Taboola (TBLA)

Taboola doesn’t impress us. Its poor investment decisions are evident in its negative returns on capital, a troubling sign for investors.― StockStory Analyst Team

1. News

2. Summary

Why Taboola Is Not Exciting

Often appearing as those "You May Also Like" or "Recommended For You" boxes at the bottom of news articles, Taboola (NASDAQ:TBLA) operates a digital platform that recommends personalized content to users across publisher websites, helping both publishers monetize their sites and advertisers reach target audiences.

- Push for growth has led to negative returns on capital, signaling value destruction

- Earnings per share have dipped by 25.3% annually over the past four years, which is concerning because stock prices follow EPS over the long term

- One positive is that its annual revenue growth of 10.4% over the past five years was outstanding, reflecting market share gains this cycle

Taboola is skating on thin ice. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than Taboola

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Taboola

At $4.14 per share, Taboola trades at 9.3x forward P/E. This is a cheap valuation multiple, but for good reason. You get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Taboola (TBLA) Research Report: Q3 CY2025 Update

Content discovery platform Taboola (NASDAQ:TBLA) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 14.7% year on year to $496.8 million. On top of that, next quarter’s revenue guidance ($537 million at the midpoint) was surprisingly good and 3.3% above what analysts were expecting. Its GAAP profit of $0.02 per share was $0.02 above analysts’ consensus estimates.

Taboola (TBLA) Q3 CY2025 Highlights:

- Revenue: $496.8 million vs analyst estimates of $467.2 million (14.7% year-on-year growth, 6.3% beat)

- EPS (GAAP): $0.02 vs analyst estimates of $0 ($0.02 beat)

- Adjusted EBITDA: $48.22 million vs analyst estimates of $45.77 million (9.7% margin, 5.4% beat)

- Revenue Guidance for Q4 CY2025 is $537 million at the midpoint, above analyst estimates of $519.9 million

- EBITDA guidance for the full year is $211.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 1.3%, in line with the same quarter last year

- Free Cash Flow Margin: 9.3%, similar to the same quarter last year

- Market Capitalization: $987.4 million

Company Overview

Often appearing as those "You May Also Like" or "Recommended For You" boxes at the bottom of news articles, Taboola (NASDAQ:TBLA) operates a digital platform that recommends personalized content to users across publisher websites, helping both publishers monetize their sites and advertisers reach target audiences.

Taboola's technology uses algorithms and machine learning to analyze user behavior and preferences, then serves relevant content recommendations that keep readers engaged. These recommendations appear as thumbnail images with headlines, typically placed at the end of articles or in dedicated sections of publisher websites.

For publishers, Taboola offers a way to increase user engagement and generate additional revenue streams. When users click on sponsored content recommendations, publishers receive a share of the advertising revenue. Major news sites, blogs, and digital media companies integrate Taboola's widgets to monetize their traffic without relying solely on traditional display advertising.

For advertisers, Taboola provides access to massive audience reach across thousands of publisher sites. Marketers can promote their content, products, or services through native-looking recommendations that blend with the surrounding editorial content. Advertisers typically pay on a cost-per-click (CPC) basis, meaning they only pay when users actually engage with their content.

A typical use case might involve a financial services company using Taboola to promote an article about retirement planning. When users reading news on a publisher's site see and click this recommendation, they're directed to the advertiser's content, potentially becoming leads for financial products.

Taboola's platform includes analytics tools that help both publishers and advertisers track performance metrics like click-through rates, engagement time, and conversion rates. The company continuously refines its recommendation algorithms to improve relevance and performance.

Founded in 2007, Taboola has expanded its operations globally, serving markets across North America, Europe, Asia, and other regions. The company experiences some seasonality in its business, with higher advertising demand during holiday periods and promotional seasons when marketers increase their spending.

4. Advertising & Marketing Services

The sector is on the precipice of both disruption and growth as AI, programmatic advertising, and data-driven marketing reshape how things are done. For example, the advent of the Internet broadly and programmatic advertising specifically means that brand building is not a relationship business anymore but instead one based on data and technology, which could hurt traditional ad agencies. On the other hand, the companies in the sector that beef up their tech chops by automating the buying of ad inventory or facilitating omnichannel marketing, for example, stand to benefit. With or without advances in digitization and AI, the sector is still highly levered to the macro, and economic uncertainty may lead to fluctuating ad spend, particularly in cyclical industries.

Taboola's main competitors include Outbrain (NASDAQ:OB), which offers similar content recommendation services, as well as major digital advertising platforms like Google (NASDAQ:GOOGL), Meta (NASDAQ:META), and other native advertising networks such as Nativo and MGID.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.88 billion in revenue over the past 12 months, Taboola is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

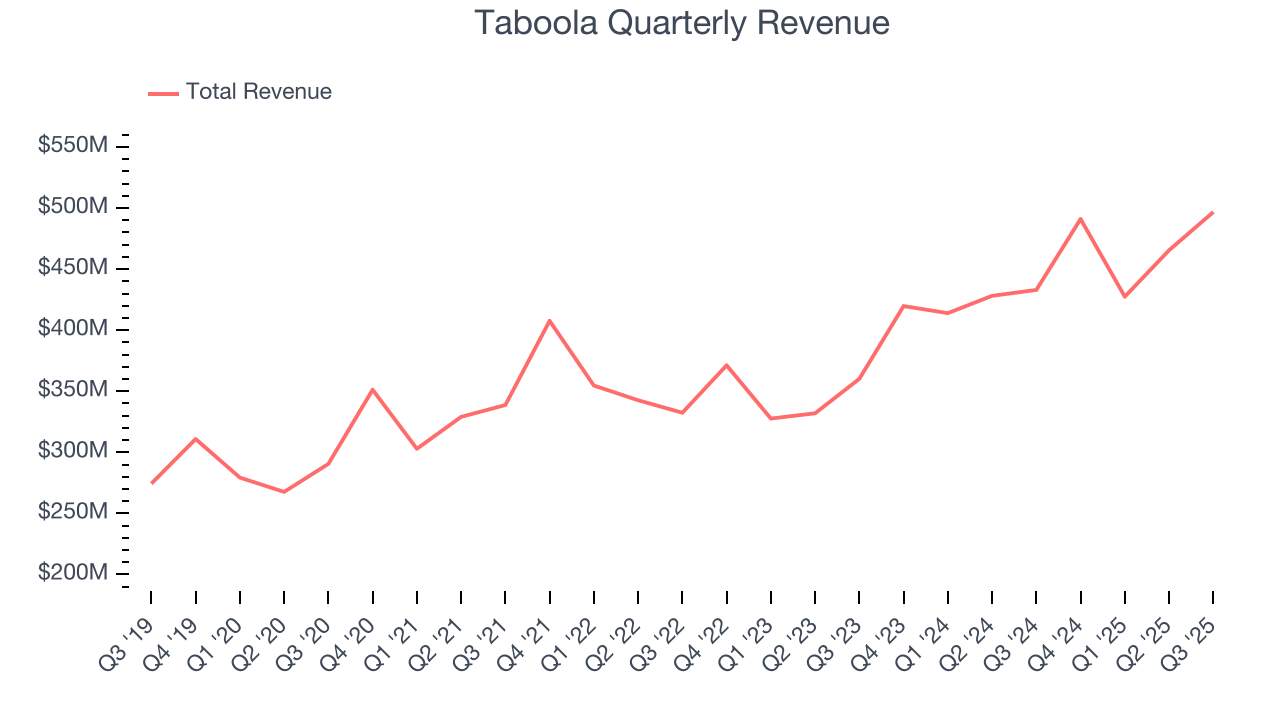

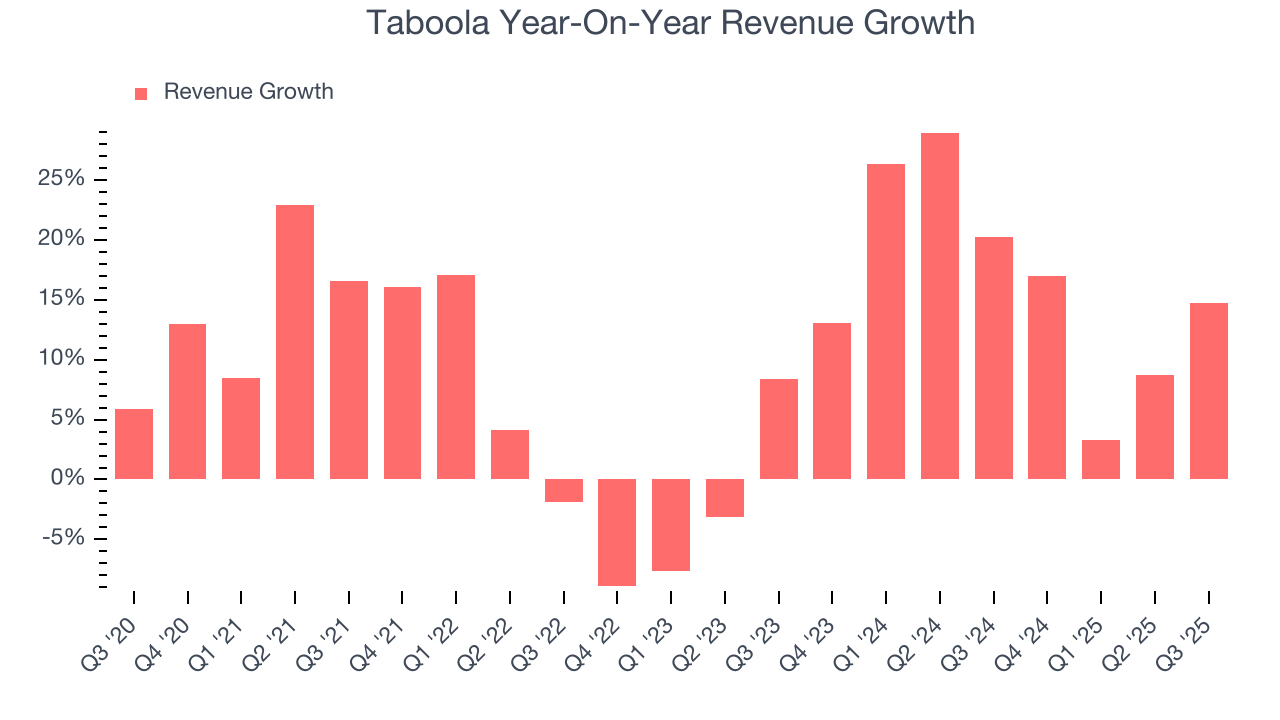

As you can see below, Taboola’s sales grew at an impressive 10.4% compounded annual growth rate over the last five years. This shows it had high demand, a useful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Taboola’s annualized revenue growth of 16.3% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Taboola reported year-on-year revenue growth of 14.7%, and its $496.8 million of revenue exceeded Wall Street’s estimates by 6.3%. Company management is currently guiding for a 9.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.6% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above average for the sector and suggests the market is baking in some success for its newer products and services.

6. Operating Margin

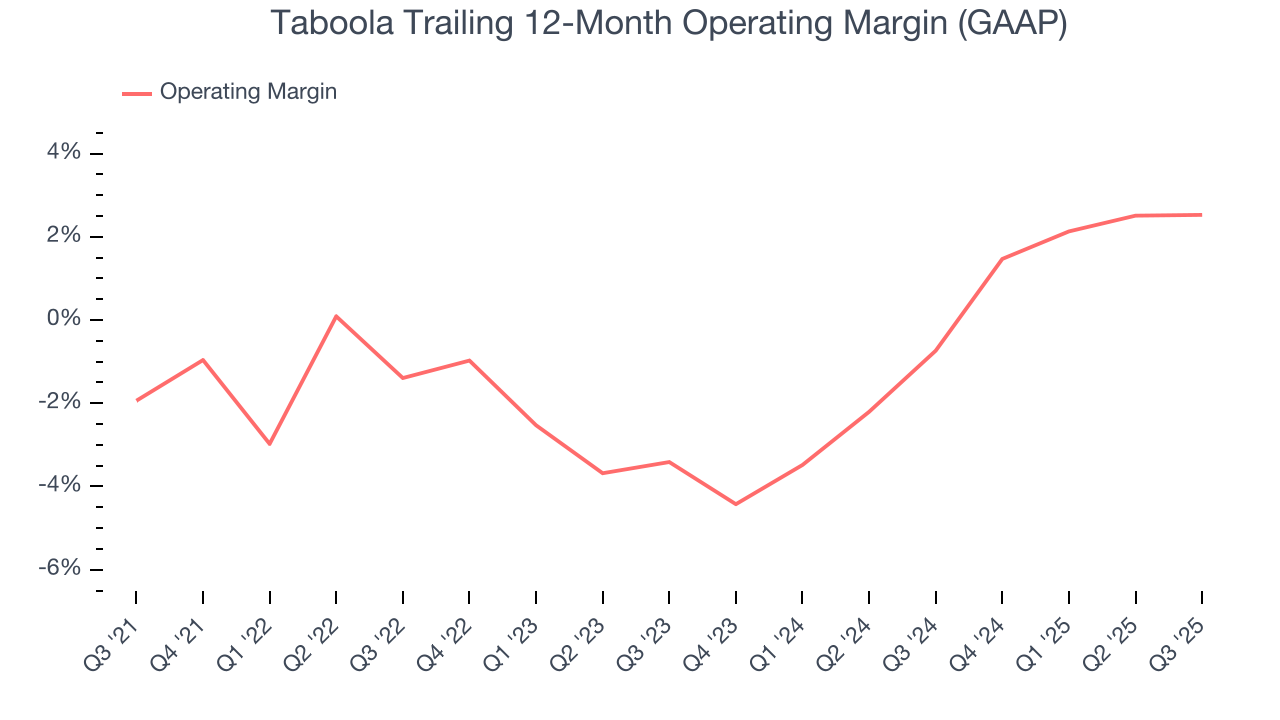

Taboola was roughly breakeven when averaging the last five years of quarterly operating profits, one of the worst outcomes in the business services sector.

On the plus side, Taboola’s operating margin rose by 4.5 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Taboola generated an operating margin profit margin of 1.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

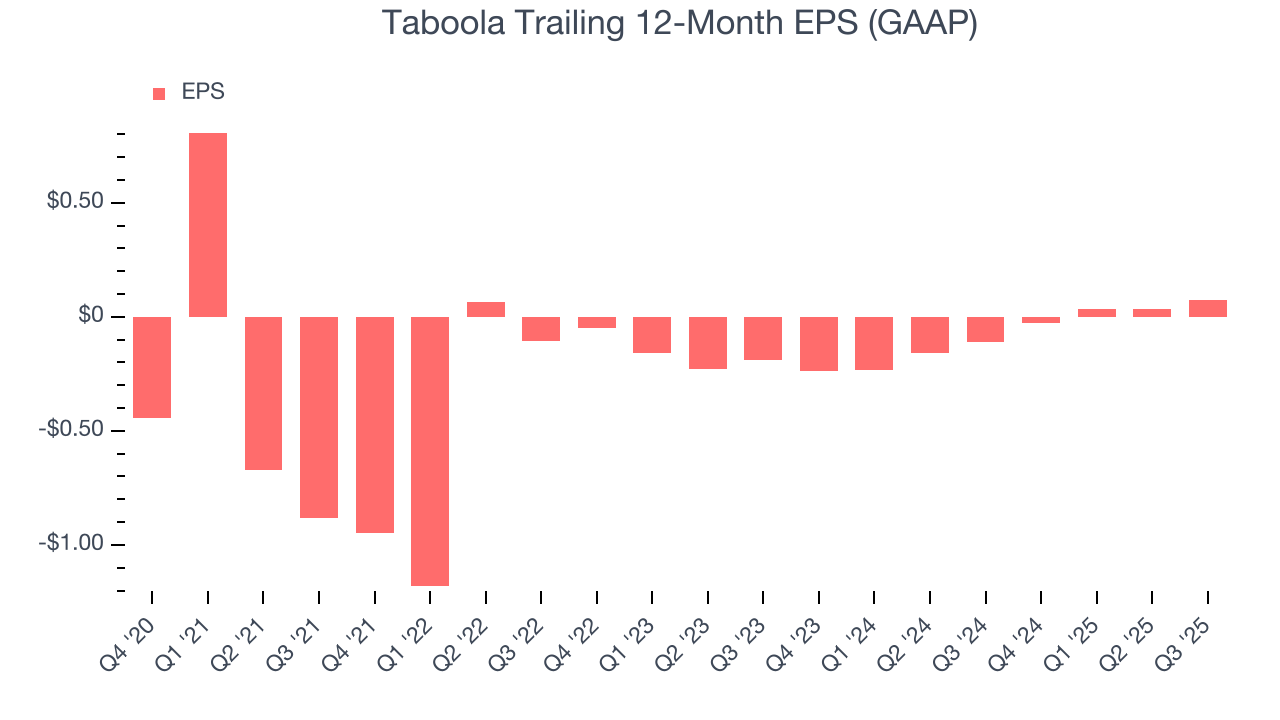

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Taboola’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Taboola, its two-year annual EPS growth of 54.2% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q3, Taboola reported EPS of $0.02, up from negative $0.02 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

8. Cash Is King

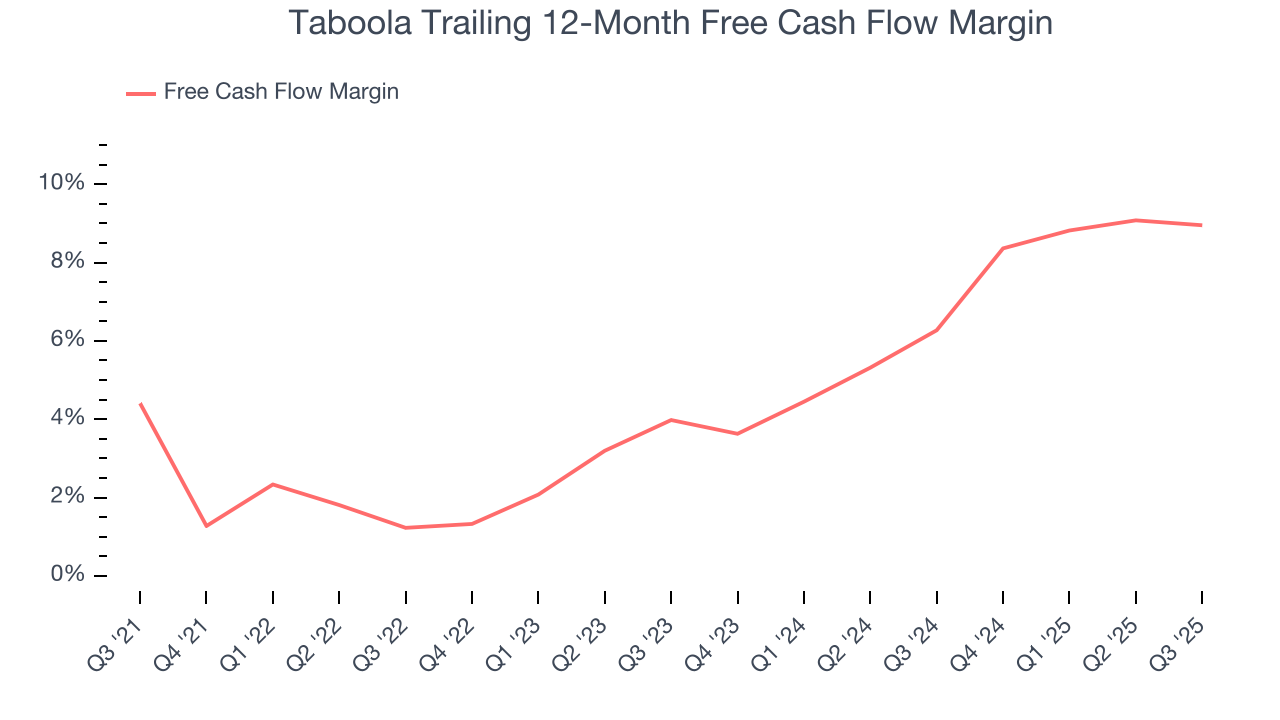

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Taboola has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.3% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that Taboola’s margin expanded by 4.5 percentage points during that time. This is encouraging because it gives the company more optionality.

Taboola’s free cash flow clocked in at $46.29 million in Q3, equivalent to a 9.3% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Taboola’s five-year average ROIC was negative 4.3%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Taboola’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

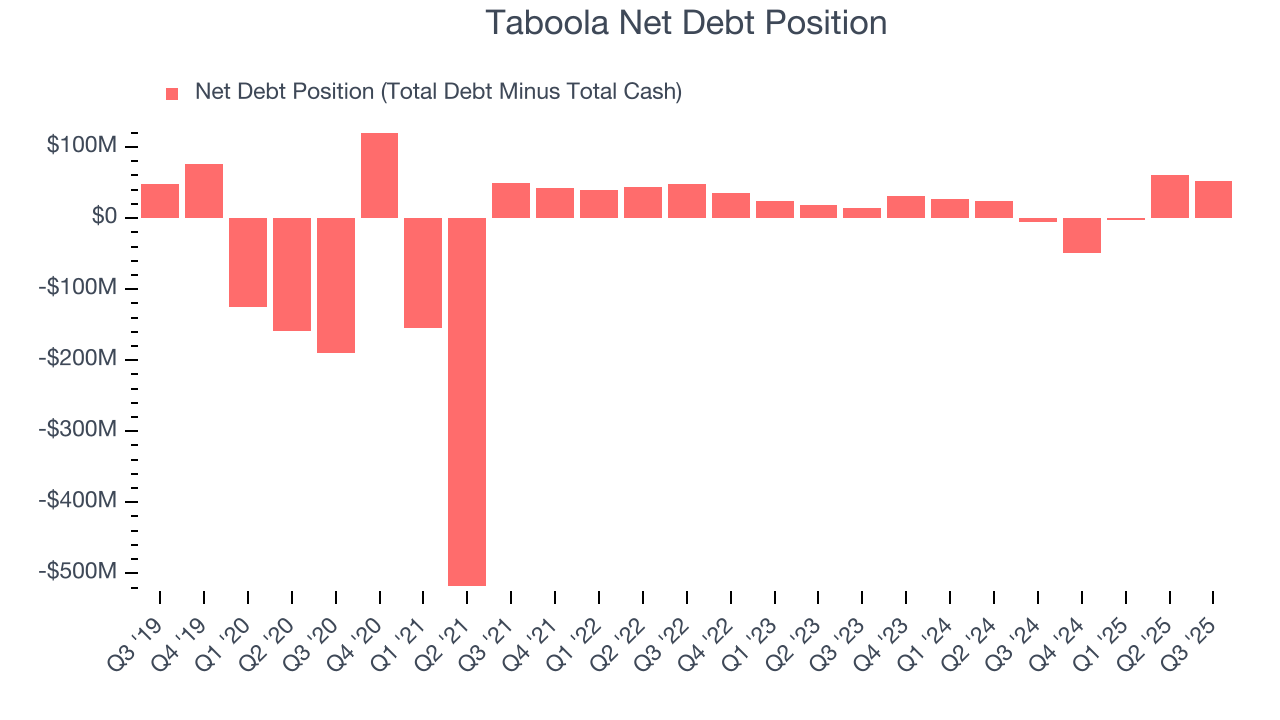

10. Balance Sheet Assessment

Taboola reported $116.9 million of cash and $168.6 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $221.6 million of EBITDA over the last 12 months, we view Taboola’s 0.2× net-debt-to-EBITDA ratio as safe. We also see its $3.69 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Taboola’s Q3 Results

It was good to see Taboola beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 7.6% to $3.59 immediately following the results.

12. Is Now The Time To Buy Taboola?

Updated: January 22, 2026 at 10:59 PM EST

Before deciding whether to buy Taboola or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Taboola doesn’t top our investment wishlist, but we understand that it’s not a bad business. To kick things off, its revenue growth was impressive over the last five years. And while Taboola’s relatively low ROIC suggests management has struggled to find compelling investment opportunities, its rising returns show management's prior bets are at least better than before.

Taboola’s P/E ratio based on the next 12 months is 9.3x. While this valuation is reasonable, we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $4.80 on the company (compared to the current share price of $4.14).