C3.ai (AI)

We wouldn’t recommend C3.ai. Its poor revenue growth shows demand is soft and its cash burn makes us question its business model.― StockStory Analyst Team

1. News

2. Summary

Why We Think C3.ai Will Underperform

Named after the three Cs of its original focus—carbon, cloud computing, and customer relationship management—C3.ai (NYSE:AI) provides enterprise AI software that helps organizations develop, deploy, and operate large-scale artificial intelligence applications across various industries.

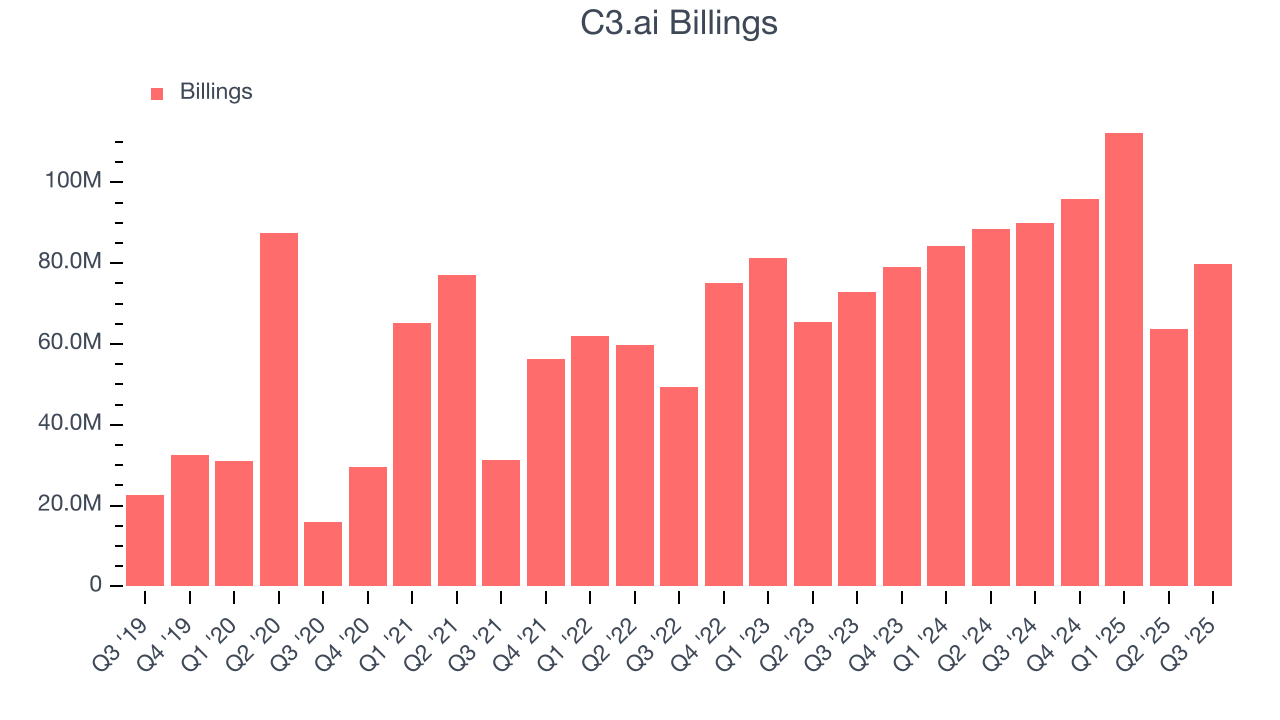

- Customers had second thoughts about committing to its platform over the last year as its average billings growth of 3.8% underwhelmed

- Projected sales decline of 10.4% for the next 12 months points to a tough demand environment ahead

- Gross margin of 51.8% reflects its high servicing costs

C3.ai falls short of our quality standards. We’re redirecting our focus to better businesses.

Why There Are Better Opportunities Than C3.ai

High Quality

Investable

Underperform

Why There Are Better Opportunities Than C3.ai

C3.ai’s stock price of $12.69 implies a valuation ratio of 5.7x forward price-to-sales. C3.ai’s multiple may seem like a great deal among software peers, but we think there are valid reasons why it’s this cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. C3.ai (AI) Research Report: Q3 CY2025 Update

Enterprise AI software company C3.ai (NYSE:AI) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 20.3% year on year to $75.15 million. The company expects next quarter’s revenue to be around $76 million, close to analysts’ estimates. Its non-GAAP loss of $0.25 per share was 24.8% above analysts’ consensus estimates.

C3.ai (AI) Q3 CY2025 Highlights:

- Revenue: $75.15 million vs analyst estimates of $75.03 million (20.3% year-on-year decline, in line)

- Adjusted EPS: -$0.25 vs analyst estimates of -$0.33 (24.8% beat)

- Adjusted Operating Income: -$42.22 million vs analyst estimates of -$52.63 million (-56.2% margin, 19.8% beat)

- Revenue Guidance for the full year is $299.5 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: -149%, down from -79.8% in the same quarter last year

- Free Cash Flow was -$46.88 million compared to -$34.3 million in the previous quarter

- Market Capitalization: $1.98 billion

Company Overview

Named after the three Cs of its original focus—carbon, cloud computing, and customer relationship management—C3.ai (NYSE:AI) provides enterprise AI software that helps organizations develop, deploy, and operate large-scale artificial intelligence applications across various industries.

The company's offerings are organized into three main product families: the C3 AI Platform, C3 AI Applications, and C3 Generative AI. The C3 AI Platform serves as the foundation for all the company's solutions, utilizing a model-driven architecture that enables customers to build AI applications without writing extensive code. This approach significantly reduces development time and complexity, allowing organizations to deploy enterprise-scale AI applications in as little as four weeks.

C3 AI Applications comprises a suite of pre-built, industry-specific AI solutions targeting high-value use cases across sectors like manufacturing, energy, financial services, defense, and supply chain management. Each application is designed to address specific business challenges, such as predictive maintenance, inventory optimization, fraud detection, or emissions management.

With its most recent addition, C3 Generative AI, the company has expanded its capabilities to include large language models and generative AI technologies. This solution allows users to access enterprise data through natural language interfaces while maintaining security controls and reducing the risk of AI "hallucinations" by connecting responses to verified data sources.

The company employs a consumption-based pricing model where customers either pay monthly fees based on computing resources used or enter into multi-period commitments. Its go-to-market strategy involves strategic partnerships with major technology providers like Google Cloud, AWS, Microsoft Azure, and industry specialists like Baker Hughes in the oil and gas sector, allowing C3.ai to extend its reach across global markets.

4. Data Infrastructure

Generating insights from system level data is an increasing priority for most businesses, but to do so requires connecting and analyzing piles of data stored and siloed in separate databases. This is the demand driver for cloud based data infrastructure software providers, who can more readily integrate, distribute and process information vs. legacy on-premise software providers.

C3.ai competes with large enterprise software providers like Microsoft (NASDAQ:MSFT), IBM (NYSE:IBM), and Oracle (NYSE:ORCL), cloud service providers offering AI platforms including Google (NASDAQ:GOOGL), Amazon (NASDAQ:AMZN), and specialized AI companies such as Palantir Technologies (NYSE:PLTR) and DataRobot.

5. Revenue Growth

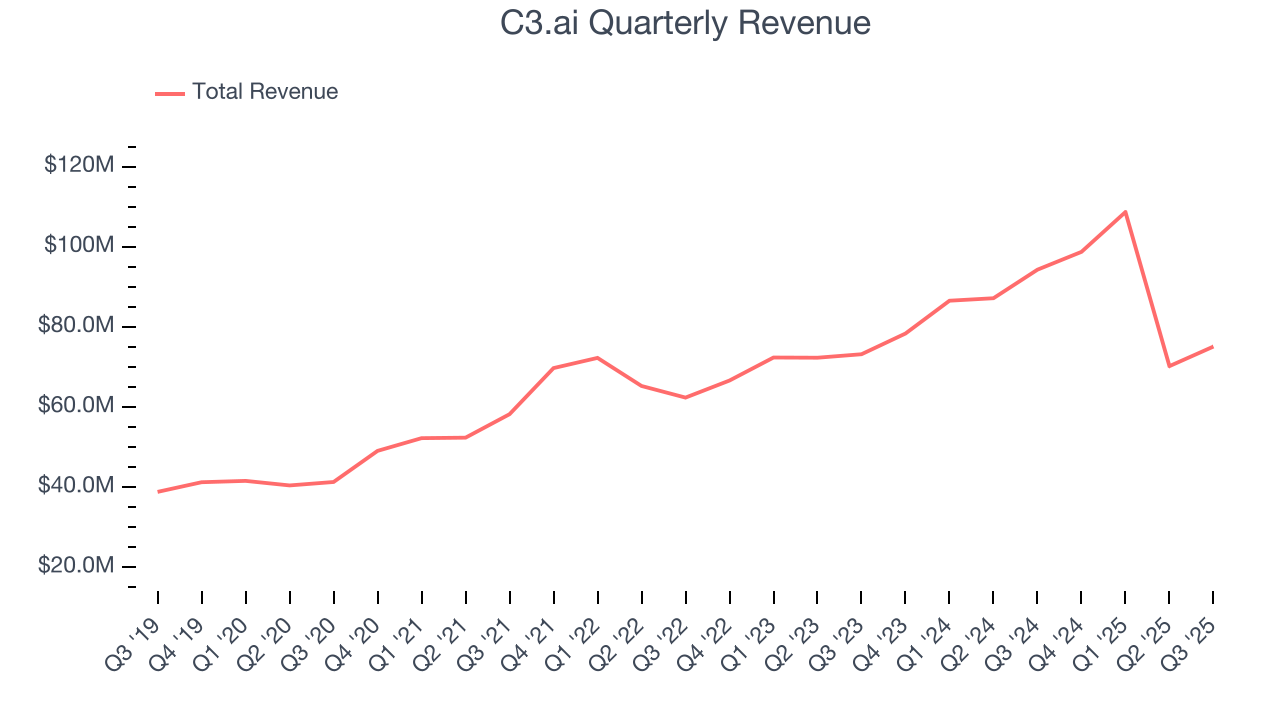

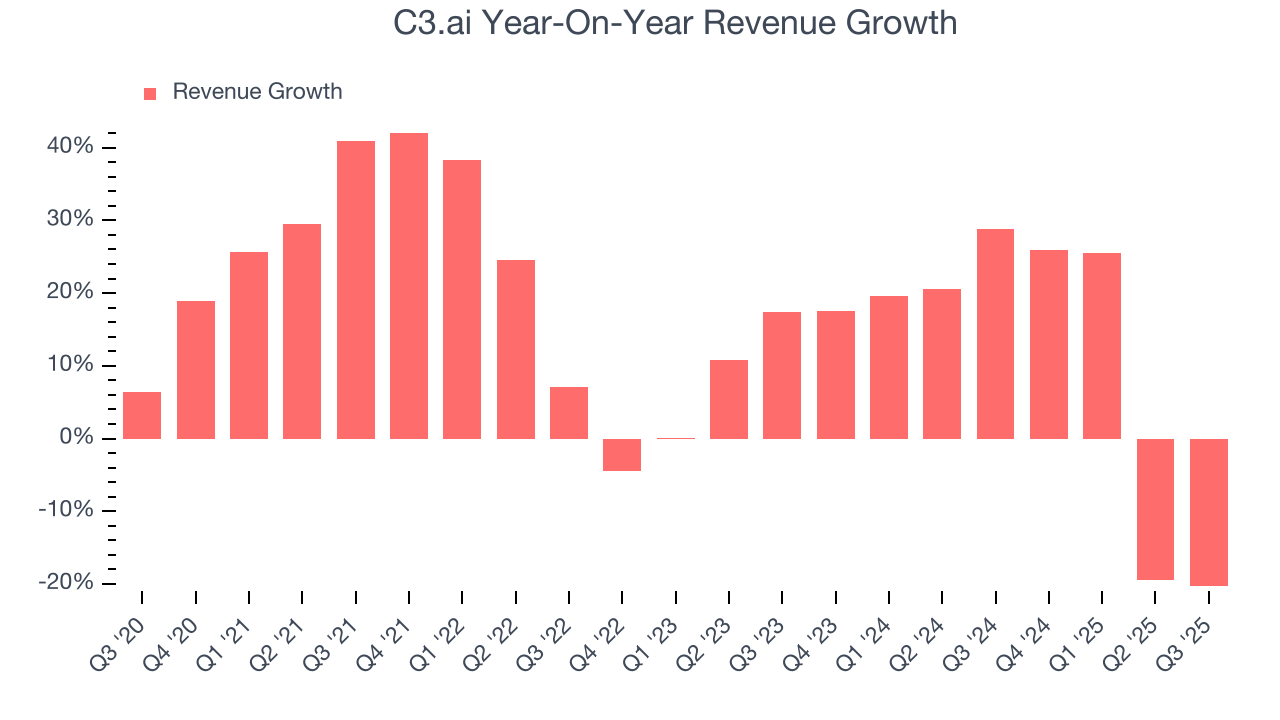

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, C3.ai grew its sales at a 16.5% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. C3.ai’s recent performance shows its demand has slowed as its annualized revenue growth of 11.3% over the last two years was below its five-year trend.

This quarter, C3.ai reported a rather uninspiring 20.3% year-on-year revenue decline to $75.15 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 23.1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 10.4% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

C3.ai’s billings came in at $79.9 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 3.8% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

C3.ai does a decent job acquiring new customers, and its CAC payback period checked in at 43.4 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

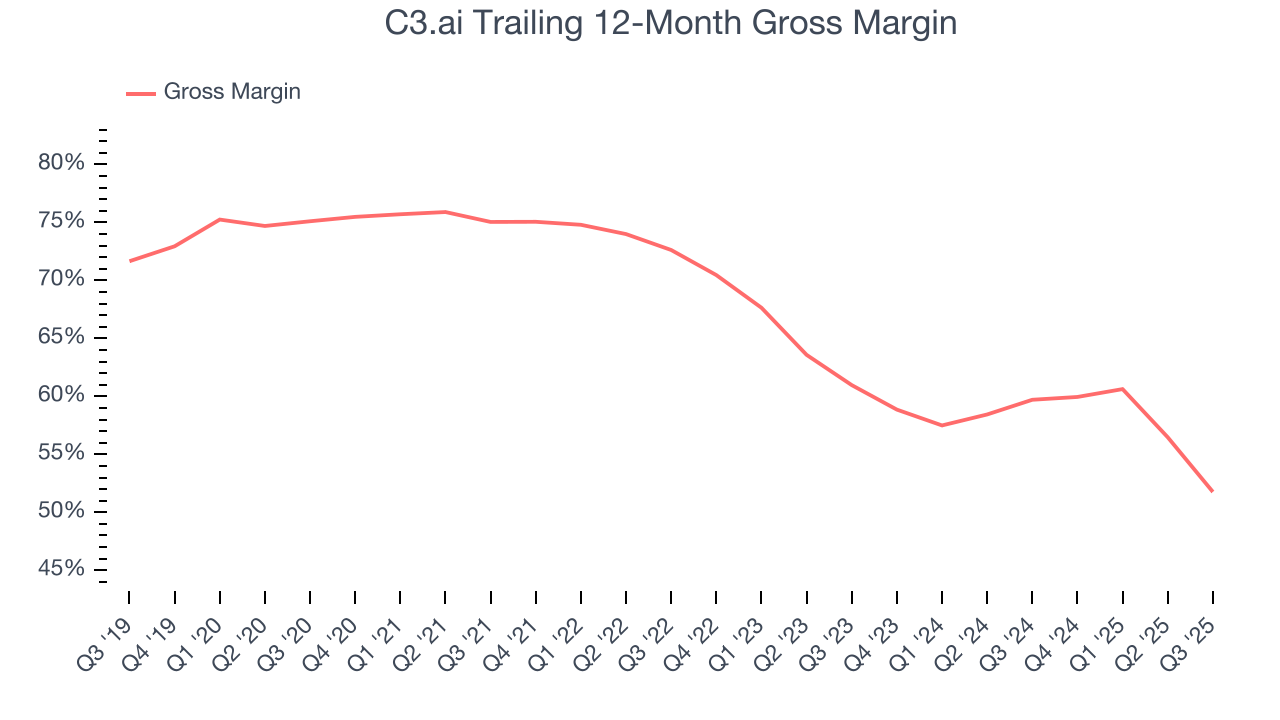

8. Gross Margin & Pricing Power

For software companies like C3.ai, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

C3.ai’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 51.8% gross margin over the last year. That means C3.ai paid its providers a lot of money ($48.24 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. C3.ai has seen gross margins decline by 9.2 percentage points over the last 2 year, which is among the worst in the software space.

This quarter, C3.ai’s gross profit margin was 40.4%, marking a 20.9 percentage point decrease from 61.3% in the same quarter last year. C3.ai’s full-year margin has also been trending down over the past 12 months, decreasing by 7.9 percentage points. If this move continues, it could suggest deteriorating pricing power and higher input costs.

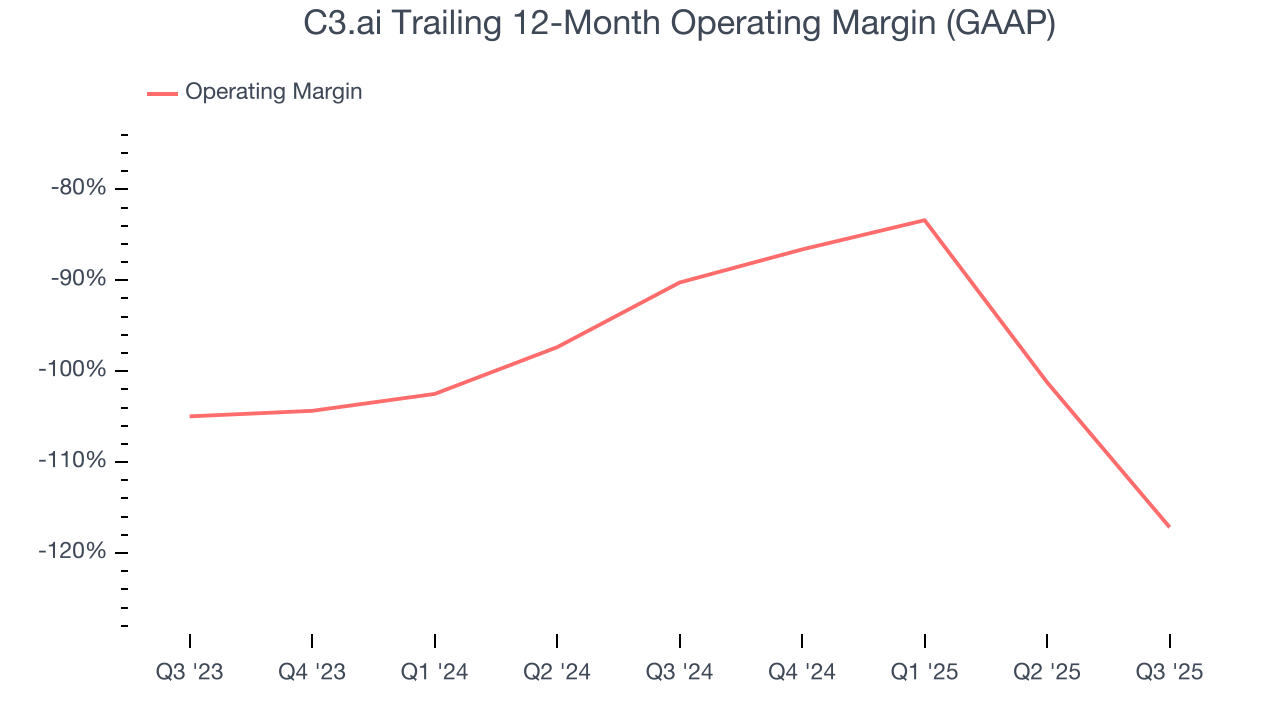

9. Operating Margin

C3.ai’s expensive cost structure has contributed to an average operating margin of negative 117% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if C3.ai reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Looking at the trend in its profitability, C3.ai’s operating margin decreased by 26.9 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. C3.ai’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, C3.ai generated a negative 149% operating margin. The company's consistent lack of profits raise a flag.

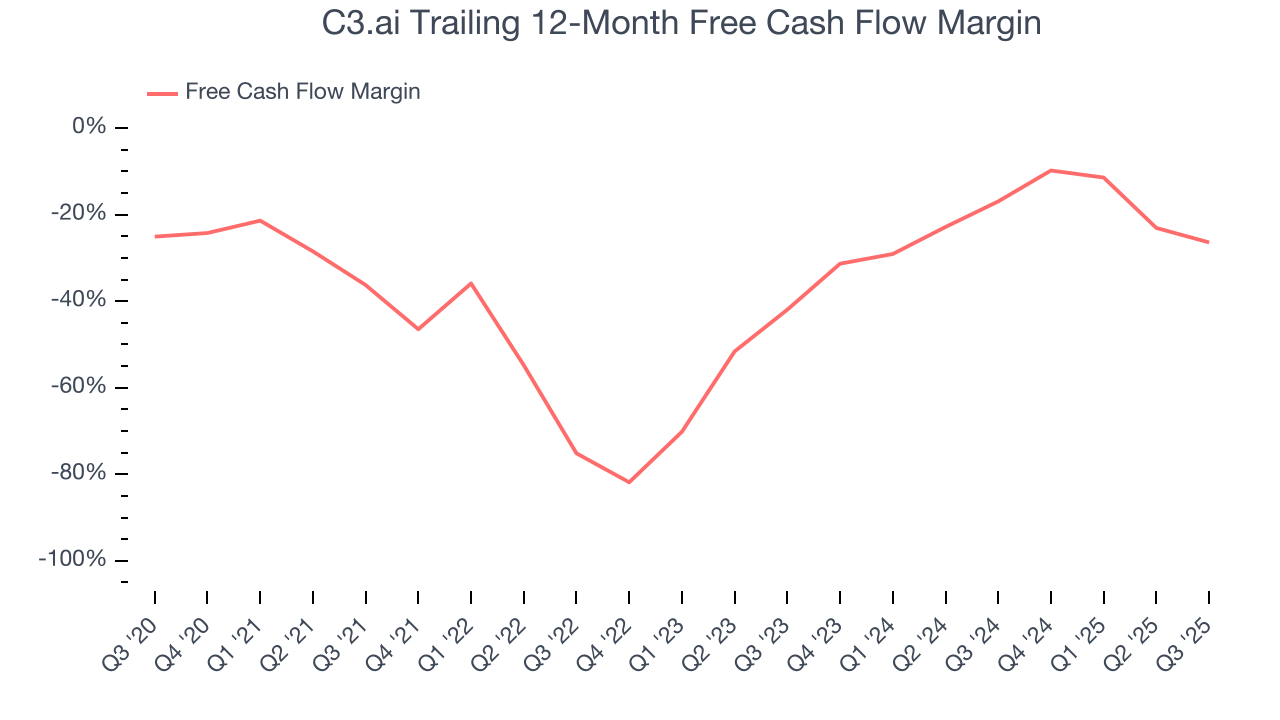

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

C3.ai’s demanding reinvestments have drained its resources over the last year, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 26.4%, meaning it lit $26.42 of cash on fire for every $100 in revenue.

C3.ai burned through $46.88 million of cash in Q3, equivalent to a negative 62.4% margin. The company’s cash burn was similar to its $39.51 million of lost cash in the same quarter last year.

Over the next year, analysts predict C3.ai’s cash burn will increase. Their consensus estimates imply its free cash flow margin of negative 26.4% for the last 12 months will fall to negative 32.5%.

11. Balance Sheet Assessment

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

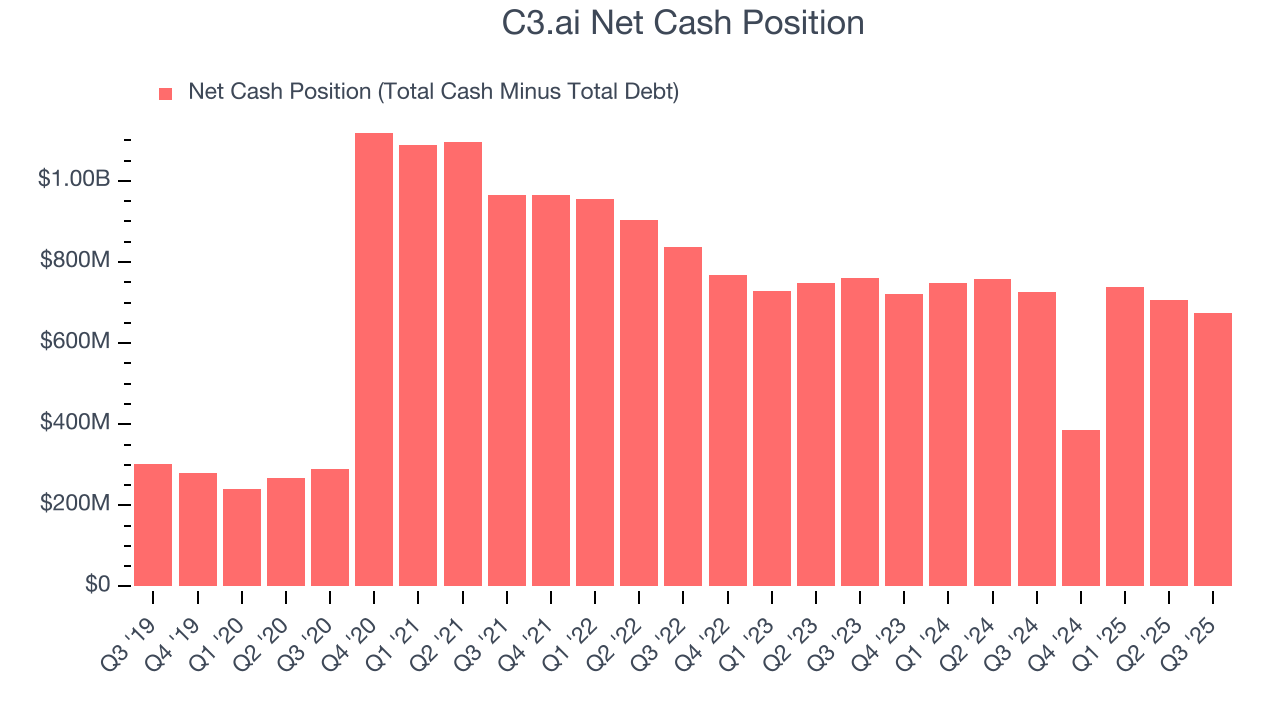

C3.ai burned through $93.23 million of cash over the last year. With $675 million of cash and no debt on its balance sheet, we think the company is in a strong financial position and has enough runway (we typically look for at least two years) to continue prioritizing growth over profitability.

12. Key Takeaways from C3.ai’s Q3 Results

We struggled to find many positives in these results. Overall, this was a softer quarter. The stock remained flat at $15.06 immediately following the results.

13. Is Now The Time To Buy C3.ai?

Updated: January 24, 2026 at 9:14 PM EST

Before deciding whether to buy C3.ai or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

We see the value of companies addressing major business pain points, but in the case of C3.ai, we’re out. First off, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its efficient sales strategy leads to fast integrations, the downside is its declining operating margin shows it’s becoming less efficient at building and selling its software. On top of that, its operating margins reveal poor profitability compared to other software companies.

C3.ai’s price-to-sales ratio based on the next 12 months is 5.7x. This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $14.67 on the company (compared to the current share price of $12.69).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.