Amentum (AMTM)

We’re skeptical of Amentum. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why Amentum Is Not Exciting

With operations spanning approximately 80 countries and a workforce of specialized engineers and technical experts, Amentum Holdings (NYSE:AMTM) provides advanced engineering and technology solutions to U.S. government agencies, allied governments, and commercial enterprises across defense, energy, and space sectors.

- Projected sales are flat for the next 12 months, implying demand will slow from its two-year trend

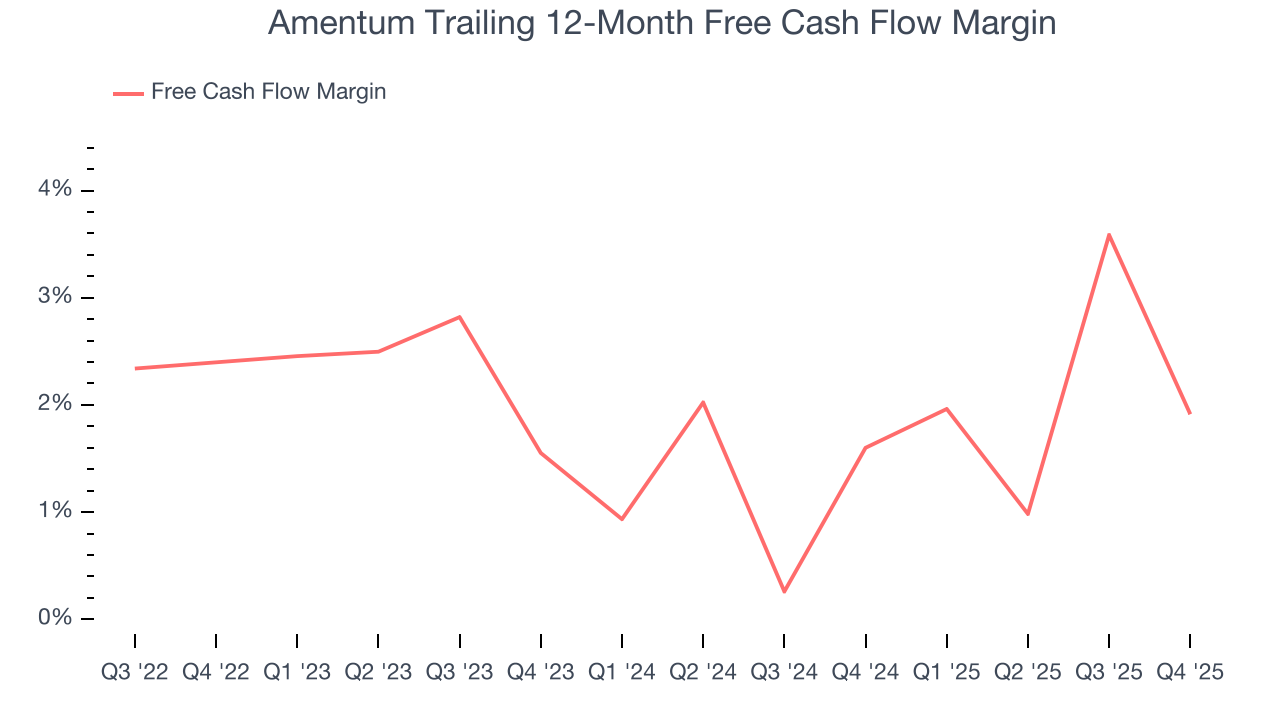

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

- On the plus side, its unparalleled revenue scale of $14.21 billion gives it an edge in distribution

Amentum doesn’t meet our quality standards. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than Amentum

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Amentum

At $30 per share, Amentum trades at 12.3x forward P/E. Amentum’s valuation may seem like a bargain, especially when stacked up against other business services companies. We remind you that you often get what you pay for, though.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Amentum (AMTM) Research Report: Q4 CY2025 Update

Government engineering solutions provider Amentum Holdings (NYSE:AMTM) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 5.2% year on year to $3.24 billion. The company’s full-year revenue guidance of $14.13 billion at the midpoint came in 0.5% below analysts’ estimates. Its non-GAAP profit of $0.54 per share was 4.4% above analysts’ consensus estimates.

Amentum (AMTM) Q4 CY2025 Highlights:

- Revenue: $3.24 billion vs analyst estimates of $3.32 billion (5.2% year-on-year decline, 2.5% miss)

- Adjusted EPS: $0.54 vs analyst estimates of $0.52 (4.4% beat)

- Adjusted EBITDA: $263 million vs analyst estimates of $256 million (8.1% margin, 2.8% beat)

- The company reconfirmed its revenue guidance for the full year of $14.13 billion at the midpoint

- Management reiterated its full-year Adjusted EPS guidance of $2.35 at the midpoint

- EBITDA guidance for the full year is $1.12 billion at the midpoint, in line with analyst expectations

- Operating Margin: 4.3%, up from 3.2% in the same quarter last year

- Free Cash Flow was -$142 million, down from $102 million in the same quarter last year

- Backlog: $47.2 billion at quarter end

- Market Capitalization: $8.92 billion

Company Overview

With operations spanning approximately 80 countries and a workforce of specialized engineers and technical experts, Amentum Holdings (NYSE:AMTM) provides advanced engineering and technology solutions to U.S. government agencies, allied governments, and commercial enterprises across defense, energy, and space sectors.

Amentum serves as a critical partner for government agencies tackling complex technical challenges. The company's services cover the entire lifecycle of government programs, from design and development to operations and sustainment. Its work is divided across several key capability areas that align with national priorities.

In environmental solutions, Amentum manages large-scale remediation projects at sites like Savannah River and Hanford, cleaning up radioactive and hazardous materials from legacy nuclear programs. The company also develops technologies for energy transition, including work on advanced modular reactors and small modular reactors with various manufacturers.

For space programs, Amentum delivers "launch to landing" solutions for NASA and other agencies. This includes ground systems development, launch operations, satellite payload engineering, and mission support services. The company holds major contracts like NASA's Consolidated Operations, Management, Engineering and Test (COMET) program.

In the intelligence and cybersecurity domain, Amentum provides specialized services to the Intelligence Community and Department of Defense. These include intelligence analytics, threat recognition, cybersecurity operations, and digital engineering solutions that help agencies modernize their information systems and protect critical infrastructure.

Amentum also excels in Research, Development, Test and Evaluation (RDT&E), helping military and civilian agencies develop and test new technologies. This includes creating virtual environments for simulating system performance and providing engineering support for test infrastructure.

The company generates revenue primarily through government contracts, with approximately 90% coming directly from U.S. federal agencies. It also serves international customers, particularly in the United Kingdom and Australia, where it supports defense and energy programs.

4. Government & Technical Consulting

The sector has historically benefitted from steady government spending on defense, infrastructure, and regulatory compliance, providing firms long-term contract stability. However, the Trump administration is showing more willingness than previous administrations to upend government spending and bloat. Whether or not defense budgets get cut, the rising demand for cybersecurity, AI-driven defense solutions, and sustainability consulting should benefit the sector for years, as agencies and enterprises seek expertise in navigating complex technology and regulations. Additionally, industrial automation and digital engineering are driving efficiency gains in infrastructure and technical consulting projects, which could help profit margins.

Amentum's competitors include major government contractors such as Booz Allen Hamilton, Leidos Holdings, SAIC, KBR, CACI International, and Parsons Corporation. In certain markets, it also competes with large defense contractors like Lockheed Martin, Northrop Grumman, and RTX Corporation, as well as specialized environmental services firms like Fluor Corporation and Bechtel.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $14.21 billion in revenue over the past 12 months, Amentum is a behemoth in the business services sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. To expand meaningfully, Amentum likely needs to tweak its prices, innovate with new offerings, or enter new markets.

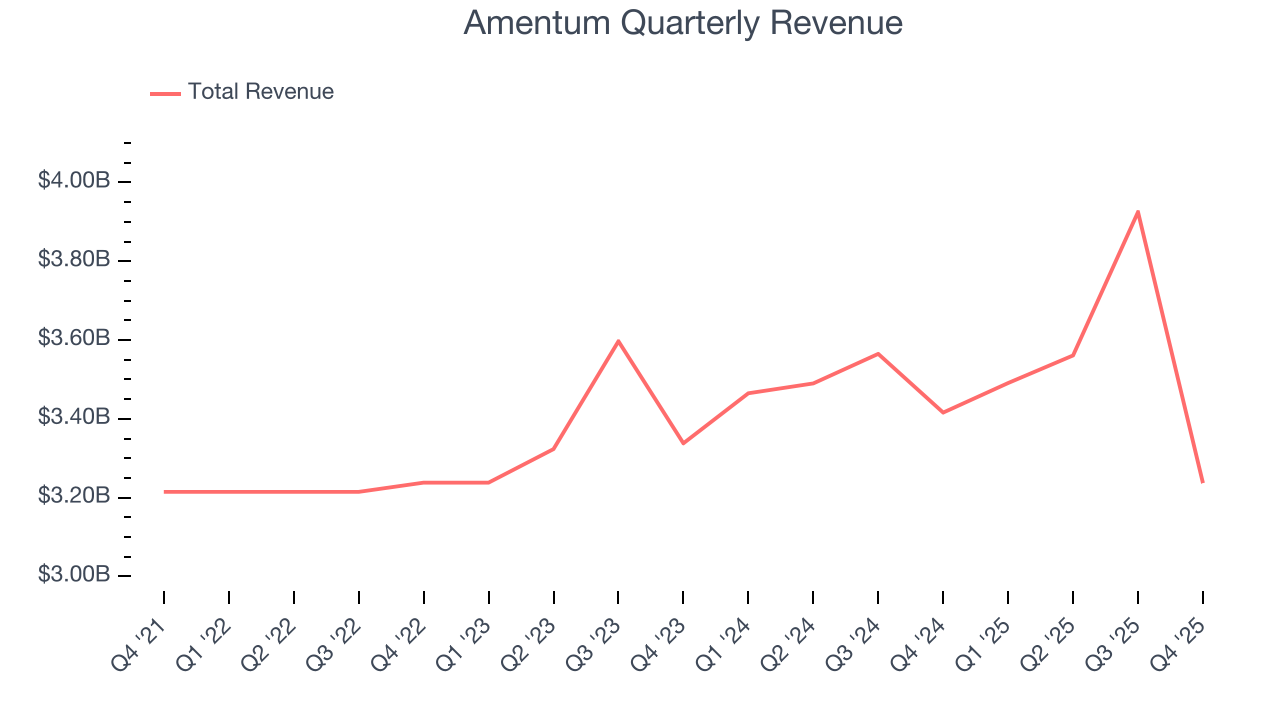

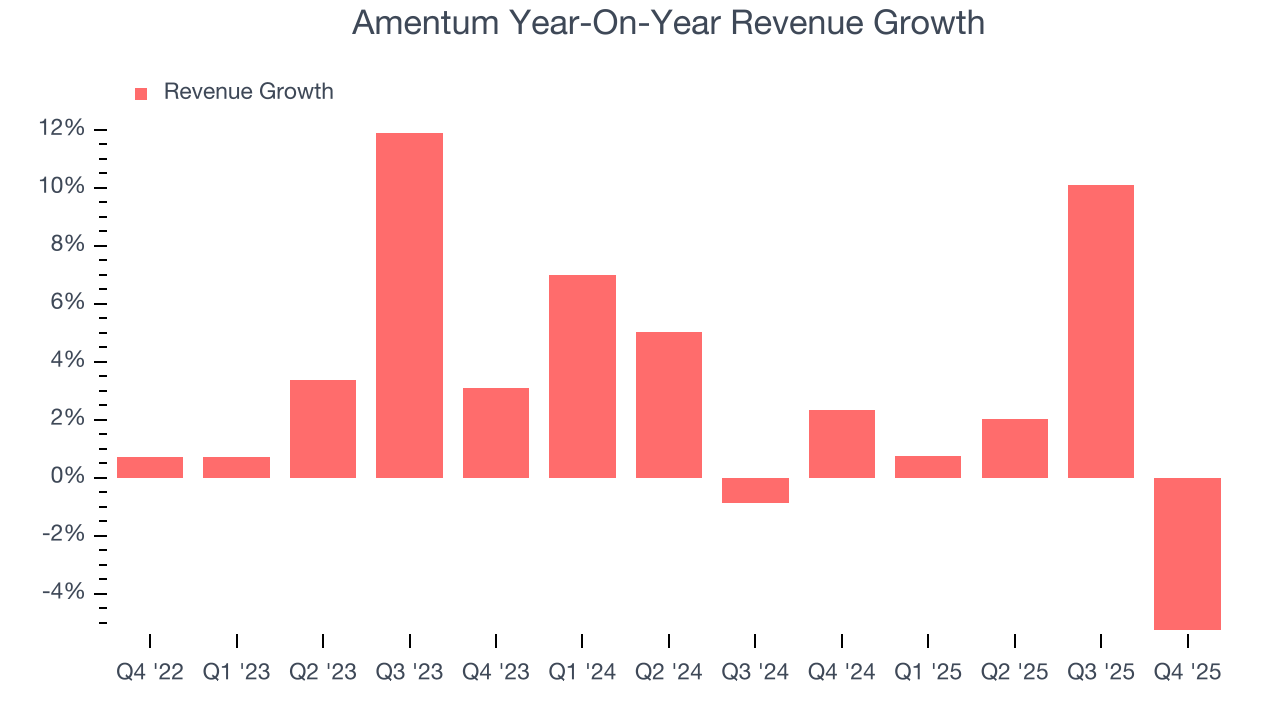

As you can see below, Amentum’s 3.1% annualized revenue growth over the last three years was tepid. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

Long-term growth is the most important, but within business services, a stretched historical view may miss new innovations or demand cycles. Amentum’s annualized revenue growth of 2.6% over the last two years aligns with its three-year trend, suggesting its demand was consistently weak.

This quarter, Amentum missed Wall Street’s estimates and reported a rather uninspiring 5.2% year-on-year revenue decline, generating $3.24 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

6. Adjusted Operating Margin

Adjusted operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies because it excludes non-recurring expenses, interest on debt, and taxes.

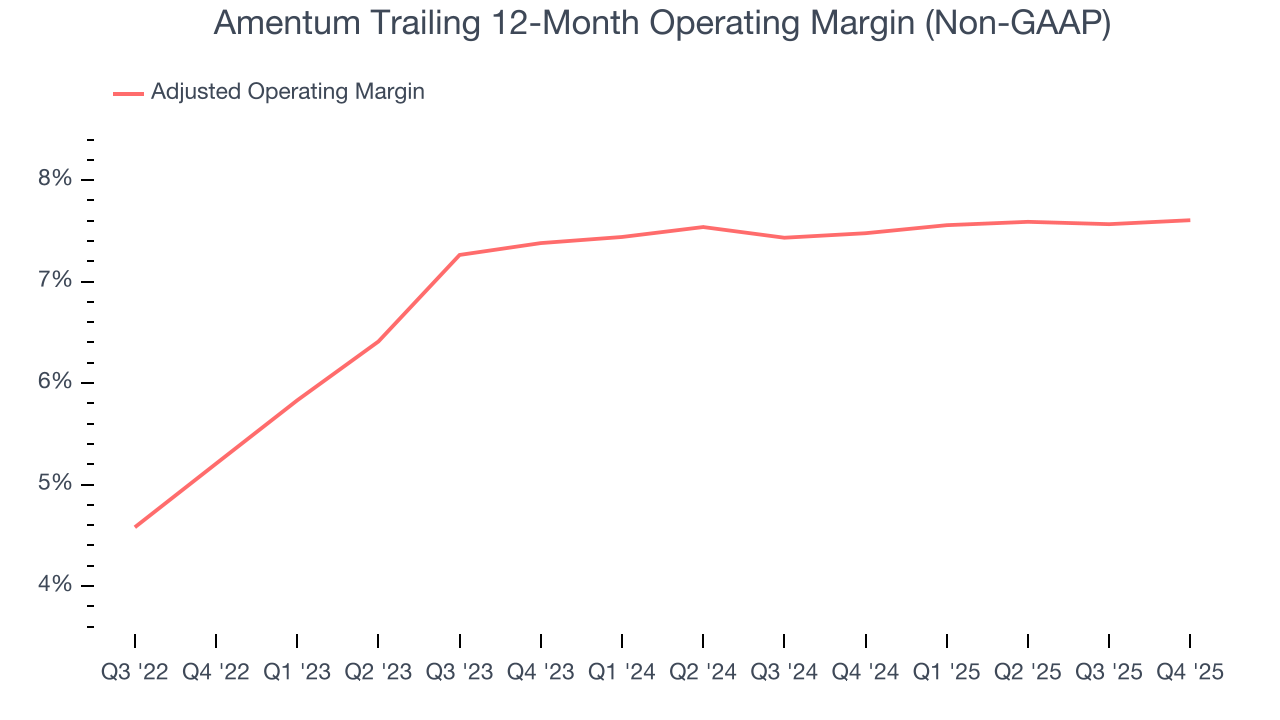

Amentum was profitable over the last five years but held back by its large cost base. Its average adjusted operating margin of 6.8% was weak for a business services business.

On the plus side, Amentum’s adjusted operating margin rose by 2.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Amentum generated an adjusted operating margin profit margin of 7.9%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

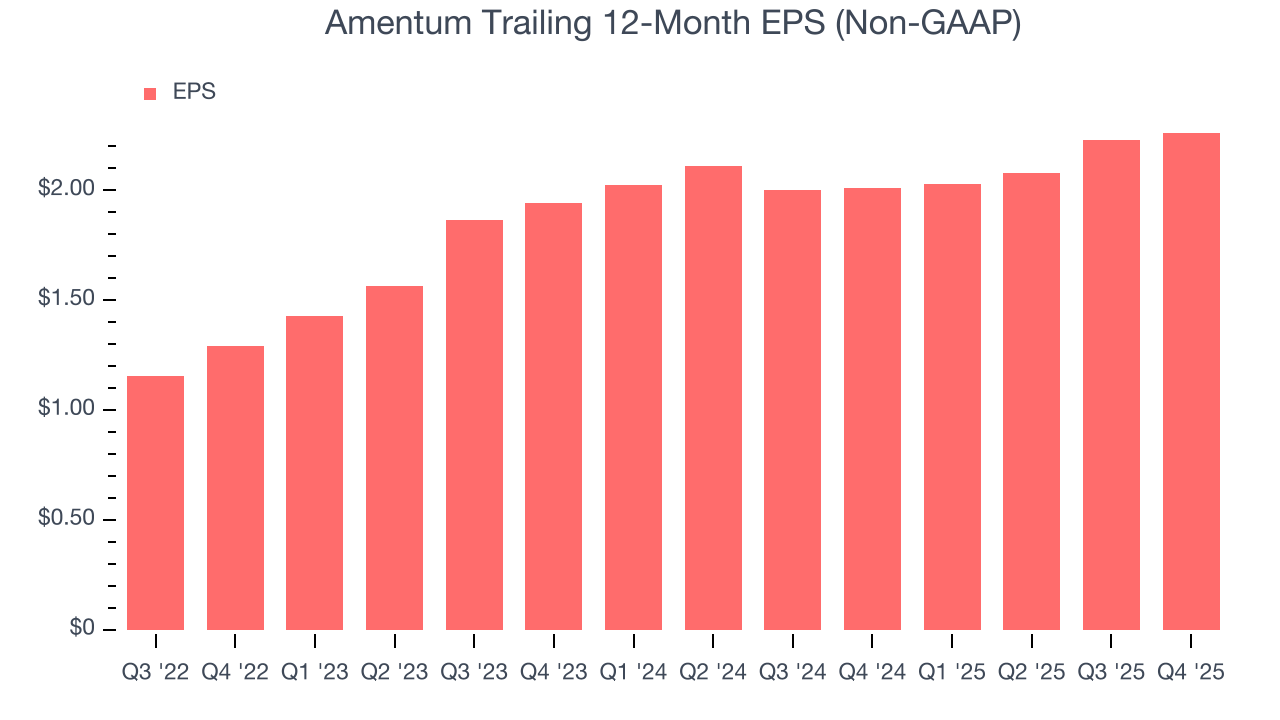

Amentum’s EPS grew at an astounding 23.6% compounded annual growth rate over the last three years, higher than its 3.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

In Q4, Amentum reported adjusted EPS of $0.54, up from $0.51 in the same quarter last year. This print beat analysts’ estimates by 4.4%. Over the next 12 months, Wall Street expects Amentum’s full-year EPS of $2.26 to grow 9.8%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Amentum has shown poor cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.9%, lousy for a business services business.

Amentum burned through $142 million of cash in Q4, equivalent to a negative 4.4% margin. The company’s cash flow turned negative after being positive in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

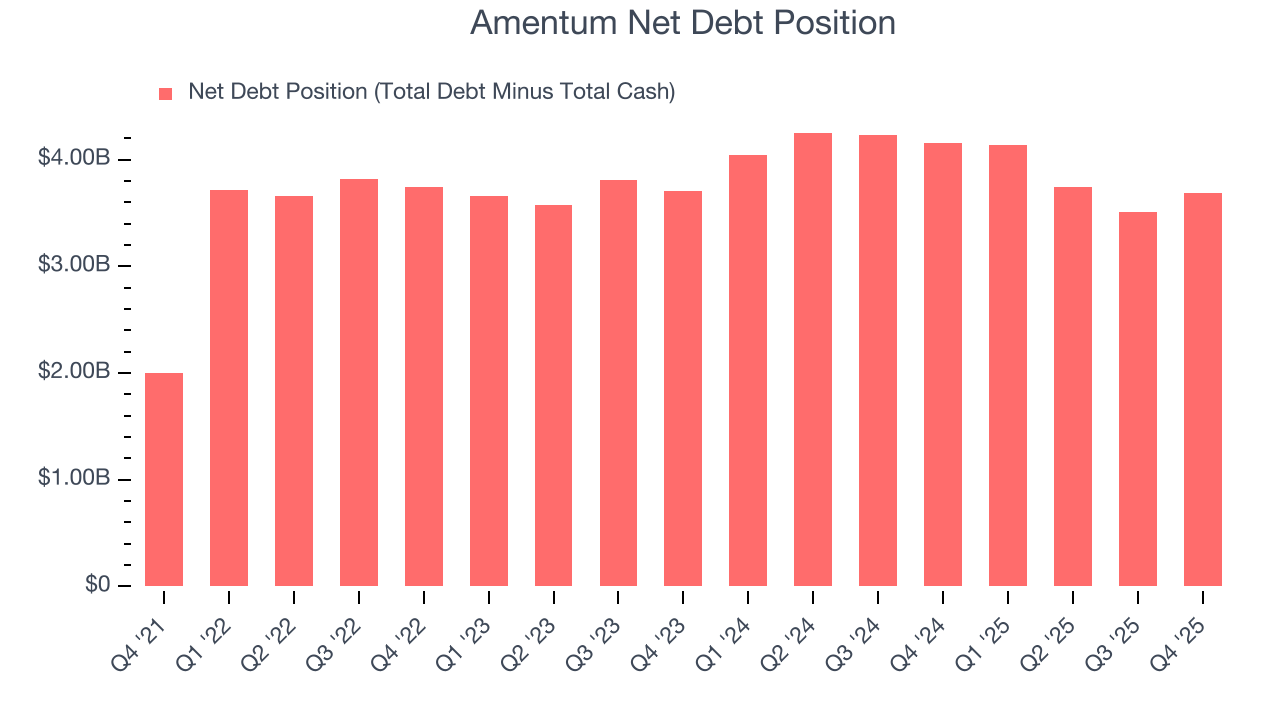

9. Balance Sheet Assessment

Amentum reported $247 million of cash and $3.94 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.11 billion of EBITDA over the last 12 months, we view Amentum’s 3.3× net-debt-to-EBITDA ratio as safe. We also see its $340 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

10. Key Takeaways from Amentum’s Q4 Results

It was good to see Amentum beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 13% to $31.83 immediately after reporting.

11. Is Now The Time To Buy Amentum?

Updated: February 12, 2026 at 11:08 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Amentum.

Amentum isn’t a terrible business, but it doesn’t pass our quality test. To begin with, its revenue growth was uninspiring over the last three years, and analysts expect its demand to deteriorate over the next 12 months. While its scale makes it a trusted partner with negotiating leverage, the downside is its low free cash flow margins give it little breathing room. On top of that, its operating margins are low compared to other business services companies.

Amentum’s P/E ratio based on the next 12 months is 12.3x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $36.64 on the company (compared to the current share price of $30).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.