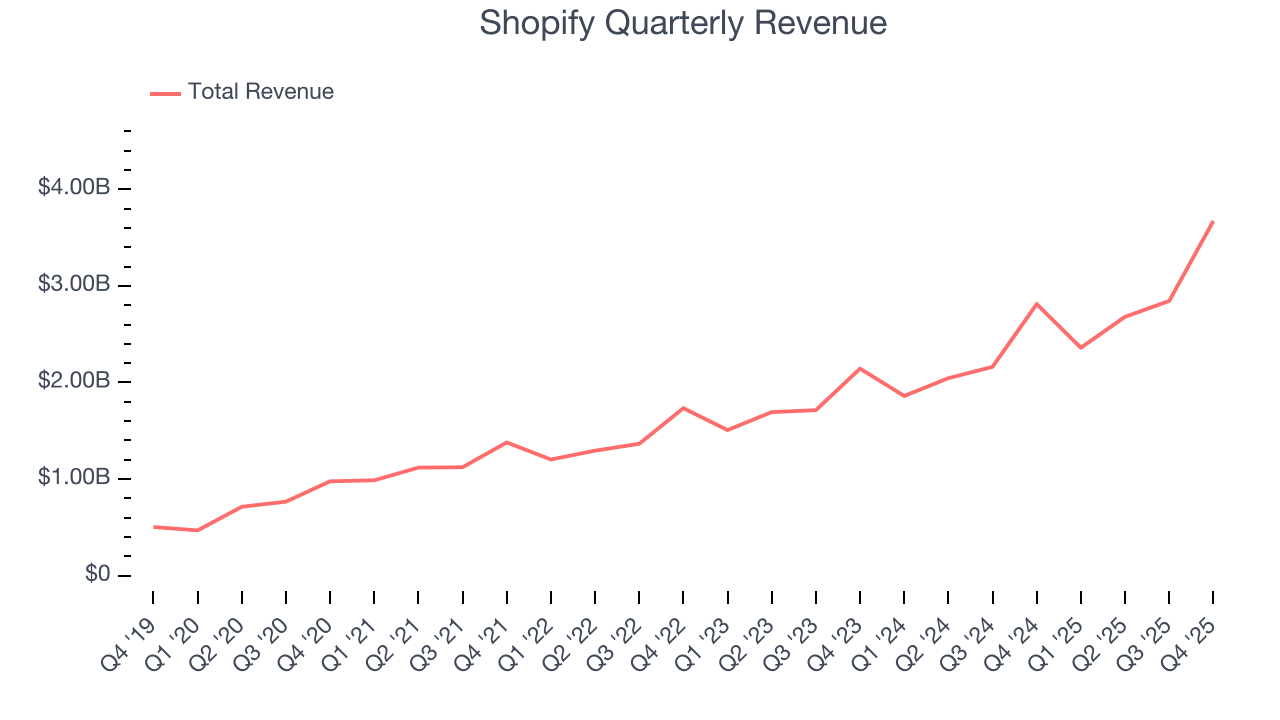

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Shopify is extremely efficient at acquiring new customers, and its CAC payback period checked in at 5.5 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation due to its scale. These dynamics give Shopify more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

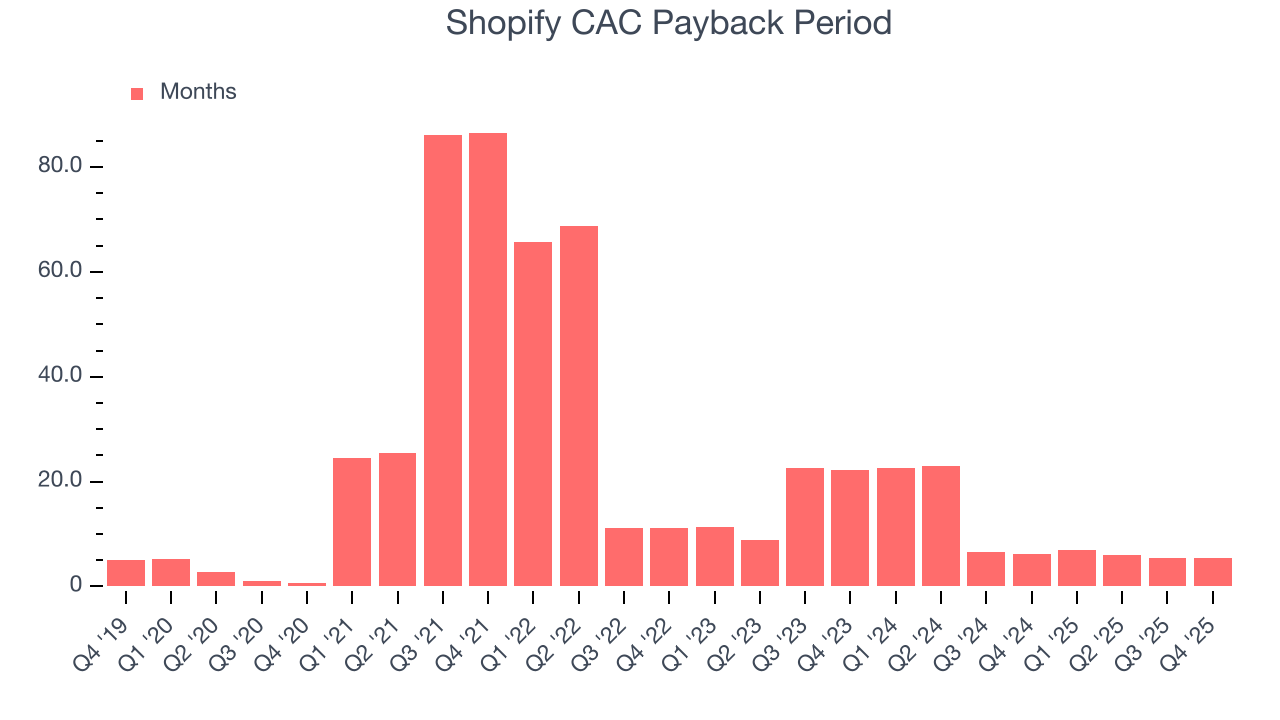

7. Gross Margin & Pricing Power

For software companies like Shopify, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Shopify’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 48.1% gross margin over the last year. Said differently, Shopify had to pay a chunky $51.93 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Shopify has seen gross margins decline by 1.7 percentage points over the last 2 year, which is poor compared to software peers.

Shopify’s gross profit margin came in at 46.1% this quarter, marking a 2 percentage point decrease from 48.1% in the same quarter last year. Shopify’s full-year margin has also been trending down over the past 12 months, decreasing by 2.3 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

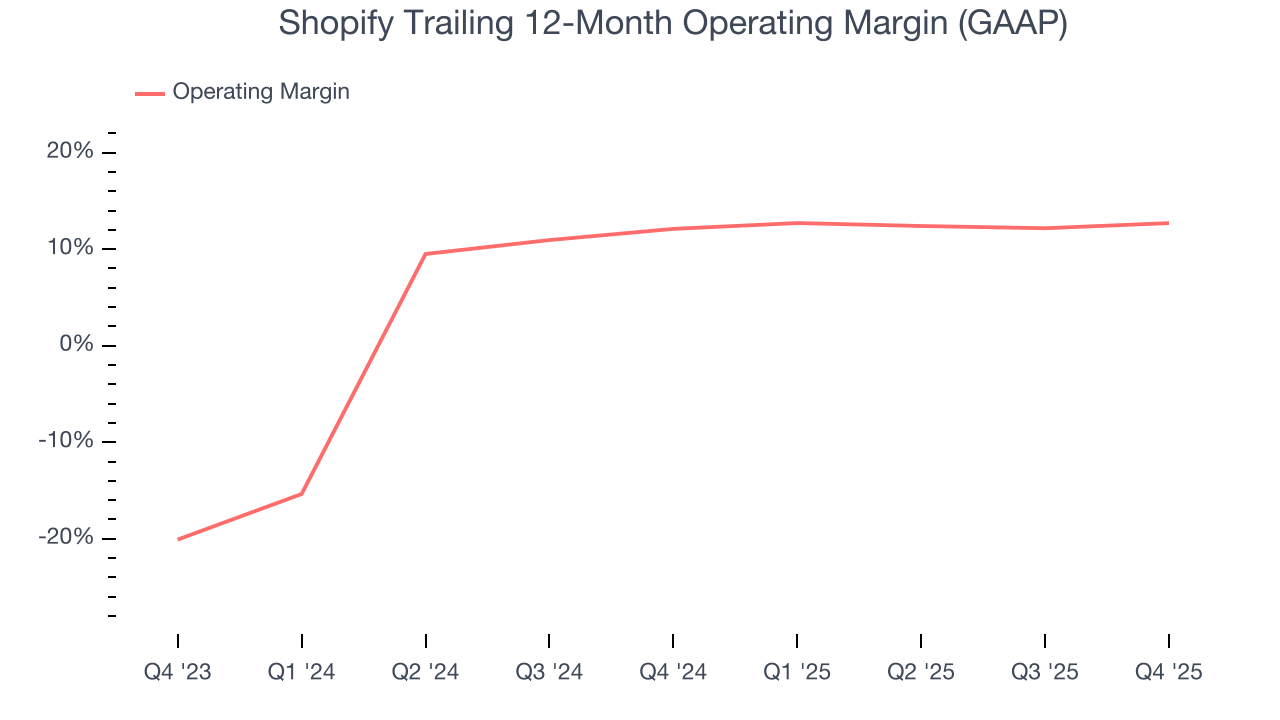

8. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Shopify has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 12.7%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Shopify’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Shopify generated an operating margin profit margin of 17.2%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

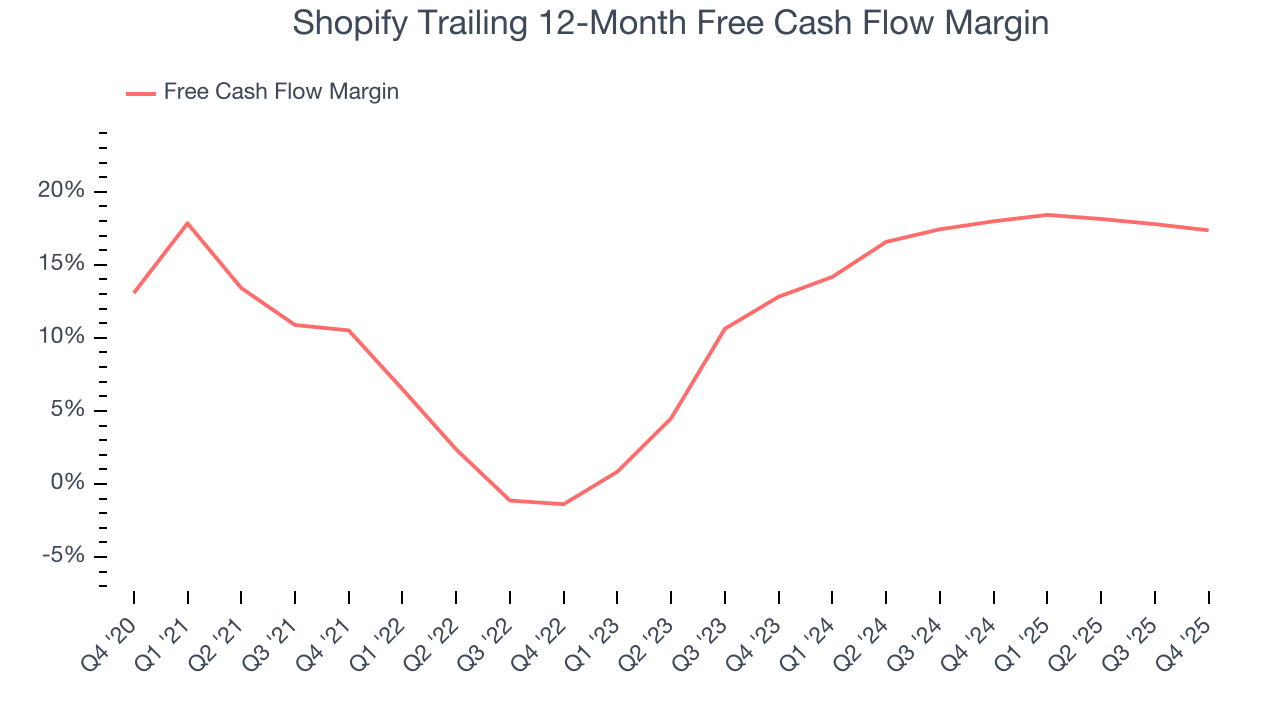

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Shopify has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 17.4% over the last year, slightly better than the broader software sector.

Shopify’s free cash flow clocked in at $715 million in Q4, equivalent to a 19.5% margin. The company’s cash profitability regressed as it was 2.3 percentage points lower than in the same quarter last year, but it’s still above its one-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Over the next year, analysts’ consensus estimates show they’re expecting Shopify’s free cash flow margin of 17.4% for the last 12 months to remain the same.

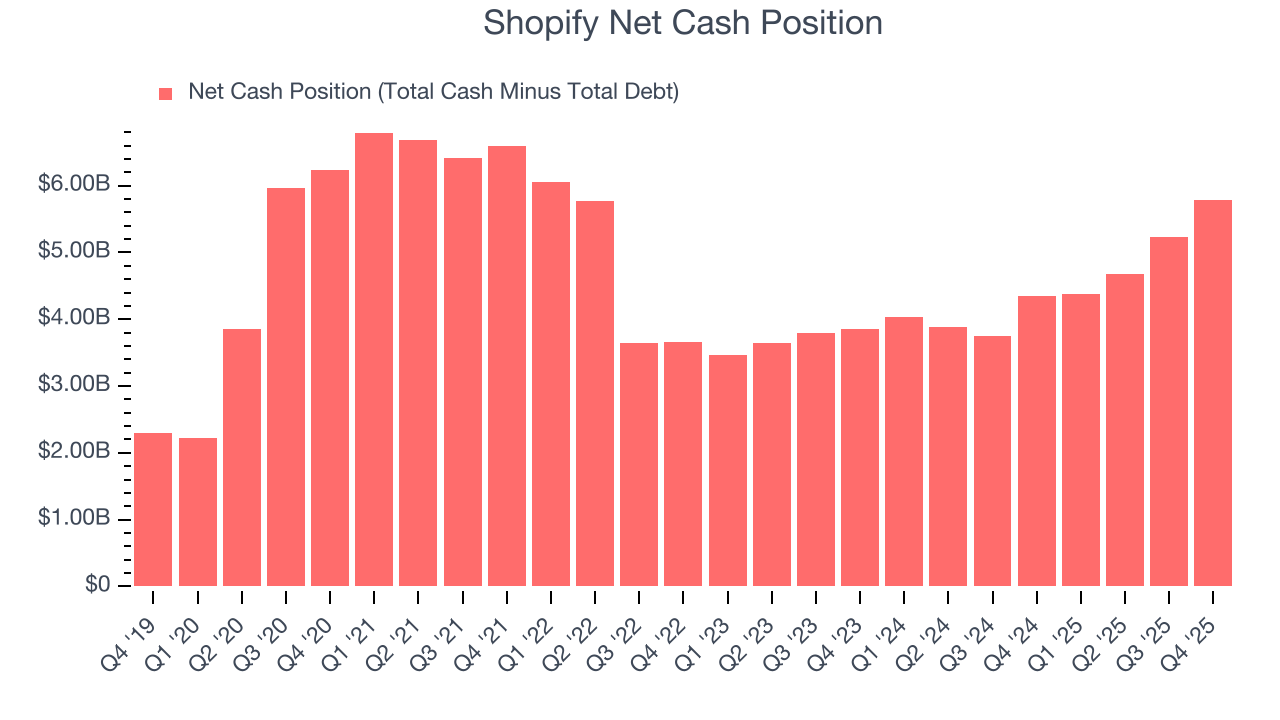

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Shopify is a profitable, well-capitalized company with $5.78 billion of cash and no debt. This position is 3.5% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Shopify’s Q4 Results

We enjoyed seeing Shopify beat analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 10.6% to $141.03 immediately after reporting.

12. Is Now The Time To Buy Shopify?

Updated: February 11, 2026 at 7:17 AM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Shopify is a high-quality business worth owning. For starters, its revenue growth was strong over the last five years. And while its gross margins show its business model is much less lucrative than other companies, its efficient sales strategy allows it to target and onboard new users at scale. Additionally, Shopify’s gross merchandise volume has soared, showcasing high user engagement and robust platform activity.

Shopify’s price-to-sales ratio based on the next 12 months is 11.6x. Scanning the software space today, Shopify’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $178.13 on the company (compared to the current share price of $141.03), implying they see 26.4% upside in buying Shopify in the short term.