BD (BDX)

We aren’t fans of BD. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think BD Will Underperform

With a history dating back to 1897 and a presence in virtually every hospital around the globe, Becton Dickinson (NYSE:BDX) develops and manufactures medical supplies, devices, laboratory equipment and diagnostic products used by healthcare institutions and professionals worldwide.

- Estimated sales decline of 12% for the next 12 months implies a challenging demand environment

- Underwhelming 4.3% return on capital reflects management’s difficulties in finding profitable growth opportunities

- One positive is that its disciplined cost controls and effective management have materialized in a strong adjusted operating margin

BD falls below our quality standards. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than BD

High Quality

Investable

Underperform

Why There Are Better Opportunities Than BD

BD is trading at $183.24 per share, or 14.3x forward P/E. BD’s valuation may seem like a bargain, especially when stacked up against other healthcare companies. We remind you that you often get what you pay for, though.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. BD (BDX) Research Report: Q4 CY2025 Update

Medical technology company Becton, Dickinson and Company (NYSE:BDX) announced better-than-expected revenue in Q4 CY2025, with sales up 1.6% year on year to $5.25 billion. Its non-GAAP profit of $2.91 per share was 3.5% above analysts’ consensus estimates.

BD (BDX) Q4 CY2025 Highlights:

- Revenue: $5.25 billion vs analyst estimates of $5.15 billion (1.6% year-on-year growth, 2.1% beat)

- Adjusted EPS: $2.91 vs analyst estimates of $2.81 (3.5% beat)

- Management lowered its full-year Adjusted EPS guidance to $12.50 at the midpoint, a 16.1% decrease

- Operating Margin: 10.5%, up from 8.8% in the same quarter last year

- Free Cash Flow Margin: 10.5%, similar to the same quarter last year

- Constant Currency Revenue was flat year on year (9.6% in the same quarter last year)

- Market Capitalization: $59.84 billion

Company Overview

With a history dating back to 1897 and a presence in virtually every hospital around the globe, Becton Dickinson (NYSE:BDX) develops and manufactures medical supplies, devices, laboratory equipment and diagnostic products used by healthcare institutions and professionals worldwide.

BD operates through three main business segments that cover a vast array of healthcare needs. The BD Medical segment produces technologies for medication management and delivery, including infusion pumps, prefillable syringes, catheters, and vascular access devices. These products help healthcare providers administer medications safely and efficiently, from a nurse using an IV catheter in a hospital to a patient self-injecting medication at home.

The BD Life Sciences segment focuses on diagnostic systems and research tools. This includes equipment for collecting and testing blood samples, automated systems for detecting infectious diseases, and sophisticated instruments for analyzing cells. For example, a laboratory technician might use BD's equipment to identify bacteria in a patient's blood sample and determine which antibiotics would be most effective for treatment.

The BD Interventional segment provides single-use or implantable devices for vascular, surgical, and urological applications. These include products like stents to open blocked blood vessels, hernia repair materials, and catheters for managing urinary conditions. A surgeon might use BD's specialized balloon catheter to clear a blocked artery during a minimally invasive procedure.

BD generates revenue by selling these products to hospitals, laboratories, clinics, physicians' offices, and pharmaceutical companies. The company maintains manufacturing facilities across North America, Europe, and Asia, allowing it to serve healthcare providers globally. BD also invests in developing new technologies that address evolving healthcare challenges, such as reducing healthcare-associated infections and improving medication management.

The company's products touch virtually every aspect of healthcare delivery, from routine blood draws and medication administration to complex surgical procedures and advanced diagnostic testing. This broad portfolio allows BD to provide integrated solutions that address multiple points in a patient's healthcare journey.

4. Surgical Equipment & Consumables - Diversified

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

Becton Dickinson competes with other medical technology companies including Medtronic (NYSE:MDT), Abbott Laboratories (NYSE:ABT), Baxter International (NYSE:BAX), and Thermo Fisher Scientific (NYSE:TMO) across its various business segments.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $21.92 billion in revenue over the past 12 months, BD sports economies of scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, BD’s sales grew at a mediocre 4.4% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. BD’s annualized revenue growth of 6.1% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can better understand the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 5.8% year-on-year growth. Because this number aligns with its normal revenue growth, we can see that BD has properly hedged its foreign currency exposure.

This quarter, BD reported modest year-on-year revenue growth of 1.6% but beat Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

BD has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 11.3%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, BD’s operating margin rose by 1.6 percentage points over the last five years, as its sales growth gave it operating leverage. The company’s two-year trajectory shows its performance was mostly driven by its recent improvements.

This quarter, BD generated an operating margin profit margin of 10.5%, up 1.7 percentage points year on year. This increase was a welcome development and shows it was more efficient.

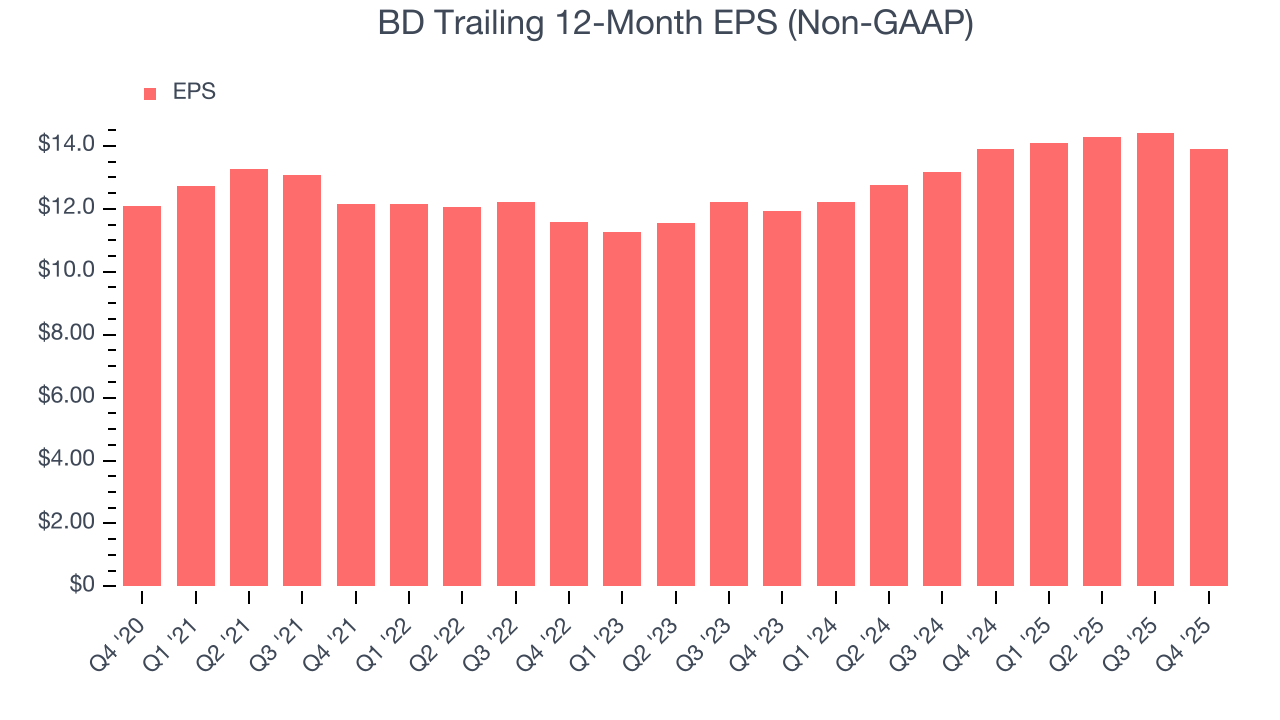

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

BD’s unimpressive 2.8% annual EPS growth over the last five years aligns with its revenue performance. On the bright side, this tells us its incremental sales were profitable.

In Q4, BD reported adjusted EPS of $2.91, down from $3.43 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 3.5%. Over the next 12 months, Wall Street expects BD’s full-year EPS of $13.90 to grow 8.7%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

BD has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 12.1% over the last five years, better than the broader healthcare sector.

Taking a step back, we can see that BD’s margin dropped by 1.9 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

BD’s free cash flow clocked in at $549 million in Q4, equivalent to a 10.5% margin. This cash profitability was in line with the comparable period last year but below its five-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

BD historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.3%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, BD’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

11. Balance Sheet Assessment

BD reported $1.04 billion of cash and $19.54 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $6.18 billion of EBITDA over the last 12 months, we view BD’s 3.0× net-debt-to-EBITDA ratio as safe. We also see its $294 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from BD’s Q4 Results

It was encouraging to see BD beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed. This guidance weighed on shares. The stock traded down 4.9% to $199.69 immediately following the results.

13. Is Now The Time To Buy BD?

Updated: February 24, 2026 at 11:01 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

BD isn’t a terrible business, but it doesn’t pass our quality test. To kick things off, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. While its strong operating margins show it’s a well-run business, the downside is its mediocre ROIC lags the market and is a headwind for its stock price. On top of that, its unimpressive EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

BD’s P/E ratio based on the next 12 months is 14.3x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $197.15 on the company (compared to the current share price of $183.24).