Zillow (ZG)

We wouldn’t recommend Zillow. Not only did its demand evaporate but also its negative returns on capital show it destroyed shareholder value.― StockStory Analyst Team

1. News

2. Summary

Why We Think Zillow Will Underperform

Founded by Expedia co-founders Lloyd Frink and Rich Barton, Zillow (NASDAQ:ZG) is the leading U.S. online real estate marketplace.

- Products and services aren't resonating with the market as its revenue declined by 5% annually over the last five years

- Historical operating margin losses point to an inefficient cost structure

- Low free cash flow margin gives it little breathing room, constraining its ability to self-fund growth or return capital to shareholders

Zillow’s quality is inadequate. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Zillow

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Zillow

Zillow is trading at $45.28 per share, or 24.5x forward P/E. Not only is Zillow’s multiple richer than most consumer discretionary peers, but it’s also expensive for its revenue characteristics.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Zillow (ZG) Research Report: Q4 CY2025 Update

Online real estate marketplace Zillow (NASDAQ:ZG) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 18.1% year on year to $654 million. Its GAAP profit of $0.01 per share was $0.03 above analysts’ consensus estimates.

Zillow (ZG) Q4 CY2025 Highlights:

- Revenue: $654 million vs analyst estimates of $650.5 million (18.1% year-on-year growth, 0.5% beat)

- EPS (GAAP): $0.01 vs analyst estimates of -$0.02 ($0.03 beat)

- Adjusted EBITDA: $149 million vs analyst estimates of $151.5 million (22.8% margin, 1.6% miss)

- Operating Margin: -1.7%, up from -12.5% in the same quarter last year

- Free Cash Flow Margin: 6.7%, down from 15.9% in the same quarter last year

- Market Capitalization: $13.12 billion

Company Overview

Founded by Expedia co-founders Lloyd Frink and Rich Barton, Zillow (NASDAQ:ZG) is the leading U.S. online real estate marketplace.

Zillow is an online residential real estate database with information on more than 100 million homes in the U.S. on its three main properties: Zillow, Trulia, and StreetEasy. Home buyers come to the site to search for available homes along with detailed information regarding everything from school districts to crime rates and estimated property taxes along with access to mortgages, and most importantly, real estate agents whom interested buyers can connect with. Zillow’s most differentiated feature is its Z-estimate – a feature that provides real-time estimates of a home’s value and attracts potential home sellers to the platform.

The company generates the bulk of its revenues from its Premier Agent business, where real estate agents pay Zillow to advertise on its platform while receiving a suite of customer relationship management tools. It also generates advertising revenues from mortgage lenders and other real estate professionals, as well as fees from its Mortech mortgage software. For both mortgage lenders and real estate agents, Zillow provides a massive aggregated audience of potential customers in the US, customers who are both actively showing intent, and able to be targeted at granular zip code levels.

As you will see in our report, Zillow's historical financials are distorted given its rapid entry and exit of Zillow Offers, its former iBuying division (buying and selling homes). The company closed this business line in November 2021 after losing $1 billion+ over 3.5 years. The properties Zillow purchased as part of this venture are no longer on its balance sheet today.

4. Real Estate Services

Technology has been a double-edged sword in real estate services. On the one hand, internet listings are effective at disseminating information far and wide, casting a wide net for buyers and sellers to increase the chances of transactions. On the other hand, digitization in the real estate market could potentially disintermediate key players like agents who use information asymmetries to their advantage.

Zillow competes with online advertising platforms such as Google (NASDAQ:GOOGL), Yelp (NYSE:YELP) and Meta Platforms (NASDAQ:META), along with rival real estate platforms Move.com (owned by NASDAQ: NWSA), Redfin (NASDAQ:RDFN), Realogy (NYSE:RLGY), and Compass (NYSE:COMP).

5. Revenue Growth

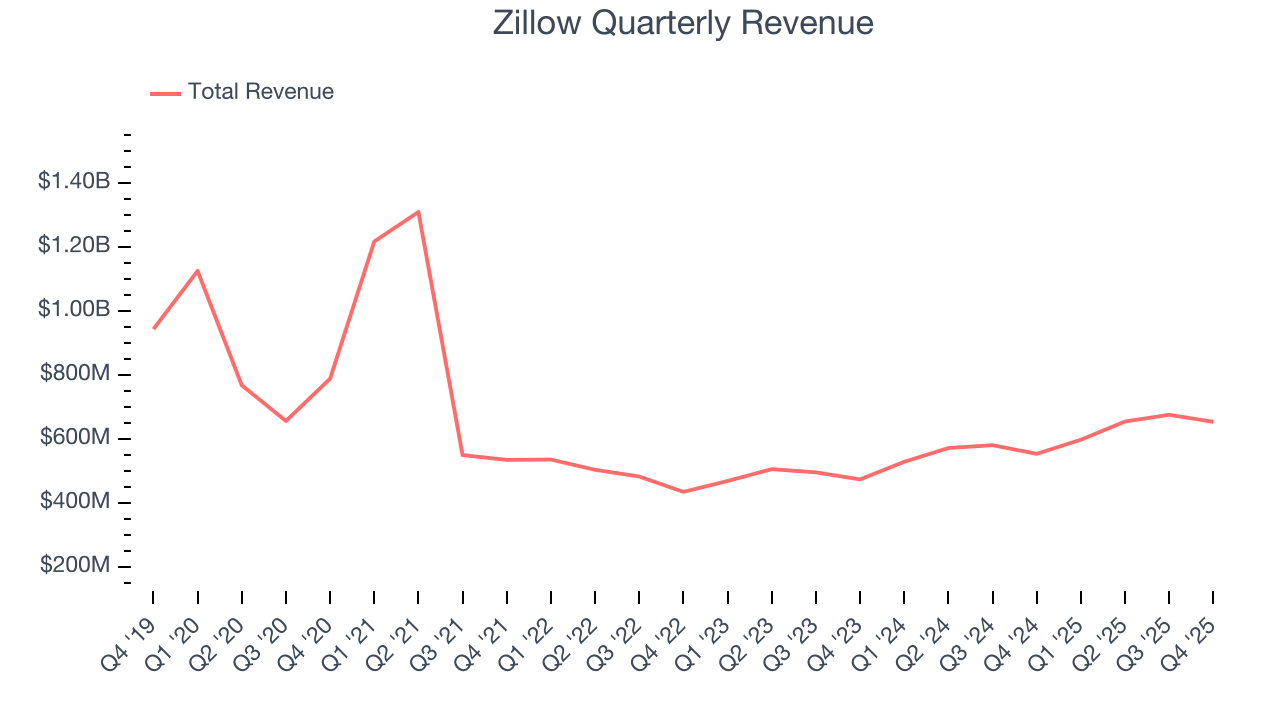

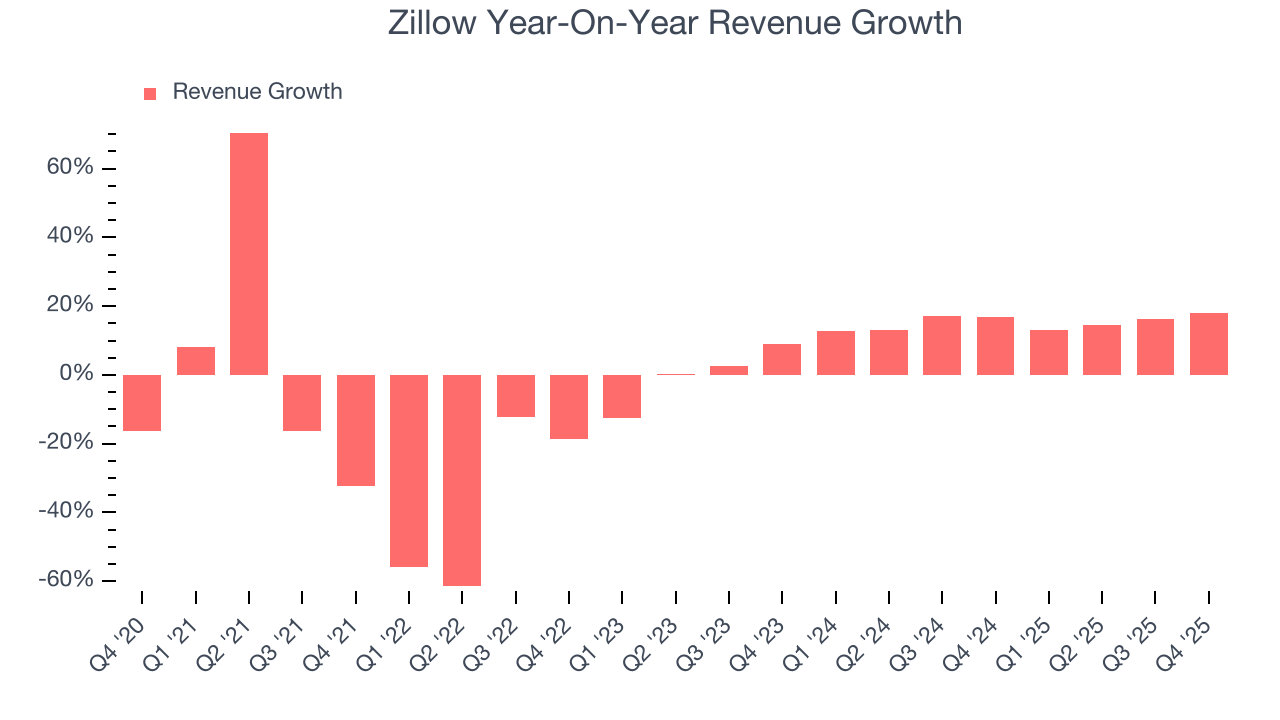

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Zillow’s demand was weak and its revenue declined by 5% per year. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Zillow’s annualized revenue growth of 15.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Zillow reported year-on-year revenue growth of 18.1%, and its $654 million of revenue exceeded Wall Street’s estimates by 0.5%.

Looking ahead, sell-side analysts expect revenue to grow 14.5% over the next 12 months, similar to its two-year rate. This projection is above the sector average and implies its newer products and services will help sustain its recent top-line performance.

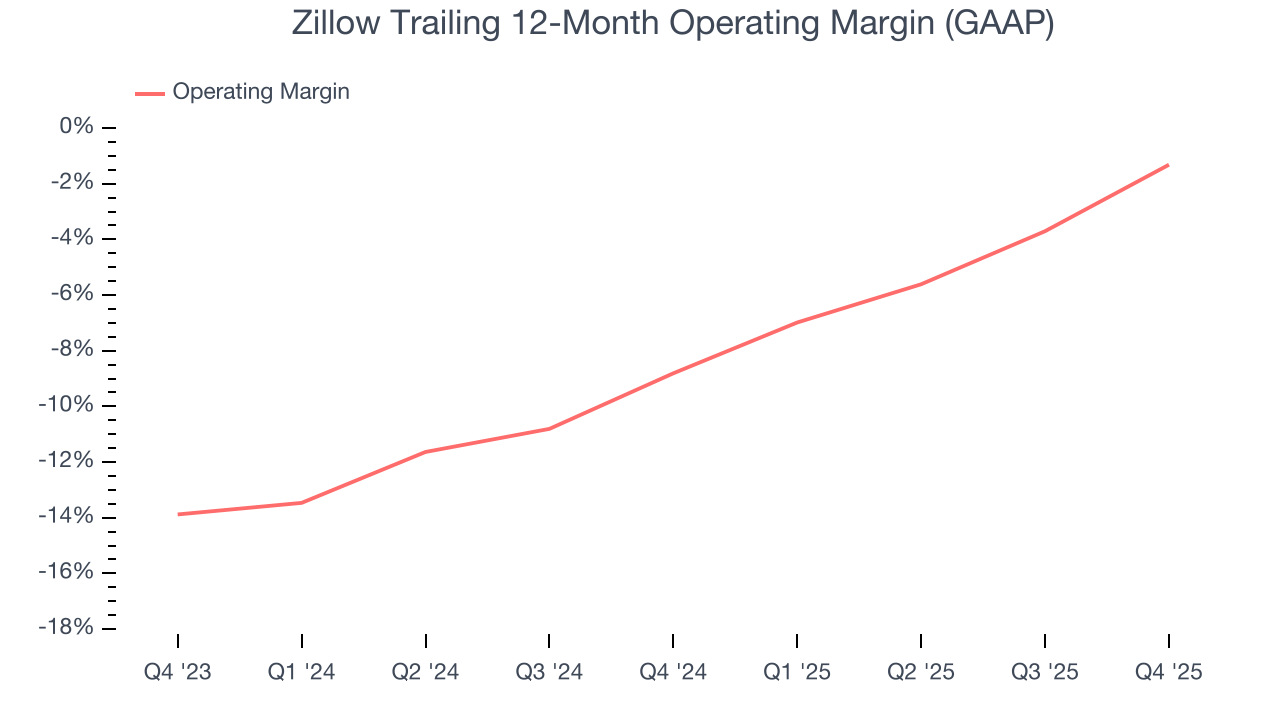

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Zillow’s operating margin has risen over the last 12 months, but it still averaged negative 4.8% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, Zillow generated a negative 1.7% operating margin. The company's consistent lack of profits raise a flag.

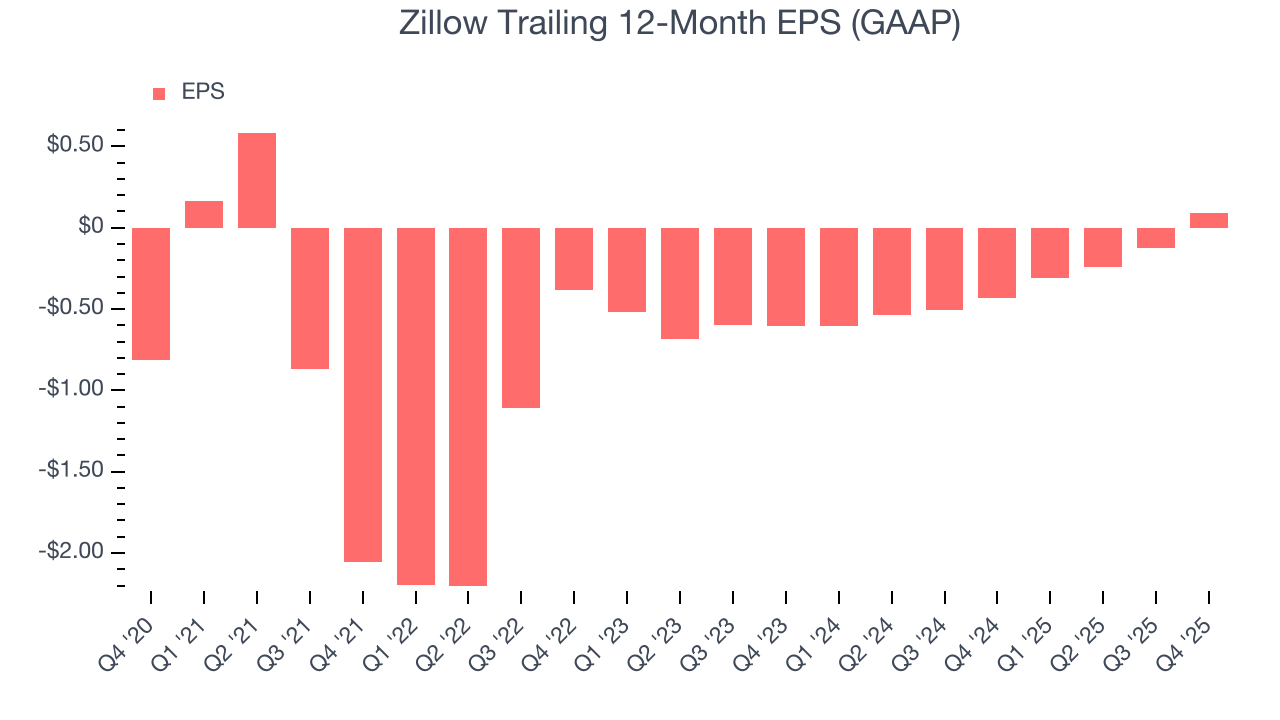

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Zillow’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Zillow reported EPS of $0.01, up from negative $0.20 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Zillow’s full-year EPS of $0.09 to grow 527%.

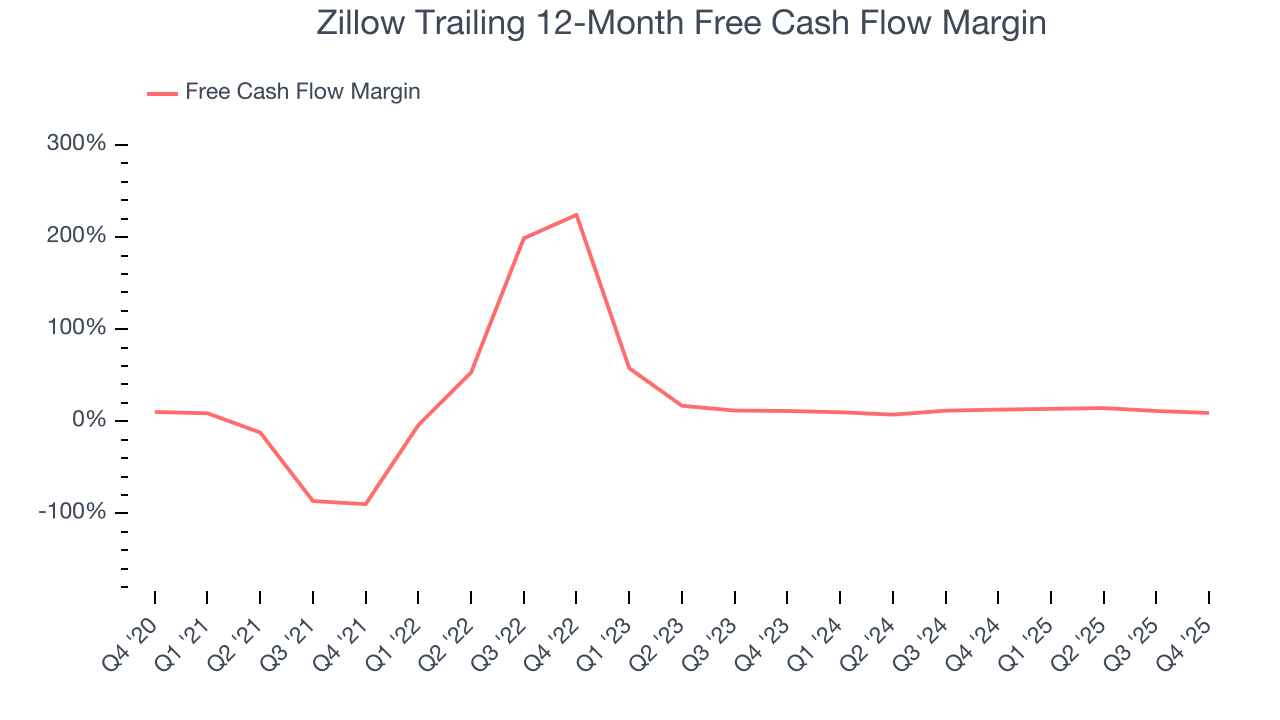

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Zillow has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 10.8%, lousy for a consumer discretionary business.

Zillow’s free cash flow clocked in at $44 million in Q4, equivalent to a 6.7% margin. The company’s cash profitability regressed as it was 9.2 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Zillow’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 9.1% for the last 12 months will increase to 21%, it options for capital deployment (investments, share buybacks, etc.).

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Zillow’s five-year average ROIC was negative 4.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Zillow’s ROIC increased by 1.7 percentage points annually each year over the last few years. This is a good sign, and we hope the company can continue improving.

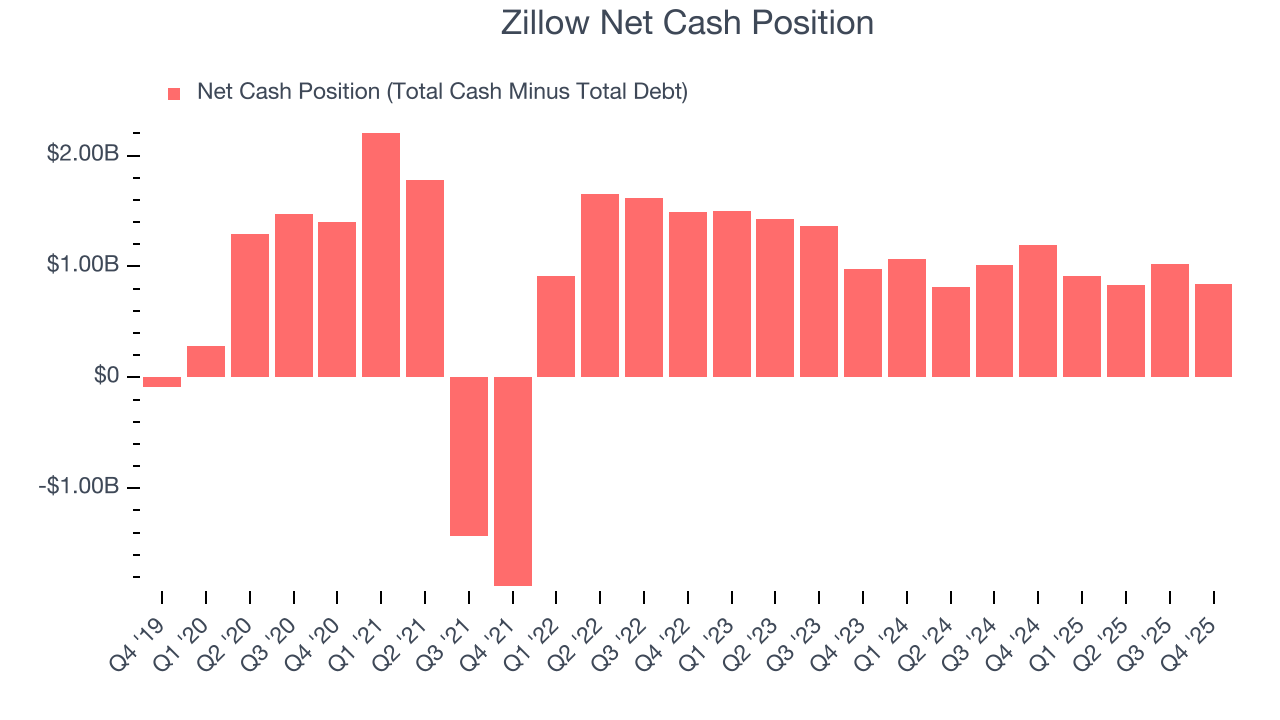

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Zillow is a well-capitalized company with $1.3 billion of cash and $457 million of debt on its balance sheet. This $843 million net cash position is 6.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Zillow’s Q4 Results

Revenue beat by a small amount, but adjusted EBITDA missed. Overall, this was a mixed quarter, and the stock traded down 5% to $51.68 immediately after reporting.

12. Is Now The Time To Buy Zillow?

Updated: February 11, 2026 at 9:34 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Zillow, you should also grasp the company’s longer-term business quality and valuation.

Zillow doesn’t pass our quality test. While its Forecasted free cash flow margin suggests the company will have more capital to invest or return to shareholders next year, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its low free cash flow margins give it little breathing room.

Zillow’s P/E ratio based on the next 12 months is 24.5x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $77.42 on the company (compared to the current share price of $45.28).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.