Viasat (VSAT)

Viasat is intriguing. Although it has burned cash, its growth shows it’s deploying the Jeff Bezos reinvestment strategy.― StockStory Analyst Team

1. News

2. Summary

Why Viasat Is Interesting

Operating a fleet of 23 satellites that orbit the Earth and beam connectivity from space, Viasat (NASDAQ:VSAT) provides satellite-based communications networks and services for airlines, maritime vessels, governments, businesses, and residential customers worldwide.

- Annual revenue growth of 15.1% over the past five years was outstanding, reflecting market share gains this cycle

- Economies of scale give it more fixed cost leverage than its smaller competitors

- One pitfall is its historical adjusted operating margin losses point to an inefficient cost structure

Viasat is solid, but not perfect. You should keep tabs on this company.

Why Should You Watch Viasat

Why Should You Watch Viasat

At $40.02 per share, Viasat trades at 55.9x forward P/E. The market certainly has elevated expectations given its relatively high multiple, which could cause short-term volatility if there is a hiccup in company performance or even that of its peers.

If Viasat strings together a few solid quarters and proves it can be a high-quality company, we’d be more open to investing.

3. Viasat (VSAT) Research Report: Q4 CY2025 Update

Global satellite communications provider Viasat (NASDAQ:VSAT) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 3% year on year to $1.16 billion. Its non-GAAP profit of $0.79 per share was significantly above analysts’ consensus estimates.

Viasat (VSAT) Q4 CY2025 Highlights:

- Revenue: $1.16 billion vs analyst estimates of $1.17 billion (3% year-on-year growth, 1% miss)

- Adjusted EPS: $0.79 vs analyst estimates of $0.24 (significant beat)

- Adjusted EBITDA: $387 million vs analyst estimates of $387.2 million (33.5% margin, in line)

- Operating Margin: 2.3%, in line with the same quarter last year

- Free Cash Flow was $444.2 million, up from -$33.17 million in the same quarter last year

- Market Capitalization: $5.37 billion

Company Overview

Operating a fleet of 23 satellites that orbit the Earth and beam connectivity from space, Viasat (NASDAQ:VSAT) provides satellite-based communications networks and services for airlines, maritime vessels, governments, businesses, and residential customers worldwide.

Viasat's business spans two main segments: communication services and defense technologies. The communication services division manages satellite networks that enable internet connectivity across multiple markets. For aviation, Viasat has equipped over 4,100 commercial aircraft and 2,000 business jets with in-flight connectivity systems, allowing passengers to browse, stream, and work while in the air. In the maritime sector, the company serves approximately 14,000 vessels, providing critical communications for commercial shipping fleets operating far from shore.

The company's residential internet service reaches approximately 189,000 U.S. subscribers, primarily serving rural and underserved areas where terrestrial broadband infrastructure is limited. For government and military clients, Viasat delivers secure tactical communications networks, cybersecurity solutions, and specialized satellite systems designed for defense applications.

The technological foundation of Viasat's services is its diverse satellite fleet operating in different orbital positions and frequency bands (Ka-, L-, and S-bands), allowing for global coverage with particular strength over oceans. The company's newest ViaSat-3 satellites represent a significant leap in capacity, designed to deliver dramatically more bandwidth to high-demand locations compared to previous generations. This technology enables Viasat to allocate bandwidth dynamically to areas with the highest customer demand, whether that's over busy air corridors, shipping lanes, or remote communities.

4. Satellite Telecommunication Services

Satellite telecommunication is generally buoyed by rising global demand for connectivity in costly-to-connect and remote areas. IoT (Internet of Things) expansion and government-backed space and defense initiatives also help. As advancements in low Earth orbit (LEO) technology happen, companies in the space will have more favorable competitive positions, which could lead to further partnerships with mobile network operators to extend coverage. On the other hand, headwinds include high capital expenditures for satellite deployment as well as regulatory hurdles related to spectrum allocation. Competition from larger players like SpaceX’s Starlink and Amazon’s Kuiper could also intensify over time, especially if tech advancements lead to better unit economics and financial prospects.

Viasat competes with other satellite communications providers including SpaceX's Starlink, Intelsat, SES, Eutelsat, and EchoStar. In the aviation connectivity market, it faces competition from Panasonic Avionics, Gogo, and Thales Group, while its defense business competes with L3Harris, General Dynamics, and BAE Systems.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $4.62 billion in revenue over the past 12 months, Viasat is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

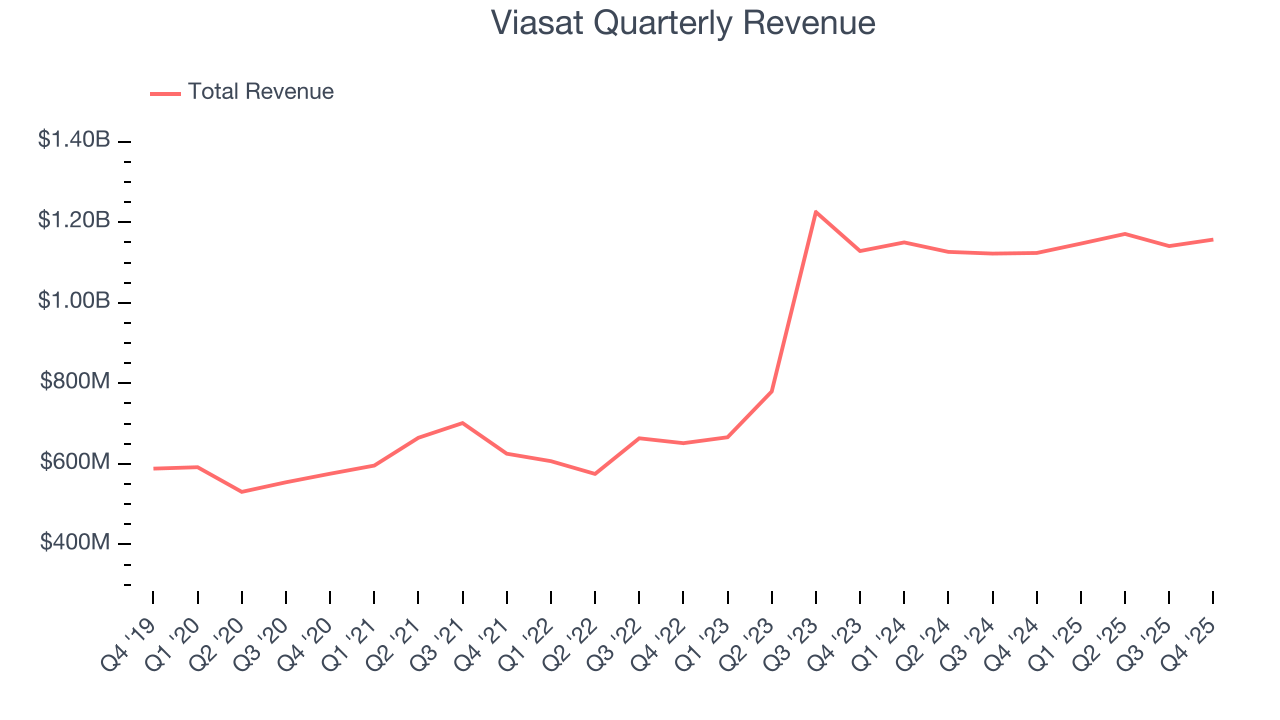

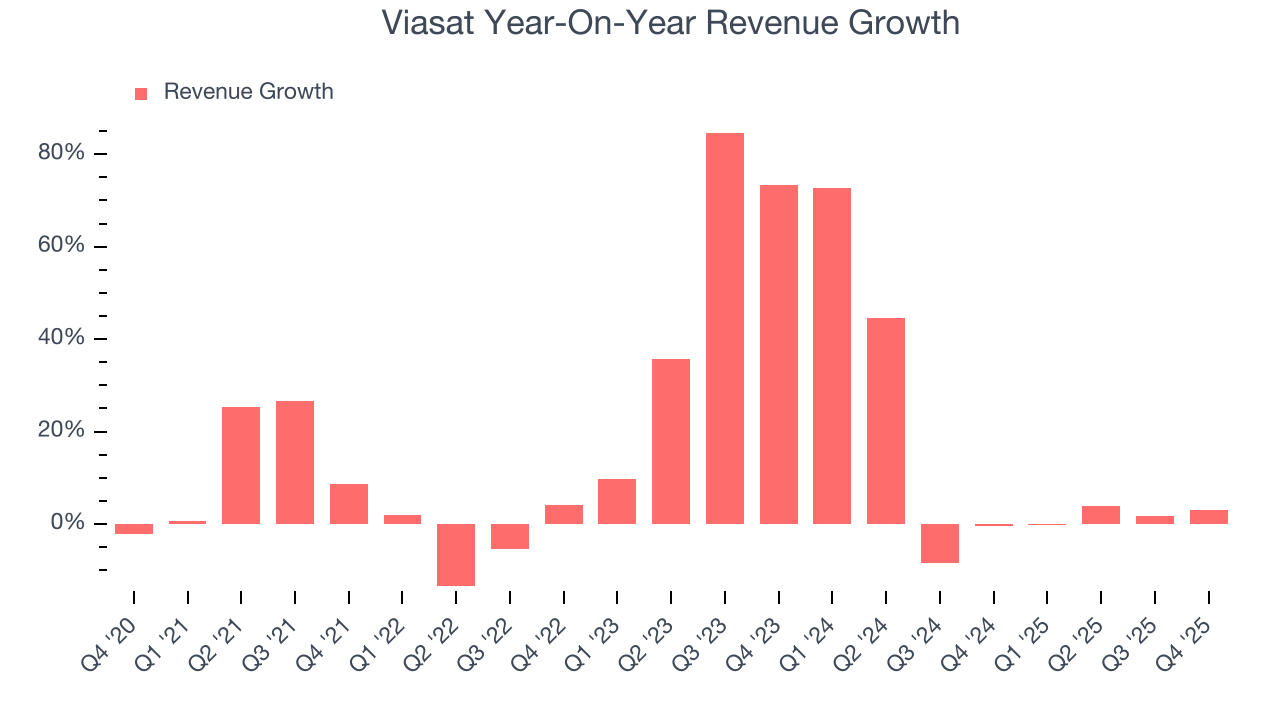

As you can see below, Viasat’s 15.4% annualized revenue growth over the last five years was incredible. This is an encouraging starting point for our analysis because it shows Viasat’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Viasat’s annualized revenue growth of 10.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Viasat’s revenue grew by 3% year on year to $1.16 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.2% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

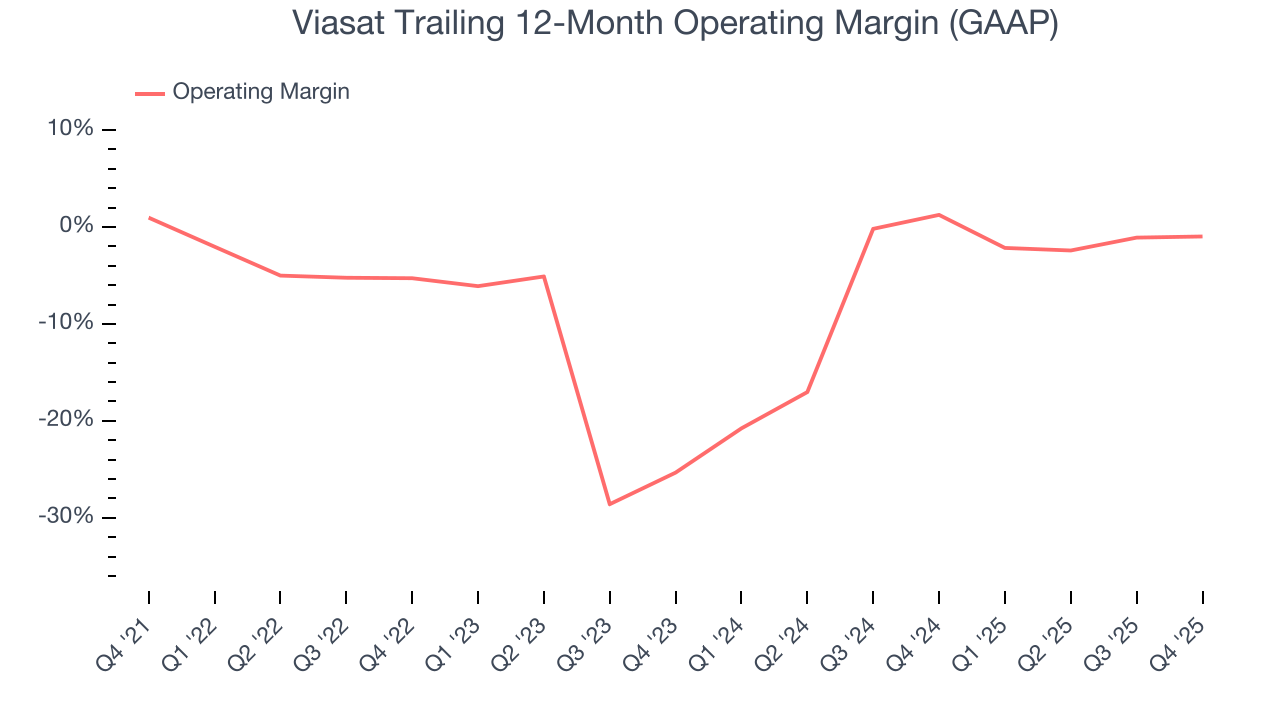

Although Viasat was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 5.9% over the last five years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

Analyzing the trend in its profitability, Viasat’s operating margin decreased by 1.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Viasat’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Viasat generated an operating margin profit margin of 2.3%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

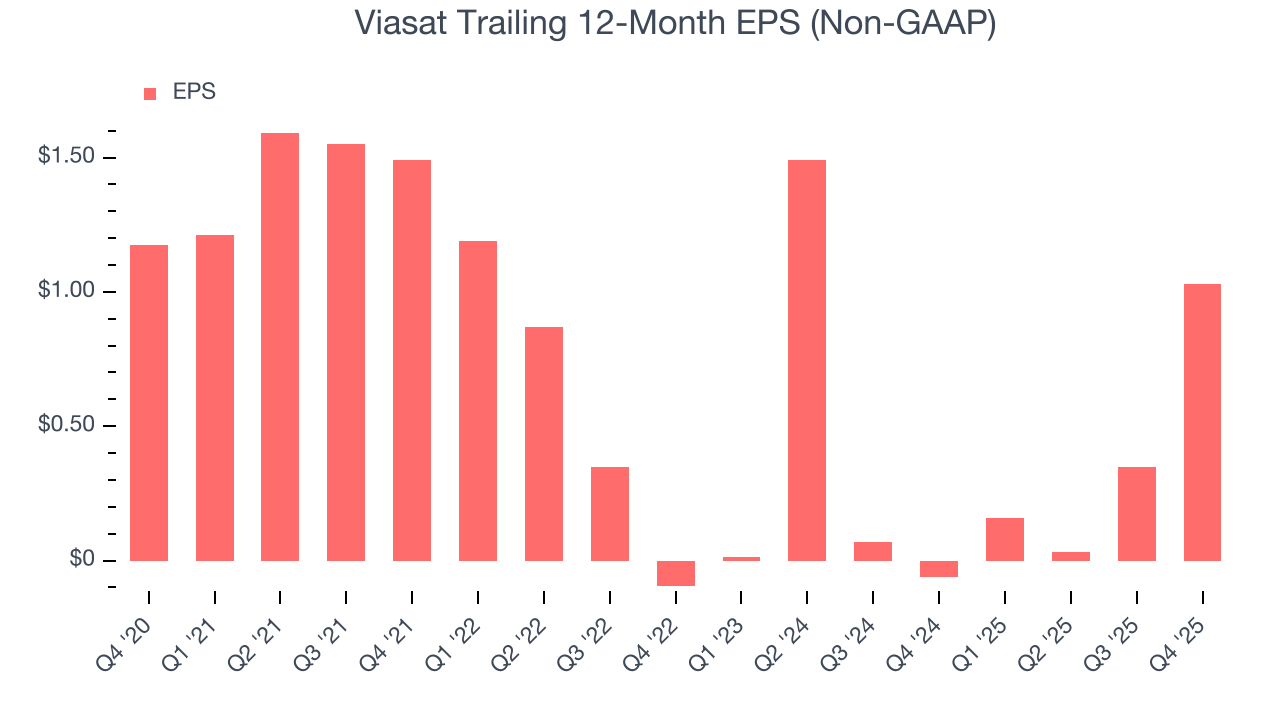

Sadly for Viasat, its EPS declined by 2.6% annually over the last five years while its revenue grew by 15.4%. This tells us the company became less profitable on a per-share basis as it expanded.

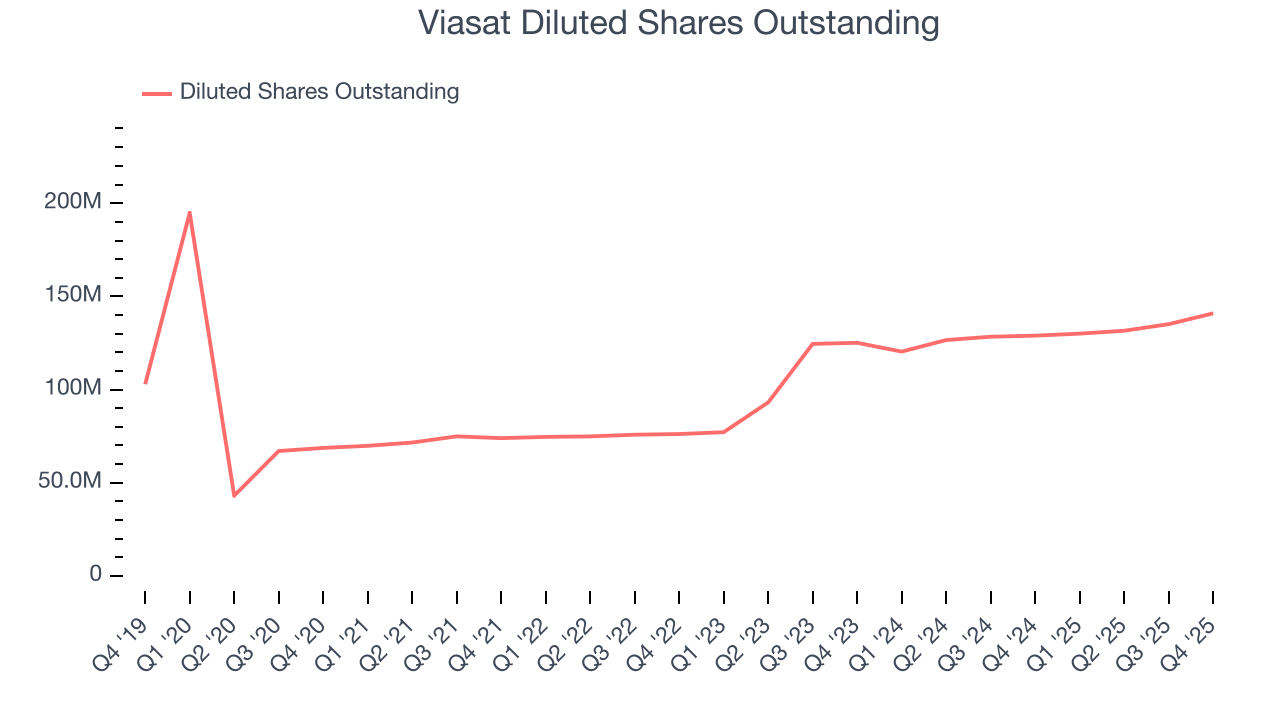

We can take a deeper look into Viasat’s earnings to better understand the drivers of its performance. As we mentioned earlier, Viasat’s operating margin was flat this quarter but declined by 1.9 percentage points over the last five years. Its share count also grew by 105%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Viasat, its two-year annual EPS declines of 26.7% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, Viasat reported adjusted EPS of $0.79, up from $0.11 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Viasat’s full-year EPS of $1.03 to shrink by 27.5%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

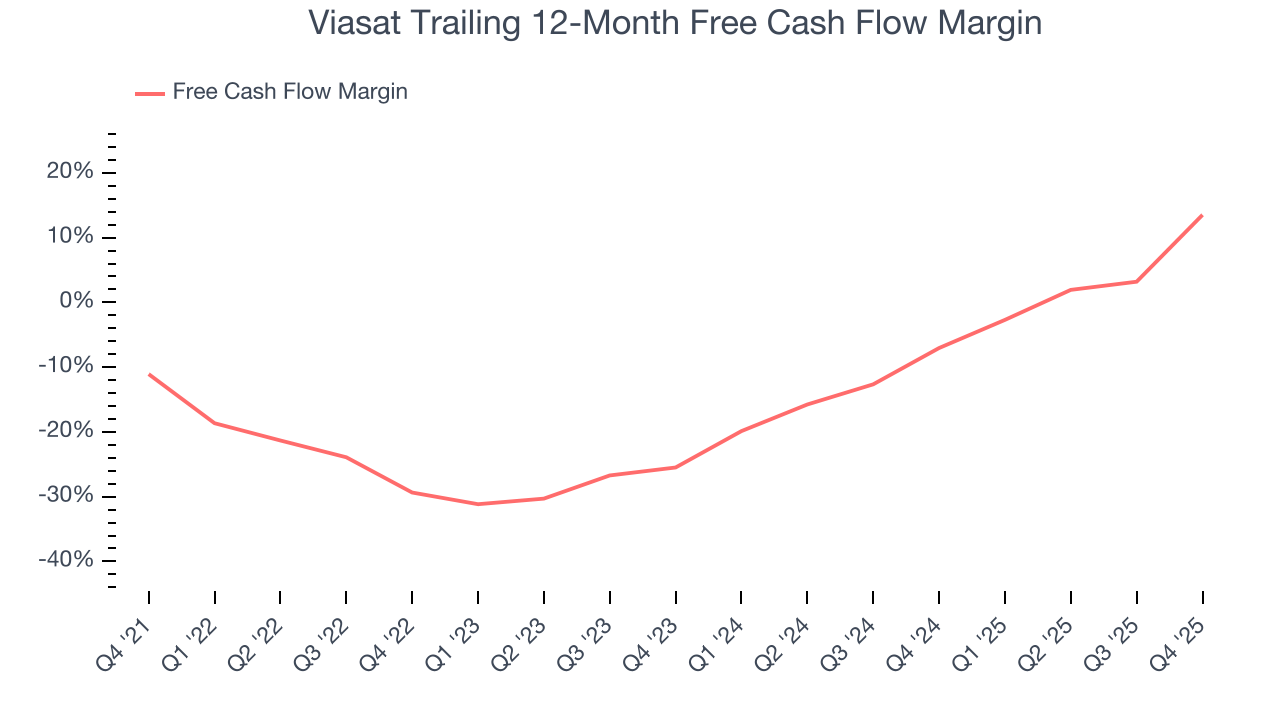

While Viasat posted positive free cash flow this quarter, the broader story hasn’t been so clean. Viasat’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 9.3%, meaning it lit $9.34 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that Viasat’s margin expanded by 24.6 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise.

Viasat’s free cash flow clocked in at $444.2 million in Q4, equivalent to a 38.4% margin. Its cash flow turned positive after being negative in the same quarter last year, marking a potential inflection point.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

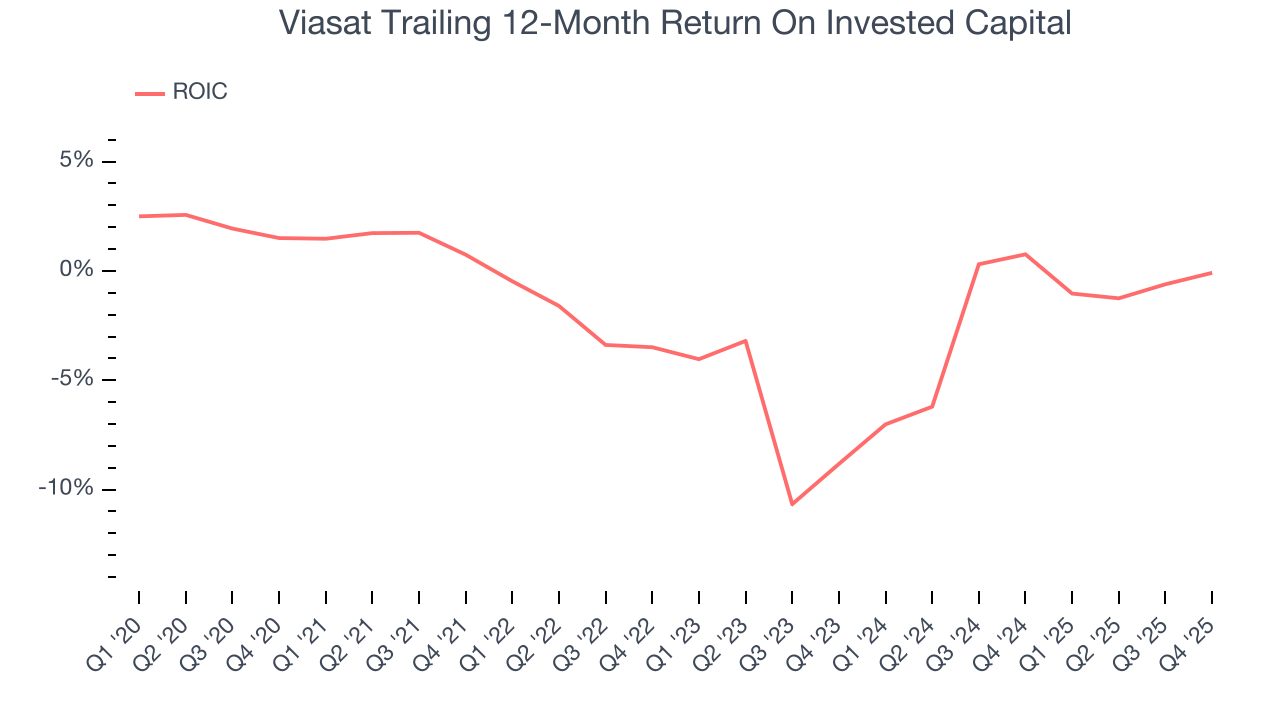

Although Viasat has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 2.2%, meaning management lost money while trying to expand the business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Viasat’s ROIC averaged 1.7 percentage point increases each year over the last few years. its rising ROIC is a good sign and could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

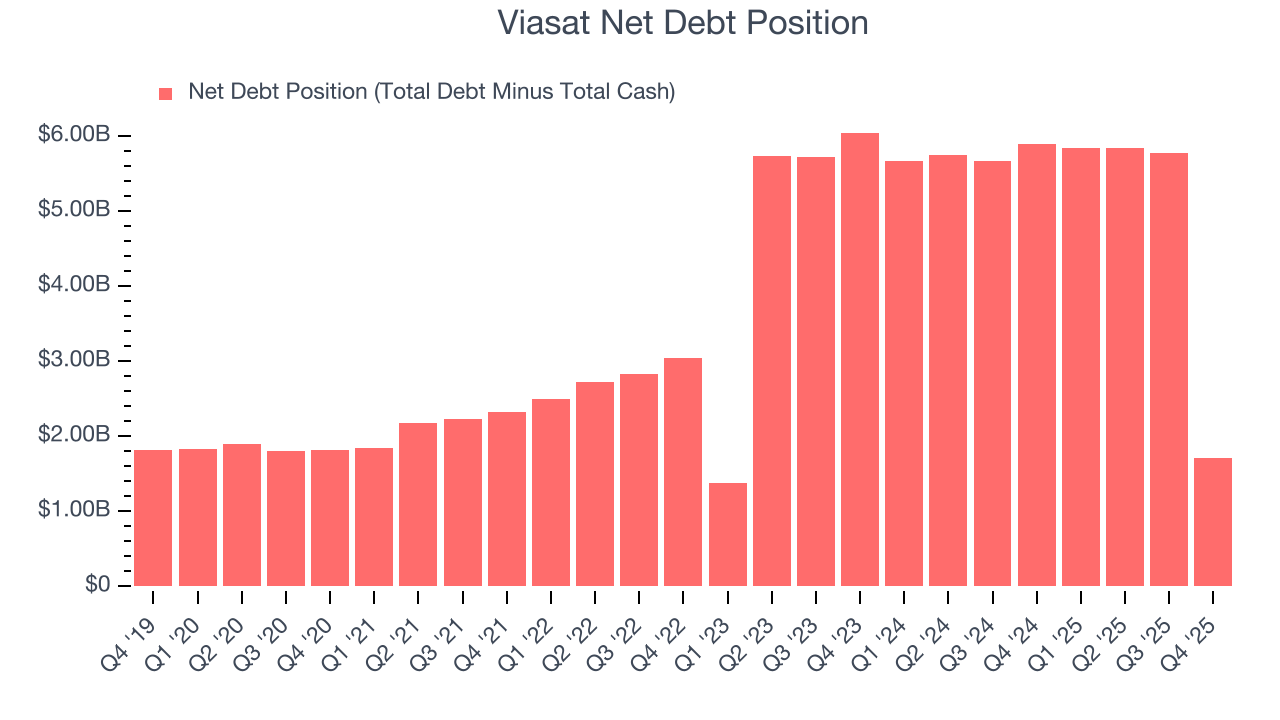

Viasat reported $1.35 billion of cash and $3.05 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.56 billion of EBITDA over the last 12 months, we view Viasat’s 1.1× net-debt-to-EBITDA ratio as safe. We also see its $332 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Viasat’s Q4 Results

It was good to see Viasat beat analysts’ EPS expectations this quarter. On the other hand, its revenue slightly missed. Overall, we think this was a solid quarter with some key areas of upside. Investors were likely hoping for more, and shares traded down 1.5% to $36.91 immediately after reporting.

12. Is Now The Time To Buy Viasat?

Updated: February 5, 2026 at 5:05 PM EST

Are you wondering whether to buy Viasat or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Viasat isn’t a terrible business, but it doesn’t pass our bar. Although its revenue growth was exceptional over the last five years, it’s expected to deteriorate over the next 12 months and its relatively low ROIC suggests management has struggled to find compelling investment opportunities. And while the company’s rising cash profitability gives it more optionality, the downside is its projected EPS for the next year is lacking.

Viasat’s P/E ratio based on the next 12 months is 50.2x. At this valuation, there’s a lot of good news priced in. Add this one to your watchlist and come back to it later.

Wall Street analysts have a consensus one-year price target of $44.14 on the company (compared to the current share price of $36.91).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.