Brown-Forman (BF.B)

We’re skeptical of Brown-Forman. Its plummeting sales and returns on capital show its profits are shrinking as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Brown-Forman Will Underperform

Best known for its Jack Daniel’s whiskey, Brown-Forman (NYSE:BF.B) is an alcoholic beverage company with a broad portfolio of brands in wines and spirits.

- Products have few die-hard fans as sales have declined by 2% annually over the last three years

- Absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

- On the plus side, its successful business model is illustrated by its impressive operating margin

Brown-Forman is in the doghouse. There are more profitable opportunities elsewhere.

Why There Are Better Opportunities Than Brown-Forman

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Brown-Forman

At $29.01 per share, Brown-Forman trades at 17.1x forward P/E. This multiple rich for the business quality. Not a great combination.

We’d rather pay up for companies with elite fundamentals than get a decent price on a poor one. High-quality businesses often have more durable earnings power, helping us sleep well at night.

3. Brown-Forman (BF.B) Research Report: Q3 CY2025 Update

Alcohol company Brown-Forman (NYSE:BF.B) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 5.4% year on year to $1.04 billion. Its non-GAAP profit of $0.47 per share was in line with analysts’ consensus estimates.

Brown-Forman (BF.B) Q3 CY2025 Highlights:

- Revenue: $1.04 billion vs analyst estimates of $1.02 billion (5.4% year-on-year decline, 1.7% beat)

- Adjusted EPS: $0.47 vs analyst estimates of $0.48 (in line)

- Adjusted EBITDA: $327.9 million vs analyst estimates of $334.8 million (31.7% margin, 2.1% miss)

- Operating Margin: 29.4%, down from 31.1% in the same quarter last year

- Free Cash Flow Margin: 10.3%, up from 7.4% in the same quarter last year

- Market Capitalization: $13.31 billion

Company Overview

Best known for its Jack Daniel’s whiskey, Brown-Forman (NYSE:BF.B) is an alcoholic beverage company with a broad portfolio of brands in wines and spirits.

Aside from Jack Daniel’s, the company also goes to market with Woodford Reserve (bourbon), Finlandia (Vodka), Herradura and El Jimador (tequila), Sonoma-Cutrer Vineyards (wine), Korbel (champagne), and others. Brown-Forman’s history dates back to 1870, and some of its brands were developed and nurtured organically while others were acquired.

The core Brown-Forman customer is a discerning spirits and wine enthusiast. These customers value exceptional taste as well as authenticity and are not afraid to pay for it. Brown-Forman therefore uses quality ingredients and time-honored production techniques to meet these needs, and the company’s products are on the more premium end of the alcoholic beverage price spectrum.

Brown-Forman products can be found in a wide range of establishments. These include grocery stores that feature liquor and wine sections based on state regulations, liquor stores, premium retail outlets such as duty-free stores, and high-end restaurants and bars worldwide.

4. Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors in the alcohol, spirits, and wine space include Diageo (LSE:DGE), Pernod Ricard (ENXTPA:RI), and Constellation Brands (NYSE:STZ).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $3.89 billion in revenue over the past 12 months, Brown-Forman carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

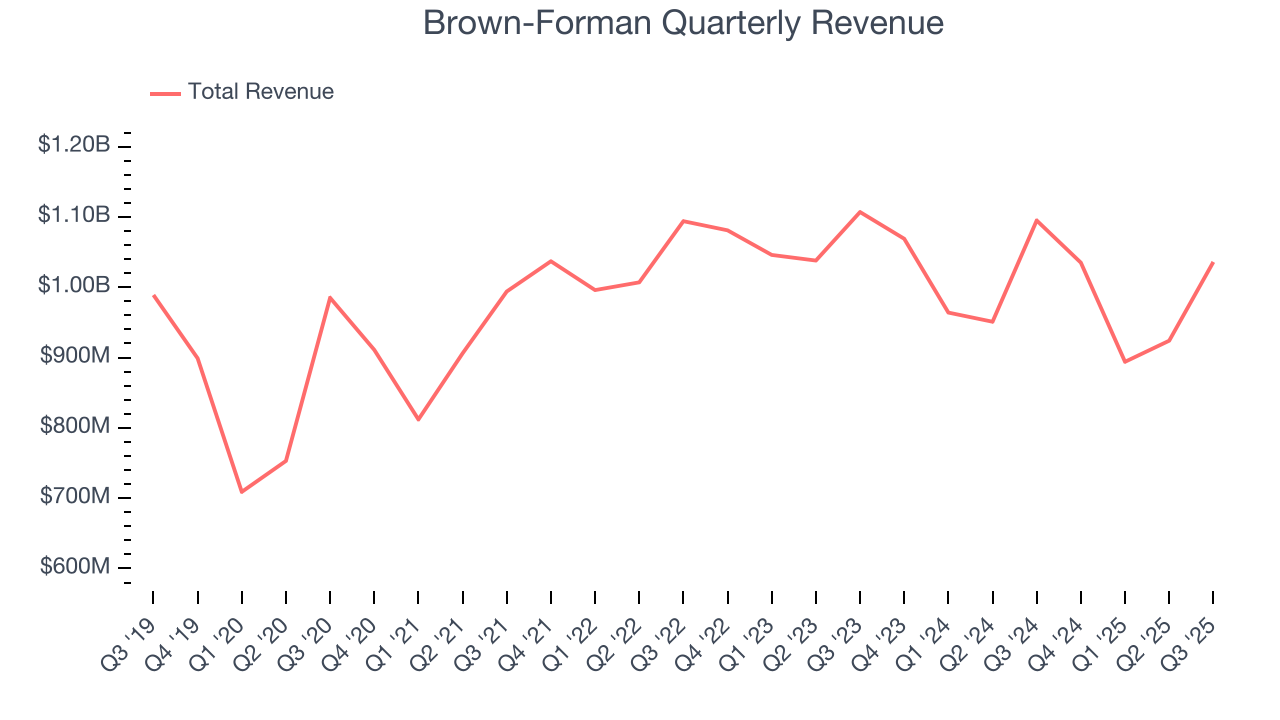

As you can see below, Brown-Forman struggled to generate demand over the last three years. Its sales dropped by 2% annually, a rough starting point for our analysis.

This quarter, Brown-Forman’s revenue fell by 5.4% year on year to $1.04 billion but beat Wall Street’s estimates by 1.7%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products will spur better top-line performance, it is still below average for the sector.

6. Gross Margin & Pricing Power

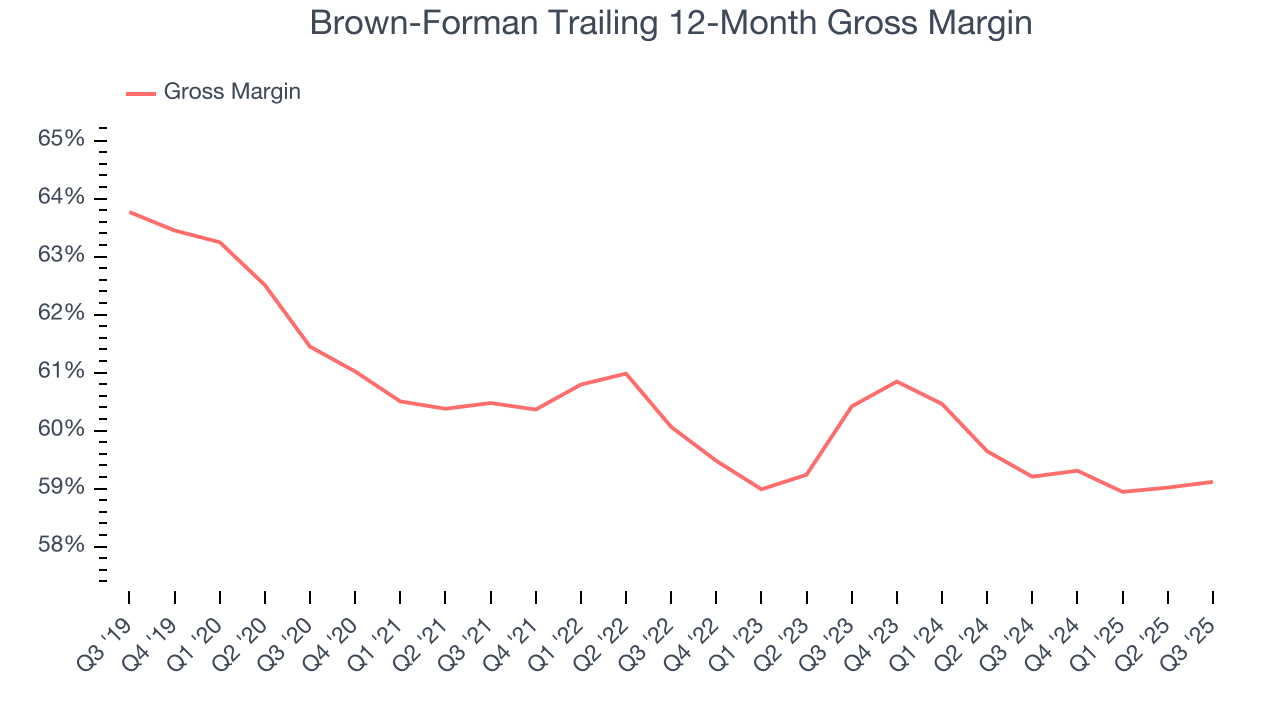

Brown-Forman has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 59.2% gross margin over the last two years. That means for every $100 in revenue, only $40.84 went towards paying for raw materials, production of goods, transportation, and distribution.

In Q3, Brown-Forman produced a 59.4% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Brown-Forman has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 30.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Brown-Forman’s operating margin decreased by 6.6 percentage points over the last year. Even though its historical margin was healthy, shareholders will want to see Brown-Forman become more profitable in the future.

This quarter, Brown-Forman generated an operating margin profit margin of 29.4%, down 1.7 percentage points year on year. Since Brown-Forman’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

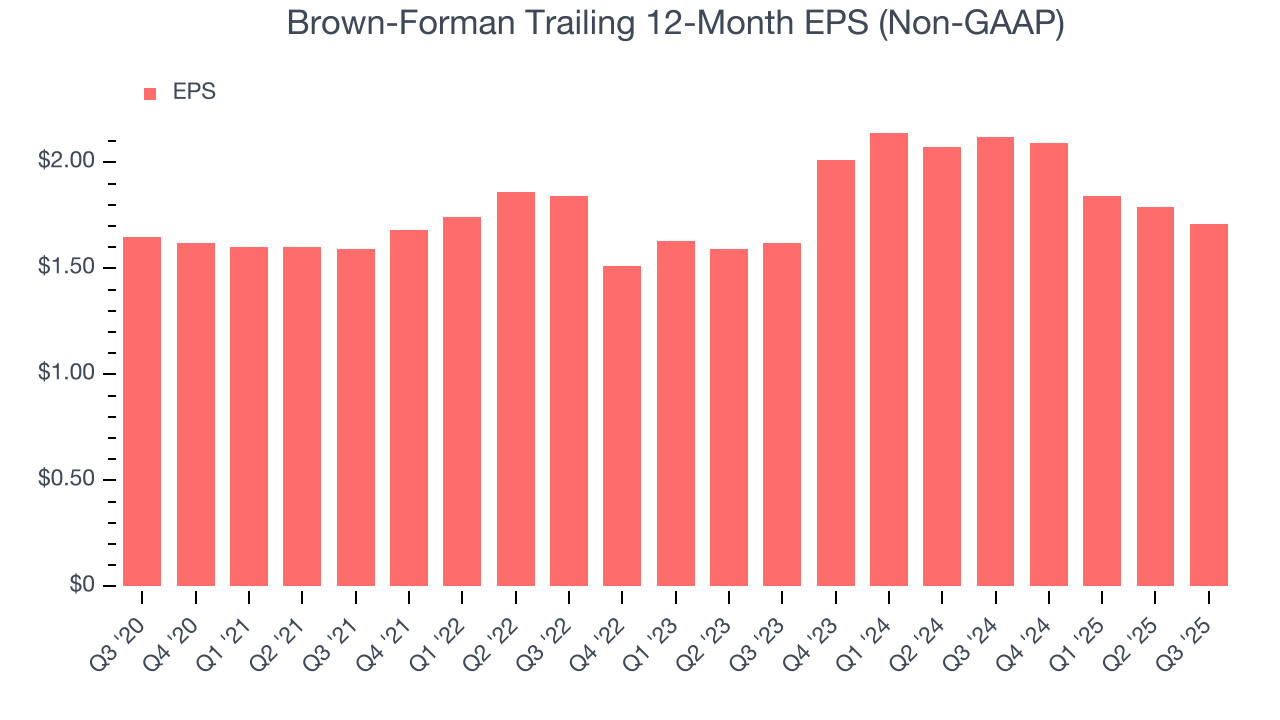

In Q3, Brown-Forman reported adjusted EPS of $0.47, down from $0.55 in the same quarter last year. This print slightly missed analysts’ estimates. Over the next 12 months, Wall Street expects Brown-Forman’s full-year EPS of $1.71 to shrink by 1.5%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

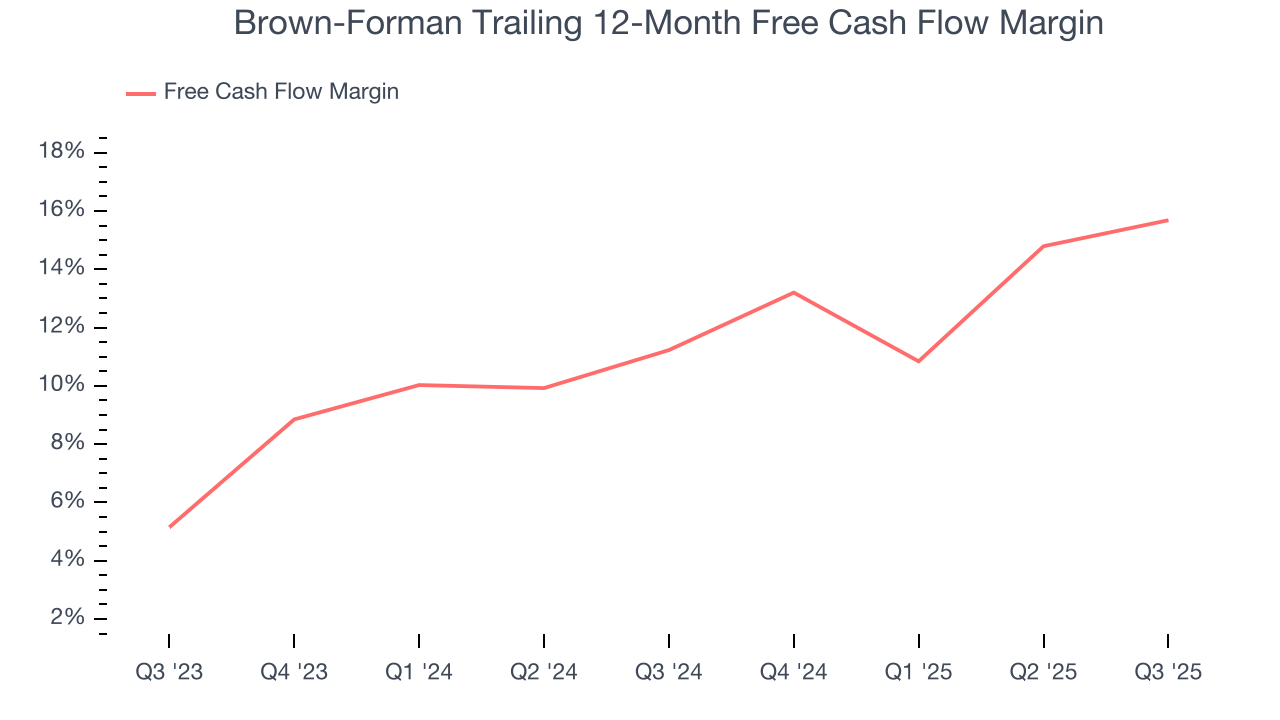

Brown-Forman has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 13.4% over the last two years.

Taking a step back, we can see that Brown-Forman’s margin expanded by 4.5 percentage points over the last year. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Brown-Forman’s free cash flow clocked in at $107 million in Q3, equivalent to a 10.3% margin. This result was good as its margin was 2.9 percentage points higher than in the same quarter last year, building on its favorable historical trend.

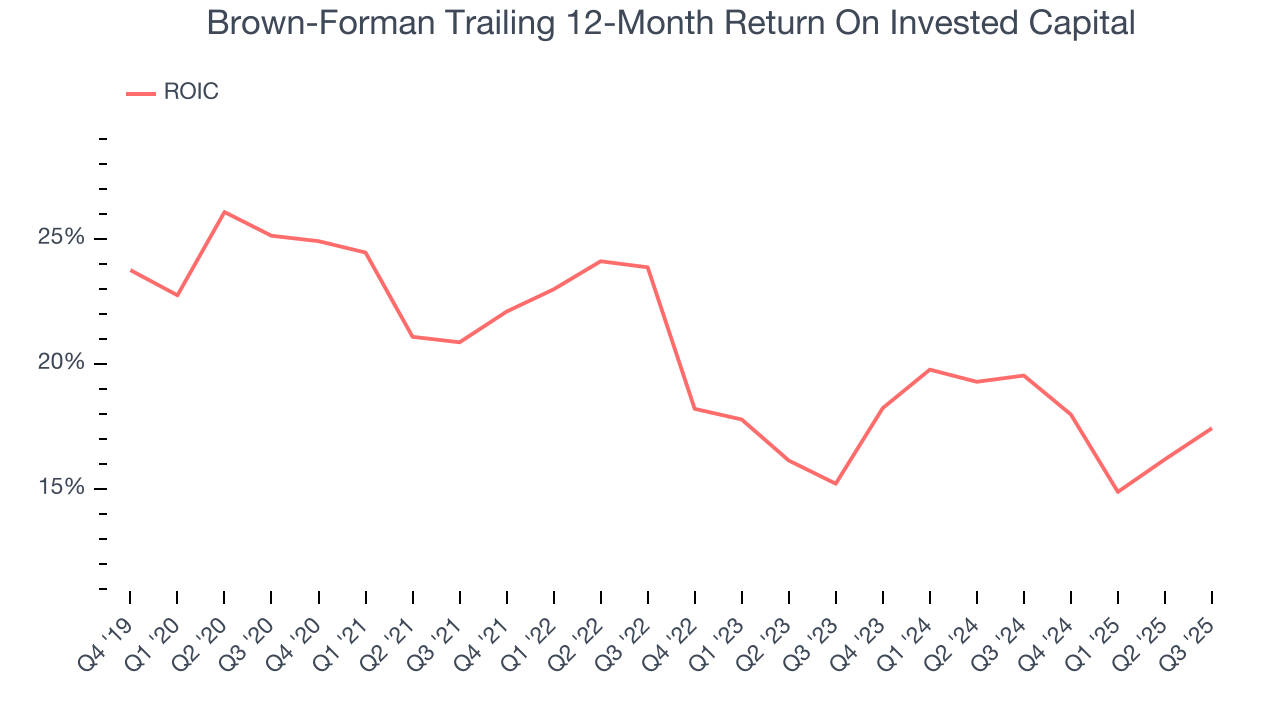

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Brown-Forman hasn’t been the highest-quality company lately because of its poor top-line performance, it historically found a few growth initiatives that worked out well. Its five-year average ROIC was 19.4%, impressive for a consumer staples business.

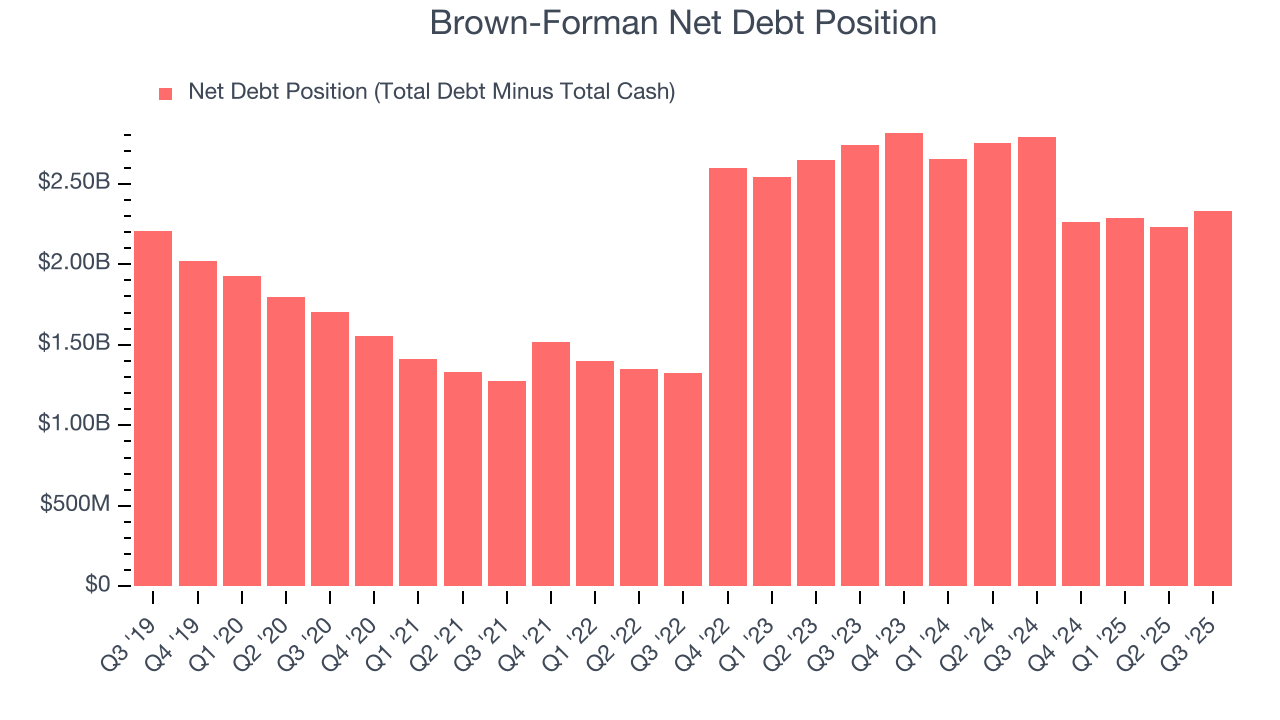

11. Balance Sheet Assessment

Brown-Forman reported $319 million of cash and $2.65 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.16 billion of EBITDA over the last 12 months, we view Brown-Forman’s 2.0× net-debt-to-EBITDA ratio as safe. We also see its $48 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Brown-Forman’s Q3 Results

It was encouraging to see Brown-Forman beat analysts’ revenue expectations this quarter. On the other hand, its EBITDA missed and its EPS was in line with Wall Street’s estimates. Overall, this quarter could have been better. The stock remained flat at $29.02 immediately following the results.

13. Is Now The Time To Buy Brown-Forman?

Updated: December 18, 2025 at 10:13 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own Brown-Forman, you should also grasp the company’s longer-term business quality and valuation.

Brown-Forman’s business quality ultimately falls short of our standards. To begin with, its revenue has declined over the last three years. And while its impressive operating margins show it has a highly efficient business model, the downside is its declining operating margin shows the business has become less efficient. On top of that, its projected EPS for the next year is lacking.

Brown-Forman’s P/E ratio based on the next 12 months is 17.1x. Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $30.63 on the company (compared to the current share price of $29.01).