WEBTOON (WBTN)

We love companies like WEBTOON. Its expanding adjusted operating margin shows it’s becoming a more efficient business.― StockStory Analyst Team

1. News

2. Summary

Why We Like WEBTOON

Pioneering a vertical-scrolling format optimized for mobile devices, WEBTOON Entertainment (NASDAQ:WBTN) operates a global platform where creators publish serialized web-comics and web-novels that users can read in bite-sized episodes.

- Performance over the past two years shows its incremental sales were extremely profitable, as its annual earnings per share growth of 75.9% outpaced its revenue gains

- Annual revenue growth of 7.2% over the last two years beat the sector average and underscores the unique value of its offerings

- Sales outlook for the upcoming 12 months implies the business will stay on its desirable two-year growth trajectory

We’re fond of companies like WEBTOON. There’s a lot to like here.

Is Now The Time To Buy WEBTOON?

Is Now The Time To Buy WEBTOON?

At $11.35 per share, WEBTOON trades at 55x forward P/E. There’s no denying that the lofty valuation means there’s much good news priced into the stock.

If you’re a fan of the company and its story, we suggest a small position as the long-term outlook seems solid. Keep in mind that its premium valuation could result in rocky short-term stock performance.

3. WEBTOON (WBTN) Research Report: Q3 CY2025 Update

Digital storytelling platform WEBTOON (NASDAQ:WBTN) fell short of the markets revenue expectations in Q3 CY2025, but sales rose 8.7% year on year to $378 million. Next quarter’s revenue guidance of $335 million underwhelmed, coming in 15.8% below analysts’ estimates. Its GAAP loss of $0.09 per share was 23.9% above analysts’ consensus estimates.

WEBTOON (WBTN) Q3 CY2025 Highlights:

- Revenue: $378 million vs analyst estimates of $382.2 million (8.7% year-on-year growth, 1.1% miss)

- EPS (GAAP): -$0.09 vs analyst estimates of -$0.12 (23.9% beat)

- Adjusted EBITDA: $5.12 million vs analyst estimates of $5.58 million (1.4% margin, 8.3% miss)

- Revenue Guidance for Q4 CY2025 is $335 million at the midpoint, below analyst estimates of $397.8 million

- EBITDA guidance for Q4 CY2025 is -$4 million at the midpoint, below analyst estimates of $12.06 million

- Operating Margin: -3.9%, down from -2.3% in the same quarter last year

- Free Cash Flow Margin: 3.1%, up from 0.1% in the same quarter last year

- Monthly Active Users: 155 million, down 13.41 million year on year

- Market Capitalization: $2.15 billion

Company Overview

Pioneering a vertical-scrolling format optimized for mobile devices, WEBTOON Entertainment (NASDAQ:WBTN) operates a global platform where creators publish serialized web-comics and web-novels that users can read in bite-sized episodes.

WEBTOON's platform connects approximately 24 million creators with around 170 million monthly active users across more than 150 countries. The company's content consists primarily of long-form stories serialized into short episodes released on a weekly schedule, creating a habitual engagement pattern particularly appealing to Gen Z and millennial audiences.

The platform serves both amateur and professional creators. Amateur creators can publish their work on CANVAS (known as Challenge Comics in Korea), while professional creators earn revenue through various monetization channels. As amateur creators gain popularity, WEBTOON may sign formal agreements with them, allowing them to share revenue from paid content.

Users can access most content for free, but premium episodes require virtual currency called "Coins." These can be used to purchase "Fast Passes" for early access to upcoming episodes or "Daily Passes" to unlock episodes from completed series. Users typically spend 26-57 minutes per day on the platform, depending on the region.

WEBTOON employs a "One Story Multi-Use" strategy, extending popular content into other media formats through IP adaptations. The company licenses stories for adaptation into films, streaming series, animation, video games, merchandise, and print books. Successful adaptations include "True Beauty," "All of Us Are Dead," and "Lore Olympus," which have appeared on platforms like Netflix and become New York Times bestsellers.

The company's technology stack includes content management tools, AI-powered creation support tools, and community features that enable user interaction. WEBTOON also offers advertisers access to its engaged audience through display ads, achievement-based ads, pre-roll videos, engagement products, and branded creator content.

WEBTOON Entertainment operates different consumer-facing applications tailored to regional preferences. In Korea, it offers WEBTOON Korea, CANVAS, Munpia, and NAVER SERIES. In Japan, its primary offering is LINE MANGA with LINE MANGA INDIES for creators. In North America, it operates WEBTOON, CANVAS, and Wattpad, which it acquired in 2023.

4. Digital Media & Content Platforms

AI-driven content creation, personalized media experiences, and digital advertising are evolving, which could benefit companies investing in these themes. For example, companies with a portfolio of licensed visual content or platforms facilitating direct monetization models could see increased demand for years. On the other hand, headwinds include growing regulatory scrutiny on AI-generated content, with many publishers balking at anything that gets no human oversight. Additional areas to navigate include the phasing out of third-party cookies, which could make traditional ways of tracking the online behavior of consumers (a secret sauce in digital marketing) much less effective.

WEBTOON's competitors include Kakao Webtoon and Kidari Studio in Korea, Piccoma and Jump Toon in Japan, and Tapas and Manta in the U.S. In the web-novel space, it competes with KakaoPage and RIDI in Korea, and Radish, GoodNovel, and Dreame in the U.S. More broadly, WEBTOON competes for user attention with social media platforms like TikTok and Instagram, streaming services like Netflix, and gaming companies.

5. Revenue Growth

A company’s top-line performance is one signal of its overall business quality. Strong growth can indicate it’s riding a successful new product or emerging trend.

With $1.40 billion in revenue over the past 12 months, WEBTOON is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

We can dig further into the company’s revenue dynamics by analyzing its number of monthly active users, which reached 155 million in the latest quarter. Over the last two years, WEBTOON’s monthly active users averaged 3.2% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, WEBTOON’s revenue grew by 8.7% year on year to $378 million, missing Wall Street’s estimates. Company management is currently guiding for a 5.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.7% over the next 12 months, an improvement versus the last two years. This projection is healthy and implies its newer products and services will catalyze better top-line performance.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

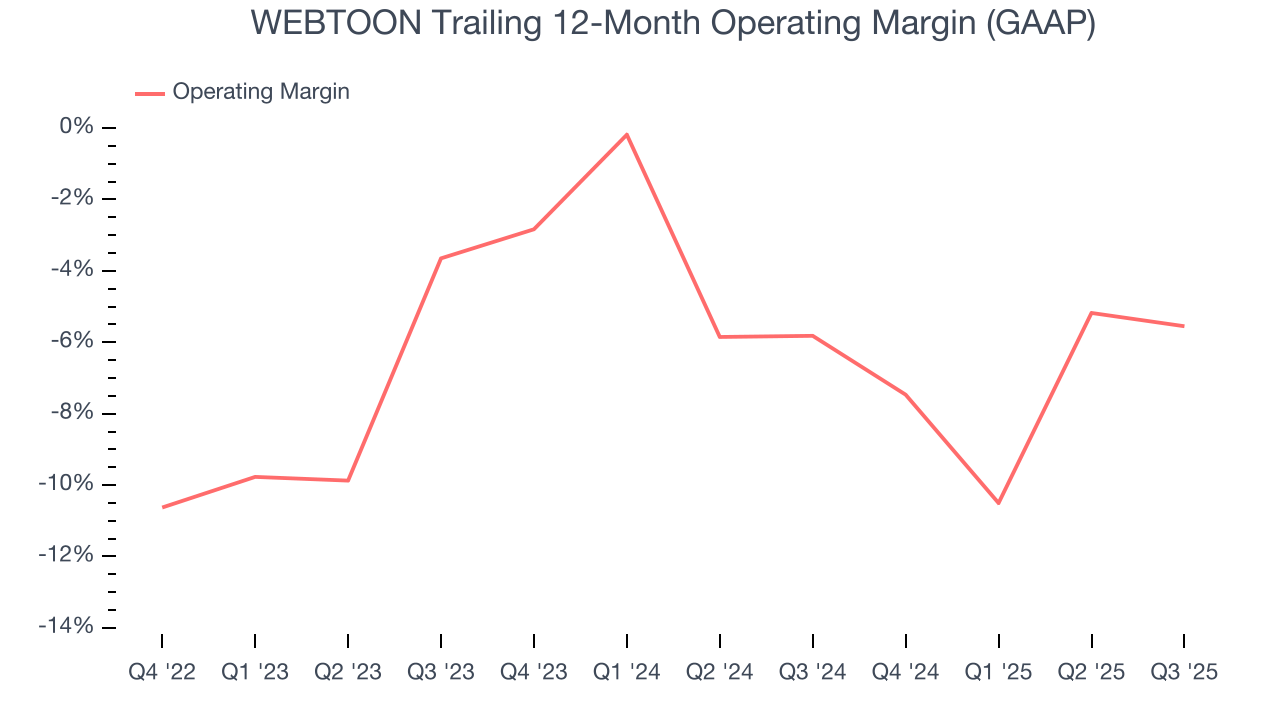

WEBTOON’s high expenses have contributed to an average operating margin of negative 6.3% over the last four years. Unprofitable business services companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, WEBTOON’s operating margin rose by 7.9 percentage points over the last four years. Still, it will take much more for the company to reach long-term profitability.

WEBTOON’s operating margin was negative 3.9% this quarter.

7. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

WEBTOON broke even from a free cash flow perspective over the last three years, giving the company limited opportunities to return capital to shareholders.

WEBTOON’s free cash flow clocked in at $11.84 million in Q3, equivalent to a 3.1% margin. This result was good as its margin was 3 percentage points higher than in the same quarter last year. Its cash profitability was also above its three-year level, and we hope the company can build on this trend.

8. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

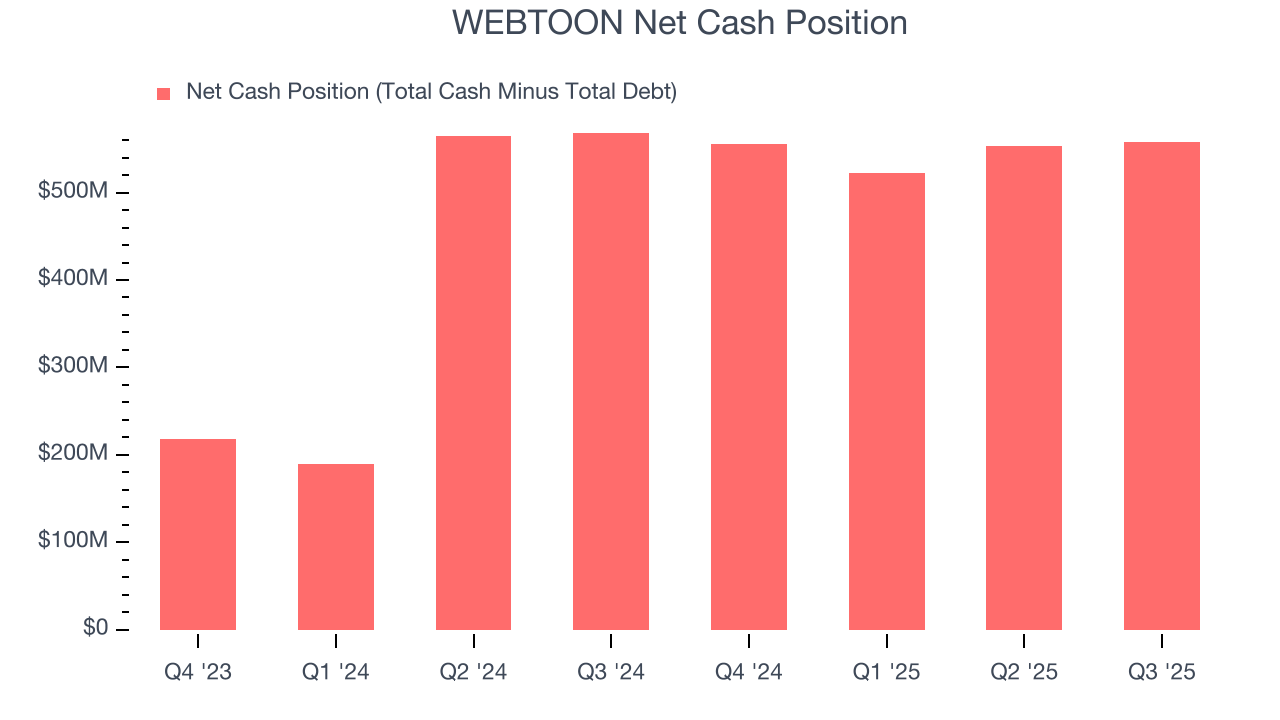

WEBTOON is a well-capitalized company with $584.6 million of cash and $26.3 million of debt on its balance sheet. This $558.3 million net cash position is 25.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

9. Key Takeaways from WEBTOON’s Q3 Results

It was good to see WEBTOON beat analysts’ EPS expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 18.3% to $13.75 immediately following the results.

10. Is Now The Time To Buy WEBTOON?

Updated: February 27, 2026 at 12:41 AM EST

Before making an investment decision, investors should account for WEBTOON’s business fundamentals and valuation in addition to what happened in the latest quarter.

There are several reasons why we think WEBTOON is a great business. Although the company’s operating margins reveal poor profitability compared to other business services companies, its expanding adjusted operating margin shows the business has become more efficient. On top of that, its astounding EPS growth over the last two years shows its profits are trickling down to shareholders.

WEBTOON’s P/E ratio based on the next 12 months is 53.7x. There’s no doubt it’s a bit of a market darling given the lofty multiple, but we don’t mind owning a high-quality business, even if it’s expensive. It’s often wise to hold investments like this for at least three to five years, as the power of long-term compounding negates short-term price swings that can accompany high valuations.

Wall Street analysts have a consensus one-year price target of $16.29 on the company (compared to the current share price of $11.42).