VSE Corporation (VSEC)

VSE Corporation is a sound business. Its rising free cash flow margin gives it more chips to play with.― StockStory Analyst Team

1. News

2. Summary

Why VSE Corporation Is Interesting

With roots dating back to 1959 and a strategic focus on extending the life of transportation assets, VSE Corporation (NASDAQ:VSEC) provides aftermarket parts distribution and maintenance, repair, and overhaul services for aircraft and vehicle fleets in commercial and government markets.

- Sales outlook for the upcoming 12 months implies the business will stay on its desirable two-year growth trajectory

- Incremental sales over the last five years boosted profitability as its annual earnings per share growth of 12.5% outstripped its revenue performance

- One pitfall is its cash-burning tendencies make us wonder if it can sustainably generate shareholder value

VSE Corporation is solid, but not perfect. The stock is up 423% over the last five years.

Why Should You Watch VSE Corporation

High Quality

Investable

Underperform

Why Should You Watch VSE Corporation

VSE Corporation is trading at $216.45 per share, or 52x forward P/E. The market certainly has elevated expectations given its relatively high multiple, which could cause short-term volatility if there is a hiccup in company performance or even that of its peers.

If VSE Corporation strings together a few solid quarters and proves it can be a high-quality company, we’d be more open to investing.

3. VSE Corporation (VSEC) Research Report: Q3 CY2025 Update

Aviation and fleet aftermarket services provider VSE Corporation (NASDAQ:VSEC) reported revenue ahead of Wall Street’s expectations in Q3 CY2025, with sales up 3.4% year on year to $282.9 million. Its GAAP profit of $0.19 per share was 77.3% below analysts’ consensus estimates.

VSE Corporation (VSEC) Q3 CY2025 Highlights:

- Revenue: $282.9 million vs analyst estimates of $277 million (3.4% year-on-year growth, 2.1% beat)

- EPS (GAAP): $0.19 vs analyst expectations of $0.83 (77.3% miss)

- Adjusted EBITDA: $47.35 million vs analyst estimates of $42.66 million (16.7% margin, 11% beat)

- Operating Margin: 3.6%, down from 8.7% in the same quarter last year

- Free Cash Flow Margin: 6.4%, up from 1.6% in the same quarter last year

- Market Capitalization: $3.71 billion

Company Overview

With roots dating back to 1959 and a strategic focus on extending the life of transportation assets, VSE Corporation (NASDAQ:VSEC) provides aftermarket parts distribution and maintenance, repair, and overhaul services for aircraft and vehicle fleets in commercial and government markets.

VSE operates through two primary business segments: Aviation and Fleet. The Aviation segment serves as a critical link in the aerospace supply chain, providing aftermarket parts distribution and maintenance, repair, and overhaul (MRO) services for aircraft components and engine accessories. This segment caters to a diverse clientele including commercial airlines, regional carriers, cargo transporters, business and general aviation operators, and fixed-base operators (FBOs). When an aircraft requires maintenance or component replacement, VSE's Aviation segment supplies the necessary parts and provides repair services to minimize aircraft downtime.

The Fleet segment, operating under the Wheeler Fleet Solutions brand, specializes in parts distribution, engineering solutions, and supply chain management for medium and heavy-duty vehicle fleets. For instance, when a commercial trucking company needs to maintain its fleet of delivery vehicles, VSE can provide the necessary parts and inventory management services to keep those trucks operational. This segment primarily serves government agencies and commercial fleet operators who rely on VSE to extend the service life of their vehicles.

VSE's business model revolves around creating value by sustaining and extending the life of transportation assets. The company maintains global distribution centers strategically positioned to ensure expedient delivery of parts, while its repair facilities are designed to minimize turnaround time for serviced components. This infrastructure allows VSE to help customers maximize the operational availability of their aircraft and vehicle fleets.

Revenue is generated through parts sales, distribution services, supply chain management, and MRO services. The company's customer base spans from commercial airlines and corporate aircraft owners to government agencies and commercial truck fleets. VSE's operations are subject to extensive regulation, including oversight from agencies such as the Federal Aviation Administration (FAA).

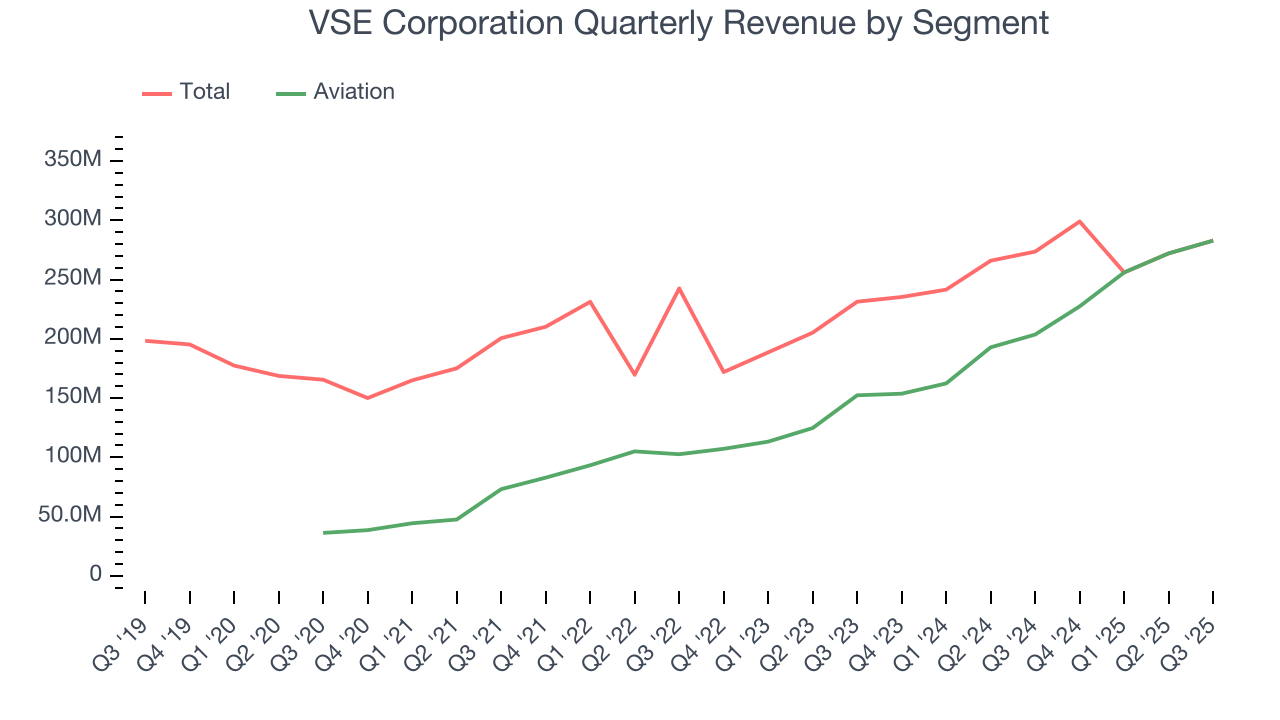

Until recently, VSE also operated a Federal and Defense segment providing services to the Department of Defense, but announced plans to divest this business in 2023, completing the sale of substantially all these assets in early 2024 to focus on its core Aviation and Fleet segments.

4. Maintenance and Repair Distributors

Supply chain and inventory management are themes that grew in focus after COVID wreaked havoc on the global movement of raw materials and components. Maintenance and repair distributors that boast reliable selection and quickly deliver products to customers can benefit from this theme. While e-commerce hasn’t disrupted industrial distribution as much as consumer retail, it is still a real threat, forcing investment in omnichannel capabilities to serve customers everywhere. Additionally, maintenance and repair distributors are at the whim of economic cycles that impact the capital spending and construction projects that can juice demand.

VSE Corporation competes with several aftermarket parts and MRO service providers including AAR Corp (NYSE: AIR), Heico Corporation (NYSE: HEI), and TransDigm Group (NYSE: TDG) in the aviation segment, while its Fleet segment faces competition from companies like Genuine Parts Company (NYSE: GPC) and LKQ Corporation (NASDAQ: LKQ).

5. Revenue Growth

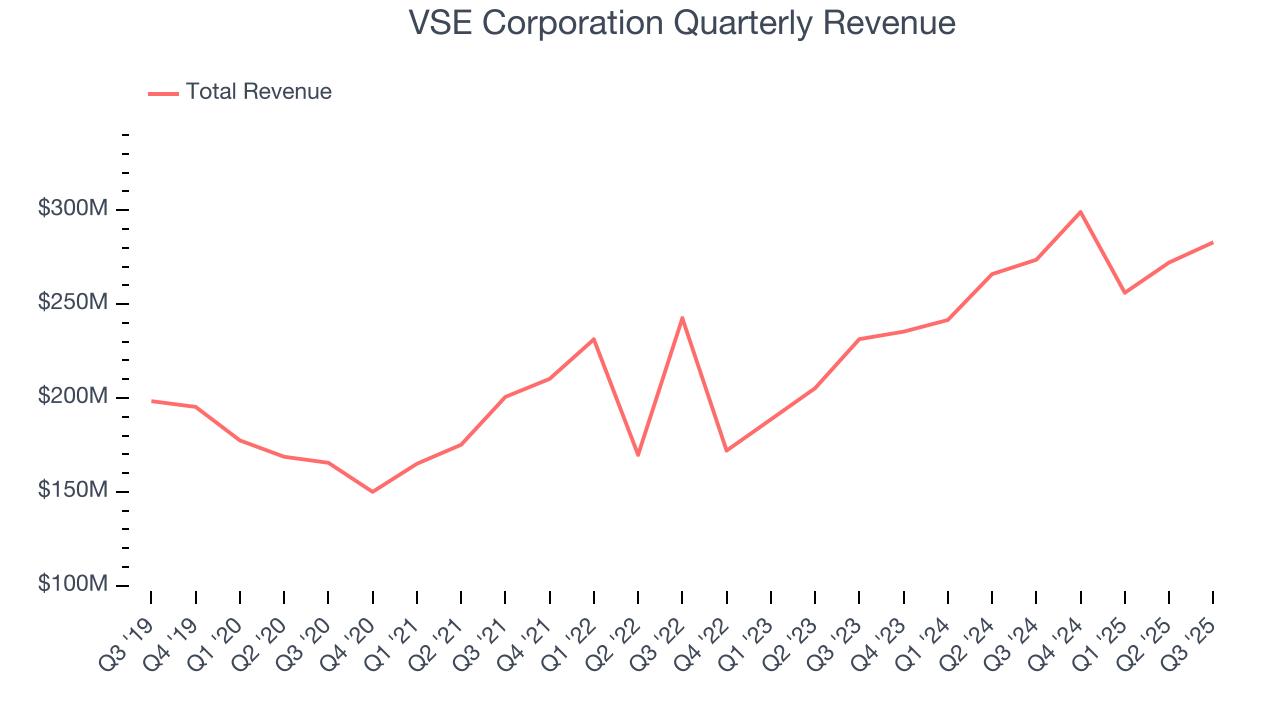

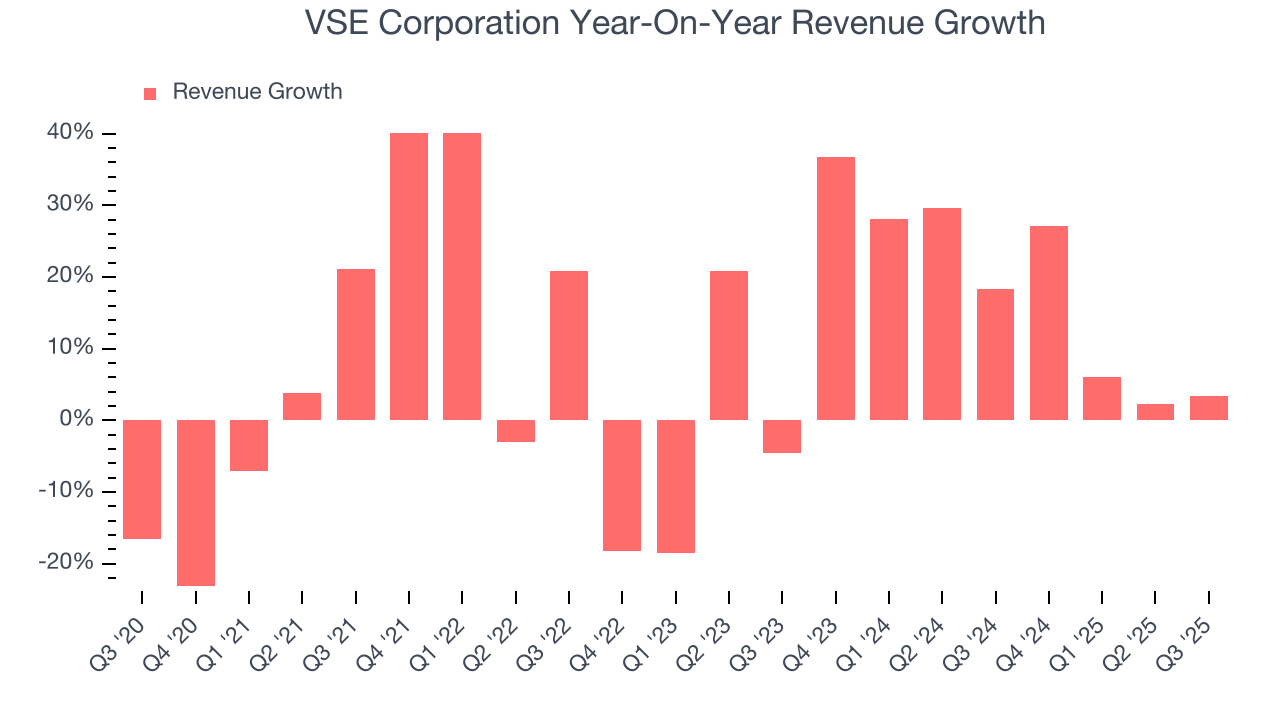

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, VSE Corporation grew its sales at a solid 9.4% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. VSE Corporation’s annualized revenue growth of 18% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Aviation. Over the last two years, VSE Corporation’s Aviation revenue (aftermarket parts, maintenance) averaged 45.1% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, VSE Corporation reported modest year-on-year revenue growth of 3.4% but beat Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 9.9% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and indicates the market is forecasting success for its products and services.

6. Gross Margin & Pricing Power

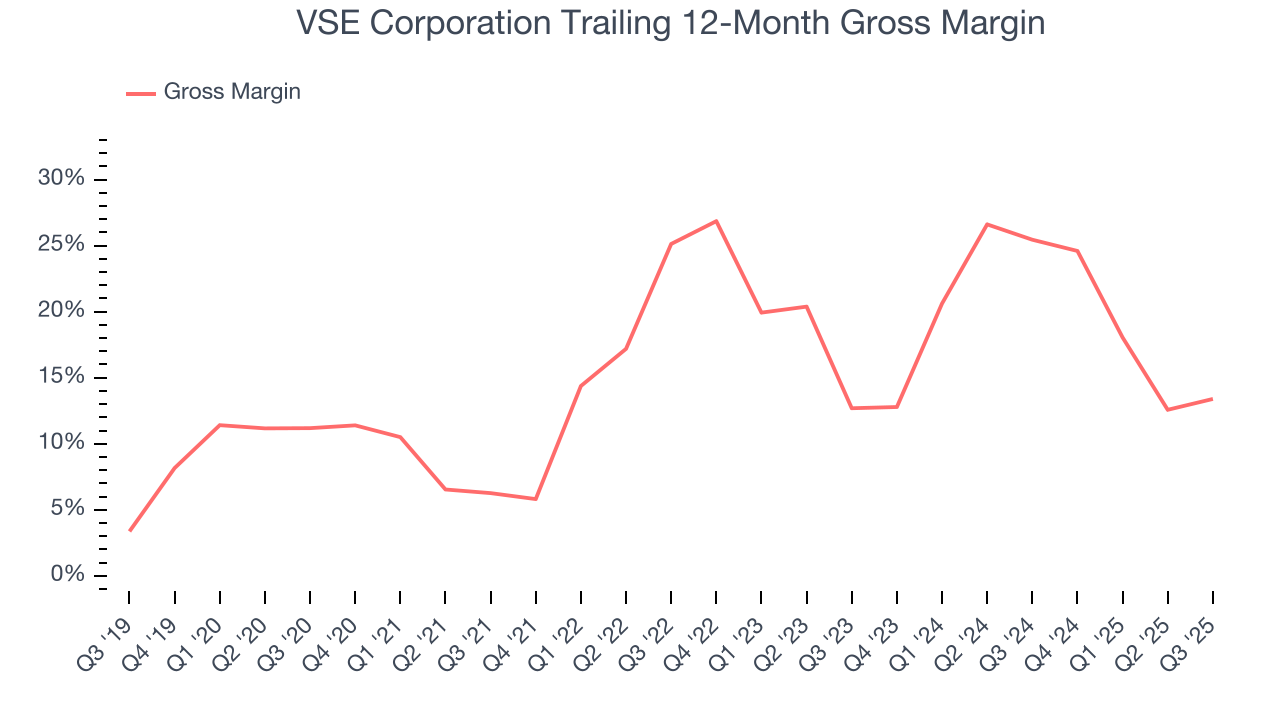

VSE Corporation has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 17.2% gross margin over the last five years. Said differently, VSE Corporation had to pay a chunky $82.85 to its suppliers for every $100 in revenue.

In Q3, VSE Corporation produced a 14.4% gross profit margin, up 3.3 percentage points year on year. On a wider time horizon, however, VSE Corporation’s full-year margin has been trending down over the past 12 months, decreasing by 12.1 percentage points. If this move continues, it could suggest a more competitive environment with pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

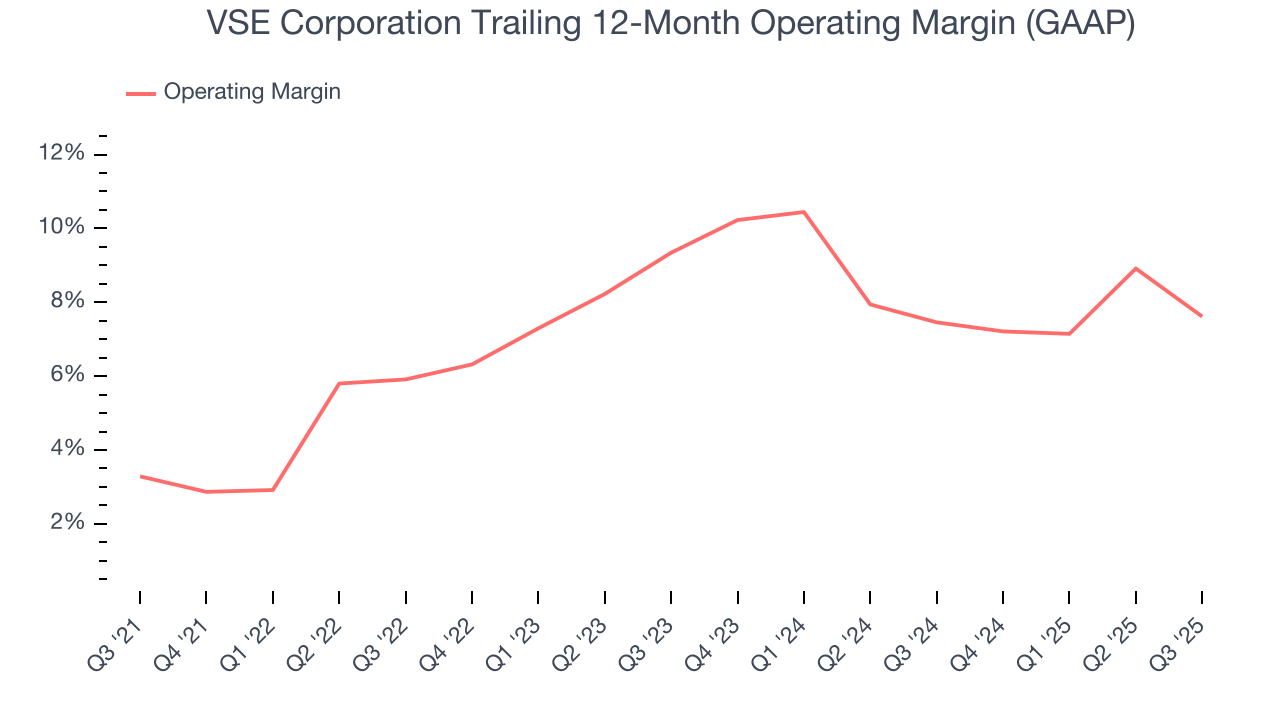

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

VSE Corporation was profitable over the last five years but held back by its large cost base. Its average operating margin of 6.9% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, VSE Corporation’s operating margin rose by 4.3 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, VSE Corporation generated an operating margin profit margin of 3.6%, down 5.1 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, R&D, and administrative overhead grew faster than its revenue.

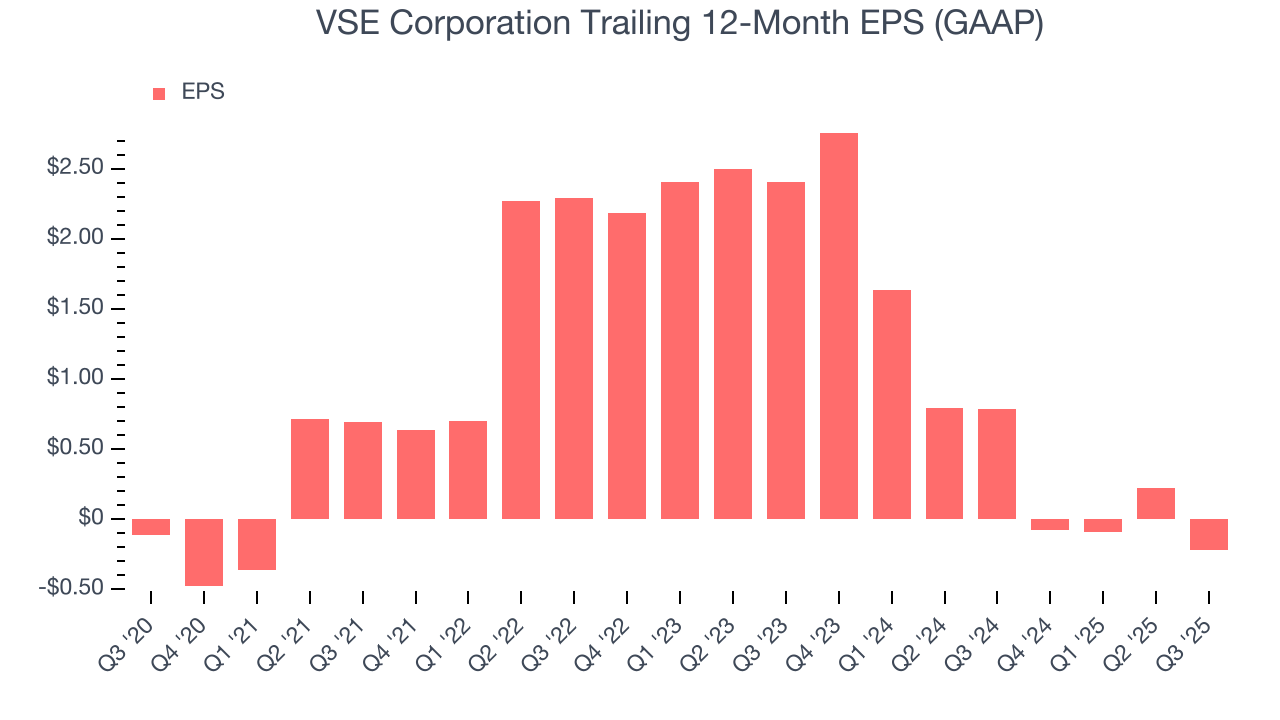

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

VSE Corporation’s earnings losses deepened over the last five years as its EPS dropped 13.7% annually. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, VSE Corporation’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

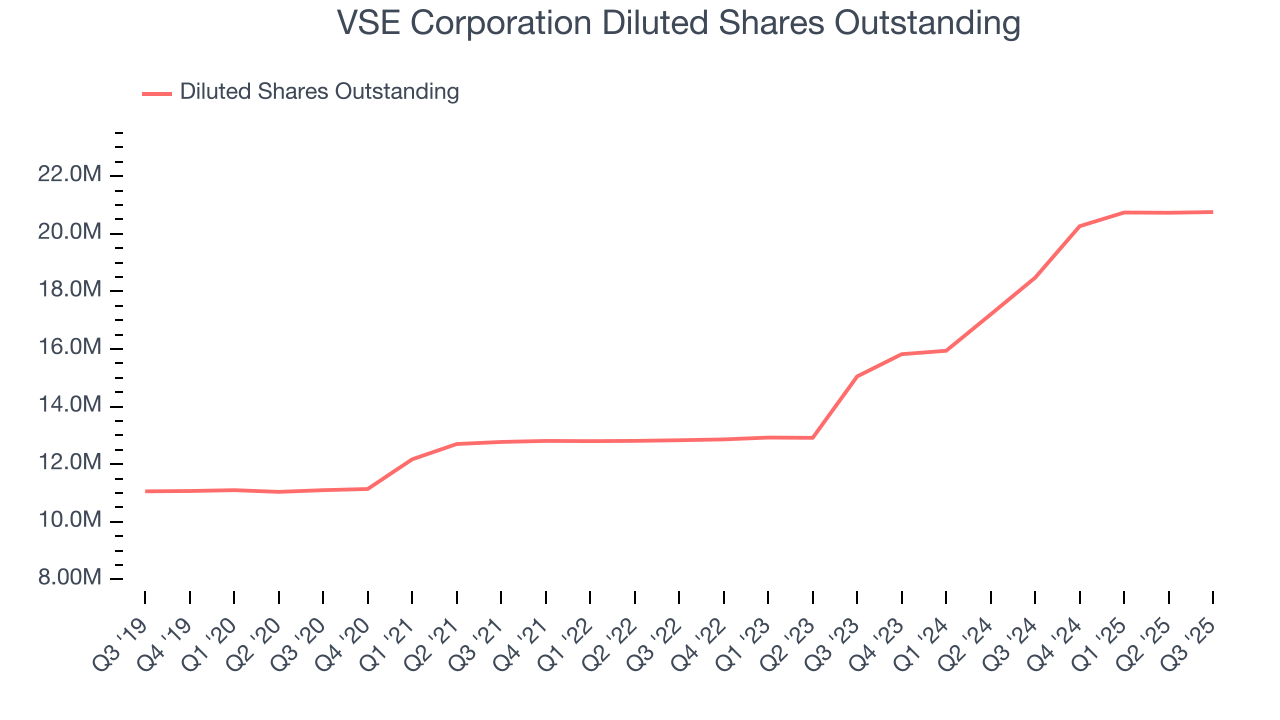

Sadly for VSE Corporation, its EPS declined by 44.6% annually over the last two years while its revenue grew by 18%. This tells us the company became less profitable on a per-share basis as it expanded.

We can take a deeper look into VSE Corporation’s earnings to better understand the drivers of its performance. VSE Corporation’s operating margin has declined over the last two yearswhile its share count has grown 37.9%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, VSE Corporation reported EPS of $0.19, down from $0.63 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street is optimistic. Analysts forecast VSE Corporation’s full-year EPS of negative $0.22 will flip to positive $4.00.

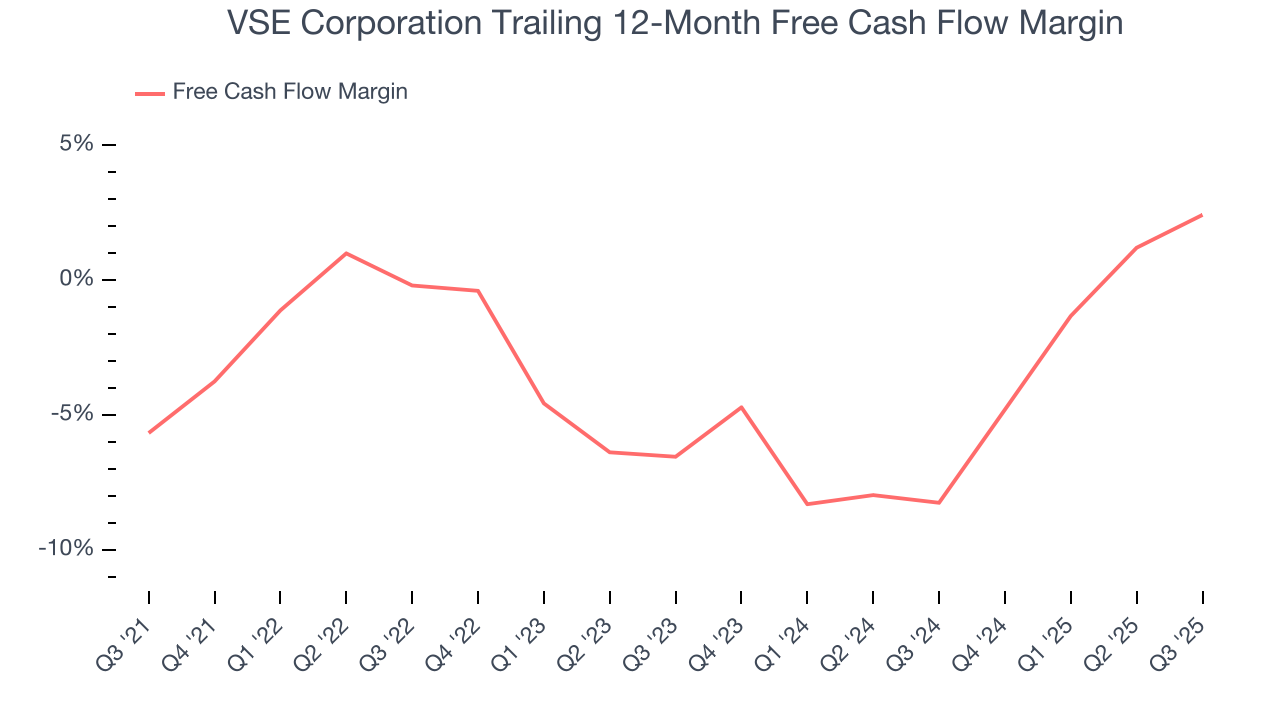

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

While VSE Corporation posted positive free cash flow this quarter, the broader story hasn’t been so clean. VSE Corporation’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 3.3%, meaning it lit $3.35 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that VSE Corporation’s margin expanded by 8.1 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise.

VSE Corporation’s free cash flow clocked in at $18.04 million in Q3, equivalent to a 6.4% margin. This result was good as its margin was 4.8 percentage points higher than in the same quarter last year, building on its favorable historical trend.

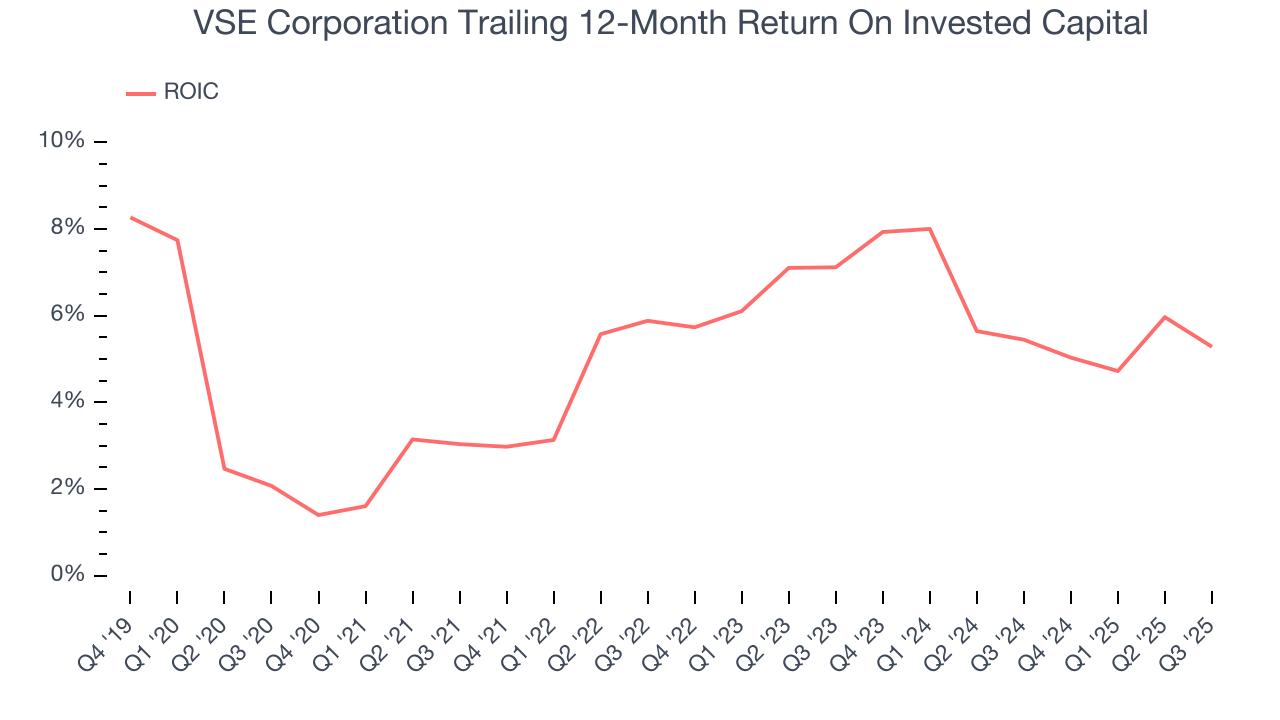

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although VSE Corporation has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.4%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, VSE Corporation’s ROIC has stayed the same over the last few years. We still think it’s a good business, but if the company wants to reach the next level, it must improve its returns.

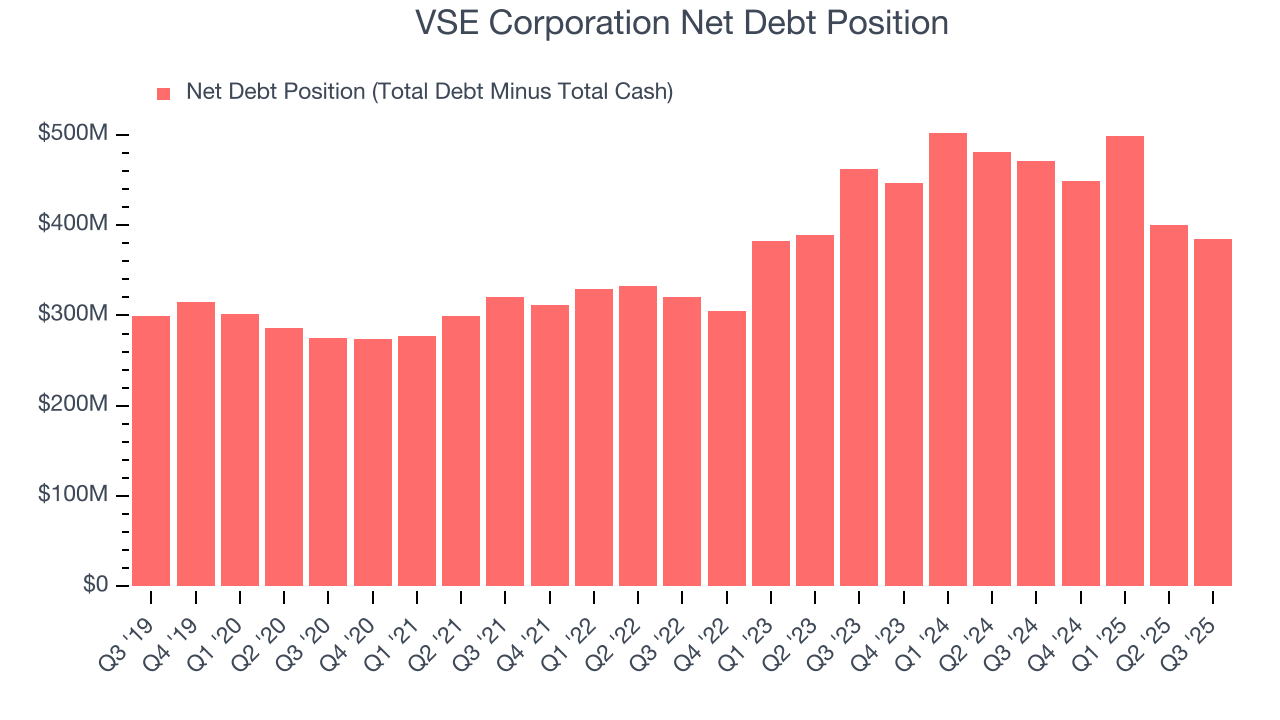

11. Balance Sheet Assessment

VSE Corporation reported $8.78 million of cash and $393.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $170.7 million of EBITDA over the last 12 months, we view VSE Corporation’s 2.3× net-debt-to-EBITDA ratio as safe. We also see its $21.33 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from VSE Corporation’s Q3 Results

We were impressed by how significantly VSE Corporation blew past analysts’ EBITDA expectations this quarter. On the other hand, its adjusted operating income missed and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2.4% to $175 immediately following the results.

13. Is Now The Time To Buy VSE Corporation?

Updated: January 21, 2026 at 9:06 PM EST

Are you wondering whether to buy VSE Corporation or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

VSE Corporation possesses a number of positive attributes. First off, its revenue growth was solid over the last five years and is expected to accelerate over the next 12 months. And while its cash burn raises the question of whether it can sustainably maintain growth, its rising cash profitability gives it more optionality. On top of that, its expanding operating margin shows the business has become more efficient.

VSE Corporation’s P/E ratio based on the next 12 months is 52x. This valuation tells us that a lot of optimism is priced in. This is a good one to add to your watchlist - there are better opportunities elsewhere at the moment.

Wall Street analysts have a consensus one-year price target of $218.51 on the company (compared to the current share price of $216.45).