Sirius XM (SIRI)

Sirius XM is up against the odds. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Sirius XM Will Underperform

Known for its commercial-free music channels, Sirius XM (NASDAQ:SIRI) is a broadcasting company that provides satellite radio and online radio services across North America.

- Muted 1.3% annual revenue growth over the last five years shows its demand lagged behind its consumer discretionary peers

- Earnings per share lagged its peers over the last five years as they only grew by 5.3% annually

- Projected sales for the next 12 months are flat and suggest demand will be subdued

Sirius XM doesn’t satisfy our quality benchmarks. We see more attractive opportunities in the market.

Why There Are Better Opportunities Than Sirius XM

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Sirius XM

Sirius XM is trading at $20.93 per share, or 6.8x forward P/E. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Sirius XM (SIRI) Research Report: Q4 CY2025 Update

Satellite radio and media company Sirius XM (NASDAQ:SIRI) beat Wall Street’s revenue expectations in Q4 CY2025, but sales were flat year on year at $2.19 billion. Its GAAP profit of $0.24 per share was 69% below analysts’ consensus estimates.

Sirius XM (SIRI) Q4 CY2025 Highlights:

- Revenue: $2.19 billion vs analyst estimates of $2.17 billion (flat year on year, 1% beat)

- EPS (GAAP): $0.24 vs analyst expectations of $0.77 (69% miss)

- Adjusted EBITDA: $691 million vs analyst estimates of $661.1 million (31.5% margin, 4.5% beat)

- Operating Margin: 10.3%, down from 23.1% in the same quarter last year

- Free Cash Flow Margin: 24.7%, up from 23.6% in the same quarter last year

- Subscribers: 38.56 million, down 443,000 year on year

- Market Capitalization: $6.98 billion

Company Overview

Known for its commercial-free music channels, Sirius XM (NASDAQ:SIRI) is a broadcasting company that provides satellite radio and online radio services across North America.

Formed by the 2008 merger of Sirius Satellite Radio and XM Satellite Radio, Sirius XM offers a diverse range of radio content with broader coverage than traditional AM/FM radio. This move addressed the demand for varied and accessible nationwide content, overcoming the constraints of conventional radio broadcasts that are confined by the reach of their local radio signals.

Sirius XM delivers an extensive lineup of music, sports, news, talk shows, and entertainment through satellite and online streaming. Sirius XM differentiates itself by offering premium, hard-to-find content, appealing to listeners seeking a superior radio experience.

The company's revenue model centers on subscription fees, augmented by advertising on some channels, along with equipment and service sales.

4. Wireless, Cable and Satellite

The massive physical footprints of cell phone towers, fiber in the ground, or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their landlines and traditional cable subscriptions in favor of wireless communications and streaming video. These trends do mean that more households need cell phone plans and high-speed internet. Companies that successfully serve customers can enjoy high retention rates and pricing power since the options for mobile and internet connectivity in any geography are usually limited.

Competitors in the radio broadcasting and media services sector include iHeartMedia (NASDAQ:IHRT), Cumulus Media (NASDAQ:CMLS), and Urban One (NASDAQ:UONE).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Sirius XM grew its sales at a weak 1.3% compounded annual growth rate. This was below our standards and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Sirius XM’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.2% annually.

This quarter, Sirius XM’s $2.19 billion of revenue was flat year on year but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will catalyze better top-line performance, it is still below average for the sector.

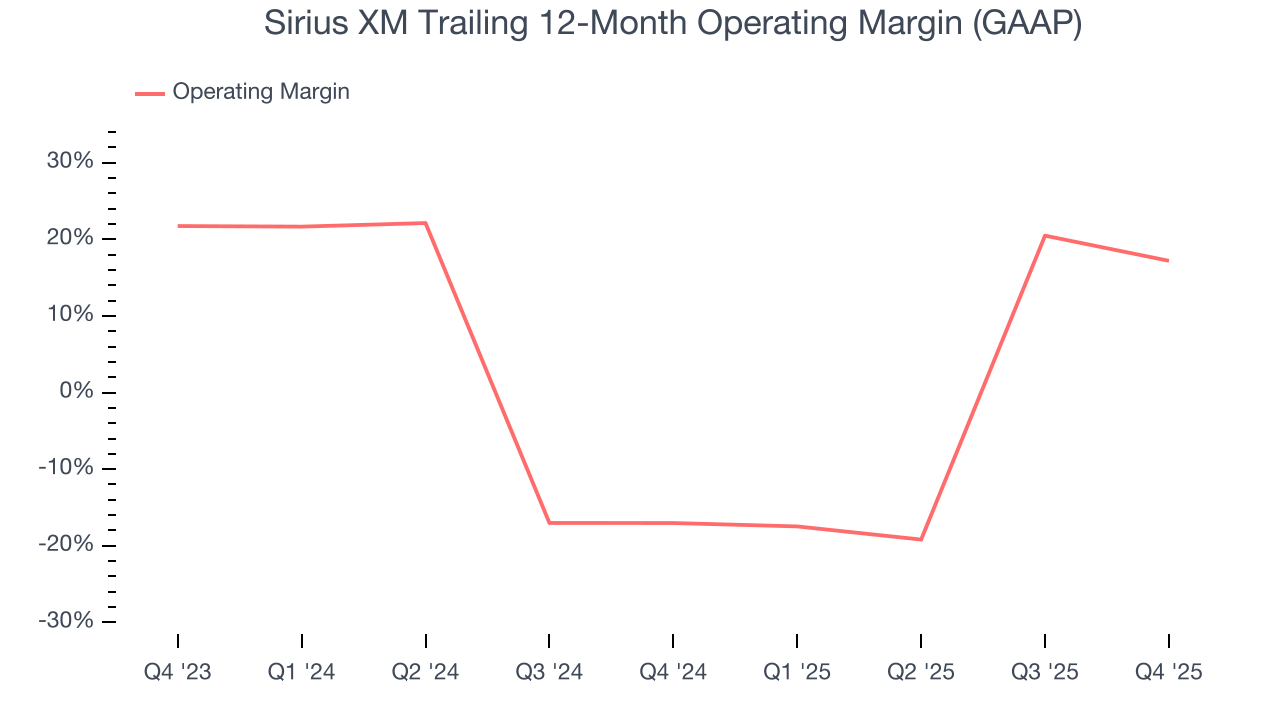

6. Operating Margin

Sirius XM’s operating margin has been trending up over the last 12 months, leading to break even profits over the last two years. However, its large expense base and inefficient cost structure mean it still sports inadequate profitability for a consumer discretionary business.

This quarter, Sirius XM generated an operating margin profit margin of 10.3%, down 12.8 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

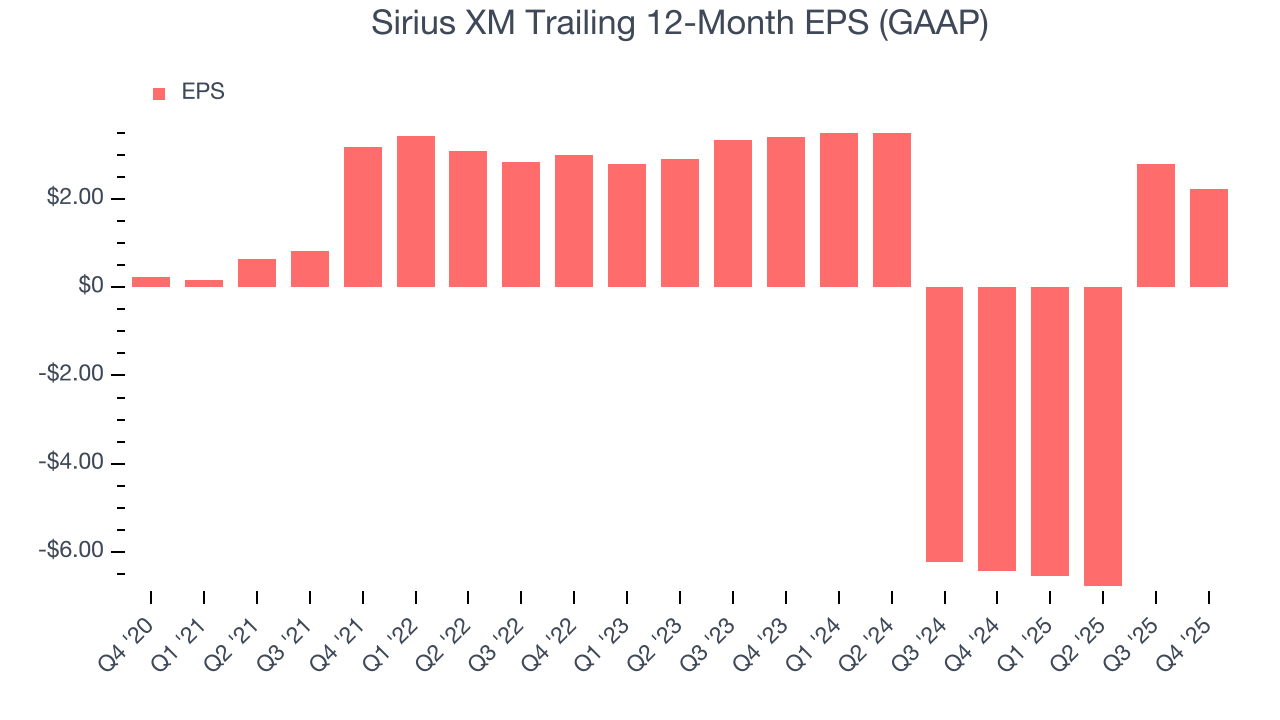

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sirius XM’s EPS grew at a spectacular 58.2% compounded annual growth rate over the last five years, higher than its 1.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, Sirius XM reported EPS of $0.24, down from $0.80 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Sirius XM’s full-year EPS of $2.22 to grow 39.8%.

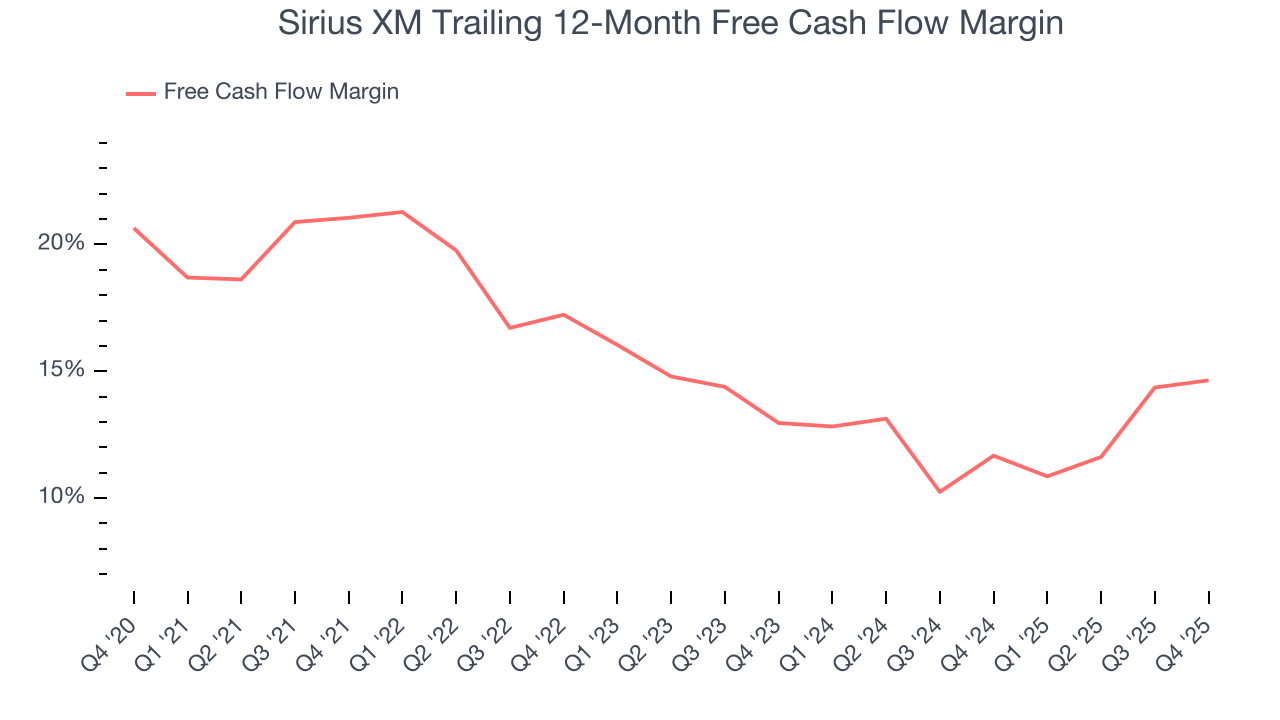

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Sirius XM has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 13.1%, lousy for a consumer discretionary business.

Sirius XM’s free cash flow clocked in at $541 million in Q4, equivalent to a 24.7% margin. This result was good as its margin was 1.1 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Over the next year, analysts predict Sirius XM’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 14.6% for the last 12 months will increase to 17.2%, giving it more flexibility for investments, share buybacks, and dividends.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Sirius XM historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 15.3%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Sirius XM’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

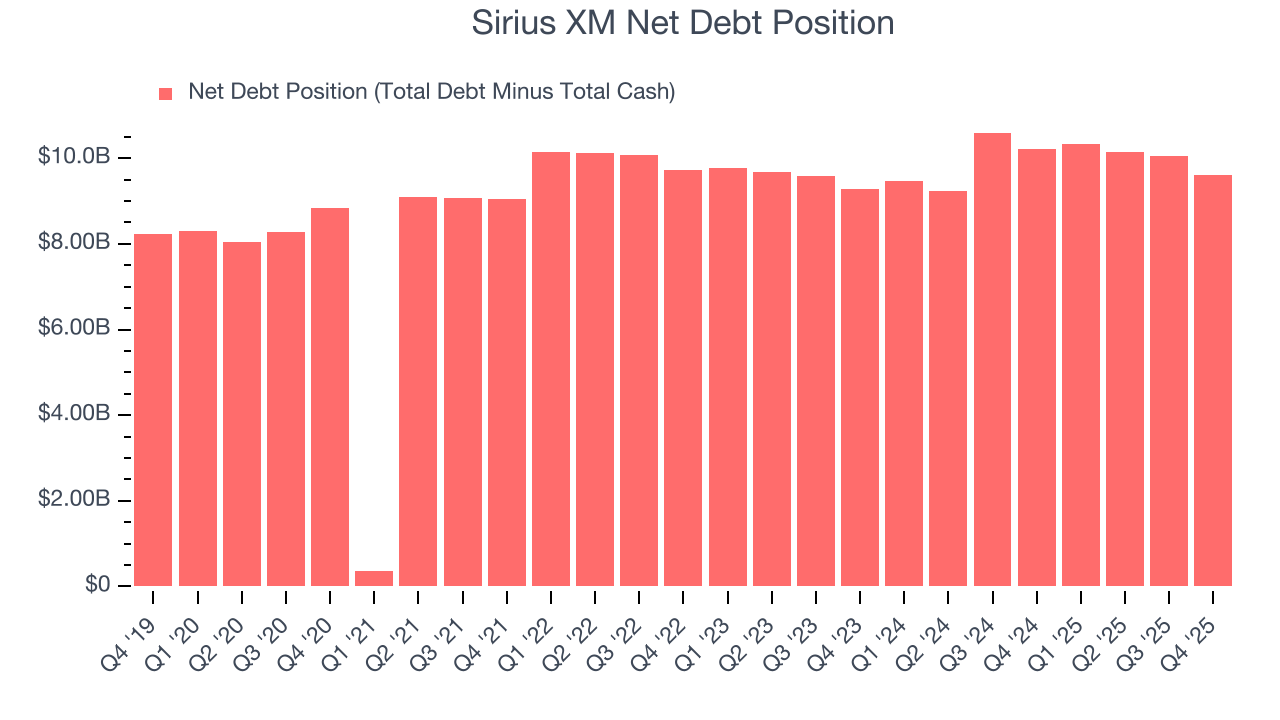

10. Balance Sheet Assessment

Sirius XM reported $102 million of cash and $9.71 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $2.66 billion of EBITDA over the last 12 months, we view Sirius XM’s 3.6× net-debt-to-EBITDA ratio as safe. We also see its $237 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Sirius XM’s Q4 Results

It was encouraging to see Sirius XM beat analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this was a weaker quarter. The stock traded up 8.7% to $22.53 immediately after reporting.

12. Is Now The Time To Buy Sirius XM?

Updated: February 23, 2026 at 10:02 PM EST

When considering an investment in Sirius XM, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of Sirius XM, we’ll be cheering from the sidelines. On top of that, Sirius XM’s Forecasted free cash flow margin suggests the company will have more capital to invest or return to shareholders next year, and its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Sirius XM’s P/E ratio based on the next 12 months is 6.8x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $24.23 on the company (compared to the current share price of $20.93).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.