Brink's (BCO)

Brink's piques our interest. Its eye-popping 17.9% annualized EPS growth over the last five years has significantly outpaced its peers.― StockStory Analyst Team

1. News

2. Summary

Why Brink's Is Interesting

Known for its iconic armored trucks that have been a fixture in American cities since 1859, Brink's (NYSE:BCO) provides secure transportation and management of cash and valuables for banks, retailers, and other businesses worldwide.

- Earnings per share grew by 17.9% annually over the last five years and trumped its peers

- Economies of scale give it some operating leverage when demand rises

- The stock is trading at a reasonable price if you like its story and growth prospects

Brink's is close to becoming a high-quality business. If you’ve been itching to buy the stock, the price seems fair.

Why Is Now The Time To Buy Brink's?

Why Is Now The Time To Buy Brink's?

At $117.64 per share, Brink's trades at 13.4x forward P/E. Brink’s multiple is lower than that of many business services companies. Even so, we think it is justified for the top-line growth you get.

It could be a good time to invest if you see something the market doesn’t.

3. Brink's (BCO) Research Report: Q4 CY2025 Update

Cash management services provider Brink's (NYSE:BCO) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 9.1% year on year to $1.38 billion. Guidance for next quarter’s revenue was optimistic at $1.37 billion at the midpoint, 2.6% above analysts’ estimates. Its non-GAAP profit of $2.54 per share was 2.7% above analysts’ consensus estimates.

Brink's (BCO) Q4 CY2025 Highlights:

- Revenue: $1.38 billion vs analyst estimates of $1.35 billion (9.1% year-on-year growth, 1.8% beat)

- Adjusted EPS: $2.54 vs analyst estimates of $2.47 (2.7% beat)

- Adjusted EBITDA: $277 million vs analyst estimates of $276.7 million (20.1% margin, in line)

- Revenue Guidance for Q1 CY2026 is $1.37 billion at the midpoint, above analyst estimates of $1.33 billion

- Adjusted EPS guidance for Q1 CY2026 is $1.70 at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for Q1 CY2026 is $230 million at the midpoint, above analyst estimates of $227.5 million

- Operating Margin: 13.1%, down from 16.8% in the same quarter last year

- Free Cash Flow Margin: 23.6%, similar to the same quarter last year

- Market Capitalization: $5.38 billion

Company Overview

Known for its iconic armored trucks that have been a fixture in American cities since 1859, Brink's (NYSE:BCO) provides secure transportation and management of cash and valuables for banks, retailers, and other businesses worldwide.

Brink's operates a vast global network spanning more than 100 countries, with a fleet of approximately 16,400 vehicles and 1,300 facilities. The company's core business revolves around three main service lines: Cash and Valuables Management, Digital Retail Solutions, and ATM Managed Services.

The Cash and Valuables Management division includes the company's traditional armored transport services, moving cash between retail businesses and financial institutions. This division also handles the secure transportation of high-value items like diamonds, jewelry, precious metals, and fine art through its Brink's Global Services unit. Additionally, it provides cash processing services such as counting, sorting, and counterfeit detection.

Digital Retail Solutions leverages technology to help businesses manage their cash more efficiently. These services include the company's patented Brink's Complete and CompuSafe offerings, which allow merchants to securely store cash on-site and receive credit to their bank accounts before physical pickup occurs. This provides faster access to funds, particularly beneficial for small and mid-sized retailers.

The ATM Managed Services division goes beyond basic cash replenishment to offer comprehensive ATM management. Services include cash forecasting, remote monitoring, transaction processing, and in some cases, Brink's even takes ownership of ATM devices as part of its service package.

Brink's generates revenue through service contracts with customers, typically lasting one to three years for cash logistics services and longer for cash management services. The company's business model experiences seasonal fluctuations, with higher revenues in the second half of the year, particularly during the holiday season when cash usage increases.

The company organizes its operations into four geographic segments: North America, Latin America, Europe, and Rest of World, allowing it to tailor services to regional needs while maintaining global standards.

4. Safety & Security Services

Rising concerns over physical security, cybersecurity threats, and workplace safety regulations will present opportunities for companies in this sector. AI and digitization will enhance surveillance, access control, and threat detection, which could benefit key players in Safety & Security Services. These trends could also introduce ethical and regulatory concerns over data privacy and automated decision-making in security operations, giving rise to headline risks. Finally, increasing scrutiny on private security practices and evolving criminal justice policies again mean that companies in the space need to operate with the utmost care or risk being the poster child of abuse of power.

Brink's main competitors in the global cash management and secure logistics industry include Loomis AB (Sweden), Prosegur (Spain), and Garda World Security Corporation (Canada).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $5.26 billion in revenue over the past 12 months, Brink's is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

As you can see below, Brink's grew its sales at a solid 7.3% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows Brink’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Brink’s recent performance shows its demand has slowed as its annualized revenue growth of 3.9% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Brink's reported year-on-year revenue growth of 9.1%, and its $1.38 billion of revenue exceeded Wall Street’s estimates by 1.8%. Company management is currently guiding for a 9.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not accelerate its top-line performance yet. At least the company is tracking well in other measures of financial health.

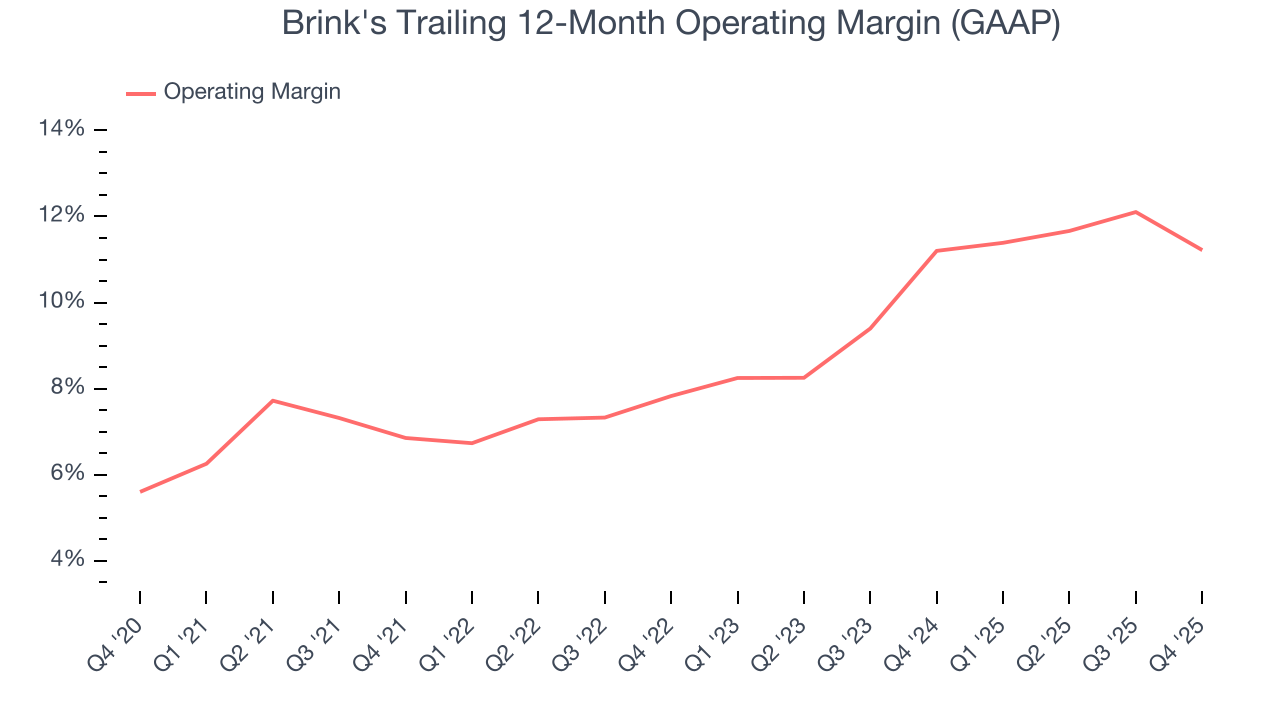

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Brink's was profitable over the last five years but held back by its large cost base. Its average operating margin of 9.4% was weak for a business services business.

On the plus side, Brink’s operating margin rose by 4.4 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, Brink's generated an operating margin profit margin of 13.1%, down 3.8 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

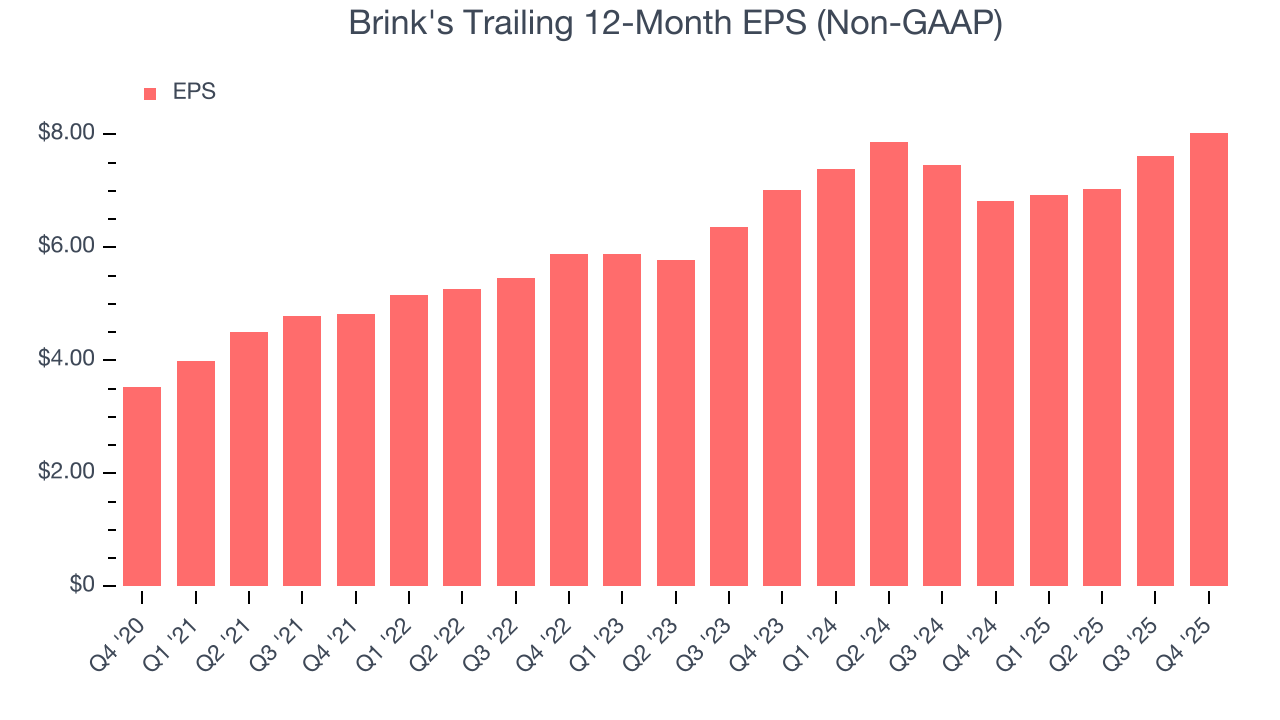

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Brink’s EPS grew at an astounding 17.9% compounded annual growth rate over the last five years, higher than its 7.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Brink’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Brink’s operating margin declined this quarter but expanded by 4.4 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Brink's, its two-year annual EPS growth of 7% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q4, Brink's reported adjusted EPS of $2.54, up from $2.12 in the same quarter last year. This print beat analysts’ estimates by 2.7%. Over the next 12 months, Wall Street expects Brink’s full-year EPS of $8.03 to grow 13.4%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Brink's has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.3% over the last five years, better than the broader business services sector. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Brink’s free cash flow clocked in at $325.9 million in Q4, equivalent to a 23.6% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Brink’s five-year average ROIC was 15.2%, higher than most business services businesses. This illustrates its management team’s ability to invest in profitable growth opportunities and generate value for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Brink’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

Brink's reported $2.27 billion of cash and $4.52 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $977.3 million of EBITDA over the last 12 months, we view Brink’s 2.3× net-debt-to-EBITDA ratio as safe. We also see its $159.3 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Brink’s Q4 Results

We were impressed by Brink’s optimistic revenue guidance for next quarter, which blew past analysts’ expectations. However, EPS guidance for the coming quarter was just in line. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. Investors were likely hoping for more, and shares traded down 6.3% to $127 immediately following the results.

12. Is Now The Time To Buy Brink's?

Updated: March 6, 2026 at 11:54 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Brink's possesses a number of positive attributes. First off, its revenue growth was solid over the last five years, and analysts believe it can continue growing at these levels. Plus, Brink’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, and its rising returns show management's prior bets are paying off.

Brink’s P/E ratio based on the next 12 months is 13.4x. Looking at the business services landscape right now, Brink's trades at a pretty interesting price. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $154 on the company (compared to the current share price of $117.64), implying they see 30.9% upside in buying Brink's in the short term.