Callaway Golf Company (CALY)

We wouldn’t buy Callaway Golf Company. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Callaway Golf Company Will Underperform

Formed between the merger of Callaway and Topgolf, Callaway Golf Company (NYSE:CALY) sells golf equipment and operates technology-driven golf entertainment venues.

- Muted 17.1% annual revenue growth over the last five years shows its demand lagged behind its consumer discretionary peers

- Incremental sales over the last five years were much less profitable as its earnings per share fell by 40.1% annually while its revenue grew

- Projected sales decline of 40.4% over the next 12 months indicates demand will continue deteriorating

Callaway Golf Company’s quality is insufficient. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Callaway Golf Company

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Callaway Golf Company

At $12.85 per share, Callaway Golf Company trades at 66.4x forward P/E. This valuation multiple seems a bit much considering the tepid revenue growth profile.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Callaway Golf Company (CALY) Research Report: Q4 CY2025 Update

Golf entertainment and gear company Callaway Golf Company (NYSE:CALY) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 60.2% year on year to $367.5 million. On the other hand, the company expects next quarter’s revenue to be around $650 million, close to analysts’ estimates. Its non-GAAP loss of $0.25 per share was 41.1% above analysts’ consensus estimates.

Callaway Golf Company (CALY) Q4 CY2025 Highlights:

- Revenue: $367.5 million vs analyst estimates of $790.5 million (60.2% year-on-year decline, 53.5% miss)

- Adjusted EPS: -$0.25 vs analyst estimates of -$0.42 (41.1% beat)

- Adjusted EBITDA: -$25.1 million vs analyst estimates of $18.91 million (-6.8% margin, significant miss)

- Revenue Guidance for Q1 CY2026 is $650 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for the upcoming financial year 2026 is $182.5 million at the midpoint, below analyst estimates of $204.2 million

- Operating Margin: -14.7%, up from -158% in the same quarter last year

- Market Capitalization: $2.77 billion

Company Overview

Formed between the merger of Callaway and Topgolf, Callaway Golf Company (NYSE:CALY) sells golf equipment and operates technology-driven golf entertainment venues.

Callaway, known for its golf equipment, merged with Topgolf in 2021 to broaden its reach within the golf industry. The merger allowed Callaway to tap into the casual player market as Topgolf seeks to lower golf's steep learning curve and intimidating atmosphere.

Topgolf attempts to enhance traditional golf experiences by infusing technology and entertainment. Its venues' main attraction is the driving range, which features swing-tracking technology and mini-games suited for players of all levels. There are also spaces for dining and socializing where customers can purchase food and beverages.

By integrating Callaway's product line and Topgolf Callaway's apparel segment, which includes brands such as TravisMatthew, Topgolf has expanded its revenue streams to include sales of golf gear and equipment, complementing its income from gameplay reservations, event hosting, and dining services. The company also sells its swing-tracking technology, Top Tracer, to third-party driving ranges. This strategy positions Topgolf Callaway to provide a comprehensive golf experience.

4. Consumer Discretionary - Leisure Facilities

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Leisure facilities companies own and operate theme parks, fitness centers, bowling alleys, and other venue-based entertainment destinations, generating revenue from admissions, memberships, and on-site spending. Tailwinds include consumer preference for experiential spending, tourism recovery, and technology-enhanced guest experiences that support premium pricing. Headwinds are notable: high fixed costs—real estate, labor, maintenance—make profitability highly sensitive to attendance fluctuations during economic slowdowns. Weather, pandemics, and safety incidents can disrupt operations unpredictably. Rising construction and labor costs inflate expansion budgets, while competition from at-home entertainment alternatives and other experiential options limits pricing power in many markets.

Competitors of Callaway Golf Company (NYSE:CALY) include TaylorMade Golf, Acushnet (NASDAQ:GOLF), and Johnson Outdoors (NASDAQ:JOUT).

5. Revenue Growth

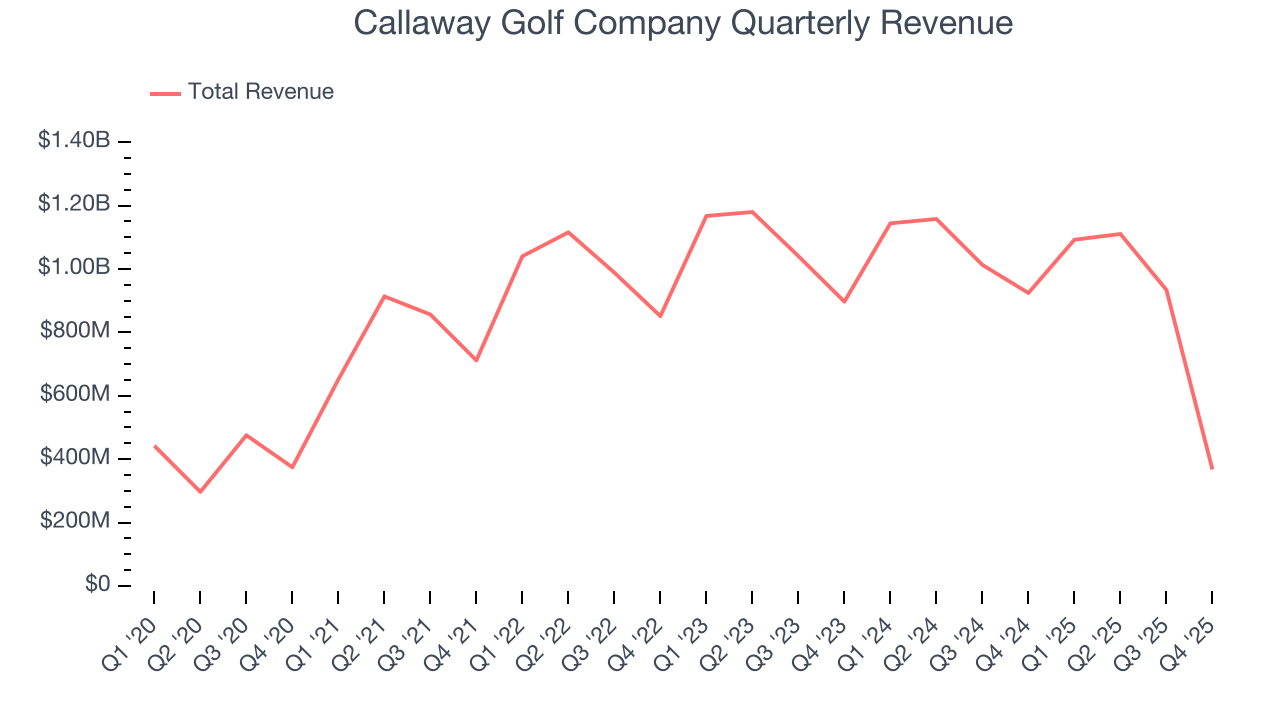

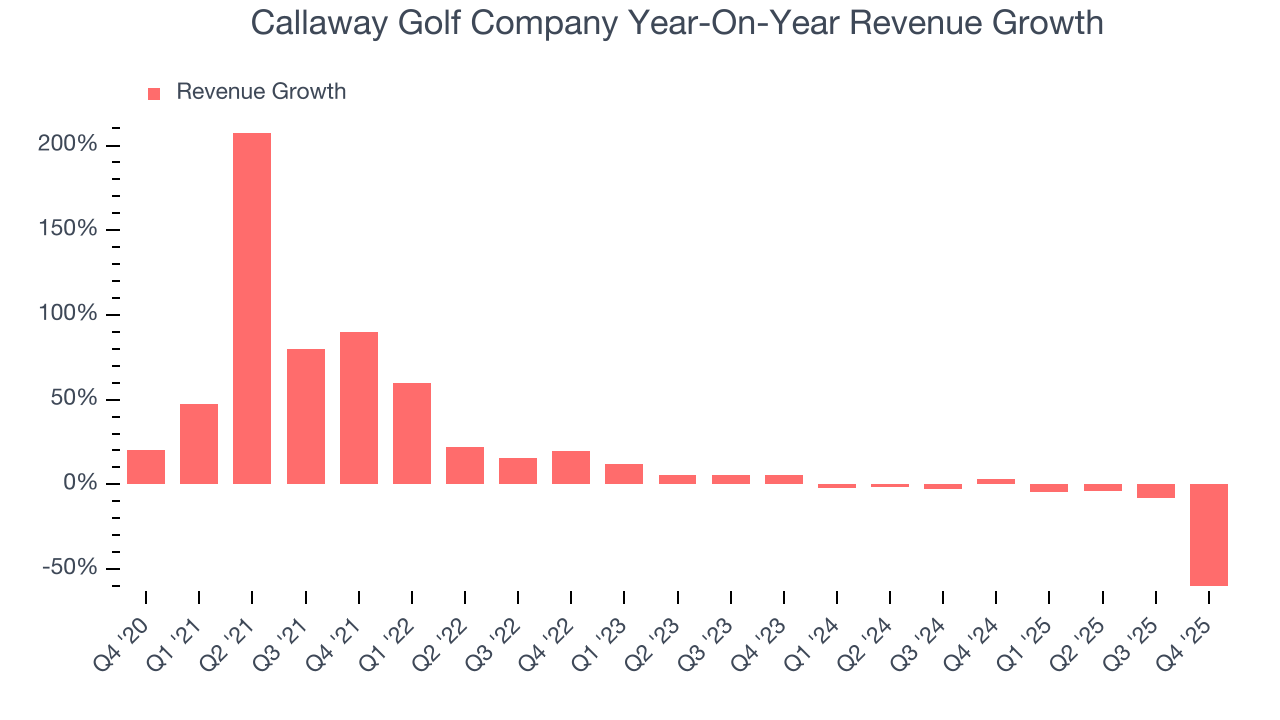

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Callaway Golf Company grew its sales at a 17.1% compounded annual growth rate. Though this growth is acceptable on an absolute basis, we need to see more than just topline growth for the consumer discretionary sector, which can display significant earnings volatility. This means our bar for the sector is particularly high, reflecting the non-essential and hit-driven nature of the products and services offered. Additionally, five-year CAGR starts around Covid, when revenue was depressed then rebounded.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Callaway Golf Company’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 9.6% annually. Note that COVID hurt Callaway Golf Company’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

This quarter, Callaway Golf Company missed Wall Street’s estimates and reported a rather uninspiring 60.2% year-on-year revenue decline, generating $367.5 million of revenue. Company management is currently guiding for a 40.5% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 40.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Callaway Golf Company’s operating margin has been trending up over the last 12 months, but it still averaged negative 14.3% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q4, Callaway Golf Company generated a negative 14.7% operating margin. The company's consistent lack of profits raise a flag.

7. Earnings Per Share

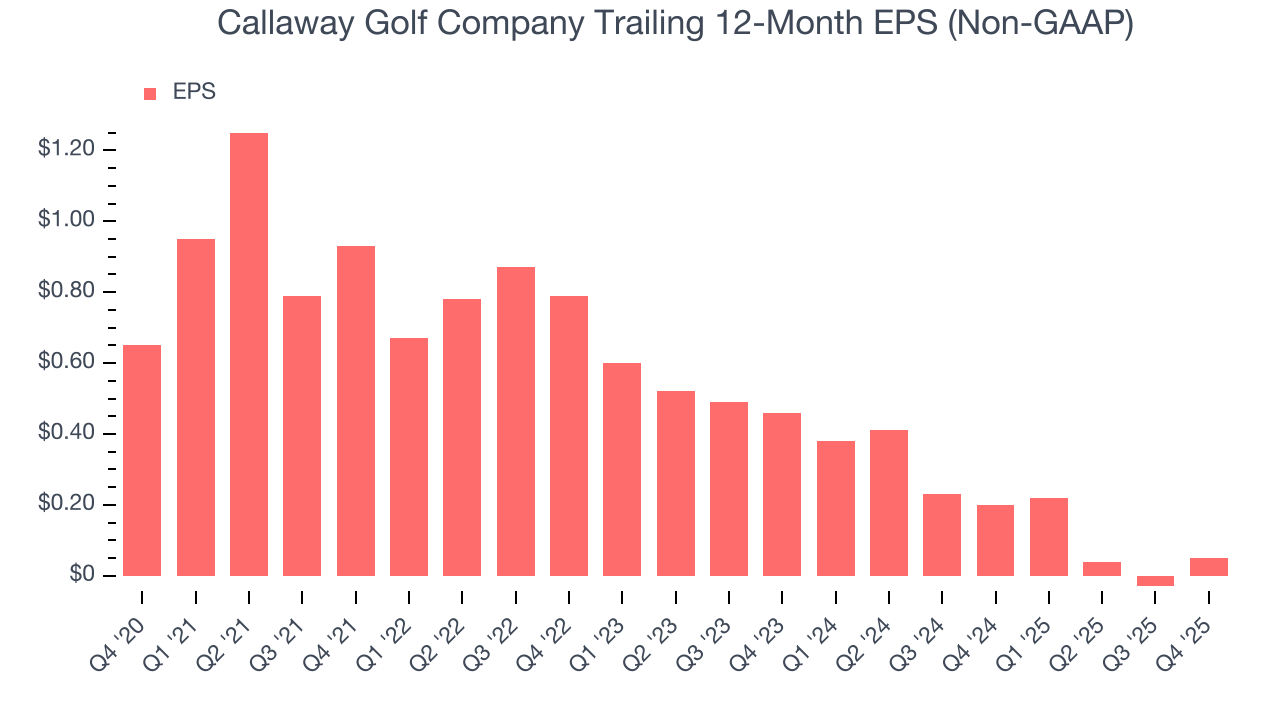

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Callaway Golf Company, its EPS declined by 40.1% annually over the last five years while its revenue grew by 17.1%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q4, Callaway Golf Company reported adjusted EPS of negative $0.25, up from negative $0.33 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Callaway Golf Company’s full-year EPS of $0.05 to grow 353%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Callaway Golf Company has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 2%, lousy for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Callaway Golf Company’s five-year average ROIC was negative 1%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Callaway Golf Company’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

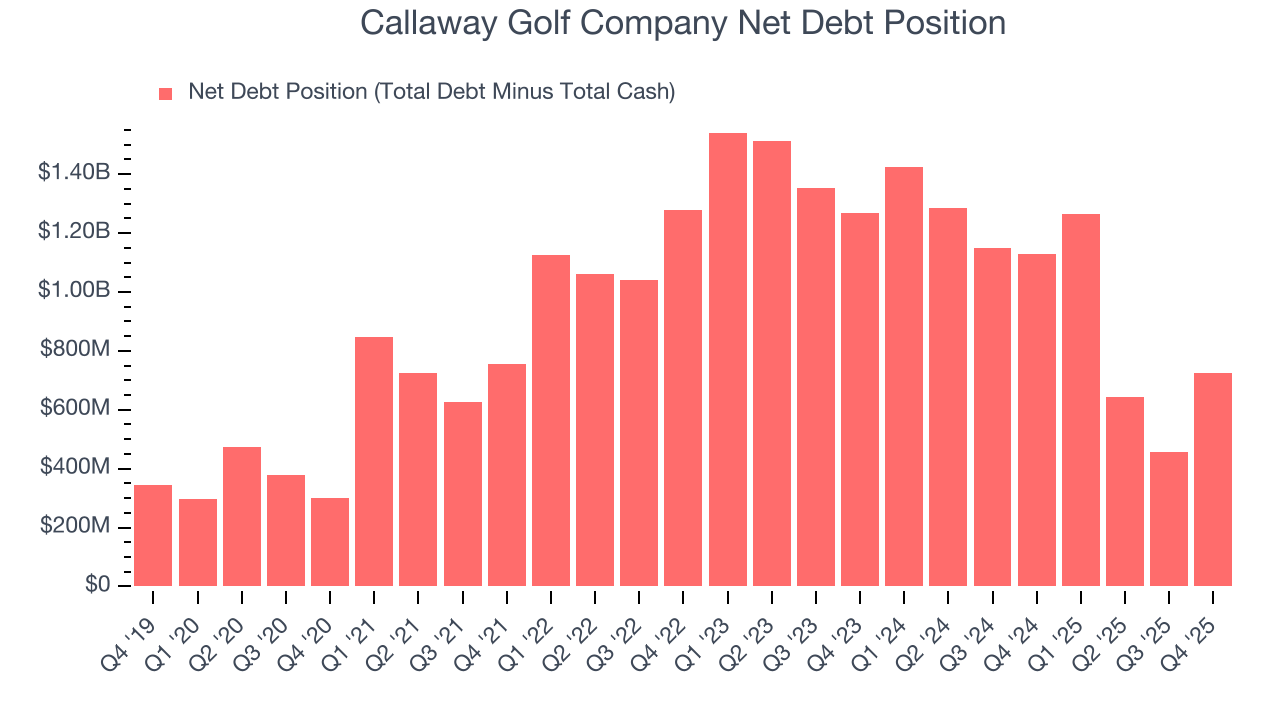

Callaway Golf Company reported $903.2 million of cash and $1.63 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $452.4 million of EBITDA over the last 12 months, we view Callaway Golf Company’s 1.6× net-debt-to-EBITDA ratio as safe. We also see its $179.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Callaway Golf Company’s Q4 Results

We were impressed by Callaway Golf Company’s optimistic EBITDA guidance for next quarter, which blew past analysts’ expectations. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 8.8% to $13.50 immediately after reporting.

12. Is Now The Time To Buy Callaway Golf Company?

Updated: February 12, 2026 at 10:13 PM EST

Before investing in or passing on Callaway Golf Company, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Callaway Golf Company doesn’t pass our quality test. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its constant currency sales performance has disappointed. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

Callaway Golf Company’s P/E ratio based on the next 12 months is 66.4x. This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $15.72 on the company (compared to the current share price of $12.85).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.