Array (AD)

Array keeps us up at night. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Array Will Underperform

Operating as a majority-owned subsidiary of Telephone and Data Systems since its founding in 1983, Array (NYSE:Array) is a regional wireless telecommunications provider serving 4.6 million customers across 21 states with mobile phone, internet, and IoT services.

- Sales tumbled by 6.8% annually over the last five years, showing market trends are working against its favor during this cycle

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- Sales are expected to decline once again over the next 12 months as it continues working through a challenging demand environment

Array doesn’t pass our quality test. We’re on the lookout for more interesting opportunities.

Why There Are Better Opportunities Than Array

Why There Are Better Opportunities Than Array

Array’s stock price of $50.37 implies a valuation ratio of 23.9x forward EV-to-EBITDA. This multiple is high given its weaker fundamentals.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects.

3. Array (AD) Research Report: Q4 CY2025 Update

Wireless telecommunications provider Array (NYSE:AD) reported Q4 CY2025 results topping the market’s revenue expectations, but sales fell by 93.8% year on year to $60.33 million. Its GAAP profit of $0.48 per share was 39.6% above analysts’ consensus estimates.

Array (AD) Q4 CY2025 Highlights:

- Revenue: $60.33 million vs analyst estimates of $56.37 million (93.8% year-on-year decline, 7% beat)

- EPS (GAAP): $0.48 vs analyst estimates of $0.34 (39.6% beat)

- Adjusted EBITDA: $52.09 million vs analyst estimates of $38.77 million (86.3% margin, 34.3% beat)

- Operating Margin: 14.3%, up from -0.9% in the same quarter last year

- Market Capitalization: $4.35 billion

Company Overview

Operating as a majority-owned subsidiary of Telephone and Data Systems since its founding in 1983, Array (NYSE:Array) is a regional wireless telecommunications provider serving 4.6 million customers across 21 states with mobile phone, internet, and IoT services.

US Cellular maintains a regional network infrastructure that includes thousands of cell towers (owning over 4,300 of its 7,000 cell sites) and holds wireless spectrum licenses covering portions of 30 states with a potential reach of approximately 51 million people. The company generates revenue primarily through postpaid wireless service plans, which represent about 90% of its customer connections, with the remainder coming from prepaid services.

The company's service offerings include voice and data plans, home internet via fixed wireless access, and specialized solutions for business and government customers. For residential customers, US Cellular provides various service tiers with features like unlimited data, high-definition video streaming, and international services. Its fixed wireless internet solutions include self-installed devices and professionally mounted equipment to deliver broadband, particularly in underserved communities.

For business clients, US Cellular offers more advanced solutions including Internet of Things (IoT) connectivity for applications like remote monitoring, business automation, fleet management, and private cellular networks. First responders can access critical connectivity solutions with priority services during emergencies.

US Cellular distributes its products and services through multiple channels: company-owned retail stores, direct sales representatives for business customers, telesales, e-commerce, and partnerships with independent agents and national retailers. A typical customer might purchase a smartphone on an installment plan through a US Cellular store, subscribe to a monthly unlimited data plan, and add device protection services.

The company has recently been expanding its 5G network deployment, initially using low-band spectrum across most markets and now adding mid-band spectrum to enhance speed and capacity for both mobile and fixed wireless services. In early 2024, US Cellular completed the decommissioning of its older 3G network as part of its network modernization strategy.

4. Terrestrial Telecommunication Services

Terrestrial telecommunication companies face an uphill battle, as they mostly sell into a deflationary market, where the price of moving a bit tends to decrease over time with better technology. Without dependable volume growth, revenue growth could be challenged. Unfortunately, broadband penetration in their core US market is quite high already. On the other hand, data consumption from streaming entertainment and 5G expansion could provide a floor on growth for the next number of years. As if that wasn't enough to worry about, competition is intense, with larger telecom providers and hyperscalers expanding their own networks.

Array competes with national wireless carriers including Verizon (NYSE: VZ), AT&T (NYSE: T), T-Mobile (NASDAQ: TMUS), and Dish Network (NASDAQ: DISH), as well as cable companies offering wireless services such as Comcast (NASDAQ: CMCSA) and Charter Communications (NASDAQ: CHTR).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $1.91 billion in revenue over the past 12 months, Array is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

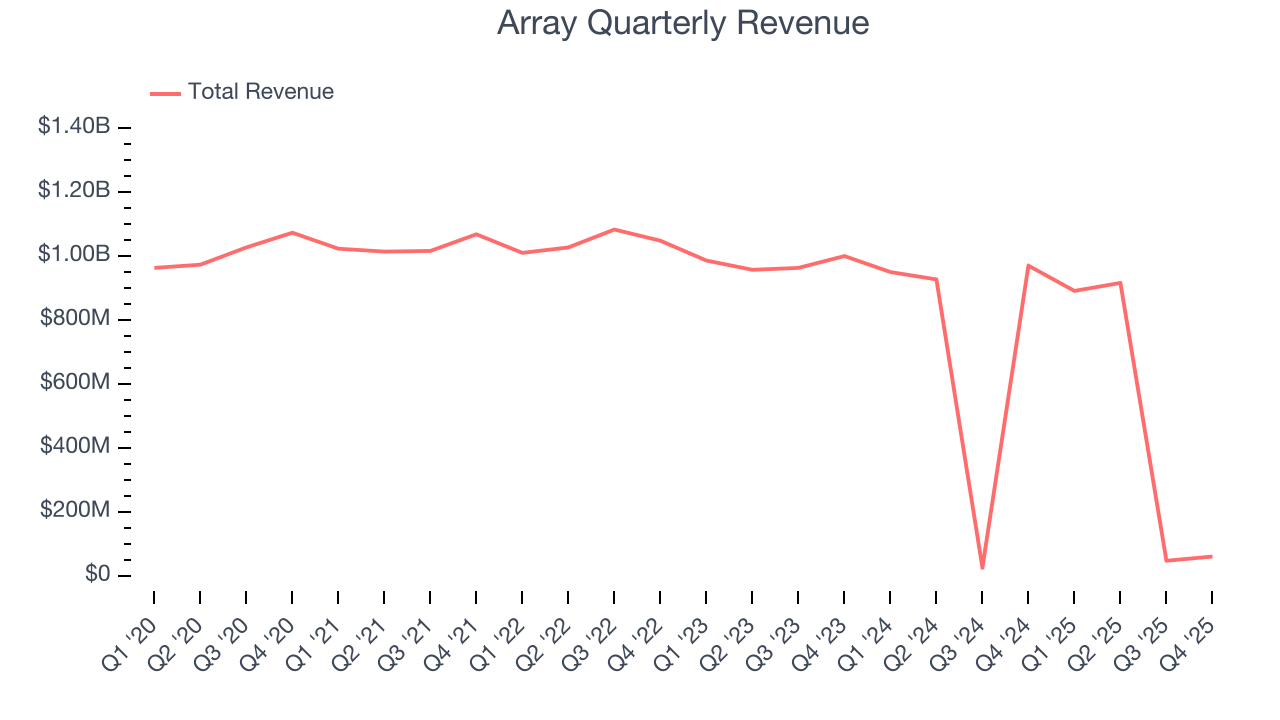

As you can see below, Array’s revenue declined by 13.9% per year over the last five years, a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Array’s recent performance shows its demand remained suppressed as its revenue has declined by 30% annually over the last two years.

This quarter, Array’s revenue fell by 93.8% year on year to $60.33 million but beat Wall Street’s estimates by 7%.

Looking ahead, sell-side analysts expect revenue to decline by 88.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

6. Operating Margin

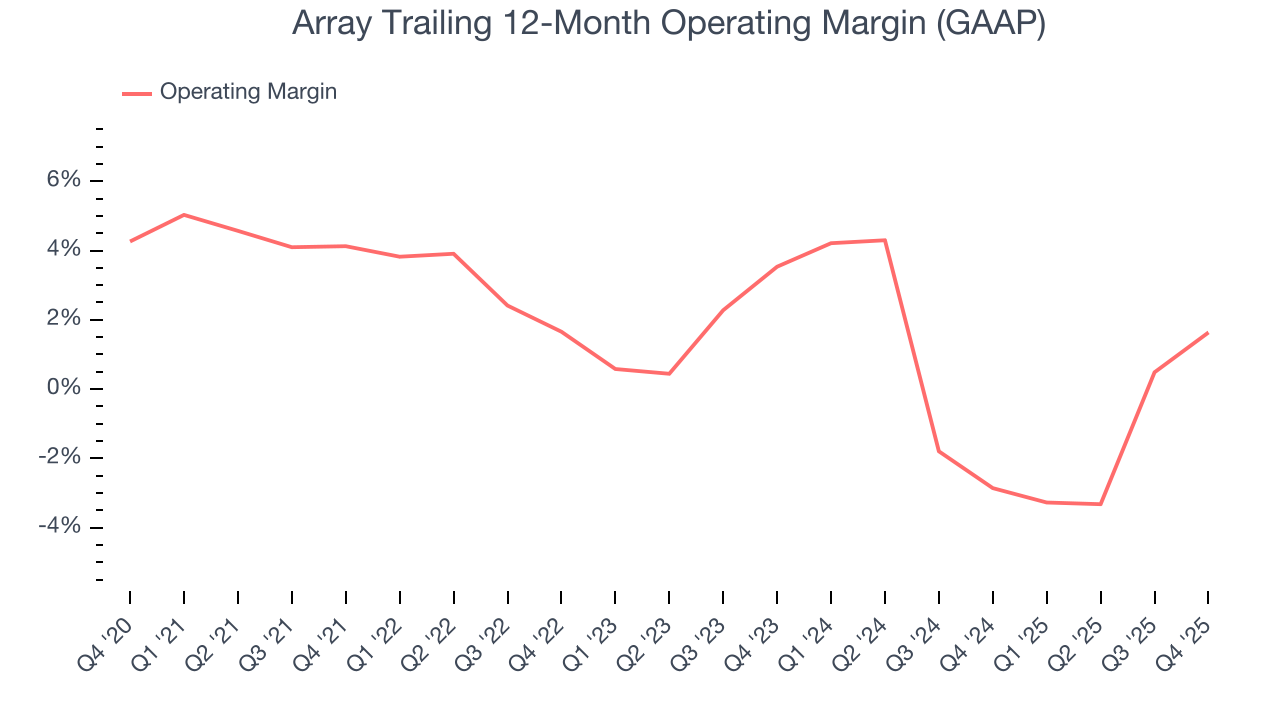

Array was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.9% was weak for a business services business.

Analyzing the trend in its profitability, Array’s operating margin decreased by 2.5 percentage points over the last five years. Array’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Array generated an operating margin profit margin of 14.3%, up 15.2 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

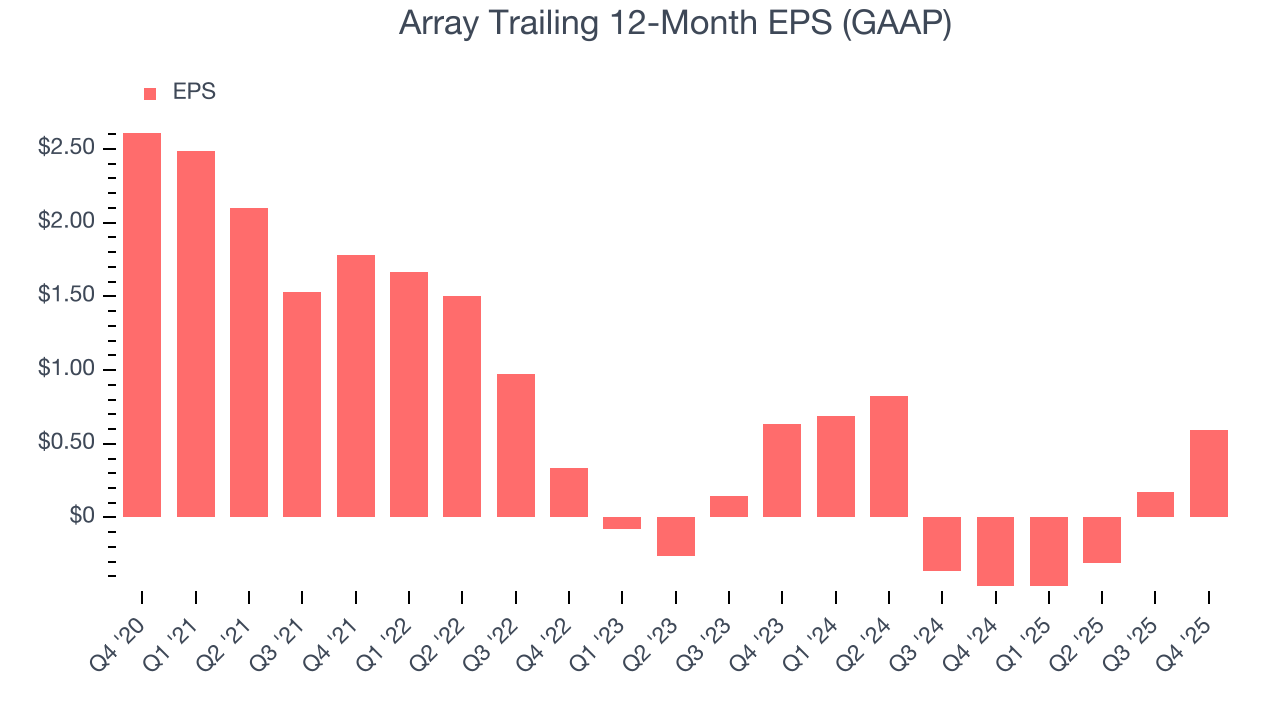

Sadly for Array, its EPS declined by 25.6% annually over the last five years, more than its revenue. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

We can take a deeper look into Array’s earnings to better understand the drivers of its performance. As we mentioned earlier, Array’s operating margin expanded this quarter but declined by 2.5 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Although it wasn’t great, Array’s two-year annual EPS declines of 3.4% topped its two-year revenue losses.

In Q4, Array reported EPS of $0.48, up from $0.06 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Array’s full-year EPS of $0.59 to grow 98.9%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

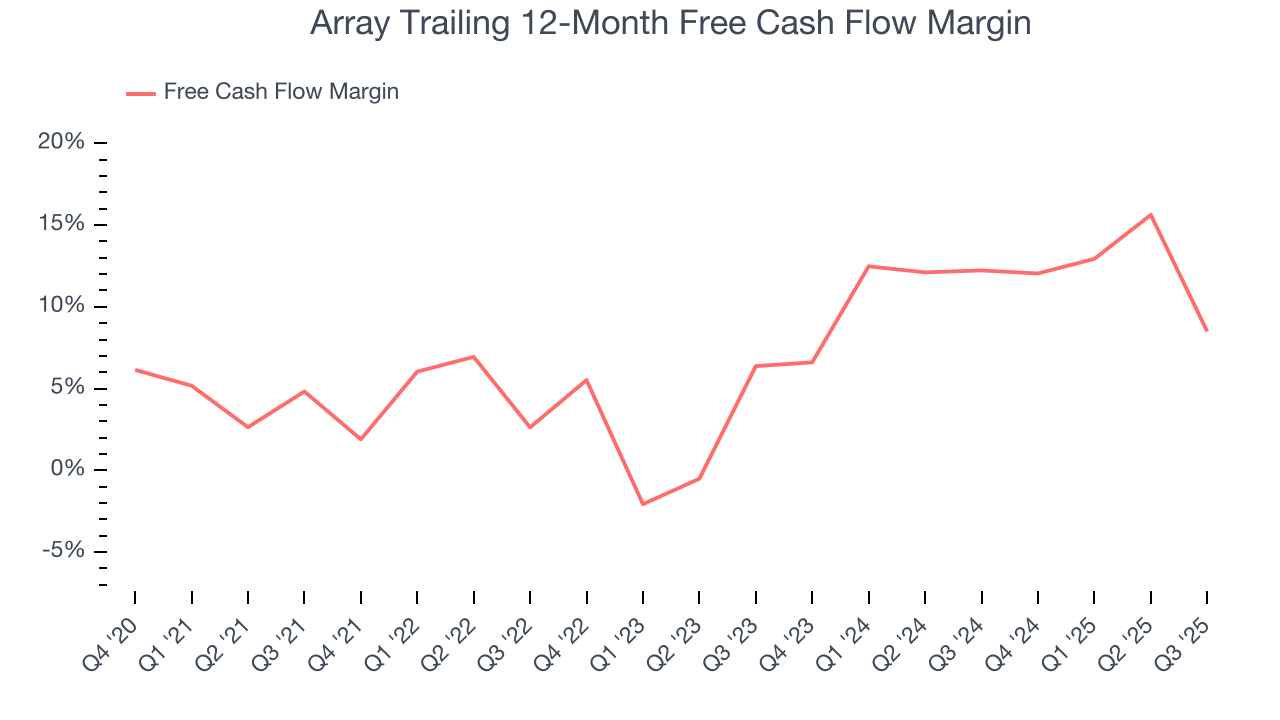

Array has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.9% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that Array’s margin expanded by 6.9 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

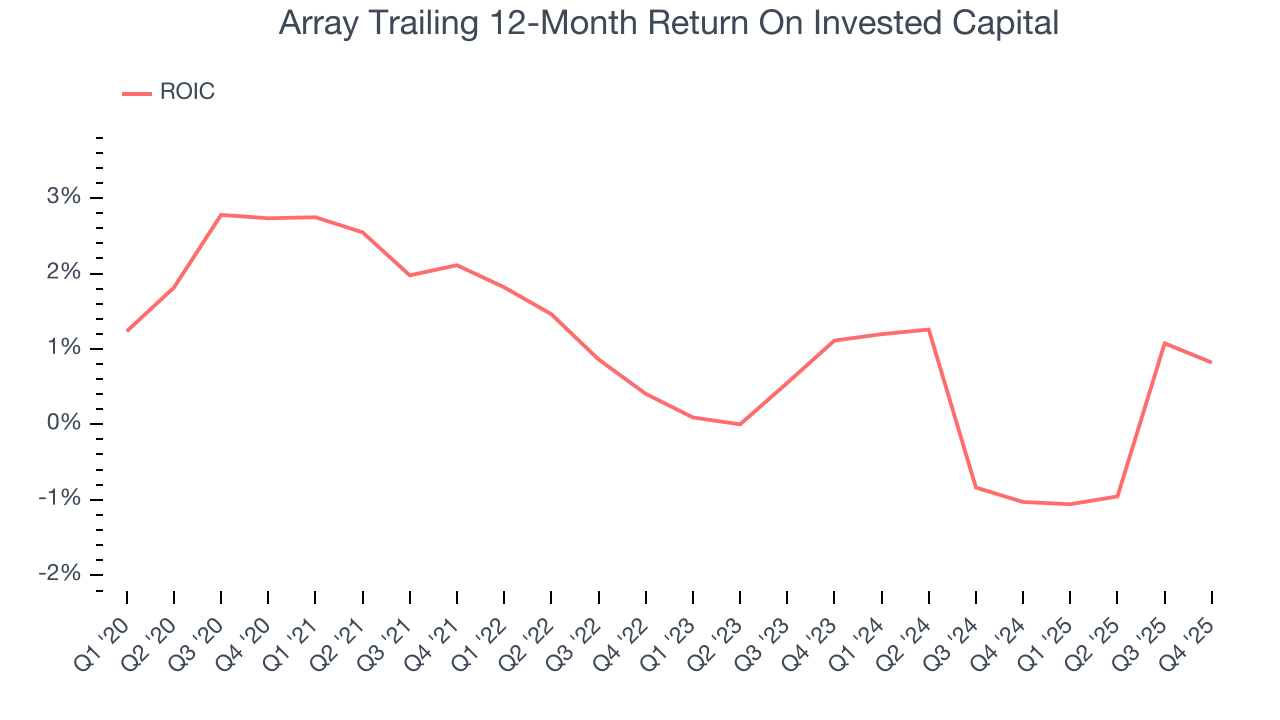

Array historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 0.7%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Array’s ROIC averaged 1.4 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

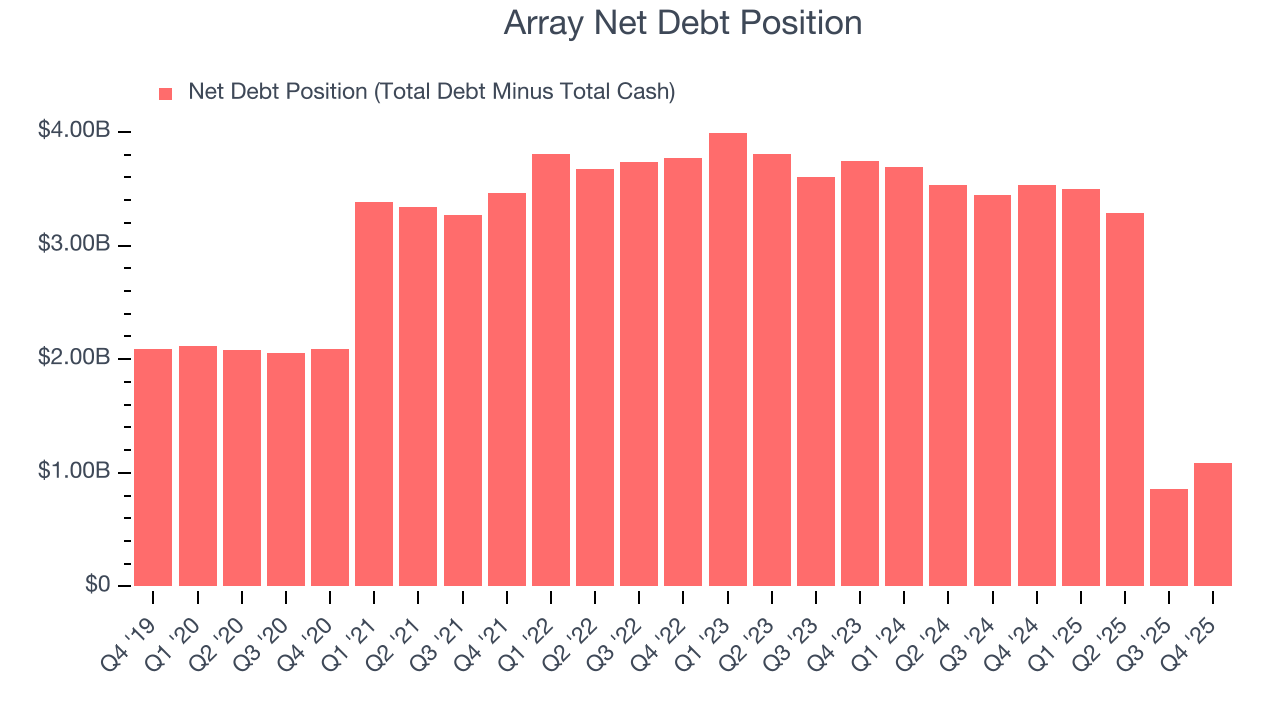

Array reported $113.4 million of cash and $1.20 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $645.2 million of EBITDA over the last 12 months, we view Array’s 1.7× net-debt-to-EBITDA ratio as safe. We also see its $12.39 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Array’s Q4 Results

It was good to see Array beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $50.50 immediately following the results.

12. Is Now The Time To Buy Array?

Updated: February 20, 2026 at 7:49 AM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Array.

We see the value of companies helping their customers, but in the case of Array, we’re out. To begin with, its revenue has declined over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its rising cash profitability gives it more optionality, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Array’s EV-to-EBITDA ratio based on the next 12 months is 23.4x. At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $58.17 on the company (compared to the current share price of $50.50).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.