AECOM (ACM)

We’re wary of AECOM. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think AECOM Will Underperform

Founded in 1990 when a group of engineers from five companies decided to merge, AECOM (NYSE:ACM) provides various infrastructure consulting services.

- Sales are projected to tank by 3.4% over the next 12 months as demand evaporates

- Sizable revenue base leads to growth challenges as its 3.7% annual revenue increases over the last five years fell short of other industrials companies

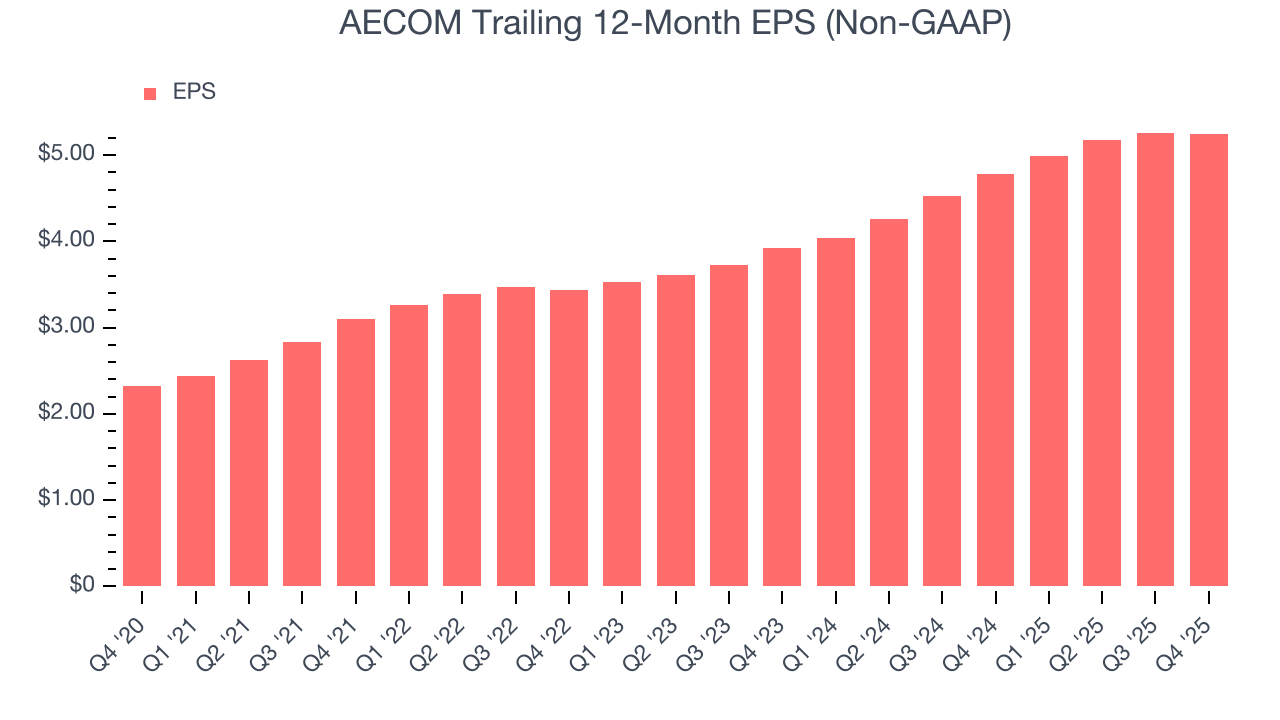

- On the bright side, its earnings per share have outperformed its peers over the last five years, increasing by 17.7% annually

AECOM doesn’t satisfy our quality benchmarks. Better stocks can be found in the market.

Why There Are Better Opportunities Than AECOM

Why There Are Better Opportunities Than AECOM

At $107.15 per share, AECOM trades at 18.7x forward P/E. Yes, this valuation multiple is lower than that of other industrials peers, but we’ll remind you that you often get what you pay for.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. AECOM (ACM) Research Report: Q4 CY2025 Update

Infrastructure consulting service company AECOM (NYSE:ACM) reported Q4 CY2025 results topping the market’s revenue expectations, but sales fell by 4.6% year on year to $3.83 billion. Its non-GAAP profit of $1.29 per share was 10.9% above analysts’ consensus estimates.

AECOM (ACM) Q4 CY2025 Highlights:

- Revenue: $3.83 billion vs analyst estimates of $3.74 billion (4.6% year-on-year decline, 2.5% beat)

- Adjusted EPS: $1.29 vs analyst estimates of $1.16 (10.9% beat)

- Adjusted EBITDA: $286.8 million vs analyst estimates of $265.9 million (7.5% margin, 7.9% beat)

- Management raised its full-year Adjusted EPS guidance to $5.95 at the midpoint, a 3.5% increase

- EBITDA guidance for the full year is $1.29 billion at the midpoint, above analyst estimates of $1.21 billion

- Operating Margin: 5.8%, in line with the same quarter last year

- Free Cash Flow Margin: 1.1%, down from 2.8% in the same quarter last year

- Backlog: $25.96 billion at quarter end, up 8.7% year on year

- Market Capitalization: $13.06 billion

Company Overview

Founded in 1990 when a group of engineers from five companies decided to merge, AECOM (NYSE:ACM) provides various infrastructure consulting services.

The company provides advisory, planning, consulting, architectural, and engineering design services to public and private clients. Businesses and government organizations in industries like transportation, facilities, water management and go to AECOM for its consulting services.

The company offers its consulting services to five types of markets, which include transportation, like rail, highways, bridges, and ports; water, like drought response and wastewater management; and energy, like hydropower and solar power.

The US Government makes up half of the company’s operating revenue, with the other half going to private companies. Operating revenue from the US Government is divided into multiple subsegments ranging from local municipalities to the federal government, so no single public (or private) entity makes up a significant portion of the company’s revenue source. Recurring revenue is a part of AECOM’s business model in the form of multi-year contracts and recurring consulting services for the same project.

4. Engineering and Design Services

Companies providing engineering and design services boast ever-evolving technical expertise. Compared to their counterparts who manufacture and sell physical products, these companies can also pivot faster to more trending areas due to their smaller physical asset bases. Green energy and water conservation, for example, are current themes driving incremental demand in this space. On the other hand, those providing engineering and design services are at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

AECOM’s competitors include Jacobs Engineering (NYSE:J), Fluor (NYSE:FLR), and KBR (NYSE:KBR).

5. Revenue Growth

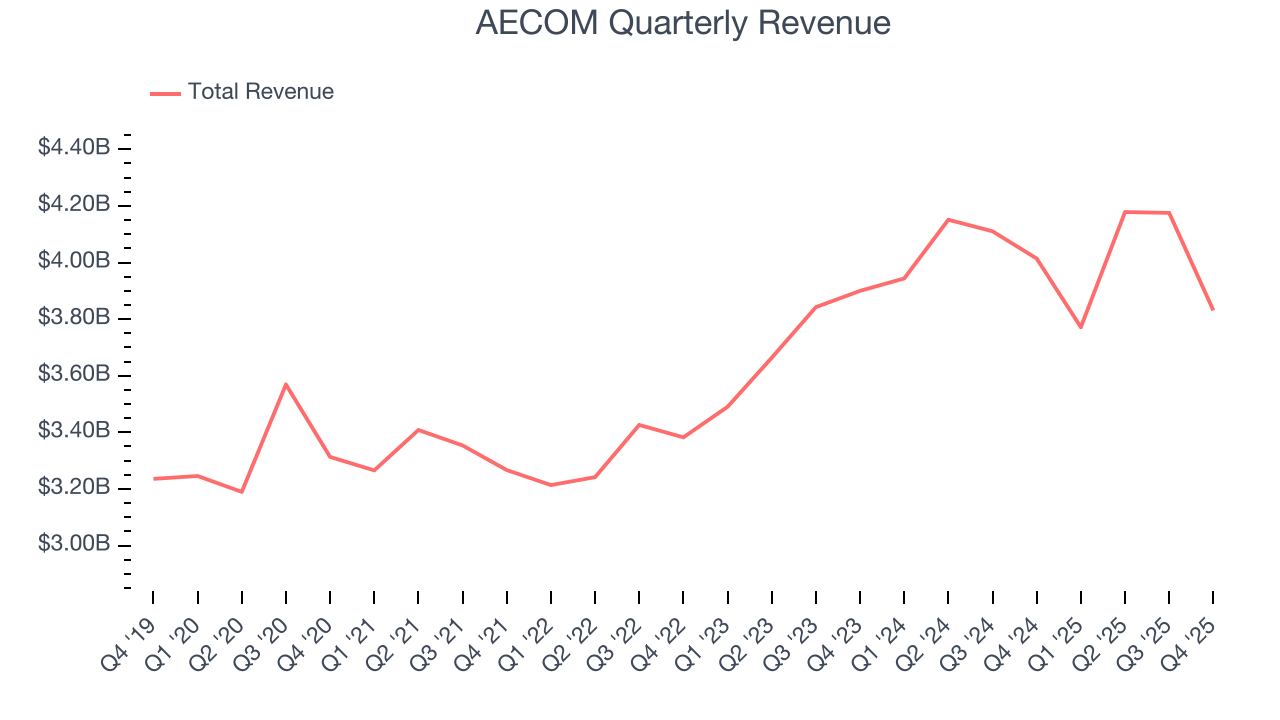

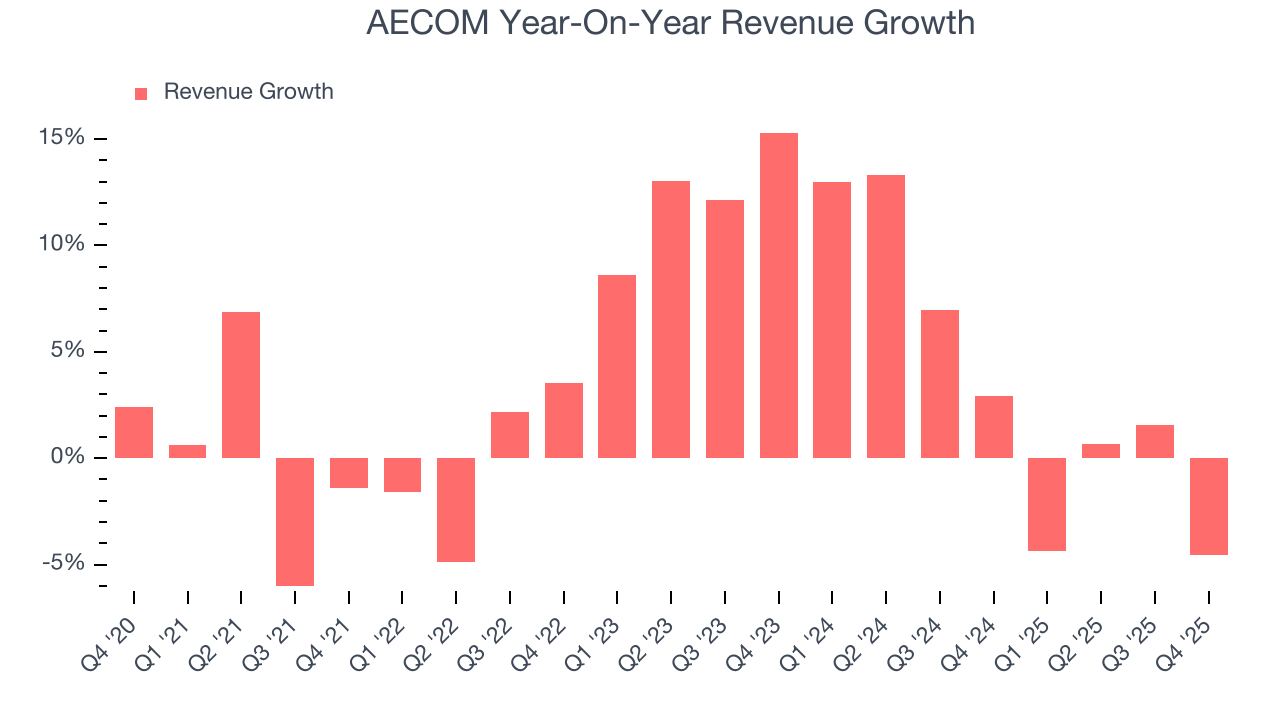

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, AECOM’s 3.7% annualized revenue growth over the last five years was sluggish. This was below our standard for the industrials sector and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. AECOM’s annualized revenue growth of 3.5% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

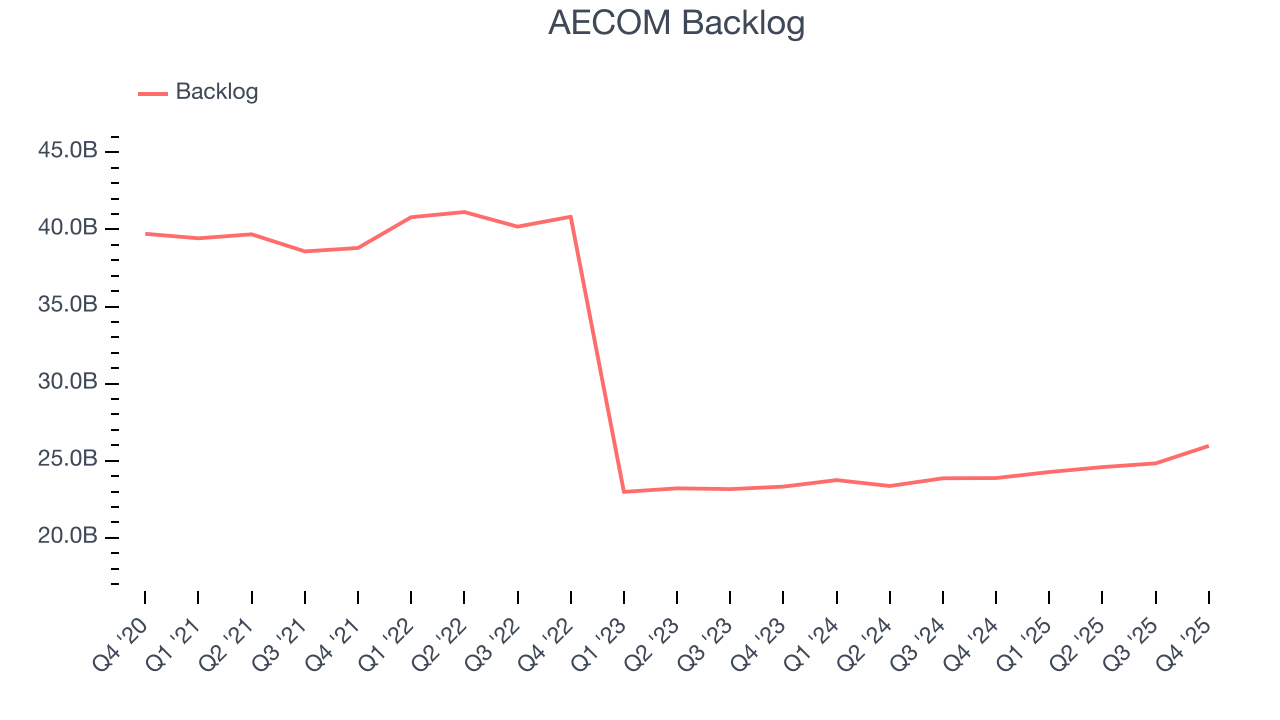

We can better understand the company’s revenue dynamics by analyzing its backlog, or the value of its outstanding orders that have not yet been executed or delivered. AECOM’s backlog reached $25.96 billion in the latest quarter and averaged 3.7% year-on-year growth over the last two years. Because this number is in line with its revenue growth, we can see the company effectively balanced its new order intake and fulfillment processes.

This quarter, AECOM’s revenue fell by 4.6% year on year to $3.83 billion but beat Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to decline by 3.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

6. Operating Margin

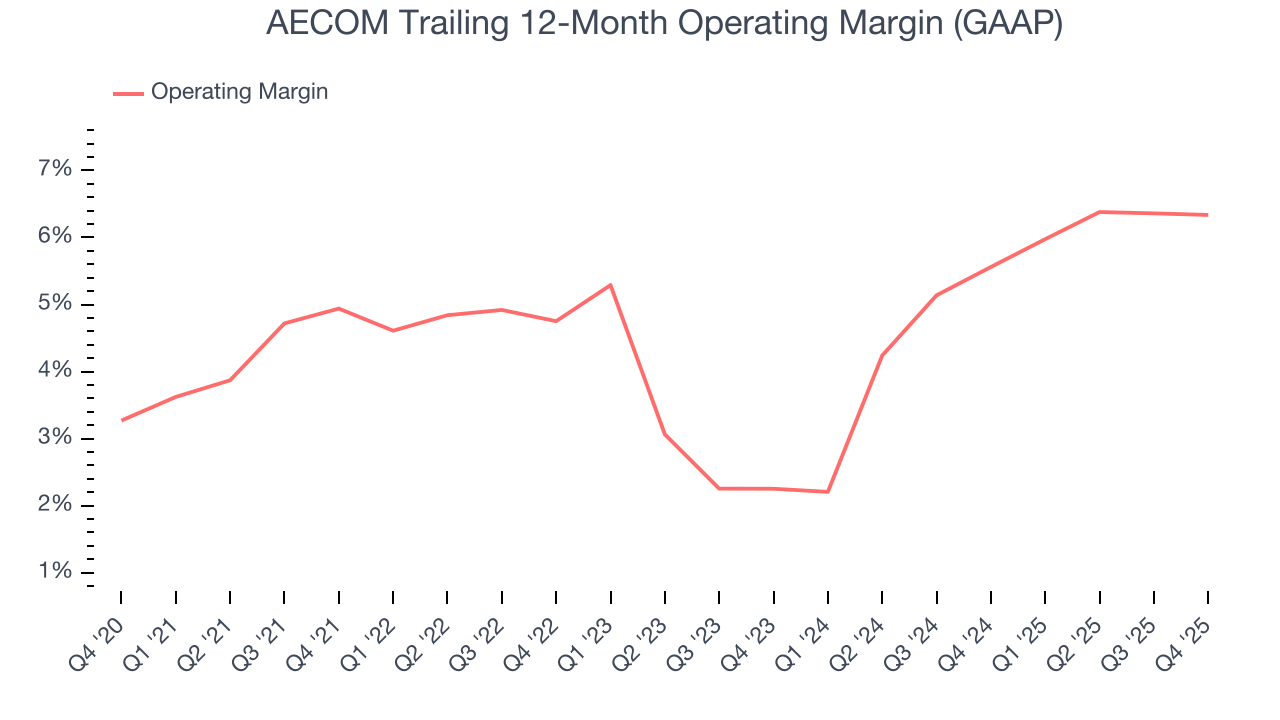

AECOM was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.8% was weak for an industrials business.

On the plus side, AECOM’s operating margin rose by 1.4 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, AECOM generated an operating margin profit margin of 5.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

AECOM’s EPS grew at an astounding 17.7% compounded annual growth rate over the last five years, higher than its 3.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

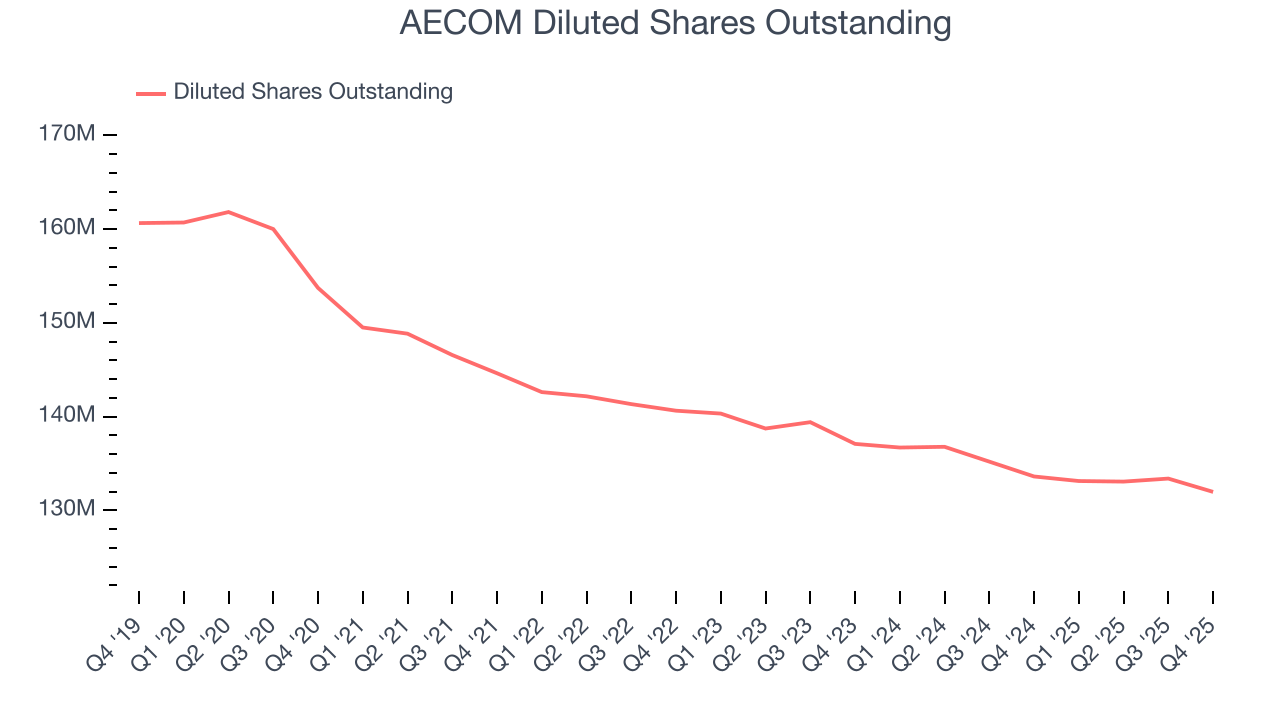

Diving into the nuances of AECOM’s earnings can give us a better understanding of its performance. As we mentioned earlier, AECOM’s operating margin was flat this quarter but expanded by 1.4 percentage points over the last five years. On top of that, its share count shrank by 14.2%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For AECOM, its two-year annual EPS growth of 15.6% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, AECOM reported adjusted EPS of $1.29, down from $1.31 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects AECOM’s full-year EPS of $5.24 to grow 2.5%.

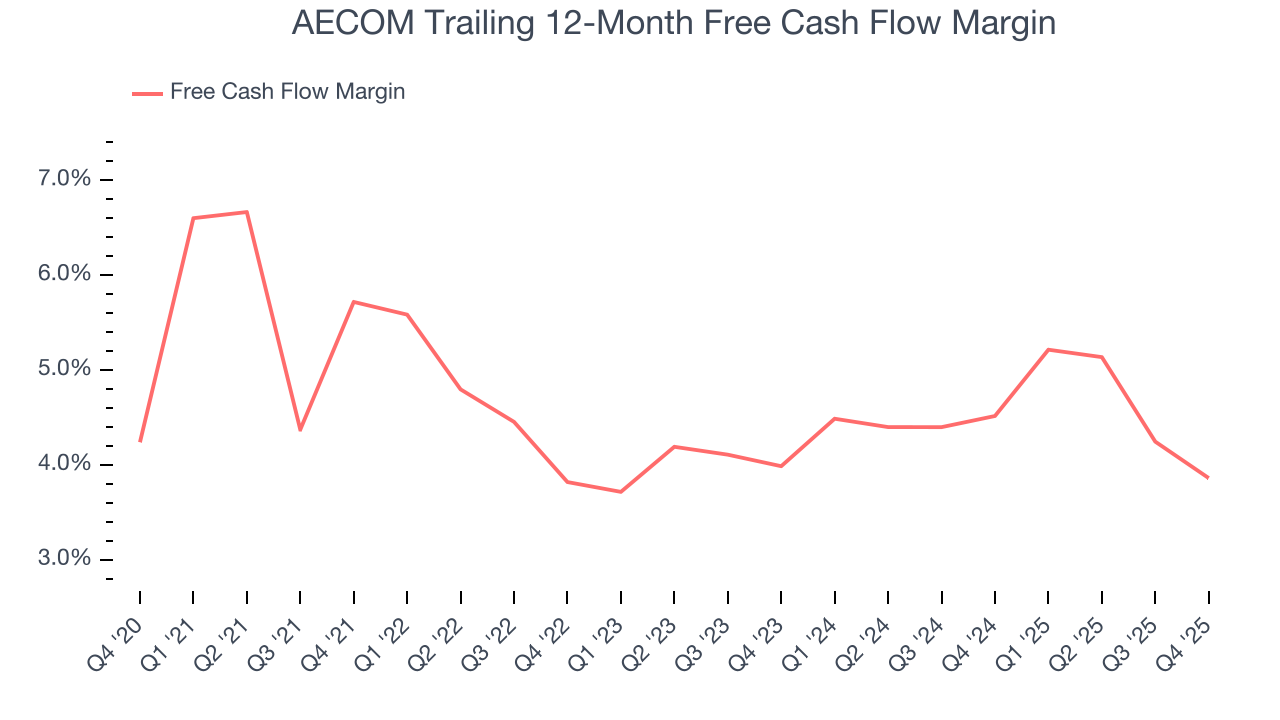

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

AECOM has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4.4%, subpar for an industrials business.

Taking a step back, we can see that AECOM’s margin dropped by 1.9 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business.

AECOM’s free cash flow clocked in at $41.9 million in Q4, equivalent to a 1.1% margin. The company’s cash profitability regressed as it was 1.7 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

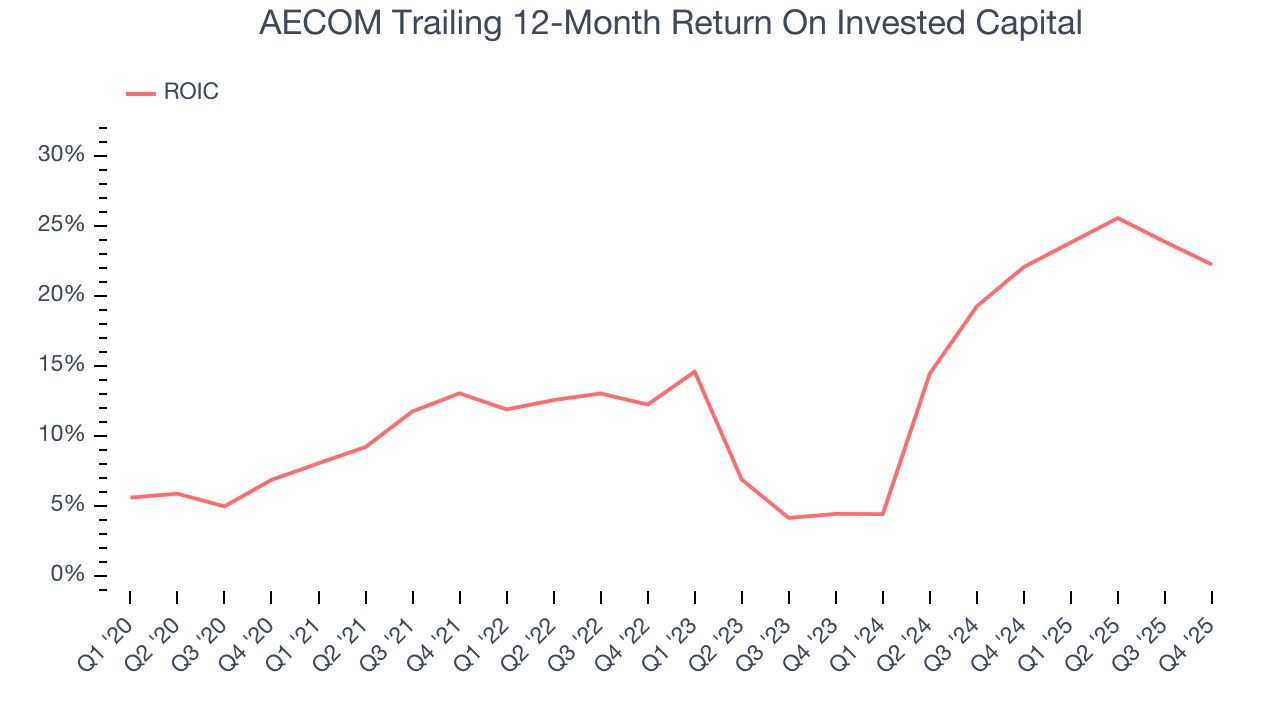

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although AECOM hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 14.8%, impressive for an industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, AECOM’s has increased over the last few years. This is a good sign, and we hope the company can keep improving.

10. Balance Sheet Assessment

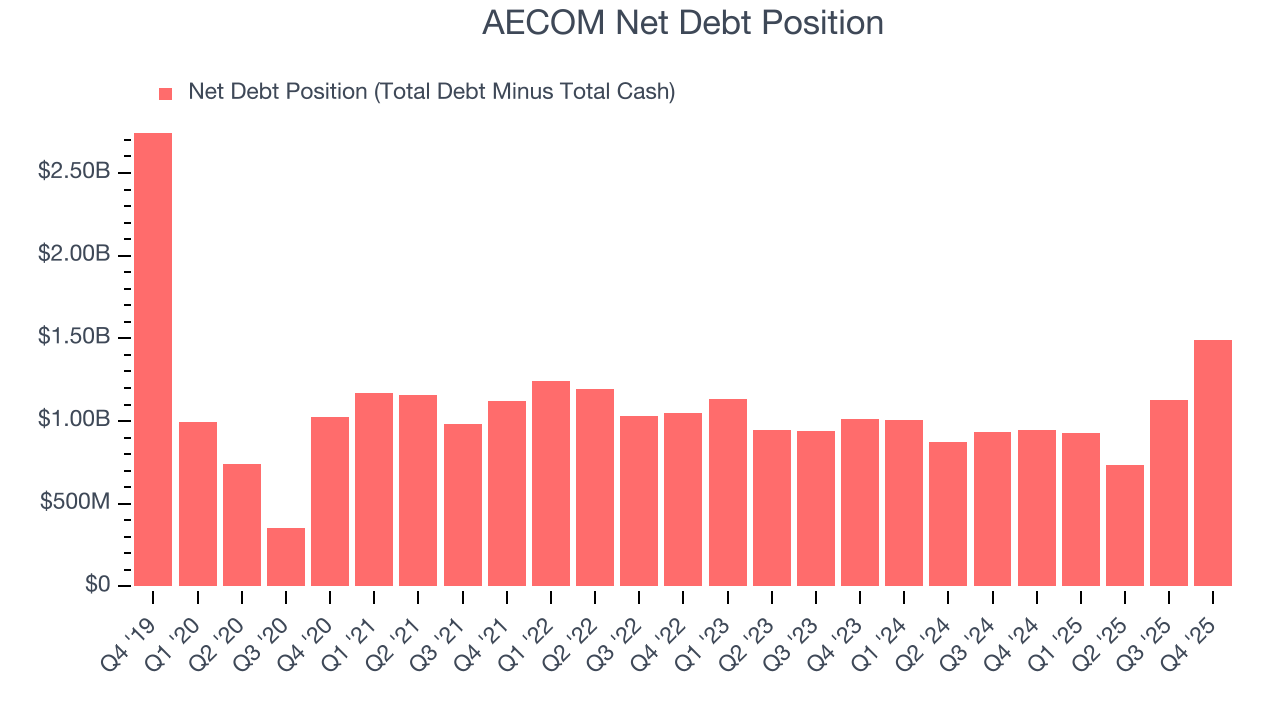

AECOM reported $1.25 billion of cash and $2.74 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.22 billion of EBITDA over the last 12 months, we view AECOM’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $63.42 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from AECOM’s Q4 Results

We were impressed by how significantly AECOM blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance trumped Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 3% to $105.76 immediately after reporting.

12. Is Now The Time To Buy AECOM?

Updated: February 9, 2026 at 10:04 PM EST

Before investing in or passing on AECOM, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

AECOM isn’t a terrible business, but it doesn’t pass our bar. For starters, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking. On top of that, its backlog growth has disappointed.

AECOM’s P/E ratio based on the next 12 months is 18.8x. This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $126.83 on the company (compared to the current share price of $107.15).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.