Frontier (ULCC)

Frontier faces an uphill battle. Not only has its sales growth been weak but also its negative returns on capital show it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Frontier Will Underperform

Recognizable for the colorful animals adorning each aircraft tail, Frontier Group Holdings (NASDAQ:ULCC) is an ultra low-cost airline that provides budget-friendly flights throughout the United States and select international destinations in the Americas.

- 17.9% annual revenue growth over the last five years was slower than its consumer discretionary peers

- Earnings per share lagged its peers over the last four years as they only grew by 8.7% annually

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

Frontier’s quality is inadequate. You should search for better opportunities.

Why There Are Better Opportunities Than Frontier

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Frontier

Frontier is trading at $5.96 per share, or 6.4x forward EV-to-EBITDA. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Frontier (ULCC) Research Report: Q4 CY2025 Update

Ultra low-cost airline Frontier Group Holdings (NASDAQ:ULCC) beat Wall Street’s revenue expectations in Q4 CY2025, but sales were flat year on year at $997 million. Its non-GAAP profit of $0.23 per share was 71.8% above analysts’ consensus estimates.

Frontier (ULCC) Q4 CY2025 Highlights:

- Revenue: $997 million vs analyst estimates of $974.4 million (flat year on year, 2.3% beat)

- Adjusted EPS: $0.23 vs analyst estimates of $0.13 (71.8% beat)

- Adjusted EBITDA: $287 million vs analyst estimates of $257.1 million (28.8% margin, 11.6% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $0.05 at the midpoint, beating analyst estimates by 318%

- Operating Margin: 4.9%, in line with the same quarter last year

- Revenue passenger miles: 7.74 billion, in line with the same quarter last year

- Market Capitalization: $1.36 billion

Company Overview

Recognizable for the colorful animals adorning each aircraft tail, Frontier Group Holdings (NASDAQ:ULCC) is an ultra low-cost airline that provides budget-friendly flights throughout the United States and select international destinations in the Americas.

Frontier operates under a "Low Fares Done Right" strategy, differentiating itself from other ultra low-cost carriers by emphasizing a family-friendly experience with a more upscale feel. The airline offers base fares at rock-bottom prices, allowing customers to pay only for the additional services they want. These optional services include carry-on and checked baggage, seat selection, extra legroom, priority boarding, and ticket changes.

The company maintains a modern fleet of Airbus A320 family aircraft, with a majority being the more fuel-efficient A320neo models, earning Frontier the distinction of being "America's Greenest Airline" based on fuel efficiency metrics. This focus on fuel efficiency is a key component of Frontier's low-cost structure, along with high-density seating configurations that maximize the number of passengers per flight.

Frontier targets price-sensitive leisure travelers and those visiting friends and relatives, with particular appeal to families through programs like "Kids Fly Free" and its animal-themed branding. The airline primarily sells tickets through its website and mobile app, keeping distribution costs low. To build customer loyalty, Frontier offers its FRONTIER Miles frequent flyer program, Discount Den subscription service for access to lower fares, and the GoWild! All-You-Can-Fly Pass for regular travelers.

4. Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Frontier's main competitors include other ultra low-cost carriers such as Spirit Airlines, Allegiant Travel Company, and Sun Country Airlines, as well as low-cost carrier Southwest Airlines. The company also competes with the major U.S. airlines including American Airlines, Delta Air Lines, and United Airlines on many domestic routes.

5. Revenue Growth

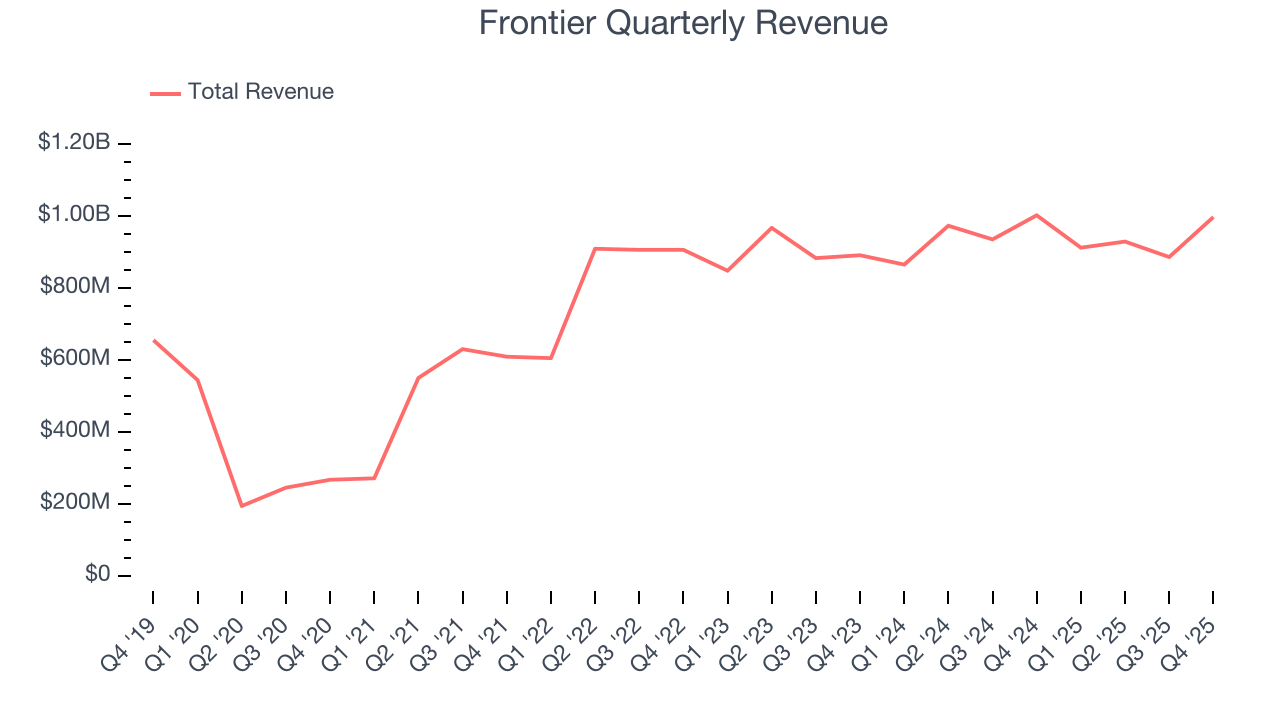

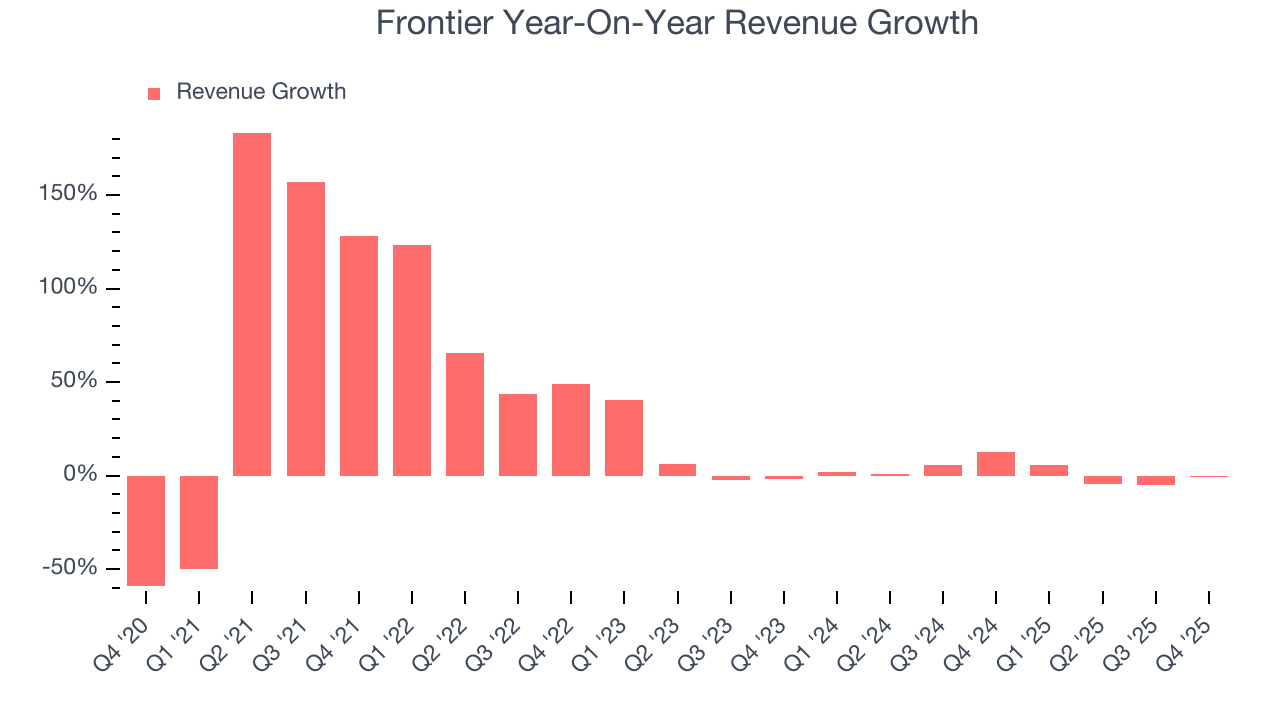

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Frontier grew its sales at a 24.4% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Frontier’s recent performance shows its demand has slowed as its annualized revenue growth of 1.9% over the last two years was below its five-year trend.

This quarter, Frontier’s $997 million of revenue was flat year on year but beat Wall Street’s estimates by 2.3%.

Looking ahead, sell-side analysts expect revenue to grow 16.6% over the next 12 months, an improvement versus the last two years. This projection is commendable and indicates its newer products and services will spur better top-line performance.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

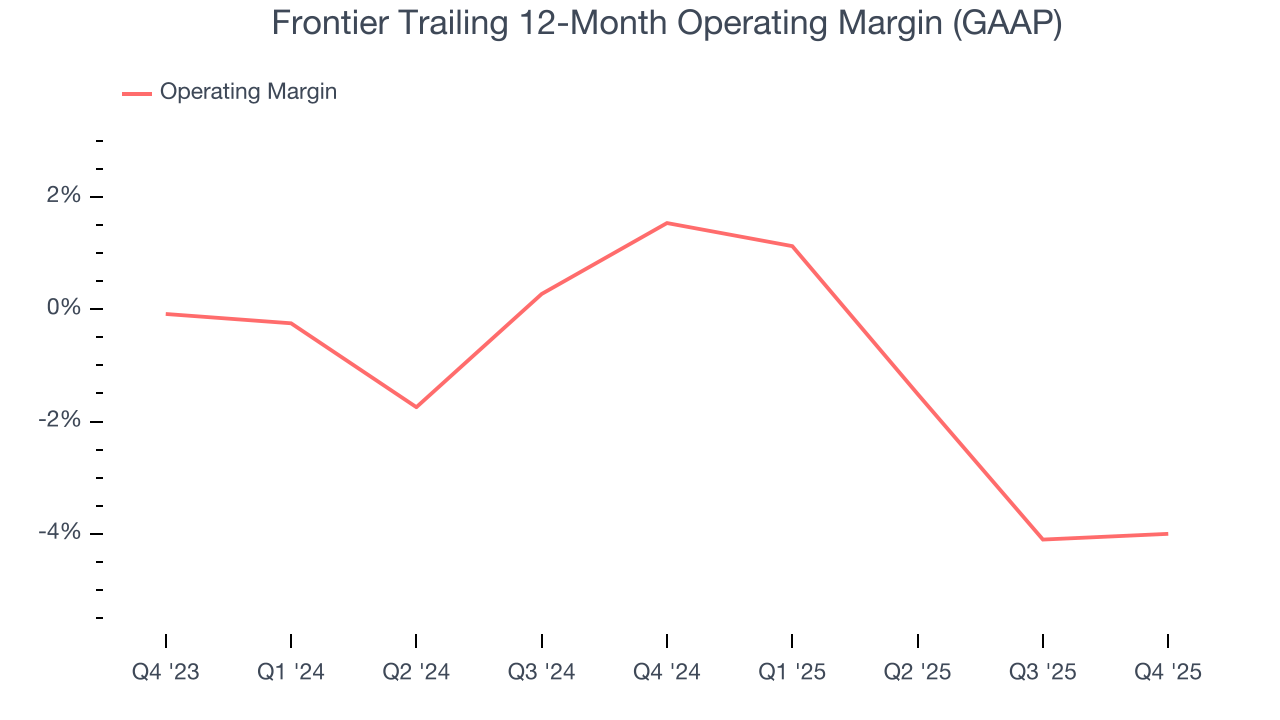

Frontier’s operating margin has shrunk over the last 12 months and averaged negative 1.2% over the last two years. Unprofitable consumer discretionary companies with falling margins deserve extra scrutiny because they’re spending loads of money to stay relevant, an unsustainable practice.

In Q4, Frontier generated an operating margin profit margin of 4.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

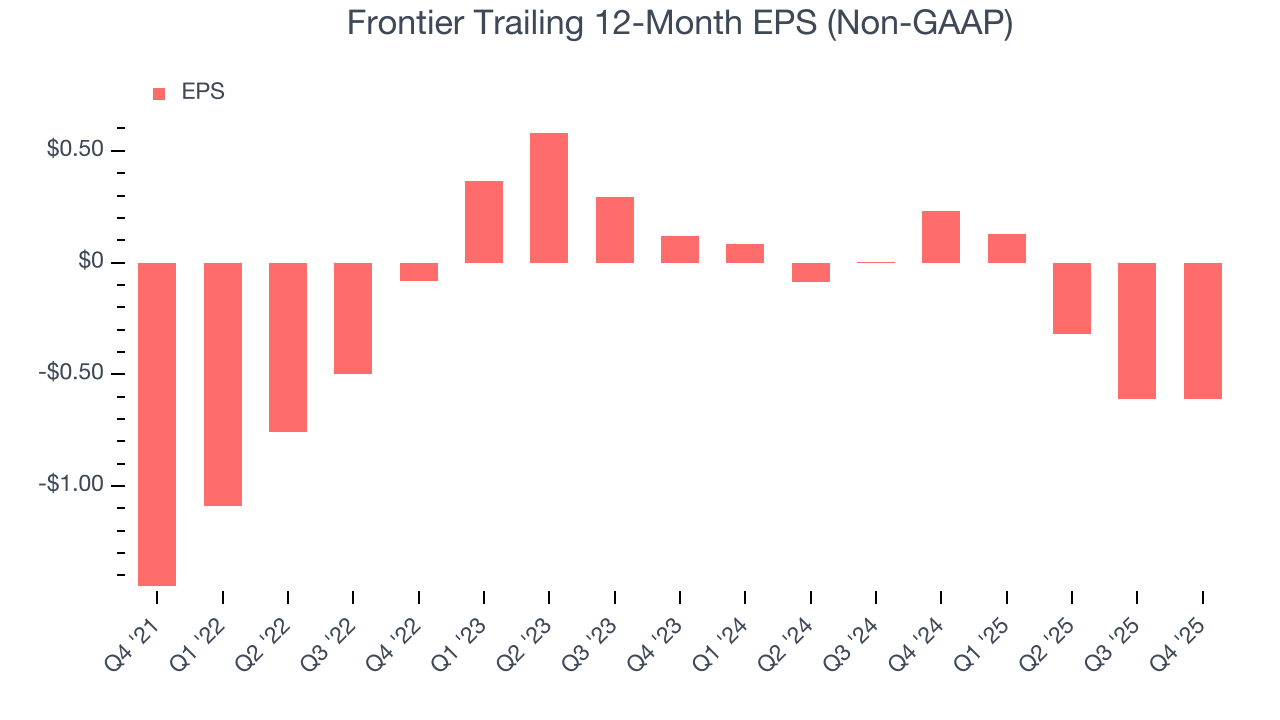

Although Frontier’s full-year earnings are still negative, it reduced its losses and improved its EPS by 19.5% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, Frontier reported adjusted EPS of $0.23, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Frontier to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.61 will advance to negative $0.04.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

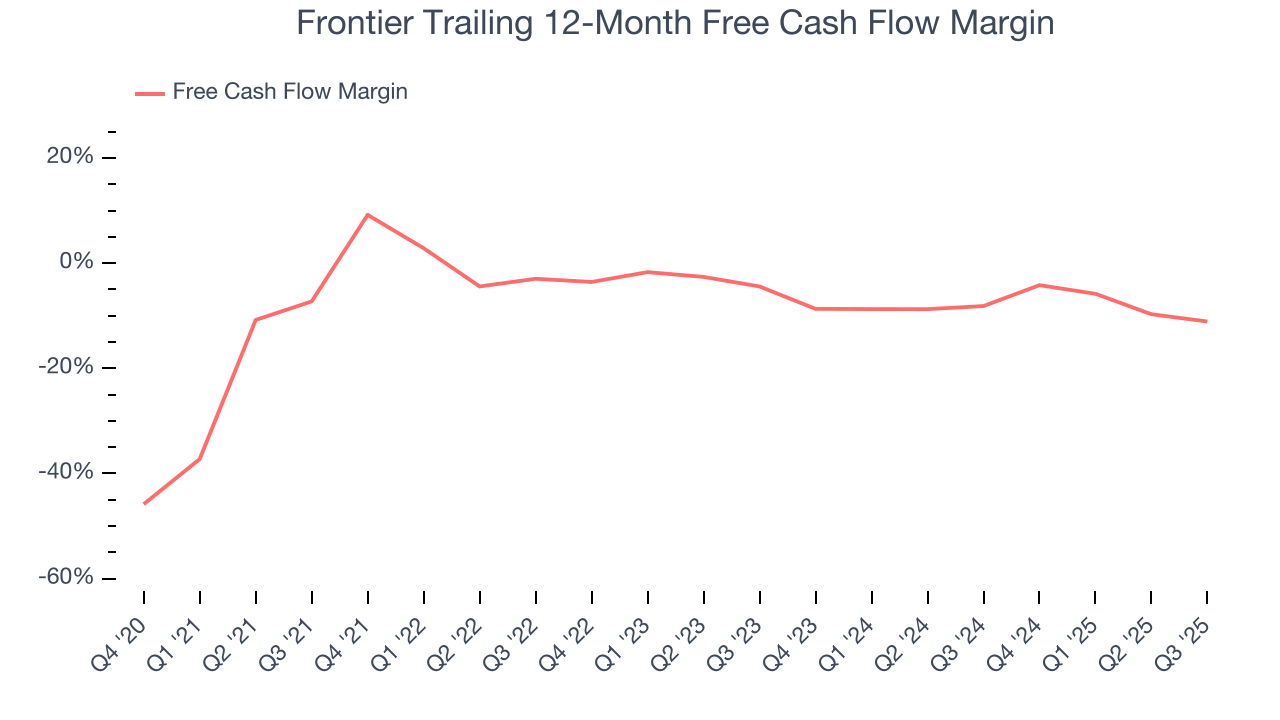

Over the last two years, Frontier’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 9.9%, meaning it lit $9.92 of cash on fire for every $100 in revenue.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Frontier’s five-year average ROIC was negative 1.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Frontier’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Key Takeaways from Frontier’s Q4 Results

It was good to see Frontier beat analysts’ EPS expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 4.1% to $6.21 immediately after reporting.

11. Is Now The Time To Buy Frontier?

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Frontier doesn’t pass our quality test. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

Frontier’s EV-to-EBITDA ratio based on the next 12 months is 1.4x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $5.56 on the company (compared to the current share price of $6.21).