BrightView (BV)

BrightView is up against the odds. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think BrightView Will Underperform

An official field consultant for Major League Baseball, BrightView (NYSE:BV) offers landscaping design, development, and maintenance.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 2.6% annually over the last two years

- Earnings per share have contracted by 1.7% annually over the last five years, a headwind for returns as stock prices often echo long-term EPS performance

- Underwhelming 2.9% return on capital reflects management’s difficulties in finding profitable growth opportunities

BrightView falls short of our quality standards. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than BrightView

High Quality

Investable

Underperform

Why There Are Better Opportunities Than BrightView

BrightView is trading at $13.20 per share, or 18.1x forward P/E. This multiple is lower than most industrials companies, but for good reason.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. BrightView (BV) Research Report: Q3 CY2025 Update

Landscaping service company BrightView (NYSE:BV) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 3.6% year on year to $702.8 million. The company’s full-year revenue guidance of $2.7 billion at the midpoint came in 1.7% below analysts’ estimates. Its non-GAAP profit of $0.27 per share was 14.7% below analysts’ consensus estimates.

BrightView (BV) Q3 CY2025 Highlights:

- Revenue: $702.8 million vs analyst estimates of $722.9 million (3.6% year-on-year decline, 2.8% miss)

- Adjusted EPS: $0.27 vs analyst expectations of $0.32 (14.7% miss)

- Adjusted EBITDA: $113.5 million vs analyst estimates of $113.3 million (16.1% margin, in line)

- EBITDA guidance for the upcoming financial year 2026 is $370 million at the midpoint, below analyst estimates of $375.8 million

- Operating Margin: 7.9%, in line with the same quarter last year

- Free Cash Flow Margin: 12%, up from 3.4% in the same quarter last year

- Market Capitalization: $1.13 billion

Company Overview

An official field consultant for Major League Baseball, BrightView (NYSE:BV) offers landscaping design, development, and maintenance.

BrightView was established in 2014 through the merger of two U.S. landscaping companies: The Brickman Group and ValleyCrest. The Brickman Group, founded in 1939, was known for landscape maintenance while ValleyCrest, established in 1949, offered landscape design, development, and maintenance. Post-merger, the company made various acquisitions targeting smaller regional landscaping companies to grow its product portfolio.

Today, BrightView enhances the aesthetics and health of outdoor environments through landscaping services such as mowing, trimming, and fertilization. Collaborating with clients, it also creates landscape designs for commercial properties, residential communities, and public spaces. During winter months, the company focus shifts to snow and ice management services such as plowing, de-icing, and snow removal.

BrightView engages with customers through direct sales and contract-based arrangements typically spanning multiple years. It often enters into long-term contracts with commercial property owners, municipalities, and large-scale developers, to provide landscape maintenance services. These contracts typically include regular site visits, seasonal landscaping services, and irrigation system management.

4. Facility Services

Many facility services are non-discretionary (office building bathrooms need to be cleaned), recurring, and performed through contracts. This makes for more predictable and stickier revenue streams. However, COVID changed the game regarding commercial real estate, and office vacancies remain high as hybrid work seems here to stay. This is a headwind for demand, and facility services companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact commercial construction projects that drive incremental demand for these companies’ services.

Competitors offering similar products include Scotts Miracle-Gro (NYSE:SMG), SiteOne (NYSE:SITE), and TruGreen (private).

5. Revenue Growth

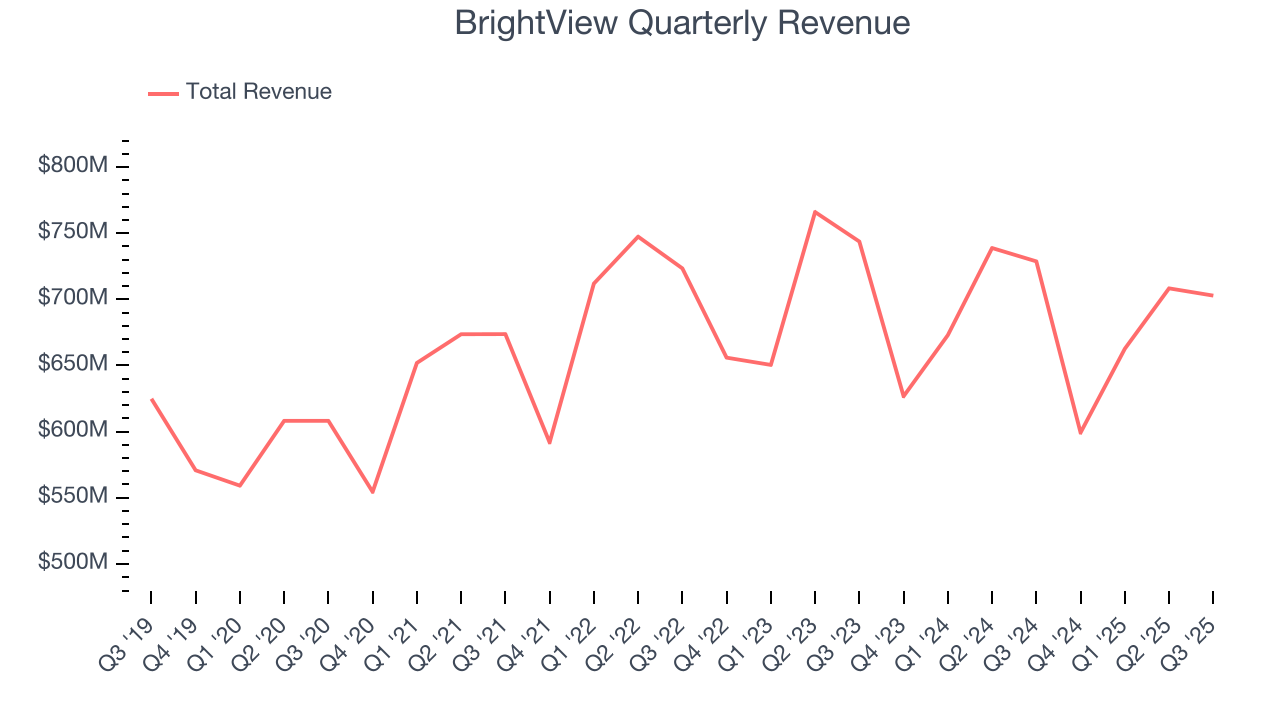

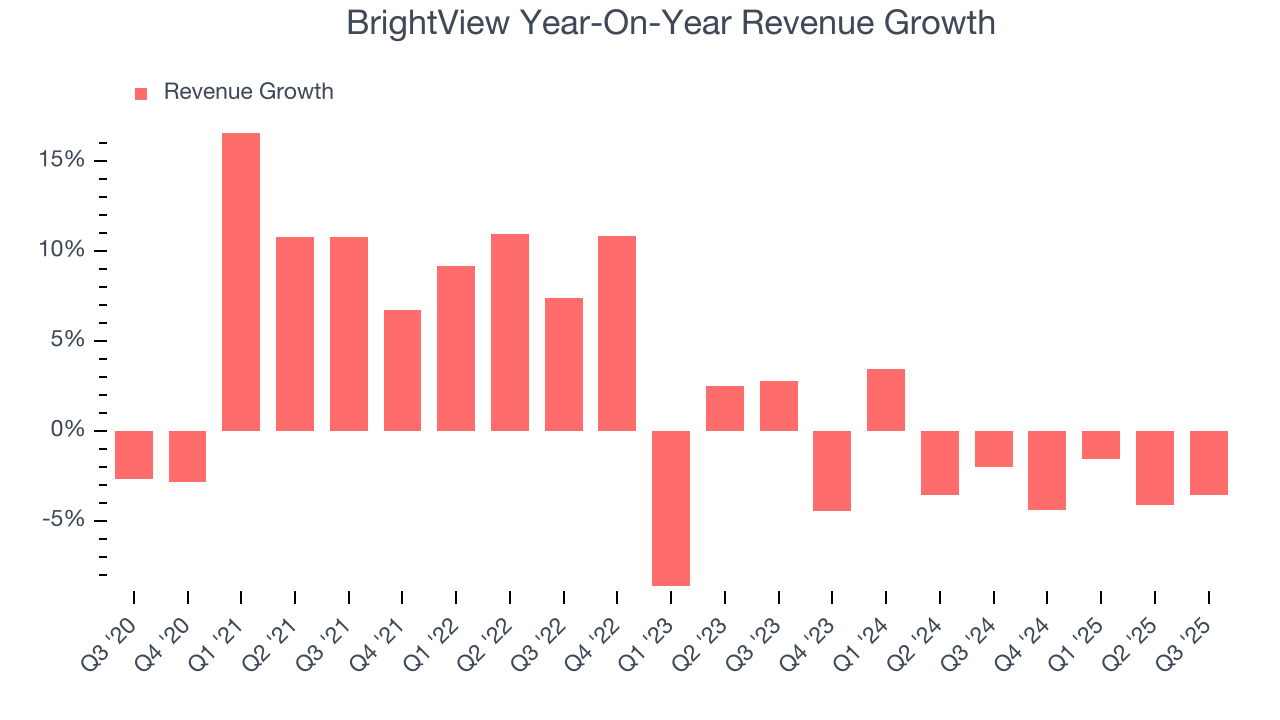

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, BrightView’s 2.6% annualized revenue growth over the last five years was sluggish. This was below our standards and is a poor baseline for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. BrightView’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 2.6% annually.

This quarter, BrightView missed Wall Street’s estimates and reported a rather uninspiring 3.6% year-on-year revenue decline, generating $702.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below average for the sector.

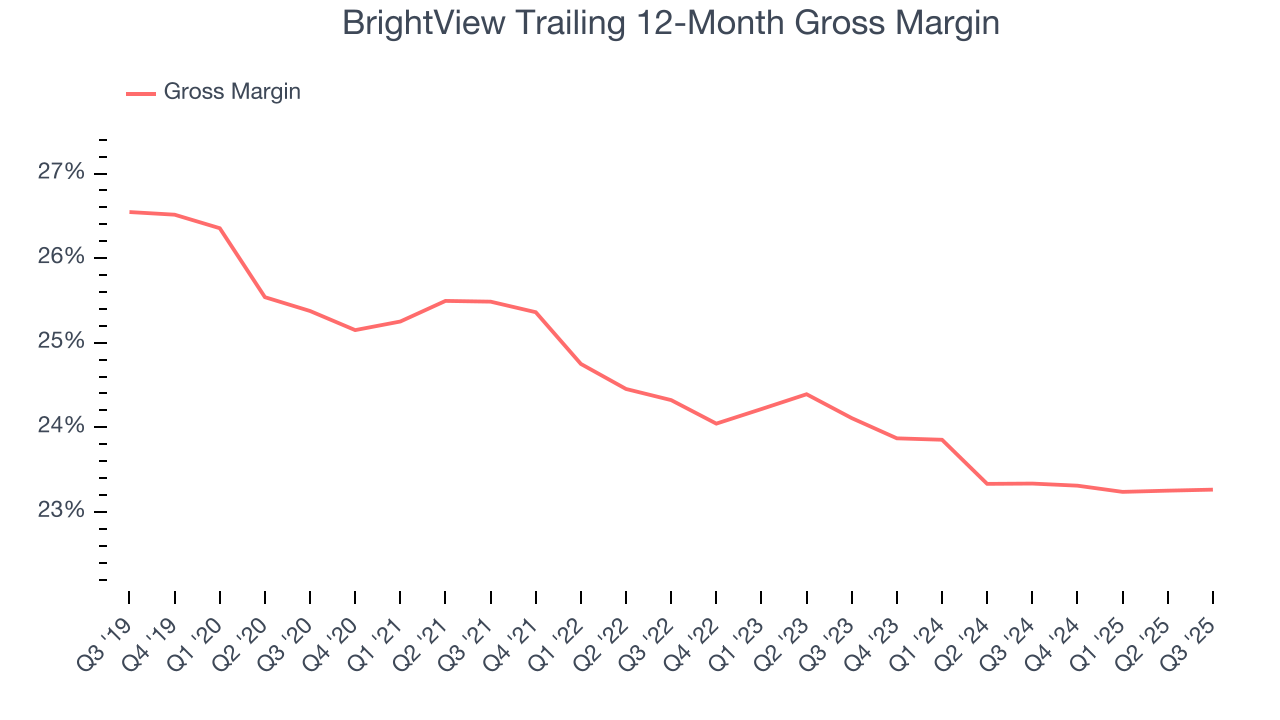

6. Gross Margin & Pricing Power

BrightView has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 24.1% gross margin over the last five years. Said differently, BrightView had to pay a chunky $75.91 to its suppliers for every $100 in revenue.

In Q3, BrightView produced a 25.1% gross profit margin, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

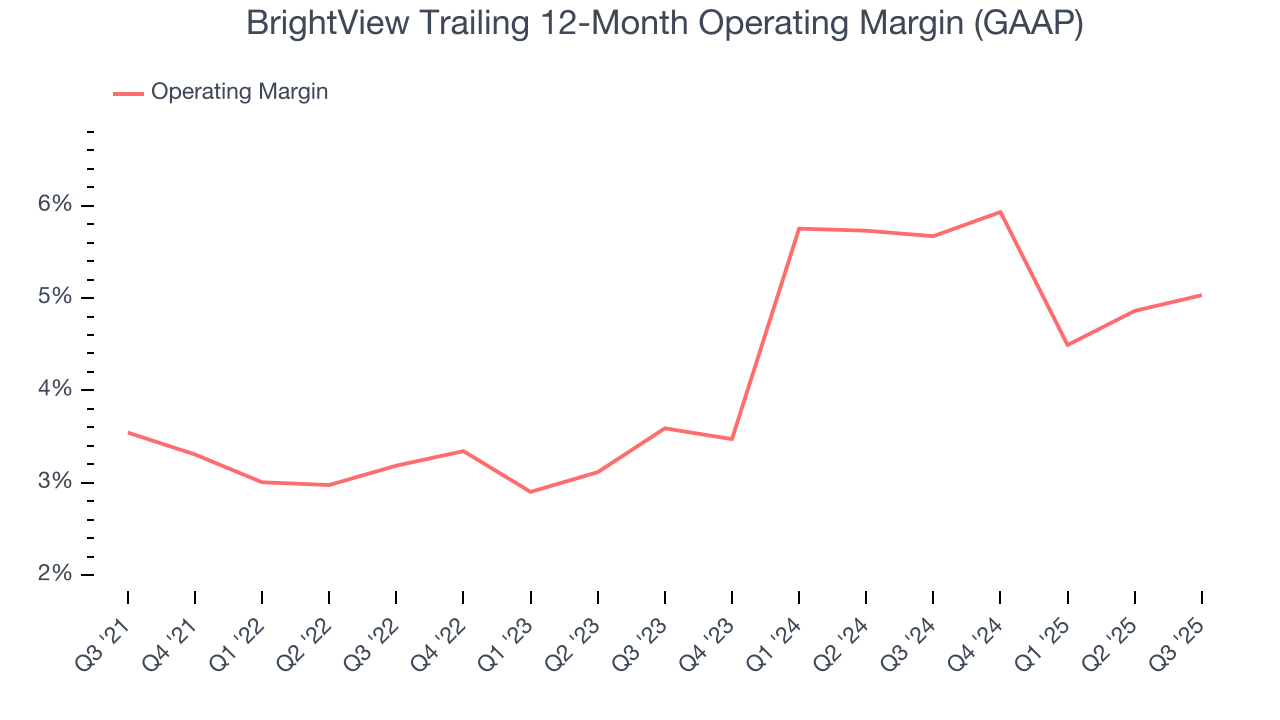

7. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

BrightView was profitable over the last five years but held back by its large cost base. Its average operating margin of 4.2% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

On the plus side, BrightView’s operating margin rose by 1.5 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, BrightView generated an operating margin profit margin of 7.9%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

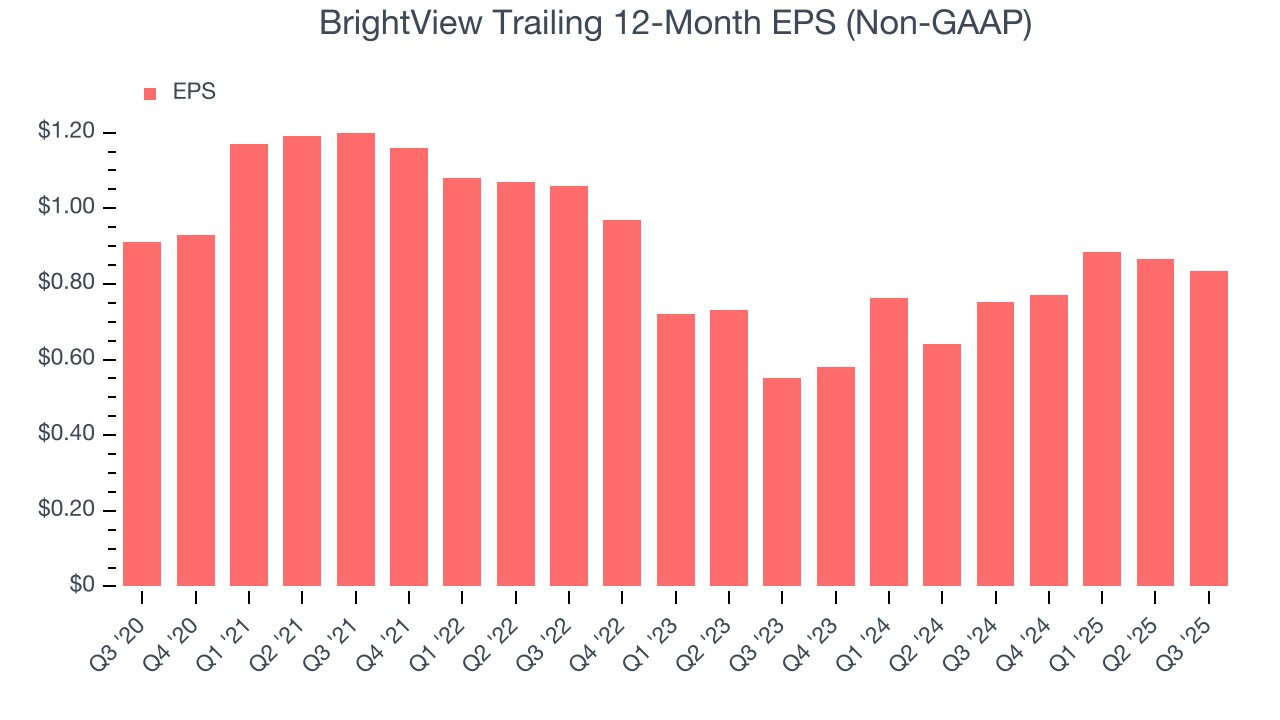

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for BrightView, its EPS declined by 1.7% annually over the last five years while its revenue grew by 2.6%. We can see the difference stemmed from higher interest expenses or taxes as the company actually improved its operating margin and repurchased its shares during this time.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For BrightView, its two-year annual EPS growth of 23.2% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

In Q3, BrightView reported adjusted EPS of $0.27, down from $0.30 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects BrightView’s full-year EPS of $0.84 to grow 1.5%.

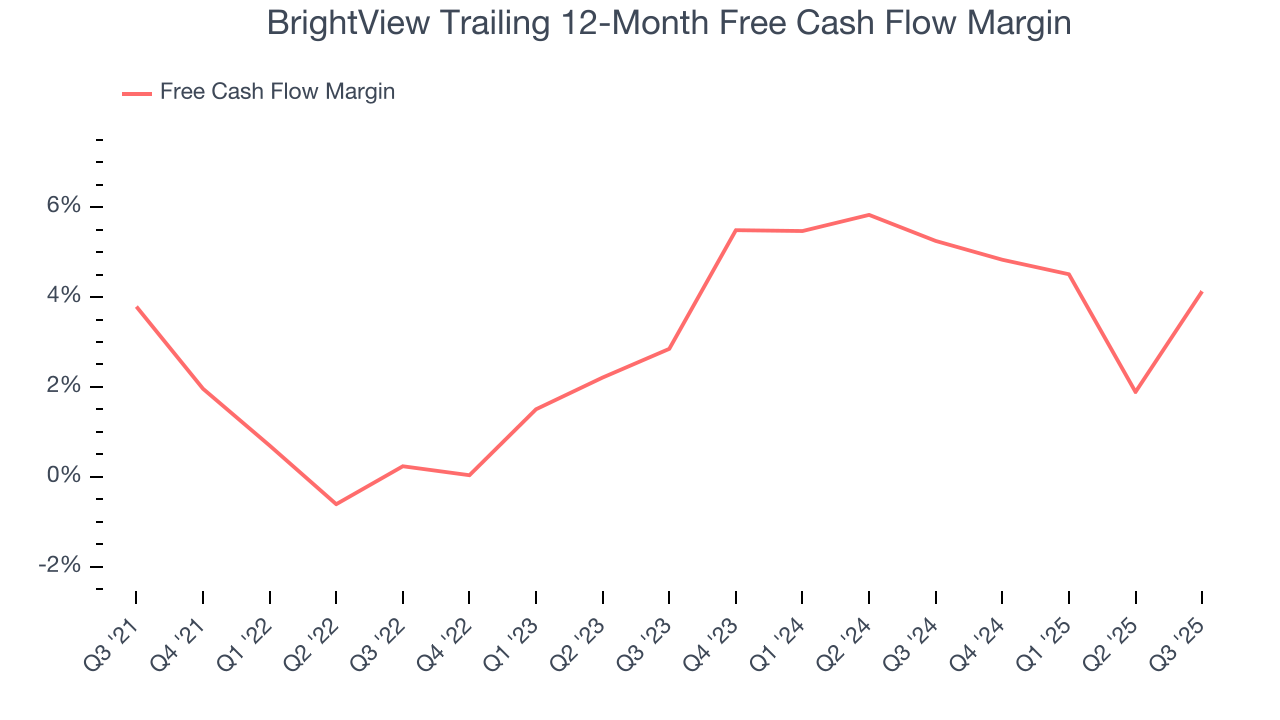

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

BrightView has shown weak cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.2%, subpar for an industrials business.

BrightView’s free cash flow clocked in at $84.4 million in Q3, equivalent to a 12% margin. This result was good as its margin was 8.6 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, leading to temporary swings. Long-term trends are more important.

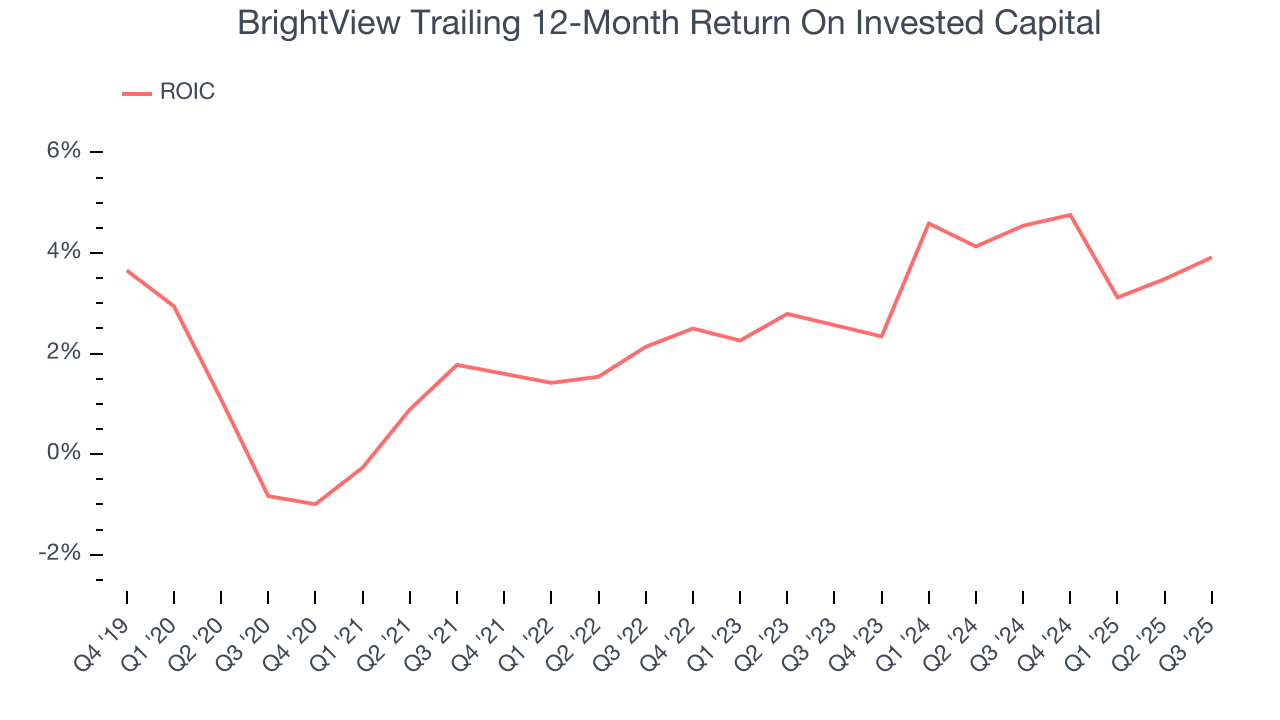

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

BrightView historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, BrightView’s ROIC averaged 2.3 percentage point increases each year. This is a good sign, and we hope the company can continue improving.

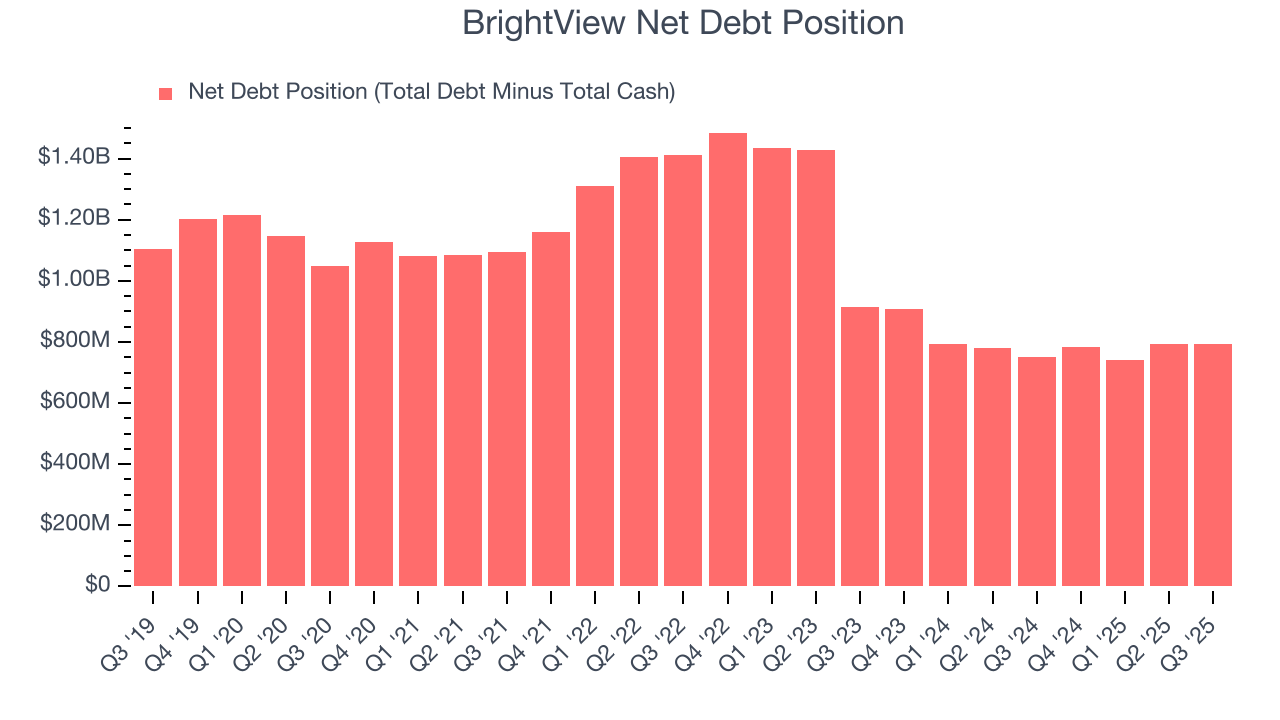

11. Balance Sheet Assessment

BrightView reported $74.5 million of cash and $868.4 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $352.3 million of EBITDA over the last 12 months, we view BrightView’s 2.3× net-debt-to-EBITDA ratio as safe. We also see its $26.9 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from BrightView’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 16.7% to $9.87 immediately following the results.

13. Is Now The Time To Buy BrightView?

Updated: January 24, 2026 at 11:02 PM EST

When considering an investment in BrightView, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We cheer for all companies making their customers lives easier, but in the case of BrightView, we’ll be cheering from the sidelines. To begin with, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its expanding operating margin shows the business has become more efficient, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its projected EPS for the next year is lacking.

BrightView’s P/E ratio based on the next 12 months is 18.1x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $16.17 on the company (compared to the current share price of $13.20).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.