Brady (BRC)

We see potential in Brady. Its robust cash flows and returns on capital showcase its management team’s strong investing abilities.― StockStory Analyst Team

1. News

2. Summary

Why Brady Is Interesting

Founded in 1914 and evolving through more than a century of industrial innovation, Brady (NYSE:BRC) manufactures and supplies identification solutions and workplace safety products that help companies identify and protect their premises, products, and people.

- Earnings per share have massively outperformed its peers over the last five years, increasing by 15.7% annually

- Disciplined cost controls and effective management have materialized in a strong operating margin

- On the other hand, its absence of organic revenue growth over the past two years suggests it may have to lean into acquisitions to drive its expansion

Brady almost passes our quality test. If you’re a believer, the price seems fair.

Why Is Now The Time To Buy Brady?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Brady?

Brady is trading at $95.33 per share, or 18.5x forward P/E. Compared to companies in the business services space, we think this multiple is warranted for the revenue growth you get.

Now could be a good time to invest if you believe in the story.

3. Brady (BRC) Research Report: Q4 CY2025 Update

Identification solutions manufacturer Brady (NYSE:BRC) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 7.7% year on year to $384.1 million. Its non-GAAP profit of $1.09 per share was in line with analysts’ consensus estimates.

Brady (BRC) Q4 CY2025 Highlights:

- Revenue: $384.1 million vs analyst estimates of $378.6 million (7.7% year-on-year growth, 1.5% beat)

- Adjusted EPS: $1.09 vs analyst estimates of $1.09 (in line)

- Adjusted EBITDA: $71.98 million vs analyst estimates of $76.4 million (18.7% margin, 5.8% miss)

- Management slightly raised its full-year Adjusted EPS guidance to $5.05 at the midpoint

- Operating Margin: 16.2%, in line with the same quarter last year

- Free Cash Flow Margin: 11%, up from 9.1% in the same quarter last year

- Market Capitalization: $4.49 billion

Company Overview

Founded in 1914 and evolving through more than a century of industrial innovation, Brady (NYSE:BRC) manufactures and supplies identification solutions and workplace safety products that help companies identify and protect their premises, products, and people.

Brady's product portfolio spans several categories designed to meet critical workplace needs. The company's safety and facility identification products include safety signs, floor-marking tape, pipe markers, lockout/tagout devices, and spill control products that help businesses maintain compliant and hazard-free environments. Its product identification solutions feature materials, printing systems, and RFID technology that enable manufacturers to track assets and label finished products. Wire identification products help electricians and engineers properly mark electrical components, while healthcare identification solutions assist hospitals in tracking patients and specimens.

The company operates through two geographic segments: Americas & Asia and Europe & Australia. This regional structure allows Brady to tailor its offerings to local market needs while maintaining global manufacturing standards. Brady's products reach customers through multiple channels, including distributors, a direct sales force, and digital platforms, with the company maintaining long-standing relationships with electrical, safety, and industrial distributors worldwide.

A manufacturing company at its core, Brady produces most of its proprietary products in-house. Its manufacturing processes involve precision techniques like compounding, coating, converting, and melt-blown operations. For example, a manufacturing plant might use Brady's lockout/tagout devices to prevent accidental equipment startups during maintenance, while simultaneously using Brady's floor-marking tape to designate safe walking paths and its identification labels to track inventory.

Brady serves diverse industries including industrial manufacturing, healthcare, chemical, oil and gas, automotive, aerospace, construction, and utilities. The company generates revenue by selling its physical products and related software solutions, with ongoing innovation driven by its research and development team that focuses on creating new products that solve customer problems and improve environmental sustainability.

4. Safety & Security Services

Rising concerns over physical security, cybersecurity threats, and workplace safety regulations will present opportunities for companies in this sector. AI and digitization will enhance surveillance, access control, and threat detection, which could benefit key players in Safety & Security Services. These trends could also introduce ethical and regulatory concerns over data privacy and automated decision-making in security operations, giving rise to headline risks. Finally, increasing scrutiny on private security practices and evolving criminal justice policies again mean that companies in the space need to operate with the utmost care or risk being the poster child of abuse of power.

Brady's competitors include 3M (NYSE: MMM) in safety and identification products, Avery Dennison (NYSE: AVY) in labeling and identification solutions, and Honeywell (NASDAQ: HON) in workplace safety equipment, along with regional players in specific market segments.

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $1.57 billion in revenue over the past 12 months, Brady is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

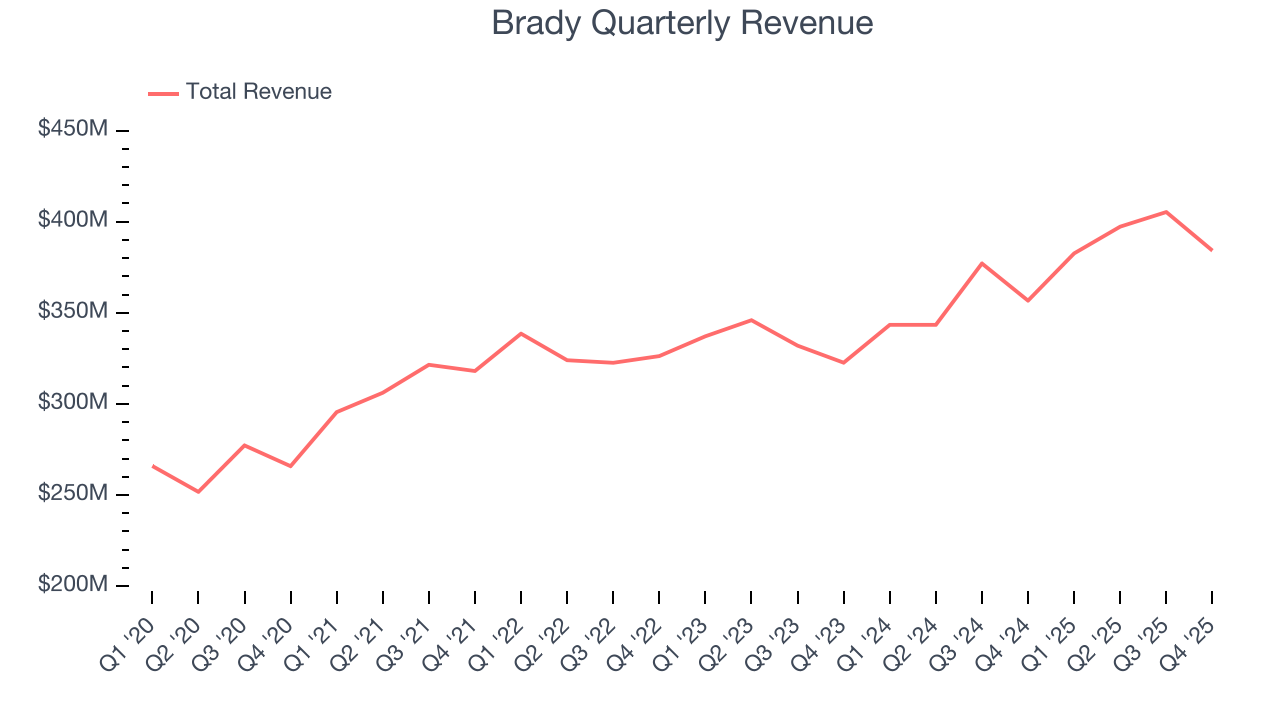

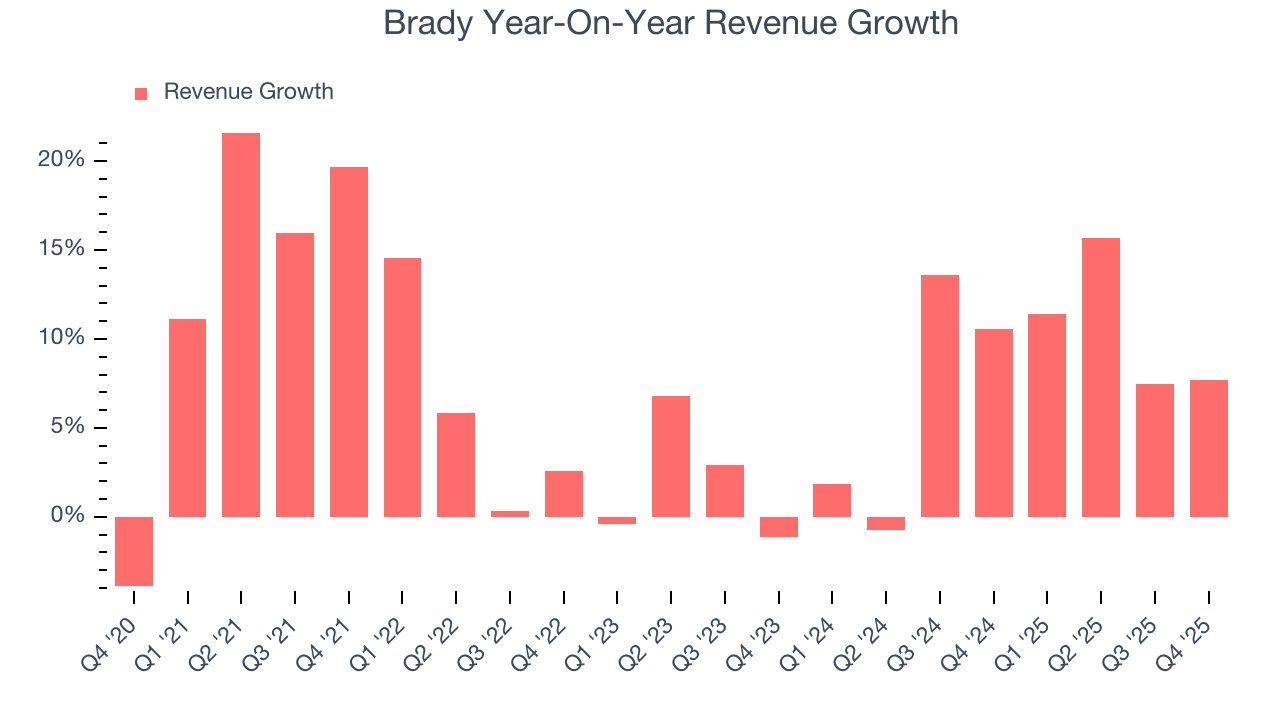

As you can see below, Brady’s 8.1% annualized revenue growth over the last five years was solid. This is an encouraging starting point for our analysis because it shows Brady’s demand was higher than many business services companies.

We at StockStory place the most emphasis on long-term growth, but within business services, a half-decade historical view may miss recent innovations or disruptive industry trends. Brady’s annualized revenue growth of 8.3% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Brady reported year-on-year revenue growth of 7.7%, and its $384.1 million of revenue exceeded Wall Street’s estimates by 1.5%.

Looking ahead, sell-side analysts expect revenue to grow 4.5% over the next 12 months, a deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

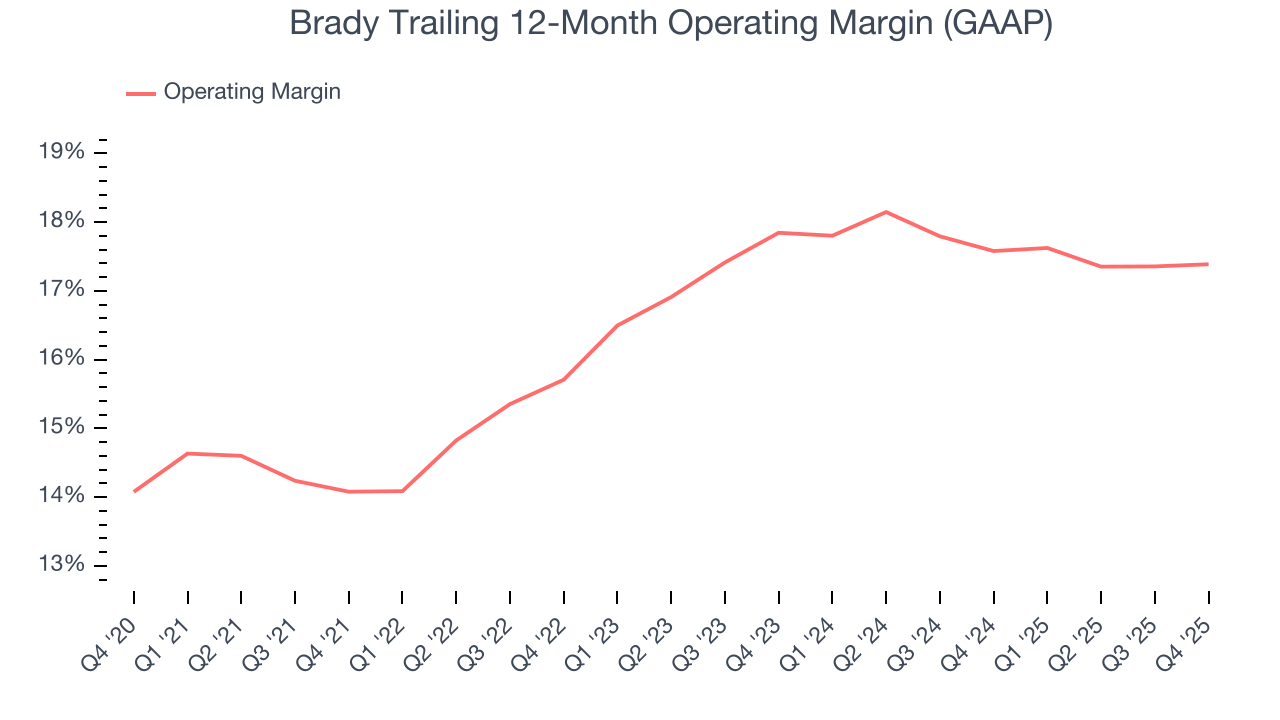

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Brady has been an efficient company over the last five years. It was one of the more profitable businesses in the business services sector, boasting an average operating margin of 16.6%.

Analyzing the trend in its profitability, Brady’s operating margin rose by 3.3 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Brady generated an operating margin profit margin of 16.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

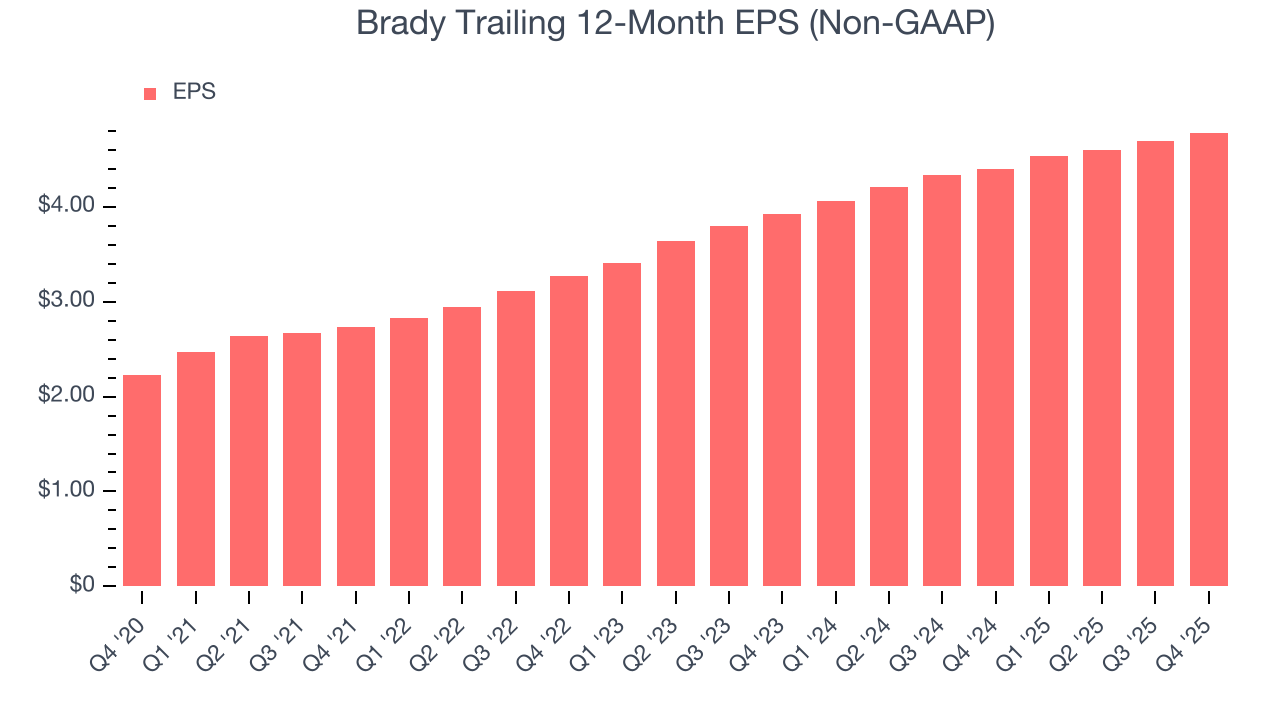

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

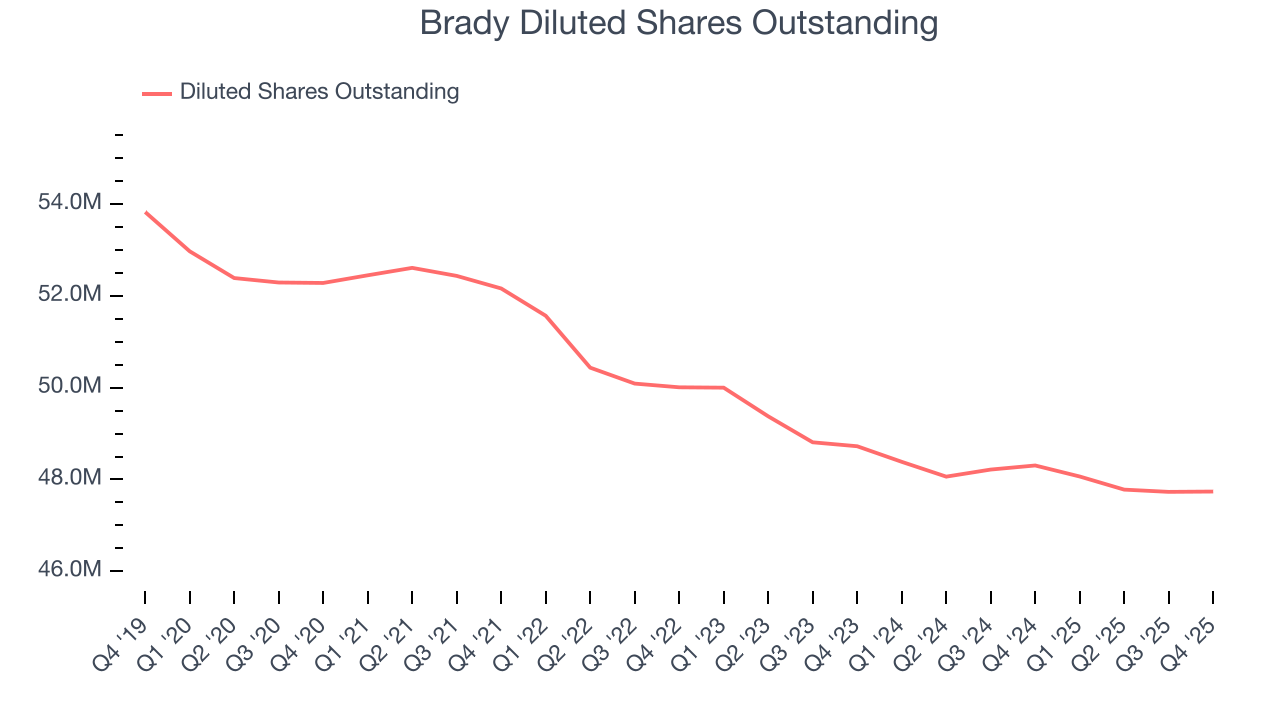

Brady’s EPS grew at an astounding 16.5% compounded annual growth rate over the last five years, higher than its 8.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Brady’s earnings to better understand the drivers of its performance. As we mentioned earlier, Brady’s operating margin was flat this quarter but expanded by 3.3 percentage points over the last five years. On top of that, its share count shrank by 8.7%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Brady, its two-year annual EPS growth of 10.4% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q4, Brady reported adjusted EPS of $1.09, up from $1 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Brady’s full-year EPS of $4.78 to grow 10.5%.

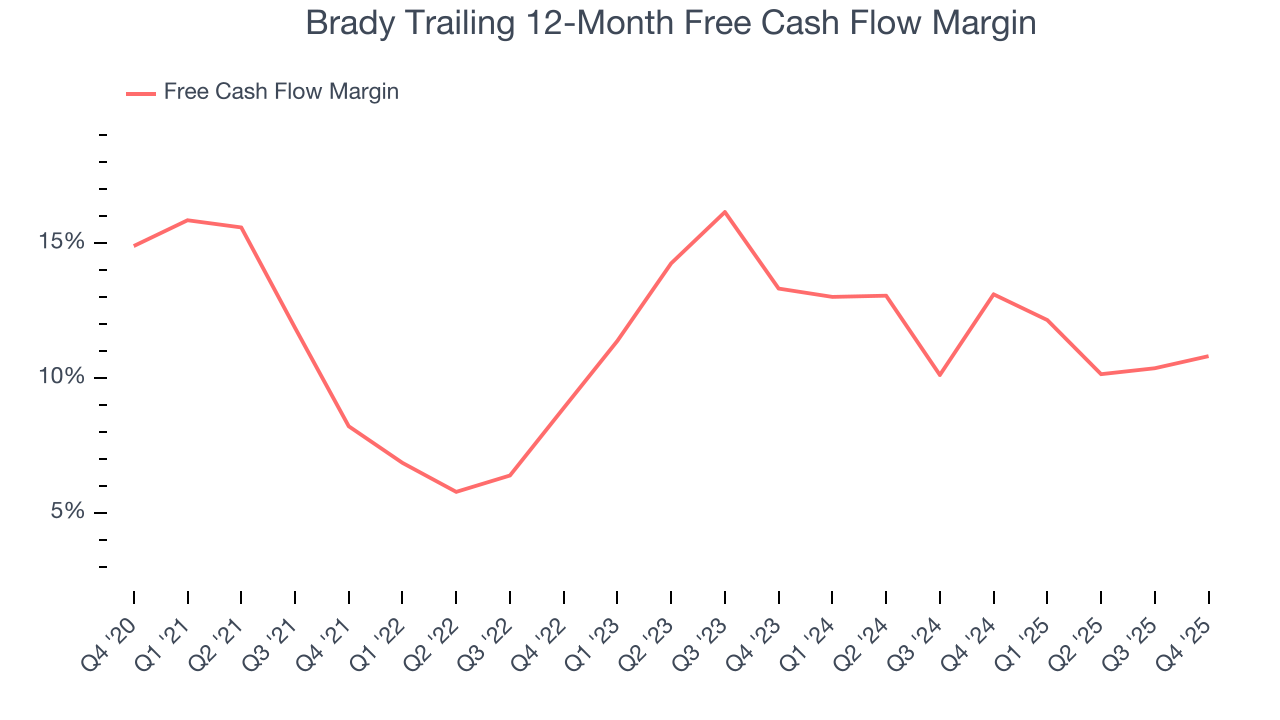

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Brady has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 10.9% over the last five years, quite impressive for a business services business.

Taking a step back, we can see that Brady’s margin expanded by 2.6 percentage points during that time. This is encouraging because it gives the company more optionality.

Brady’s free cash flow clocked in at $42.35 million in Q4, equivalent to a 11% margin. This result was good as its margin was 1.9 percentage points higher than in the same quarter last year, building on its favorable historical trend.

9. Return on Invested Capital (ROIC)

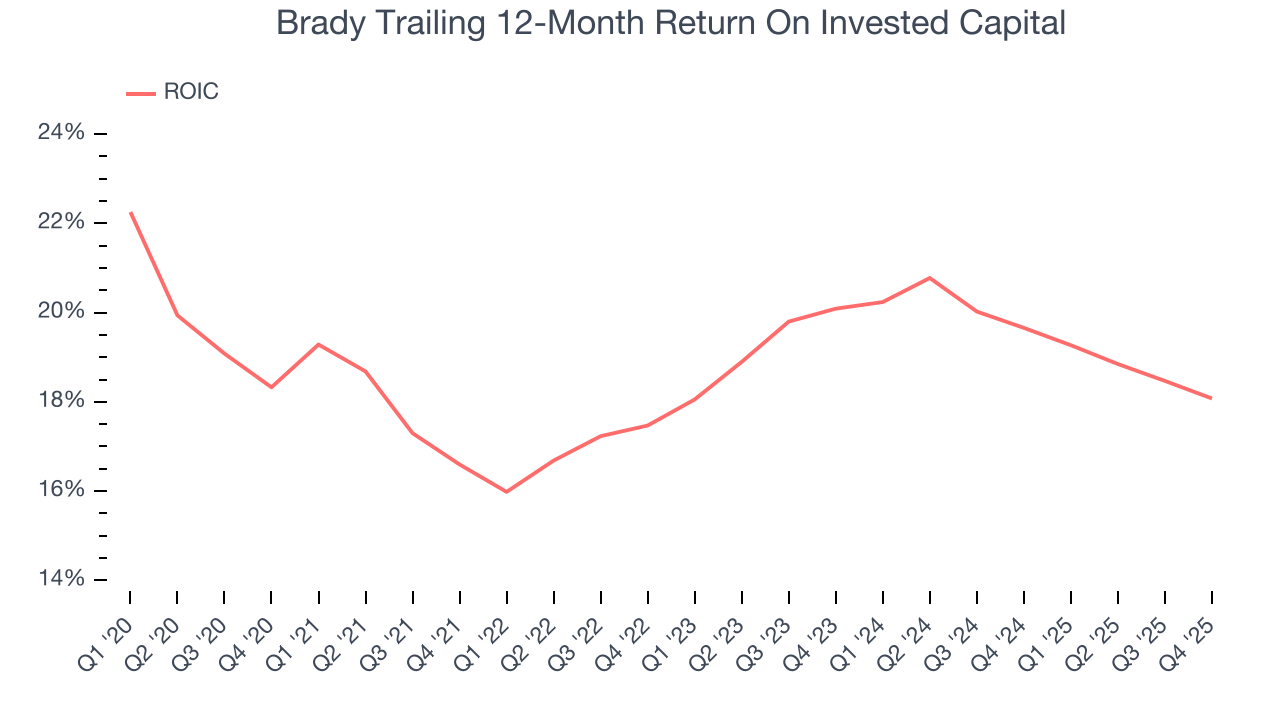

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Brady’s five-year average ROIC was 18.4%, beating other business services companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Brady’s ROIC increased by 1.8 percentage points annually each year over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

10. Balance Sheet Assessment

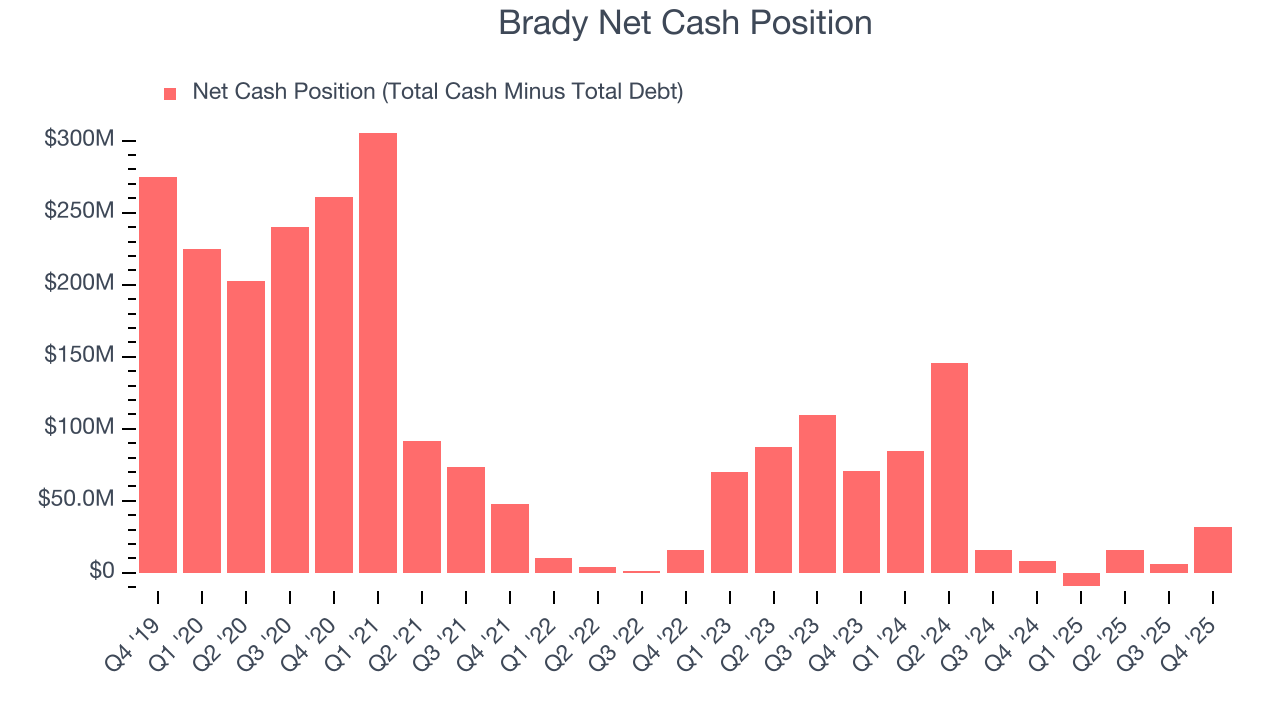

Companies with more cash than debt have lower bankruptcy risk.

Brady is a profitable, well-capitalized company with $176.5 million of cash and $144.9 million of debt on its balance sheet. This $31.59 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Brady’s Q4 Results

It was good to see Brady narrowly top analysts’ revenue expectations this quarter. Zooming out, we think this was a decent quarter. The stock remained flat at $95.26 immediately following the results.

12. Is Now The Time To Buy Brady?

Updated: February 19, 2026 at 7:32 AM EST

Are you wondering whether to buy Brady or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

First of all, the company’s revenue growth was solid over the last five years. On top of that, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, and its strong operating margins show it’s a well-run business.

Brady’s P/E ratio based on the next 12 months is 18x. Looking at the business services space right now, Brady trades at a compelling valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $101 on the company (compared to the current share price of $95.26), implying they see 6% upside in buying Brady in the short term.