Anheuser-Busch (BUD)

We’re cautious of Anheuser-Busch. Its lack of sales growth shows demand is soft, a concerning sign for investors in high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Anheuser-Busch Is Not Exciting

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE:BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.

- Sales stagnated over the last three years and signal the need for new growth strategies

- Organic sales performance over the past two years indicates the company may need to make strategic adjustments or rely on M&A to catalyze faster growth

- The good news is that its successful business model is illustrated by its impressive operating margin, and its profitability increased over the last year as it eliminated unnecessary expenses

Anheuser-Busch is in the penalty box. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Anheuser-Busch

Why There Are Better Opportunities Than Anheuser-Busch

Anheuser-Busch is trading at $64.64 per share, or 5.7x forward EV-to-EBITDA. The current valuation may be appropriate, but we’re still not buyers of the stock.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects.

3. Anheuser-Busch (BUD) Research Report: Q3 CY2025 Update

Beer powerhouse Anheuser-Busch InBev (NYSE:BUD) fell short of the markets revenue expectations in Q3 CY2025, with sales flat year on year at $15.13 billion. Its GAAP profit of $0.99 per share was 29.1% above analysts’ consensus estimates.

Anheuser-Busch (BUD) Q3 CY2025 Highlights:

- Revenue: $15.13 billion vs analyst estimates of $15.22 billion (flat year on year, 0.6% miss)

- EPS (GAAP): $0.99 vs analyst estimates of $0.77 (29.1% beat)

- Adjusted EBITDA: $5.59 billion vs analyst estimates of $5.48 billion (37% margin, 2% beat)

- Operating Margin: 27.8%, in line with the same quarter last year

- Organic Revenue was flat year on year

- Sales Volumes fell 3.7% year on year (-2.4% in the same quarter last year)

- Market Capitalization: $103.5 billion

Company Overview

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE:BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.

Anheuser-Busch InBev, or ABI as it’s often called, was formed in 2008 when InBev–a Belgian company–acquired Anheuser-Busch for $52 billion. The new company, which at the time was the largest brewer in the world, then bought Grupo Modelo in 2013 and SABMiller in 2016 to strengthen its Latin American and African presences, respectively.

Today, ABI is globally known because of its three largest brands mentioned before, but they also own regional favorites like Brahma in Brazil, Spaten in Germany, and Castle Lager in South Africa. To respond to evolving consumer tastes, the company has also gotten into the craft and specialty market with brands like Goose Island and Four Peaks Brewing Co.

The company's core customer is broad and is generally anyone who enjoys beer. Whether it's a football game or just winding down after work, ABI has a beer to fit the moment. Its products are widely available in grocery stores, liquor shops, pubs, bars, and restaurants around the world. An extensive distribution network ensures that whether you're on a beach in Brazil or a pub in the UK, you're likely to find at least one of their brands on tap or on the shelf.

4. Beverages, Alcohol, and Tobacco

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors in the beer industry include Heineken (ENXTAM:HEIA), Constellation Brands (NYSE:STZ), Carlsberg (CPSE:CARL B), and numerous regional brewers globally.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $58.61 billion in revenue over the past 12 months, Anheuser-Busch is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have). However, its scale is a double-edged sword because it’s harder to find incremental growth when your existing brands have penetrated most of the market. To accelerate sales, Anheuser-Busch likely needs to optimize its pricing or lean into new products and international expansion.

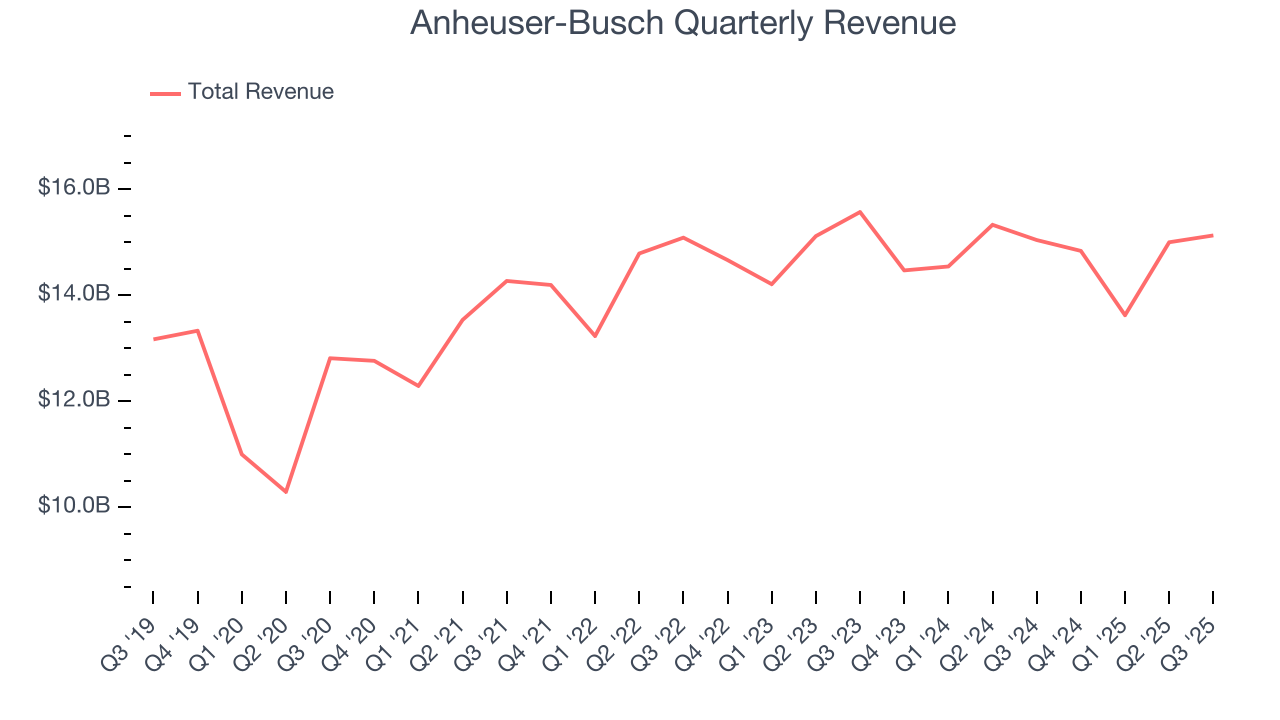

As you can see below, Anheuser-Busch struggled to increase demand as its $58.61 billion of sales for the trailing 12 months was close to its revenue three years ago. This is mainly because consumers bought less of its products - we’ll explore what this means in the "Volume Growth" section.

This quarter, Anheuser-Busch’s $15.13 billion of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, an acceleration versus the last three years. This projection is above the sector average and implies its newer products will catalyze better top-line performance.

6. Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

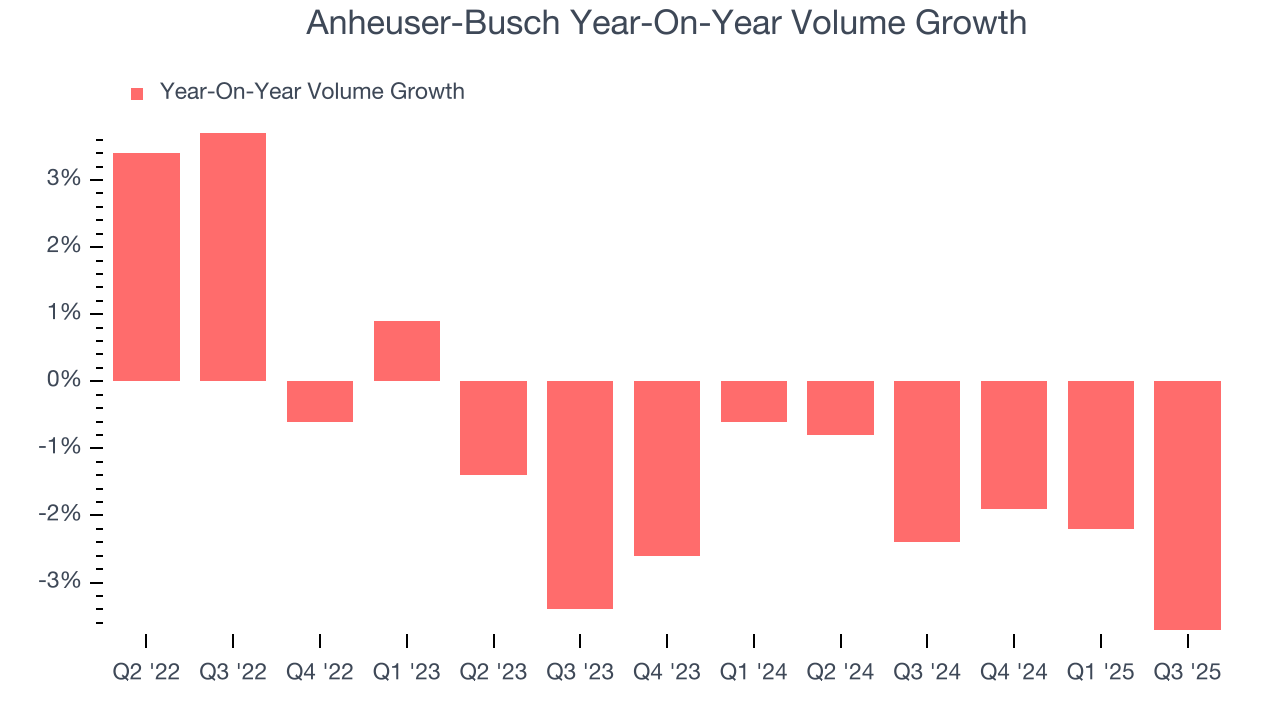

Anheuser-Busch’s average quarterly sales volumes have shrunk by 2% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Anheuser-Busch’s Q3 2025, sales volumes dropped 3.7% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

7. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

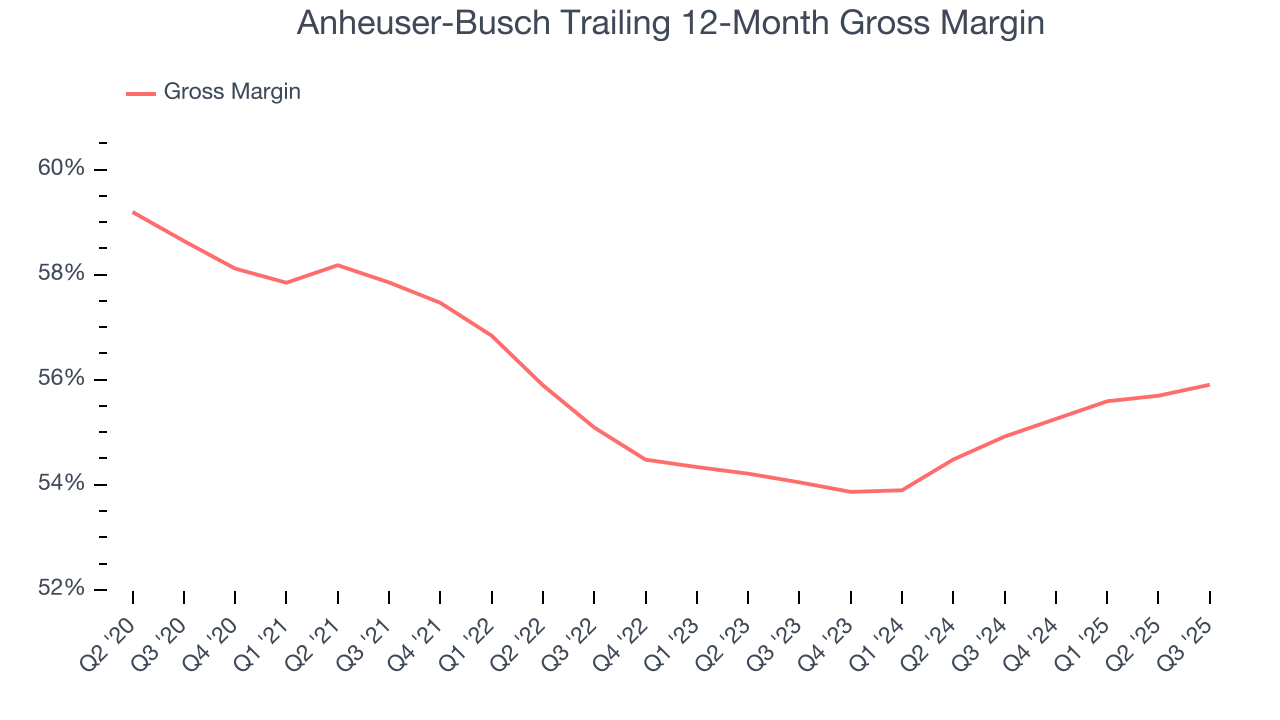

Anheuser-Busch has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 55.4% gross margin over the last two years. That means for every $100 in revenue, only $44.59 went towards paying for raw materials, production of goods, transportation, and distribution.

Anheuser-Busch’s gross profit margin came in at 56.4% this quarter, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

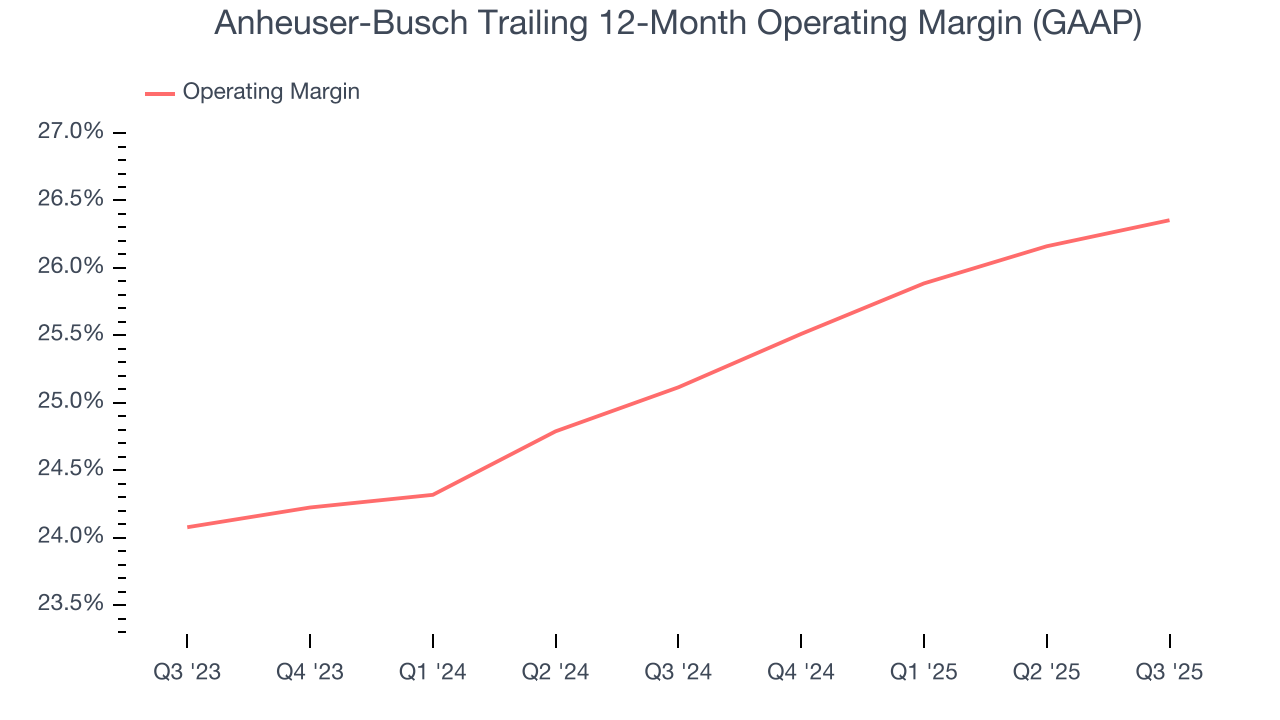

Anheuser-Busch has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 25.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Anheuser-Busch’s operating margin rose by 1.2 percentage points over the last year, showing its efficiency has improved.

This quarter, Anheuser-Busch generated an operating margin profit margin of 27.8%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

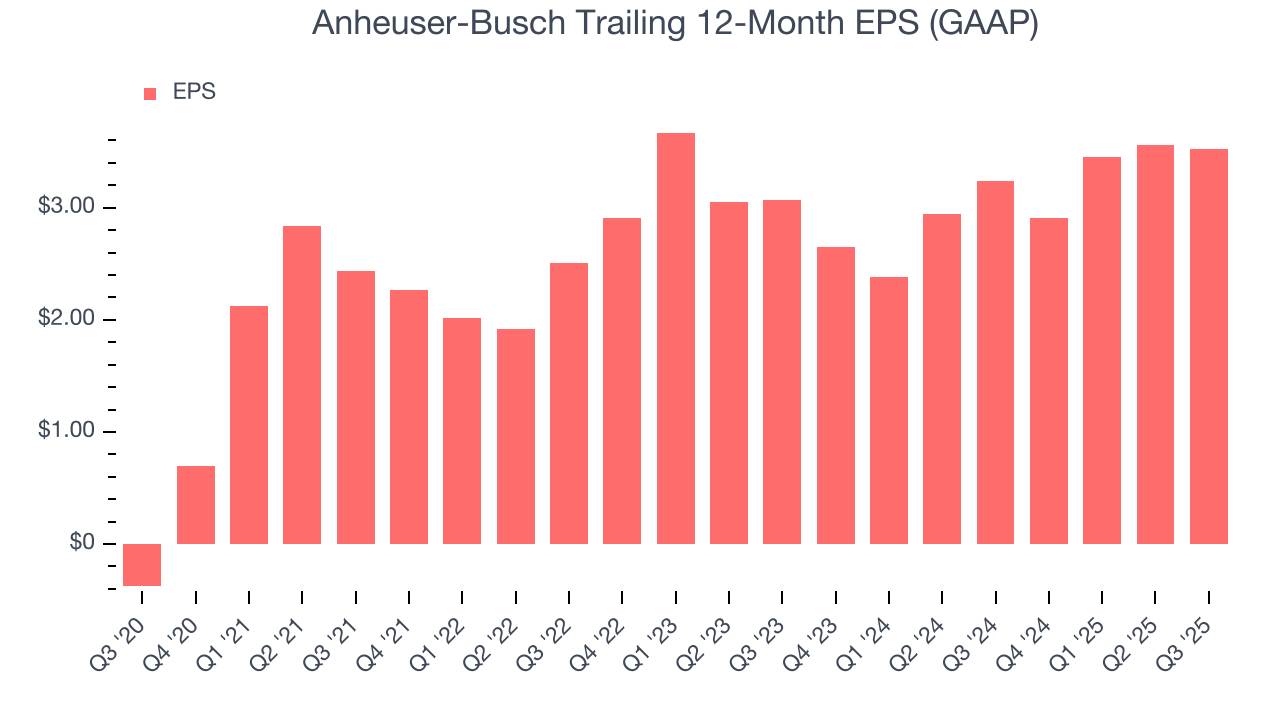

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

In Q3, Anheuser-Busch reported EPS of $0.99, down from $1.03 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

10. Key Takeaways from Anheuser-Busch’s Q3 Results

It was good to see Anheuser-Busch beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue slightly missed on declining sales volumes. Overall, this print was mixed. The market seemed to be hoping for more, and the stock traded down 1.9% to $60.28 immediately after reporting.

11. Is Now The Time To Buy Anheuser-Busch?

Updated: December 21, 2025 at 9:49 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Anheuser-Busch isn’t a terrible business, but it doesn’t pass our bar. To kick things off, its revenue growth was weak over the last three years. And while Anheuser-Busch’s impressive operating margins show it has a highly efficient business model, its shrinking sales volumes suggest it’ll need to change its strategy to succeed.

Anheuser-Busch’s EV-to-EBITDA ratio based on the next 12 months is 5.6x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $76.90 on the company (compared to the current share price of $64.37).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.