Ally Financial (ALLY)

Ally Financial keeps us up at night. Its stalling sales and falling profitability suggest it’s struggling to scale down its costs as demand fades.― StockStory Analyst Team

1. News

2. Summary

Why We Think Ally Financial Will Underperform

Born from the former GMAC (General Motors Acceptance Corporation) and rebranded in 2010, Ally Financial (NYSE:ALLY) operates a digital-first bank offering auto financing, insurance, mortgage lending, and investment services to consumers and commercial clients.

- Sales over the last two years were less profitable as its earnings per share fell by 2.6% annually while its revenue was flat

- Products and services are facing end-market challenges during this cycle, as seen in its flat sales over the last two years

Ally Financial’s quality doesn’t meet our bar. There are more promising prospects in the market.

Why There Are Better Opportunities Than Ally Financial

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Ally Financial

Ally Financial’s stock price of $43.03 implies a valuation ratio of 8.9x forward P/E. This sure is a cheap multiple, but you get what you pay for.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Ally Financial (ALLY) Research Report: Q4 CY2025 Update

Digital banking company Ally Financial (NYSE:ALLY) missed Wall Street’s revenue expectations in Q4 CY2025 as sales only rose 1.7% year on year to $2.12 billion. Its non-GAAP profit of $1.09 per share was 6.5% above analysts’ consensus estimates.

Ally Financial (ALLY) Q4 CY2025 Highlights:

- Net Interest Margin: 3.5% vs analyst estimates of 3.6% (7.4 basis point miss)

- Revenue: $2.12 billion vs analyst estimates of $2.15 billion (1.7% year-on-year growth, 1.1% miss)

- Efficiency Ratio: 50.8% vs analyst estimates of 56.9% (610 basis point beat)

- Adjusted EPS: $1.09 vs analyst estimates of $1.02 (6.5% beat)

- Tangible Book Value per Share: $40.38 vs analyst estimates of $41.10 (12.4% year-on-year growth, 1.7% miss)

- Market Capitalization: $13.07 billion

Company Overview

Born from the former GMAC (General Motors Acceptance Corporation) and rebranded in 2010, Ally Financial (NYSE:ALLY) operates a digital-first bank offering auto financing, insurance, mortgage lending, and investment services to consumers and commercial clients.

Ally's business model centers around its branchless, digital banking platform, which has grown to serve approximately 3 million primary deposit customers across savings accounts, money market accounts, certificates of deposit, and interest-bearing checking accounts. This digital-only approach has helped Ally become the largest online-only bank in the United States by retail deposit balances.

The company's automotive finance division represents a significant portion of its business, providing loans and leases to consumers purchasing vehicles, as well as floorplan financing that helps dealers maintain their inventory. Ally maintains relationships with roughly 22,000 automotive dealers nationwide, including both traditional franchised dealerships and emerging online retailers like Carvana. The company has evolved beyond its historical ties to General Motors to finance vehicles across numerous brands.

Complementing its auto financing, Ally's insurance segment offers vehicle service contracts and guaranteed asset protection to consumers, while also providing commercial insurance that protects dealers' vehicle inventories. The mortgage finance division purchases jumbo and low-to-moderate income loans while offering direct-to-consumer mortgages through its Ally Home platform.

Ally's corporate finance business provides senior-secured loans to middle-market companies owned by private equity sponsors, typically supporting leveraged buyouts, refinancings, and acquisitions. The company has also expanded into additional financial services through Ally Invest (its digital brokerage platform offering self-directed trading and robo-advisory services) and Ally Credit Card, which serves approximately 1.2 million customers.

4. Auto Loan

Auto loan providers finance vehicle purchases for consumers and businesses. They benefit from steady vehicle demand, higher average vehicle prices requiring financing, and opportunities in used car financing. Headwinds include economic cycle sensitivity affecting repayment ability, competition from dealership financing programs, and potential disruption from vehicle subscription services reducing traditional ownership models.

Ally Financial competes with traditional banks like JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), and Wells Fargo (NYSE:WFC), as well as other digital-first financial institutions such as Capital One (NYSE:COF) and Discover Financial (NYSE:DFS). In auto lending specifically, Ally faces competition from captive finance companies owned by automakers, credit unions, and specialized auto lenders like Santander Consumer USA.

5. Revenue Growth

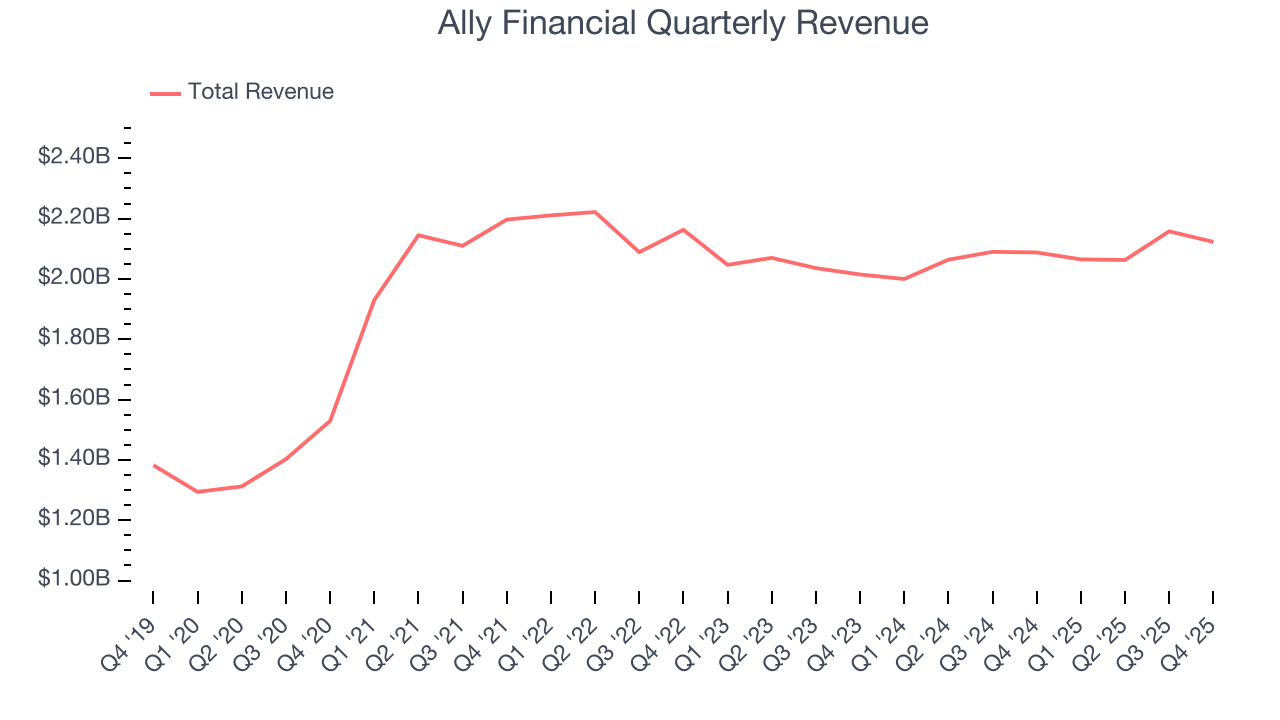

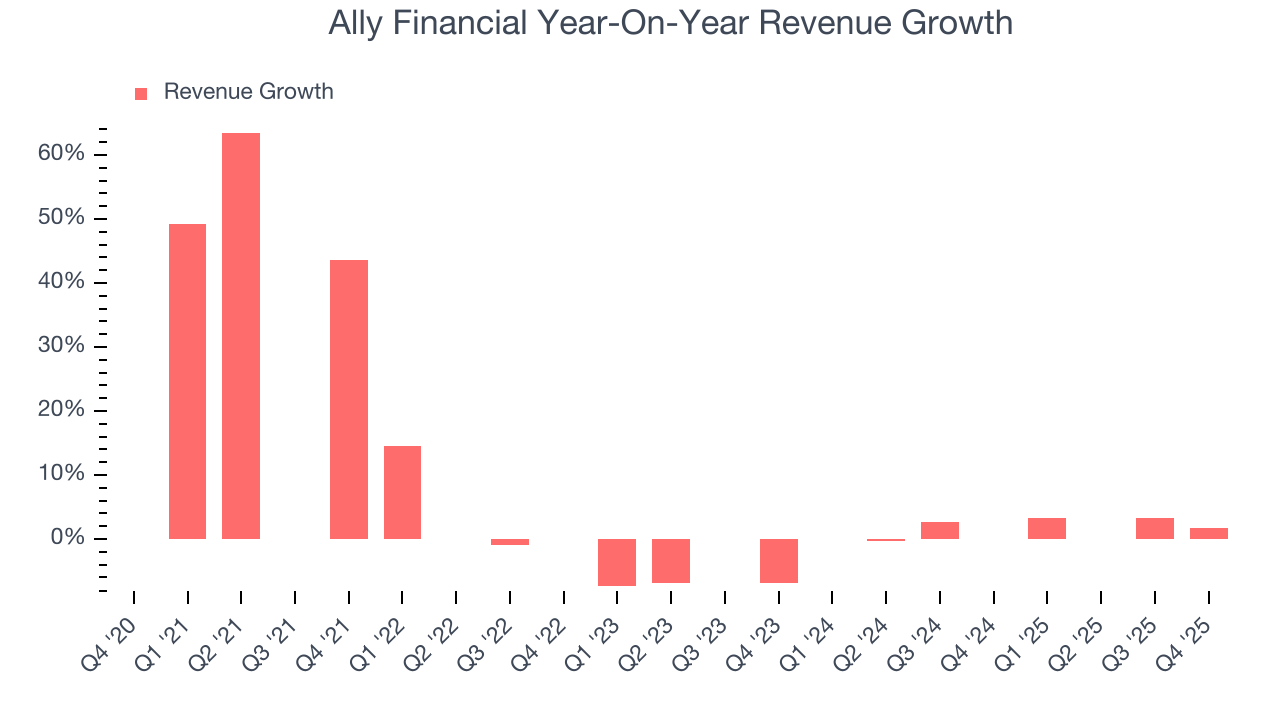

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Ally Financial’s revenue grew at a decent 8.7% compounded annual growth rate over the last five years. Its growth was slightly above the average financials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Ally Financial’s recent performance shows its demand has slowed as its annualized revenue growth of 1.5% over the last two years was below its five-year trend.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Ally Financial’s revenue grew by 1.7% year on year to $2.12 billion, falling short of Wall Street’s estimates.

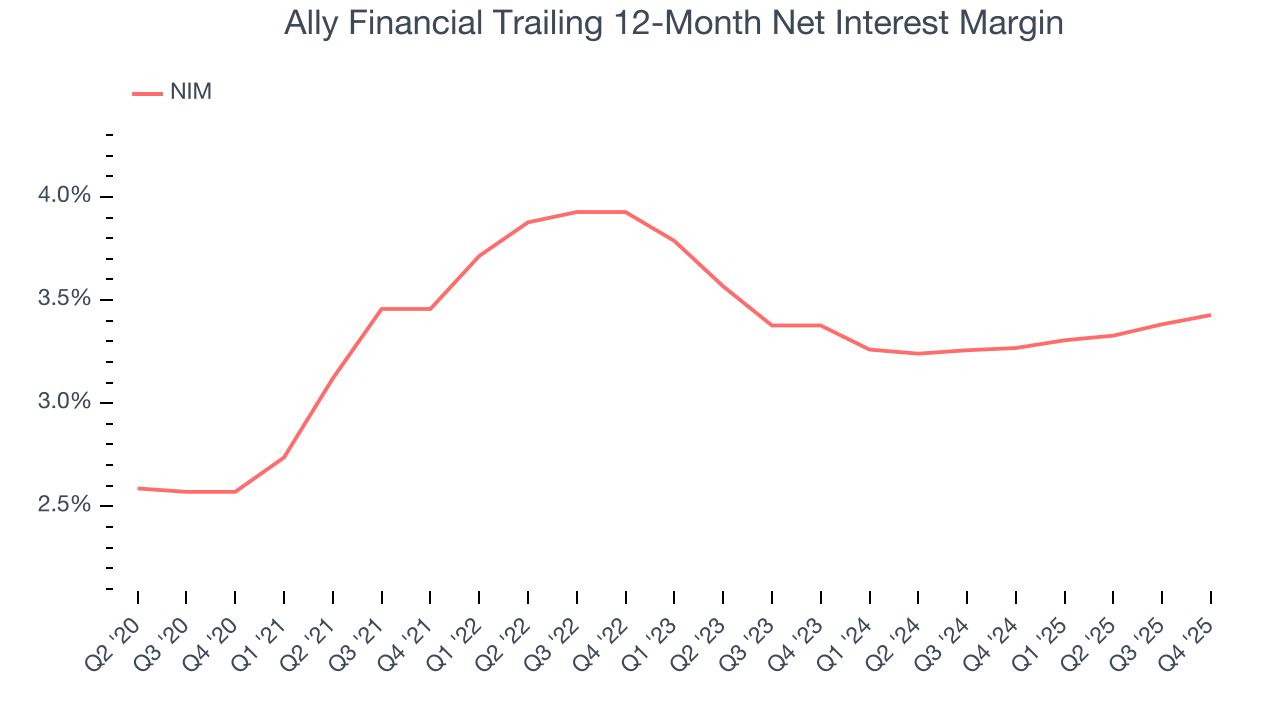

6. Net Interest Margin

Net interest margin (NIM) represents how much a financial institution earns in relation to its outstanding loans. It's one of the most important metrics to track because it shows how a bank's loans are performing and whether it has the ability to command higher premiums for its services.

Ally Financial’s net interest margin has increased by 85.7 and 5.1 basis points (100 basis points = 1 percentage point) over the last five and two years, respectively. Although the longer-term number is reassuring, the two-year change was worse than the financials industry. The firm’s NIM for the trailing 12 months was 3.4%.

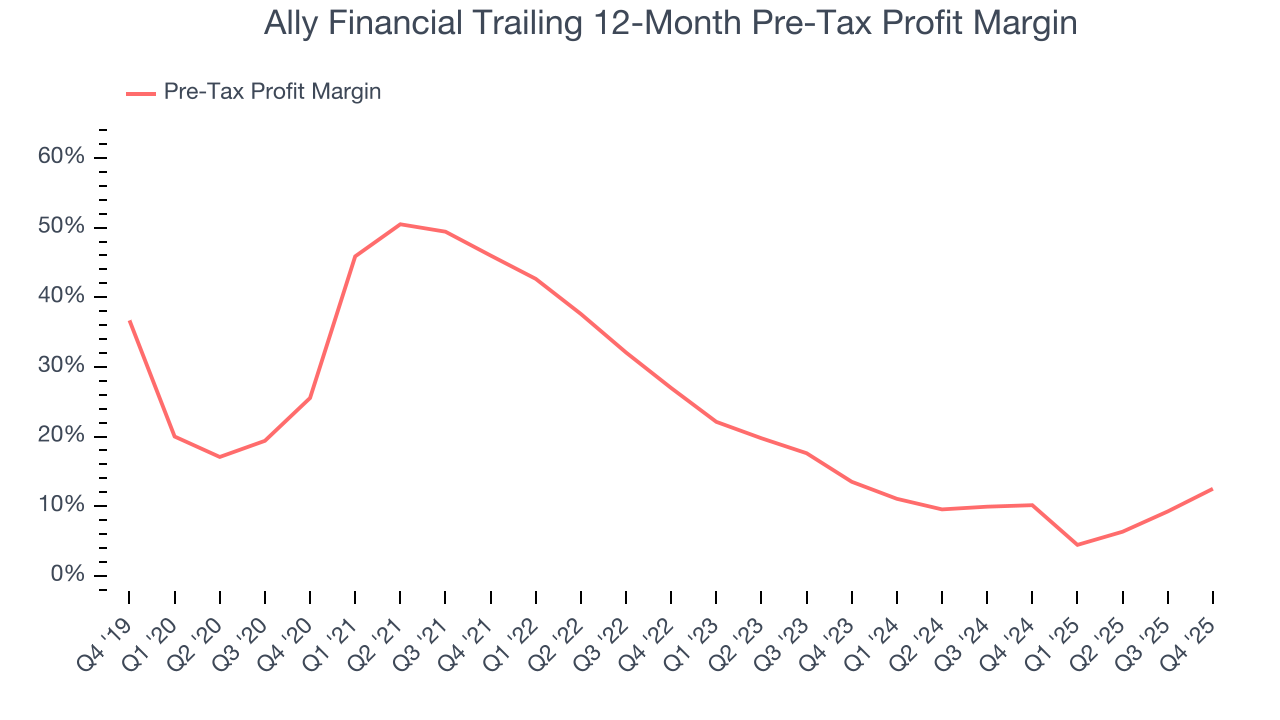

7. Pre-Tax Profit Margin

Revenue growth is one major determinant of business quality, and the efficiency of operations is another. For Auto Loan companies, we look at pre-tax profit rather than the operating margin that defines sectors such as consumer, tech, and industrials.

The pre-tax profit margin includes interest because it's central to how financial institutions generate revenue and manage costs. Tax considerations are excluded since they represent government policy rather than operational performance, giving investors a clearer view of business fundamentals.

Over the last five years, Ally Financial’s pre-tax profit margin has risen by 13 percentage points, going from 46% to 12.5%. It has also declined by 1 percentage points on a two-year basis, showing its expenses have consistently increased at a faster rate than revenue. This usually raises questions unless the company is in high-growth mode and reinvesting its profits into attractive ventures.

In Q4, Ally Financial’s pre-tax profit margin was 18.2%. This result was 13 percentage points better than the same quarter last year.

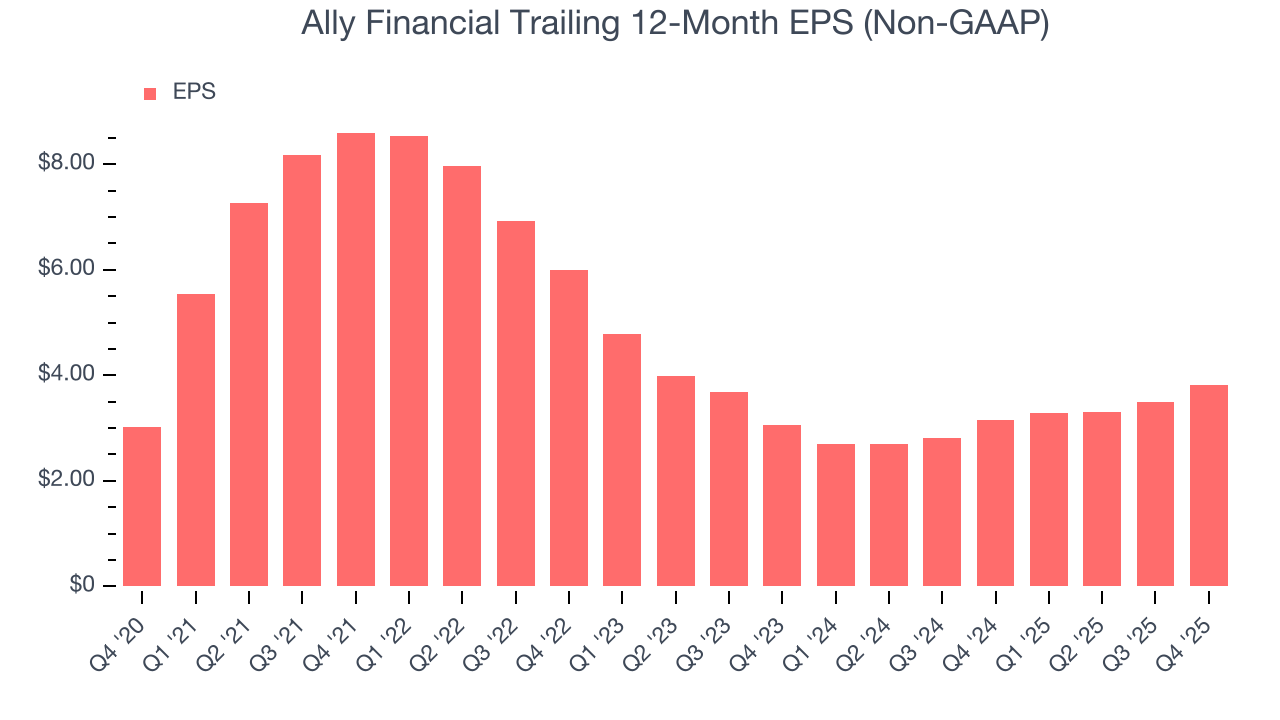

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Ally Financial’s EPS grew at a weak 4.8% compounded annual growth rate over the last five years, lower than its 8.7% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded due to factors such as interest expenses and taxes.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Ally Financial, its two-year annual EPS growth of 11.6% was higher than its five-year trend. Accelerating earnings growth is almost always an encouraging data point.

In Q4, Ally Financial reported adjusted EPS of $1.09, up from $0.78 in the same quarter last year. This print beat analysts’ estimates by 6.5%. Over the next 12 months, Wall Street expects Ally Financial’s full-year EPS of $3.81 to grow 41.3%.

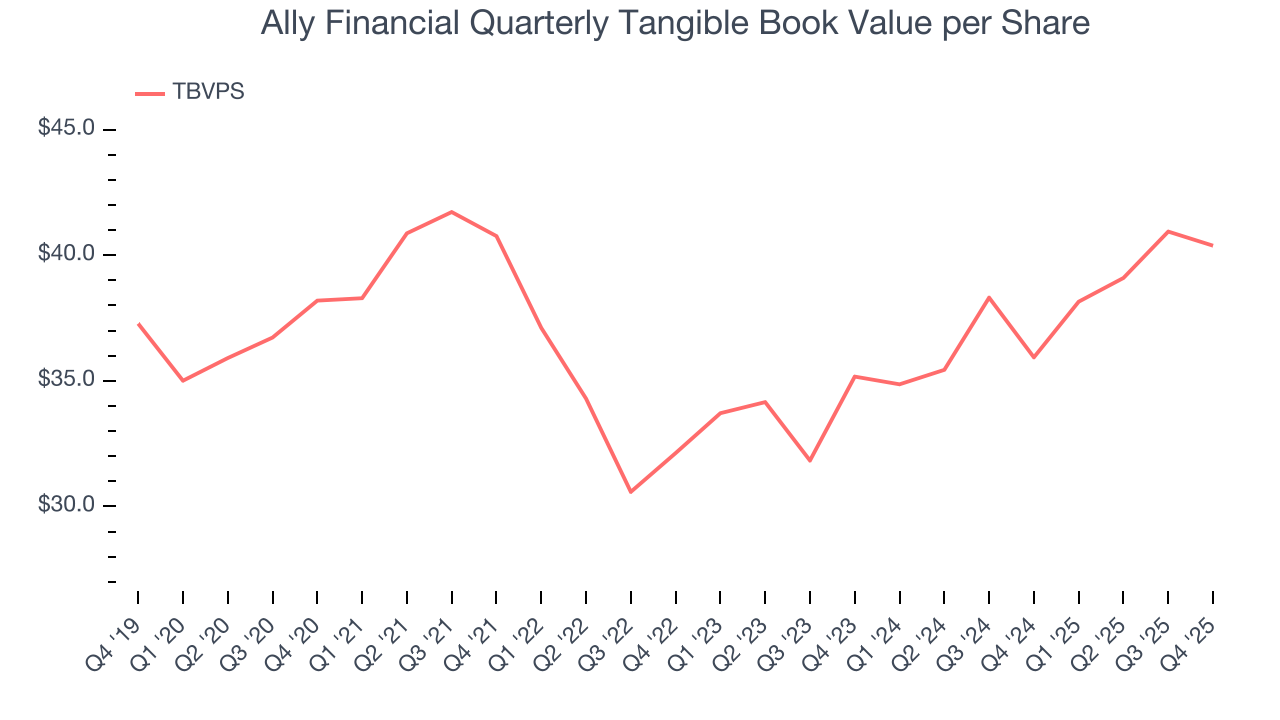

9. Tangible Book Value Per Share (TBVPS)

Financial firms are valued based on their balance sheet strength and ability to compound book value across diverse business lines.

Because of this, tangible book value per share (TBVPS) emerges as the critical performance benchmark for the sector. This metric captures real, liquid net worth per share that reflects the institution’s overall financial health across all business lines. On the other hand, EPS is often distorted by the diverse nature of operations, mergers, and various accounting treatments across different business units. Book value provides clearer performance insights.

Ally Financial’s TBVPS grew at a weak 1.1% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 7.2% annually over the last two years from $35.17 to $40.38 per share.

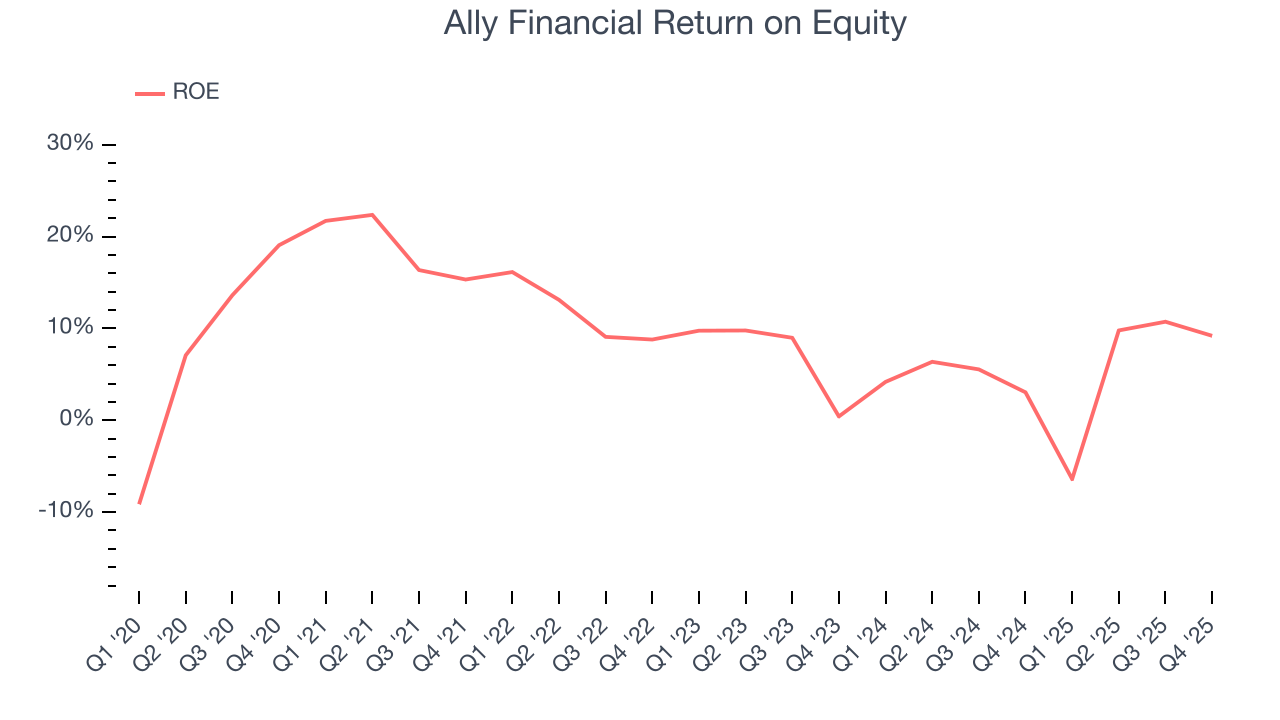

10. Return on Equity

Return on equity, or ROE, quantifies bank profitability relative to shareholder equity - an essential capital source for these institutions. Over extended periods, superior ROE performance drives faster shareholder wealth compounding through reinvestment, share repurchases, and dividend growth.

Over the last five years, Ally Financial has averaged an ROE of 9.7%, uninspiring for a company operating in a sector where the average shakes out around 10%.

11. Balance Sheet Risk

Leverage is core to a financial firm’s business model (loans funded by deposits). To ensure economic stability and avoid a repeat of the 2008 GFC, regulators require certain levels of capital and liquidity, focusing on the Tier 1 capital ratio.

Tier 1 capital is the highest-quality capital that a firm holds, consisting primarily of common stock and retained earnings, but also physical gold. It serves as the primary cushion against losses and is the first line of defense in times of financial distress.

This capital is divided by risk-weighted assets to derive the Tier 1 capital ratio. Risk-weighted means that cash and US treasury securities are assigned little risk while unsecured consumer loans and equity investments get much higher risk weights, for example.

New regulation after the 2008 financial crisis requires that all firms must maintain a Tier 1 capital ratio greater than 4.5%. On top of this, there are additional buffers based on scale, risk profile, and other regulatory classifications, so that at the end of the day, firms generally must maintain a 7-10% ratio at minimum.

Over the last two years, Ally Financial has averaged a Tier 1 capital ratio of 9.7%, which is considered unsafe in the event of a black swan or if macro or market conditions suddenly deteriorate. For this reason alone, we will be crossing it off our shopping list.

12. Key Takeaways from Ally Financial’s Q4 Results

It was good to see Ally Financial beat analysts’ EPS expectations this quarter. On the other hand, its efficiency ratio missed and its net interest margin fell short of Wall Street’s estimates. Zooming out, we think this was a mixed quarter. The stock remained flat at $42 immediately following the results.

13. Is Now The Time To Buy Ally Financial?

Updated: January 21, 2026 at 7:59 AM EST

When considering an investment in Ally Financial, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

Ally Financial doesn’t pass our quality test. Although its revenue growth was decent over the last five years and Wall Street believes it will continue to grow, its declining pre-tax profit margin shows the business has become less efficient. And while the company’s expanding net interest margin shows its loan book is becoming more profitable, the downside is its TBVPS growth was weak over the last five years.

Ally Financial’s P/E ratio based on the next 12 months is 7.9x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $52.94 on the company (compared to the current share price of $42).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.