Supernus Pharmaceuticals (SUPN)

Supernus Pharmaceuticals is up against the odds. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Supernus Pharmaceuticals Will Underperform

With a diverse portfolio of eight FDA-approved medications targeting neurological conditions, Supernus Pharmaceuticals (NASDAQ:SUPN) develops and markets treatments for central nervous system disorders including epilepsy, ADHD, Parkinson's disease, and migraine.

- Modest revenue base of $681.5 million gives it less fixed cost leverage and fewer distribution channels than larger companies

- Performance over the past five years shows its incremental sales were less profitable as its earnings per share were flat

- Underwhelming 4.2% return on capital reflects management’s difficulties in finding profitable growth opportunities, and its decreasing returns suggest its historical profit centers are aging

Supernus Pharmaceuticals is in the penalty box. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than Supernus Pharmaceuticals

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Supernus Pharmaceuticals

At $48.41 per share, Supernus Pharmaceuticals trades at 26.4x forward P/E. Not only does Supernus Pharmaceuticals trade at a premium to companies in the healthcare space, but this multiple is also high for its top-line growth.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. Supernus Pharmaceuticals (SUPN) Research Report: Q3 CY2025 Update

Specialty pharmaceutical company Supernus Pharmaceuticals (NASDAQ:SUPN) reported revenue ahead of Wall Streets expectations in Q3 CY2025, with sales up 9.3% year on year to $192.1 million. On the other hand, the company’s full-year revenue guidance of $695 million at the midpoint came in 1.1% below analysts’ estimates. Its GAAP profit of $0.80 per share was significantly above analysts’ consensus estimates.

Supernus Pharmaceuticals (SUPN) Q3 CY2025 Highlights:

- Revenue: $192.1 million vs analyst estimates of $182.1 million (9.3% year-on-year growth, 5.5% beat)

- EPS (GAAP): $0.80 vs analyst estimates of -$0.93 (significant beat)

- Adjusted EBITDA: -$35.88 million vs analyst estimates of $20 million (-18.7% margin, significant miss)

- The company lifted its revenue guidance for the full year to $695 million at the midpoint from $685 million, a 1.5% increase

- Operating Margin: -31.4%, down from 23.2% in the same quarter last year

- Market Capitalization: $3.12 billion

Company Overview

With a diverse portfolio of eight FDA-approved medications targeting neurological conditions, Supernus Pharmaceuticals (NASDAQ:SUPN) develops and markets treatments for central nervous system disorders including epilepsy, ADHD, Parkinson's disease, and migraine.

Supernus operates in the specialty pharmaceutical space, focusing exclusively on disorders of the central nervous system. The company's commercial portfolio includes Qelbree for ADHD, Trokendi XR and Oxtellar XR for epilepsy, GOCOVRI and APOKYN for Parkinson's disease, MYOBLOC for cervical dystonia and chronic sialorrhea, and XADAGO as an adjunctive treatment for Parkinson's patients experiencing "off" episodes.

The company employs a dual strategy of internal product development and strategic acquisitions to build its portfolio. For instance, Supernus expanded its Parkinson's disease offerings through the acquisition of products like GOCOVRI, which is the only FDA-approved medication that treats both dyskinesia and "off" episodes in Parkinson's patients taking levodopa-based therapy.

Supernus generates revenue primarily through prescription sales to pharmaceutical wholesalers, specialty pharmacies, and distributors. The company maintains its own specialized sales force that targets psychiatrists, neurologists, and other healthcare providers who treat CNS disorders. For example, a neurologist might prescribe Trokendi XR to a patient with epilepsy who struggles with medication adherence, as the once-daily extended-release formulation simplifies the treatment regimen.

The company's research and development efforts focus on novel compounds and proprietary drug delivery technologies. Supernus has three proprietary technology platforms—Microtrol, Solutrol, and EnSoTrol—which it uses to create extended-release formulations that can improve efficacy, reduce dosing frequency, and enhance tolerability. The company's pipeline includes SPN-830, an apomorphine infusion device for Parkinson's disease, and SPN-820, a first-in-class oral compound being investigated for treatment-resistant depression.

Supernus protects its products through an extensive patent portfolio, with key patents for its commercial products extending into the late 2020s and beyond. The company has established manufacturing partnerships with contract manufacturing organizations in North America, Europe, and Asia to produce its medications.

4. Branded Pharmaceuticals

Looking ahead, the branded pharmaceutical industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

Supernus Pharmaceuticals competes with larger pharmaceutical companies like AbbVie (NYSE:ABBV), Takeda (NYSE:TAK), and Eli Lilly (NYSE:LLY) in the ADHD market, and with UCB (OTC:UCBJF), Jazz Pharmaceuticals (NASDAQ:JAZZ), and Eisai (OTC:ESALY) in the epilepsy space. In Parkinson's disease treatments, its competitors include AbbVie, Acorda Therapeutics (NASDAQ:ACOR), and privately-held Britannia Pharmaceuticals.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $681.5 million in revenue over the past 12 months, Supernus Pharmaceuticals is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

6. Revenue Growth

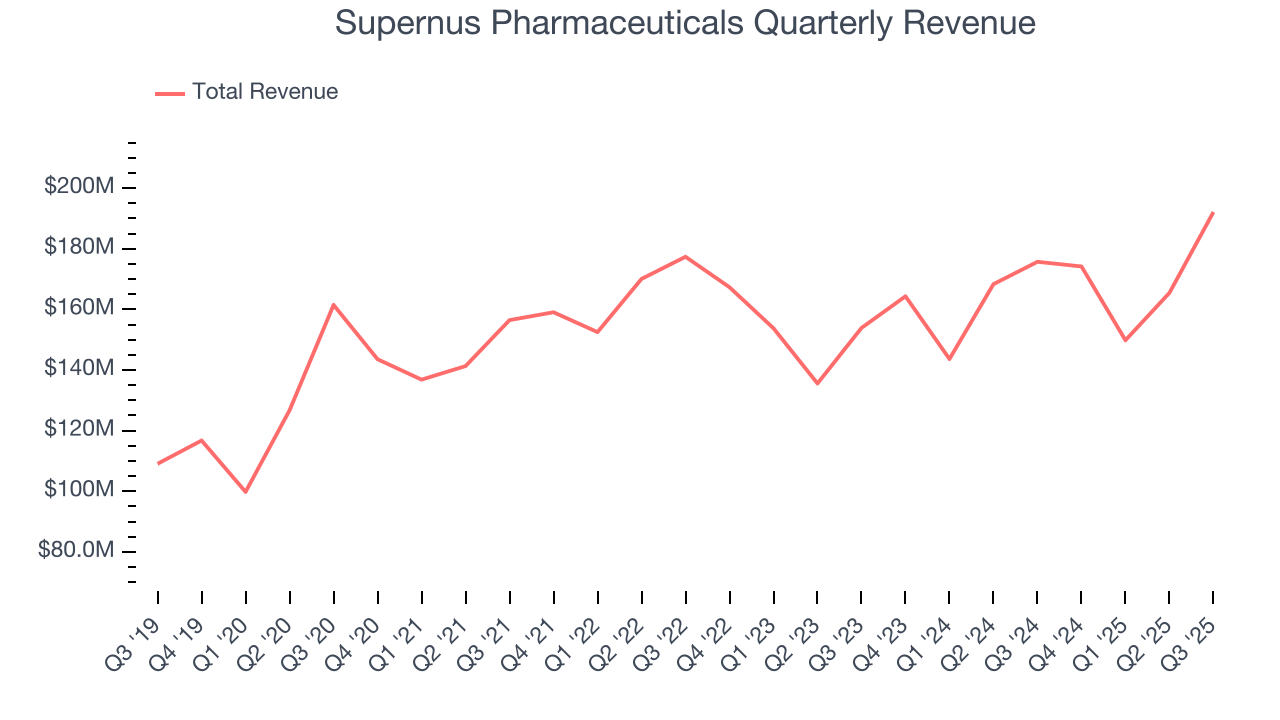

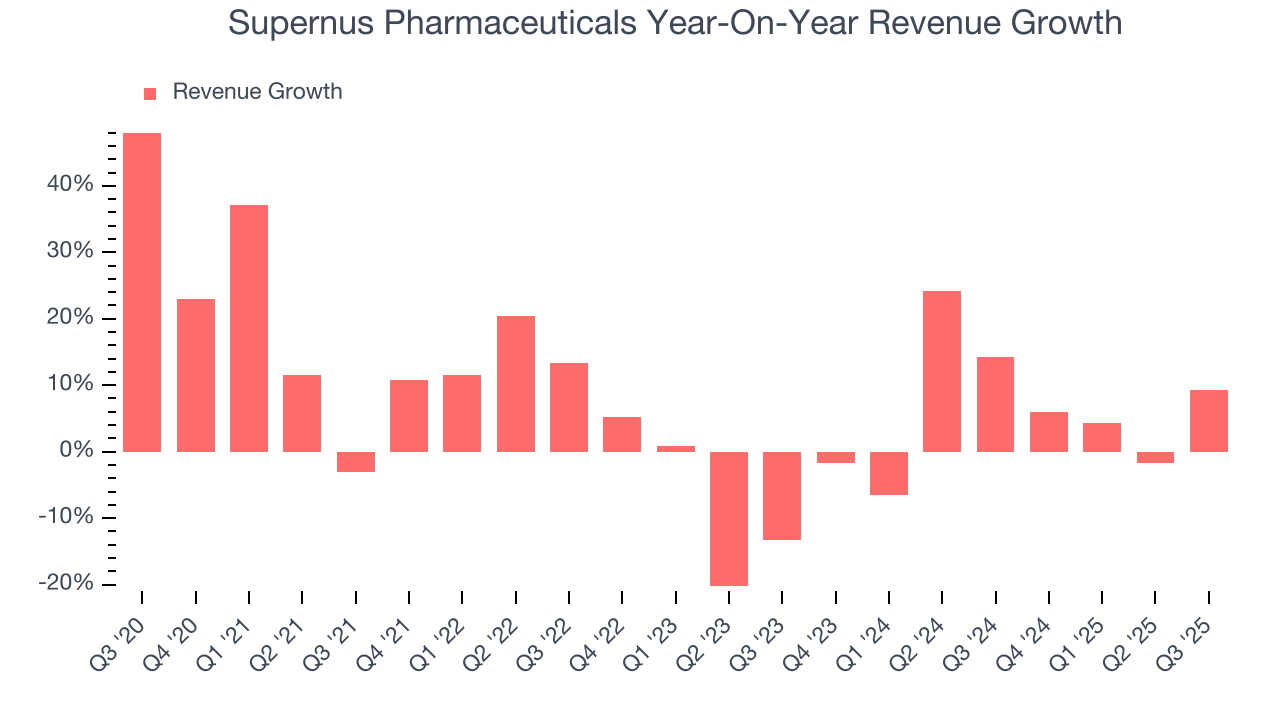

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Supernus Pharmaceuticals grew its sales at a mediocre 6.2% compounded annual growth rate. This was below our standard for the healthcare sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Supernus Pharmaceuticals’s annualized revenue growth of 5.7% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Supernus Pharmaceuticals reported year-on-year revenue growth of 9.3%, and its $192.1 million of revenue exceeded Wall Street’s estimates by 5.5%.

Looking ahead, sell-side analysts expect revenue to grow 22.6% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will spur better top-line performance.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

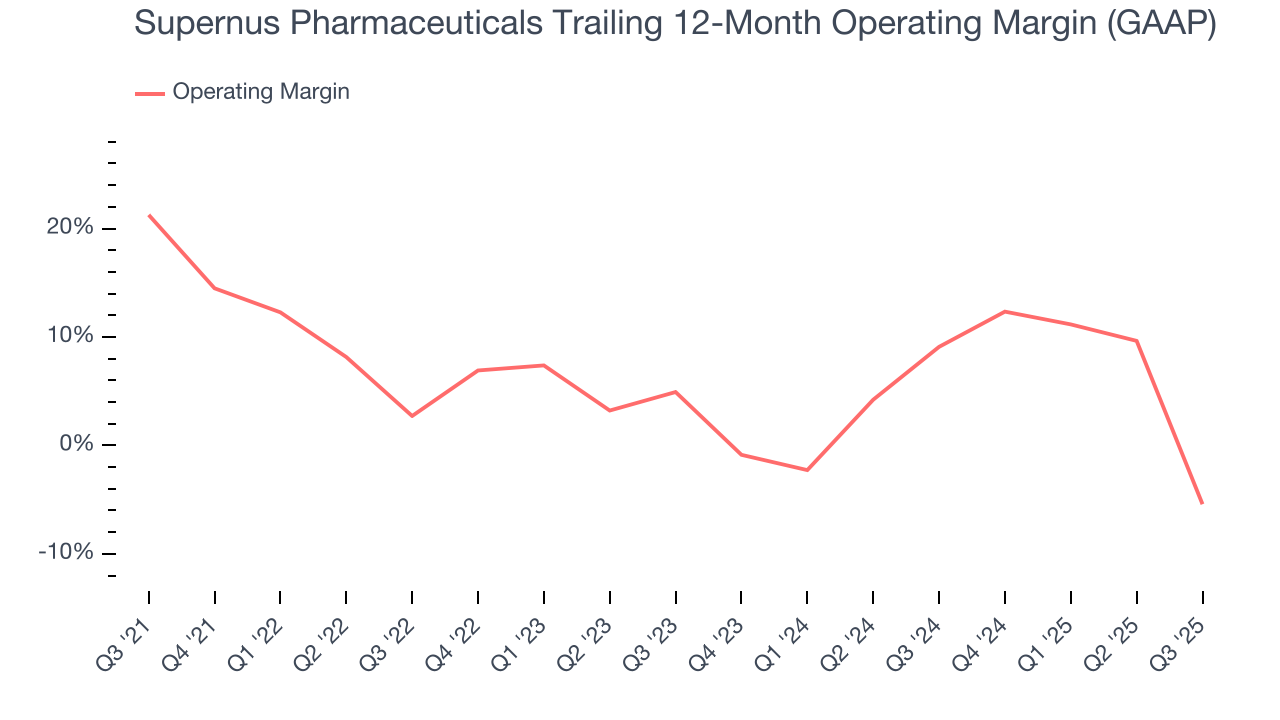

Supernus Pharmaceuticals was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.1% was weak for a healthcare business.

Looking at the trend in its profitability, Supernus Pharmaceuticals’s operating margin decreased by 26.7 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 10.3 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, Supernus Pharmaceuticals generated an operating margin profit margin of negative 31.4%, down 54.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

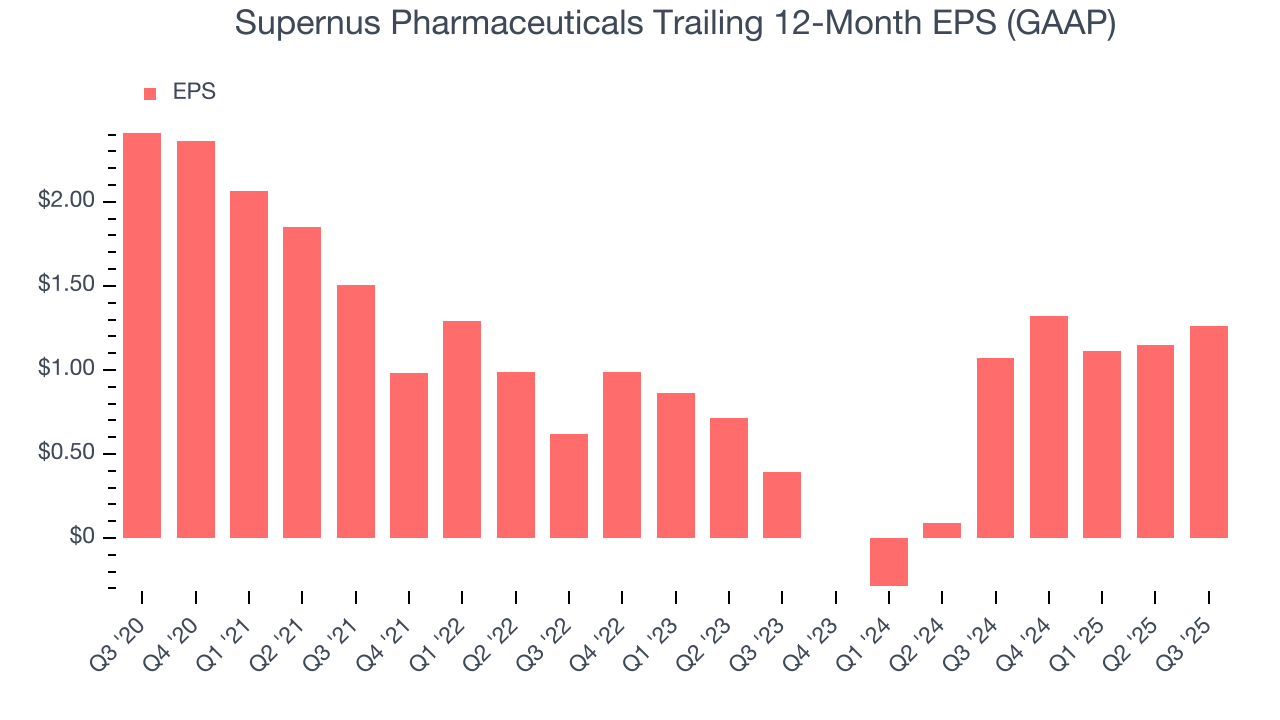

Sadly for Supernus Pharmaceuticals, its EPS declined by 12.2% annually over the last five years while its revenue grew by 6.2%. This tells us the company became less profitable on a per-share basis as it expanded.

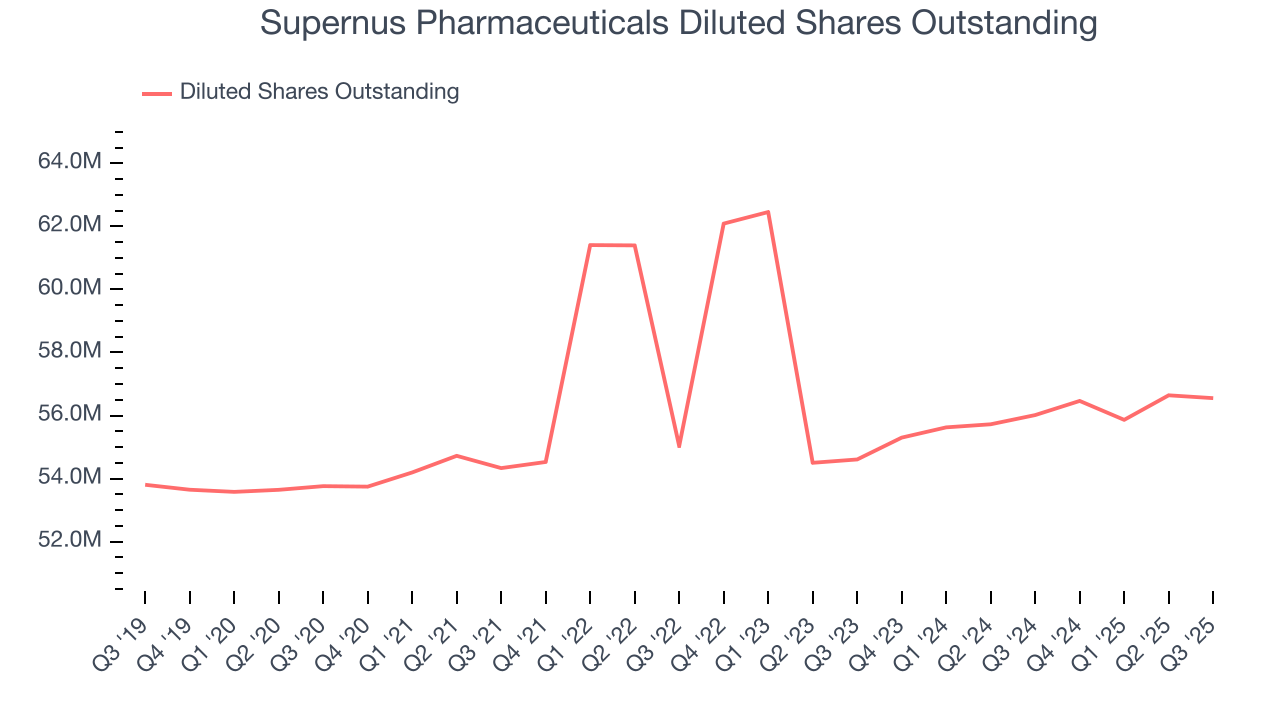

Diving into the nuances of Supernus Pharmaceuticals’s earnings can give us a better understanding of its performance. As we mentioned earlier, Supernus Pharmaceuticals’s operating margin declined by 26.7 percentage points over the last five years. Its share count also grew by 5.2%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Supernus Pharmaceuticals reported EPS of $0.80, up from $0.69 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Supernus Pharmaceuticals’s full-year EPS of $1.26 to shrink by 67.3%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

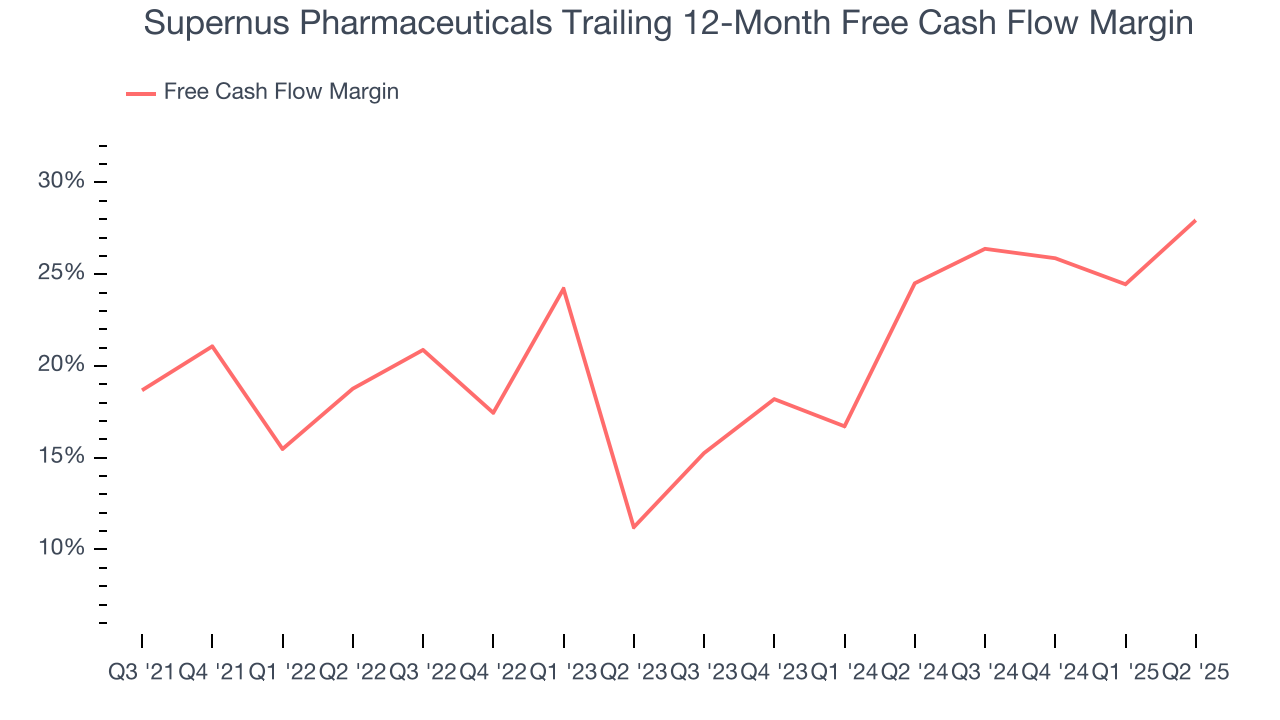

Supernus Pharmaceuticals has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 21.5% over the last five years, quite impressive for a healthcare business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

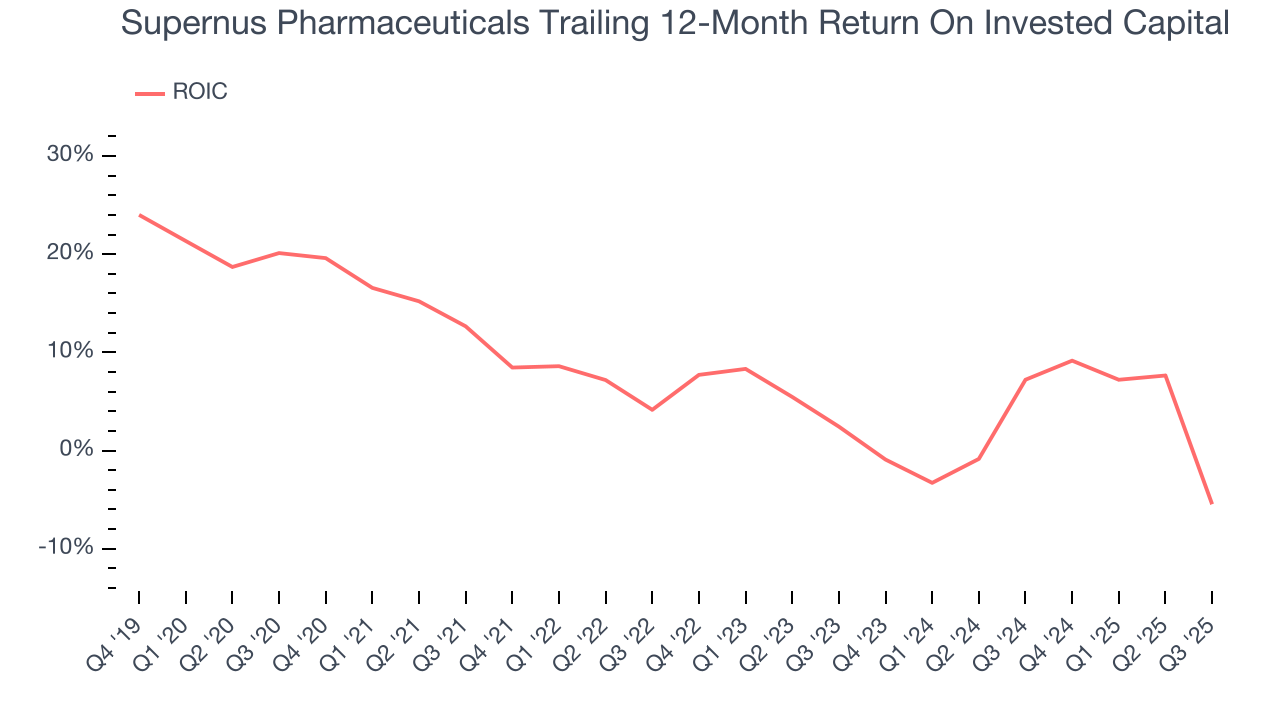

Supernus Pharmaceuticals historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.2%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Supernus Pharmaceuticals’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

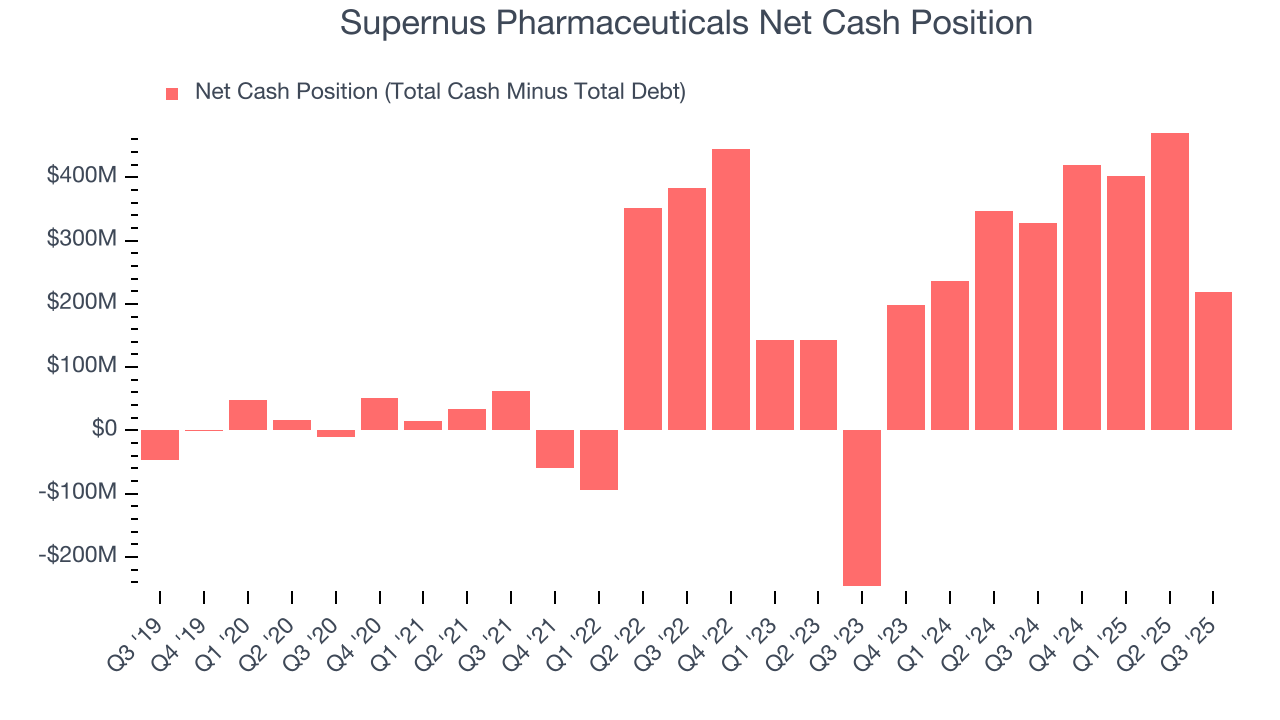

Supernus Pharmaceuticals is a well-capitalized company with $281.2 million of cash and $62.83 million of debt on its balance sheet. This $218.3 million net cash position is 8.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Supernus Pharmaceuticals’s Q3 Results

It was good to see Supernus Pharmaceuticals beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance slightly missed. Overall, we think this was a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 14.3% to $48.89 immediately following the results.

13. Is Now The Time To Buy Supernus Pharmaceuticals?

Updated: February 3, 2026 at 11:28 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Supernus Pharmaceuticals.

Supernus Pharmaceuticals falls short of our quality standards. To begin with, its revenue growth was mediocre over the last five years. And while its strong operating margins show it’s a well-run business, the downside is its subscale operations give it fewer distribution channels than its larger rivals. On top of that, its diminishing returns show management's prior bets haven't worked out.

Supernus Pharmaceuticals’s P/E ratio based on the next 12 months is 26.4x. This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $61.33 on the company (compared to the current share price of $48.41).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.