agilon health (AGL)

We see potential in agilon health. The robust demand for its offerings is leading to a surge in its customer base. This bodes well.― StockStory Analyst Team

1. News

2. Summary

Why agilon health Is Interesting

Transforming how doctors care for seniors by shifting financial incentives from volume to outcomes, agilon health (NYSE:AGL) provides a platform that helps primary care physicians transition to value-based care models for Medicare patients through long-term partnerships and global capitation arrangements.

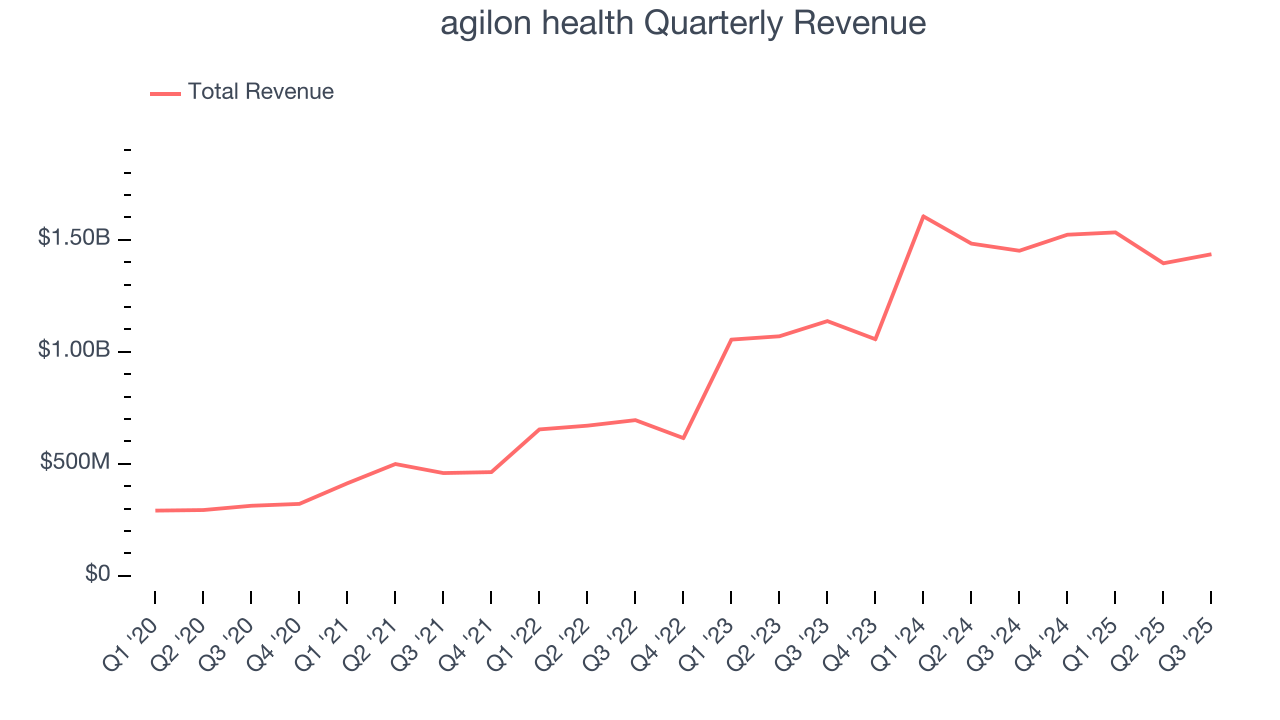

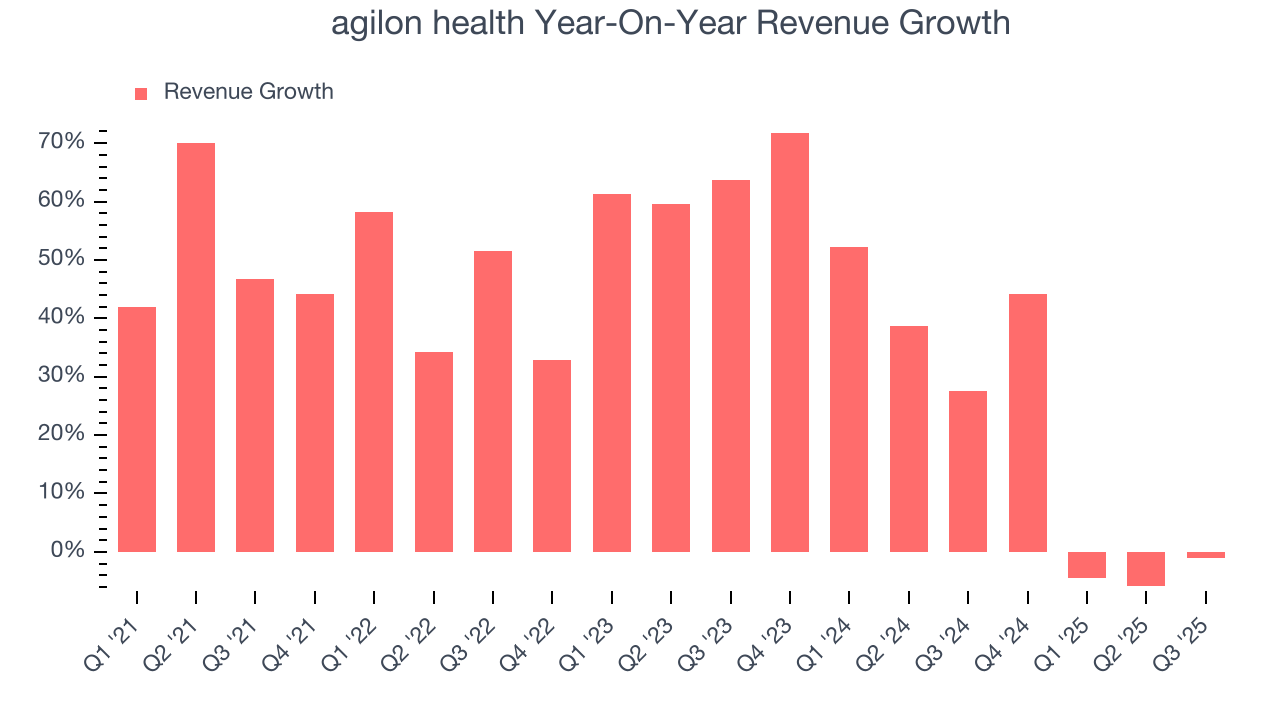

- Annual revenue growth of 37.2% over the past five years was outstanding, reflecting market share gains this cycle

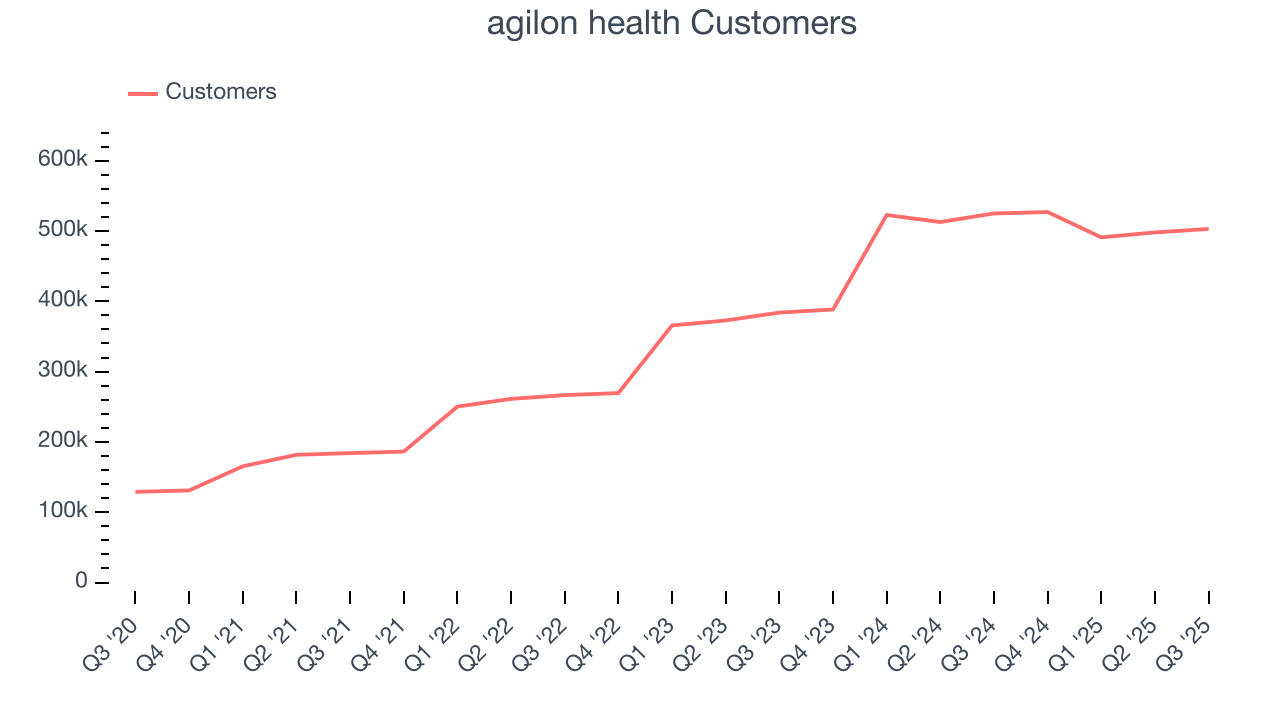

- Business is winning new contracts that can potentially increase in value as its customer base averaged 19.9% growth over the past two years

- On the flip side, its persistent adjusted operating margin losses suggest the business manages its expenses poorly

agilon health almost passes our quality test. If you like the stock, the price seems fair.

Why Is Now The Time To Buy agilon health?

High Quality

Investable

Underperform

Why Is Now The Time To Buy agilon health?

agilon health is trading at $0.98 per share, or 0.1x forward price-to-sales. Looking at the healthcare landscape right now, agilon health trades at a pretty interesting price. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

It’s an opportune time to buy the stock if you see some misunderstanding of the business that is leading to mispricing in the market.

3. agilon health (AGL) Research Report: Q3 CY2025 Update

Healthcare services company Agilon Health (NYSE:AGL) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 1.1% year on year to $1.44 billion. The company expects the full year’s revenue to be around $5.82 billion, close to analysts’ estimates. Its GAAP loss of $0.27 per share was 62.4% below analysts’ consensus estimates.

agilon health (AGL) Q3 CY2025 Highlights:

- Revenue: $1.44 billion vs analyst estimates of $1.42 billion (1.1% year-on-year decline, 1% beat)

- EPS (GAAP): -$0.27 vs analyst expectations of -$0.17 (62.4% miss)

- Adjusted EBITDA: -$91.49 million vs analyst estimates of -$50.39 million (-6.4% margin, 81.6% miss)

- EBITDA guidance for the full year is -$257.5 million at the midpoint, below analyst estimates of -$179.5 million

- Operating Margin: -9.1%, in line with the same quarter last year

- Customers: 503,000, up from 498,000 in the previous quarter

- Market Capitalization: $335.8 million

Company Overview

Transforming how doctors care for seniors by shifting financial incentives from volume to outcomes, agilon health (NYSE:AGL) provides a platform that helps primary care physicians transition to value-based care models for Medicare patients through long-term partnerships and global capitation arrangements.

At the core of agilon's business model is a fundamental shift in how healthcare is delivered and paid for. Rather than the traditional fee-for-service approach where physicians are paid for each service provided, agilon enables doctors to receive fixed monthly payments (called "global capitation") for managing the total healthcare needs of Medicare patients. This aligns financial incentives with keeping patients healthy rather than simply treating illnesses.

The company forms risk-bearing entities in local communities that contract with health insurers, then partners with established physician groups through 20-year agreements. These physician partners gain access to agilon's technology platform, operational support, and capital needed to succeed under value-based care arrangements.

For example, a primary care practice in Ohio partnering with agilon might receive a set monthly payment for each Medicare Advantage patient in their care. The practice then becomes responsible for coordinating all aspects of that patient's healthcare—from preventive screenings to specialist referrals to hospital admissions—with financial incentives to improve outcomes while managing costs.

agilon generates revenue through these per-member-per-month payments from health insurers. The company's platform includes technology for data analysis, care coordination tools, and operational support to help physicians identify high-risk patients, close care gaps, and optimize care delivery.

Beyond Medicare Advantage, agilon also participates in the Centers for Medicare & Medicaid Services' ACO REACH Model through eight Accountable Care Organizations, allowing physician partners to apply similar value-based approaches to traditional Medicare fee-for-service beneficiaries.

The company has expanded its geographic footprint across multiple states including Ohio, Connecticut, Maine, Michigan, Texas, and others, creating a network of physician partners who can share best practices and insights across communities.

4. Outpatient & Specialty Care

The outpatient and specialty care industry delivers targeted medical services in non-hospital settings that are often cost-effective compared to inpatient alternatives. This means that they are more desired as rising healthcare costs and ways to combat them become more and more top-of-mind. Outpatient and specialty care providers boast revenue streams that are stable due to the recurring nature of treatment for chronic conditions and long-term patient relationships. However, their reliance on government reimbursement programs like Medicare means stroke-of-the-pen risk. Additionally, scaling a network of facilities can be capital-intensive with uneven return profiles amid competition from integrated healthcare systems. Looking ahead, the industry is positioned to grow as demand for outpatient services expands, driven by aging populations, a rising prevalence of chronic diseases, and a shift toward value-based care models. Tailwinds include advancements in medical technology that support more complex procedures in outpatient settings and the increasing focus on preventive care, which can be aided by data and AI. However, headwinds such as reimbursement rate cuts, labor shortages, and the financial strain of digitization may temper growth.

agilon health competes with other companies focused on value-based primary care models including Oak Street Health (acquired by CVS Health), Privia Health (NASDAQ: PRVA), VillageMD (majority-owned by Walgreens Boots Alliance), and privately-held companies like Iora Health (acquired by One Medical/Amazon) and Aledade.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $5.89 billion in revenue over the past 12 months, agilon health has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, agilon health’s sales grew at an incredible 37.2% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. agilon health’s annualized revenue growth of 23.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 503,000 in the latest quarter. Over the last two years, agilon health’s customer base averaged 23% year-on-year growth. Because this number is in line with its revenue growth, we can see the average customer spent roughly the same amount each year on the company’s products and services.

This quarter, agilon health’s revenue fell by 1.1% year on year to $1.44 billion but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

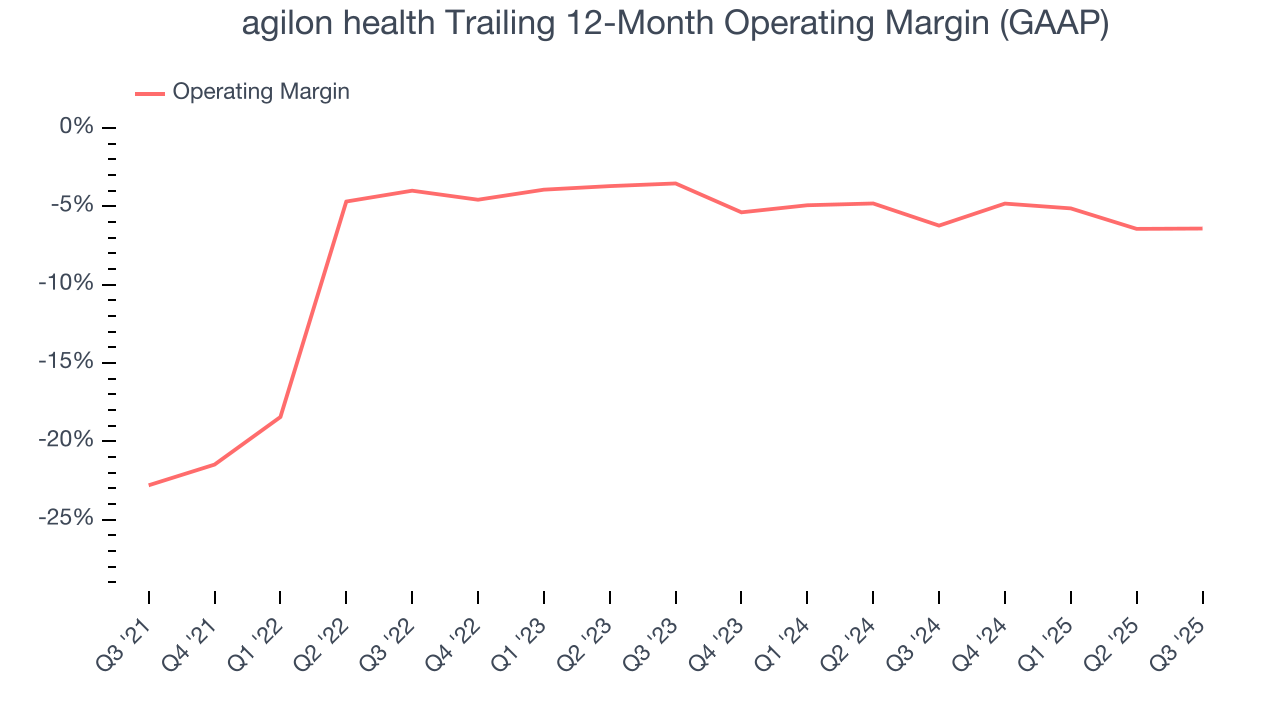

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

agilon health’s high expenses have contributed to an average operating margin of negative 6.9% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, agilon health’s operating margin rose by 16.4 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming into its more recent performance, however, we can see the company’s margin has decreased by 2.9 percentage points on a two-year basis. Given its business quality, we’re optimistic that agilon health can correct course and return to expansion.

agilon health’s operating margin was negative 9.1% this quarter.

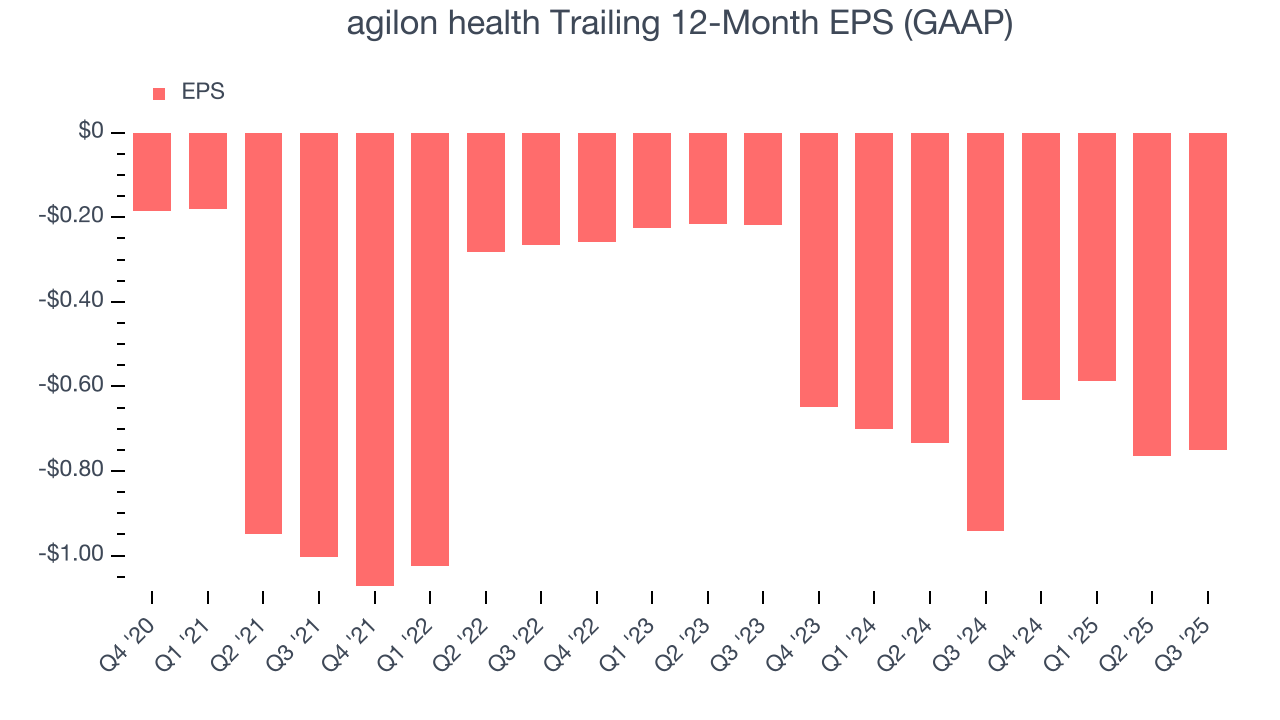

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

agilon health’s earnings losses deepened over the last five years as its EPS dropped 34.7% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

In Q3, agilon health reported EPS of negative $0.27, up from negative $0.29 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects agilon health to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.75 will advance to negative $0.46.

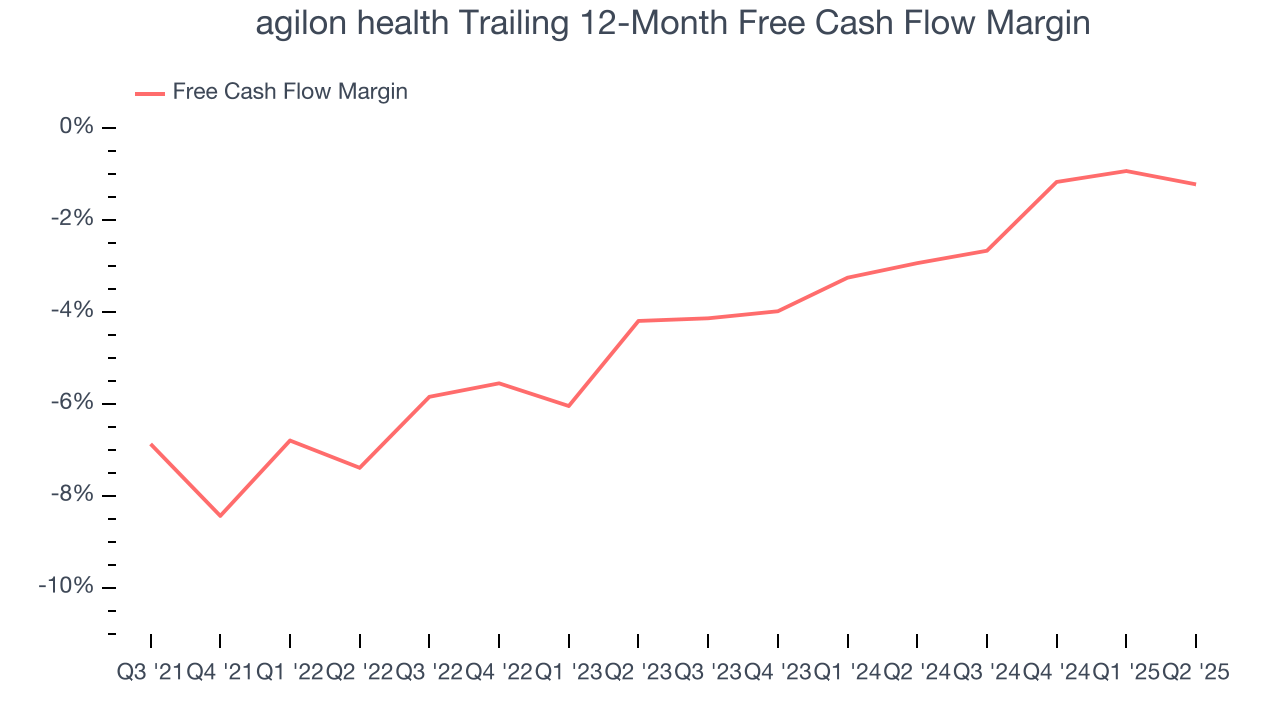

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

agilon health’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 3.5%. This means it lit $3.49 of cash on fire for every $100 in revenue.

Taking a step back, an encouraging sign is that agilon health’s margin expanded by 6.3 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and continued increases could help it achieve long-term cash profitability.

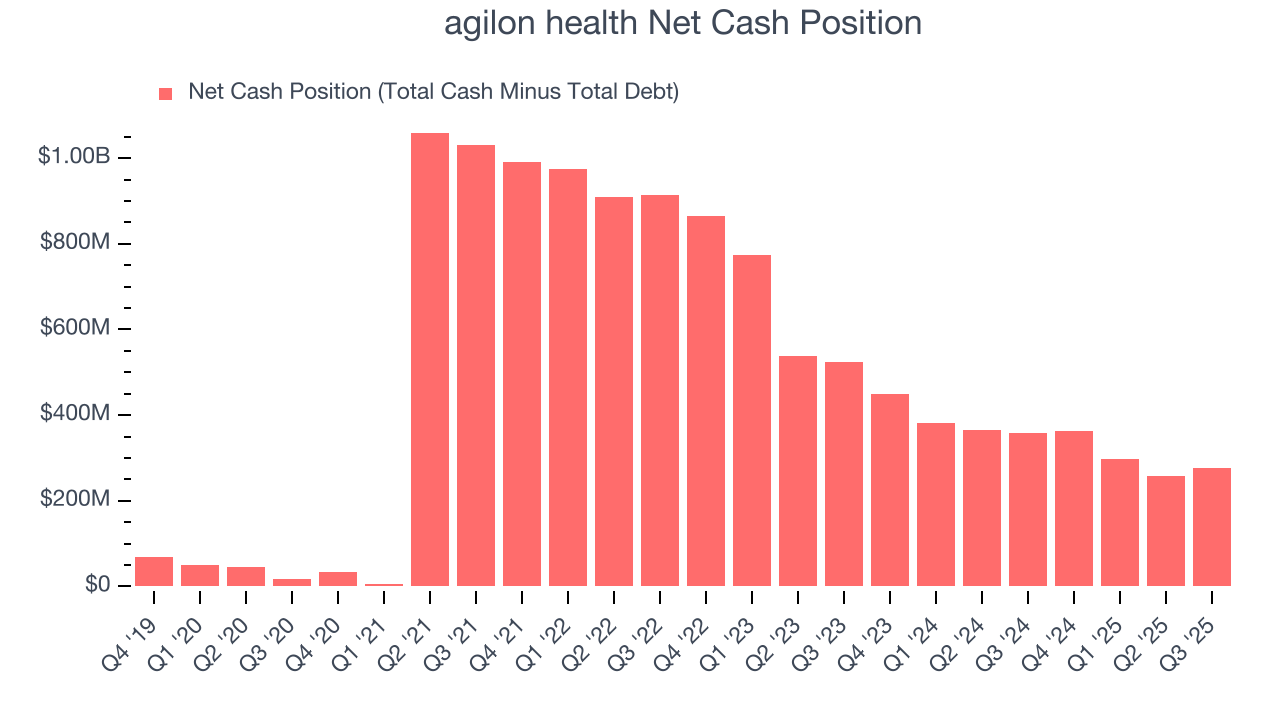

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

agilon health is a well-capitalized company with $310.9 million of cash and $34.97 million of debt on its balance sheet. This $275.9 million net cash position is 91.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from agilon health’s Q3 Results

It was good to see agilon health narrowly top analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance was in line with Wall Street’s estimates. On the other hand, its full-year EBITDA guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock remained flat at $0.72 immediately after reporting.

12. Is Now The Time To Buy agilon health?

Updated: January 21, 2026 at 10:59 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in agilon health.

We think agilon health is a good business. First off, its revenue growth was exceptional over the last five years. And while its operating margins reveal poor profitability compared to other healthcare companies, its rising cash profitability gives it more optionality. On top of that, its customer growth has been marvelous.

agilon health’s forward price-to-sales ratio is 0.1x. Looking at the healthcare landscape right now, agilon health trades at a pretty interesting price. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $0.99 on the company (compared to the current share price of $0.93), implying they see 6.5% upside in buying agilon health in the short term.