Booz Allen Hamilton (BAH)

Booz Allen Hamilton is interesting. Its outstanding and increasing returns on capital imply its market position is becoming more dominant.― StockStory Analyst Team

1. News

2. Summary

Why Booz Allen Hamilton Is Interesting

With roots dating back to 1914 and deep ties to nearly all U.S. cabinet-level departments, Booz Allen Hamilton (NYSE:BAH) provides management consulting, technology services, and cybersecurity solutions primarily to U.S. government agencies and military branches.

- Sizeable revenue base of $11.41 billion gives it economies of scale and distribution advantages

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures, and its rising returns show it’s making even more lucrative bets

- On the other hand, its demand will likely fall over the next 12 months as Wall Street expects flat revenue

Booz Allen Hamilton shows some signs of a high-quality business. If you like the story, the valuation looks reasonable.

Why Is Now The Time To Buy Booz Allen Hamilton?

Why Is Now The Time To Buy Booz Allen Hamilton?

At $79.40 per share, Booz Allen Hamilton trades at 13x forward P/E. This multiple is lower than most business services companies, and we think the valuation is reasonable for the revenue growth you get.

Now could be a good time to invest if you believe in the story.

3. Booz Allen Hamilton (BAH) Research Report: Q4 CY2025 Update

Government consulting firm Booz Allen Hamilton (NYSE:BAH) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 10.2% year on year to $2.62 billion. On the other hand, the company’s outlook for the full year was close to analysts’ estimates with revenue guided to $11.35 billion at the midpoint. Its non-GAAP profit of $1.77 per share was 39.3% above analysts’ consensus estimates.

Booz Allen Hamilton (BAH) Q4 CY2025 Highlights:

- Revenue: $2.62 billion vs analyst estimates of $2.72 billion (10.2% year-on-year decline, 3.8% miss)

- Adjusted EPS: $1.77 vs analyst estimates of $1.27 (39.3% beat)

- Adjusted EBITDA: $285 million vs analyst estimates of $279.1 million (10.9% margin, 2.1% beat)

- Adjusted EPS guidance for the full year is $6.05 at the midpoint, beating analyst estimates by 8.6%

- EBITDA guidance for the full year is $1.21 billion at the midpoint, in line with analyst expectations

- Operating Margin: 8.8%, down from 10% in the same quarter last year

- Free Cash Flow Margin: 9.5%, up from 4.6% in the same quarter last year

- Market Capitalization: $11.62 billion

Company Overview

With roots dating back to 1914 and deep ties to nearly all U.S. cabinet-level departments, Booz Allen Hamilton (NYSE:BAH) provides management consulting, technology services, and cybersecurity solutions primarily to U.S. government agencies and military branches.

Booz Allen operates at the intersection of technology and mission understanding, helping government clients tackle complex challenges across defense, intelligence, and civil sectors. The company's services span artificial intelligence, cybersecurity, data science, cloud computing, systems engineering, and digital transformation—all tailored to address specific mission needs of federal agencies.

The firm's client base includes all six branches of the U.S. military, the 18 organizations within the Intelligence Community, and numerous civilian agencies like the Departments of Veterans Affairs, Health and Human Services, and Homeland Security. These organizations turn to Booz Allen to modernize their operations, enhance their technological capabilities, and improve mission outcomes in an increasingly digital environment.

For example, a defense agency might engage Booz Allen to develop secure communication systems for battlefield operations, while a civilian department might seek help implementing data analytics to improve healthcare delivery for veterans. The company's technical experts work alongside mission specialists who understand the unique contexts and requirements of government operations.

Beyond its government work, Booz Allen serves commercial clients globally, particularly in cybersecurity. Its commercial division focuses on enterprise consulting and incident response, helping organizations in financial services, healthcare, energy, and technology sectors protect their digital assets from sophisticated threats.

The company generates revenue through government contracts, which can range from short-term consulting engagements to multi-year technology implementation projects. Booz Allen's business model combines technical innovation with deep domain expertise, allowing it to command premium rates for specialized services while maintaining long-term client relationships that often span decades.

4. Government & Technical Consulting

The sector has historically benefitted from steady government spending on defense, infrastructure, and regulatory compliance, providing firms long-term contract stability. However, the Trump administration is showing more willingness than previous administrations to upend government spending and bloat. Whether or not defense budgets get cut, the rising demand for cybersecurity, AI-driven defense solutions, and sustainability consulting should benefit the sector for years, as agencies and enterprises seek expertise in navigating complex technology and regulations. Additionally, industrial automation and digital engineering are driving efficiency gains in infrastructure and technical consulting projects, which could help profit margins.

Booz Allen Hamilton competes with other government services contractors including Leidos (NYSE:LDOS), CACI International (NYSE:CACI), and Science Applications International Corporation (NYSE:SAIC), as well as technology consulting firms like Accenture Federal Services (NYSE:ACN) and Deloitte.

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $11.41 billion in revenue over the past 12 months, Booz Allen Hamilton is larger than most business services companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. This also gives it the flexibility to offer lower prices.

As you can see below, Booz Allen Hamilton’s 7.8% annualized revenue growth over the last five years was solid. This is an encouraging starting point for our analysis because it shows Booz Allen Hamilton’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Booz Allen Hamilton’s annualized revenue growth of 5.1% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Booz Allen Hamilton missed Wall Street’s estimates and reported a rather uninspiring 10.2% year-on-year revenue decline, generating $2.62 billion of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and implies its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Operating Margin

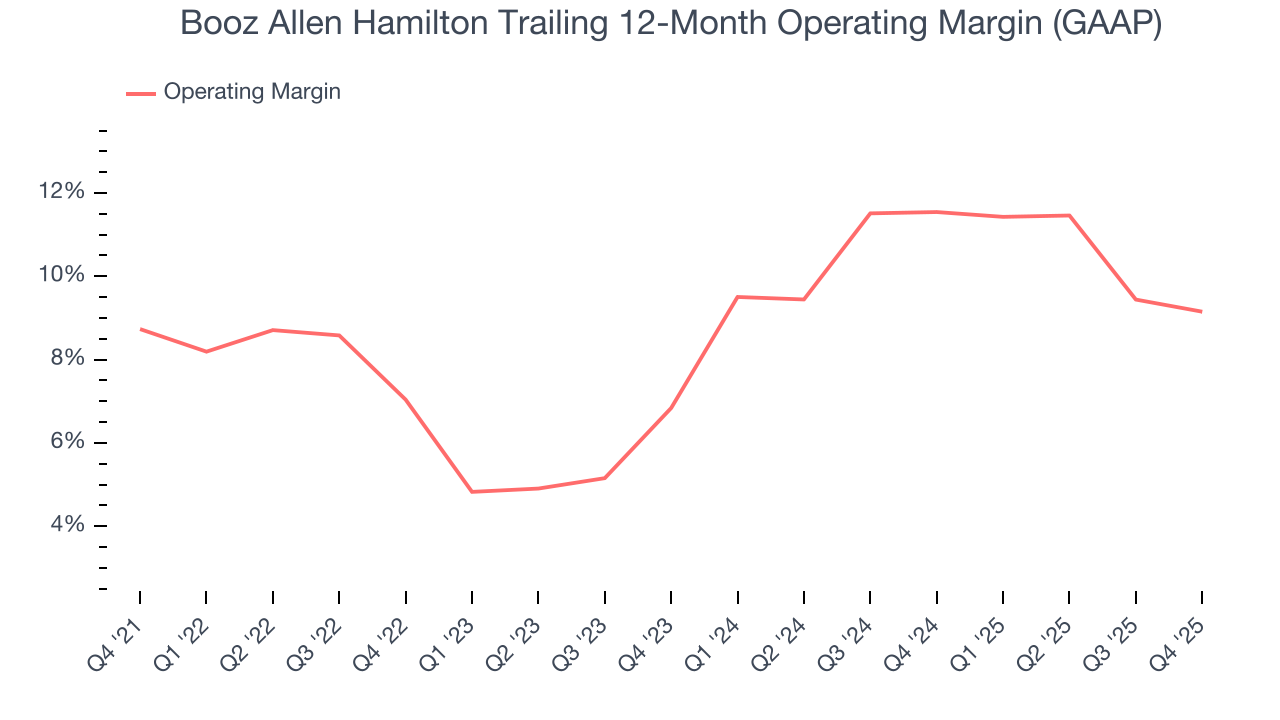

Booz Allen Hamilton’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 8.8% over the last five years. This profitability was mediocre for a business services business and caused by its suboptimal cost structure.

Looking at the trend in its profitability, Booz Allen Hamilton’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Booz Allen Hamilton generated an operating margin profit margin of 8.8%, down 1.2 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

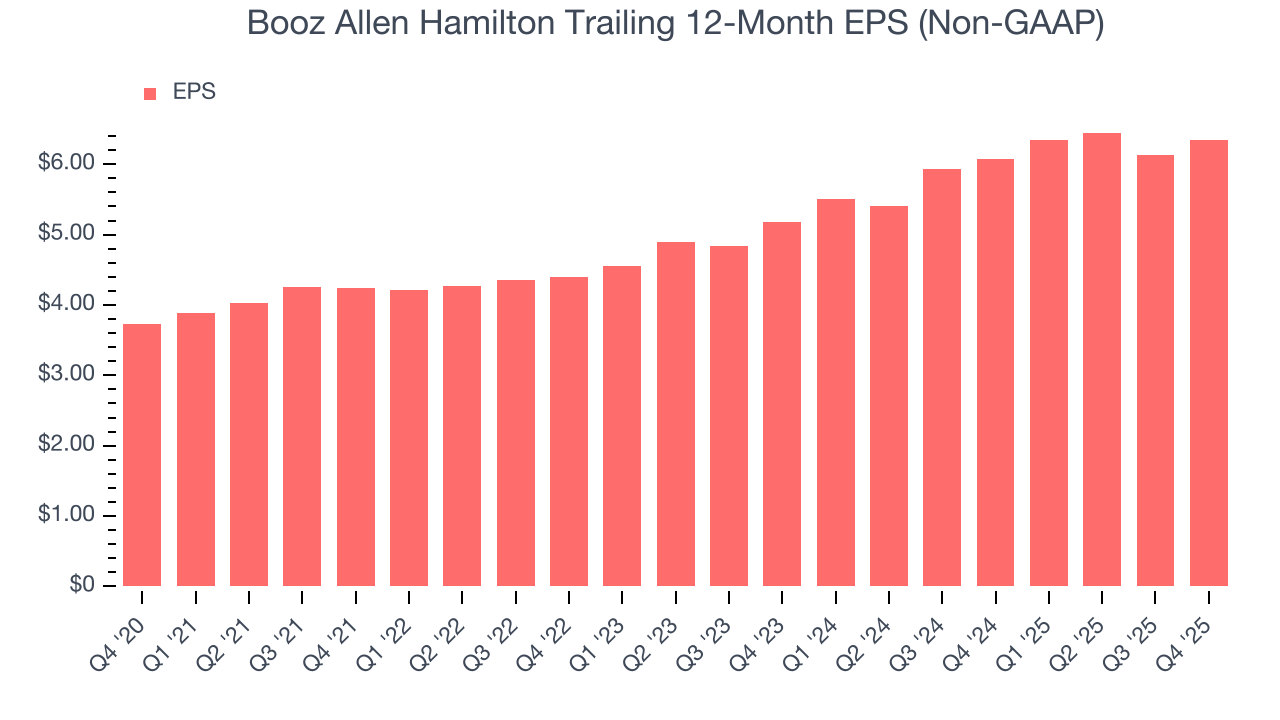

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Booz Allen Hamilton’s EPS grew at a remarkable 11.2% compounded annual growth rate over the last five years, higher than its 7.8% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Booz Allen Hamilton, its two-year annual EPS growth of 10.7% is similar to its five-year trend, implying stable earnings power.

In Q4, Booz Allen Hamilton reported adjusted EPS of $1.77, up from $1.55 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Booz Allen Hamilton’s full-year EPS of $6.35 to shrink by 8.4%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Booz Allen Hamilton has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 5.7% over the last five years, slightly better than the broader business services sector.

Taking a step back, we can see that Booz Allen Hamilton’s margin expanded by 4.3 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

Booz Allen Hamilton’s free cash flow clocked in at $248 million in Q4, equivalent to a 9.5% margin. This result was good as its margin was 4.9 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Booz Allen Hamilton’s five-year average ROIC was 19.3%, beating other business services companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Booz Allen Hamilton’s has increased over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

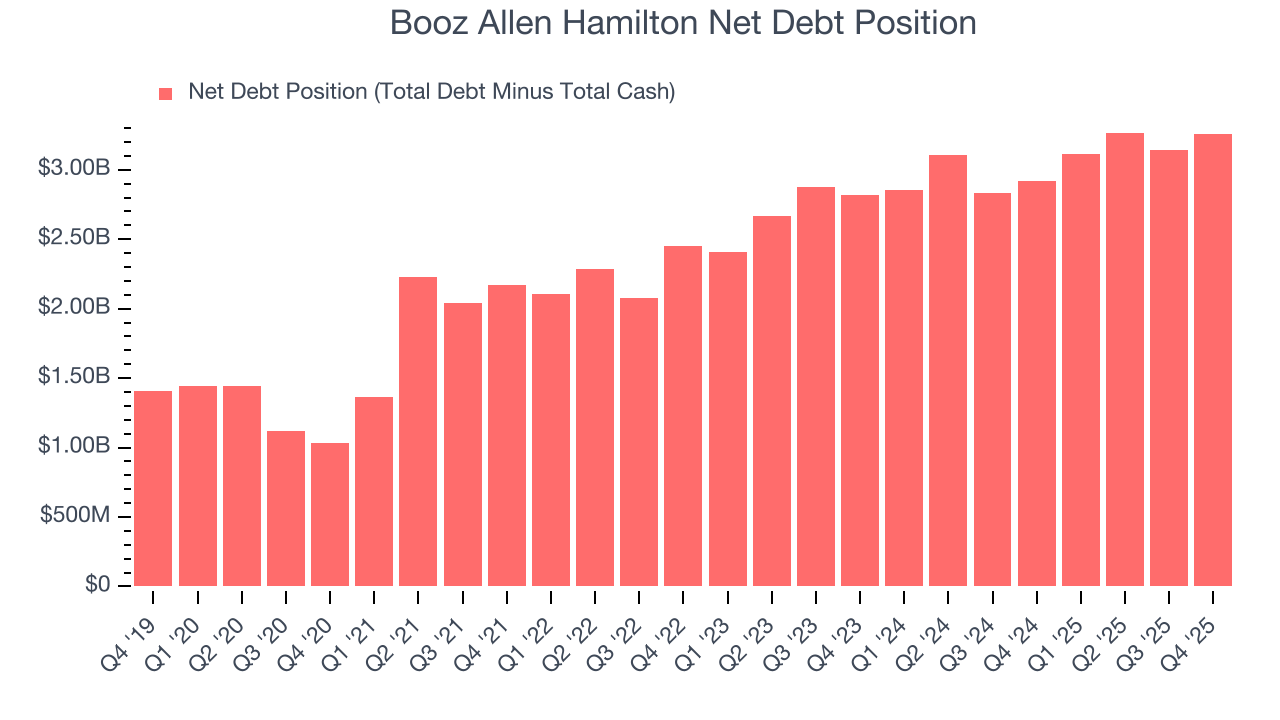

Booz Allen Hamilton reported $882 million of cash and $4.14 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.24 billion of EBITDA over the last 12 months, we view Booz Allen Hamilton’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $74.4 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Booz Allen Hamilton’s Q4 Results

It was good to see Booz Allen Hamilton beat analysts’ EPS expectations this quarter. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates by a wide margin. On the other hand, its revenue missed. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 7.5% to $102.90 immediately following the results.

12. Is Now The Time To Buy Booz Allen Hamilton?

Updated: March 3, 2026 at 11:55 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Booz Allen Hamilton, you should also grasp the company’s longer-term business quality and valuation.

Booz Allen Hamilton possesses a number of positive attributes. To kick things off, its revenue growth was solid over the last five years. And while its projected EPS for the next year is lacking, its scale makes it a trusted partner with negotiating leverage. On top of that, its rising returns show management's prior bets are paying off.

Booz Allen Hamilton’s P/E ratio based on the next 12 months is 13x. When scanning the business services space, Booz Allen Hamilton trades at a fair valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $106.82 on the company (compared to the current share price of $79.40), implying they see 34.5% upside in buying Booz Allen Hamilton in the short term.