Atlassian (TEAM)

Atlassian is interesting. It’s not only a customer acquisition machine but also sports robust unit economics, a deadly combo.― StockStory Analyst Team

1. News

2. Summary

Why Atlassian Is Interesting

Started by two Australian university friends who funded their startup with credit cards, Atlassian (NASDAQ:TEAM) provides software tools that help teams plan, track, collaborate, and share knowledge across organizations.

- Software is difficult to replicate at scale and leads to a top-tier gross margin of 84.1%

- Well-designed software integrates seamlessly with other workflows, enabling swift payback periods on marketing expenses and customer growth at scale

- A blemish is its operating margin was unchanged over the last year, suggesting it failed to gain leverage on its fixed costs

Atlassian has some respectable qualities. If you believe in the company, the valuation looks reasonable.

Why Is Now The Time To Buy Atlassian?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Atlassian?

At $83.74 per share, Atlassian trades at 3.2x forward price-to-sales. This multiple seems like a bargain for the top-line momentum you get.

It could be a good time to invest if you see something the market doesn’t.

3. Atlassian (TEAM) Research Report: Q4 CY2025 Update

Collaboration software company Atlassian (NASDAQ:TEAM) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 23.3% year on year to $1.59 billion. Guidance for next quarter’s revenue was optimistic at $1.69 billion at the midpoint, 2.9% above analysts’ estimates. Its non-GAAP profit of $1.22 per share was 6.6% above analysts’ consensus estimates.

Atlassian (TEAM) Q4 CY2025 Highlights:

- Revenue: $1.59 billion vs analyst estimates of $1.54 billion (23.3% year-on-year growth, 2.8% beat)

- Adjusted EPS: $1.22 vs analyst estimates of $1.14 (6.6% beat)

- Adjusted Operating Income: $430.2 million vs analyst estimates of $379.7 million (27.1% margin, 13.3% beat)

- Revenue Guidance for Q1 CY2026 is $1.69 billion at the midpoint, above analyst estimates of $1.64 billion

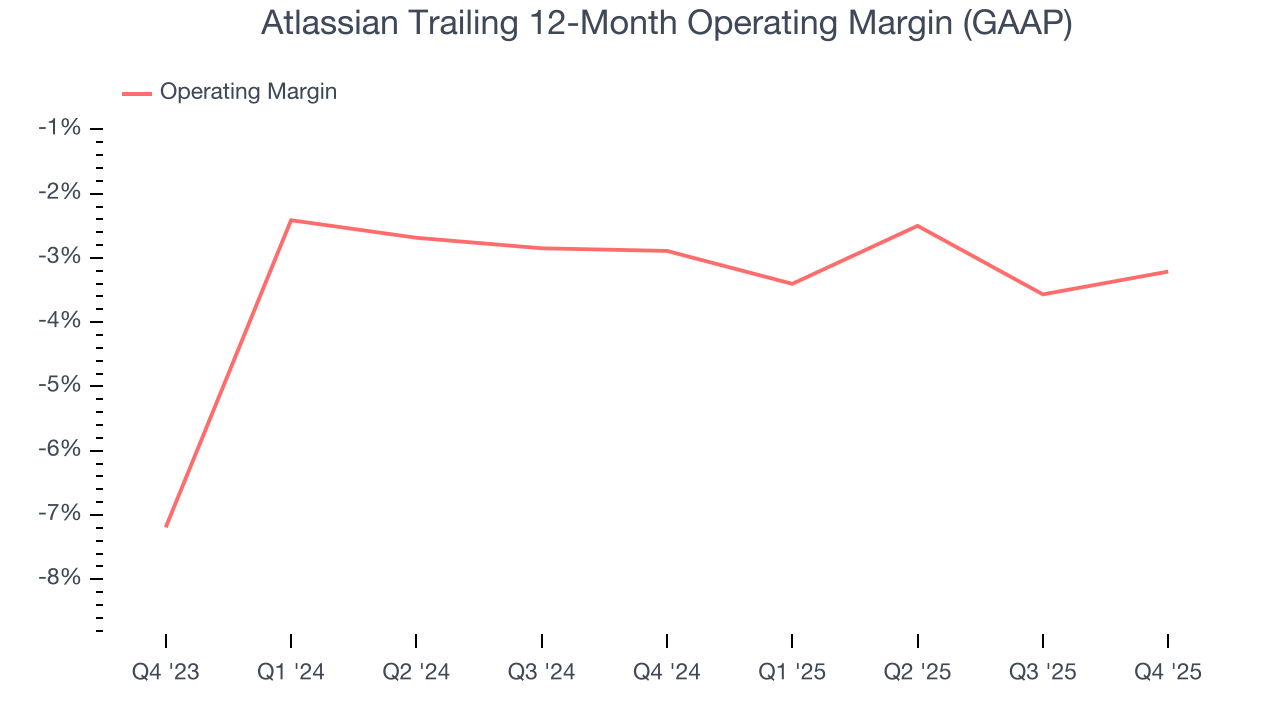

- Operating Margin: -3%, up from -4.5% in the same quarter last year

- Free Cash Flow Margin: 10.6%, up from 8% in the previous quarter

- Billings: $1.71 billion at quarter end, up 16.3% year on year

- Market Capitalization: $27.64 billion

Company Overview

Started by two Australian university friends who funded their startup with credit cards, Atlassian (NASDAQ:TEAM) provides software tools that help teams plan, track, collaborate, and share knowledge across organizations.

Atlassian's product suite includes Jira for project management and issue tracking, Confluence for document collaboration and knowledge sharing, Jira Service Management for IT service desk functionality, and Loom for asynchronous video communication. These tools collectively form what Atlassian calls its "System of Work"—a connected ecosystem built on a common technology platform that enables teams to work together effectively.

The company serves organizations of all sizes, from small teams to large enterprises, with over 80% of Fortune 500 companies using its products. Atlassian employs a distinctive go-to-market strategy that differs from traditional enterprise software companies. Rather than relying heavily on a commissioned sales force to acquire new customers, Atlassian emphasizes product-led growth with transparent pricing, self-service purchases, and word-of-mouth marketing. This approach has helped it build a global customer base across 200 countries.

Beyond its core products, Atlassian maintains the Atlassian Marketplace, an online store where third-party developers offer thousands of apps and integrations that extend the functionality of Atlassian's products. The company has also invested in AI capabilities through Atlassian Intelligence, which is embedded across its premium cloud products to enhance productivity and collaboration.

4. Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

Atlassian faces competition from large technology companies like Microsoft (with GitHub and Teams), IBM, and Google, as well as specialized players such as GitLab, ServiceNow, Asana, Monday.com, and Notion in various segments of team collaboration and project management software.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Atlassian’s 26.1% annualized revenue growth over the last five years was solid. Its growth beat the average software company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Atlassian’s annualized revenue growth of 21.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Atlassian reported robust year-on-year revenue growth of 23.3%, and its $1.59 billion of revenue topped Wall Street estimates by 2.8%. Company management is currently guiding for a 24.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.5% over the next 12 months, a slight deceleration versus the last two years. Despite the slowdown, this projection is commendable and indicates the market sees success for its products and services.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Atlassian’s billings came in at $1.71 billion in Q4, and over the last four quarters, its growth was underwhelming as it averaged 12.1% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Atlassian is extremely efficient at acquiring new customers, and its CAC payback period checked in at 20.8 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Atlassian’s gross margin is one of the highest in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 84.1% gross margin over the last year. Said differently, roughly $84.06 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Atlassian has seen gross margins improve by 2.1 percentage points over the last 2 year, which is solid in the software space.

Atlassian produced a 85% gross profit margin in Q4, marking a 2.4 percentage point increase from 82.7% in the same quarter last year. Atlassian’s full-year margin has also been trending up over the past 12 months, increasing by 2.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

9. Operating Margin

Atlassian’s expensive cost structure has contributed to an average operating margin of negative 3.2% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Analyzing the trend in its profitability, Atlassian’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

Atlassian’s operating margin was negative 3% this quarter.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Atlassian has shown impressive cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that give it the option to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 22.3% over the last year, better than the broader software sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Atlassian’s free cash flow clocked in at $168.5 million in Q4, equivalent to a 10.6% margin. The company’s cash profitability regressed as it was 16 percentage points lower than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict Atlassian’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 22.3% for the last 12 months will increase to 28.6%, it options for capital deployment (investments, share buybacks, etc.).

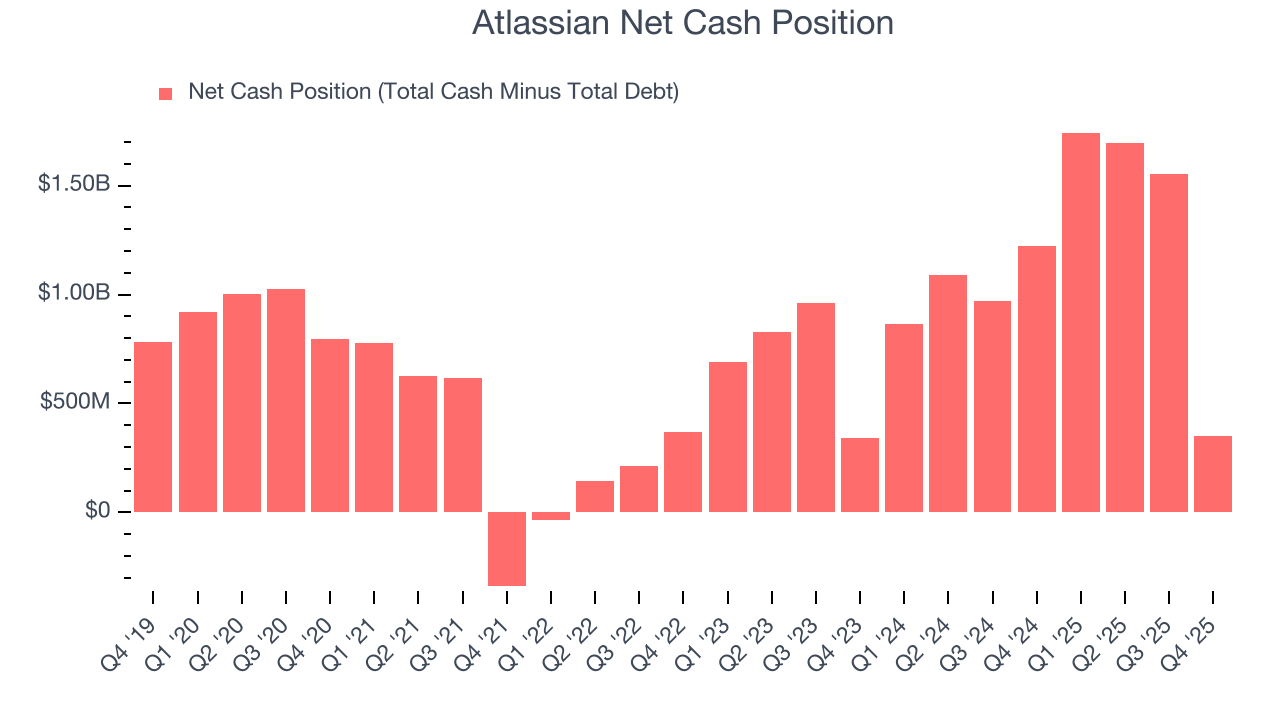

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Atlassian is a well-capitalized company with $1.57 billion of cash and $1.22 billion of debt on its balance sheet. This $351 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Atlassian’s Q4 Results

It was encouraging to see Atlassian’s revenue guidance for next quarter beat analysts’ expectations. We were also happy its revenue and adjusted operating profit outperformed Wall Street’s estimates. On the other hand, its billings slightly missed. Big picture, there has been turmoil in enterprise software as the market increasingly views AI as an existential threat to these SaaS companies and their product offerings. Without a perfect quarter, it seems tough for these stocks to rally, TEAM shares traded down 9.7% to $90.05 immediately after reporting.

13. Is Now The Time To Buy Atlassian?

Updated: March 8, 2026 at 10:12 PM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Atlassian.

Atlassian possesses a number of positive attributes. To kick things off, its revenue growth was strong over the last five years. And while its operating margin hasn't moved over the last year, its admirable gross margin indicates excellent unit economics. On top of that, its efficient sales strategy allows it to target and onboard new users at scale.

Atlassian’s price-to-sales ratio based on the next 12 months is 3.2x. Looking at the software landscape right now, Atlassian trades at a pretty interesting price. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $176.68 on the company (compared to the current share price of $83.74), implying they see 111% upside in buying Atlassian in the short term.