Varonis Systems (VRNS)

We aren’t fans of Varonis Systems. Its revenue growth has decelerated and its historical operating losses don’t give us confidence in a turnaround.― StockStory Analyst Team

1. News

2. Summary

Why Varonis Systems Is Not Exciting

Beginning with protecting Windows file shares in 2005 and evolving into a comprehensive security platform, Varonis Systems (NASDAQ:VRNS) provides data security software that helps organizations protect sensitive information, detect threats, and comply with privacy regulations.

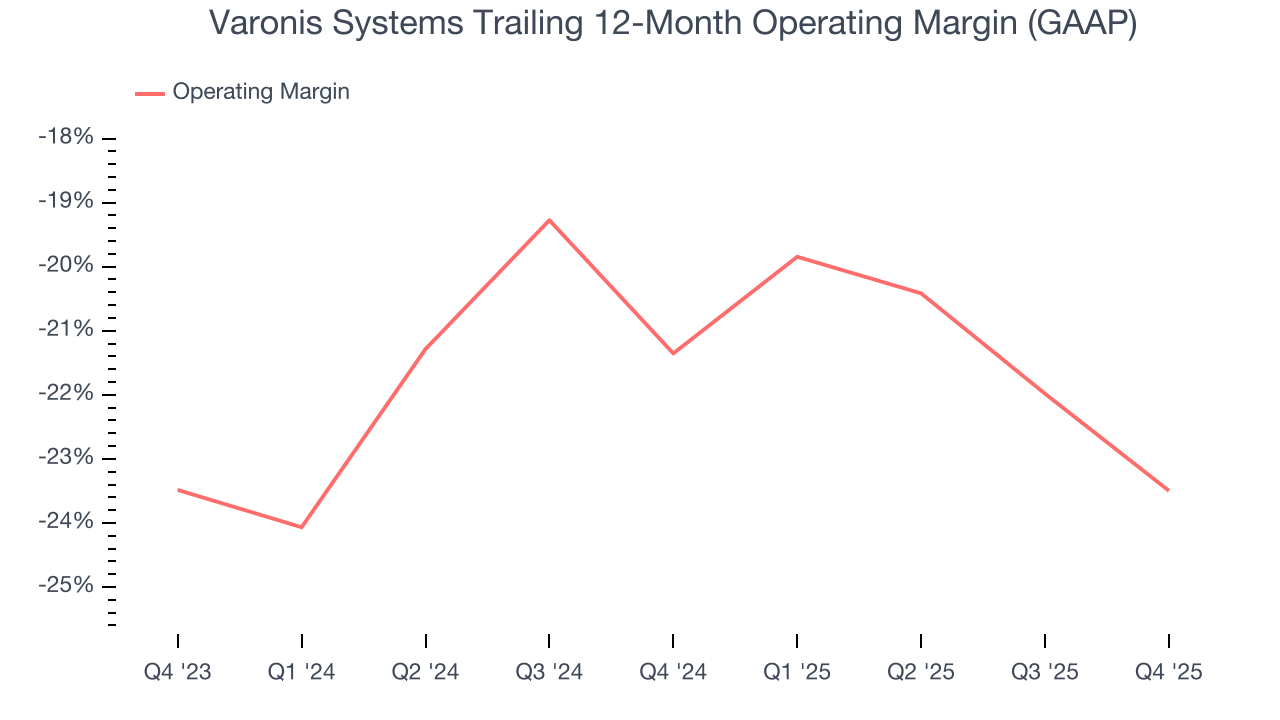

- Poor expense management has led to operating margin losses

- Expenses have increased as a percentage of revenue over the last year as its operating margin fell by 2.7 percentage points

- On the bright side, its user-friendly software enables clients to ramp up spending quickly, leading to the speedy recovery of customer acquisition costs

Varonis Systems’s quality is not up to our standards. There are more appealing investments to be made.

Why There Are Better Opportunities Than Varonis Systems

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Varonis Systems

At $29.37 per share, Varonis Systems trades at 5x forward price-to-sales. Varonis Systems’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Varonis Systems (VRNS) Research Report: Q4 CY2025 Update

Data security company Varonis Systems (NASDAQ:VRNS) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 9.4% year on year to $173.4 million. Guidance for next quarter’s revenue was better than expected at $165 million at the midpoint, 0.9% above analysts’ estimates. Its non-GAAP profit of $0.08 per share was significantly above analysts’ consensus estimates.

Varonis Systems (VRNS) Q4 CY2025 Highlights:

- Revenue: $173.4 million vs analyst estimates of $168.2 million (9.4% year-on-year growth, 3.1% beat)

- Adjusted EPS: $0.08 vs analyst estimates of $0.03 (significant beat)

- Adjusted Operating Income: $4.55 million vs analyst estimates of $1.54 million (2.6% margin, significant beat)

- Revenue Guidance for Q1 CY2026 is $165 million at the midpoint, above analyst estimates of $163.5 million

- Adjusted EPS guidance for the upcoming financial year 2026 is $0.08 at the midpoint, missing analyst estimates by 76.6%

- Operating Margin: -17.5%, down from -11.1% in the same quarter last year

- Free Cash Flow Margin: 13.4%, down from 17.9% in the previous quarter

- Market Capitalization: $3.45 billion

Company Overview

Beginning with protecting Windows file shares in 2005 and evolving into a comprehensive security platform, Varonis Systems (NASDAQ:VRNS) provides data security software that helps organizations protect sensitive information, detect threats, and comply with privacy regulations.

The Varonis Data Security Platform works by extracting metadata from an organization's IT infrastructure, creating a functional map of enterprise data and relationships. This contextual understanding enables the system to identify vulnerabilities, detect unusual activities, and automatically respond to threats. The platform covers both on-premises and cloud environments, including Microsoft 365, AWS, Azure, and numerous SaaS applications like Salesforce and Slack.

A healthcare provider might use Varonis to automatically discover and classify patient records containing protected health information, monitor who accesses this sensitive data, receive alerts about suspicious activities, and automatically remediate excessive access permissions. Financial institutions similarly rely on the platform to protect customer financial data and intellectual property.

Varonis generates revenue through subscription-based licensing, primarily using a Software-as-a-Service (SaaS) model. The company has been transitioning from on-premises subscription licenses to its cloud-based SaaS offering, which provides simpler deployment and enhanced automation capabilities. Customers can purchase different "Protection Packages" based on the environments they need to secure.

In 2023, Varonis enhanced its platform with Athena AI, incorporating generative AI capabilities to provide security analysts with automated alert response playbooks and natural language search functionality for security investigations.

4. Endpoint Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. As the volume of internet enabled devices grows, every device that employees use to connect to business networks represents a potential risk. Endpoint security software enables businesses to protect devices (endpoints) that employees use for work purposes either on a network or in the cloud from cyber threats.

Varonis Systems competes with CyberArk (NASDAQ:CYBR), Proofpoint (formerly NASDAQ:PFPT, now private), Microsoft (NASDAQ:MSFT), Crowdstrike (NASDAQ:CRWD), and several privately-held cybersecurity companies including Netwrix and SailPoint (formerly NYSE:SAIL, now private).

5. Revenue Growth

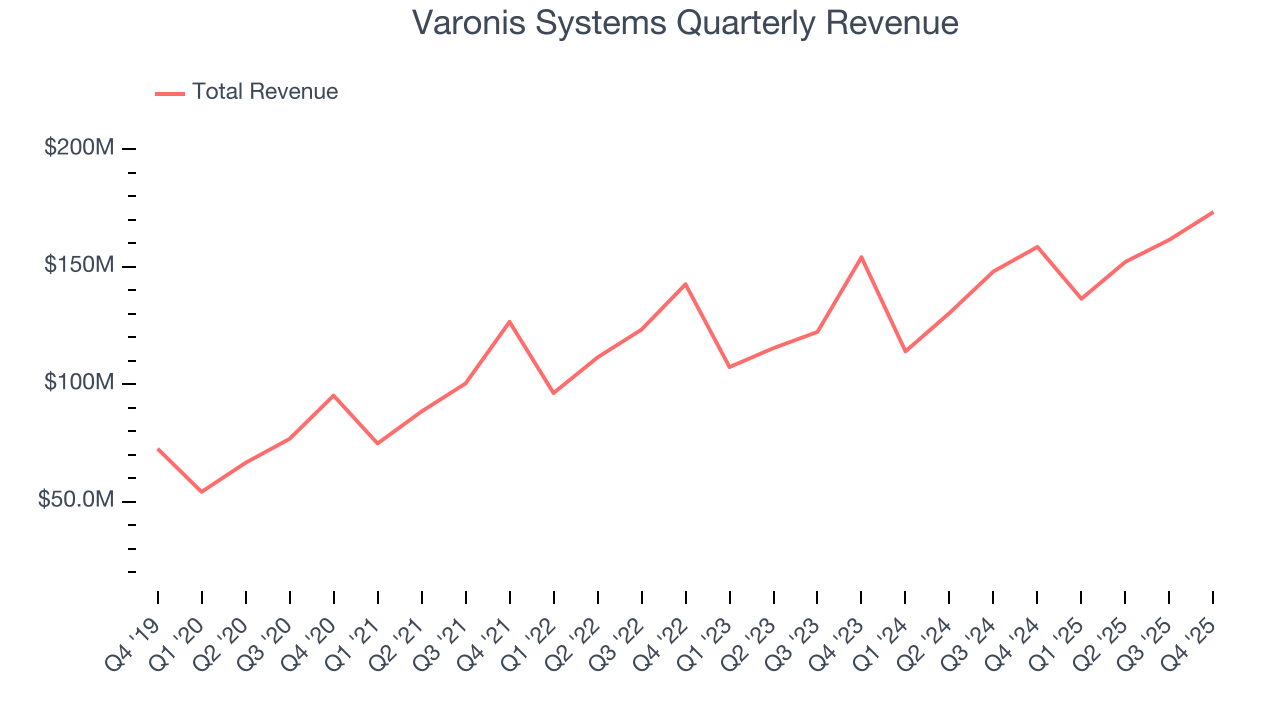

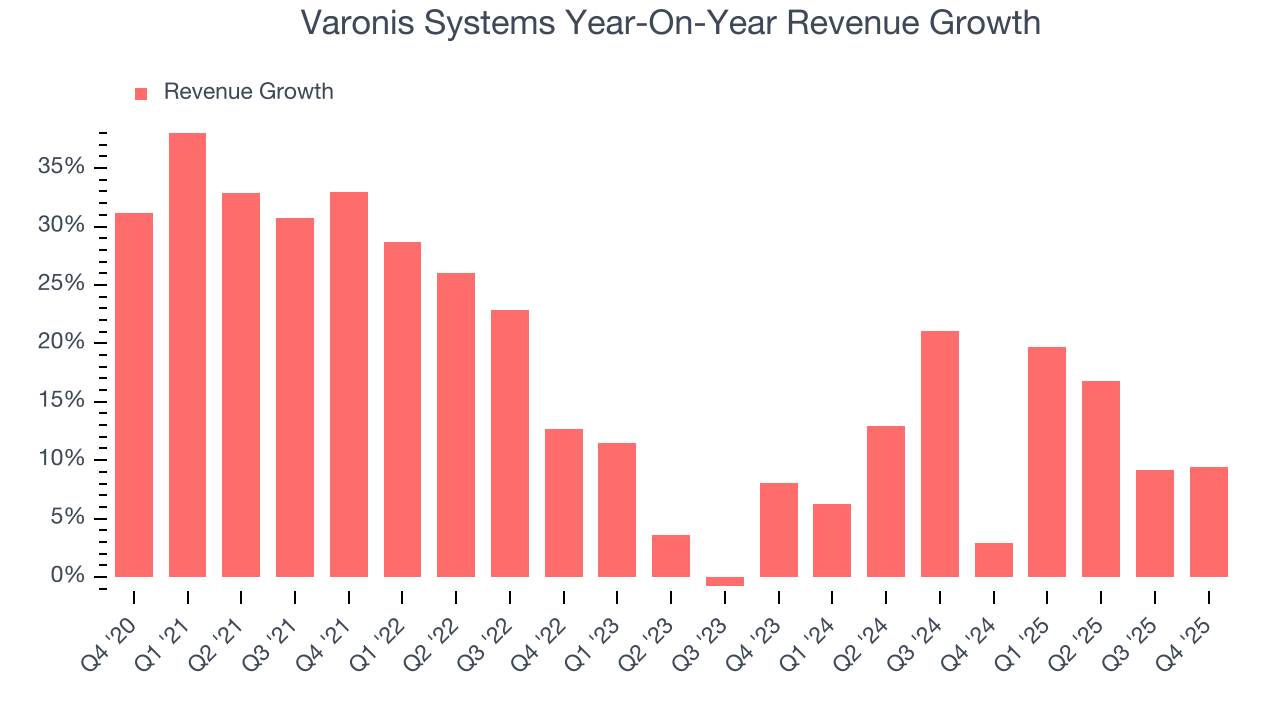

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Varonis Systems grew its sales at a 16.3% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Varonis Systems’s recent performance shows its demand has slowed as its annualized revenue growth of 11.8% over the last two years was below its five-year trend.

This quarter, Varonis Systems reported year-on-year revenue growth of 9.4%, and its $173.4 million of revenue exceeded Wall Street’s estimates by 3.1%. Company management is currently guiding for a 20.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 15.4% over the next 12 months, an improvement versus the last two years. This projection is above average for the sector and suggests its newer products and services will catalyze better top-line performance.

6. Customer Acquisition Efficiency

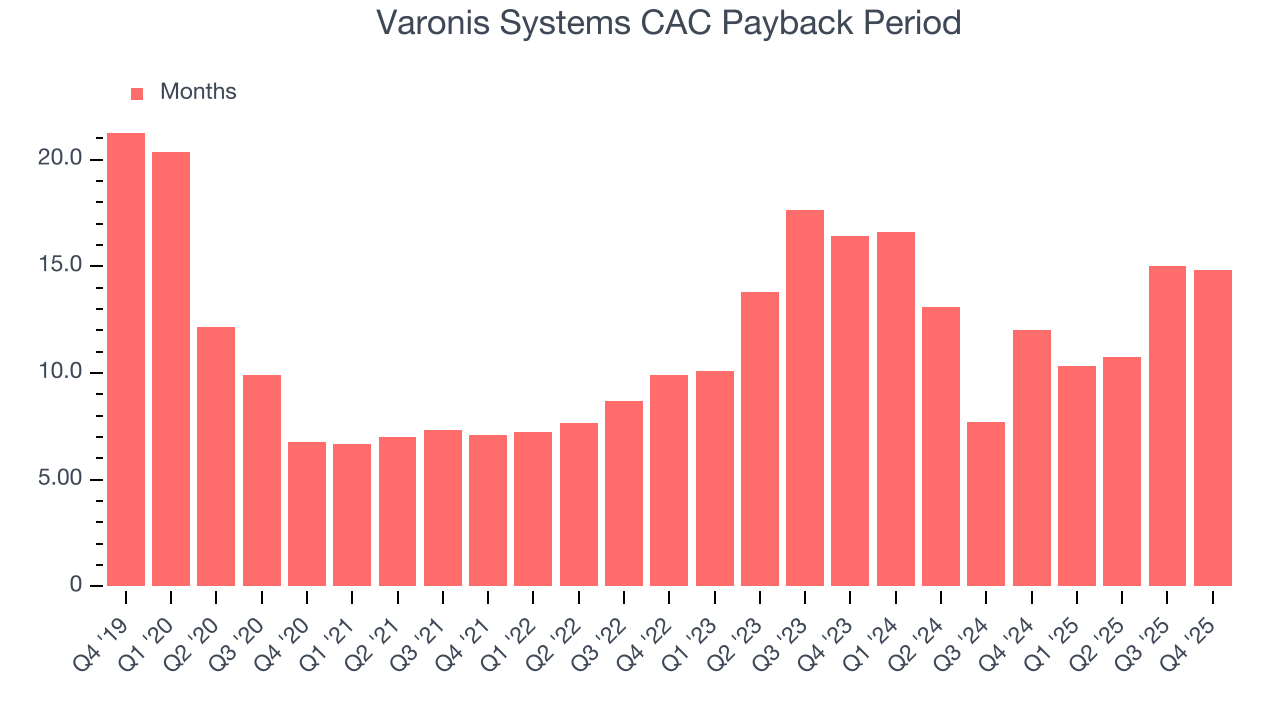

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Varonis Systems is extremely efficient at acquiring new customers, and its CAC payback period checked in at 14.8 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

7. Gross Margin & Pricing Power

For software companies like Varonis Systems, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

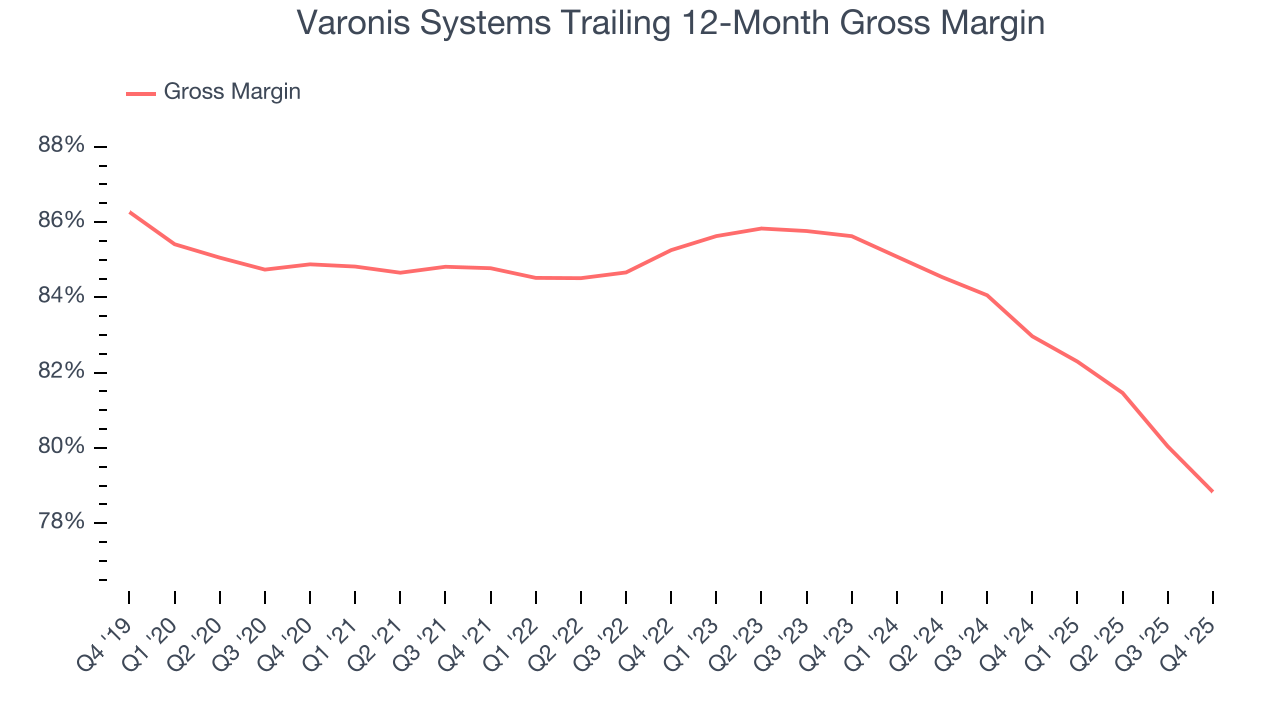

Varonis Systems’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an excellent 78.8% gross margin over the last year. Said differently, roughly $78.83 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Varonis Systems has seen gross margins decline by 6.8 percentage points over the last 2 year, which is among the worst in the software space.

Varonis Systems’s gross profit margin came in at 78.9% this quarter, down 4.6 percentage points year on year. Varonis Systems’s full-year margin has also been trending down over the past 12 months, decreasing by 4.1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

8. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Varonis Systems’s expensive cost structure has contributed to an average operating margin of negative 23.5% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Varonis Systems reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

Looking at the trend in its profitability, Varonis Systems’s operating margin decreased by 2.1 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Varonis Systems’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

Varonis Systems’s operating margin was negative 17.5% this quarter. The company's consistent lack of profits raise a flag.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

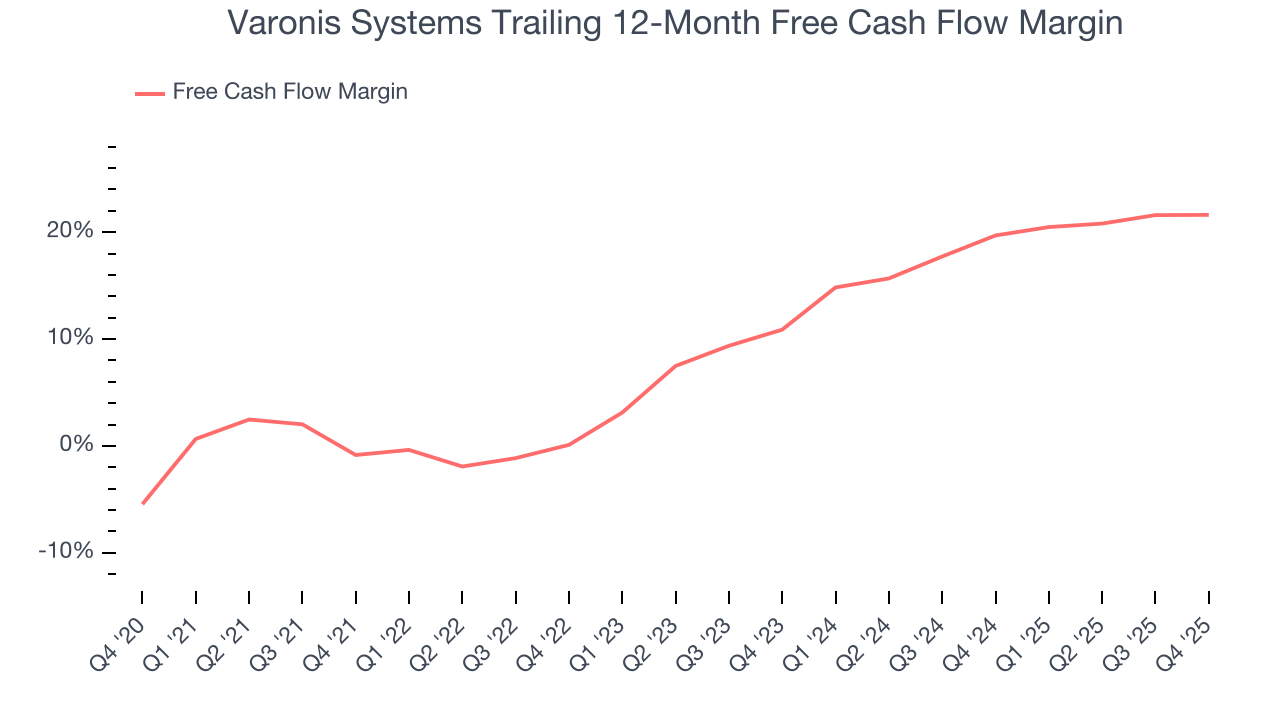

Varonis Systems has shown impressive cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that give it the option to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 21.6% over the last year, better than the broader software sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Varonis Systems’s free cash flow clocked in at $23.25 million in Q4, equivalent to a 13.4% margin. This cash profitability was in line with the comparable period last year but below its one-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting Varonis Systems’s free cash flow margin of 21.6% for the last 12 months to remain the same.

10. Key Takeaways from Varonis Systems’s Q4 Results

It was great to see Varonis Systems expecting revenue growth to accelerate next year. We were also happy its revenue and adjusted EPS in the quarter both outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed and its EPS guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock remained flat at $26.52 immediately after reporting.

11. Is Now The Time To Buy Varonis Systems?

Updated: February 3, 2026 at 4:16 PM EST

When considering an investment in Varonis Systems, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Varonis Systems’s business quality ultimately falls short of our standards. For starters, its revenue growth was mediocre over the last five years, and analysts don’t see anything changing over the next 12 months. And while its efficient sales strategy allows it to target and onboard new users at scale, the downside is its declining operating margin shows it’s becoming less efficient at building and selling its software. On top of that, its operating margins reveal poor profitability compared to other software companies.

Varonis Systems’s price-to-sales ratio based on the next 12 months is 4.3x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $48.15 on the company (compared to the current share price of $26.52).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.