WD-40 (WDFC)

WD-40 doesn’t impress us. Its growth has been lacking and its free cash flow margin has caved, suggesting it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why WD-40 Is Not Exciting

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQ:WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

- Subscale operations are evident in its revenue base of $620 million, meaning it has fewer distribution channels than its larger rivals

- Annual revenue growth of 6.1% over the last three years was below our standards for the consumer staples sector

- A positive is that its robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders

WD-40 is in the doghouse. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than WD-40

High Quality

Investable

Underperform

Why There Are Better Opportunities Than WD-40

WD-40’s stock price of $199.50 implies a valuation ratio of 32.8x forward P/E. This multiple is higher than that of consumer staples peers; it’s also rich for the top-line growth of the company. Not a great combination.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. WD-40 (WDFC) Research Report: Q4 CY2025 Update

Household products company WD-40 (NASDAQ:WDFC) met Wall Streets revenue expectations in Q4 CY2025, but sales were flat year on year at $154.4 million. On the other hand, the company’s full-year revenue guidance of $642.5 million at the midpoint came in 1% below analysts’ estimates. Its GAAP profit of $1.28 per share was 11.4% below analysts’ consensus estimates.

WD-40 (WDFC) Q4 CY2025 Highlights:

- Revenue: $154.4 million vs analyst estimates of $155.1 million (flat year on year, in line)

- EPS (GAAP): $1.28 vs analyst expectations of $1.45 (11.4% miss)

- Adjusted EBITDA: $27.09 million vs analyst estimates of $28.3 million (17.5% margin, 4.3% miss)

- The company reconfirmed its revenue guidance for the full year of $642.5 million at the midpoint

- EPS (GAAP) guidance for the full year is $5.95 at the midpoint, missing analyst estimates by 2.1%

- Operating Margin: 15.1%, down from 16.4% in the same quarter last year

- Free Cash Flow Margin: 5.9%, down from 9.3% in the same quarter last year

- Market Capitalization: $2.69 billion

Company Overview

Short for “Water Displacement perfected on the 40th try”, WD-40 (NASDAQ:WDFC) is a renowned American consumer goods company known for its iconic and versatile spray, WD-40 Multi-Use Product.

The company was founded in 1953 as the fledgling Rocket Chemical Co., and its three-person team set out to create a line of rust-prevention solvents and degreasers for use in the aerospace industry. Its first major customer was Convair, an aerospace contractor, who used WD-40 Multi-Use Product to protect the outer skin of its Atlas Missile from rust and corrosion.

The product worked so well that several Convair employees snuck some cans out of its facility to use at home. Since then, WD-40 has evolved into a consumer staple and its products can be found in an astounding four out of five American households. Beyond its famous blue and yellow can, WD-40 owns a portfolio of brands including Carpet Fresh for carpet cleaners, Lava for heavy-duty hand cleaners, and X-14 for toilet bowl cleaners.

WD-40’s products are available in more than 176 countries, making it a truly global company. Whether it be fixing squeaky hinges and loosening stubborn bolts or cleaning up after messes, the company’s reputation for helping users perform tasks more efficiently has earned it the trust of people worldwide.

4. Household Products

Household products stocks are generally stable investments, as many of the industry's products are essential for a comfortable and functional living space. Recently, there's been a growing emphasis on eco-friendly and sustainable offerings, reflecting the evolving consumer preferences for environmentally conscious options. These trends can be double-edged swords that benefit companies who innovate quickly to take advantage of them and hurt companies that don't invest enough to meet consumers where they want to be with regards to trends.

Major competitors include Clorox (NYSE:CLX), Procter & Gamble (NYSE:PG), and Unilever (NYSE:UL).

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $620.9 million in revenue over the past 12 months, WD-40 is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

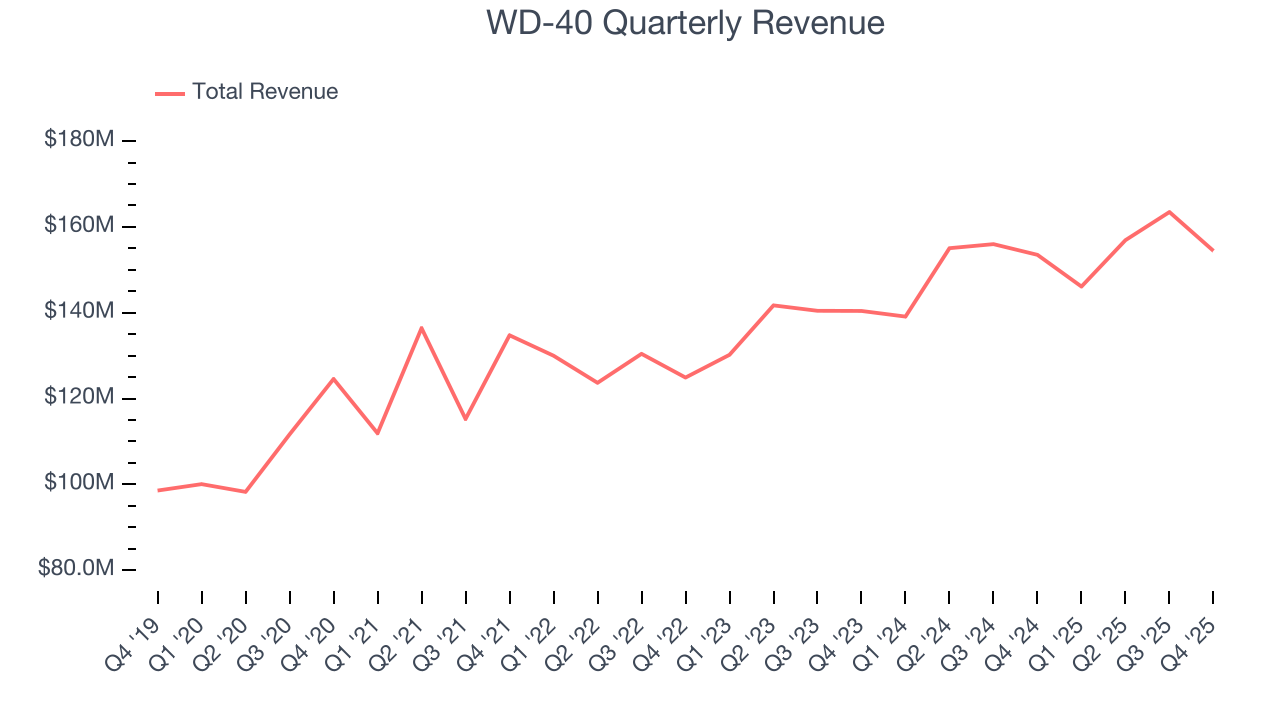

As you can see below, WD-40 grew its sales at a mediocre 6.9% compounded annual growth rate over the last three years. This shows it couldn’t generate demand in any major way and is a tough starting point for our analysis.

This quarter, WD-40’s $154.4 million of revenue was flat year on year and in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, similar to its three-year rate. Despite the slowdown, this projection is above the sector average and suggests the market is baking in some success for its newer products.

6. Gross Margin & Pricing Power

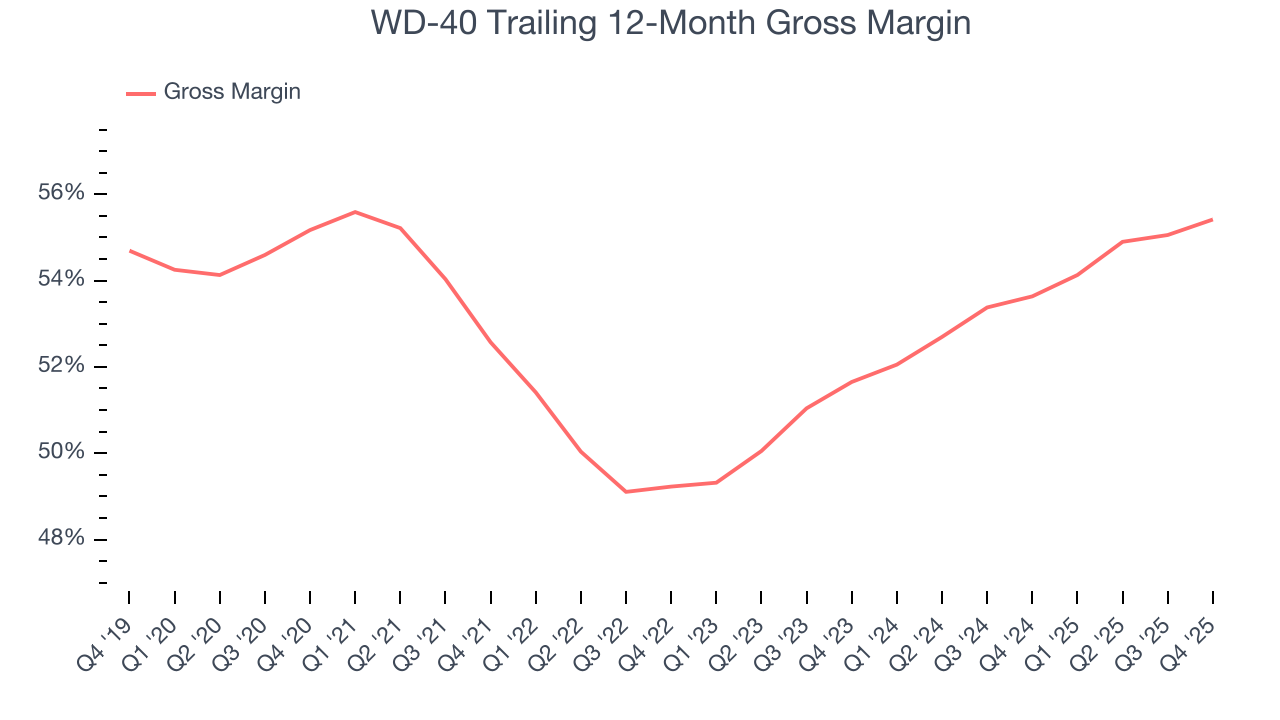

WD-40 has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 54.5% gross margin over the last two years. That means WD-40 only paid its suppliers $45.46 for every $100 in revenue.

This quarter, WD-40’s gross profit margin was 56.2%, up 1.4 percentage points year on year. WD-40’s full-year margin has also been trending up over the past 12 months, increasing by 1.8 percentage points. If this move continues, it could suggest better unit economics due to some combination of stable to improving pricing power and input costs (such as raw materials).

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

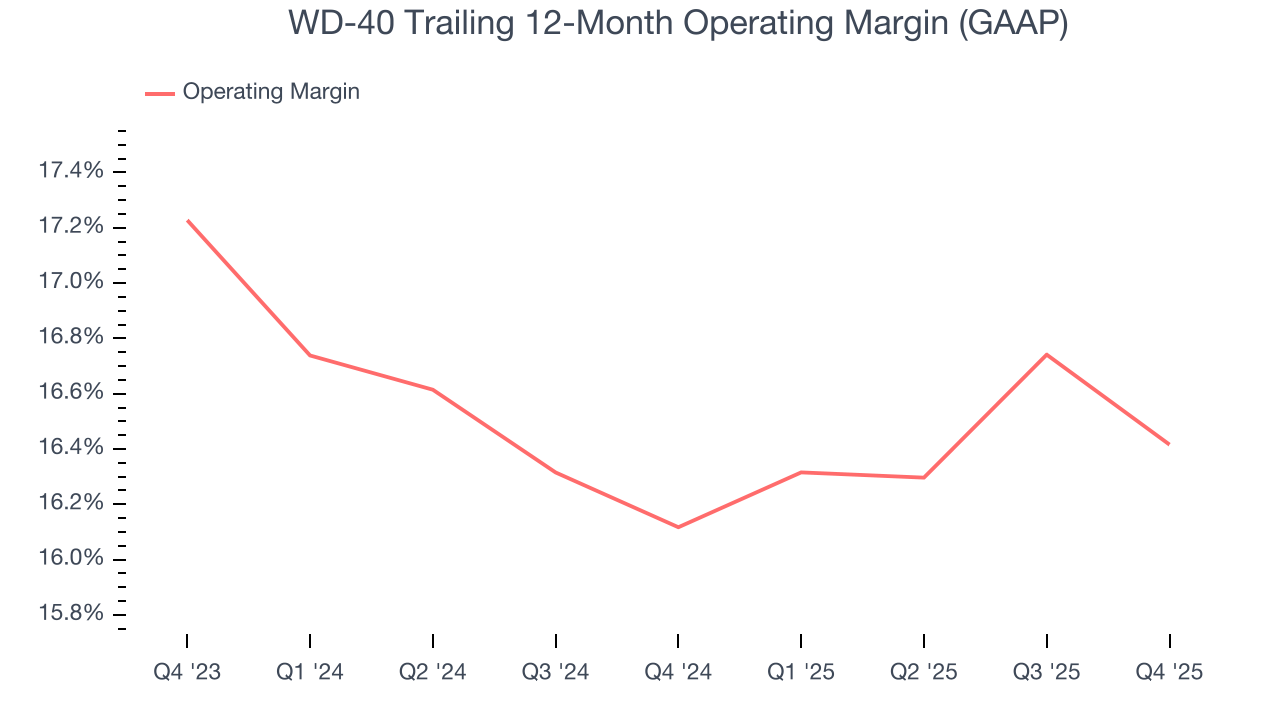

WD-40’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 16.3% over the last two years. This profitability was top-notch for a consumer staples business, showing it’s an well-run company with an efficient cost structure. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, WD-40’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, WD-40 generated an operating margin profit margin of 15.1%, down 1.3 percentage points year on year. Conversely, its gross margin actually rose, so we can assume its recent inefficiencies were driven by increased operating expenses like marketing, and administrative overhead.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

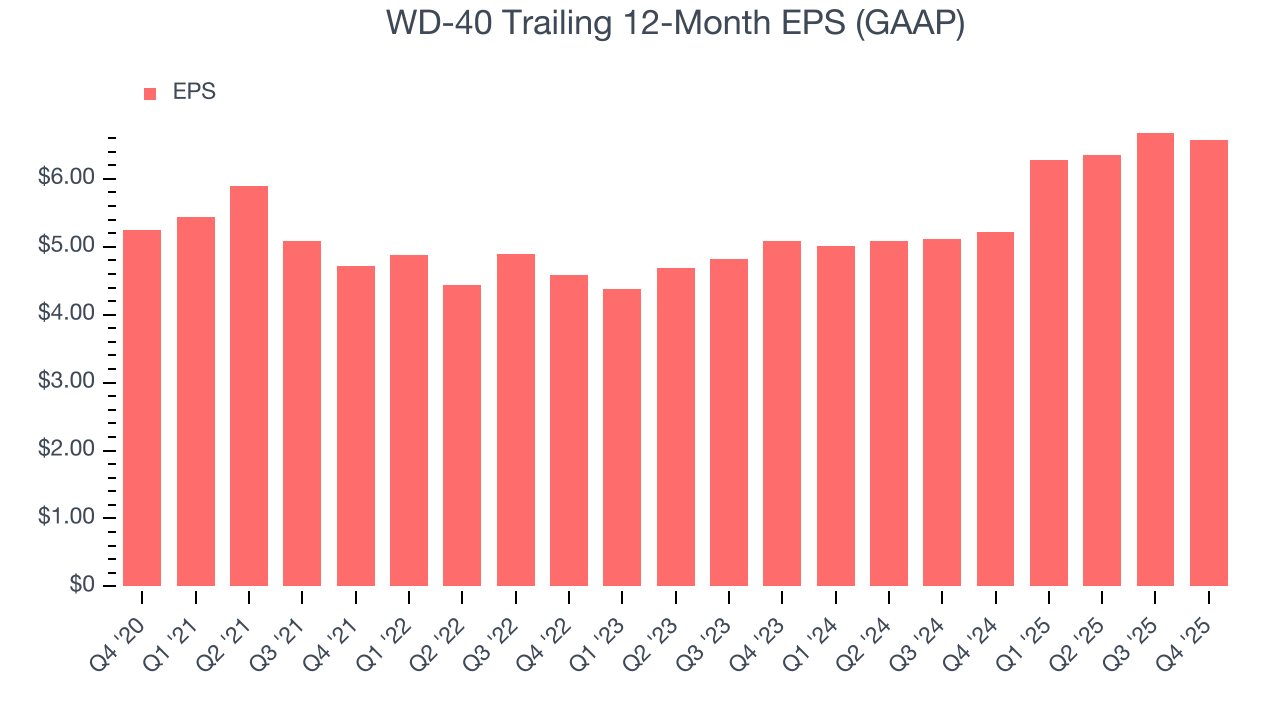

WD-40’s EPS grew at a solid 12.8% compounded annual growth rate over the last three years, higher than its 6.9% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, WD-40 reported EPS of $1.28, down from $1.39 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects WD-40’s full-year EPS of $6.57 to shrink by 6.5%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

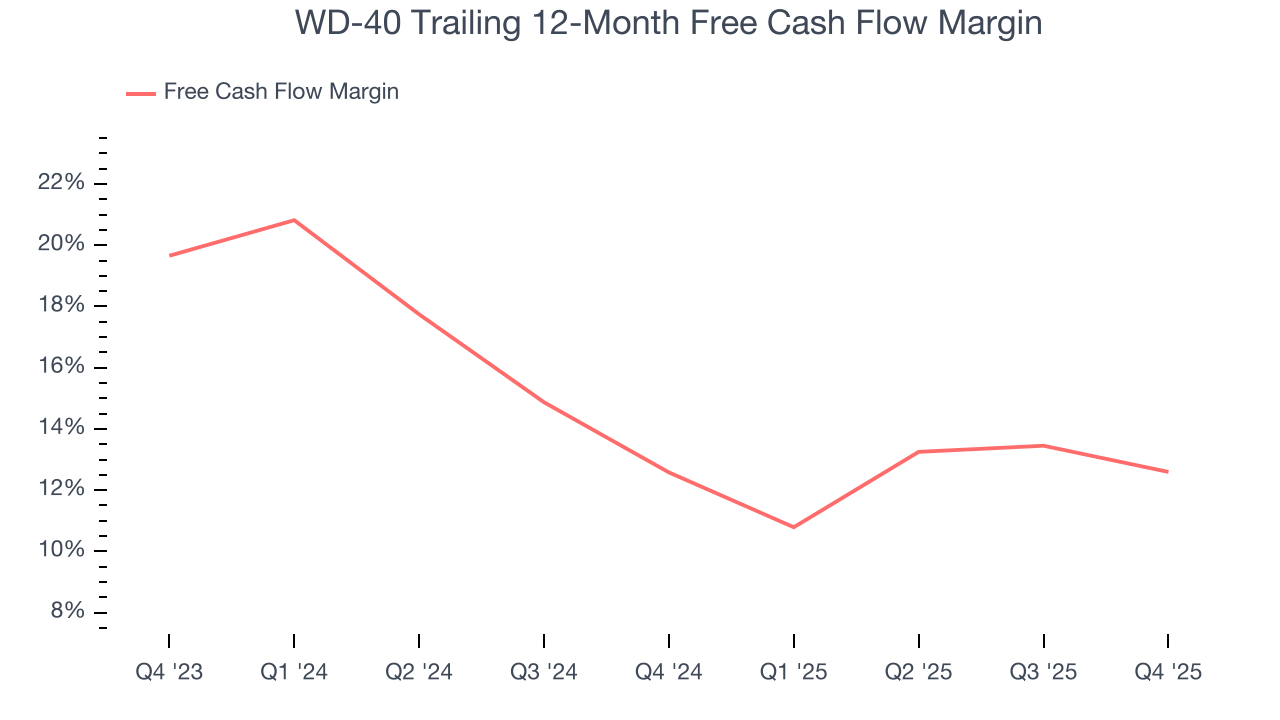

WD-40 has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.6% over the last two years, quite impressive for a consumer staples business.

WD-40’s free cash flow clocked in at $9.05 million in Q4, equivalent to a 5.9% margin. The company’s cash profitability regressed as it was 3.4 percentage points lower than in the same quarter last year, but we wouldn’t read too much into it because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to quarter-to-quarter swings. Long-term trends trump fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

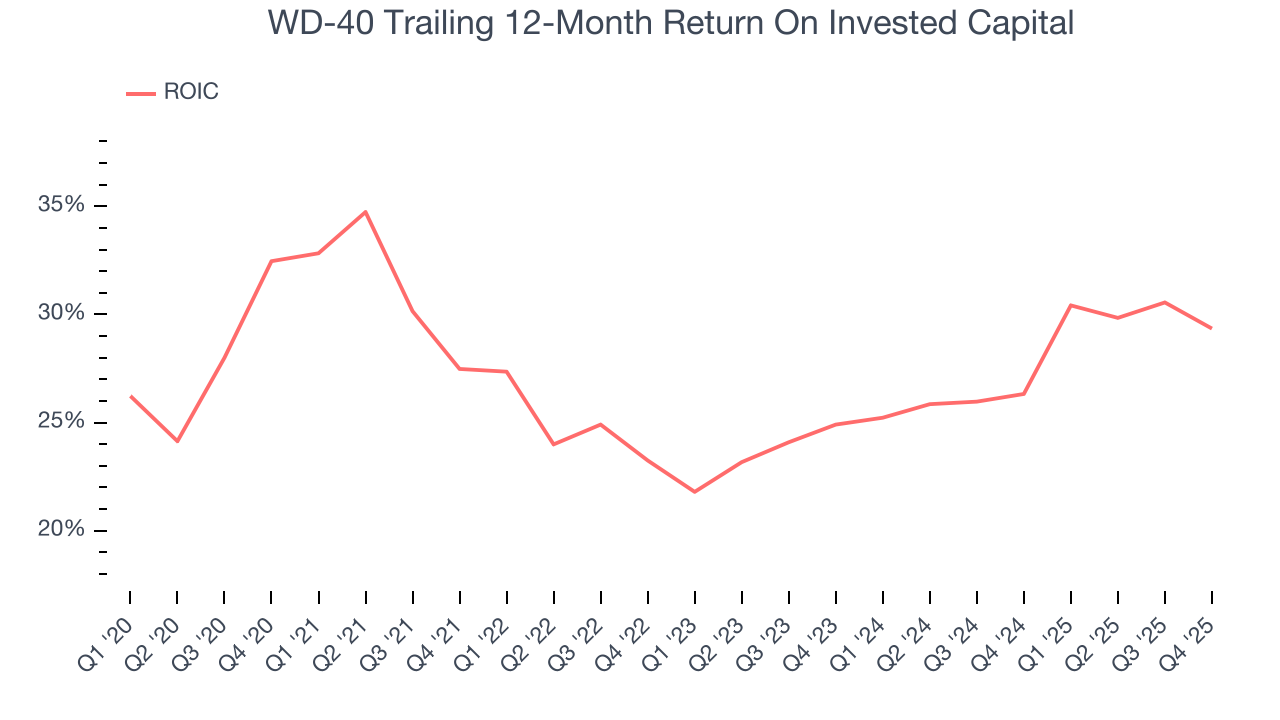

Although WD-40 hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 26.3%, splendid for a consumer staples business.

11. Balance Sheet Assessment

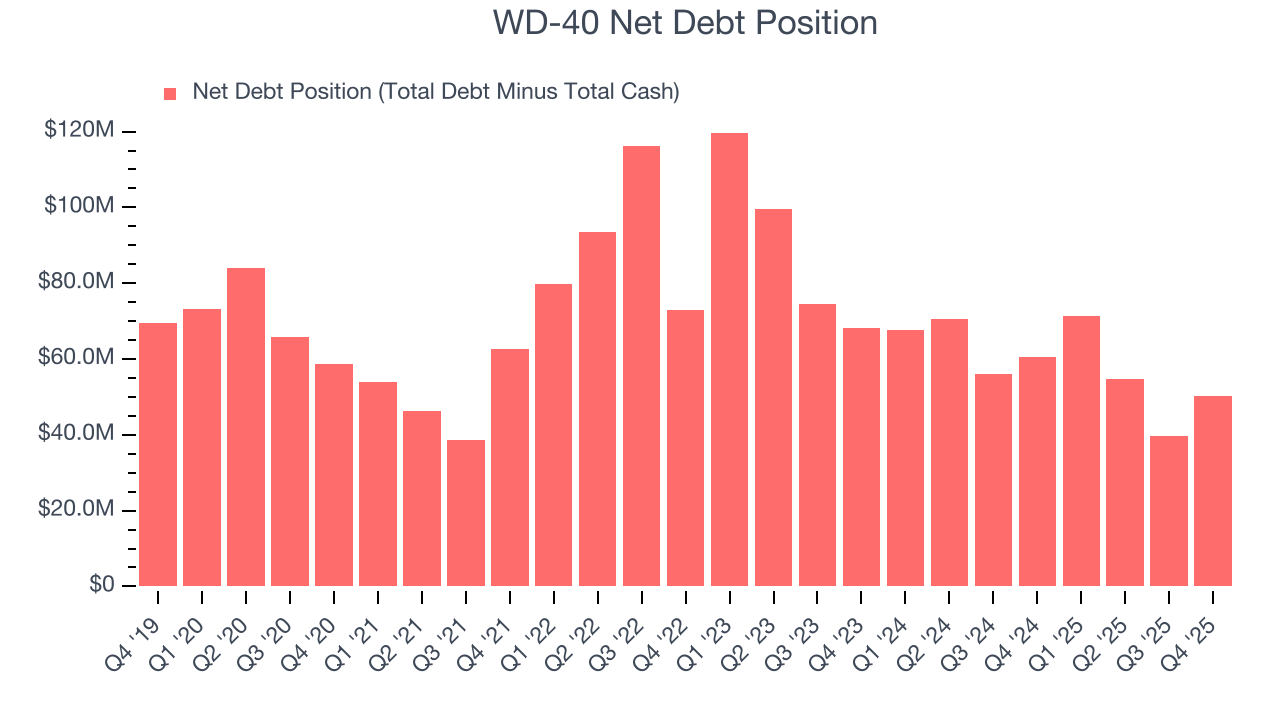

WD-40 reported $48.58 million of cash and $98.69 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $105.7 million of EBITDA over the last 12 months, we view WD-40’s 0.5× net-debt-to-EBITDA ratio as safe. We also see its $1.73 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from WD-40’s Q4 Results

It was good to see WD-40 narrowly top analysts’ gross margin expectations this quarter. On the other hand, its EPS missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 4.5% to $194.35 immediately following the results.

13. Is Now The Time To Buy WD-40?

Updated: January 8, 2026 at 4:14 PM EST

Are you wondering whether to buy WD-40 or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

When it comes to WD-40’s business quality, there are some positives, but it ultimately falls short. Although its revenue growth was mediocre over the last three years and analysts expect growth to slow over the next 12 months, its admirable gross margins are a wonderful starting point for the overall profitability of the business. And while its brand caters to a niche market, its stellar ROIC suggests it has been a well-run company historically.

WD-40’s P/E ratio based on the next 12 months is 31.6x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $264.50 on the company (compared to the current share price of $194.35).