Core & Main (CNM)

Core & Main catches our eye. Its exceptional revenue growth and returns on capital show it can expand quickly and profitably.― StockStory Analyst Team

1. News

2. Summary

Why Core & Main Is Interesting

Formerly a division of industrial distributor HD Supply, Core & Main (NYSE:CNM) is a provider of water, wastewater, and fire protection products and services.

- Annual revenue growth of 17% over the last five years was superb and indicates its market share increased during this cycle

- Market-beating returns on capital illustrate that management has a knack for investing in profitable ventures

- A blemish is its estimated sales growth of 1.6% for the next 12 months implies demand will slow from its two-year trend

Core & Main shows some signs of a high-quality business. If you’re a believer, the valuation looks fair.

Why Is Now The Time To Buy Core & Main?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Core & Main?

Core & Main’s stock price of $58.16 implies a valuation ratio of 22.7x forward P/E. A number of industrials companies feature higher multiples, but that doesn’t make Core & Main a bargain. In fact, we think the current price justly reflects the top-line growth.

Now could be a good time to invest if you believe in the story.

3. Core & Main (CNM) Research Report: Q3 CY2025 Update

Water and fire protection solutions company Core & Main (NYSE:CNM) met Wall Streets revenue expectations in Q3 CY2025, with sales up 1.2% year on year to $2.06 billion. The company’s outlook for the full year was close to analysts’ estimates with revenue guided to $7.65 billion at the midpoint. Its non-GAAP profit of $0.89 per share was 26% above analysts’ consensus estimates.

Core & Main (CNM) Q3 CY2025 Highlights:

- Revenue: $2.06 billion vs analyst estimates of $2.05 billion (1.2% year-on-year growth, in line)

- Adjusted EPS: $0.89 vs analyst estimates of $0.71 (26% beat)

- Adjusted EBITDA: $274 million vs analyst estimates of $269.5 million (13.3% margin, 1.7% beat)

- The company reconfirmed its revenue guidance for the full year of $7.65 billion at the midpoint

- EBITDA guidance for the full year is $930 million at the midpoint, in line with analyst expectations

- Operating Margin: 10.7%, in line with the same quarter last year

- Free Cash Flow Margin: 12.8%, similar to the same quarter last year

- Market Capitalization: $9.63 billion

Company Overview

Formerly a division of industrial distributor HD Supply, Core & Main (NYSE:CNM) is a provider of water, wastewater, and fire protection products and services.

Core & Main offers a range of solutions designed to support the construction and maintenance of critical infrastructure. Specifically, the company supplies municipalities with essential waterworks products, assists industrial clients with wastewater management solutions, and supports residential developers with fire protection equipment. These products range from the simple such as pipes and pipe sealants to the complex such as advanced meters that reads flow data with high precision.

The primary revenue sources for Core & Main come from the sale of its products and the provision of services such as maintenance and installation. Recurring revenue is generated through long-term contracts and ongoing maintenance services. The company's go-to-market strategy encompasses a direct sales force and robust distribution network to build enduring customer relationships.

4. Infrastructure Distributors

Focusing on narrow product categories that can lead to economies of scale, infrastructure distributors sell essential goods that often enjoy more predictable revenue streams. For example, the ongoing inspection, maintenance, and replacement of pipes and water pumps are critical to a functioning society, rendering them non-discretionary. Lately, innovation to address trends like water conservation has driven incremental sales. But like the broader industrials sector, infrastructure distributors are also at the whim of economic cycles as external factors like interest rates can greatly impact commercial and residential construction projects that drive demand for infrastructure products.

Competitors in the water and fire protection industry include Ferguson (NYSE:FERG), Mueller Water Products (NYSE:MWA), and Essential Utilities (NYSE:WTRG).

5. Revenue Growth

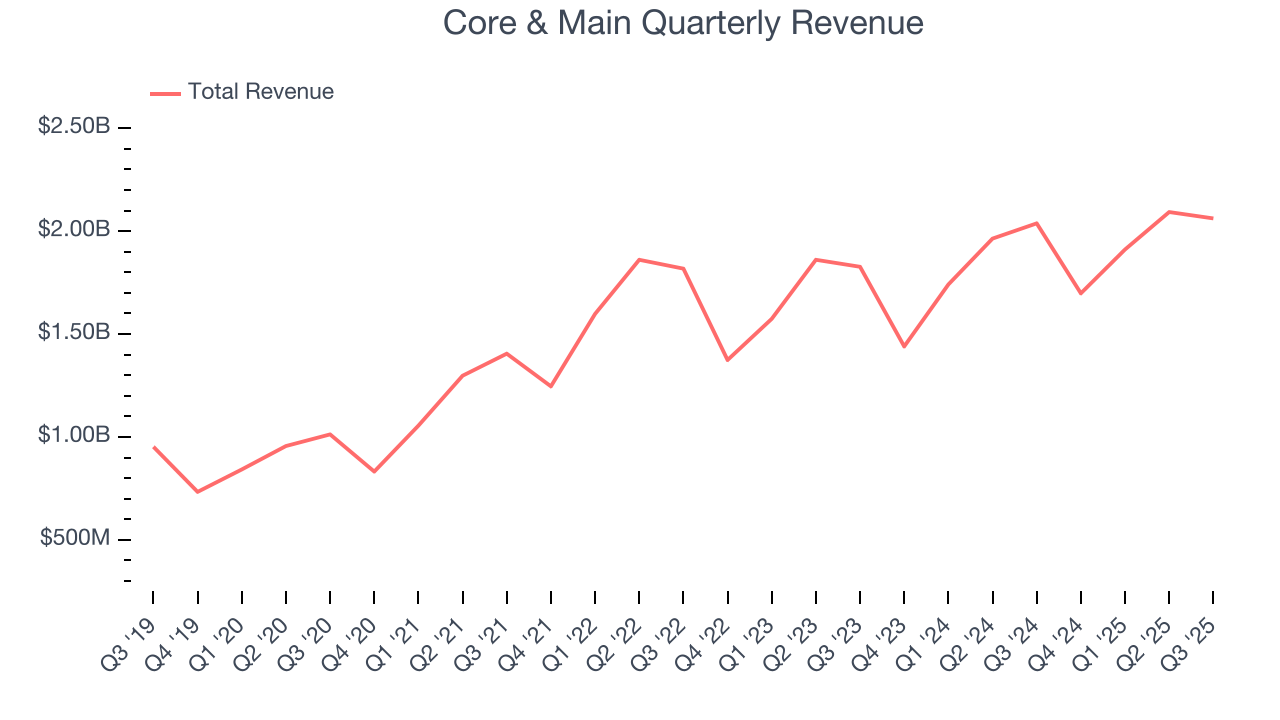

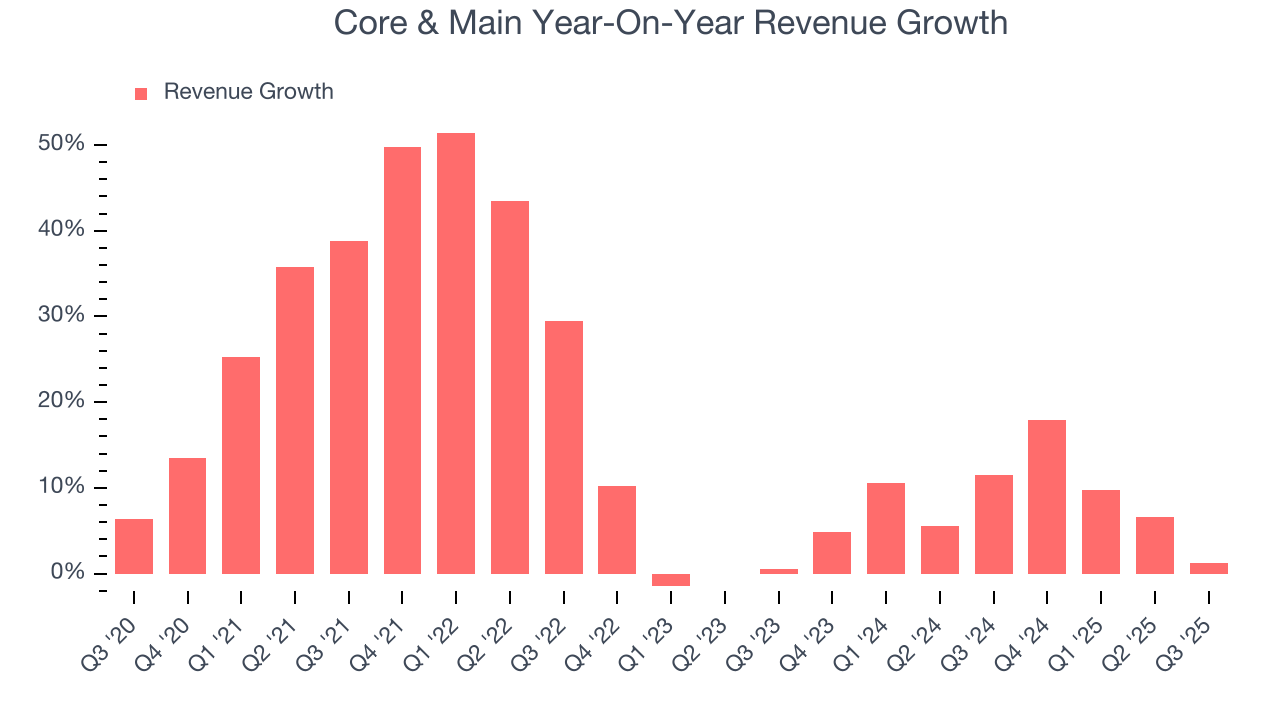

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Core & Main’s sales grew at an incredible 17% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Core & Main’s annualized revenue growth of 8.2% over the last two years is below its five-year trend, but we still think the results were respectable.

This quarter, Core & Main grew its revenue by 1.2% year on year, and its $2.06 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

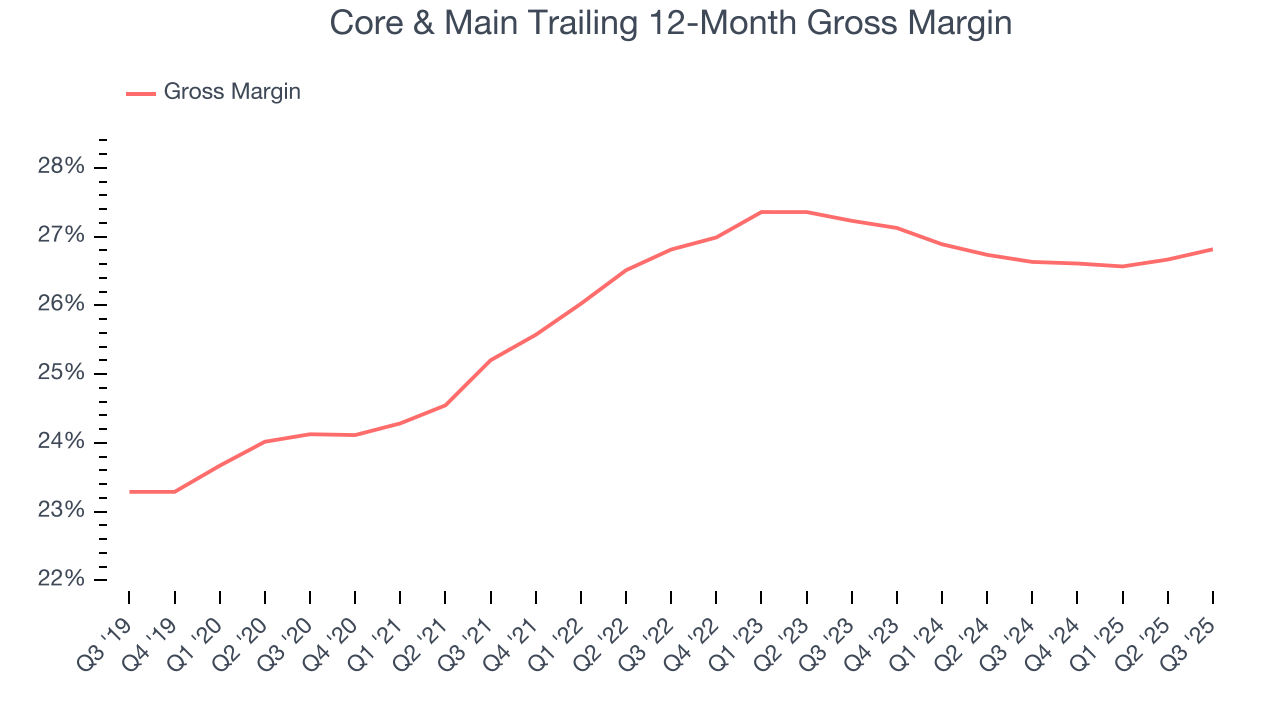

Core & Main has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 26.6% gross margin over the last five years. Said differently, Core & Main had to pay a chunky $73.37 to its suppliers for every $100 in revenue.

In Q3, Core & Main produced a 27.2% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

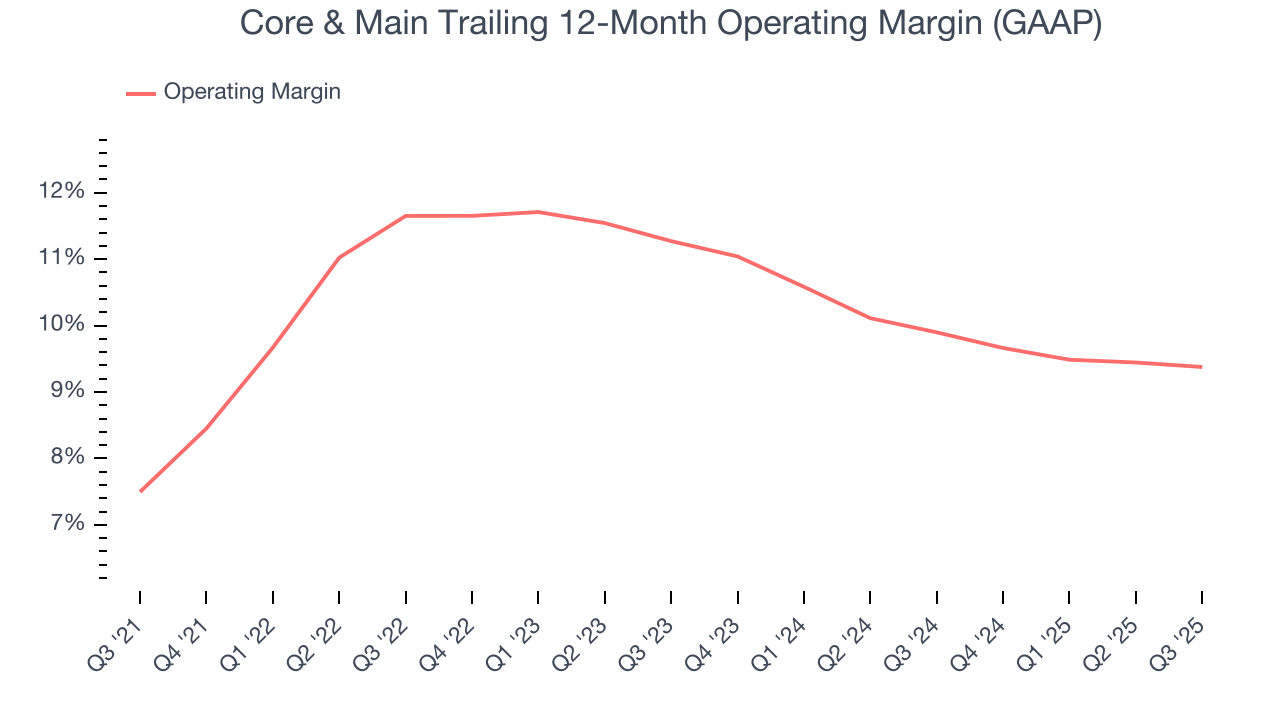

Core & Main has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.1%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Core & Main’s operating margin rose by 1.9 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q3, Core & Main generated an operating margin profit margin of 10.7%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

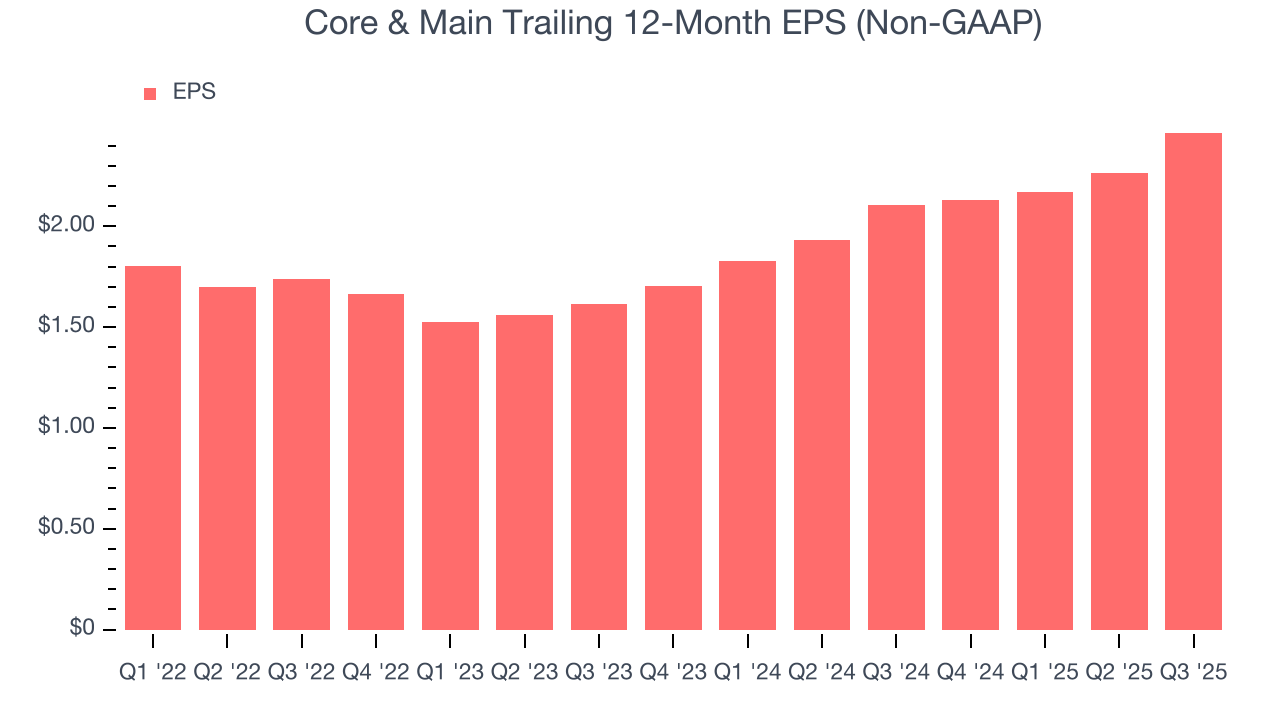

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Core & Main’s full-year EPS grew at a remarkable 12.4% compounded annual growth rate over the last four years, better than the broader industrials sector.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

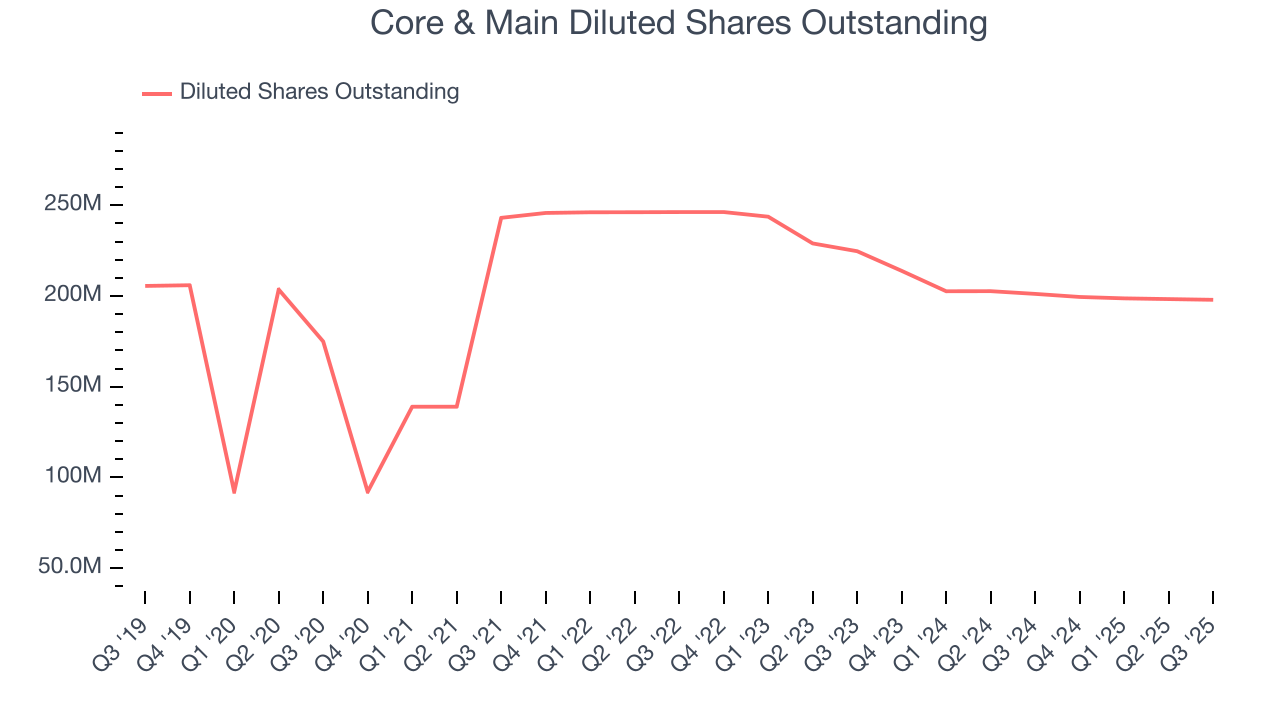

Core & Main’s EPS grew at an astounding 23.4% compounded annual growth rate over the last two years, higher than its 8.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Core & Main’s quality of earnings can give us a better understanding of its performance. A two-year view shows that Core & Main has repurchased its stock, shrinking its share count by 11.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q3, Core & Main reported adjusted EPS of $0.89, up from $0.69 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Core & Main’s full-year EPS of $2.46 to stay about the same.

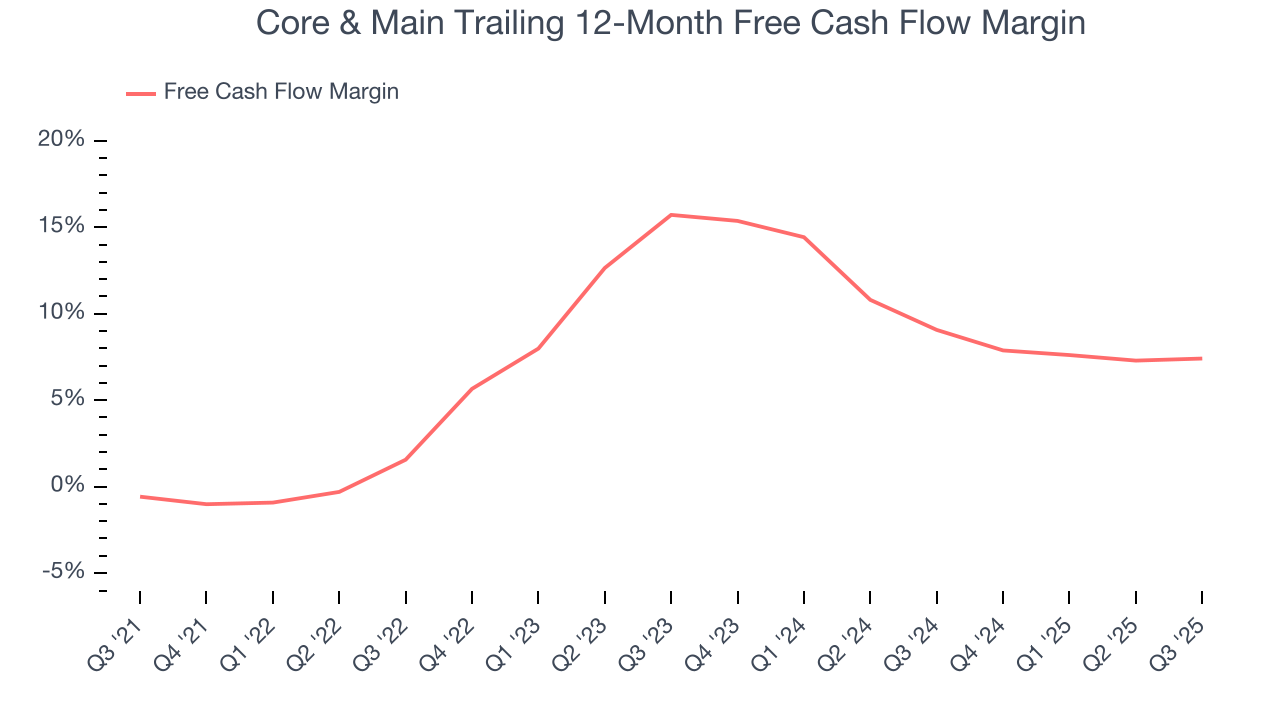

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Core & Main has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 7.2% over the last five years, slightly better than the broader industrials sector.

Taking a step back, we can see that Core & Main’s margin expanded by 8 percentage points during that time. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Core & Main’s free cash flow clocked in at $263 million in Q3, equivalent to a 12.8% margin. This cash profitability was in line with the comparable period last year and above its five-year average.

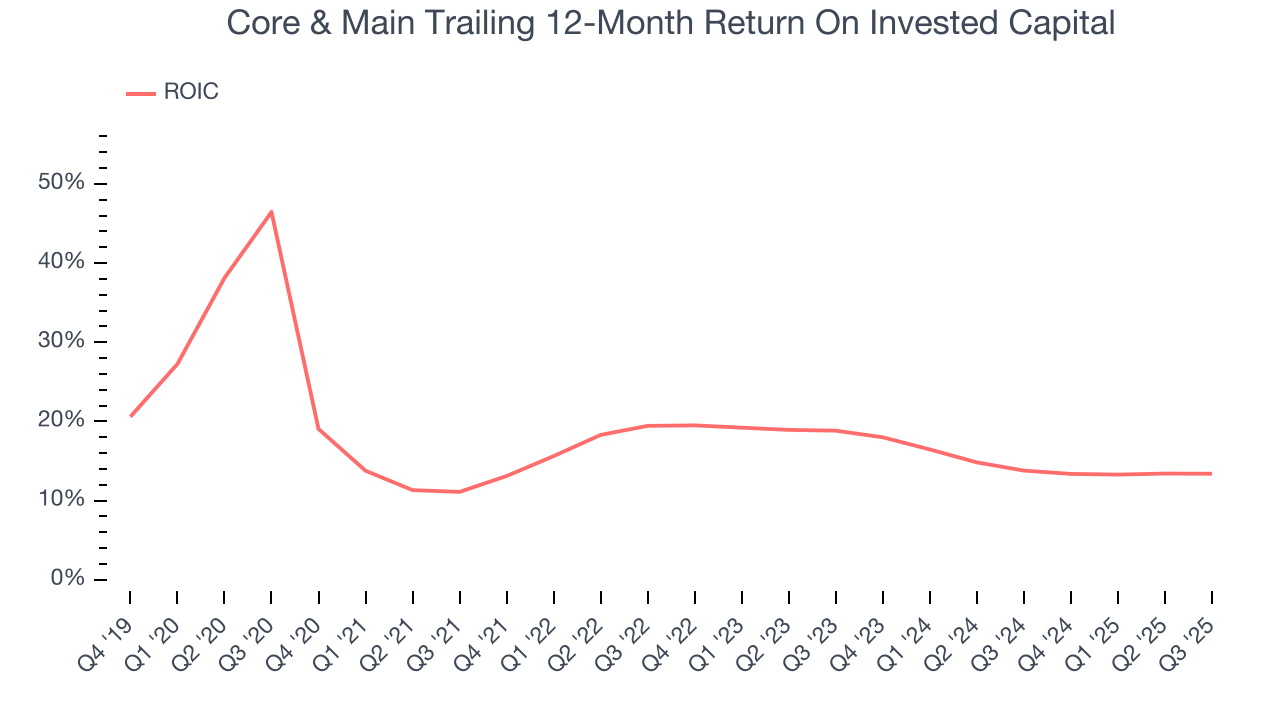

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Core & Main’s five-year average ROIC was 15.3%, beating other industrials companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Core & Main’s ROIC averaged 1.7 percentage point decreases each year. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

11. Balance Sheet Assessment

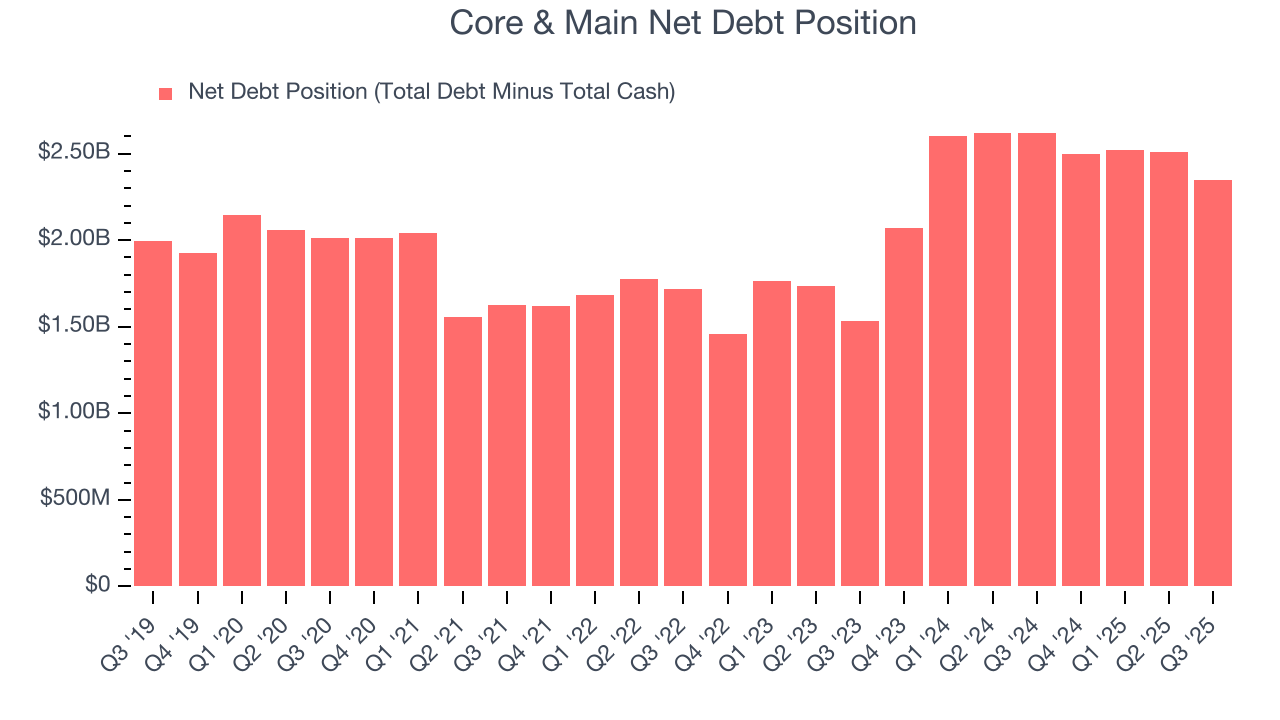

Core & Main reported $89 million of cash and $2.43 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $943 million of EBITDA over the last 12 months, we view Core & Main’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $67 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Core & Main’s Q3 Results

It was good to see Core & Main beat analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 8.6% to $54.87 immediately following the results.

13. Is Now The Time To Buy Core & Main?

Updated: January 21, 2026 at 10:02 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Core & Main.

Core & Main possesses a number of positive attributes. To kick things off, its revenue growth was exceptional over the last five years. And while its organic revenue growth has disappointed, its rising cash profitability gives it more optionality. On top of that, its market-beating ROIC suggests it has been a well-managed company historically.

Core & Main’s P/E ratio based on the next 12 months is 22.7x. When scanning the industrials space, Core & Main trades at a fair valuation. If you’re a fan of the business and management team, now is a good time to scoop up some shares.

Wall Street analysts have a consensus one-year price target of $61.06 on the company (compared to the current share price of $58.16), implying they see 5% upside in buying Core & Main in the short term.