AMC Entertainment (AMC)

We’re skeptical of AMC Entertainment. Its poor sales growth shows demand is soft and its negative returns on capital suggest it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think AMC Entertainment Will Underperform

With a profile that was raised due to meme stock mania beginning in 2021, AMC Entertainment (NYSE:AMC) operates movie theaters primarily in the US and Europe.

- Suboptimal cost structure is highlighted by its history of operating margin losses

- Negative free cash flow raises questions about the return timeline for its investments

- Short cash runway increases the probability of a capital raise that dilutes existing shareholders

AMC Entertainment doesn’t pass our quality test. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than AMC Entertainment

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AMC Entertainment

AMC Entertainment is trading at $1.17 per share, or 14.4x forward EV-to-EBITDA. Not only does AMC Entertainment trade at a premium to companies in the consumer discretionary space, but this multiple is also high for its top-line growth.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. AMC Entertainment (AMC) Research Report: Q4 CY2025 Update

Theater company AMC Entertainment (NYSE:AMC) reported Q4 CY2025 results exceeding the market’s revenue expectations, but sales fell by 1.4% year on year to $1.29 billion. Its non-GAAP loss of $0.18 per share was 28% above analysts’ consensus estimates.

AMC Entertainment (AMC) Q4 CY2025 Highlights:

- Revenue: $1.29 billion vs analyst estimates of $1.28 billion (1.4% year-on-year decline, 1% beat)

- Adjusted EPS: -$0.18 vs analyst estimates of -$0.25 (28% beat)

- Adjusted EBITDA: $134.1 million vs analyst estimates of $121 million (10.4% margin, 10.8% beat)

- Operating Margin: 0%, in line with the same quarter last year

- Free Cash Flow Margin: 3.4%, down from 8.7% in the same quarter last year

- Market Capitalization: $616.7 million

Company Overview

With a profile that was raised due to meme stock mania beginning in 2021, AMC Entertainment (NYSE:AMC) operates movie theaters primarily in the US and Europe.

The company was founded in 1920 in Kansas City by the Dubinsky Brothers as a single movie theater. In the early 1960s, AMC revolutionized the cinema industry by introducing the concept of multiplex theaters—multiple screens under one roof—allowing for more movie screenings in one location.

Throughout the 2000s and 2010s, AMC grew through several acquisitions, including the purchase of Loews Cineplex, Carmike Cinemas, and Odeon & UCI Cinemas. Today, AMC revolves around box office ticket sales for blockbuster films, indie movies, and special screenings. Concessions are the next largest revenue source, offering snacks and beverages like popcorn, candy, and sodas to moviegoers. AMC also offers premium movie experiences such as 3D screenings, which come with higher ticket prices and appeal to an audience willing to pay up for a premium viewing experience.

Unsurprisingly, AMC was hit hard during COVID. Lockdowns closed theaters, sending revenues plummeting. Since the company has fixed costs such as rent and administrative expenses, margins went meaningfully negative for a period.

As mentioned, AMC began making headlines due to its ongoing volatility as a meme stock beginning in 2021. The movement was driven by retail investors on social media platforms like Reddit, who coordinated to drive up the stock prices of companies that were heavily shorted by institutional investors. AMC, struggling financially at the time due to the pandemic’s devastating impact on theaters, became one of the key targets of this movement.

4. Consumer Discretionary - Leisure Facilities

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Leisure facilities companies own and operate theme parks, fitness centers, bowling alleys, and other venue-based entertainment destinations, generating revenue from admissions, memberships, and on-site spending. Tailwinds include consumer preference for experiential spending, tourism recovery, and technology-enhanced guest experiences that support premium pricing. Headwinds are notable: high fixed costs, such as real estate, labor, and maintenance, make profitability highly sensitive to attendance fluctuations during economic slowdowns. Weather, pandemics, and safety incidents can disrupt operations unpredictably. Rising construction and labor costs inflate expansion budgets, while competition from at-home entertainment alternatives and other experiential options limits pricing power in many markets.

Competitors in the theater and cinema space include Cinemark (NYSE:CNK), IMAX (NYSE:IMAX), and private competitors such as Alamo Drafthouse Cinema and Landmark Theaters.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, AMC Entertainment grew its sales at a 31.3% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. AMC Entertainment’s recent performance shows its demand has slowed as its revenue was flat over the last two years. Note that COVID hurt AMC Entertainment’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

This quarter, AMC Entertainment’s revenue fell by 1.4% year on year to $1.29 billion but beat Wall Street’s estimates by 1%.

Looking ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Operating Margin

AMC Entertainment’s operating margin has been trending up over the last 12 months, but it still averaged negative 1% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, AMC Entertainment’s breakeven margin was 0%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

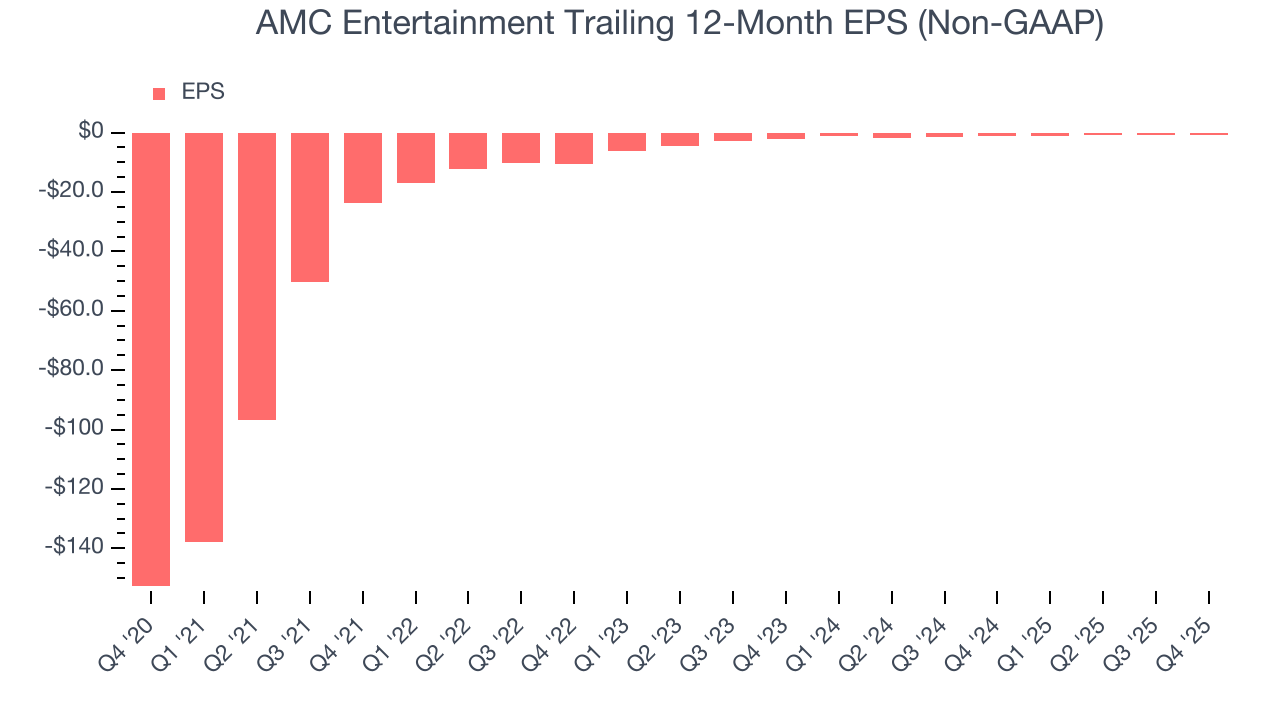

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although AMC Entertainment’s full-year earnings are still negative, it reduced its losses and improved its EPS by 63.7% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

In Q4, AMC Entertainment reported adjusted EPS of negative $0.18, in line with the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects AMC Entertainment to improve its earnings losses. Analysts forecast its full-year EPS of negative $0.97 will advance to negative $0.59.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

While AMC Entertainment posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, AMC Entertainment’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 7%, meaning it lit $6.98 of cash on fire for every $100 in revenue.

AMC Entertainment’s free cash flow clocked in at $43.3 million in Q4, equivalent to a 3.4% margin. The company’s cash profitability regressed as it was 5.4 percentage points lower than in the same quarter last year, but it’s still above its two-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends trump temporary fluctuations.

Over the next year, analysts predict AMC Entertainment will continue burning cash, albeit to a lesser extent. Their consensus estimates imply its free cash flow margin of negative 7.5% for the last 12 months will increase to negative 1.6%.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

AMC Entertainment’s five-year average ROIC was negative 11.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, AMC Entertainment’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

10. Balance Sheet Risk

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

AMC Entertainment burned through $365.9 million of cash over the last year, and its $8.14 billion of debt exceeds the $428.5 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the AMC Entertainment’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of AMC Entertainment until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

11. Key Takeaways from AMC Entertainment’s Q4 Results

It was good to see AMC Entertainment beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its adjusted operating income missed. Overall, this print had some key positives. The stock remained flat at $1.17 immediately after reporting.

12. Is Now The Time To Buy AMC Entertainment?

Updated: March 9, 2026 at 12:41 AM EDT

When considering an investment in AMC Entertainment, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

AMC Entertainment isn’t a terrible business, but it doesn’t pass our bar. While its projected EPS for the next year implies the company will continue generating shareholder value, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

AMC Entertainment’s EV-to-EBITDA ratio based on the next 12 months is 14.4x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $1.72 on the company (compared to the current share price of $1.17).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.