ASGN (ASGN)

ASGN is up against the odds. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think ASGN Will Underperform

Evolving from its roots in IT staffing to become a high-end technology consulting powerhouse, ASGN (NYSE:ASGN) provides specialized IT consulting services and staffing solutions to Fortune 1000 companies and U.S. federal government agencies.

- Annual sales declines of 6.2% for the past two years show its products and services struggled to connect with the market during this cycle

- Incremental sales over the last five years were less profitable as its earnings per share were flat while its revenue grew

- Projected sales for the next 12 months are flat and suggest demand will be subdued

ASGN is in the doghouse. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than ASGN

High Quality

Investable

Underperform

Why There Are Better Opportunities Than ASGN

ASGN is trading at $50.77 per share, or 11.1x forward P/E. This multiple is cheaper than most business services peers, but we think this is justified.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. ASGN (ASGN) Research Report: Q4 CY2025 Update

IT services provider ASGN (NYSE:ASGN) beat Wall Street’s revenue expectations in Q4 CY2025, but sales were flat year on year at $980.1 million. The company expects next quarter’s revenue to be around $970 million, close to analysts’ estimates. Its non-GAAP profit of $1.15 per share was 2.2% below analysts’ consensus estimates.

ASGN (ASGN) Q4 CY2025 Highlights:

- Revenue: $980.1 million vs analyst estimates of $973.9 million (flat year on year, 0.6% beat)

- Adjusted EPS: $1.15 vs analyst expectations of $1.18 (2.2% miss)

- Adjusted EBITDA: $107.9 million vs analyst estimates of $106.5 million (11% margin, 1.3% beat)

- Revenue Guidance for Q1 CY2026 is $970 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q1 CY2026 is $0.98 at the midpoint, below analyst estimates of $0.98

- EBITDA guidance for Q1 CY2026 is $96 million at the midpoint, in line with analyst expectations

- Operating Margin: 5.7%, down from 7.5% in the same quarter last year

- Free Cash Flow Margin: 9.6%, similar to the same quarter last year

- Market Capitalization: $2.17 billion

Company Overview

Evolving from its roots in IT staffing to become a high-end technology consulting powerhouse, ASGN (NYSE:ASGN) provides specialized IT consulting services and staffing solutions to Fortune 1000 companies and U.S. federal government agencies.

ASGN operates through two main segments: Commercial (71% of revenue) and Federal Government (29%). The Commercial segment delivers IT services across five industry verticals: Financial Services, Consumer and Industrial, Technology/Media/Telecom, Healthcare, and Business/Government Services. The Federal segment provides solutions to defense, intelligence, and civilian agencies.

The company's business model centers on deploying skilled IT professionals for both short-term projects and long-term consulting engagements. ASGN maintains a diverse talent pool of onshore, nearshore, and offshore professionals with expertise in high-demand areas like cloud computing, data analytics, cybersecurity, and artificial intelligence. For example, a financial services client might engage ASGN consultants to implement a cloud migration strategy or develop AI-powered fraud detection systems.

ASGN has strategically shifted toward higher-margin IT consulting work, which now represents over half of its revenue. This evolution allows the company to deliver more complex solutions while maintaining its traditional staffing business. The company generates revenue by billing clients for the services of its consultants, typically on a time and materials basis or through fixed-price project engagements.

To stay competitive, ASGN invests in six core areas: leadership development, recruitment of in-demand skillsets, training programs, strategic partnerships, internal AI tools, and client AI roadmaps. The company has built specialized capabilities in emerging technologies, maintaining over 1,000 certifications in AI and machine learning alone through its Data and AI Center of Excellence.

ASGN has supplemented its organic growth with strategic acquisitions, completing 11 "tuck-in" purchases over a recent five-year period to expand its service capabilities and market reach. The company operates primarily in North America with additional delivery centers in Mexico, Europe, and India.

4. IT Services & Consulting

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

ASGN competes with other IT services and staffing firms including Accenture (NYSE: ACN), Cognizant (NASDAQ: CTSH), EPAM Systems (NYSE: EPAM), and Kforce (NASDAQ: KFRC), as well as with the consulting arms of major technology companies and specialized government contractors.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $3.98 billion in revenue over the past 12 months, ASGN is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions. However, its scale is a double-edged sword because finding new avenues for growth becomes difficult when you already have a substantial market presence. To expand meaningfully, ASGN likely needs to tweak its prices, innovate with new offerings, or enter new markets.

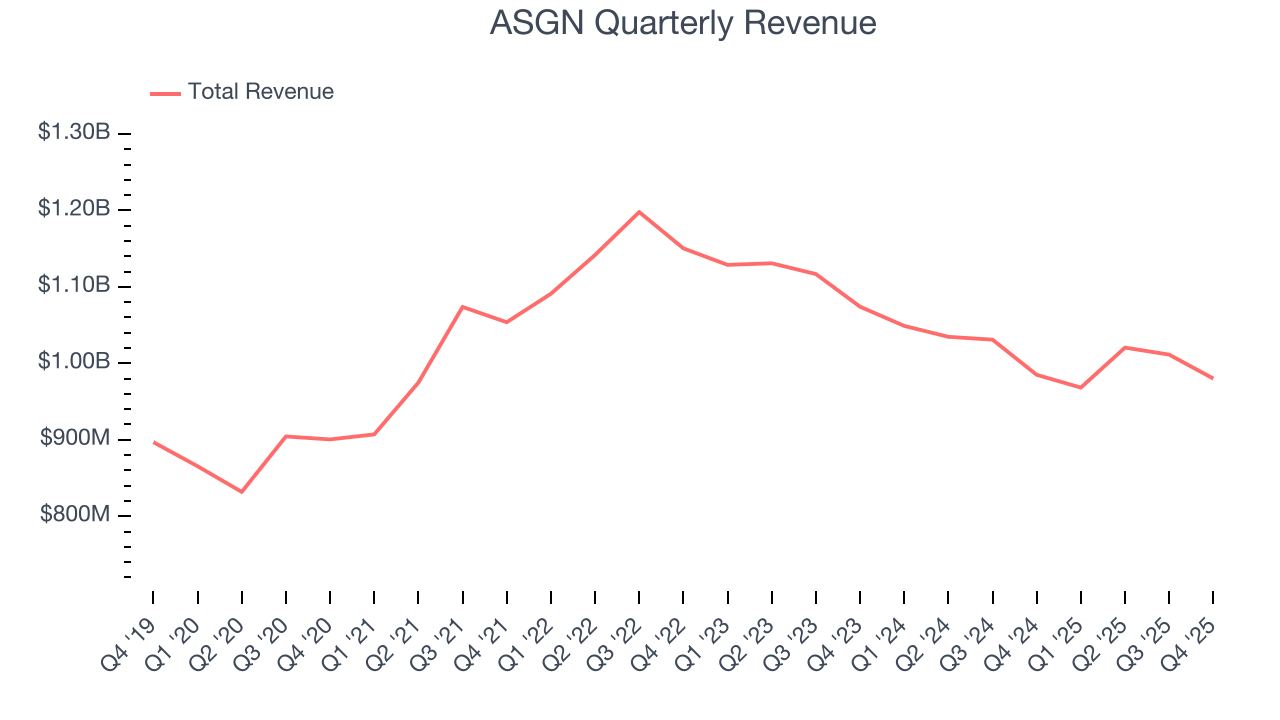

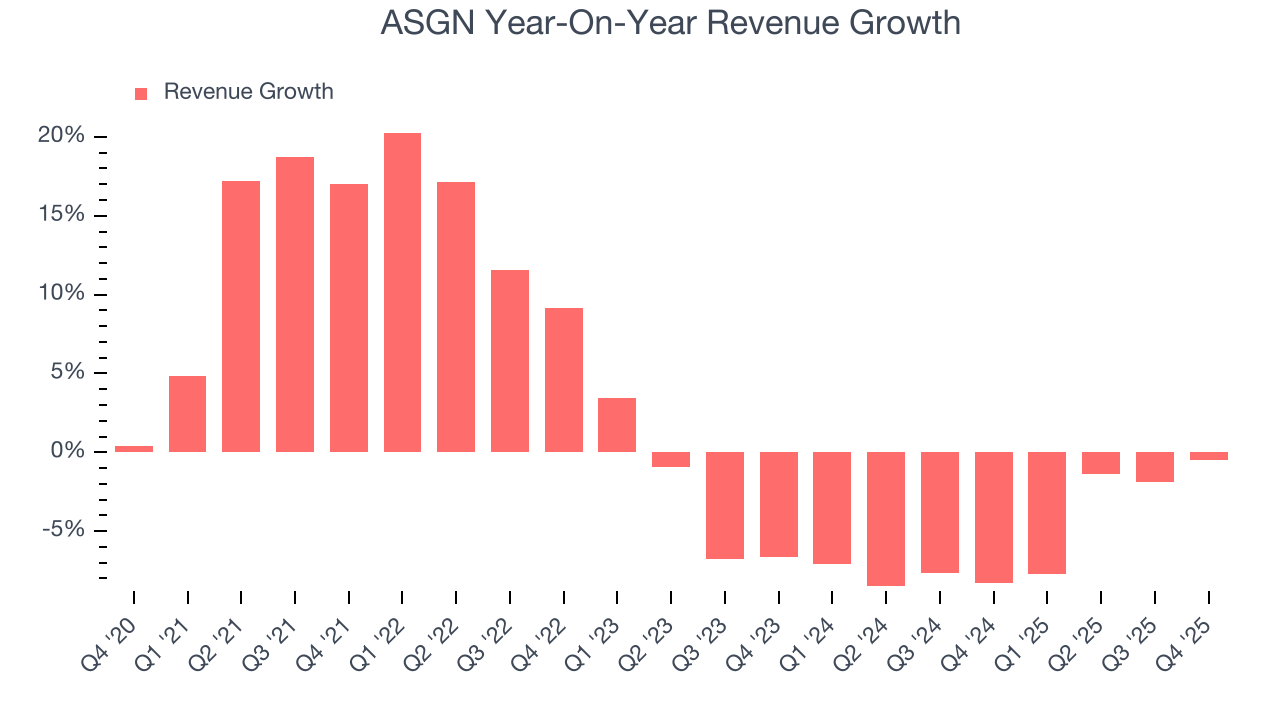

As you can see below, ASGN grew its sales at a sluggish 2.6% compounded annual growth rate over the last five years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. ASGN’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.4% annually.

This quarter, ASGN’s $980.1 million of revenue was flat year on year but beat Wall Street’s estimates by 0.6%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

6. Operating Margin

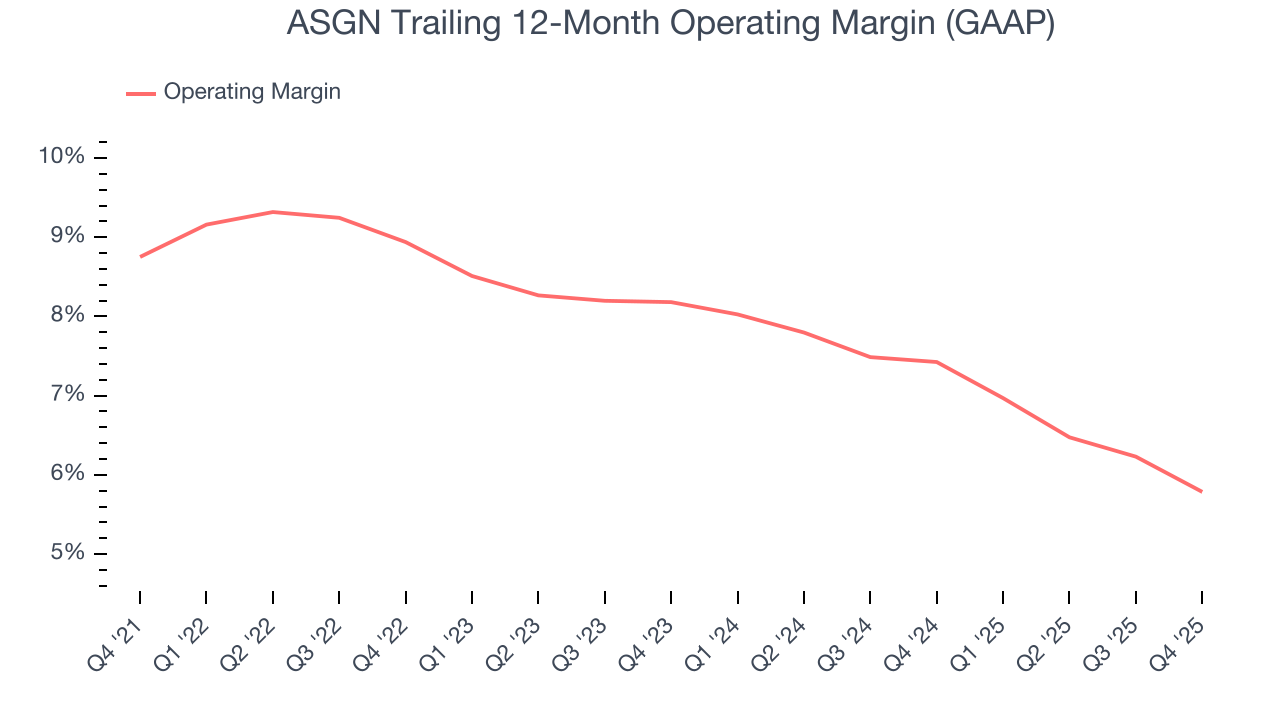

ASGN was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.9% was weak for a business services business.

Analyzing the trend in its profitability, ASGN’s operating margin decreased by 3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. ASGN’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, ASGN generated an operating margin profit margin of 5.7%, down 1.8 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

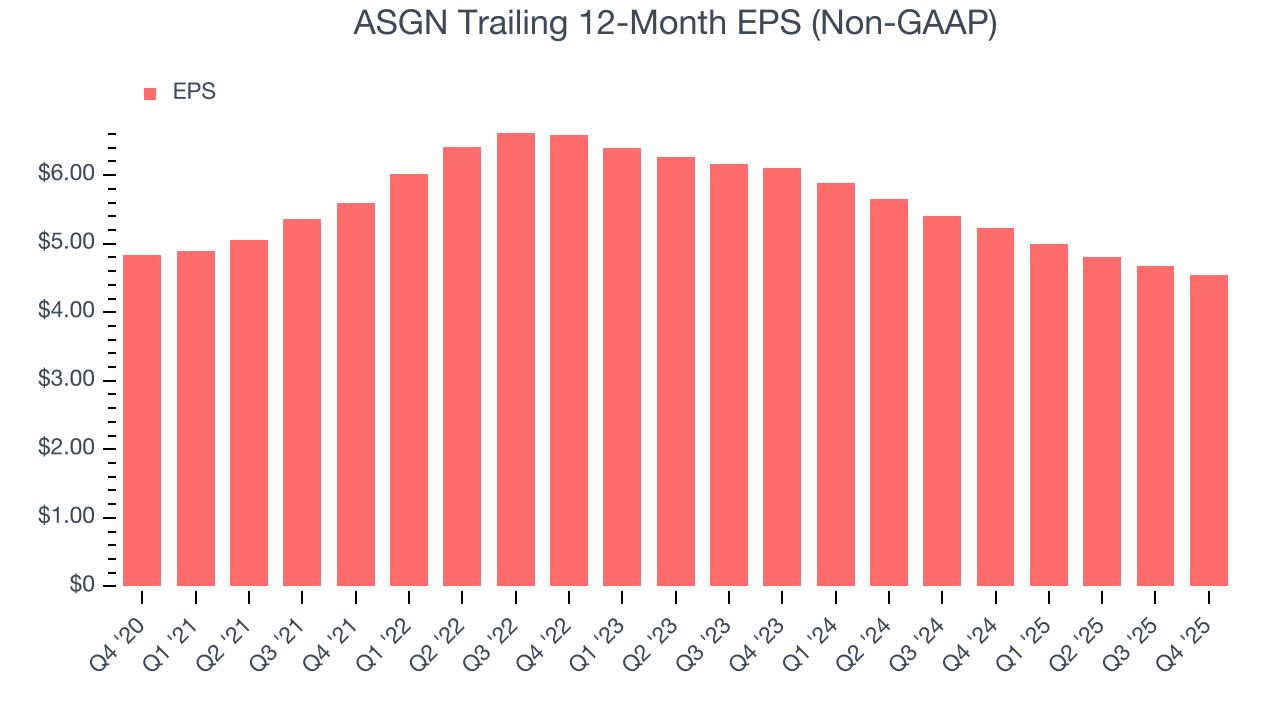

Sadly for ASGN, its EPS declined by 1.2% annually over the last five years while its revenue grew by 2.6%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into ASGN’s earnings to better understand the drivers of its performance. As we mentioned earlier, ASGN’s operating margin declined by 3 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For ASGN, its two-year annual EPS declines of 13.6% show it’s continued to underperform. These results were bad no matter how you slice the data.

In Q4, ASGN reported adjusted EPS of $1.15, down from $1.28 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects ASGN’s full-year EPS of $4.55 to grow 9.1%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

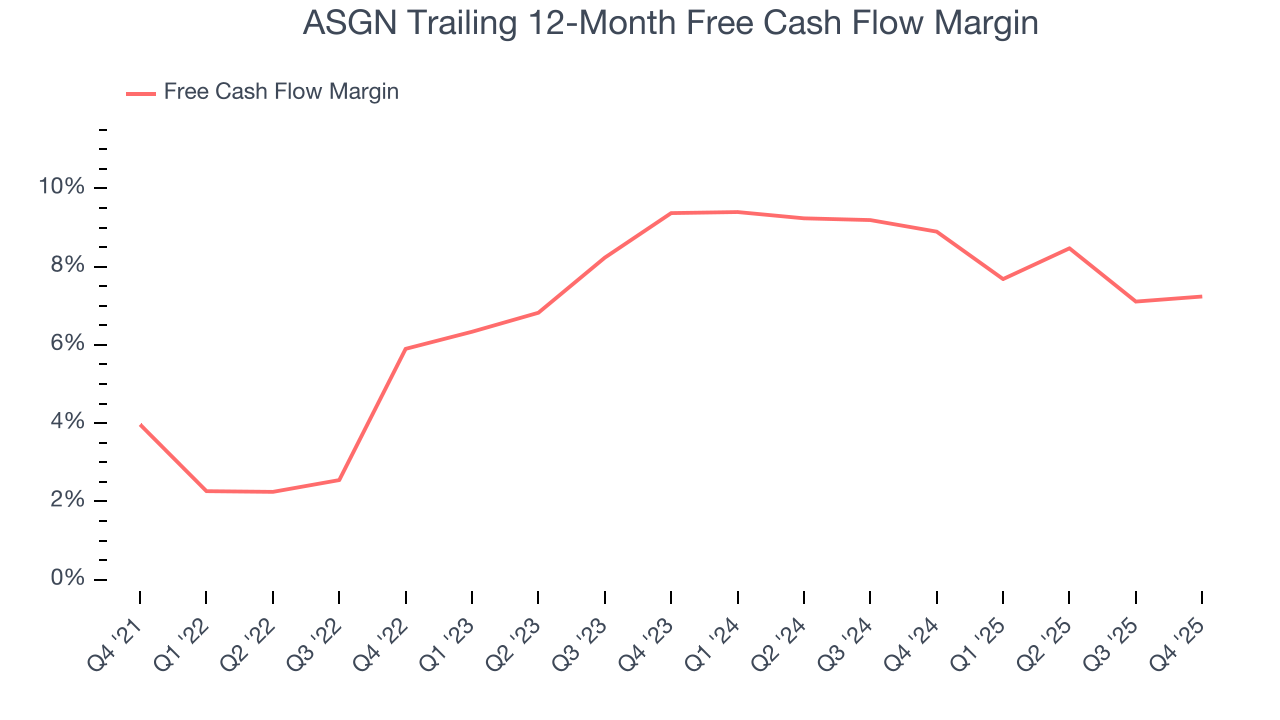

ASGN has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.1% over the last five years, better than the broader business services sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Taking a step back, we can see that ASGN’s margin expanded by 3.3 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

ASGN’s free cash flow clocked in at $93.7 million in Q4, equivalent to a 9.6% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

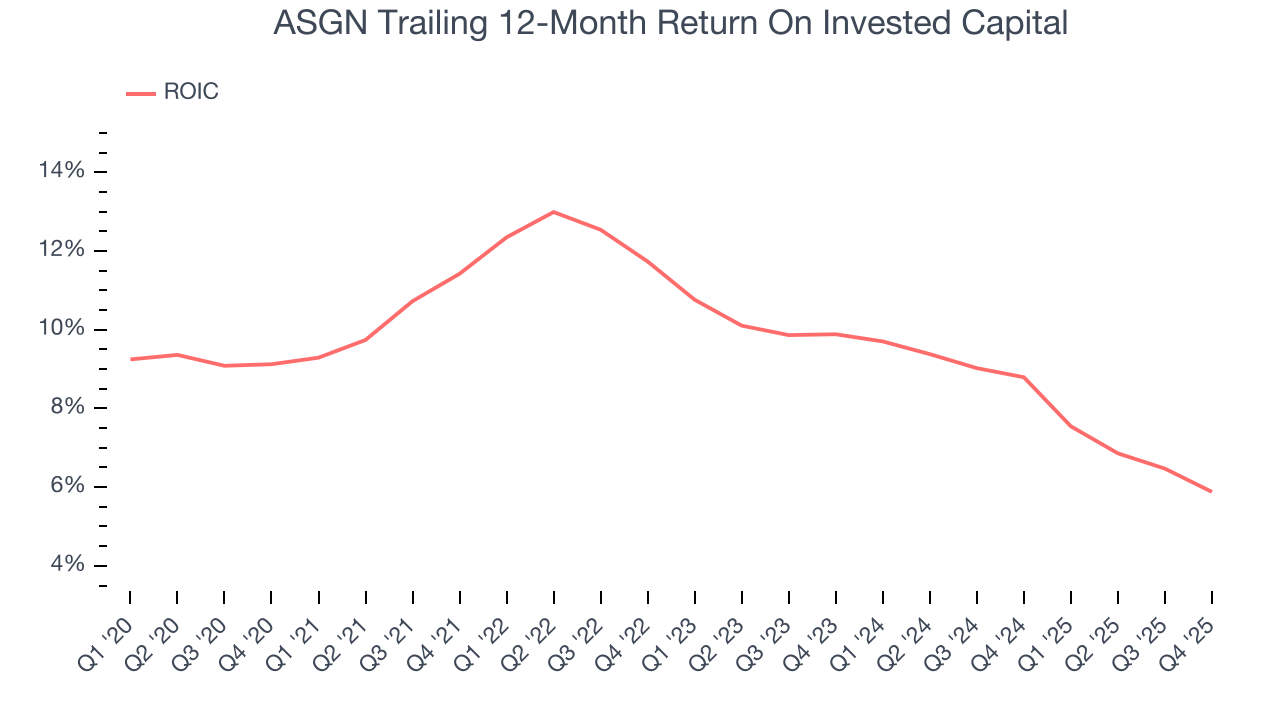

ASGN historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 9.5%, somewhat low compared to the best business services companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, ASGN’s ROIC averaged 4.2 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

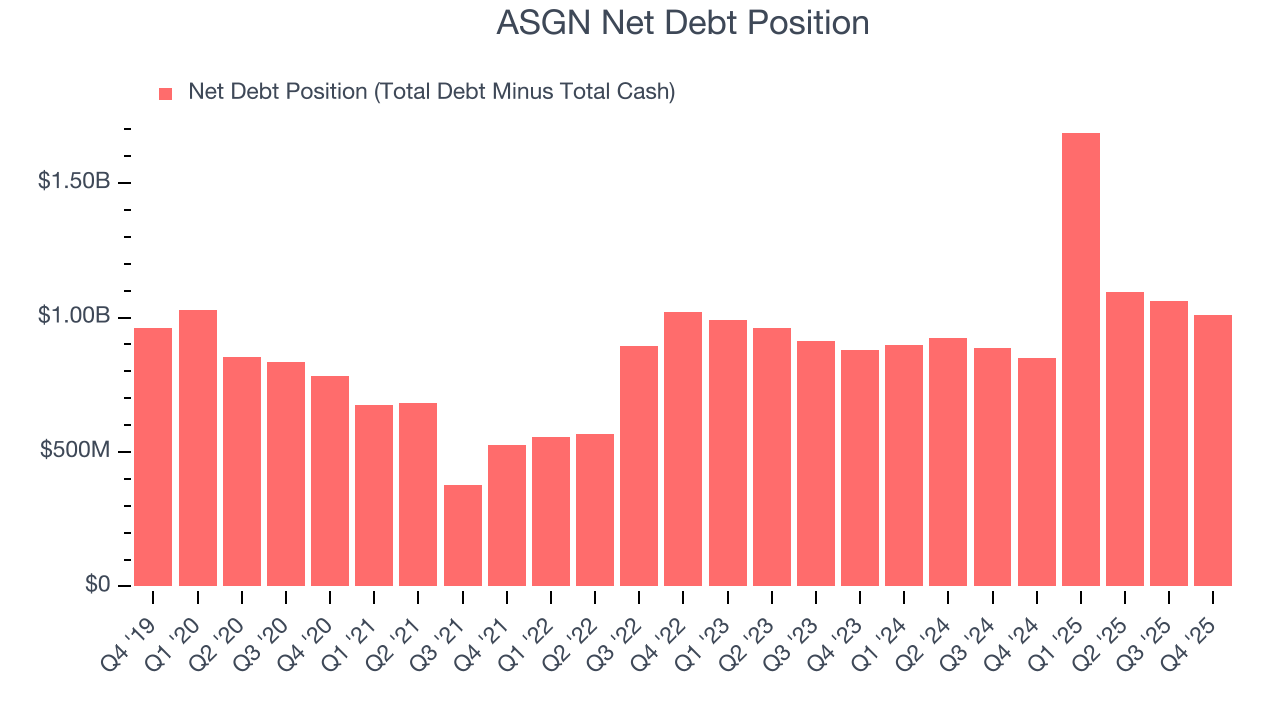

ASGN reported $161.2 million of cash and $1.17 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $422.6 million of EBITDA over the last 12 months, we view ASGN’s 2.4× net-debt-to-EBITDA ratio as safe. We also see its $34.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from ASGN’s Q4 Results

It was good to see ASGN narrowly top analysts’ revenue expectations this quarter. On the other hand, its EPS missed and its EPS guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $53.28 immediately following the results.

12. Is Now The Time To Buy ASGN?

Updated: February 4, 2026 at 11:30 PM EST

When considering an investment in ASGN, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies helping their customers, but in the case of ASGN, we’re out. To kick things off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its rising cash profitability gives it more optionality, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its declining operating margin shows the business has become less efficient.

ASGN’s P/E ratio based on the next 12 months is 10.2x. This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $52.83 on the company (compared to the current share price of $50.50).